Biosimilars Market Size, Share & Trends Analysis Report By Drug Class (Monoclonal Antibodies, Granulocyte Colony-Stimulating Factors, Erythropoiesis-Stimulating Agents, Insulin Analogs, Others), By Indication (Oncology, Autoimmune & Inflammatory Diseases, Diabetes, Blood Disorders, Ophthalmology, Others), By Distribution Channel (Hospital Pharmacies, Drug Stores and Retail Pharmacies, Online Pharmacies) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Biosimilars Market Overview

The global biosimilars market size is estimated at USD 37.73 billion in 2025 and is projected to reach USD 116.90 billion by 2034, growing at a CAGR of 13.43% during the forecast period. Significant growth of the market is propelled by the growing emphasis on cost-efficient treatments to ensure long-term healthcare sustainability. Moreover, the biosimilars market has been influenced by the rising incidence of cancer. For instance, in January 2025, the European Union reported that every minute, five people in Europe were diagnosed with cancer, and about one in twenty Europeans faced a cancer diagnosis in their lifetime, highlighting the urgent demand for affordable cancer biologics. The table below compares leading oncology biologics with their biosimilars, highlighting the significant price gap influencing market adoption and growth:

Table: Pricing Comparison of Oncology Biosimilars with Reference Biologics

|

S. No. |

Reference Biologics |

Price (USD, ASP) |

Biosimilar |

Price (USD, ASP) |

Price difference from the original |

|

1 |

Herceptin (Trastuzumab) |

3,188 |

Kanjinti |

310 |

90% cheaper |

|

Trazimera |

432 |

86% cheaper |

|||

|

2 |

Avastin (Bavacizumab) |

2795 |

Mvasi |

801 |

71% cheaper |

|

Zirabev |

637 |

77% cheaper |

|||

|

3 |

Rituxan (Rituximab) |

3,736 |

Truxima |

1,496 |

60% cheaper |

|

Ruxience |

723 |

81% cheaper |

Source: Straits Research

These substantial cost differences directly supported market growth. The affordability of oncology biosimilars improved their accessibility and encouraged broader adoption among hospitals and payers. This trend expanded patient access to modern therapies, enhanced overall healthcare affordability, and strengthened biosimilar utilization and market growth across key regions.

Key Market Trends & Insights

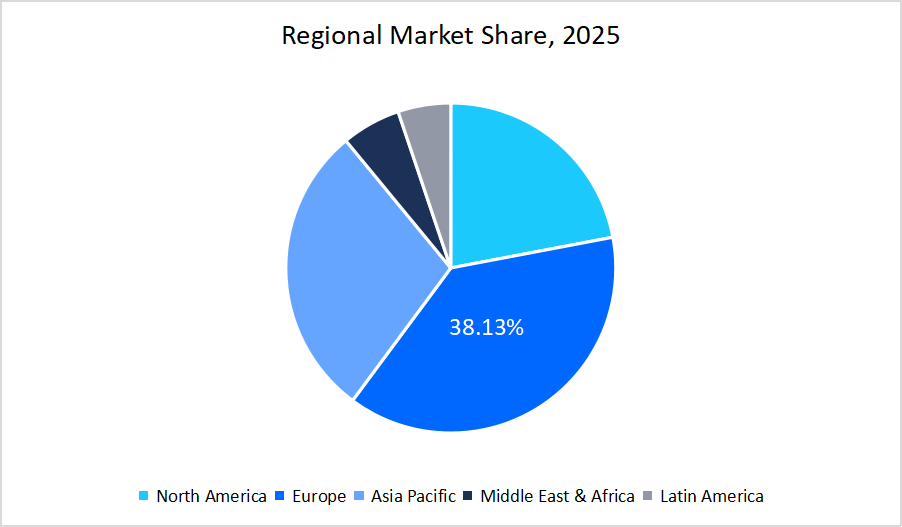

- Europe held a dominant share of the global market with a market share of 38.13% in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 15.43%.

