Cell Culture Vessels Market Size, Share & Trends Analysis Report By Product (Bags, 3D Bags, Flasks, Plates, Bottles, Dishes), By Type (Reusable, Single-use), By End Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, CMOs & CROs) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Cell Culture Vessels Market Overview

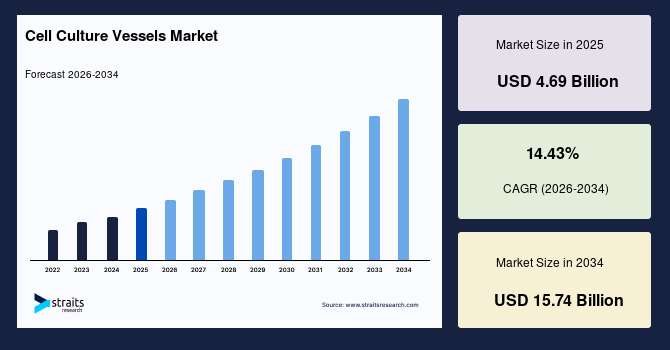

The global cell culture vessels market size is valued at USD 4.69 billion in 2025 and is estimated to reach USD 15.74 billion by 2034, growing at a CAGR of 14.43% during the forecast period. The consistent market growth is supported by expanding adoption of cell-based manufacturing workflows and rising utilization of scalable culture vessels across biologics, vaccines, and cell therapy development programs.

Key Market Trends & Insights

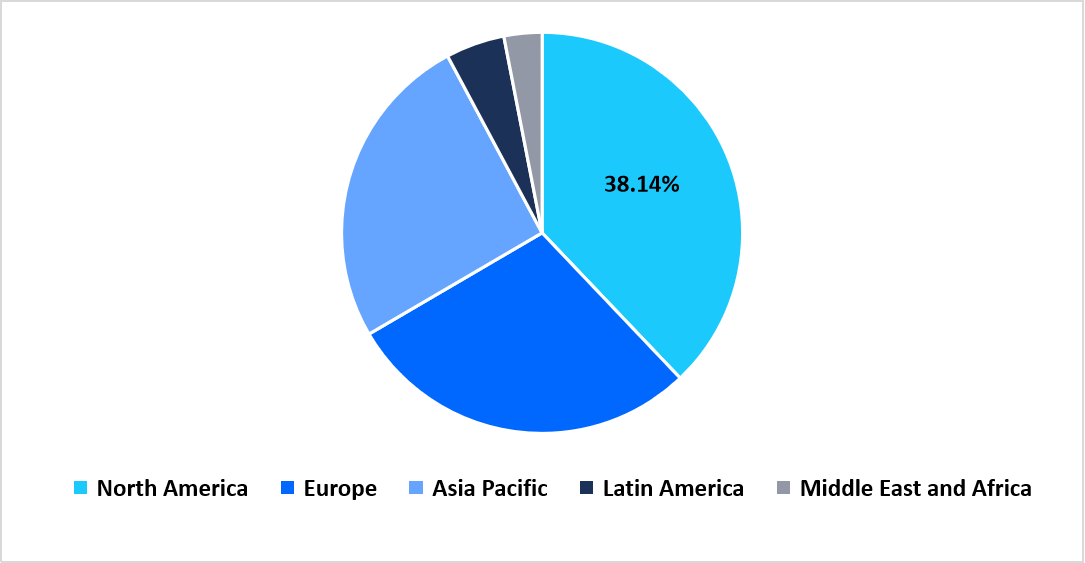

- North America held a dominant share of the global market, accounting for 38.14% in 2025.

- The Asia Pacific region is projected to grow at the fastest pace, with a CAGR of 16.43%.

- Based on product, the bags segment dominated the cell culture vessels market with a revenue share of 41.21%.

- Based on type, the reusable segment is anticipated to register the fastest CAGR of 15.89% during the forecast period.

