Clinical Trial Logistics Market Size, Share & Trends Analysis Report By Service (Transportation, Warehousing & Distribution, Value-Added Services (Labelling, Kitting, QP Release)), By Clinical Phase (Phase I, Phase II, Phase III, Phase IV / post-marketing), By Therapeutic Area (Oncology, Cardiovascular Diseases, Rare / Orphan Diseases, Immunology & Inflammation, Endocrine & Metabolic Disorders, Neurology & Psychiatry, Others), By End-user (Bio-Pharma Manufacturers, CROs (Contract Research Organizations) & CMOs (Contract Manufacturing Organizations), Hospitals & Clinical-Trial Sites, Other End Users), By Temperature Range (Cold Chain) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Clinical Trial Logistics Market Overview

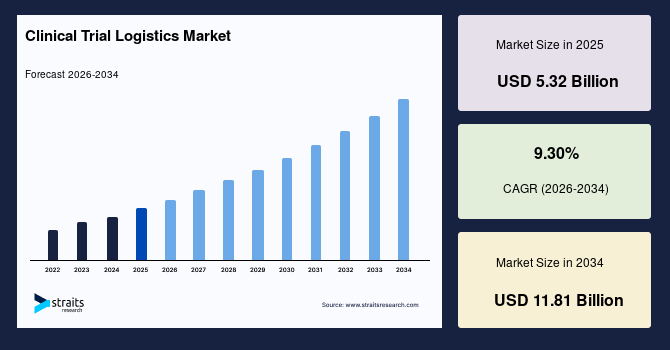

The global clinical trial logistics market size is estimated at USD 5.32 billion in 2025 and is projected to reach USD 11.81 billion by 2034, growing at a CAGR of 9.30% during the forecast period. Remarkable growth of the market is propelled by the multi-region clinical programs that require coordinated distribution networks and controlled transport solutions.

Key Market Trends & Insights

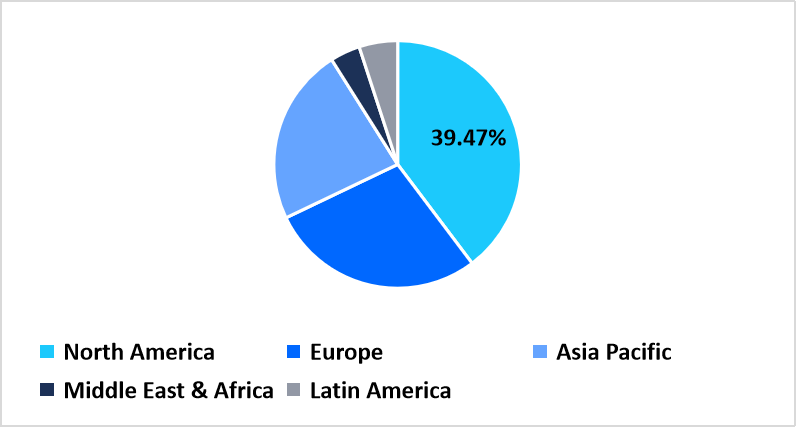

- North America held a dominant share of the global market, accounting for 39.47% share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 11.30%.

- Based on Service, the Transportation segment dominated the market with a share of 70.12%.

- Based on the Clinical Phase, Phase III dominated the segment with a share of 48.73%.

- Based on the Therapeutic area, the Oncology segment dominated the market with a share of 40.12%.