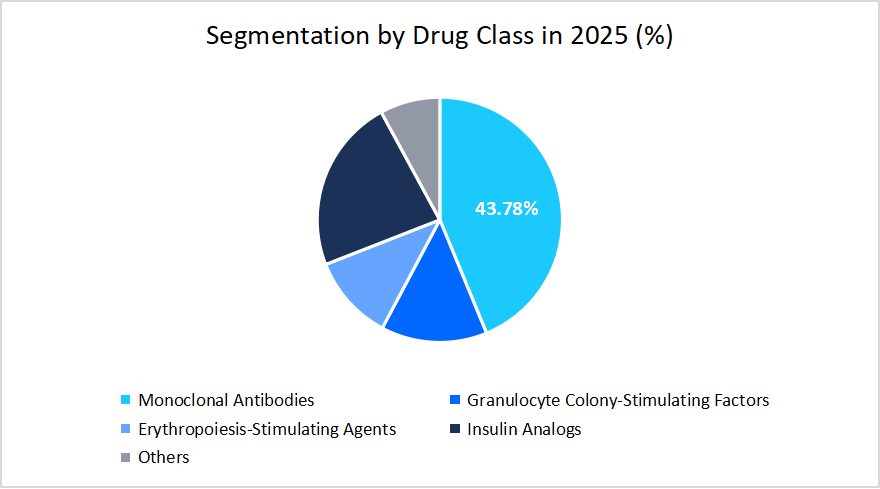

- Based on the Drug Class, the Monoclonal Antibodies segment dominated the market, holding a market share of 43.78% in 2025.

- By indication, the Oncology segment held the highest revenue share of 34.3% in 2025.

- Based on the Distribution Channel, Hospital pharmacies accounted for the largest revenue share in 2025.

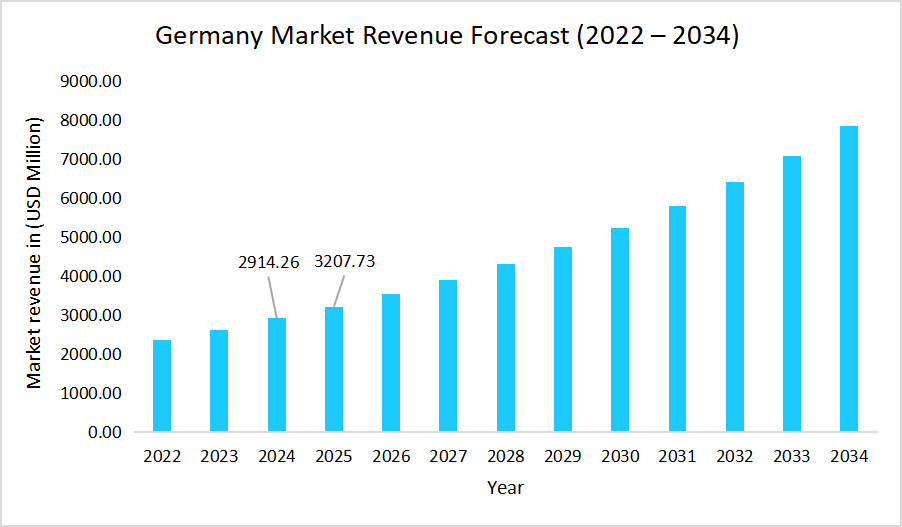

- Germany dominates the Biosimilars market, valued at USD 2914.26 million in 2024 and reaching USD 3207.73 million in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 37.73 billion

- 2034 Projected Market Size: USD 116.90 billion

- CAGR (2025 to 2034): 13.43%

- Dominating Region: Europe

- Fastest-Growing Region: Asia Pacific

The global biosimilars market encompasses a range of drug classes, including monoclonal antibodies, insulin analogs, and other biologics, targeting multiple therapeutic areas. These therapeutic areas include oncology, autoimmune and inflammatory diseases, diabetes, blood disorders, ophthalmology, and other conditions. Biosimilars are made available through various distribution channels, such as hospital pharmacies, retail and drug stores, and online pharmacies, ensuring accessibility across diverse healthcare settings and supporting the management of complex and chronic diseases.

Latest Market Trends

Evolving Landscape of Biosimilars Interchangeability

Implementation of interchangeability in Europe, presents as a considerable market trend. After the European Medicines Agency (EMA), and the Heads of Medicines Agencies' (HMA) joint statement, EU-approved biosimilars were treated as interchangeable with their reference products and with each other. Countries such as the U.K., Germany, Spain, and Italy applied this policy, so switching in hospitals and pharmacies became simpler and routine. The change built prescriber confidence, streamlined tenders and formularies, and sharpened price competition, which lowered net costs and broadened reimbursement. As access widened and treatment volumes rose, manufacturers benefited from larger convertible demand, predictable launch pathways, and resilient multi-supplier procurement. Overall, interchangeability accelerated biosimilar adoption and strengthened Europe’s market growth.

