Insulin Market Size, Share & Trends Analysis Report By Type (Human Insulin, Analog Insulin), By Product (Short-Acting Insulin, Intermediate Acting Insulin, Long-Acting Insulin, Fast-Acting Insulin), By Applications (Type I Diabetes, Type II Diabetes, Gestational Diabetes, Pre-diabetes), By Distribution Channel (Hospitals, Drug Stores & Retail Pharmacies, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Insulin Market Overview

The global insulin market size is estimated at USD 21.13 billion in 2025 and is projected to reach USD 29.01 billion by 2034, growing at a CAGR of 3.63% during the forecast period. The remarkable growth of the market is due to innovations in insulin therapy and strategic shifts in production by key pharmaceutical companies.

Key Market Trends & Insights

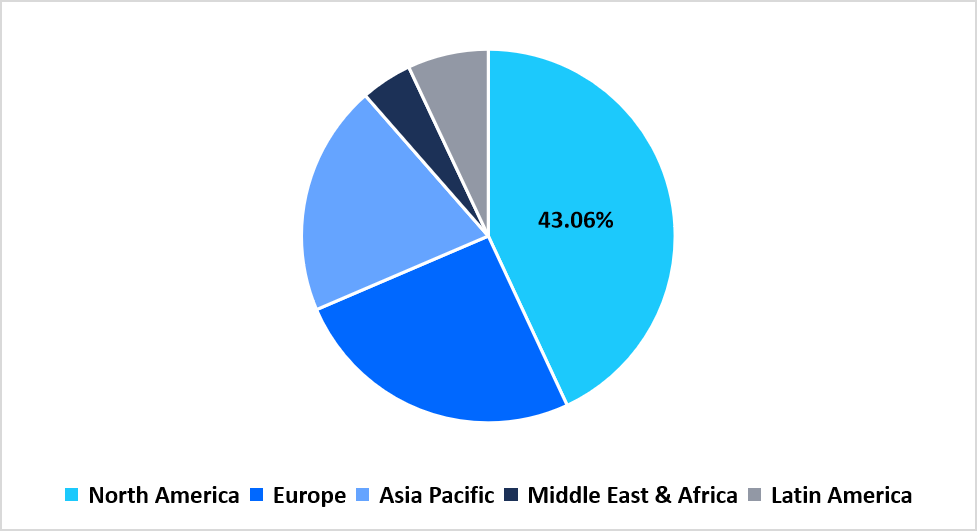

- North America held a dominant share of the global market, accounting for 43.06 % share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 5.32%.

- Based on Type, the analog insulin segment dominated the market in 2025.

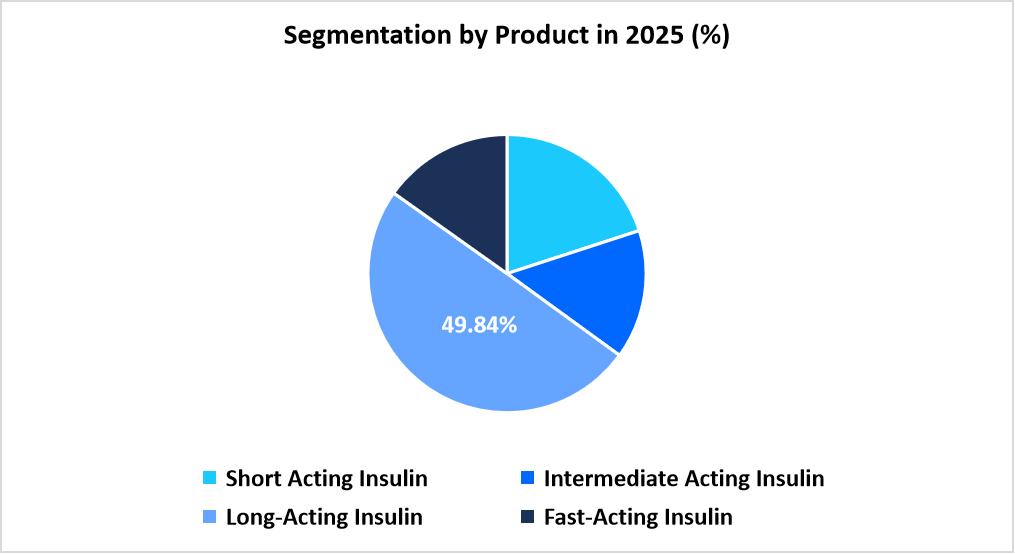

- Based on Product, the long-acting insulin segment dominated the market in 2025 with a revenue share of 49.84%.

