Beef Extract Market Size, Share & Trends Analysis Report By Form (Powder, Paste, Liquid, Granules), By Application (Food & Beverage (Soups, Broths, Sauces, Gravies, Bouillons), Biotechnology & Culture Media, Pet Nutrition (Palatants and Treats), Nutraceuticals, Pharmaceuticals (QC and Speciality Uses)), By Grade (Food-Grade, Lab/Technical-Grade, Pharmaceutical-Grade), By Source (Conventional, Grass-Fed) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Beef Extract Market Overview

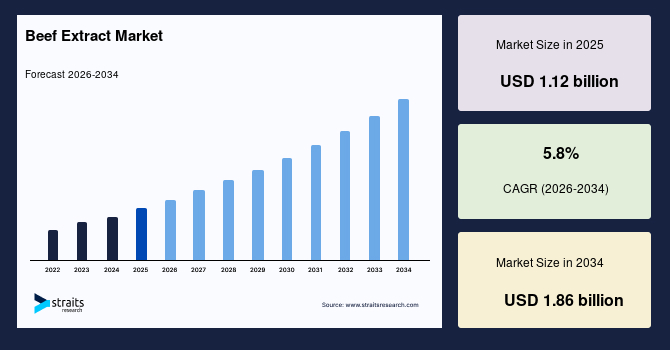

The beef extract market size was valued at USD 1.12 billion in 2025, serving as the base year, and is projected to reach USD 1.86 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.8% from 2026 to 2034, states Straits Research. The market benefited from a broad recovery in global foodservice and packaged savoury categories, which increased demand for beef-derived flavour bases in soups, broths, gravies, sauces, and ready meals. Simultaneously, laboratories continued to standardise culture media inputs, supporting technical-grade and lab-grade demand. The market forecast presents a balanced outlook across food-grade and biotechnology applications, with innovation centred on clean-label ingredients, traceability, and specialised performance attributes, such as low sodium content and stable protein profiles.

One global factor that supported market growth was the heightened adoption of quality-assured, animal-origin inputs across food safety testing and clinical microbiology. This shift, combined with stricter supplier audits and chain-of-custody visibility, strengthened the value proposition of certified beef extracts for culture media formulations. As manufacturers diversified sourcing strategies and upgraded spray-drying capabilities, supply reliability improved and broadened the addressable demand in emerging economies. The market outlook also reflects the rising demand for pet nutrition upgrades and recipe reformulations that maintain savoury intensity with fewer additives.

Key Market Trends & Insights

- Dominant Region: North America accounted for a 32% share in 2025; Asia Pacific will be the fastest-growing region at a 6.8% CAGR.

- By Form: Powder led with a 54% share in 2025; Liquid will be the fastest-growing at a 6.6% CAGR.

- By Application: Food & Beverage led with a 47% share in 2025; Biotechnology & Culture Media will grow fastest at a 7.2% CAGR.

- By Grade: Food-grade led with a 63% share in 2025; Pharmaceutical-grade will expand fastest at a 7.5% CAGR.

- By Source: Conventional led with a 74% share in 2025; Grass-fed will be the fastest-growing at an 8.1% CAGR.

- Dominant country: The U.S. Beef Extract Market was USD 0.29 billion in 2025 and will be USD 0.31 billion in 2025.

Latest Market Trends

Clean-Label Savoury Bases and Low-Sodium Reformulation

The beef extract market is being shaped by reformulation priorities that preserve savoury intensity while aligning with clean-label and sodium reduction goals. Food manufacturers are investing in enzymatically hydrolysed beef extracts that deliver consistent umami, thermal stability, and clean flavour release with shorter ingredient lists. This trend enhances the role of technical documentation (e.g., allergen statements, country-of-origin labelling, and audit trails) and supports SKUs that comply with halal and kosher requirements. The forecast indicates more granular product tiers based on protein content and salt levels, meeting regulatory expectations and retailer scorecards that favour transparent, minimally processed ingredients.