Manufacturer-Oriented Policy Framework

A major trend in the biosimilars market is the adoption of a manufacturer-oriented policy framework, driven by the European Medicines Agency’s (EMA) tailored clinical approach for biosimilar development. The EMA issued a reflection paper outlining that certain biosimilars could gain approval based primarily on comprehensive analytical comparability and pharmacokinetic studies, without requiring extensive clinical efficacy trials.

Such an approach accelerated the development timeline, reduced clinical trial costs, and enabled faster market entry for biosimilars. Therefore, this regulatory flexibility encouraged manufacturers to launch biosimilars more efficiently, which assisted in increasing market competition and improving patient access to affordable biologic therapies.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 37.73 billion |

| Estimated 2026 Value | USD 42.66 billion |

| Projected 2034 Value | USD 116.90 billion |

| CAGR (2026-2034) | 13.43% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Biocon, CELLTRION INC., Teva Pharmaceutical Industries Ltd., Samsung Bioepis, Organon |

to learn more about this report Download Free Sample Report

Market Driver

High Consumption Rate Accelerating Market Momentum

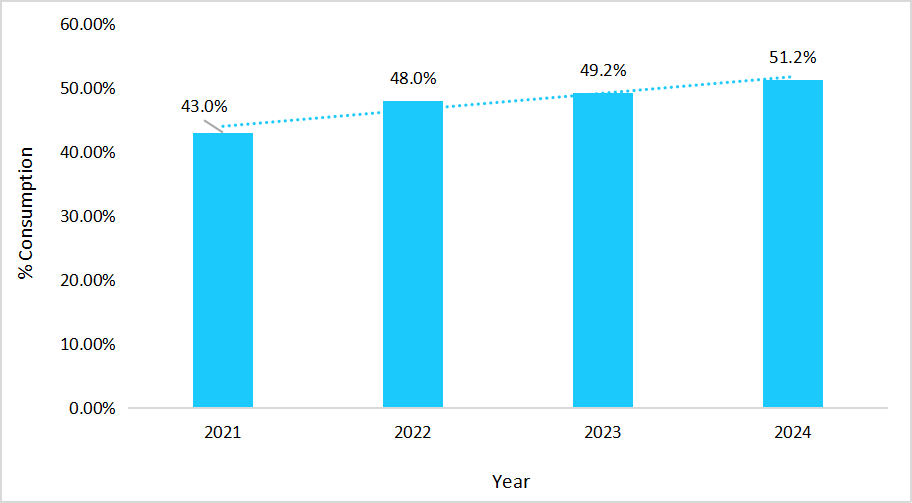

Year-on-year rise in biosimilar consumption rate due to patients’ preference for patient-centric healthcare initiatives predominantly drives the market growth. In Italy, biosimilar consumption continued to illustrate a steady upward trend, which reflected the strong and growing demand for these therapies.

Graph: Biosimilar Consumption Rate in Italy, 2021-2024

Source: Straits Research

This steady rise broadened access, scaled treatment volumes, and translated directly into stronger market growth.

Market Restraint

Limited Adoption in Major Countries

The slow uptake of biosimilars in high revenue-generating countries is restraining market growth. The U.S. Generic & Biosimilar Medicines Savings Report stated that patients from U.S. preferred reference products over biosimilars, resulting in comparatively slower adoption. Although biosimilar use generated USD 36 billion in savings between 2015 and 2023, but these savings remain modest when compared with the overall market potential of the U.S. healthcare system. In June 2025, as per the data reported in Sandoz AG, Australia's uptake of anti-TNF biosimilars was only 35%, below the OECD average of 67%, hence indicating substantial underutilization. Collectively, these adoption gaps in major markets dampened demand and constrained supply, preventing the biosimilars market from realizing its full potential.

Market Opportunity

International Cooperation: Strengthening the Biosimilars Industry

Joint initiatives from the leaders of various countries in the development and manufacturing of biosimilars present opportunities for market growth by enabling the exchange of ideas and best practices. For example, the China–CELAC Joint Action Plan for Cooperation in Key Areas (2025–2027), formulated by the China–Latin America and Caribbean Community (CELAC) Forum, highlighted member states' commitment to strengthening knowledge exchange, promoting access to high-quality biosimilars, and advancing local production capacity.

