Capsaicin Market Size, Share & Trends Analysis Report By Form (Powder, Granules, Liquid), By Application (Pharmaceuticals, Food and Beverages, Cosmetics, Agriculture, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Capsaicin Market Overview

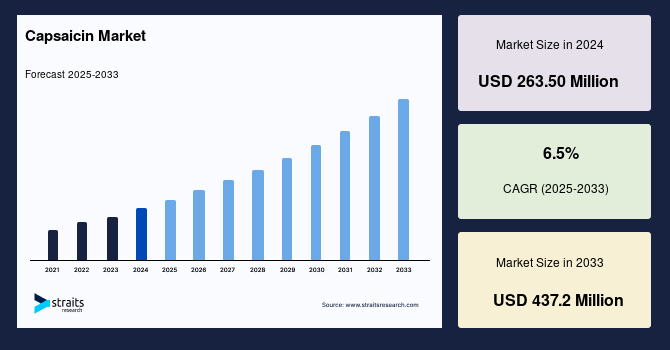

The global capsaicin market size was valued at USD 263.50 million in 2024 and is projected to reach from USD 280.63 million in 2025 to USD 437.2 million by 2033, growing at a CAGR of 6.5% during the forecast period (2025-2033). The growth is driven by its expanding use across multiple end-use industries, like food & beverages and pharmaceuticals, among others. In the food and beverage industry, it is used as a spice, flavouring, and preservative, found in various forms like fresh chilli peppers, chilli powder, red pepper paste, hot sauces, and spicy instant noodles.

Key Market Indicators

- North America was the largest regional market in 2024 with a 40% revenue share.

- Based on form powder, Form dominated the global capsaicin market in 2024, holding a 52.5% revenue share.

- Based on application, Pharmaceuticals led the market in 2024 with a 42.5% revenue share.

Market Size & Forecast

- 2024 Market Size: USD 263.50 Million

- 2033 Projected Market Size: USD 437.2 Million

- CAGR (2025-2033): 6.5%

- Largest market in 2024: North America

- Fastest-growing region: Asia Pacific

Capsaicin is a chemical compound (C₁₈H₂₇NO₃) found in chilli peppers, known for its ability to produce a burning sensation. It functions as a potent topical irritant, having analgesic, antioxidant, anti-inflammatory, and anticancer properties. Chemically, it is a fatty acid amide that is fat-soluble and can be used in various forms.