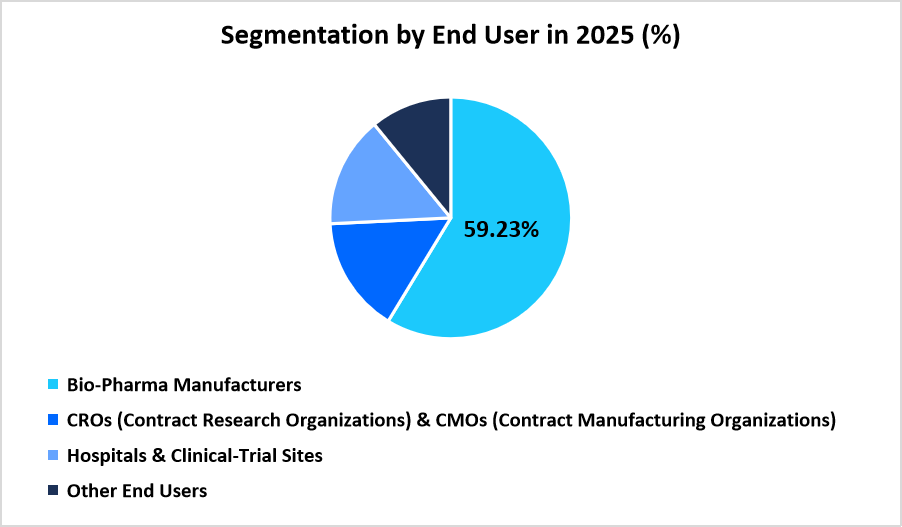

- Based on End-User, Bio-Pharma Manufacturers dominated the market with a share of 59.23%.

- Based on the Temperature range, the Non-Cold Chain segment is the fastest-growing with a projected rate of 10.52% during the forecast period.

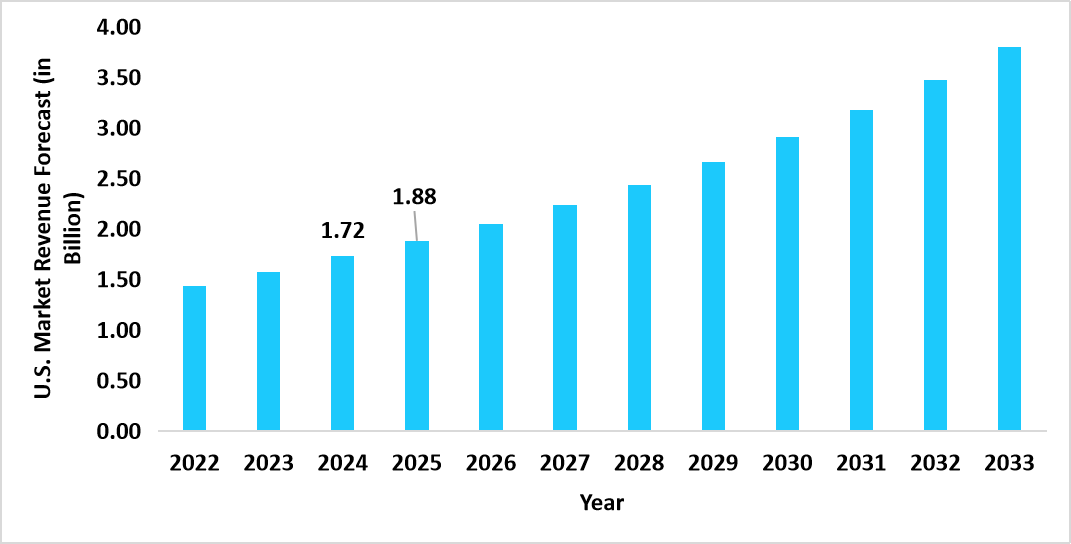

- The U.S. dominates the global clinical trial logistics market, valued at USD 1.72 billion in 2024 and reaching USD 1.88 billion in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 5.32 billion

- 2034 Projected Market Size: USD 11.81 billion

- CAGR (2025 to 2034): 9.30%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The clinical trial logistics market encompasses the systems, processes, and services that support the movement, storage, and preparation of investigational products, clinical supplies, and biological specimens throughout all stages of a clinical study. It includes transportation through road, air, and other distribution routes, warehousing and distribution operations, and value-added activities such as labeling, kitting, and QP release. The market spans logistics requirements across Phase I to Phase IV trials and addresses diverse therapeutic areas including oncology, cardiovascular diseases, rare disorders, immunology, metabolic conditions, neurology, psychiatry, and other research domains. It serves biopharma manufacturers, CROs and CMOs, hospitals, and clinical-trial sites that depend on controlled material flow, structured site coordination, and compliant handling practices to support patient enrollment and study execution. The market also covers temperature-controlled and non-cold-chain pathways, ranging from ambient and refrigerated storage to frozen and ultra-cold conditions, ensuring suitable environments for varied drug formulations and specimen types across global research networks.