Such an action plan depicted the collaborative role of countries in widening the global biosimilars access and also benefited manufacturers by facilitating streamlined production, reducing development costs, and opening new regional markets.

Regional Analysis

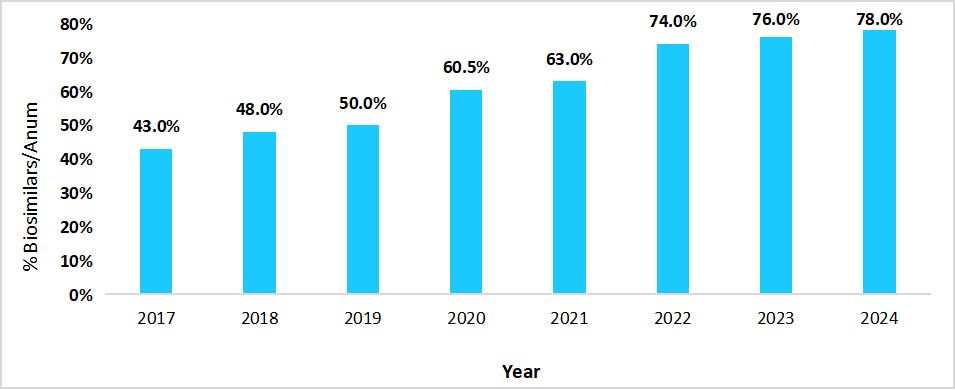

The Europe region dominated the market with a revenue share of 38.13% in 2025. Europe’s dominance in the biosimilars market was strongly supported by the increase in the hospital penetration of biosimilars, which further enhanced the market growth across the region, as it expanded their utilization across a wide range of therapeutic areas. The below table presents the hospital penetration rate of biosimilars in Spain:

Graph: Biosimilars Hospital Penetration in Spain, 2017 to 2024

Source: Straits Research

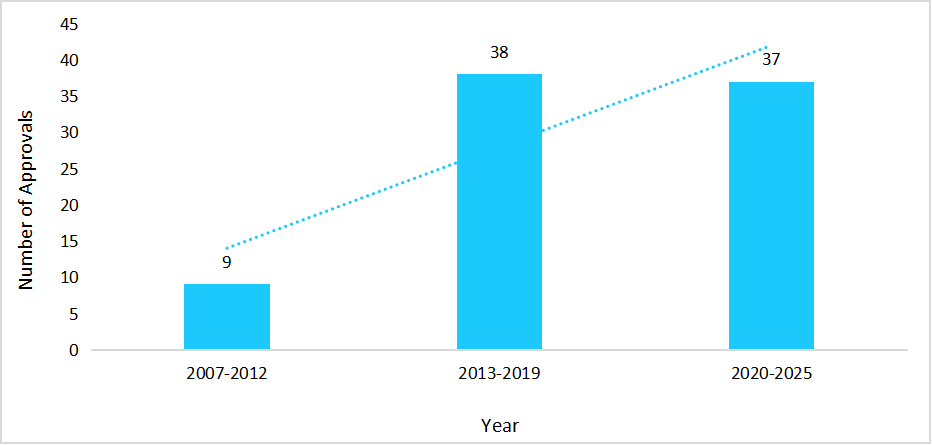

The biosimilars market in Germany is fuelled by a strong biopharmaceutical ecosystem, with over 135 companies active in the sector and increase in the number of biosimilar approvals. Such a factor supports in diversifying treatment options and addressing unmet patient needs across various therapeutic segments.

Graph: Biosimilars Approved by European Medicines Agency & Marketed in Germany, 2007-2025

Source: Straits Research

Asia Pacific Market Insights

The Asia Pacific region is the fastest-growing region with a CAGR of 15.43% during the forecast timeframe, owing to the international collaborations focused towards advancing cost development of biosimilars as well as distribution strategies. Global pharmaceutical firms increasingly partnered with regional biotech companies and contract development and manufacturing organizations (CDMOs) to leverage Asia Pacific’s lower production costs and skilled scientific workforce.

The market growth in India is due to programs such as the National Biopharma Mission (NBM), Innovate in India, which played a pivotal role in strengthening the country’s biotechnology ecosystem. Such initiatives facilitated funding support for research and clinical development, and accelerated the creation of advanced manufacturing infrastructure for biosimilars.

