Building Twin Market Size, Share & Trends Analysis Report By Type (Asset Twin, Component Twin, System Twin, Process Twin, Building Lifecycle Twin), By Technology (IoT Sensors & Embedded Electronics, Artificial Intelligence & Machine Learning, Edge Computing, Cloud Computing Platforms, Connectivity Technologies), By Component (Hardware, Software, Services), By Application (Predictive Maintenance, HVAC Optimization, Space Utilization, Security Monitoring, Construction Planning, Building Operations, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Building Twin Market Overview

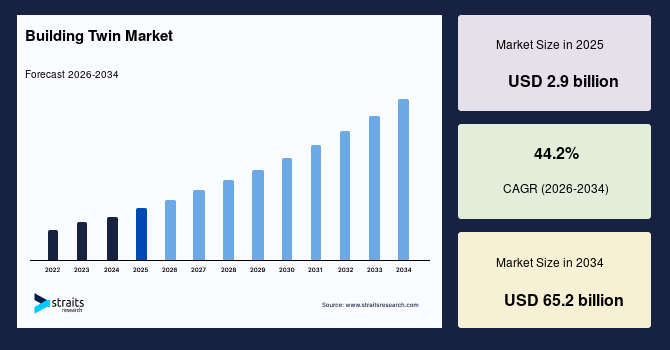

The global building twin market size is valued at USD 2.9 billion in 2025 and is estimated to reach USD 65.2 billion by 2034, growing at a CAGR of 44.2% during the forecast period. Consistent market growth is supported by the rising deployment of digital replicas across commercial, industrial, and public infrastructure facilities, enabling real-time monitoring, performance optimization, and predictive issue resolution, which strengthens operational reliability and accelerates the transition toward intelligent, data-driven building management.

Key Market Trends & Insights

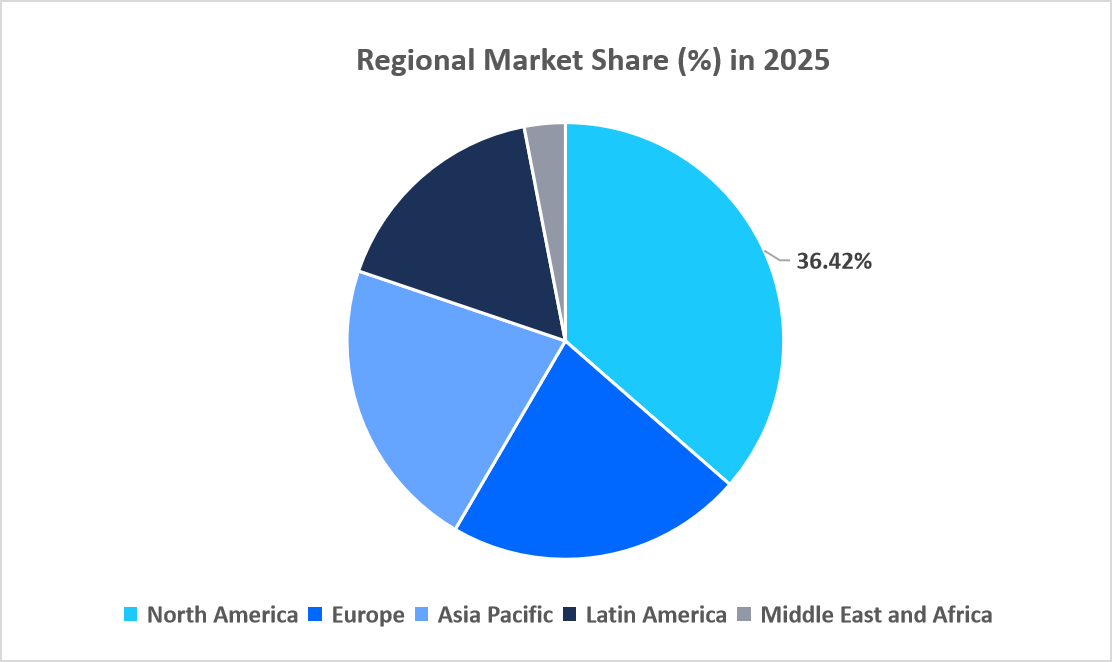

- North America dominated the market with a revenue share of 36.42% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 44.2% during the forecast period.

