Automotive Headliners Market Size, Share & Trends Analysis Report By Type (Fabric Headliners, Leatherette Headliners, Perforated Headliners, Others), By Technology (Standard Headliners, Acoustic Headliners, Lightweight Composite Headliners, Smart Headliners), By Vehicle Application (Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Luxury Vehicles) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Automotive Headliners Market Overview

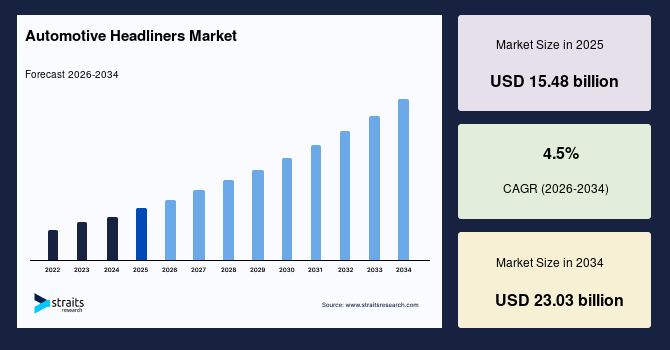

The global automotive headliners market size is valued at USD 15.48 billion in 2025 and is estimated to reach USD 23.03 billion by 2034, growing at a CAGR of 4.5% during the forecast period. Consistent growth of the market is supported by increasing demand for enhanced vehicle interior aesthetics, improved acoustic comfort, and lightweight materials, which help automakers meet fuel efficiency targets, elevate passenger experience, and accelerate the adoption of advanced headliner technologies across passenger, commercial, electric, and luxury vehicles.

Key Market Trends & Insights

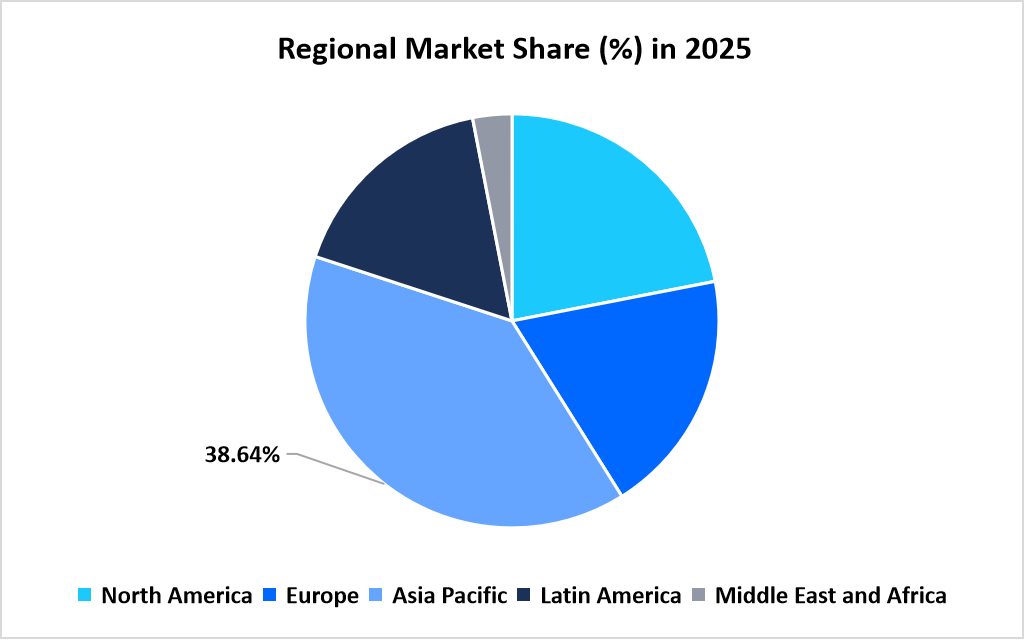

- Asia Pacific dominated the market with a revenue share of 38.64% in 2025.

- North America is anticipated to grow at the fastest CAGR of 6.2% during the forecast period.

