Casein and Derivatives Market Size, Share & Trends Analysis Report By Product Type (Acid Casein, Rennet Casein, Caseinates), By Form (Powder, Granules), By Application (Food and Beverages, Dairy Products, Bakery and Confectionery, Nutritional and Functional Foods, Sports and Clinical Nutrition, Pharmaceuticals, Industrial Applications, Adhesives, Coatings and Paper, Others (Cosmetics, Animal Nutrition)), By Distribution Channel (Direct Sales (B2B Contracts), Distributors and Ingredient Traders, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Casein and Derivatives Market Overview

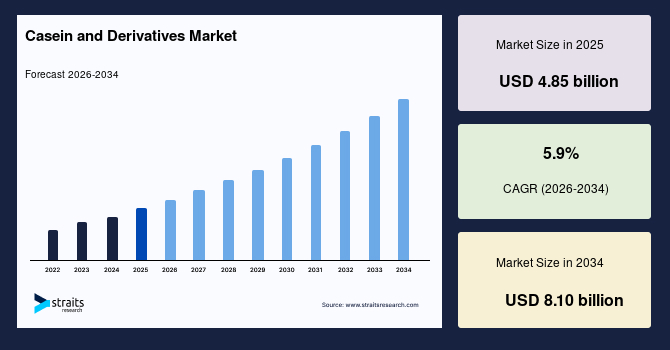

The global casein & derivatives market size is valued at USD 4.85 billion in 2025 and is projected to reach USD 8.10 billion by 2034, expanding at a CAGR of 5.9% during the forecast period. The market growth is supported by rising demand for high-protein nutrition, growing food processing and pharmaceutical applications, and increasing use of functional dairy proteins in clean-label, medical, and performance-oriented products.

Key Market Trends & Insights

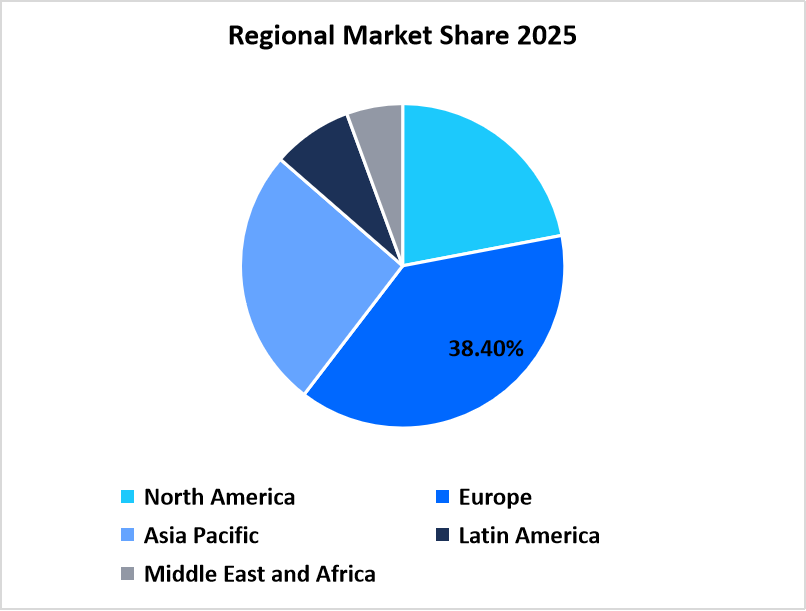

- Europe dominated the market with a revenue share of 38.4% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 7.1% during the forecast period.

- Based on Product Type, the Caseinates segment held the highest market share of 48.3% in 2025.

- By Form, the Granules segment is estimated to register the fastest CAGR growth of 6.4%.