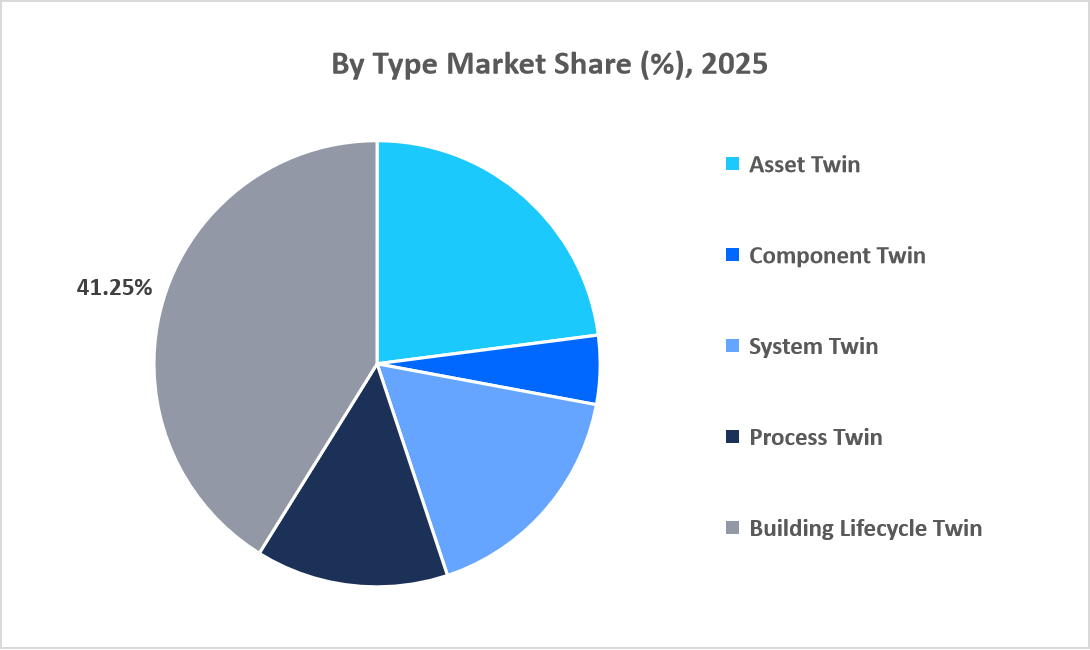

- Based on type, the Building Lifecycle Twin segment held the highest market share of 41.25% in 2025.

- By technology, the Cloud Computing Platforms segment is estimated to register the fastest CAGR growth of 47.86%.

- Based on component, the Software segment dominated the market in 2025 with a revenue share of 38.67%.

- Based on application, the Building Operations segment is projected to grow at a CAGR of 46.15% during the forecast period.