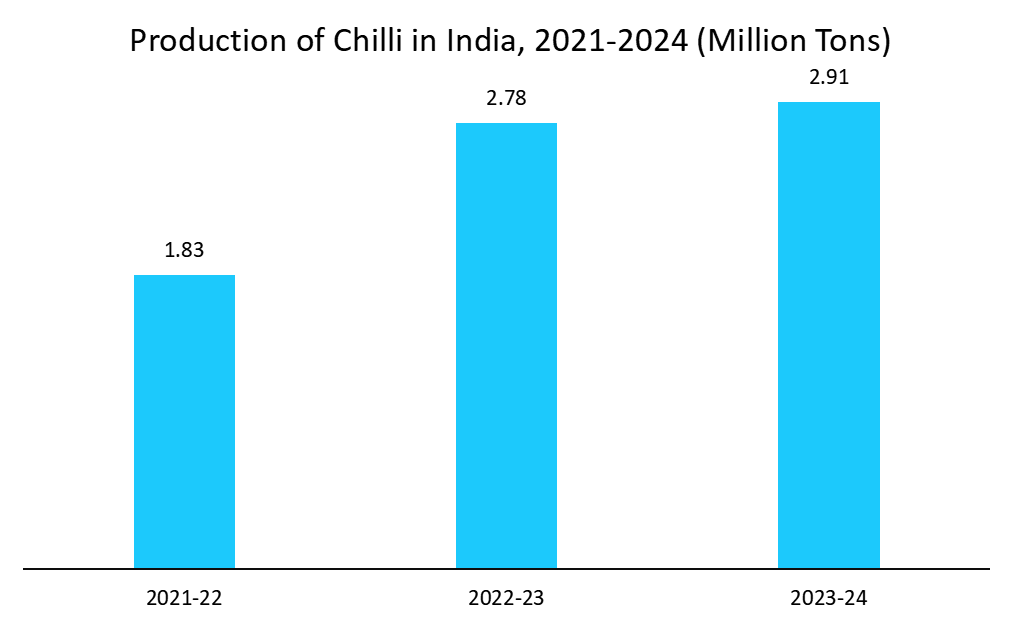

Chilli is the primary natural feedstock for capsaicin production, as capsaicin is synthesised and stored within the placental tissue of the chilli pepper fruit. Many components of the plant, including the fruits and even plant waste like the placenta and seeds, can be utilised to extract capsaicinoids, a class of chemicals that includes capsaicin, which are abundant in chilli peppers.

Source: Straits Research Analysis

Asia Pacific is expected to witness significant growth in the market due to the geographical concentration of chilli-producing countries. India, followed by China and Bangladesh, contributes nearly 45% of the total world chilli production.

The companies are widely focusing on the green extraction methods for capsaicin (e.g., enzymatic methods). These enzymatic methods are a sustainable approach for producing and extracting capsaicin, offering a greener alternative to conventional chemical synthesis and extraction processes by using non-toxic reagents, improving yields, and enabling the use of waste materials. Companies are widely adopting this method to promote sustainability.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 263.50 Million |

| Estimated 2025 Value | USD 280.63 Million |

| Projected 2033 Value | USD 437.2 Million |

| CAGR (2025-2033) | 6.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | AOS Products Pvt. Ltd, ChengSoutheastch Group, Arjuna Natural, Fengchen Group Co Ltd, Naturite Agro Products Ltd |

to learn more about this report Download Free Sample Report

Market Drivers

Growing Demand for Capsaicin in the Pharmaceuticals Industry

Capsaicin is widely used in the pharmaceutical industry as an analgesic to relieve various types of pain, including neuropathic pain (like shingles-related pain), musculoskeletal pain, and pain from conditions like arthritis. It is available in various topical forms, such as creams, lotions, patches, and even advanced drug delivery systems.

- The U.S. is the most dominant country in the pharmaceutical industry. The U.S. pharmaceutical industry stands at a pivotal point, with projected overall spending expected to exceed USD 1 trillion by 2030. The growth in the pharmaceutical industry is further expected to drive the demand for Capsaicin in the region.

Rising demand for Capsaicin in the Food Processing Industry

Capsaicin is widely used in the food processing industry as a flavouring to provide spiciness, and as a natural antioxidant and preservative due to its antimicrobial and oxidation-resistant properties.

- India's food processing sector will grow significantly, reaching USD 1,100 billion by FY35, USD 1,500 billion USD 2,150 billion by FY47. The increase in the food processing industry will increase the demand for capsaicin in India.

Market Restraint

There are stringent rules and regulations mentioned by the EU on the Capsaicin market. Capsaicin is regarded as a food additive and is frequently prohibited due to concerns about its potential as an irritant. The EU has established specific limits for a synthesised capsaicin analogue, phenylcapsaicin, in food supplements and foods for special medical purposes, allowing a maximum of 2.5 mg. The limit imposed on the use of capsaicin will be a restraining factor for the market.

Market Opportunity

Capsaicin is used in food processing primarily as a flavouring agent to provide spiciness and as a functional food additive due to its antioxidant, antimicrobial, and anti-inflammatory properties. It is also used in the manufacturing of edible packaging films to improve shelf life and as a component in some functional foods designed for controlled spice release.

- China is the world's second-largest country in the food processing industry. The sector grew by 2.2% to USD 1.26 trillion in 2024 as compared to the previous year. The growth in the food processing industry will increase the demand for the Capsaicin market.

Region Analysis

The North America region dominated the product market with a revenue share of 40% in 2024. The growth is attributed to its increasing application as a flavouring agent in the food processing industry. The food and beverage processing industry was the largest manufacturing industry in Canada in 2024 in terms of value of production, with sales of goods manufactured worth USD 173.4 billion; it accounted for 20.3% of total manufacturing sales and for 1.6% of the national Gross Domestic Product (GDP).