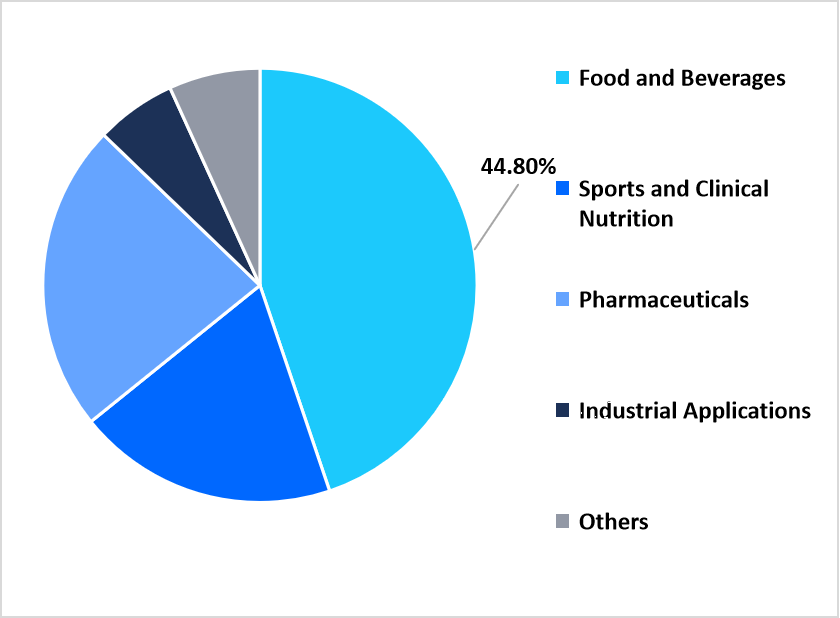

- Based on Application, the food and beveragescategory dominated the market in 2025 with a revenue share of 44.80%.

- Based on Distribution Channel, the Distributors and ingredient traderssegment is projected to register the fastest CAGR of 6.6% during the forecast period.

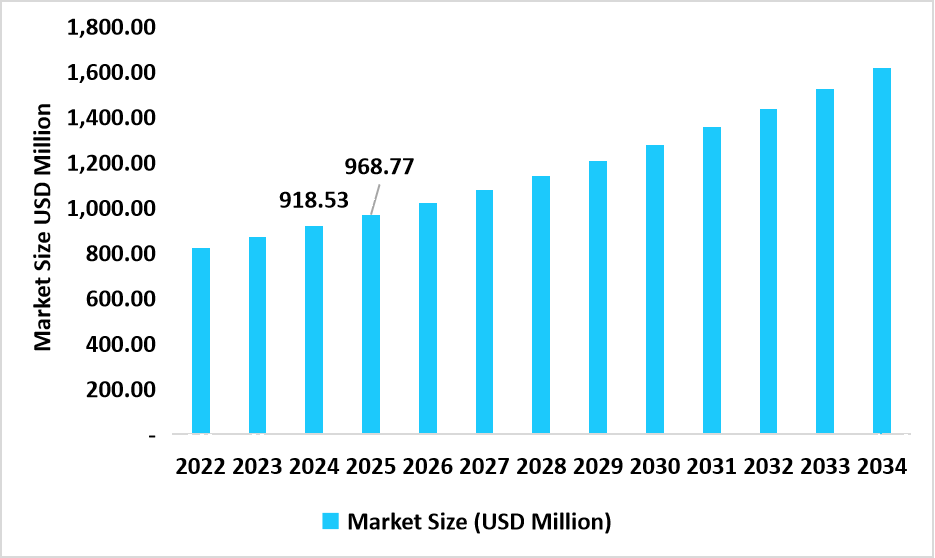

- France dominates the market, valued at USD 918.53 million in 2024 and reaching USD 968.77 million in 2025.

France Casein & Derivatives Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 4.85 billion

- 2034 Projected Market Size: USD 8.10 billion

- CAGR (2026-2034): 5.9%

- Dominating Region: Europe

- Fastest-Growing Region: Asia Pacific

The global casein & derivatives market encompasses milk-derived proteins, including acid casein, rennet casein, and caseinates (sodium, calcium, and potassium), supplied in powder or granular forms. These products are widely used due to their slow-digesting protein profile, excellent emulsification properties, binding capabilities, and nutritional value. The market growth is driven by rising protein consumption, innovation in functional nutrition, increasing industrial utilisation, and the expansion of organised dairy processing and global distribution networks.

Latest Market Trends

Rising Demand for Functional and Medical Nutrition Proteins

The use of casein and its derivatives is increasing in functional, sports, and medical nutrition as greater emphasis is placed on protein quality and sustained nutrient delivery. Casein digests slowly, making it suitable for meal replacements, clinical nutrition, elderly diets, and products that support muscle maintenance and metabolic health. Manufacturers increasingly position casein as a functional, science-based ingredient rather than a basic dairy input. Its use in high-protein foods also improves texture and stability without compromising taste, supporting its growing role in value-added nutrition applications.