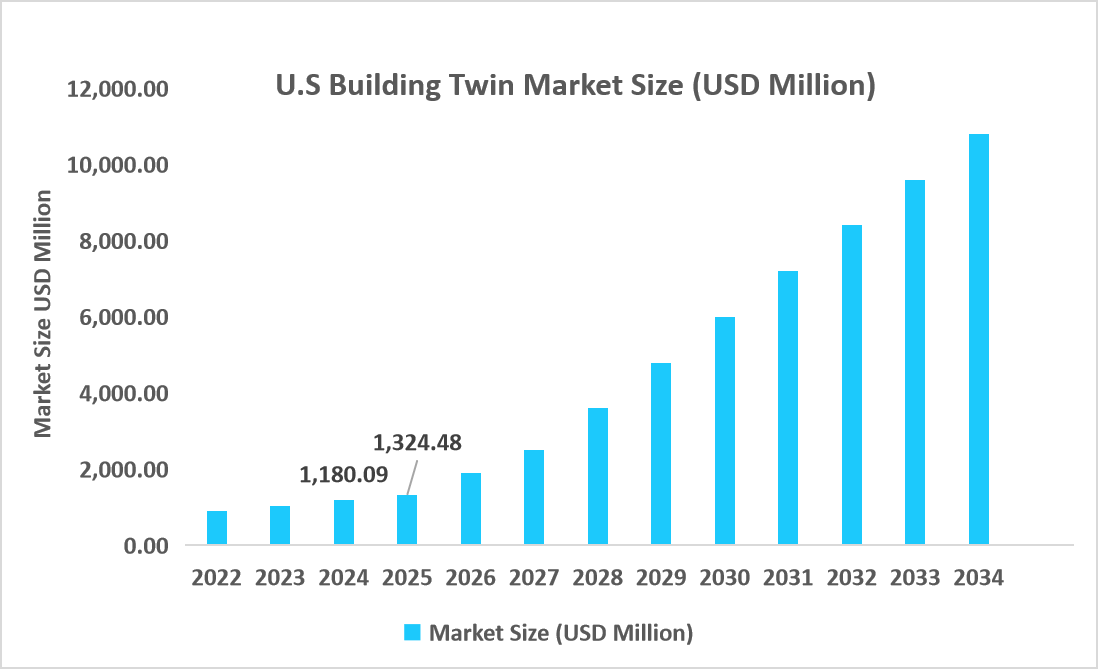

- The U.S. dominates the market, valued at USD 1.18 billion in 2024 and reaching USD 1.32 billion in 2025.

Source: Straits Research

Market Size and Forecast

- 2025 Market Size: USD 2.9 billion

- 2034 Projected Market Size: USD 65.2 billion

- CAGR (2026-2034): 44.2%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The global building twin market encompasses various digital twin solutions, including asset twin, component twin, system twin, process twin, and full building lifecycle twin models. These solutions are enabled through a host of technology layers, including IoT sensors and embedded electronics, cloud computing platforms, edge computing frameworks, and advanced connectivity infrastructures, allowing for real-time data ingestion, simulation, and performance optimization. Building twin platforms integrates hardware, software, and service components in support of applications such as predictive maintenance, HVAC optimization, space utilization, security monitoring, construction planning, and continuous operational management. Building twin systems have been widely deployed in commercial, industrial, residential, healthcare, data center, and public infrastructure environments, delivering critical, technology-enabled insights that advance efficiency, minimize downtime, improve occupant safety, and ensure intelligent decision-making throughout the entire building lifecycle.

Market Trends

Shift From Static Building Management To Real-Time, Data-Driven Operations

The operations within these facilities are presently seeing a paradigm shift from traditional and intermittent inspections followed by manually generated reports within a digital twin space. Building operations were previously dependent on scheduled inspections with delayed reporting and data from various systems within a facility, making it more likely for facilities to be reactive instead of proactive with regard to maintenance and energy consumption. Buildings within a digital twin space combine various sources within a single virtual representation. Moreover, such an advancement enhances responsiveness, shortens maintenance downtimes, and boosts occupants’ comfort. Practical implementation and experiences have confirmed that online monitoring and testing enable quicker fault identification and resolve issues with reduced unplanned downtime without requiring on-site appraisals. It represents an end to wait-and-react activities and marks a fundamental shift towards proactive and data-informed facility and resource management.

Lifecycle Planning With a Focus on Acceleration At An Industry Scale

The use of lifecycle-based “building twins” is on the increase as various organizations attempt to integrate pre-construction modeling with operational life cycles. Historically, various stakeholders within the entire project life cycle, from design, construction, and operations, have operated in isolation. Lifecycle twins integrate all phases, from planning and design through to commissioning and operation. By taking an integrated approach, it becomes possible to simulate workflows, analyze structural and system performance before actual construction, and document changes digitally on an ongoing basis. As more and more businesses focus on reliable and sustainable assets for an extended period, lifecycle digital twins have emerged as an increasingly important strategy that can be adopted for better collaboration, error-free construction, and optimal performance.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.9 billion |

| Estimated 2026 Value | USD 4.18 billion |

| Projected 2034 Value | USD 65.2 billion |

| CAGR (2026-2034) | 44.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Siemens AG, Schneider Electric, Honeywell International, IBM Corporation, Microsoft Corporation |

to learn more about this report Download Free Sample Report

Market Drivers

Increase in Government-Led Digital Construction Initiatives

The digital transformation of construction and infrastructure is accelerating because governments worldwide are placing mandates on the delivery of digital models for public projects, which significantly accelerates the adoption of building twin platforms. Countries like the United Kingdom, Singapore, the United Arab Emirates, and Australia have implemented directives requiring digital modeling and continued asset digitization for large-scale development projects. For example, the UK's National Digital Twin Programme will develop connected digital replicas of national infrastructure to provide a framework that incentivizes the use of building twins in monitoring the lifecycle for performance, long-term asset sustainability, and other aspects. These government-driven mandates are changing procurement standards and forcing contractors, facility operators, and real estate developers to incorporate digital twin solutions upstream in the project life cycle. Compliance is becoming a prerequisite for bids on public tenders, and the market is showing good momentum, with increased investment in digital infrastructure and further reliance on real-time data systems to meet the set regulatory expectations.

