Australia Carbon Capture and Storage Market Size, Share & Trends Analysis Report By Technology (Pre-combustion capture, Oxy-fuel combustion capture, Post-combustion capture), By Service (Capture, Transportation, Storage, Utilization), By Utilization Technology (Uptake, Catalytic conversion, Mineralization), By End-User (Power Generation, Oil and Gas, Metal Production, Others) and Forecasts, 2025-2033

Australia Carbon Capture and Storage Market Size

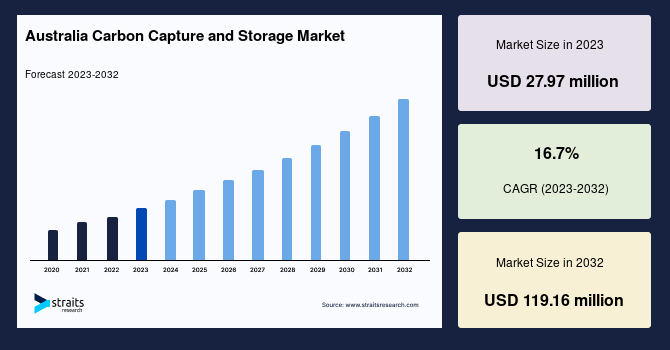

The Australia carbon capture and storage (CCS) market size was valued at USD 32.64 million in 2024 and is projected to reach from USD 38.09 million in 2025 to reach USD 131.04 million by 2033, with a CAGR of 16.7% during the forecast period (2025–2033).Government policies, net-zero commitments, integration with the hydrogen economy, and carbon utilization boost market growth.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 32.64 Million |

| Estimated 2025 Value | USD 38.09 Million |

| Projected 2033 Value | USD 131.04 Million |

| CAGR (2025-2033) | 16.7% |

| Key Market Players | Aker Solutions , Air Liquide, Baker Hughes, Dakota Gasification Company , Exxon Mobil Corporation |

to learn more about this report Download Free Sample Report

Australia Carbon Capture and Storage Market Growth Factor

Government Policies and Net-Zero Commitments

Australia’s commitment to reaching net-zero emissions by 2050 is a significant growth driver for the CCS market. The government’s National Greenhouse Gas Inventory highlights the necessity of large-scale CCS technologies to meet emission reduction targets. By 2024, the ERF allocated AUD 2 billion for low-emission technologies, supporting CCS adoption across sectors. In addition, Australia’s federal and state governments are providing funding for CCS infrastructure and research, with recent funding announcements including AUD 500 million for CCS initiatives in Queensland. This regulatory push, coupled with Australia’s heavy reliance on fossil fuels, positions CCS as a critical solution to decarbonize the economy.

Market Restraint

High Initial Capital Costs and Storage Capacity Limitations

Despite strong governmental support, one key constraint to CCS adoption in Australia is the high capital investment required for building and retrofitting industrial facilities. Establishing CCS infrastructure, including transportation pipelines and storage sites, demands large-scale investment. Additionally, geological suitability for CO₂ storage is a concern in certain regions, leading to challenges in identifying safe and efficient storage sites. The Australian Energy Market Operator (AEMO) has projected that a shortage of adequate storage capacity could delay the realization of large-scale CCS deployment in the country, potentially raising costs and limiting widespread adoption.

Market Opportunity

Integration with Hydrogen Economy and Carbon Utilization

An exciting opportunity lies in the synergy between CCS and the hydrogen economy. As Australia transitions toward green hydrogen, combining blue hydrogen production with CCS can significantly reduce emissions from the energy sector. For instance, Santos' Moomba CCS Project is designed to capture and store CO₂ from natural gas and blue hydrogen production. Additionally, the growth of carbon utilization technologies, such as catalytic conversion (growing at a CAGR of 17.0%), presents an opportunity to convert captured CO₂ into valuable products like methanol and synthetic fuels. These complementary technologies will create a circular carbon economy, enhancing the commercial viability of CCS in Australia.

Country Insights

The market is characterized by diverse CCS applications across Australia’s energy, mining, and industrial hubs. As one of the world’s largest carbon emitters, Australia focuses on CCS technologies to achieve its net-zero emissions target by 2050. The government has invested significantly in CCS initiatives through its Emissions Reduction Fund (ERF) and the National Low Emissions Technology Roadmap. Industry giants like Woodside Energy and Santos are critical players in the market, implementing CCS projects for the energy and industrial sectors and making Australia a key market for CCS technology development in the Asia-Pacific region.