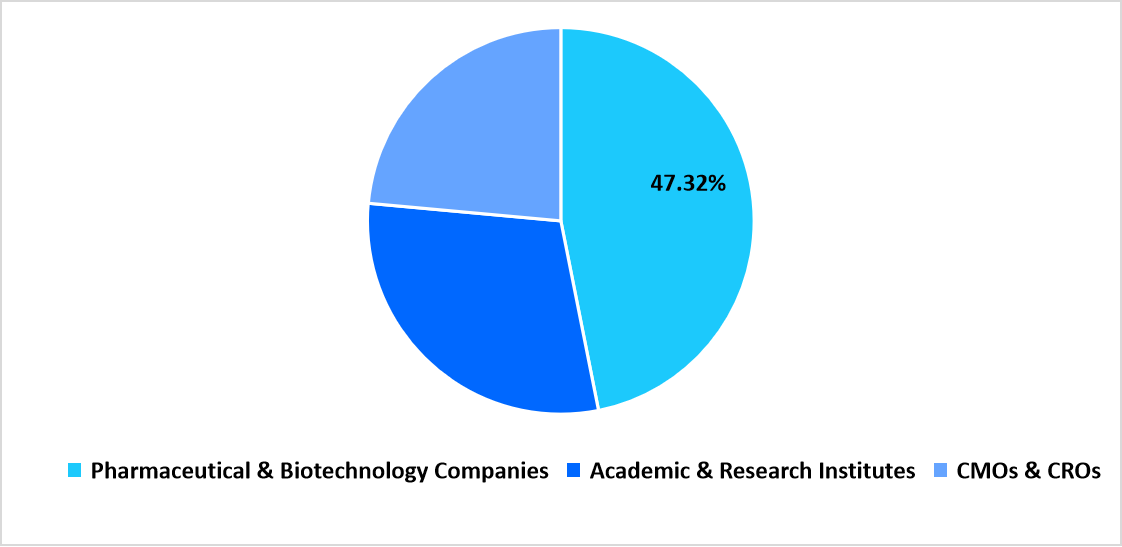

- Based on end use, the pharmaceutical and biotechnology companies segment dominated the market with a revenue share of 47.32%.

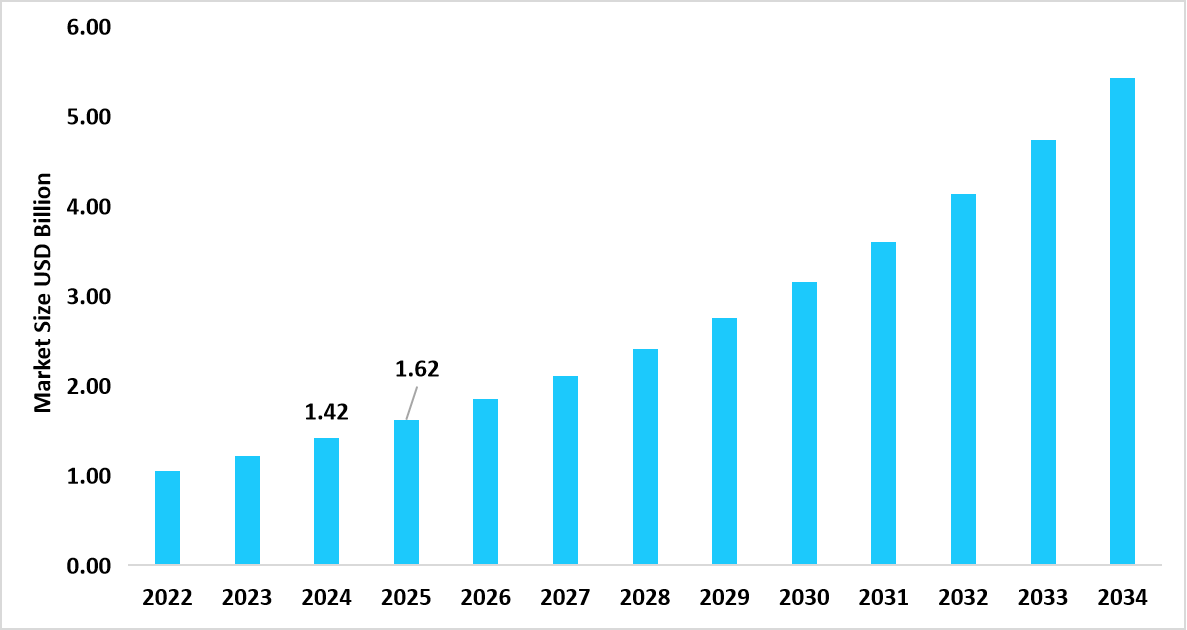

- The U.S. dominates the cell culture vessels market, valued at USD 1.42 billion in 2024 and reaching USD 1.62 billion in 2025.

Table: U.S. Cell Culture Vessels Market Size (USD Billion)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 4.69 billion

- 2034 Projected Market Size: USD 15.74 billion

- CAGR (2026-2034): 14.43%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The cell culture vessels market encompasses a wide range of laboratory containers designed to support the growth, maintenance, and expansion of cells under controlled in vitro conditions across research and biomanufacturing environments. These vessels include bags, flasks, plates, bottles, dishes, and tubes that accommodate varying culture volumes, formats, and cell types for adherent and suspension-based workflows. Cell culture vessels are used throughout upstream research activities, process development, and production stages to provide controlled environments for nutrient exchange, gas transfer, and contamination management.