Source: Straits Research

North America Market Insights

The North American biosimilars market is growing due to a shift towards payer-led preferences. Pharmacy benefit managers (PBMs) are increasingly revising formularies to include cost-efficient biosimilars, prioritizing long-term savings and broader patient access. While rebate-driven exclusivity previously limited uptake, the inclusion of biosimilars in preferred drug lists is accelerating market growth.

In the U.S., the expanding influence of integrated delivery networks (IDNs) is driving the uptake of biosimilars across healthcare systems. Vertically integrated organizations like IDNs combine insurance companies, physician groups, and other providers under a unified administrative framework. By standardizing formularies and emphasizing cost control, IDNs promote the use of biosimilars. They evaluate cost efficiency and clinical equivalence through value-based purchasing strategies, enabling faster adoption, improved supply chain efficiency, and enhanced provider education for complex biologics used in hematology, rheumatology, and oncology.

Middle East & Africa Market Insights

In the Middle East and Africa, the implementation of fast track registration systems for human medicines, including biosimilars, is a key trend. Regulatory authorities, such as the Egyptian Drug Authority, are taking proactive measures to improve patient access to biologic therapies. As a result, countries are emerging as leaders in the adoption of biosimilars across the region.

Increasing approvals of biosimilars are driving the commercialization of these therapies in Egypt. For example, in December 2024, Eva Pharma in collaboration with Eli Lilly, received Egyptian Drug Authority approval for its insulin glargine injection, and in August 2023, Alvotech and Bioventure obtained approval for their AVT02 (adalimumab) biosimilar to promote the use of low cost biologics. The localization of affordable biologic alternatives is accelerating biosimilar adoption in the country, which in turn is fueling market growth.

Latin America Market Insights

The integration of digital health and telemedicine in Latin America is indirectly supporting the adoption of biosimilars by improving patient monitoring and access to care. Through remote consultations, digital tracking of treatment outcomes, and better communication between patients and healthcare providers, these technologies ensure the timely and efficient use of biosimilar therapies. This enhanced connectivity and data-driven approach are facilitating broader acceptance and utilization of cost-efficient biologic treatments across the region.

A key factor driving the growth of the biosimilars market in Brazil is government initiatives aimed at expanding access to affordable biologics. The Brazilian Ministry of Health has implemented policies supporting the inclusion of biosimilars in public healthcare programs, such as the Sistema Único de Saúde (SUS). By prioritizing cost-efficient alternatives to originator biologics, these initiatives contribute to reducing treatment costs, increasing patient access, and accelerating the adoption of biosimilars across the country.

Drug Class Insights

According to Straits Research, the monoclonal segment dominated the market in 2025 with a revenue share of 43.78%. Its prominence is driven by the ongoing research and development of biosimilars and the increasing accessibility of such biologics in developing countries, where the demand for low-cost treatment is high.

The insulin analogs category is projected to be the fastest-growing during the forecast period, registering a CAGR of around 14.1%. The growth of this segment is primarily attributed to the rising prevalence of diabetes, expanding biosimilar insulin approvals, and favourable regulatory support for interchangeability of insulin products. Increasing affordability and wider patient access through government reimbursement programs further accelerated adoption, particularly in emerging economies, positioning insulin analog biosimilars as the most rapidly advancing category within the overall biosimilars landscape.

Source: Straits Research

Indication Insights

The oncology segment held the largest market share in 2025, accounting for 34.3% of total revenues. The segment’s expansion was reinforced by extensive clinical adoption programs, stronger hospital formulary integration, and rising inclusion of biosimilars in multidisciplinary cancer care pathways. Continuous physician education and value-based procurement practices by healthcare institutions also enhanced the penetration of oncology biosimilars, positioning this segment as the cornerstone of the global biosimilars landscape.

The autoimmune and inflammatory diseases segment is projected to witness the fastest growth of 14.6%, driven by expanding therapeutic diversity and deeper integration of biosimilars into specialty care. Broader treatment adoption in chronic immune disorders, improved patient adherence programs, and inclusion in earlier therapy lines collectively positioned this segment for sustained high growth.

Distribution Channel Insights

The hospital pharmacies segment dominated the market in 2025. This dominance is driven by the fact that most oncology and autoimmune biosimilars are administered intravenously in hospital settings, where formulary inclusion enables large volume adoption.