U.S.: Capsaicin is used in the cosmetic industry for its stimulating, antioxidant, and anti-inflammatory properties, appearing in products like anti-ageing treatments, cellulite creams, hair care formulations, and lip plumpers. The U.S. is one of the prominent countries in the cosmetics industry. The U.S. cosmetics industry grew by 7%, year over year, to reach USD 33.9 billion in 2024. The growth in the U.S. cosmetics industry will increase the demand for capsaicin in the U.S.

Asia Pacific Market Trends

Asia Pacific is one of the largest producers and consumers of capsaicin, owing to its increasing application in the pharmaceutical industry, from large economies like India and China. India’s PLI scheme for pharmaceuticals is being implemented with a total outlay of USD 2.04 billion spanning from 2020-21 to 2028-29, to boost India's manufacturing capacity. The growth in the pharmaceutical industry will increase the demand for capsaicin in India.

India: Capsaicin is used in the pharmaceutical industry to relieve neuropathic pain from conditions like post-herpetic neuralgia and diabetic neuropathy. India is one of the prominent players in the pharmaceuticals industry India is a prominent. According to the Government of India, the total market size of the Indian Pharma Industry is poised to reach USD 130 billion by 2030 and a USD 450 billion market by 2047. The growth in the pharmaceutical industry will increase the demand for Capsaicin in India.

China : Capsaicin is primarily used as a biopesticide and animal repellent to protect crops and plants from pests like insects, deer, and rodents. It can act as a herbicide due to its allelopathic effects, inhibiting seed germination and plant growth. Additionally, it possesses antifungal and nematocidal properties, while also being explored for plant growth regulation and as a feed additive for poultry. The 15th Five-Year Development plan (2021-2025) of China laid plans for boosting the agriculture sector in the country, with emphasis on prevention and control of crop diseases and insect pests, eventually driving the market development of bio-insecticides in the country.

Brazil Market Trends

Brazil is one of the emerging countries in the pharmaceutical industry. The pharmaceutical industry growth is ranging from a steady growth of 5.8% to a robust 10.2% through the next decade. The growth in the industry will increase the demand for the capsaicin market in Brazil.

Form Insights

Capsaicin powder dominated the global market with a revenue share of 52.5 % in 2024, owing to its convenience, versatility, and ease of incorporation into various food products and spice blends, allowing for even distribution, consistent heat, and extended shelf life compared to liquid and granule forms. Powdered capsaicin also serves as a versatile flavouring and colouring agent in ethnic cuisines, spice mixes, and processed foods, and it offers a concentrated form of heat and flavour without the bulk of fresh chillies.

Application Insights

The pharmaceutical industry dominated the global capsaicin industry with a revenue share of 42.5% in 2024 due to capsaicin's proven efficacy in treating various conditions, particularly chronic pain and inflammation, making it a valuable natural ingredient in pain-relief medications and therapeutic applications. The increasing global prevalence of chronic pain and the growing demand for natural and synthetic drugs.