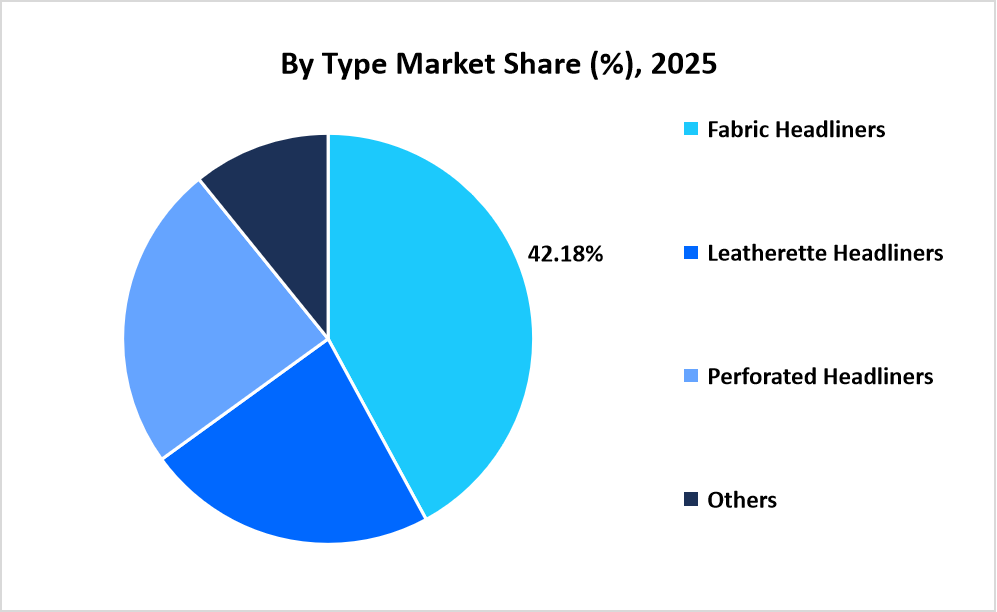

- Based on type, the Fabric Headliners segment held the highest market share of 42.18% in 2025.

- By technology, the Lightweight Composite Headliners segment accounted for a market share of 34.26% in 2025.

- Based on vehicle application, the Passenger Cars segment is projected to grow at a CAGR of 4.7% during the forecast period

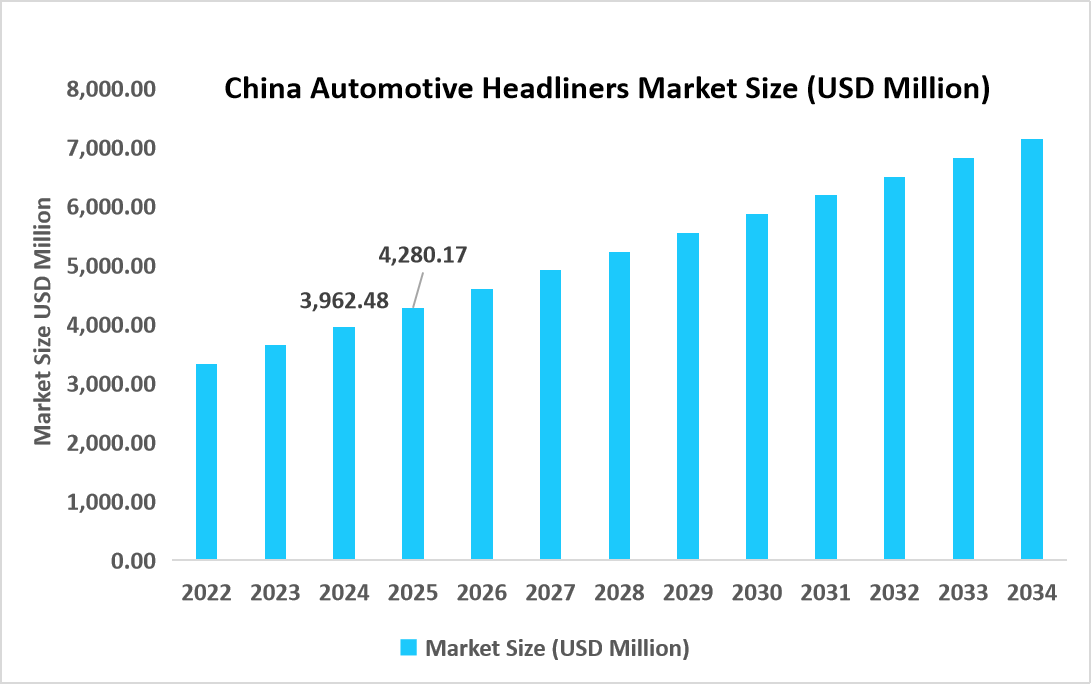

- China dominates the automotive headliners market, valued at USD 3.96 billion in 2024 and reaching USD 4.28 billion in 2025.