Clean-Label and Reformulation in Food Processing

Clean-label reformulation is reshaping demand for casein and caseinates in the food manufacturing industry. As consumers and regulators scrutinise ingredient lists, manufacturers seek functional ingredients that are familiar and minimally processed. Caseinates provide natural emulsification, binding, and foaming properties, reducing the need for synthetic additives. Dairy-derived proteins are widely perceived as safe and label-friendly, making them suitable for clean-label formulations. This trend is particularly strong in processed foods such as bakery, confectionery, and ready-to-eat products.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 4.85 billion |

| Estimated 2026 Value | USD 5.12 billion |

| Projected 2034 Value | USD 8.10 billion |

| CAGR (2026-2034) | 5.9% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Arla Foods Ingredients, Lactalis Ingredients, FrieslandCampina Ingredients, Fonterra Co-operative Group, Kerry Group |

to learn more about this report Download Free Sample Report

Market Drivers

Growth in High-Protein Diets and Performance Nutrition

The rising popularity of high-protein diets continues to drive demand for casein across sports, lifestyle, and medical nutrition segments. Protein is increasingly associated with muscle health, weight management, and overall wellness, expanding consumption beyond athletes to general and ageing populations. Casein’s slow amino acid release differentiates it from faster-digesting proteins, making it suitable for sustained nutrition and recovery-focused products. As protein intake becomes a regular dietary priority, the role of casein within diversified protein formulations supports steady and recurring market demand.

Expanding Industrial and Pharmaceutical Applications

Casein and its derivatives are widely used beyond food and nutrition, supporting demand from pharmaceutical and industrial sectors. In pharmaceuticals, casein serves as a binder, stabiliser, and carrier for active ingredients due to its compatibility and safety profile. Industrial applications include biodegradable adhesives, coatings, and speciality paper processing. Growth in pharmaceutical manufacturing and interest in bio-based industrial materials continue to support these uses. The diversity of applications reduces dependence on a single end-use sector, providing structural stability to overall market growth.

Market Restraint

Volatility in Raw Milk Supply and Pricing

Casein production relies heavily on the availability of raw milk, which is subject to fluctuations caused by weather conditions, feed costs, and changes in dairy policy. Variability in milk supply directly affects production costs and pricing stability for casein manufacturers. This volatility complicates long-term supply contracts and margin planning, particularly for food-grade applications. Smaller buyers and price-sensitive manufacturers may hesitate to adopt or expand casein-based formulations due to cost uncertainty. As a result, raw material volatility remains a key factor that can moderate market growth.

Market Opportunity

Growth in Emerging Markets and Organised Dairy Processing

Emerging markets offer strong growth potential as dairy processing infrastructure improves and protein consumption rises. Urbanisation, expanding middle-class populations, and enhanced cold-chain logistics support the increased use of functional dairy ingredients in packaged foods and nutritional products. As food systems become more organised, demand grows for reliable and standardised protein inputs such as casein. Expansion into these regions enables suppliers to diversify their revenue sources and reduce their reliance on mature markets. An increasing focus on nutrition, food fortification, and the development of processed foods in developing economies supports long-term growth.

Regional Analysis

Europe dominated the market in 2025, accounting for 38.40% market share, supported by its strong dairy-processing base, advanced food manufacturing sector, and long-established use of milk proteins in food and industrial applications. The region benefits from a well-developed dairy supply chain, strict quality standards, and high per-capita consumption of protein-enriched foods. Casein and caseinates are widely used in cheese production, bakery, nutritional foods, and pharmaceuticals across Western and Northern Europe. In addition, demand for clean-label, natural, and functional ingredients supports stable adoption.

- France is a leading contributor to Europe’s market due to its strong dairy heritage, advanced cheese-making industry, and large-scale milk processing capacity. French manufacturers extensively use casein and rennet casein in traditional and speciality cheese production, supporting consistent demand. The country also shows growing use of caseinates in nutritional foods and medical nutrition, driven by ageing demographics and health-focused consumption.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 7.1% from 2026-2034, driven by rapid urbanisation, rising disposable incomes, and expanding food-processing industries. The region’s growing middle class increasingly consumes protein-fortified foods, dairy-based beverages, and nutritional supplements. Casein and caseinates are gaining traction as functional ingredients in bakery, confectionery, and sports nutrition products. Additionally, investments in domestic dairy processing and improved cold-chain infrastructure facilitate the broader adoption of these products.

- China is the principal market in the Asia Pacific due to rising demand for high-protein foods, infant nutrition, and clinical nutrition products. The expansion of urban populations and increasing health awareness are driving manufacturers to incorporate caseinates into functional foods and supplements. Strong e-commerce penetration and growing demand for Western-style nutrition products further accelerate market growth.