Sydney is home to government institutions and research organizations that support CCS policy development and technological advancement. The University of New South Wales (UNSW) is actively engaged in CCS research, working with industry players to scale solutions for Australia’s energy-intensive sectors.

Melbourne, known for its industrial heritage, has seen several CCS pilots aimed at decarbonizing cement and steel production. The Carbon Clean Solutions project in Melbourne’s manufacturing sector is one of the country’s most promising carbon utilization initiatives, converting captured CO₂ into methanol.

Perth is a crucial location for Australia’s CCS efforts, particularly in oil and gas. The Gorgon CO₂ Injection Project, one of the world’s most significant CO₂ storage projects, is located off the coast of Perth and aims to store up to 4 million tons of CO₂ annually.

Brisbane, as a central coal mining hub, is critical to the adoption of CCS in Australia’s heavy industries. The Queensland Government’s Global CCS Institute is based here, driving several large-scale CCS projects targeting the mining and energy sectors.

Adelaide hosts several CCS initiatives, especially those related to hydrogen production. The World-class Hydrogen Export Hub in the region, coupled with CCS for blue hydrogen production, is helping position Adelaide as a leader in low-carbon technologies.

Technology Insights

Pre-combustion capture dominates the technology segment and is expected to grow at a CAGR of 16.3% in Australia’s industrial and power sectors. Key players like Woodside Energy focus on integrating pre-combustion capture in their natural gas and coal-fired power plants. This technology allows CO₂ to be captured before combustion, making it ideal for industries that rely on fossil fuels for energy production. With the country’s infrastructure heavily reliant on coal and natural gas, pre-combustion capture remains a practical solution for reducing emissions in the short to medium term.

Service Insights

Capture services dominate the segment and are expected to grow at a CAGR of 16.2% during the forecast period. Capture services are poised to see increasing demand in Australia’s energy and manufacturing sectors. Companies like Santos and Chevron are incorporating innovative CO₂ capture methods to reduce oil and gas production facility emissions. These services are essential for companies looking to comply with stringent emissions reduction targets, particularly in Australia’s carbon-intensive industries.

Utilization Technology Insights

Catalytic conversion dominates the utilization technology and is expected to grow at a CAGR of 17.0% over the forecast period. These technologies enable the conversion of CO₂ into commercially viable products such as methanol, biofuels, and plastics, creating an economically sustainable model for carbon capture. The Carbon Clean Solutions facility in Melbourne focused on CO₂-to-methanol conversion, demonstrates the commercial potential of catalytic conversion in Australia’s industrial landscape.

End-User Insights

Oil and gas dominate the end-user segment and is expected to grow at a CAGR of 16.1% during the forecast period. Major energy companies like Woodside Energy and Santos are at the forefront of integrating CCS with oil and gas production processes. Projects like the Gorgon CO₂ Injection Project have set the stage for large-scale CCS in Australia, where captured CO₂ from gas processing is stored underground. The sector remains critical in achieving Australia's emission reduction goals, particularly as the oil and gas industry accounts for a substantial portion of national emissions.

List of Key and Emerging Players in Australia Carbon Capture and Storage Market

- Aker Solutions

- Air Liquide

- Baker Hughes

- Dakota Gasification Company

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric

Analyst’s Perspective

As per our analyst, the Australia carbon capture and storage market is poised for rapid expansion in the coming years. This growth is primarily driven by Australia’s robust government support for CCS technologies and the increasing demand for low-carbon solutions in the energy and industrial sectors. With favorable policies, investments in large-scale CCS projects, and integration of CCS with hydrogen and carbon utilization technologies, Australia is positioned to become a regional leader in carbon capture and storage.

However, addressing storage capacity concerns and lowering operational costs will be critical for ensuring widespread adoption across industries. The growth of CCS in Australia offers a pathway toward achieving national climate goals while creating significant business opportunities.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 32.64 Million |

| Market Size in 2025 | USD 38.09 Million |

| Market Size in 2033 | USD 131.04 Million |

| CAGR | 16.7% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Technology, By End-User Industry |

to learn more about this report Download Free Sample Report

Australia Carbon Capture and Storage Market Segments

By Technology

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

- Post-combustion Capture

By End-User Industry

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemical

Frequently Asked Questions (FAQs)

Akanksha Yaduvanshi

Research Analyst

Akanksha Yaduvanshi is a Research Analyst with over 4 years of experience in the Energy and Power industry. She focuses on market assessment, technology trends, and competitive benchmarking to support clients in adapting to an evolving energy landscape. Akanksha’s keen analytical skills and sector expertise help organizations identify opportunities in renewable energy, grid modernization, and power infrastructure investments.