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 15.48 billion

- 2034 Projected Market Size: USD 23.03 billion

- CAGR (2026-2034): 4.5%

- Dominating Region: Asia Pacific

- Fastest Growing Region: North America

The global automotive headliners market comprises a vast array of interior roof trim solutions such as fabric headliners, leatherette headliners, perforated headliners, and other customized interior versions developed for boosting interior comfort and looks. These headliners are produced through various technology platforms, such as standard headliners, acoustic headliners, lightweight composite headliners, and smart headliners that are equipped with advanced features and material technology. In addition, automotive headliners are applied in a vast array of vehicular applications such as passenger vehicles, commercial vehicles, electric vehicles, and luxury vehicles, allowing automobile manufacturers to develop upgraded interior quality, noise-reduction, and weight-reduction functionalities in their vehicles across global automobile markets.

Market Trends

Transition from Conventional Interior Materials to Lightweight and Sustainable Headliner Solutions

Automotive headliner development is shifting from traditional, heavier interior materials to lightweight, recyclable, low-emission composites supportive of both efficiency and sustainability goals on vehicles. Headliner designs have traditionally been centered around basic aesthetics and structural coverage, with generally unnecessary mass addition to the interior of the vehicle. Presently, automakers and Tier-1 suppliers are increasingly targeting lightweight composite headliners that decrease overall vehicle mass for better fuel economy and increased driving ranges in electric vehicles. The opportunity to address performance needs with environmental compliance is attained through the use of advanced fiber composites, bio-based foams, and recyclable substrates. This has brought improved material utilization, reduced lifecycle emissions, and closer alignment of OEMs with global sustainability mandates.

Rising Integration of Acoustic and Smart Headliners to Enhance In-Cabin Experience

The automotive industry is seeing accelerated adoption of acoustic and smart headliner technologies as consumer expectations continue to rise for comfort, quietness, and connected interiors. Headliners have conventionally played a passive role in noise control and cabin functionality. The advanced sound-absorbing layers, integrated lighting, sensors, and embedded controls in modern headliner systems add a new dimension to improving passenger comfort and driving experience. These are especially relevant in electric and luxury vehicles, where reduced powertrain noise raises sensitivity to interior acoustics. Headliners will thus become an integral part of the multifunctional interior system, offering added value in noise reduction, ambience enrichment, and intelligent cabin design, further reinforcing their strategic relevance in next-generation vehicles.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 15.48 billion |

| Estimated 2026 Value | USD 16.18 billion |

| Projected 2034 Value | USD 23.03 billion |

| CAGR (2026-2034) | 4.5% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Adient plc, Grupo Antolin, Faurecia, Lear Corporation, Toyota Boshoku Corporation |

to learn more about this report Download Free Sample Report

Market Driver

Government-Backed Vehicle Safety and Cabin Noise Regulations Elevating Headliner Demand

Automotive regulatory requirements are also shifting their focus to occupant safety, noise control in the interior, and material fulfillment, thereby directly driving the demand for more sophisticated headliner systems. The authorities in major automotive markets have set more stringent requirements for interior noise, vibration, and harshness performance as well as flammability of interior materials. Regulations concerning better acoustic insulation, fire-resistance, and low-emission interior parts have forced OEMs to move beyond conventional roof linings to more sophisticated acoustic and composite headliners. At the same time, country-level road safety initiatives and new homologation regulations have increased the demand for interior material tests concerning resistance to heat, impact, and endurance, thereby making headliners a regulatory component rather than an ornamental one.

Market Restraint

Stringent Chemical Emission and Interior Material Compliance Norms Slowing Product Approvals

The most important factors restraining the car headliners industry is the increasing government restrictions on emissions and the composition of interior materials. The REACH Regulations within the European Union, ELV Directive, and GB/T standards in China set some restrictions on interior parts’ VOC emission, flame resistance, and recyclability of parts. These government restrictions make it necessary to test interior materials repeatedly before car headliners can be considered for assembly into vehicles. This has been proven to slow down new product developments and new material replacements in car headliners due to stringent government norms.

Market Opportunity

Expansion of Customization and Premium Interior Differentiation Across Vehicle Segments

The rising opportunity of personalizing vehicle interiors is unleashing new potential for the automotive headliners market. Car manufacturers are shifting toward providing owners with the possibility of customizing cabin designs, colors, textures, and hole patterns to stand out and give the brand its identity. Automotive headliners will become an essential component in this process of differentiating vehicles, especially in the case of vehicles like passenger cars, luxury cars, and premium electric vehicles, where the interior surroundings have become an important consideration for buyers when purchasing a vehicle. This trend towards personalization will give automotive headliner manufacturers the opportunity to provide modular and flexible designs for headliners, which will easily integrate with different models of vehicles and unlock additional revenue streams for the market due to value-added customization rather than just relying on increased sales volumes.