The market includes both reusable and single-use vessel formats to address diverse operational preferences and laboratory practices. End users such as pharmaceutical and biotechnology companies, academic and research institutes, and CMOs and CROs utilize cell culture vessels for applications spanning basic research, drug discovery, biologics development, and cell-based manufacturing, making these products a foundational component of modern life science and bioprocessing infrastructure.

Latest Market Trends

Shift From Reusable Glassware To Disposable Polymer-based Culture Vessels

Cell culture workflows are steadily transitioning from reusable glass and rigid containers toward disposable polymer-based vessels that align with modern laboratory and manufacturing practices. Disposable vessels support streamlined handling, simplified validation, and reduced cleaning-related downtime across research and production environments. This shift reflects growing emphasis on workflow continuity, faster experimental turnover, and alignment with closed system processing strategies adopted in cell-based manufacturing.

Shift From Static Culture Containers To Functionally Engineered Vessel Surfaces

The market is evolving from basic static culture containers toward vessels featuring specialized surface treatments and geometries designed to influence cell attachment, growth behavior, and metabolic activity. Advanced surface chemistries and gas exchange designs enable improved control over cellular microenvironments, supporting higher cell densities and consistent growth patterns. This transition mirrors rising demand for vessels that actively participate in culture-performance rather than serving solely as passive containers.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 4.69 Billion |

| Estimated 2026 Value | USD 5.35 Billion |

| Projected 2034 Value | USD 15.74 Billion |

| CAGR (2026-2034) | 14.43% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | FUJIFILM Irvine Scientific, Thermo Fisher Scientific Inc., Corning Incorporated, Merck KGaA, STEMCELL Technologies |

to learn more about this report Download Free Sample Report

Market Driver

Expansion Of Cell Therapy and Biologics Development Pipelines

Growing investment in cell therapies, vaccines, and recombinant biologics drives sustained demand for diverse cell culture vessels across development stages. Upstream research, process optimization, and scale-up activities require consistent vessel performance across formats, supporting continuous procurement by pharmaceutical and biotechnology organizations engaged in advanced therapeutic development.

Market Restraint

Material Compatibility and Extractables-related Concerns

Use of polymer-based vessels introduces challenges related to leachables, surface stability, and material interactions with sensitive cell types. These concerns increase validation requirements and prolong adoption cycles, particularly in regulated manufacturing environments where material consistency and process assurance influence purchasing decisions.

Market Opportunity

Customization of Vessels For Specialized Cell Types and Workflows

Rising diversification of cell-based research creates an opportunity for tailored vessel designs optimized for stem cells, immune cells, and primary cultures. Custom volume ranges, surface properties, and gas exchange configurations enable alignment with specific experimental objectives, opening avenues for differentiated product development and premium offerings within the cell culture vessels market.

Regional Analysis

North America represents a dominant region in the cell culture vessels market with a market share of 38.14% in 2025, supported by extensive utilization of cell culture flasks, plates, and multilayer vessels across biopharmaceutical manufacturing and academic research laboratories. High concentration of biologics producers and contract manufacturing organizations sustains continuous demand for standardized cultureware supporting cell expansion and process development.

In the U.S., market growth is reinforced by rising deployment of cell culture vessels in monoclonal antibody production and cell therapy research, strengthening the country’s leadership within the regional market.

Asia Pacific Market Insights

Asia Pacific records the fastest growth with a CAGR of 16.43%, driven by the rapid expansion of biomanufacturing facilities and the increasing establishment of research laboratories. Rising focus on vaccine development and biosimilar production accelerates the adoption of disposable and scalable cell culture vessels.

In India, growth is supported by the expansion of pharmaceutical research centers and contract manufacturing activities that integrate cell culture vessels into routine upstream processing workflows.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe maintains steady adoption of cell culture vessels through integration within pharmaceutical research institutes and publicly funded life science programs. Laboratories emphasize controlled cell growth environments, supporting sustained use of standardized cultureware.

In the UK, market expansion is driven by strong biologics research clusters and increasing utilization of scalable cell culture systems in early stage therapeutic research.

Latin America Market Insights

Latin America experiences gradual market development as universities and biotechnology companies expand laboratory capabilities for cell based research. Growing interest in biologics and diagnostic research encourages consistent uptake of cell culture vessels.

In Mexico, adoption is reinforced by strengthening the pharmaceutical research infrastructure and collaboration with international research organizations.

Middle East and Africa Market Insights

The Middle East and Africa region advances through the development of biomedical research facilities and a rising focus on life science education and research. Demand for cell culture vessels is supported by increasing laboratory-based cellular studies.

In Saudi Arabia, market momentum is sustained by national research initiatives and the establishment of modern laboratory environments utilizing standardized cell culture consumables.

