Cargo Drone Market Size, Share & Trends Analysis Report By Type (Fixed Wing, Hybrid, Rotary Wing), By Automation Level (Fully Autonomous, Semi-Autonomous, Remotely Controlled), By Range (Very Short (up to 45km), Short (45km to 150km), Medium (150km to 550km), Long (Above 550 km)), By Payload Capacity (Featherweight (0.004 to 5 kg), Lightweight (5-45kg), Middleweight (45-150 kg), Heavy-lift (150 kg & above)), By Component (Camera, Sensors, Equipment, Delivery Packages, Others), By Application (Commercial Cargo, Military Cargo), By End User Industry (E-Commerce, Construction, Government and Defense Organization, Healthcare, Offshore and Energy, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Cargo Drone Market Overview

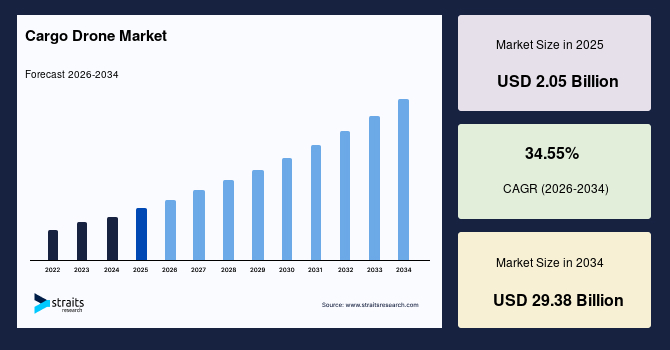

The global cargo drone market size was valued at USD 2.05 billion in 2025 and is estimated to reach USD 29.38 billion by 2034, growing at a CAGR of 34.55% during the forecast period (2026–2034). The market is driven by the rapid growth of e-commerce, increasing demand for faster last-mile deliveries, advancements in drone technology, and the need for cost-efficient logistics solutions, enabling businesses to enhance operational efficiency and meet consumer expectations.

Key Market Trends & Insights

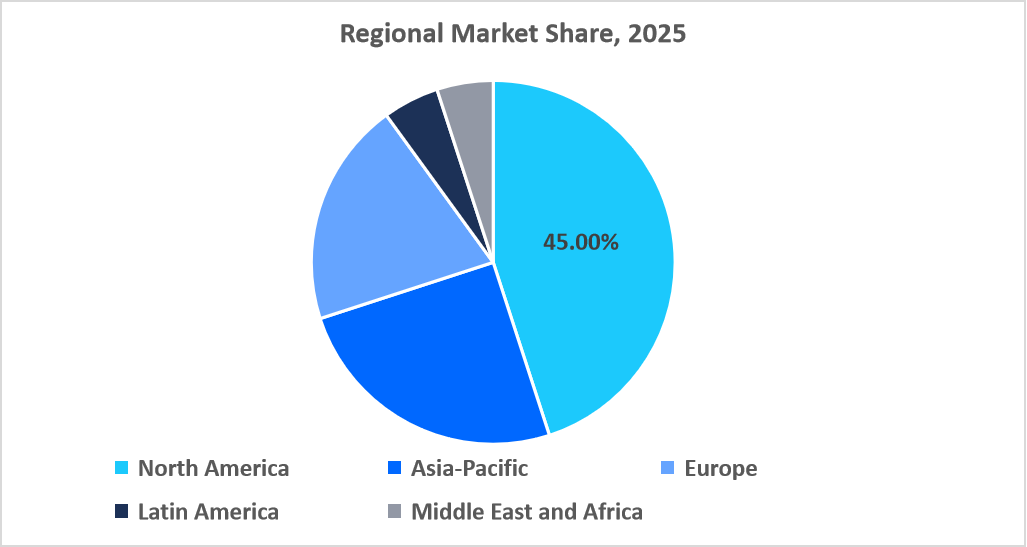

- North America held the largest market share, over 45% of the global market.

- Asia-Pacific is the fastest-growing region, with a CAGR of 37.87%.

- By Type, the Fixed-wing segment held the highest market share of over 50%.

- By Automation Level, the Fully autonomous segment is expected to witness the fastest CAGR of 85%.

- By Range, the Medium-range segment held the highest market share of over 40%.