Regional Analysis

Asia Pacific led the market in 2025, accounting for 38.64% market share. This is because the region has favorable conditions, such as large-scale car production, robust car manufacturing, and developing local OEMs. The Asia Pacific region has the benefits of locally manufacturing interior parts on a massive scale, making it feasible for fabric, perforated, and composite headliners to enter the market quickly. Moreover, the Asia Pacific region has a rising middle-class population, along with increased demands for improved comfort, propelling carmakers to focus on interior material development, hence increasing the adoption rate for headliners in the Asia Pacific region.

The automotive headliners market in China grows due to the fact that it is the world’s largest car-producing nation with a rapidly increasing focus on sophisticated interior designs. The local automakers are now emphasizing upgrading the interior acoustic and aesthetics to rival international models, thereby resulting in an increased uptake of the latest headliner technologies. The rise of local electric and luxury car models has also led to an increased demand for lightweight composite acoustic headliners in the market.

North America Market Insights

North America is anticipated to grow at the fastest CAGR of 6.2% during the forecast period, supported by rising consumer expectations for premium interiors and increasing adoption of advanced vehicle platforms. Automakers in the region are placing greater emphasis on cabin quietness, material quality, and integrated interior features, which is driving demand for technologically advanced headliner systems. The growing share of electric and luxury vehicles is further amplifying the need for high-performance headliners that enhance comfort and driving experience.

The U.S. automotive headliners market is expanding steadily due to strong demand for passenger cars, SUVs, and premium vehicle trims that emphasize interior differentiation. Automakers operating in the country are increasingly incorporating upgraded headliner materials to improve acoustic performance and interior aesthetics, particularly in higher-end models. Additionally, the presence of leading automotive OEMs and interior system suppliers supports rapid adoption of innovative headliner designs, reinforcing the U.S. as a key growth engine within the North American market.

Source: Straits Research

Europe Market Insights

Europe is experiencing continuous growth in the automotive headliners market due to the rising demand for improving the quality of the car interior and an increasing tendency to use high-quality materials for the interior of the automobile. The presence of worldwide automobile brands as well as interior systems suppliers in the Europe market is pushing the use of advanced headliner designs to improve sound insulation and aesthetics in the coming years. Further, the demand for automobile interior comfort and distinction in Europe is pushing automobile manufacturers to improve roof lining solutions.

The headliners market for automobiles in Germany is growing with the country’s dominance in the global market for premium and sport cars. German car manufacturers are heavily investing in optimizing interior designing, precision engineering, and sound insulation, thus propelling demand for advanced headliner technologies made from innovative materials. The growing domestic output of premium cars and EVs is thereby adding to a need for aligned innovative headliner solutions, thus propelling market demand for headliners in Germany.

Latin America Market Insights

Latin America market is gaining traction as car production in Latin America is slowly reviving and consumer preference is shifting towards enhanced comfort levels inside vehicles. Rising demand for passenger cars with better-equipped cabins is being witnessed in various nations in Latin America, and as a result, manufacturers are upgrading their standards of interior materials. Rising local production and rising use of vehicles in Latin America are contributing towards rising adoption of advanced headliners in Latin America.

In Brazil, the market for headliner products is slowly growing, with vehicle manufacturers accentuating the focus of enhanced interior designs that have appealed to consumers seeking value-for-money deals. Increasing sales of passenger cars and compact SUVs with improved interior designs have showcased demand for fabric and perforated headliner products. Also, the domestic vehicle industry is slowly expanding its capacity, allowing the use of improved headliner materials.

Middle East & Africa Market Insights

The Middle Eastern and African automotive headliners market is emerging due to the increase in demand for vehicles in urban areas and logistics routes. The trend of purchasing comfort-focused passenger cars and imported premium vehicles in the region is fueling the demand for better quality interior parts, including automotive headliners. The automotive distribution channel in the Middle Eastern and African markets is also favoring the increased use of modern headliners.

The market for automotive headliners in the UAE is witnessing growth because of the increasing demand for high-quality automobiles and SUVs, which highlight the qualitative designs of the headliner. Automakers catering to the UAE market are making use of the enhanced features of automotive headliners. The preference of the UAE for high-quality automotive interiors is making the market one of the major contributors in the global market.

Type Insights

Fabric Headliners held the dominant position in the market and contributed 42.18% of revenue in 2025. This dominant position is attributed by the wide usage of these products in passenger vehicles and mass-market vehicles due to their affordability and adaptability.

The Leatherette Headliners segment is likely to register the fastest growth rate, with a projected CAGR of approximately 5.6% over the forecast period. This is driven by consumer preference for premium interiors, increased luxury and high-end passenger vehicles, and growing consumer need for robust interior solutions that are easy to maintain and provide a luxury feel.