- Based on the Application, the type II diabetes segment is expected to register the fastest CAGR growth of 5.03%.

- Based on the Distribution Channel, the hospitals segment dominated the market in 2025, with a revenue share of 53%.

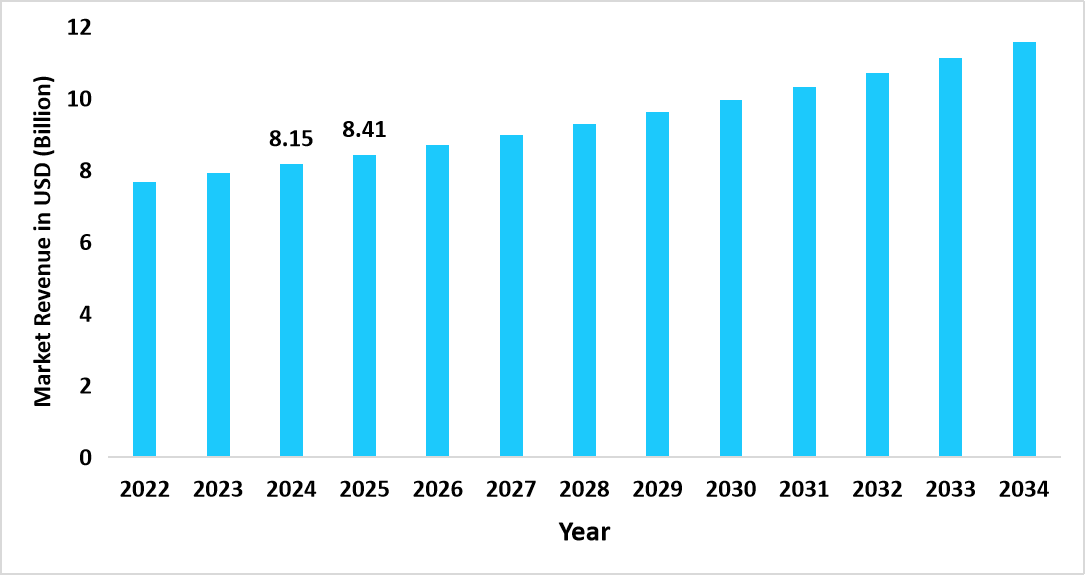

- The U.S. dominates the global insulin market, valued at USD 8.15 billion in 2024 and reaching USD 8.41 billion in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 21.13 billion

- 2034 Projected Market Size: USD 29.01 billion

- CAGR (2025 to 2034): 3.63%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global insulin market encompasses a comprehensive portfolio of therapeutic formulations designed to maintain glycemic control, enhance metabolic stability, and improve the quality of life of diabetic patients worldwide. By type, the market is divided into human insulin and analog insulin, with analog insulin accounting for a high share due to its superior pharmacokinetic profile, reduced risk of hypoglycemia, and enhanced patient compliance through flexible dosing regimens. By product, the market includes short-acting, intermediate-acting, long-acting, and fast-acting insulin formulations, with long-acting insulin dominating the segment owing to its extended duration of action, lower injection frequency, and ability to provide stable basal insulin levels for better glycemic control. By application, insulin is used for managing Type I diabetes, Type II diabetes, gestational diabetes, and pre-diabetes, with Type II diabetes representing the largest segment due to the growing prevalence of lifestyle-related metabolic disorders and rising insulin dependence in advanced disease stages. By distribution channel, the market is segmented into hospitals, drug stores & retail pharmacies, and others, where drug stores and retail pharmacies hold a prominent share as the primary point of access for chronic disease medication refills and patient counselling, supported by strong distribution networks and prescription-based sales models.

Latest Market Trends

Shift from Human Insulin to Biosimilar Insulin

The insulin sector is transitioning from traditional human insulin to biosimilar and insulin analogs, which offer improved glycemic control and cost-efficient alternatives, this presents as a market trend. Recently, Biocon Biologics partnered with Civica to supply affordable insulin aspart biosimilars to millions of patients across over 120 countries. Such a factor reflected the growing adoption of biosimilar insulins for diabetes management, enabling wider patient access and supporting more affordable diabetes management solutions.