Market Restraints

Fragmented Regulatory Frameworks Hampering Cross-Border Adoption

The inconsistency and fragmentation of regulatory frameworks across countries are considerably holding back the large-scale implementation of unified digital building models. Although several governments have now rolled out digital policies, they vary widely in terms of data governance, privacy rules, interoperability standards, and compliance requirements. The updated EPBD for energy performance requires European Union member states to mandate digital documentation and regular monitoring in pursuit of operational efficiency. In contrast, most developing regions lack defined guidelines, even on digital modelling of assets, let alone standards for data exchange.

Market Opportunity

Increasing Focus on Integrated Building Ecosystems and Platform Convergence

One of the greatest opportunities that is arising within the building twin market relates to platform consolidation. Historically, there have been various stand-alone systems within a building that relate to functions such as heating and air conditioning control, security monitoring, space allocation, and maintenance scheduling. The result has been data silos and inconsistencies within operations. The rising demand for integrated building ecosystems makes it easier for suppliers of building twin solutions to carve out a market space as a core orchestration layer that integrates data on environments, equipment, and space utilization. Various actual business operations with diversified digital ecosystems have shown considerable improvements in operational insights and overall planning of assets. As large business enterprises with multiple facilities focus on making digital infrastructure simpler, it will be easier to build twin solutions with immense market growth opportunities to emerge as a single source of integral and historical data.

Regional Analysis

North America accounted for a revenue share of 36.42% in the global market in 2025, dominating the market. This is supported by a strong adoption of enterprise-scale facility digitization in the region and the increasing penetration of integrated building management systems into the commercial real estate portfolio. Many major operators in large buildings have moved to a unified operational platform in order for the seamless integration of structural data, energy performance metrics, and equipment behavior into detailed digital replicas. Growing demand for real-time asset visibility, along with increased operational reliability, accelerates the deployment of solutions concerning building twin solutions among corporate campuses, healthcare networks, and industrial facilities.

Driven by the rapid modernization of aging building infrastructure and a growing emphasis on lifecycle-based asset performance tracking, the building twin market in the United States will grow. Large property owners and facility operators are implementing digital twins to map system interactions, detect emerging performance issues, and ultimately automate operational workflows. In fact, leading real estate portfolios have reported measurable improvements in energy efficiency and reduced operational downtime following deployment of the building twin systems, thus reinforcing adoption across both newly developed and retrofit projects. This trend continues to gain strong momentum as multi-site organizations expand, building twin usage in an attempt to create more transparency and long-term value creation.

Asia Pacific Building Twin Market Insights

The Asia Pacific is coming up as the fastest-growing region, poised to expand at a CAGR of 44.2% from 2026 to 2034. Growth in the region is supported by accelerated digitalization across commercial buildings, smart manufacturing plants, and rapidly expanding urban development. Most enterprises in this region are now adopting building twin platforms with a view to streamlining operational planning, optimizing space utilization, and encouraging environmental performance in high-density urban environments. Private construction groups in this region have also further increased investment into mega-scale smart complexes, fueling strong interest in dynamic building simulations along with continuous operational diagnostics; this is, in turn, driving wide-scale adoption of building twin technologies across the APAC region.

India's building twin industry is growing rapidly among commercial developers, IT parks, and industrial clusters, adopting digital replicas to better operational efficiency and centralize the management of their assets. Several large real estate portfolios have implemented unified digital platforms monitoring occupancy flows, equipment performance, and environmental parameters, that allow them to optimize resource allocations and reduce operational disruptions. With a rising integrated facility ecosystem and growing preference for intelligent space planning tools, India is emerging as a rising hub for the deployment of building twins in both newly constructed and redeveloped urban assets.

Source: Straits Research

Europe Market Insights

Strong expansion is seen in building twins across Europe as more enterprises consider the adoption of integrated digital infrastructure to smooth operations across large commercial and industrial facilities. The region enjoys widespread modernization of old buildings and a growing interest in integrating energy monitoring, space planning, and system diagnostics into a single digital environment. Consistent market momentum is witnessed with growing adoption among property developers, manufacturing hubs, and large facility operators, where organizations are turning to digital replicas for enhanced building performance and reduced operational disruption.