Standardised Culture Media Inputs and Diagnostics

The beef extract market is also being influenced by the standardisation of lab-grade inputs in clinical and industrial microbiology. Diagnostic labs and QC departments require consistent total nitrogen, amino acid distribution, and batch-to-batch uniformity to ensure reliable organism recovery. Suppliers are responding with tighter specifications, lot traceability, and validated performance for specific organisms. As laboratories modernise and outsourcing grows, demand will shift toward documented, certificate-backed beef extract grades, including sterile options and ready-to-hydrate blends for media houses and diagnostic kit makers. The trend will support value-added differentiation and margins for compliant, audited suppliers.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.12 billion |

| Estimated 2026 Value | USD 1.22 billion |

| Projected 2034 Value | USD 1.86 billion |

| CAGR (2026-2034) | 5.8% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Kerry Group plc, Thermo Fisher Scientific Inc. (Oxoid), Merck KGaA (MilliporeSigma), Becton, Dickinson and Company (Difco), Essentia Protein Solutions |

to learn more about this report Download Free Sample Report

Beef Extract Market Drivers

Expansion of Convenient Savoury Meals and Culinary Bases

The market is supported by steady demand from soups, broths, sauces, gravies, bouillon cubes, and meal kits. Foodservice operators and packaged food companies are standardising flavour bases to ensure portion control, consistency, and cost predictability across multiple kitchens and markets. As private label grows and inflation-sensitive shoppers seek value in shelf-stable formats, beef extracts help deliver recognisable taste with efficient storage and transport. Formulations balance fat and protein to achieve a clean mouthfeel, enabling line extensions with regional flavour profiles and convenient formats, such as paste and concentrated liquid.

Upgrades in Pet Palatants and Premium Pet Nutrition

The market benefits from premiumization in pet food and treats, where palatability, aroma, and digestibility are critical purchase drivers. Beef extract provides a recognisable animal-derived note that supports acceptance in reformulated recipes featuring novel proteins, grain-free bases, or limited-ingredient diets. As pet humanisation continues and brands launch functional products, beef extract contributes to flavour masking and taste delivery with standardised sensory performance. R&D teams are incorporating low-ash, low-sodium variants that pair with hydrolysed proteins to meet the needs of sensitive pets while maintaining label clarity.

Market Restraint

Volatility in Bovine Supply, Biosecurity Risks, and Compliance Costs

The market faces key restraints from supply variability and compliance overheads tied to animal-origin inputs. Livestock disease events, changes in by-product utilisation, and traceability requirements elevate procurement complexity. Processors must ensure robust sourcing, validated heat treatments, and material segregation to comply with food safety and pharmaceutical guidelines. This increases cost-to-serve and may compress margins, particularly for small and mid-sized suppliers. Additionally, periodic scrutiny of animal-based additives in certain markets raises labelling hurdles and reformulation pressures, prompting some end users to explore partial substitution strategies. While diversified sourcing and inventory buffers help mitigate shocks, the industry must manage certification renewals, multi-market regulatory audits, and documentation demands that add non-trivial fixed costs. The beef extract Market outlook, therefore, assumes continued investments in quality systems, contingency sourcing, and equipment upgrades to stabilise supply and protect product integrity.

Market Opportunity

Certified, Traceable, and Grass-Fed Product Lines

As brands seek to differentiate themselves on provenance and sustainability, the market will see expanded lines featuring certified, grass-fed, and region-specific sourcing. Enhanced traceability from the slaughterhouse to the spray dryer will support claims and align with retailer audits and export documentation. Suppliers will leverage QR-coded batch data, antimicrobial interventions, and validated HACCP plans to capture premium segments in North America and Europe. Grass-fed variants will appeal to premium culinary bases and speciality manufacturers pursuing cleaner labels without synthetic enhancers.

Process Innovation for Functional and Reduced-Salt Extracts

Process innovation presents another opportunity for the market. Enzymatic hydrolysis, gentle concentration, and advanced spray drying will enable the production of reduced-salt extracts with improved solubility, controlled Maillard browning, and stable sensory profiles. These attributes will help formulators meet regional sodium targets while maintaining taste performance. Suppliers can also deliver higher protein concentrates for broth beverages and clinical nutrition, addressing crossover applications in these areas. Co-development projects with foodservice, biotech, and pet food brands will create proprietary blends that secure multi-year supply agreements and protect pricing through technical differentiation.

Regional Analysis

North America accounted for 32% of the market in 2025 and will expand at a 5.2% CAGR through 2034. The region benefited from a stable base of culture media manufacturers, strong packaged savoury categories, and active menu innovation across quick-service and casual dining. Compliance expectations and established cold-chain infrastructure supported consistent quality. The forecast reflects steady adoption of low-sodium extracts and documented, audit-ready supply relationships that prioritise lot traceability and supplier scorecards.

The U.S. dominated North America, anchored by structured R&D programs in food companies and a dense network of clinical and industrial labs. Growth will be supported by co-manufacturing partnerships that enhance fill-finish efficiency for culinary bases and align with sustainability targets through energy-optimised drying. Canada will contribute incremental demand from private label and regional processors seeking premium gravies and soups that emphasise clean sensory notes.