Source: Straits Research

North America Market Insights

North America represents a high-value and technologically advanced market for casein & derivatives. The region benefits from strong demand in sports nutrition, medical nutrition, and processed foods. Consumers show high awareness of protein quality, supporting the use of slow-digesting casein in supplements and functional beverages. Well-established dairy infrastructure and large-scale food manufacturers ensure a stable supply of raw materials and consistent demand. Innovation in nutritional formulations and clinical applications sustains market growth.

- The U.S. dominates the North American market due to its large sports nutrition industry, advanced pharmaceutical sector, and strong processed food manufacturing base. Caseinates are widely used in protein powders, meal replacements, and medical nutrition products. Growing interest in muscle recovery, ageing health, and weight management supports long-term demand. The presence of large ingredient manufacturers and contract-based sourcing further strengthens market stability.

Latin America Casein & Derivatives Market Insights

Latin America exhibits steady growth potential, supported by rising dairy consumption, gradual industrialisation of food processing, and an increasing use of milk proteins in bakery and confectionery products. Countries with strong dairy sectors are adopting caseinates to improve product consistency and nutritional value. While price sensitivity remains a constraint, improving retail infrastructure and expanding middle-class consumption support demand.

- Brazil leads the Latin American market due to its large dairy herd, growing food-processing sector, and expanding demand for protein-enriched foods. Urbanisation and rising health awareness are driving the consumption of fortified foods, thereby supporting demand for these ingredients. Brazil’s improving logistics and investment in food manufacturing further strengthen its position as the regional leader.

Middle East and Africa Market Insights

The Middle East & Africa (MEA) is a strategically important region. Food security initiatives, the expansion of food-processing capacity, and the rising consumption of nutritional and fortified foods in urban centres drive demand. Gulf countries exhibit a strong demand for imported casein derivatives, which are used in dairy alternatives, dietary beverages, and medical nutrition. In Africa, adoption remains uneven but is gradually increasing in commercial food manufacturing hubs.

- The UAE is the leading market in MEA due to its advanced food-processing sector, high reliance on imported ingredients, and strong demand for premium nutrition products. High per-capita income, strong retail infrastructure, and a growing fitness-oriented population support demand. The UAE also serves as a regional distribution hub, reinforcing its strategic importance within the MEA market.

Product Type Insights

Caseinates dominated the market with a revenue share of 48.3% in 2025, due to their superior solubility, emulsification, and binding properties. Sodium and calcium caseinate are widely used across food processing, sports nutrition, and pharmaceutical formulations, where functional performance and consistency are critical. Their versatility enables manufacturers to utilise a single ingredient across multiple applications, thereby improving cost efficiency, supported by steady adoption in processed foods and nutrition products.

Rennet casein is the fastest-growing product type, expanding at an estimated CAGR of 6.7% during the forecast period. Growth is driven by strong demand in cheese production and specialised nutritional applications where an intact protein structure is required. Rennet casein offers excellent curd formation and functional stability, making it essential for premium cheese varieties and high-protein formulations. Increasing consumption of natural and artisanal cheeses, particularly in Europe and emerging urban markets, supports growth.

Form Insights

Powdered casein and its derivatives are expected to dominate the market with a majority share in 2025, as powders offer superior shelf life, ease of transportation, and compatibility with industrial processing systems. The powder form enables precise dosing and facilitates easy blending into food, nutritional, and pharmaceutical formulations. Most large-scale manufacturers prefer powders due to their cost efficiency and standardised production.

Food and beverage products are growing at a faster rate, with a projected CAGR of 6.4%, driven by their use in specialised industrial and pharmaceutical applications where controlled dissolution is required. Granules reduce dust formation and handling losses, improving safety and processing efficiency. The increasing demand for industrial automation and quality control is driving faster adoption.

By Application Market Share (%), 2025

Source: Straits Research

Application Insights

The food and beverages segment holds the largest share of the casein & derivatives market, accounting for approximately 44.8% of total revenue in 2025. Casein and caseinates are extensively used in dairy products, bakery, confectionery, and fortified foods due to their emulsifying, thickening, and nutritional properties. Manufacturers value these ingredients for their ability to improve texture, stability, and protein content without altering flavour. The rising demand for high-protein and clean-label foods further strengthens the adoption of these products. The segment benefits from large-scale, recurring demand from food processors.