This is underpinned by rapid building digitization in complex industrial facilities and multi-site commercial properties. Building twins are increasingly being used by large enterprises to simulate the interaction of equipment, test various operational workflows, and enhance predictive maintenance accuracy across production campuses of production. Progressive engineering firms are laying out digital twins in the country to achieve system behavior optimization and reduce downtime in logistics centers, research facilities, and office towers. All these factors keep Germany in pole position among adopters of building twin solutions in Europe, with added emphasis on efficiency, transparency, and long-term planning.

Latin America Market Insights

Latin America's building twin market is growing as developers and facility operators are looking to modern asset management frameworks to remedy the inefficiencies in building operations. It finds growing adoption across commercial complexes, retail infrastructure, and mixed-use developments where owners are keen to have better visibility into equipment performance and energy consumption. Centrally, building oversight and dynamic operational modeling are showing increasing interest in digital twin platforms across the key cities of the region.

Increasing deployment of digital platforms across corporate campuses, high-density residential developments, and large commercial buildings is reinforcing market growth in Brazil. Building twins are being increasingly adopted by leading facility operators to model occupancy flow, streamline equipment diagnostics, and coordinate maintenance activity across multi-tower developments. This progressive movement toward a structured approach for building operations and a data-driven decision-making policy is expected to drive wider adoption, with the country emerging as a developing hub for the use of building twins in Latin America.

Middle East & Africa Market Insight

The Middle East and Africa are seeing accelerated uptake of building twin solutions as large commercial districts, hospitality chains, and industrial zones go for digital replicas to enhance predictability in operations and resilience in buildings. Due to rapid growth in mixed-use development and high-performance structures, there has been a strong demand for platforms across the region that map system interactions, forecast maintenance needs, and manage building efficiency across different climatic conditions.

Saudi Arabia's building twin market will grow fast because many big real estate projects and commercial developments across it integrate digital twins to operate complex facilities. Large business parks, hospitality centers, and entertainment venues operators make use of building twins for system behavior simulation, refining maintenance strategies, and energy performance. The country's direction on advanced facility planning and operational optimization is accelerating the adoption of building twins, with Saudi Arabia expected to lead the Middle East and Africa markets in terms of building twin deployments.

Type Insights

The Building Lifecycle Twin submarket was the most prominent with a market share of 41.25% in 2025. This market leadership will be fueled by the increasingly rapid adoption of comprehensive and end-to-end managed systems for buildings, with a growing reliance on digital twins that extend from planning and construction through start-up and operation. Large-scale adoption will signal a need for deep performance understanding and better overall reliability.

The System Twin area is likely to demonstrate the fastest growth and attain a projected CAGR of 43.72% within the forecast period. The major reason for its rapid growth is the rising need for dynamic and real-time visualization of various building system infrastructures, including heating, ventilation, and air conditioning systems, security systems, energy, and mechanical systems. Organizations have been widely employing System Twins to simulate interactions at various system levels.

Source: Straits Research

Technology Insights

IoT Sensors & Embedded Electronics dominated the market share with 33.74% in 2025, driven by the increasing requirement for high-frequency, real-time data capture across the environment of a building. Whether monitoring occupancy patterns, equipment health, or temperature and environmental quality, modern facilities are reliant on dense sensor networks.

The Cloud Computing Platforms segment is expected to see the fastest growth, recording a projected CAGR of 47.86% during the forecast period. Such rapid growth is due to the fact that scalable, centralized cloud-based platforms facilitate building owners and operators in managing large volumes of information, running simulations, and helping multi-site portfolios with integrated operation.

Component Insights

The Software category led the market in 2025 with a revenue share of 38.67%, as it became more common for twin platforms to be at the core of data modeling, simulation, workflow, and operational analytics. Software vendors showcase comprehensive end-to-end solutions with capabilities spanning real-time monitoring, asset tracking, prediction analytics, and system synthesis, which help building owners systematically manage intricate facilities.

The Services business area is anticipated to display the quickest growth rate within the forecast period. Notable factors influencing this growth include an escalation in demands for advanced consulting, integration, and lifecycle services as more and more facilities undertake the adoption of building twin solutions. Higher interactions between various participants, including facility operating companies and engineering and digital integrators, are fueling demands for services ranging from deployment assistance to data organization and simulation setup.