Europe Market Insights

Europe held a 28% share of the beef extract market in 2025 and will register a 5.5% CAGR through 2034. The region’s performance was underpinned by stringent standards for raw material traceability, allergen controls, and supplier audits. European buyers favoured certified supplies and detailed specifications for nitrogen content and microbiological criteria. The market will benefit from the rising acceptance of grass-fed and specialised provenance claims in Western Europe, alongside consistent demand from laboratory media producers in Northern and Central Europe.

Germany dominated the European market based on a strong footprint in diagnostics, pharmaceutical QC labs, and advanced food processing. Growth will be supported by investments in automated blending and packaging lines that deliver consistent solubility and dispersion in large-scale kettles. Italy and the U.K. will contribute with artisanal and industrial sauce manufacturers that prioritise clean label reformulation and reliable, low-variability inputs.

Asia Pacific Market Insights

Asia Pacific accounted for 27% of the market in 2025 and will be the fastest-growing region at a 6.8% CAGR through 2034. The region’s baseline demand stemmed from the expansion of food processing clusters, the growth of quick-service footprints, and the modernisation of clinical diagnostics. A growing middle class and urbanisation sustained retail demand for broth and soup bases. Suppliers will benefit from localisation strategies, including regional flavour profiles and halal-certified production, which support Southeast Asian markets.

China dominates the Asia Pacific, supported by its scale in ready meals, sauces, and an expanding network of third-party labs serving food and pharmaceutical clients. Growth will be driven by equipment upgrades that enhance throughput and minimise the thermal impact on flavour quality. Japan and South Korea will drive premium demand for consistent, low-sodium extracts used in convenience meal lines and hybrid broths that balance traditional flavour expectations with modern nutritional targets.

Middle East & Africa Market Insights

The Middle East & Africa represented 6% of the market in 2025 and is expected to advance at a 6.1% CAGR through 2034. The region’s baseline was shaped by hospitality development, the rapid growth of quick-service restaurants in urban centres, and the ongoing expansion of food production parks. Import-dependent markets placed a premium on reliable, halal-compliant supplies and short lead times. The forecast reflects menu diversification and an increased use of concentrated bases to stabilise flavour and cost under variable import conditions.

Saudi Arabia dominated the region due to a robust foodservice ecosystem and large-scale catering operations. Growth will come from public and private investments in food parks, as well as from multinational brands that localise savoury products while maintaining consistent taste. South Africa will contribute with retail-focused soups and sauces, as well as the development of regional distributors that can manage certifications and logistics reliably.

Latin America Market Insights

Latin America captured a 7% share of the beef extract market in 2025 and will post a 5.9% CAGR through 2034. The region benefited from abundant bovine resources, a strong culinary tradition in broths and stews, and a growing packaged food industry. While currency swings influenced import dynamics, integrated processors and ingredient exporters established resilient supply chains. The forecast anticipates growth in private-label gravies and cost-optimised blends adapted to regional palates.

Brazil dominated Latin America, supported by integrated meat processing and an evolving ingredients sector that positions itself for export. Growth will be strengthened by investments in sustainable rendering and energy-efficient dryers, which support third-party certifications and documentation. Mexico will drive demand from convenience sauces and institutional kitchens that value consistent flavour delivery and predictable cost structures.

Form Insights

Powder was the dominant form segment of the beef extract market, accounting for 54% of the revenue in 2025. Powdered extract offered superior shelf stability, measured dispersion, and efficient transport costs. Large-scale food manufacturers favoured powders for precision batching and compatibility with automated dosing. In lab settings, powdered formats supported standardised media preparation and reduced variability across lots. Paste and liquid formats held niche roles in culinary applications seeking faster incorporation and specific mouthfeel attributes.

Liquid will be the fastest-growing form with a projected 6.6% CAGR through 2034. Operators will adopt liquid concentrates for speed and consistency in commissaries and high-throughput kitchens, reducing prep time and minimising waste. As cold-chain solutions improve and packaging advances minimise oxidation, liquid extracts will gain market share in quick-service chains and meal-kit production that benefit from rapid hydration and stable flavour profiles.

Application Insights

Food & Beverage was the leading application in the beef extract market and accounted for 47% of revenue in 2025. Core uses included soups, broths, gravies, sauces, and bouillons for retail and foodservice channels. The segment capitalised on recipe standardisation, clean-label initiatives, and regional flavour adaptation. Pet nutrition also represented a significant portion, with beef extract underpinning the palatability of treats and premium dry formulas.