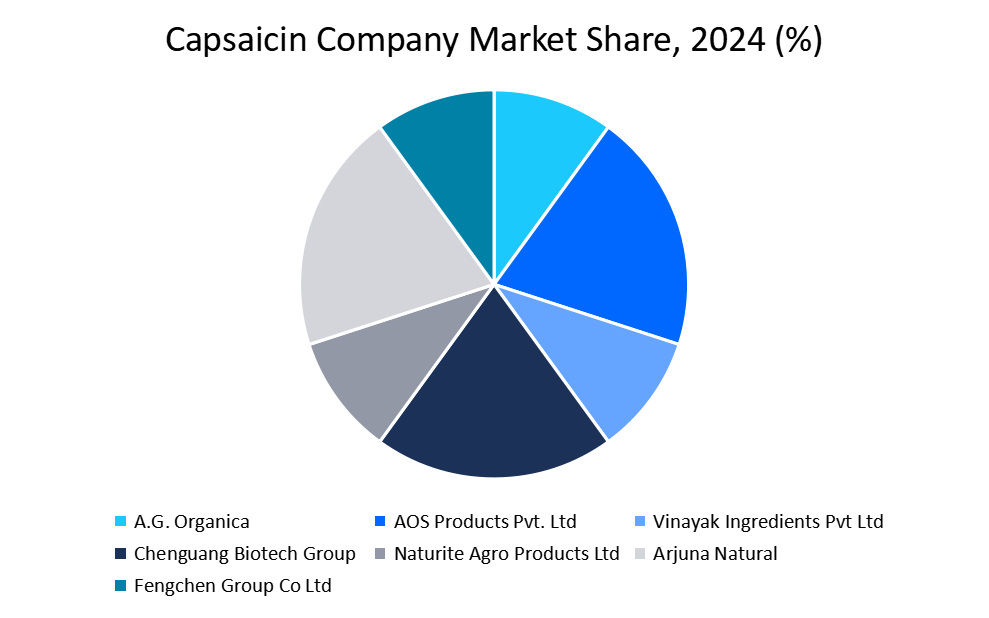

Company Market Share

The capsaicin market is moderately consolidated with a few players, including A.G. Organica, AOS Products Pvt Limited, Chenguang Biotech Group, Arjuna Natural, Natuite Agro Products Ltd, Fengchen Group Co Ltd, among others, trying to increase their market share by undertaking strategic initiatives, including mergers, acquisitions, new product development, and partnerships.

- For Instance, in April 2025, Of Business, a B2B raw materials procurement platform, acquired Elixir Extracts Pvt Ltd, a Kerala-based manufacturer of herbs and spice-based products.

The other category includes regional manufacturers and niche players who cater to local markets or specific industries. While the market leans toward consolidation, the presence of numerous smaller producers creates opportunities for competition and innovation.

Source: Straits Research Analysis

Natuite Agro Products Ltd: An emerging player in the market

Naturite Agro Products Ltd., established in 1990, is one of the prominent manufacturers, suppliers and exporters of capsicum oleoresin, pure capsaicin natural, paprika oleoresin, turmeric oleoresin & curcumin powder. Owing to its commitments to quality, the company has earned the Spice House Certificate from the Spices Board, Government of India. The company is engaged in exporting products all over India as well as outside India, covering the region of South East Asia, America, East/Middle Africa, the Middle East, the US, Japan, Korea, etc.

List of Key and Emerging Players in Capsaicin Market

- AOS Products Pvt. Ltd

- ChengSoutheastch Group

- Arjuna Natural

- Fengchen Group Co Ltd

- Naturite Agro Products Ltd

- G. Organica

- Vinayak Ingredients Pvt Ltd

- Venkatramna Industries

- Audi Pharma Ingredients

- Yunnan Honglv Capsaicin Co., Ltd

Recent Developments

- In 2025 : Mane Kancor received an award for Excellence in Sustainable Practices at Fi India 2025 for its Mint Sustainability Initiatives. This program emphasises traceable sourcing, farmer empowerment, and eco-friendly cultivation of mint (used in related herbal oleoresin production), aligning with broader trends in sustainable spice processing.

- August 2025 : Synthite Industries Ltd. and Plant Lipids have actively participated in major trade events such as FI Asia 2025, Fi India 2025, and the IFEAT conference to promote their oleoresin and other plant-derived ingredient portfolios. These events serve as crucial platforms for showcasing new concepts, connecting with customers and suppliers, and building industry relationships.

Analyst Opinion

The capsaicin market is steadily growing owing to its increasing application in pharmaceuticals, food and beverages, cosmetics, and agriculture. Capsaicin is considered sustainable due to its natural origin from chilli peppers, its ready biodegradability, and its potential to be sourced from agricultural waste, making it an eco-friendly option for various applications such as antifouling coatings, pest repellents, and in the development of nutraceuticals. Capsaicin can reduce the use of harmful insecticides and herbicides as it acts as a bioinsecticide. Capsaicin helps the agriculture sector in crop protection and also enhances the crops by reducing weeds.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 263.50 Million |

| Market Size in 2025 | USD 280.63 Million |

| Market Size in 2033 | USD 437.2 Million |

| CAGR | 6.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Form, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Capsaicin Market Segments

By Form

- Powder

- Granules

- Liquid

By Application

- Pharmaceuticals

- Food and Beverages

- Cosmetics

- Agriculture

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.