- By Payload Capacity, the Heavy-lift segment is expected to witness the fastest CAGR of 80%

- By Component, the Sensors segment held the highest market share of over 35%.

- By Application, the Military segment is expected to witness the fastest CAGR of 19%.

- By end-user industry, the E-commerce segment held the highest market share of over 50%.

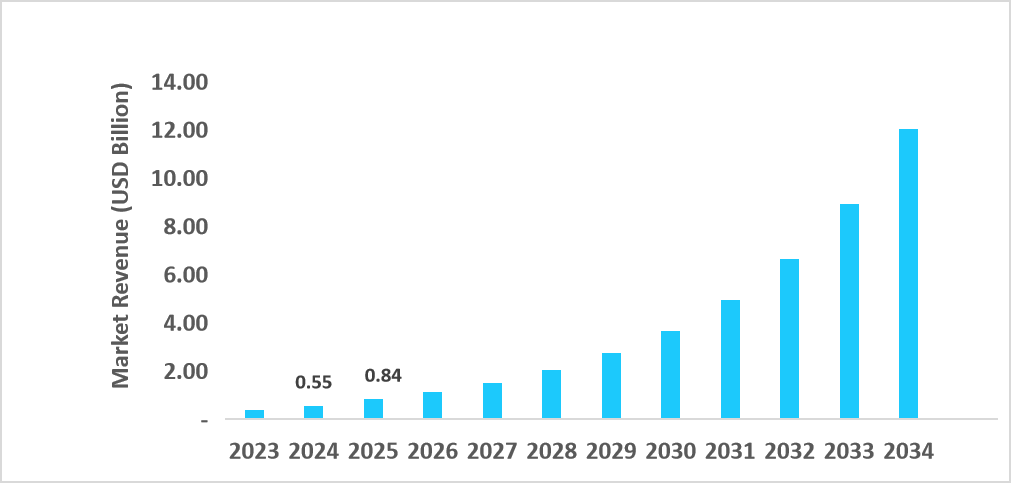

- The U.S. market was valued at USD 0.55 billion in 2024 and reached USD 0.84 billion in 2025.

Graph: The U.S. Market Revenue Forecast (2023 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 2.05 billion

- 2034 Projected Market Size: USD 29.38 billion

- CAGR (2026-2034): 34.55%

- Dominating Region: North America

- Fastest-Growing Region: Asia-Pacific

Cargo drones are unmanned aerial vehicles designed to transport goods quickly and efficiently, especially over short distances. They are widely used in logistics, e-commerce deliveries, medical supply transport, and disaster relief operations, where traditional vehicles may face delays. With capabilities ranging from carrying small parcels to heavier payloads, these drones help reduce delivery times, lower operational costs, and improve accessibility to remote or hard-to-reach locations, making them a transformative solution in modern supply chains.

The global market is witnessing strong growth due to rising demand for faster and cost-effective deliveries, technological advancements in drone design, and supportive regulatory frameworks. Opportunities also lie in expanding commercial applications across sectors such as healthcare, retail, and emergency logistics, alongside the potential for improved operational efficiency through advanced navigation systems, battery innovations, and seamless integration with existing supply chain networks, driving widespread adoption globally.

Latest Market Trends

Increasing Adoption of Autonomous Aerial Delivery Systems

The global cargo drone market is witnessing rapid adoption of autonomous aerial delivery systems, particularly within logistics and e-commerce sectors. As companies seek faster and more efficient delivery solutions, drones offer an attractive alternative to ground-based transport, reducing congestion and enabling quicker turnaround times for high-volume deliveries.

Moreover, advancements in automation, navigation, and sensor technologies are driving the commercial viability of these systems. Businesses are increasingly leveraging drones for middle-mile and last-mile delivery to optimize logistics networks and reach remote locations. This trend aligns with the growing global shift toward contactless and sustainable transportation solutions.

Integration of AI and ML for Efficient Route Optimization and Load Management

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming the cargo drone industry by enabling intelligent route optimization, predictive maintenance, and adaptive load management. These technologies allow drones to analyze flight conditions in real time, enhancing delivery precision, fuel efficiency, and overall operational safety.