Product Insights

Bags dominated the product segment with a share of 41.21%, supported by their widespread use in upstream bioprocessing and large-scale cell expansion activities. High adoption of 2D and 3D bags across biopharmaceutical manufacturing reflects preference for scalable volumes, closed system processing, and compatibility with suspension cell cultures used in biologics and vaccine production.

Flasks are anticipated to register the fastest growth of 15.43%, driven by continuous use of T flasks, spinner flasks, and gas-permeable membrane flasks in laboratory-scale research, cell line development, and routine cell maintenance activities.

Type Insights

Single-use cell culture vessels dominated the type segment, supported by rising preference for disposable cultureware that supports contamination control, operational flexibility, and reduced turnaround time across manufacturing and research workflows. Adoption remains high across biopharmaceutical production and contract manufacturing settings.

Reusable vessels are expected to witness the fastest growth of 15.12%, driven by sustained utilization in academic laboratories and long-term research studies where repeated experimentation and cost management support continued use.

End Use Insights

Pharmaceutical and biotechnology companies led the end-use segment with a share of 47.32%, reflecting extensive utilization of cell culture vessels across drug discovery, process development, biologics manufacturing, and cell-based assay workflows.

CMOs and CROs are anticipated to record the fastest growth of 15.89%, supported by increasing outsourcing of cell culture operations and rising demand for scalable vessel formats aligned with contract research and manufacturing services.

End Use Market share (%) in 2025

Source: Straits Research

Competitive Landscape

The global cell culture vessels market is moderately fragmented, with a combination of established life science manufacturers and specialized laboratory consumables suppliers operating across research, biopharmaceutical manufacturing, and clinical development environments. Market participants compete through the breadth of vessel formats, surface treatment technologies, and compatibility with adherent and suspension cell culture workflows used in upstream processing and laboratory research.

Corning Incorporated: An Emerging Market Player

Corning Incorporated maintains a strong position in the cell culture vessels market through its extensive portfolio of cell culture flasks, plates, multilayer vessels, and surface-treated cultureware designed for mammalian cell growth and expansion. The company supports cell-based research and bioproduction activities across pharmaceutical, biotechnology, and academic laboratories by offering vessels that enable controlled cell attachment, scalable growth, and consistent culture conditions. Corning culture vessels are widely adopted in applications such as cell line development, vaccine production, and biologics manufacturing, where standardized vessel performance supports reproducible experimental outcomes. The company continues to expand its market presence by aligning vessel design with evolving laboratory automation requirements and increased demand for scalable cell expansion systems across research and manufacturing settings.

List of Key and Emerging Players in Cell Culture Vessels Market

- FUJIFILM Irvine Scientific

- Thermo Fisher Scientific Inc.

- Corning Incorporated

- Merck KGaA

- STEMCELL Technologies

- Greiner Bio-One International GmbH

- DH Life Sciences, LLC.

- Sartorius AG

- Wilson Wolf

- DWK Life Sciences.

- Lonza

- Eppendorf SE

- HiMedia Laboratories.

- Others

Strategic Initiatives

-

April 2024: Fujifilm Corporation announced an investment of USD 1.2 billion to expand its cell culture CDMO business and increase its investment in the Fujifilm Diosynth Biotechnologies facility in Holly Springs, North Carolina, to over USD 3.2 billion in total.

- March 2024: Novartis announced an investment of USD 556.26 million each in its Kundl and Schaftenau sites to improve the continuous production of biopharmaceuticals from Austria and support its strategy to expand cell culture technology. Thereby, boosting the demand for cell culture vessels.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 4.69 Billion |

| Market Size in 2026 | USD 5.35 Billion |

| Market Size in 2034 | USD 15.74 Billion |

| CAGR | 14.43% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Type, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Cell Culture Vessels Market Segments

By Product

-

Bags

- 2D Bags

- Up to 10L

- 11L - 100L

- Above 100L

-

3D Bags

- 5L - 100L

- 101L - 500L

- 501L - 1500L

- Above 1500L

-

Flasks

- T-flasks

- Spinner Flasks

- Gas Permeable Membrane Flasks

- Others

-

Plates

- Up to 5 Well

- 6 Well - 15 Well

- 16 Well - 50 Well

- 51 Well - 100 Well

- 101 Well - 500 Well

- Above 500 Well

-

Bottles

- Up to 100 mL

- 101 mL - 500 mL

- 501 mL - 1000 mL

-

Dishes

- 30 mm - 60 mm

- 61 mm - 100 mm

- 101 mm - 150 mm

- Tubes

By Type

- Reusable

- Single-use

By End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- CMOs & CROs

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.