Shift from Limited Access to Essential Care in Obesity and Diabetes Treatment

The insulin and diabetes care sector is witnessing a transition from limited availability of advanced anti-obesity and diabetes therapies, thus boosting the adoption of insulin globally. For example, in September 2025, the World Health Organization (WHO) included glucagon-like peptide-1 (GLP-1) receptor agonists, such as semaglutide, on its Essential Medicines List, recognizing their role in managing both obesity and type 2 diabetes, which were closely related metabolic conditions, hence reflecting a shift from restricted use to recognition as essential treatments. Such a factor aimed to improve accessibility, particularly in low-resource settings, and supported more equitable diabetes and obesity management worldwide.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 21.13 Billion |

| Estimated 2026 Value | USD 21.81 Billion |

| Projected 2034 Value | USD 29.01 Billion |

| CAGR (2026-2034) | 3.63% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Novo Nordisk A/S, Eli Lilly and Company, Sanofi, Biocon, Wockhardt |

to learn more about this report Download Free Sample Report

Insulin Market Drivers

Increased Focus on Diabetes Education and Screening

The growing emphasis on diabetes education programs and screening is driving the sector’s growth by promoting early diagnosis and efficient disease management. According to the American Diabetes Association, programs such as the U.S. National Diabetes Prevention Program (NDPP) focus on preventing or delaying type 2 diabetes through evidence-based lifestyle interventions. Such factors strengthened early detection, patient education, and proper disease management, boosting the adoption and demand for insulin worldwide.

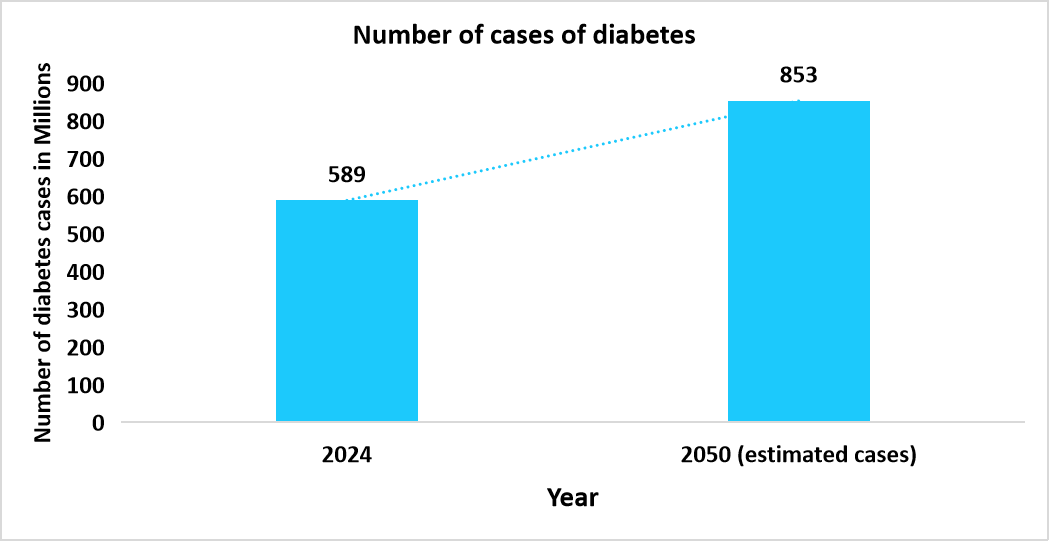

Increasing Prevalence of Diabetes

The increasing prevalence of diabetes directly drives the demand for the insulin market. The graph below depicts the diabetes cases around the world in 2024 and 2025.

Graph: Diabetes cases around the world in 2024 and 2025

Source: Straits Research

Such a surge in cases encouraged manufacturers to expand production, improve formulations, and invest in distribution networks to meet growing patient demand.

Market Restraint

Supply Chain Inefficiencies

Inefficient global supply chains lead to high insulin costs and limited access, particularly in low- and middle-income countries, hindering the insulin market growth. The Access to Medicine Foundation highlighted that major insulin manufacturers, such as Biocon, Eli Lilly and Company, Novo Nordisk A/S, and Sanofi, struggled to reach all patients due to persistent supply chain challenges. Addressing these inefficiencies is critical to improving affordability, accessibility, and overall patient outcomes in diabetes care worldwide.