Source: Straits Research

Technology Insights

In 2025, the Lightweight Composite Headliners segment accounted for a market share of 34.26% as more and more automakers bestowed top priority on efforts toward weight reduction and material efficiency across different vehicle platforms. This lightweight composite headliner accelerates economy in fuel and extends driving ranges, particularly in passenger cars and electric vehicles, while offering superior structural stability and design flexibility.

The Smart Headliners segment is likely to grow faster during the forecast period. It is driven by growing demand for smart cabin functionalities and rich interior experiences. The smart headliner integrates ambient lighting features, touch-sensitive controls, and sensor-enabled systems. Growing demand for connected and premium vehicles would escalate the introduction of intelligent interior features, thus making the smart headliner segment one of the high-growth technology segments in the market.

Vehicle Application Insights

The Passenger Cars segment is expected to record the highest growth rate of 4.7% during the forecast period due to the growing demand for passenger cars across the globe and the increasing focus on the interior comfort and interior refinement of the cars. With the growing focus on better looks and overall interior experience, the demand for advanced headliner solutions is expected to increase among automobile manufacturers across the globe.

Competitive Landscape

The global automotive headliners market is moderately fragmented, with a number of recognized suppliers of automotive interior systems and specialized component manufacturers. Few players have a large market share, owing to strong ties with original equipment manufacturers, vertical integration of production, and a wide product base of interior components, including headliner systems.

The prominent participants in this market are Adient plc, Grupo Antolin, Faurecia, and several other companies. The companies compete with each other to enhance their market status through constant developments in their offerings, enhancing their manufacturing capacity, and mergers and acquisitions. The emphasis on lightweight material, acoustic performance, and interior design different solutions for headliners by the companies allows them to sign up with contracts from global car manufacturers, entering into a competitive market for automotive headliners.

Autostop Global: An emerging market player

Autostop Global, a supplier of automotive interior components from Serbia, is also making headlines with its niche headliner products that satisfy the needs of local OEMs and with growing global partnerships.

- In March 2025, Autostop Global launched a lightweight acoustic headliner lineup optimized for integration with wiring harnesses and acoustic modules for compact electric vehicles. This is in line with a growing demand for interior components with multifunctionality and weight savings, particularly for new segments such as compact EVs.

Thus, Autostop Global found itself as one of the prominent players in the automotive headliners market, using its novel approach to penetrate markets beyond their geographical boundaries.

List of Key and Emerging Players in Automotive Headliners Market

- Adient plc

- Grupo Antolin

- Faurecia

- Lear Corporation

- Toyota Boshoku Corporation

- Yanfeng Automotive Interiors

- Sage Automotive Interiors

- International Automotive Components

- Benecke-Kaliko

- Kasai Kogyo Co., Ltd.

- TS Tech Co., Ltd.

- Motus Integrated Technologies

- Howa Textile Industry Co., Ltd.

- UGN, Inc.

- Martur Fompak International

- Hayashi Telempu Corporation

- Seiren Co., Ltd.

- Freudenberg Performance Materials

- Autoneum Holding AG

- Tachi-S Co., Ltd.

- Others

Strategic Initiatives

- November 2025: Grupo Antolin introduced a next-generation immersive audio headliner solution in collaboration with Mobility Audio Innovations, transforming traditional headliners into advanced sound systems that reduce wiring and weight while delivering a 360° audio experience.

- September 2025: Adient introduced the “Pure Ergonomics” seating concept, which enhances interior space by up to 60 mm and optimizes material use, supporting automotive headliner integration with adjacent interior systems to improve overall cabin design and occupant comfort.

- July 2025: Howa Tramico partnered with Fibroline to launch a solvent-free automotive headliner that eliminates volatile organic compounds (VOCs) from production and significantly enhances recyclability while simplifying end-of-life material recovery.

- April 2025: FORVIA unveiled nine world premiere innovations at Auto Shanghai 2025, showcasing breakthrough automotive interior technologies, including sustainable materials and enhanced interior modules designed to improve comfort, acoustic performance, and integration with advanced vehicle platforms for major global OEMs.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 15.48 billion |

| Market Size in 2026 | USD 16.18 billion |

| Market Size in 2034 | USD 23.03 billion |

| CAGR | 4.5% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Technology, By Vehicle Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Automotive Headliners Market Segments

By Type

- Fabric Headliners

- Leatherette Headliners

- Perforated Headliners

- Others

By Technology

- Standard Headliners

- Acoustic Headliners

- Lightweight Composite Headliners

- Smart Headliners

By Vehicle Application

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles (EVs)

- Luxury Vehicles

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.