Sports and clinical nutrition is the fastest-growing application segment, projected to expand at a CAGR of 7.2%. Growth is supported by increasing awareness of protein timing, muscle recovery, and nutritional needs among ageing populations. Casein’s slow-digesting profile makes it ideal for sustained protein delivery in supplements and clinical formulas. Demand extends beyond athletes to lifestyle consumers and healthcare settings.

Distribution Channel Insights

Direct sales dominate the distribution landscape, accounting for roughly 62–64% of market revenue in 2025. Large food, nutrition, and pharmaceutical manufacturers prefer long-term supply contracts to ensure quality consistency, pricing stability, and regulatory compliance. Direct relationships also allow suppliers to offer customised grades and technical support.

Distributors and ingredient traders represent the fastest-growing channel, expanding at a CAGR of 6.6%. Growth is driven by rising demand from small and mid-sized manufacturers in emerging markets that lack direct sourcing capabilities. Distributors enhance market access, simplify logistics, and facilitate regional penetration.

Competitive Landscape

The casein and derivatives market is moderately consolidated, characterised by a mix of legacy dairy cooperatives, diversified ingredient manufacturers, and specialised protein suppliers. Established players dominate the market through their control over milk sourcing, large-scale processing capacity, and strong R&D capabilities, which enable consistent quality and functional customisation of casein and caseinates. These companies benefit from long-standing relationships with food, nutrition, and pharmaceutical manufacturers, which reinforces their pricing power and supply reliability. Mid-tier producers and newer entrants compete by focusing on value-added derivatives, clean-label positioning, sustainability credentials, and tailored solutions for sports and medical nutrition.

Arla Foods Ingredients: A Heritage Innovator

Arla Foods Ingredients operates as a specialised division of a global dairy cooperative and has a long-standing presence in the casein and milk-protein ingredient market. The company has built its position through strong upstream milk sourcing, advanced protein fractionation technologies, and continuous investment in application-focused innovation. Its caseinates and functional milk proteins are widely used in infant nutrition, medical nutrition, sports supplements, and processed foods.

Latest News:

- In April 2025, Arla Foods Ingredients launched Lacprodan MicelPure Medical, a new micellar casein isolate (MCI) with an adjusted mineral profile and higher microbiological grade.

List of Key and Emerging Players in Casein and Derivatives Market

- Arla Foods Ingredients

- Lactalis Ingredients

- FrieslandCampina Ingredients

- Fonterra Co-operative Group

- Kerry Group

- Glanbia Nutritionals

- Royal A-ware Food Group

- Saputo Ingredients

- Lactoprot Deutschland

- Armor Protéines

- Erie Foods International

- Hilmar Cheese Company

- AMCO Proteins

- Milk Specialities Global

- Hoogwegt Group

- Ingredia S.A.

- Lactalis USA

- Euroserum

- Meggle Group

- Morinaga Milk Industry (ingredients division)

- Tatua Co-operative Dairy Company

- DMV International (IFF Nutrition & Biosciences)

Strategic Initiatives

- December 2025 - FrieslandCampina Ingredients announced the intention to acquire Wisconsin Whey Protein in the United States. This acquisition will more than double the company's whey protein isolate capacity in North America.

- October 2025 - FrieslandCampina Ingredients heavily promoted its Excellion Caseinates at SupplySide Global, focusing on its utility for slow, sustained amino acid release, specifically targeting overnight recovery and the growing market for GLP-1 companion products.

- March 2025 - Arla Foods Ingredients signed a contract manufacturing agreement with Valley Queen (South Dakota, USA) to produce high-demand protein ingredients, strengthening its foothold and ability to serve the growing North American dairy protein market locally.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 4.85 billion |

| Market Size in 2026 | USD 5.12 billion |

| Market Size in 2034 | USD 8.10 billion |

| CAGR | 5.9% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Form, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Casein and Derivatives Market Segments

By Product Type

- Acid Casein

- Rennet Casein

-

Caseinates

- Sodium Caseinate

- Calcium Caseinate

- Potassium Caseinate

By Form

- Powder

- Granules

By Application

- Food and Beverages

- Dairy Products

- Bakery and Confectionery

- Nutritional and Functional Foods

- Sports and Clinical Nutrition

- Pharmaceuticals

- Industrial Applications

- Adhesives

- Coatings and Paper

- Others (Cosmetics, Animal Nutrition)

By Distribution Channel

- Direct Sales (B2B Contracts)

- Distributors and Ingredient Traders

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.