Market Opportunity

Government Policies Driving Market Expansion

Government programs and policies are playing a key role in expanding the market by improving accessibility and supporting innovation. For example, in June 2025, the U.S. Department of Health and Human Services' Health Resources and Services Administration (HRSA) announced new requirements for HRSA-funded health centers to provide insulin and injectable epinephrine to low-income patients at or below the price paid by the center through the 340B Drug Pricing Program. Such initiatives not only enhanced access to essential medications for underserved populations but also stimulated market growth by expanding the patient base and fostering innovation in insulin delivery systems.

Regional Analysis

The North America region dominated the market with a revenue share of 43.06% in 2025, owing to factors such as the strong presence of leading insulin manufacturers, which ensures consistent product availability, increased distribution networks, and rapid adoption of advanced insulin formulations and delivery technologies.

The market in the U.S. is widely driven by the Medicare USD 35 monthly insulin cap under the Inflation Reduction Act. This policy lowered out-of-pocket costs for millions of Medicare patients, improving affordability, adherence, and access to essential diabetes care. By reducing financial barriers and increasing annual prescription volumes, the cap is driving higher demand for insulin therapies and boosting the overall U.S. diabetes market size.

Asia Pacific Market Insights

The Asia Pacific region is the fastest-growing region with a CAGR of 5.32% during the forecast timeframe. The growth is attributed to factors such as greater adoption of advanced insulin delivery devices as patients and healthcare providers increasingly prefer technologies. These innovations not only enhance treatment accuracy and convenience but also improve patient compliance, thereby driving stronger demand across both urban and emerging healthcare markets in the region.

India continues to position itself in the insulin market, due to the rapid expansion of the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP), which, by February 2025, opened 15,000 Jan Aushadhi Kendras supplying affordable insulin, which further increased treatment uptake, expanded market size, and supported the market growth by improving access and lowering out-of-pocket costs for patients under PMBJP's affordable medicines initiative nationwide.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

The increasing integration of digital health technologies, such as smart insulin pens, within national healthcare programs, drives the market growth. These technologies enable precise dosing, real-time tracking, and personalized diabetes management, aligning with Europe’s focus on patient-centric care, chronic disease monitoring, and reducing hospital visits, thereby boosting demand for advanced insulin therapies and supporting market expansion in the region.

The market in the UK is propelling due to NHS England’s national rollout of hybrid closed-loop (HCL) systems, which uniquely bundle insulin pumps with continuous glucose monitoring underfunded implementation. This reimbursement model boosts device-linked insulin prescribing, which further supports in expanding market size and stimulating market growth by promoting sustained use of advanced insulin delivery tools that enhance clinical outcomes, thereby supporting sustained market growth.

Middle East and Africa Market Insights

Expansion of government-led diabetes screening and management initiatives in response to the rising prevalence of lifestyle-related Type II diabetes drives the market growth. Coupled with increasing investment in cold-chain infrastructure and the establishment of regional insulin manufacturing and distribution hubs, these efforts improve access to affordable insulin across urban and rural areas.

In South Africa, a factor fueling the insulin market growth is the increasing focus on decentralized diabetes care through community clinics and telemedicine programs, which aim to improve access to insulin in both urban townships and rural regions. Coupled with government-supported initiatives to subsidize essential diabetes medications and expand patient education on self-management, these efforts are driving higher adoption of both human and analog insulin. Furthermore, partnerships with private healthcare providers and pharmacy chains are enhancing distribution efficiency, making insulin more readily available and supporting consistent therapy adherence across the country.

Latin America Market Insights

The rising adoption of biosimilar insulin products, coupled with expanding public healthcare programs targeting diabetes management in underserved populations, drives the market growth. Governments in countries like Brazil, Mexico, and Argentina are increasingly incorporating insulin into national health schemes, improving affordability and access. Additionally, growing patient awareness campaigns on early diagnosis, coupled with expanding retail pharmacy networks and telehealth initiatives, are facilitating timely insulin therapy, particularly in semi-urban and rural regions, supporting sustained market growth.