The online pharmacies segment is expected to record a CAGR of 15.1% during the forecast period. This rise is attributed to the increasing adoption of digital healthcare platforms, improved e-prescription systems, and expanding patient preference for doorstep delivery of biologics. Enhanced logistics networks and competitive pricing further accelerated biosimilar sales through online channels.

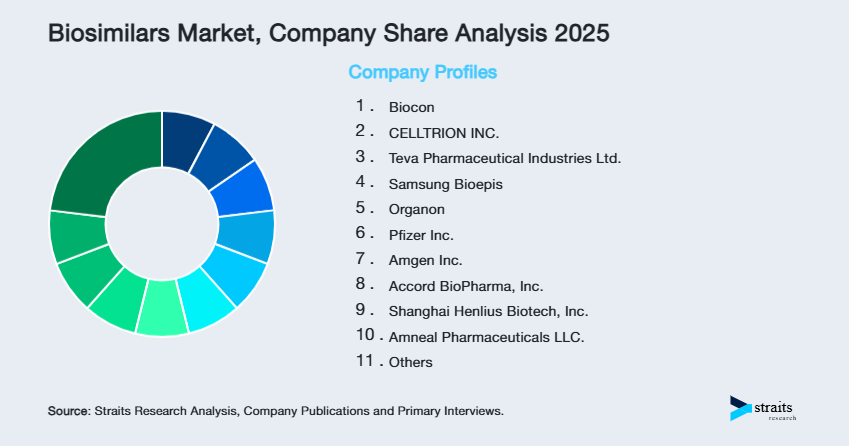

Competitive Landscape

The global biosimilars market is highly fragmented in nature due to the presence of numerous players, including pharmaceutical and biopharmaceutical companies. The top players in the industry are Biocon, CELLTRION INC., Samsung Bioepis, Pfizer Inc., Teva Pharmaceutical Industries Ltd and others.

Alvotech: An emerging market player

Alvotech company is focused on broadening the availability of the essential biologic medicines to patients across the world by developing high quality and cost efficient biosimilars.

- In June 2025, Alvotech collaborated with Dr. Reddy's Laboratories for the co-development, manufacturing and commercialization of a biosimilar candidate to Keytruda (pembrolizumab) for the global markets as it was developed for the treatment of numerous cancer types.

List of Key and Emerging Players in Biosimilars Market

- Biocon

- CELLTRION INC.

- Teva Pharmaceutical Industries Ltd.

- Samsung Bioepis

- Organon

- Pfizer Inc.

- Amgen Inc.

- Accord BioPharma, Inc.

- Shanghai Henlius Biotech, Inc.

- Amneal Pharmaceuticals LLC.

- Sandoz Group AG

- Bio-Thera Solutions, Ltd.

- Meitheal Pharmaceuticals

- Boehringer Ingelheim

- Fresenius Kabi AG

- Formycon AG

- Tanvex BioPharma Inc.

- Alvotech

- Biogen

- Reddy’s Laboratories Ltd.

- Others

to learn more about this report Download Market Share

Strategic Initiatives

- July 2025: Samsung Bioepis Co., Ltd announced a strategic partnership agreement with Boryung for the domestic sales of Xbrig, which is a biosimilar of bone disease treatment.

- July 2025: Biocon Biologics Ltd announced the launch of Nepexto, a biosimilar to the reference product Enbreal (Etanercept) in Australia. This biosimilar was promoted by the Generic Health with a purpose of expanding access to patients in Australia.

- July 2025: Biocon Biologics received MHRA UK approval to Vevzuo for the prevention of skeletal-related events and Evfraxy for the treatment of osteoporosis in postmenopausal women. Both are biosimilars of Denosumab.

- July 2025: Frensenius Kabi received European Commission approval for denosumab biosimilars.

- July 2025: mAbxience announced European Commission approval for denosumab biosimilars Denbrayce and Izamby.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 37.73 billion |

| Market Size in 2026 | USD 42.66 billion |

| Market Size in 2034 | USD 116.90 billion |

| CAGR | 13.43% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Drug Class, By Indication, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Biosimilars Market Segments

By Drug Class

- Monoclonal Antibodies

- Granulocyte Colony-Stimulating Factors

- Erythropoiesis-Stimulating Agents

- Insulin Analogs

- Others

By Indication

- Oncology

- Autoimmune & Inflammatory Diseases

- Diabetes

- Blood Disorders

- Ophthalmology

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores and Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.