As per Straits Research, AI-driven analytics are becoming central to autonomous drone operations, helping companies streamline logistics and reduce human intervention. By utilizing machine learning algorithms, drones can plan efficient flight paths, avoid obstacles, and adjust payload balance dynamically, ultimately improving turnaround times and lowering operational costs across logistics networks.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.05 Billion |

| Estimated 2026 Value | USD 2.74 Billion |

| Projected 2034 Value | USD 29.38 Billion |

| CAGR (2026-2034) | 34.55% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | DJI, Elroy Air, Dronamics, Sabrewing Aircraft Company, Natilus |

to learn more about this report Download Free Sample Report

Cargo Drone Market Drivers

Growth of E-commerce and On-Demand Delivery Services

The global cargo drone market is being propelled by the rapid growth of e-commerce and the rising demand for on-demand delivery services. As consumers increasingly expect faster and more efficient deliveries, businesses are turning to drone technology to streamline logistics and reduce last-mile delivery times.

- In June 2025, Walmart and Wing (Alphabet’s drone company) announced a significant expansion of their drone delivery program in the U.S., adding 100 more stores across cities like Atlanta, Charlotte, Houston, Orlando, and Tampa. Their drones, designed to carry small packages of up to 5 pounds, can deliver products in under 19 minutes.

Such initiatives highlight how retailers are embracing drone technology to reduce delivery times, lower operational costs, and meet growing customer expectations for instant delivery.

Market Restraints

High Startup Costs and Strict Drone Operation Regulations

The market faces significant challenges due to high startup costs and stringent operational regulations. Developing, testing, and certifying cargo drones requires substantial investment in technology, safety systems, and regulatory compliance, which limits entry for smaller firms. Moreover, strict aviation laws governing airspace usage, payload limits, and flight permissions slow down large-scale deployment. These constraints hinder innovation and delay commercial operations, particularly in densely populated or restricted zones, where navigating complex approval processes adds both time and financial burdens to drone-based logistics ventures.

Market Opportunities

Development of Dedicated Drone Corridors and Unmanned Traffic Management Systems

The global market presents significant opportunities as governments and private organizations invest in dedicated drone corridors and unmanned traffic management (UTM) systems. These developments aim to ensure the safe and efficient integration of drones into crowded airspaces, particularly for commercial and logistical operations.

- For instance, in June 2025, the Virginia Tech Mid-Atlantic Aviation Partnership (MAAP), in collaboration with NASA and the Federal Aviation Administration (FAA), operationalized the first UTM system in North Texas, enabling real-time monitoring and coordination of drone traffic.

- Similarly, in July 2025, the University of Michigan introduced a dedicated air mobility corridor equipped with a UTM system to support beyond-visual-line-of-sight (BVLOS) operations and swarm testing for electric vertical takeoff and landing (eVTOL) aircraft.

These initiatives highlight the growing infrastructure and regulatory support that will accelerate cargo drone adoption worldwide.

Regional Analysis

North America’s cargo drone market is dominant with a market share of over 45%, driven by the rapid adoption of autonomous delivery solutions, the expansion of e-commerce, and the integration of drones into logistics networks. Advanced regulatory frameworks, extensive drone testing facilities, and collaboration between tech startups and established aerospace firms support innovation. Companies are focusing on hybrid and fully autonomous drones, longer flight ranges, and higher payload capacities. Increasing investments in AI navigation, collision avoidance, and real-time tracking systems further strengthen operational efficiency, establishing North America as a global leader in the market.

- The United States market is growing with companies such as Wing (Alphabet), UPS Flight Forward, and Zipline developing autonomous and semi-autonomous drones for parcel and medical deliveries. Partnerships with retailers, hospitals, and logistics firms enhance operational testing and adoption, while R&D efforts aim at efficiency, reliability, and compliance with evolving FAA regulations.

- Canada’s market is expanding with firms like Drone Delivery Canada, Aeryon Labs, and Bell Textron focusing on hybrid drones, heavy payload transport, and AI-based routing. Investments target infrastructure development, weather-resilient designs, and collaboration with logistics companies. Moreover, government support for drone trials and technology integration is enhancing readiness and regional adoption.