The emergence of locally produced biosimilar insulin formulations, which are gaining traction due to their affordability and government support, drives the market growth. These biosimilars enable wider access to insulin for patients in public healthcare programs and cost-sensitive populations, while fostering competition that encourages innovation and improved distribution networks, particularly in regions outside major metropolitan areas.

Product Insights

The long-acting insulin segment dominated the market in 2025 with a revenue share of 49.84%. The growth is attributed to its ability to provide stable, 24-hour blood glucose control, reducing the risk of hypoglycaemia and improving patient adherence.

The short-acting insulin is expected to register the fastest CAGR of 4.12% during the forecast period, due to its rising use in combination therapy with basal (long-acting) insulin for improved postprandial glucose control.

Source: Straits Research

Type Insights

The analog insulin dominated the market in 2025. The growth is attributed to factors, such as it offers improved pharmacokinetic profiles, including faster onset, longer duration, and more predictable action, which enhances glycaemic control and reduces hypoglycaemia risk.

The human insulin is anticipated to register the fastest CAGR of 4.38%, due to the increasing demand for affordable diabetes management solutions, expanding access to biosimilar formulations, and wider adoption in developing regions where cost-sensitive healthcare systems favor conventional human insulin over analog variants.

Application Insights

The type II diabetes segment is anticipated to grow at a CAGR of 5.03% during 2026 - 2034. This growth is attributed to the rising global prevalence of type II diabetes, increasing awareness, and advancements in treatment options.

The type I diabetes dominated the market in 2025 due to the lifelong dependency of patients on insulin therapy, the increasing prevalence of autoimmune diabetes globally, and the demand for precise glycemic control to prevent acute and long-term complications.

Competitive Landscape

The global insulin market is moderately consolidated in nature due to the presence of a small number of dominant players such as Novo Nordisk A/S, Eli Lilly and Company, and Sanofi controlling the majority share. However, the rising presence of biosimilar manufacturers, particularly in emerging markets, is gradually introducing elements of fragmentation and intensifying competition.

Eli Lilly and Company: An emerging market player

Eli Lilly and Company is an emerging player in the insulin market, focusing on a once-weekly injectable basal insulin, efsitora alfa (LY-3209590), which aims to reduce the treatment burden associated with daily injections.

- In June 2025, Eli Lilly and Company presented strong, positive Phase III trial results from its QWINT 1, QWINT 3, and QWINT 4 studies, showing that efsitora achieved noninferior A1C reductions compared to daily basal insulins, including insulin glargine and insulin degludec, in patients with type 2 diabetes.

List of Key and Emerging Players in Insulin Market

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Biocon

- Wockhardt

- Boehringer Ingelheim International GmbH

- Julphar Diabetes

- The United Laboratories International Holdings Limited.

- Tonghua Dongbao Pharmaceutical Co., Ltd.

- Medtronic

- Merck & Co., Inc.

- BD

- Tandem Diabetes Care, Inc.

- Ypsomed Diabetes Care AG

- UNDBIO Co., Ltd.

- Insulet Corporation

- Lantus

- Bioton S.A.

- Pfizer Inc.

- Gan & Lee Pharmaceuticals.

- Others

Strategic Initiatives

- February 2025: Tandem Diabetes Care, Inc. received FDA clearance for its Control-IQ+ technology, an advanced automated dosing system designed for people with Type 2 diabetes, marking a step in expanding digital diabetes management beyond Type 1 cases.

- November 2024: Medtronic received FDA clearance for its InPen smart insulin pen app, which provided real time correction recommendations for missed or inaccurate doses.

- June 2024: Insulet Corporation announced the availability of its Omnipod 5 Automated Insulin Delivery System in France for individuals aged two years and older with type 1 diabetes.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 21.13 Billion |

| Market Size in 2026 | USD 21.81 Billion |

| Market Size in 2034 | USD 29.01 Billion |

| CAGR | 3.63% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Product, By Applications, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Insulin Market Segments

By Type

- Human Insulin

- Analog Insulin

By Product

- Short-Acting Insulin

- Intermediate Acting Insulin

- Long-Acting Insulin

- Fast-Acting Insulin

By Applications

- Type I Diabetes

- Type II Diabetes

- Gestational Diabetes

- Pre-diabetes

By Distribution Channel

- Hospitals

- Drug Stores & Retail Pharmacies

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.