Latest Market Trend

Expansion of Patient-Centric Distribution Pathways

A rising trend in the clinical trial logistics market is the expansion of patient-centric distribution pathways that support direct-to-home delivery, specimen collection, and coordinated return shipments. Sponsors are widening outreach programs that involve patient communities located far from research sites, encouraging logistics providers to develop structured visit-based routing and controlled handover procedures. This movement is strengthening trial participation across diverse regions and expanding demand for coordinated transport workflows tailored to individual study participants.

Increasing Use of Digital Monitoring Tools Across Shipment Cycles

The major trend shaping the market is the rising use of digital monitoring tools that track temperature profiles, shipment location, and chain-of-custody events throughout transport cycles. Trial sponsors are adopting data-enabled platforms to maintain oversight of investigational product movement from central depots to study sites. This shift reflects broader adoption of automated alerts, shipment analytics, and integrated dashboards that support better planning and reduce delivery variability during multi-country studies.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 5.32 Billion |

| Estimated 2026 Value | USD 5.79 Billion |

| Projected 2034 Value | USD 11.81 Billion |

| CAGR (2026-2034) | 9.30% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Arvato SE, Eurofins Scientific, Almac Group, Thermo Fisher Scientific Inc., MARKEN |

to learn more about this report Download Free Sample Report

Clinical Trial Logistics Market Driver

Growth of Global Clinical Programs Requiring Coordinated Supply Routes

A key driver for the clinical trial logistics market is the rapid expansion of global clinical programs that involve wide patient enrollment and diverse study locations. Sponsors conducting distributed trials across therapeutic areas such as oncology, metabolic disorders, and rare diseases require structured supply routes, validated packaging, and controlled distribution lanes to support study execution. This growth in international trial activity is prompting logistics providers to expand network coverage, enhance storage infrastructure, and develop coordinated pathways for complex material flow.

Market Restraint

Constraints in Managing Multi-Region Compliance Procedures

A major restraint for the market is the challenge of navigating varied compliance requirements across countries involved in multi-site trials. Each region maintains its own customs workflows, import regulations, and documentation guidelines, which can slow shipment movement and introduce uncertainty into trial timelines. Smaller study teams may encounter administrative delays that affect delivery precision, especially for temperature-sensitive materials, creating barriers for smooth operation across regions with differing regulatory systems.

Market Opportunities

Rising Expansion of Specialized Depots and Regional Distribution Hubs

A growing opportunity exists in the development of specialized depots and regional distribution hubs designed to support controlled storage, packaging preparation, and coordinated shipment scheduling. Expansion of these facilities across emerging trial locations allows sponsors to position investigational materials closer to patient sites, reducing transit time and improving study responsiveness. This model supports growth in decentralized and hybrid trials and encourages broader participation in countries undergoing rapid development of research infrastructure.

Regional Analysis

North America accounted for 39.47% of the clinical trial logistics market in 2025, supported by strong expansion of clinical research programs, well-structured regulatory processes, and wide availability of temperature-controlled transport networks across the region. Pharmaceutical sponsors and CROs continue to broaden trial portfolios that require controlled storage, compliant distribution channels, and high-frequency site deliveries. Growth is further influenced by the region’s mature ecosystem of depots, packaging centers, and API handling facilities that streamline clinical material movement for multi-phase trials.

The U.S. market is driven by broad deployment of clinical supply depots, specialty couriers, and advanced packaging operations that assist large-scale trials across oncology, cardiovascular research, and rare disease studies. Federal agencies and academic centers continue to support decentralized and hybrid trial formats, increasing demand for direct-to-patient shipments and specimen return logistics. Integration of digital tracking systems within distribution channels is allowing sponsors to maintain greater temperature visibility, shipment traceability, and site-level coordination.