Asia-Pacific Market Trends

The Asia-Pacific cargo drone market is the fastest-growing, with a CAGR of 37.87%, driven by rising e-commerce penetration, urban logistics demands, and government-backed drone initiatives. Investments in autonomous systems, high-capacity drones, and advanced battery technologies accelerate adoption. Companies are exploring hybrid propulsion, AI-enabled navigation, and networked operations for smart city deliveries. Expanding infrastructure, regulatory support, and partnerships with global tech providers further enhance operational deployment. As per Straits Research, the regional growth is supported by rising demand in remote deliveries, medical supply transport, and industrial logistics.

- China’s market is expanding with companies like DJI, EHang, and SF Express developing fully autonomous drones for commercial and industrial deliveries. Focus areas include high payload capacity, extended flight range, and AI-driven route optimization. Collaborations with e-commerce giants and logistics providers enhance network deployment, while R&D efforts prioritize safety and operational efficiency.

- India’s market is growing with firms such as Garuda Aerospace, IdeaForge, and Throttle Aerospace innovating autonomous and hybrid drones for medical, e-commerce, and industrial logistics. In addition, partnerships with healthcare and retail sectors strengthen adoption, while domestic R&D efforts enhance navigation, reliability, and operational scalability.

Source: Straits Research

Europe Market Trends

Europe’s cargo drone market is growing steadily, driven by urban delivery initiatives, logistics modernization, and government-backed drone pilot programs. Increasing investments in hybrid and fully autonomous drones, long-range capabilities, and smart navigation systems support commercial and industrial applications. Moreover, collaborative programs between aerospace companies, logistics providers, and regulatory authorities strengthen innovation while ensuring compliance with EU aviation and safety regulations, enabling Europe to emerge as a competitive market in cargo drone technology.

- Germany’s market is advancing with companies like Volocopter, Wingcopter, and DHL Innovation Center focusing on autonomous aerial deliveries and hybrid drones. Investments include urban logistics integration, precision navigation, and payload optimization, while partnerships with e-commerce and healthcare providers accelerate deployment and operational scalability.

Latin America Market Trends

The Latin America cargo drone market is steadily expanding, driven by the rapid growth of e-commerce, the need for connectivity in remote areas, and ongoing logistics modernization. Both governments and private players are investing in drone infrastructure, AI-assisted flight planning, and advanced fleet management systems to enhance operational efficiency. Moreover, initiatives with international technology providers and regional logistics firms, combined with increasing regulatory support and autonomous flight pilot programs, are accelerating adoption and positioning Latin America as a high-potential market.

- Brazil’s market is growing with companies like EmbraerX, XMobots, and Altave Aero focusing on autonomous drone networks, medical supply deliveries, and industrial logistics solutions. Efforts include route optimization, payload efficiency, and regulatory compliance for commercial and rural applications.

The Middle East and Africa Market Trends

The Middle East and Africa cargo drone market is expanding steadily, driven by logistics modernization, healthcare delivery needs, and infrastructure challenges in remote areas. Investments focus on autonomous navigation, hybrid propulsion systems, and long-range drones suitable for harsh climates. Moreover, growth is further fueled by initiatives to reduce delivery times, enhance operational safety, and deploy drones for industrial, commercial, and humanitarian applications, strengthening the region’s role in the cargo drone landscape.

- The UAE market is evolving with companies like FalconViz, Skyports, and Emirates Drone Center focusing on autonomous delivery, fleet optimization, and hybrid drone development. Investments prioritize route efficiency, payload capacity, and integration with urban logistics networks, supporting rapid adoption across commercial and industrial sectors.

Type Insights

Fixed-wing cargo drones dominate with over 50% market share, valued for extended range, energy efficiency, and payload capacity. Their aerodynamic design supports long-duration flights, making them ideal for commercial logistics and industrial applications. Widespread adoption across e-commerce and transport sectors, combined with robust manufacturing and operational reliability, reinforces their dominance, ensuring steady revenue growth and maintaining fixed-wing drones as the backbone of global cargo drone operations.

Hybrid drones are the fastest-growing segment, expanding at a CAGR of 37.55%. Combining vertical takeoff capabilities of rotary drones with efficient forward flight of fixed-wing designs, they address both range and versatility needs. Rapid adoption in commercial delivery and specialized industrial operations, particularly in North America and the Asia-Pacific, is driving growth. Moreover, increasing demand for adaptable cargo solutions ensures that hybrid drones steadily capture a higher market share globally.