Application Insights

The segment of Building Operations is expected to rise at the highest growth rate of 46.15%, driven by growing demands for continuous monitoring, optimized resource utilization, and value performance oversight across modern facilities. As more buildings move toward centralized operational approaches, operators are giving high priority to real-time visibility into equipment behavior, energy flows, occupancy patterns, and system interactions. This increasing focus on operational efficiency is driving demand for building twin solutions that can support proactive issue detection, seamless workflow coordination, and accurate performance benchmarking, thereby strengthening the adoption of building operations applications in the forecast period.

Competitive Landscape

The building twin market shows moderate fragmentation on a global scale. This is because there are some prominent market participants who have impressive building technologies as well as expertise in developing digital platforms. It can be seen that some prominent competitors have a large market share due to their integrated building management solutions and digital twin platforms.

The main competitors operating within the market include Siemens AG, Schneider Electric, Honeywell International, and several more. The key market leaders are competing with each other to improve market share with enhancements on their platform, partnerships with the involvement of real estate and industrial businesses, and extending digital solutions for buildings on a global scale. Launching new products and services, partnerships, and acquisitions have emerged as very prominent methods today for market leaders.

AIOTEL: An Emerging Market Player

AIOTEL, based out of Bengaluru and working on deep-tech digital twin solutions related to the environment of buildings and industries, is receiving recognition at a fast pace within the market for building twin with its 4D digital twin solution for comprehensive visualization and intelligence

- In September 2025, AIOTEL launched its 4D Digital Twin platform, TWINVRSE™, as a B2B PaaS solution enabling enterprises to visualize physical assets in real time with integrated IoT, 3D spatial models, and advanced analytics, marking its first commercial product release.

Thus, AIOTEL positioned itself as a prominent actor within the global market, utilizing its novel product offering, launched at that very time, to provide a differentiated set of digital replica services.

List of Key and Emerging Players in Building Twin Market

- Siemens AG

- Schneider Electric

- Honeywell International

- IBM Corporation

- Microsoft Corporation

- Johnson Controls

- ABB Ltd.

- Oracle Corporation

- PTC Inc.

- Dassault Systèmes

- Bentley Systems

- Autodesk Inc.

- Cisco Systems

- Hitachi Vantara

- Emerson Electric

- Huawei Technologies

- Bosch.IO

- GE Digital

- Toshiba Digital Solutions

- Mitsubishi Electric Corporation

- Others

Strategic Initiatives

- November 2025:EraTwin, a real-time residential building twin platform provider, launched its pilot digital twin project at a residential complex in Kyiv, integrating multiple communication protocols (RS-485, Wi-Fi, LoRaWAN, Zigbee) to unify heating, electrical infrastructure, and solar power data into a single operational twin interface.

- October 2025: AVEVA announced new enhancements to its core industrial digital twin components within the AVEVA CONNECT platform at the Schneider Electric Innovation Summit, improving cloud-based data availability and real-time analytics to scale digital twin applications with flexible UI and reduced infrastructure overhead.

- March 2025: Schneider Electric and ETAP unveiled the world’s first electrical digital twin to simulate AI factory and building power requirements from grid to chip level using NVIDIA Omniverse integration, enabling comprehensive electrical system simulation for smart buildings and infrastructure.

- January 2025: Siemens Digital Industries Software launched the Teamcenter Digital Reality Viewer, a high-performance visualization solution that embeds NVIDIA Omniverse real-time ray tracing capabilities into its digital twin environment for enhanced photorealistic interaction with complex building and product data.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.9 billion |

| Market Size in 2026 | USD 4.18 billion |

| Market Size in 2034 | USD 65.2 billion |

| CAGR | 44.2% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Technology, By Component, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Building Twin Market Segments

By Type

- Asset Twin

- Component Twin

- System Twin

- Process Twin

- Building Lifecycle Twin

By Technology

- IoT Sensors & Embedded Electronics

- Artificial Intelligence & Machine Learning

- Edge Computing

- Cloud Computing Platforms

- Connectivity Technologies

By Component

- Hardware

- Software

- Services

By Application

- Predictive Maintenance

- HVAC Optimization

- Space Utilization

- Security Monitoring

- Construction Planning

- Building Operations

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.