Biotechnology & Culture Media will be the fastest-growing application at a 7.2% CAGR over the forecast period. Diagnostic and industrial labs will prioritise validated performance, consistent nitrogen content, and tight microbial specifications. Suppliers will introduce lot-traceable grades and sterile options designed to enhance organism recovery and workflow efficiency, aligning with the shift toward outsourced lab services and harmonised QC procedures.

Grade Insights

Food-grade was the dominant grade in the beef extract market and represented 63% of revenue in 2025. It catered to mass-market culinary bases, private label expansions, and customised blends for the foodservice industry. Buyers valued dependable flavour delivery, clean labels, and flexible sodium options. Lab-grade held a notable share, serving media houses and institutional laboratories with well-documented quality metrics and batch consistency.

Pharmaceutical-grade will be the fastest-growing grade with a 7.5% CAGR through 2034. As pharmaceutical QC and select clinical applications demand higher documentation and purity thresholds, suppliers will tailor their grades to include stricter endotoxin controls and expanded certificates of analysis. This specialisation will support differentiation and strengthen long-term supply contracts with regulated customers.

Source Insights

Conventional sourcing was the leading subsegment of the beef extract market by source, accounting for 74% of revenue in 2025. Established rendering and processing networks, standardised inputs, and competitive cost structures supported broad adoption across culinary and lab applications. Conventional sources underpinned high-volume, cost-sensitive formulations and ensured reliable supply for large manufacturers.

Grass-fed sourcing will be the fastest-growing subsegment with an 8.1% CAGR during 2025–2034. Demand will be driven by premium brands seeking to establish provenance and sustainability narratives, particularly in North America and Europe. Grass-fed extracts will benefit from clearer on-pack claims and alignment with retailer programs that elevate environmental and animal welfare credentials, allowing suppliers to capture price premiums and improve margin stability.

Competitive Landscape

The beef extract market is moderately consolidated, with competition primarily focused on quality systems, documentation, and application-specific functionality among food-grade and lab-grade suppliers. Key players include Kerry Group plc, Thermo Fisher Scientific Inc. (Oxoid), Merck KGaA (MilliporeSigma), Becton, Dickinson and Company (Difco), and Essentia Protein Solutions. Kerry Group is a prominent leader in culinary bases, with a portfolio that emphasises clean-label solutions and sodium optimisation. In early 2025, Kerry announced a new low-sodium beef extract line targeting retail soups and foodservice sauces. Lab-focused players strengthened their positions by implementing tighter lot traceability, validating performance for culture media, and upgrading drying technologies to ensure batch uniformity and sensory stability across applications in the market.

List of Key and Emerging Players in Beef Extract Market

- Kerry Group plc

- Thermo Fisher Scientific Inc. (Oxoid)

- Merck KGaA (MilliporeSigma)

- Becton, Dickinson and Company (Difco)

- Essentia Protein Solutions

- Neogen Corporation

- HiMedia Laboratories

- Titan Biotech Ltd.

- Proliant Biologicals

- Organotechnie

- Condalab

- Hardy Diagnostics

- Biolife Italiana

- Solabia Group (Biokar Diagnostics)

- JBS Ingredients

- Givaudan

- Symrise AG

- Ajinomoto Co., Inc.

- Angel Yeast Co., Ltd. (for complementary savoury systems)

- Scharlab S.L.

Strategic Initiatives

- October 2025 - Certificates of Analysis (COA) were issued for multiple batches of Oxoid™ Lab-Lemco Beef Extract Powder (Catalogue No. LP0029B) by Thermo Fisher.

- March 2025 – Essentia Protein Solutions exhibited at IFFA 2025, a major international trade fair for the meat industry. They showcased their ScanPro Beef 95 proteins, which are 100% beef-derived and processed to concentrate protein for use in ground products and emulsions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.12 billion |

| Market Size in 2026 | USD 1.22 billion |

| Market Size in 2034 | USD 1.86 billion |

| CAGR | 5.8% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Form, By Application, By Grade, By Source |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Beef Extract Market Segments

By Form

- Powder

- Paste

- Liquid

- Granules

By Application

- Food & Beverage (Soups, Broths, Sauces, Gravies, Bouillons)

- Biotechnology & Culture Media

- Pet Nutrition (Palatants and Treats)

- Nutraceuticals

- Pharmaceuticals (QC and Speciality Uses)

By Grade

- Food-Grade

- Lab/Technical-Grade

- Pharmaceutical-Grade

By Source

- Conventional

- Grass-Fed

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.