Automation Level Insights

Semi-autonomous dominates with over 45% market share, balancing human oversight and automated operations. These drones are widely deployed in logistics, construction, and delivery applications, providing reliability and operational safety. Integration with existing navigation systems and moderate regulatory approval make semi-autonomous drones the preferred choice. Their adoption across commercial and government sectors reinforces dominance, sustaining continuous growth and ensuring steady demand worldwide.

Fully autonomous is the fastest-growing segment, growing at a CAGR of 38.85%. Advanced AI, navigation algorithms, and obstacle detection enable independent operation, reducing human intervention. Adoption is strongest in e-commerce, healthcare logistics, and military applications in North America and Europe. Rising investment in drone autonomy and regulatory frameworks supporting automated operations drives rapid market share expansion, positioning fully autonomous drones as the future of cargo transport.

Source: Straits Research

Range Insights

Medium-range cargo drones dominate with over 40% market share, offering an optimal balance of distance, payload, and efficiency. Widely used in regional delivery, logistics hubs, and industrial supply chains, these drones meet operational and cost requirements effectively. Their versatility across commercial and governmental sectors ensures steady adoption, establishing medium-range drones as the standard choice for most cargo operations worldwide, maintaining sustained market dominance.

Long-range cargo drones are growing fastest at a CAGR of 36.95%, meeting increasing demand for extended delivery and remote area logistics. Capable of high payload efficiency over long distances, they are gaining adoption in e-commerce, healthcare, and defense. Rapid development in North America and Asia-Pacific, combined with improved energy systems and navigation technologies, drives growth and steadily increases their market share in strategic cargo transport solutions.

Payload Capacity Insights

Lightweight drones dominate with over 45% market share, providing ideal payload capacity for small- to medium-sized deliveries. Their efficiency, lower operational costs, and compatibility with most commercial logistics applications make them widely adopted. E-commerce and industrial users rely on lightweight drones for reliable, fast, and cost-effective transportation. Strong operational flexibility ensures this segment maintains a dominant position across global cargo drone markets consistently.

Heavy-lift cargo drones are the fastest-growing segment, expanding at a CAGR of 35.80%. Designed for industrial, humanitarian, and defense logistics, they transport large volumes over medium and long ranges. Rapid adoption is strongest in North America and Asia-Pacific, where large-scale deliveries and specialized operations drive demand. As per Straits Research, advancements in propulsion, battery efficiency, and structural design are steadily boosting market share for heavy-lift drones globally.

Component Insights

Sensors dominate with over 35% market share, crucial for navigation, obstacle detection, and flight stability. Integration with GPS, LiDAR, and imaging technologies enhances safety, accuracy, and operational reliability across cargo drone fleets. High adoption in e-commerce, healthcare, and industrial sectors maintains dominance. Continuous technological improvements and regulatory compliance reinforce sensors as the essential component ensuring efficient cargo drone operations worldwide.

Delivery package systems are the fastest-growing segment, growing at a CAGR of 39.14%. Innovation in modular payload compartments, secure transport mechanisms, and smart release systems enhances delivery efficiency. Strong growth is seen in North America and Europe due to rapid e-commerce adoption. Moreover, increasing demand for reliable, automated cargo drop solutions is steadily increasing market share, making delivery packages a critical focus area for next-generation cargo drone development.

Application Insights

Commercial cargo applications dominate with over 55% market share, driven by e-commerce, retail logistics, and supply chain optimization. Drones efficiently transport packages, reduce delivery times, and enhance operational flexibility. Adoption across warehouses, regional hubs, and urban centers ensures a strong market presence. Moreover, commercial cargo remains the primary revenue driver, reinforcing global dominance and sustaining consistent investments in drone infrastructure and technological upgrades.

Military cargo applications are the fastest-growing segment, expanding at a CAGR of 35.19%. Drones are increasingly deployed for equipment transport, medical evacuation, and tactical logistics in defense operations. Growth is strongest in North America and Asia-Pacific, where modernization and unmanned logistics initiatives are prioritized. Moreover, the rising adoption of rapid, reliable, and flexible battlefield supply solutions steadily increases market share in military cargo operations worldwide.

End User Industry Insights

E-commerce dominates with over 50% market share, leveraging drones for last-mile deliveries, speed optimization, and operational cost reduction. Rapid growth in online retail and demand for faster deliveries reinforce adoption. Integration with warehouses and logistics networks ensures high reliability. Moreover, e-commerce companies worldwide continue to expand drone fleets, solidifying their dominance in the cargo drone end-user market and driving technological innovation across the industry.

The healthcare segment is the fastest-growing end-user segment, growing at a CAGR of 36.93%. Drones transport medical supplies, vaccines, and emergency equipment to remote or urban areas efficiently. Adoption is particularly strong in Asia-Pacific and North America, where time-critical delivery systems are prioritized. Rising focus on life-saving logistics and emergency preparedness steadily boosts market share, positioning healthcare as a key growth driver in the cargo drone industry.

Competitive Landscape

Leading companies are focusing on developing advanced autonomous delivery systems, expanding payload capacities, and enhancing battery efficiency to extend flight range. Efforts are also being directed toward integrating sophisticated navigation and collision-avoidance technologies, streamlining logistics software, and establishing partnerships for regulatory compliance and airspace management. These initiatives aim to improve delivery speed, reliability, and scalability, positioning cargo drones as a viable solution for commercial and industrial logistics worldwide.

Zipline

Zipline is an American drone delivery company founded in 2014 by Keller Rinaudo Cliffton, Keenan Wyrobek, Ryan Oksenhorn, and William Hetzler. Headquartered in South San Francisco, California, Zipline specializes in autonomous logistics, focusing on the rapid delivery of medical supplies. Since its inception, Zipline has expanded operations across multiple countries, including Rwanda, Ghana, Japan, Kenya, Nigeria, and Côte d'Ivoire.

- In August 2025, Zipline partnered with Chipotle to launch "Zipotle," a drone delivery service in Rowlett, Texas. This service allows customers to receive their orders via Zipline's quiet, zero-emission drones, marking a significant step in integrating drone technology into everyday retail logistics.

List of Key and Emerging Players in Cargo Drone Market

- DJI

- Elroy Air

- Dronamics

- Sabrewing Aircraft Company

- Natilus

- Silent Arrow

- Wing (Alphabet)

- Amazon Prime Air

- Zipline

- UPS Flight Forward

- Matternet

- Joby Aviation

- AeroVironment

- Skydrive

- MightyFly

- Skyports Infrastructure

- Raphe mPhibr

- Draganfly

- Aergility

- BAE Systems

Strategic Initiatives

- October 2025 - Lockheed Martin unveiled the S-70UAS U-Hawk, an uncrewed version of the UH-60 Black Hawk helicopter. Designed for autonomous logistics and combat missions, it boasts a 25% increase in cargo capacity and can carry over 33 tonnes of supplies, vehicles, or weaponry.

- October 2025 - German energy company RWE successfully pioneered cargo drone operations at offshore wind farms. Collaborating with Skyways Drone Services and Skyports, RWE conducted trials that demonstrated how drones can make offshore logistics faster, safer, and more sustainable.

- October 2025 - Indian drone startup BonV Aero achieved the country's first 60km Beyond Visual Line of Sight (BVLOS) drone mission with a 20 kg payload and 75 minutes of flight time. This milestone marks a significant advancement in India's drone logistics capabilities.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.05 Billion |

| Market Size in 2026 | USD 2.74 Billion |

| Market Size in 2034 | USD 29.38 Billion |

| CAGR | 34.55% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Automation Level, By Range, By Payload Capacity, By Component, By Application, By End User Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Cargo Drone Market Segments

By Type

- Fixed Wing

- Hybrid

- Rotary Wing

By Automation Level

- Fully Autonomous

- Semi-Autonomous

- Remotely Controlled

By Range

- Very Short (up to 45km)

- Short (45km to 150km)

- Medium (150km to 550km)

- Long (Above 550 km)

By Payload Capacity

- Featherweight (0.004 to 5 kg)

- Lightweight (5-45kg)

- Middleweight (45-150 kg)

- Heavy-lift (150 kg & above)

By Component

- Camera

- Sensors

- Equipment

- Delivery Packages

- Others

By Application

- Commercial Cargo

- Military Cargo

By End User Industry

- E-Commerce

- Construction

- Government and Defense Organization

- Healthcare

- Offshore and Energy

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.