Asia Pacific Market Insights

Asia Pacific is the fastest-growing regional market, projected to register a CAGR of 11.30% during the forecast period as countries expand clinical trial capacity, upgrade storage infrastructure, and strengthen regional distribution corridors. Pharmaceutical companies and CROs are increasing trial enrolment across oncology, metabolic disorders, and infectious disease research, which drives demand for controlled transport, compliant packaging, and multi-country coordination. Growth is also supported by rising involvement in biologics and biosimilar trials that require precise cold-chain systems.

India’s market is progressing as trial sponsors widen patient recruitment programs across public hospitals, specialty clinics, and academic centers. Expansion of biopharma manufacturing hubs has encouraged greater use of temperature-controlled distribution lanes for investigational products and diagnostic materials. Government initiatives focused on streamlining trial administration have encouraged partnerships with logistics providers offering secure site delivery, regional storage, and specimen movement services that support large patient pools.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

The Europe market is expanding as trial sponsors conduct multi-country studies that require coordinated distribution channels, specialized storage hubs, and compliant returns management. Consistent support from regional research frameworks and country-level health agencies has enhanced the environment for pharmaceutical development, accelerating demand for structured logistics services across Phase I to Phase IV trials. Cross-border harmonization initiatives across Europe continue to strengthen clinical supply planning and study-wide material flow.

Germany’s market advances through strong clinical activity across oncology, neurology, and regenerative medicine studies. Trial centers and contract research organizations are increasing use of controlled packaging units, depot storage spaces, and validated freight lanes to support investigational treatments distributed across hospitals and specialized clinics. National focus on expanding biomedical research infrastructure is encouraging adoption of coordinated supply solutions built around temperature stability, shipment scheduling, and controlled return pathways.

Middle East and Africa Market Insights

The Middle East and Africa market is advancing as countries expand clinical trial authorization frameworks and introduce new biomedical research hubs. Trial sponsors are gradually increasing activity in therapeutic areas such as infectious diseases, dermatology, and chronic disorder treatment, driving demand for temperature-controlled transport, compliant labeling, and reliable multi-site distribution. Investments in specialized warehouses and trial support centers are improving regional readiness for complex protocols.

The UAE market is growing as research-driven medical centers and life-science parks engage in early- and mid-phase trials supported by structured logistics planning. Strong development of healthcare clusters in Dubai and Abu Dhabi has increased use of controlled storage sites and monitored transport options for investigational drugs and clinical specimens. Partnerships with global logistics companies are enhancing capability for door-to-site deliveries, specialized packaging, and coordinated sample shipment.

Latin America Market Insights

The Latin America market is developing as sponsors expand trials across oncology, metabolic diseases, and infectious disease therapy. Rising involvement of regional academic institutions in global research programs has accelerated demand for site supply, compliant packaging units, and integrated cold-chain lanes. Regional improvements in healthcare infrastructure, along with growth in biopharma investment, continue to support structured material movement across borders.

Brazil’s market is expanding due to growing participation in multinational trials that require efficient material flow across research centers and public hospitals. Local research organizations are strengthening trial support systems including depot storage, site coordination, and controlled returns. Increased collaboration between universities and international sponsors has supported broader distribution planning, enabling smoother movement of investigational products and biological samples within the country.

Service Insights

The Transportation segment dominated the market with a share of 70.12%, supported by the broad use of controlled movement of investigational products across clinical sites, depots, and laboratories. Sponsors and CROs depend on established road networks, global air freight capacity, and specialized carriers to manage time-bound deliveries, specimen transfers, and site replenishments. Growing adoption of decentralized trial models has strengthened the role of transportation services as they manage frequent site shipments and patient outreach logistics across diverse study locations.

The Value-Added Services segment is projected to record the fastest growth of 10.12%, driven by the rising focus on customized labeling, kitting programs, and QP release activities that ensure compliance during clinical material preparation. Trial sponsors are expanding multi-country studies that require tailored kits, controlled documentation, and structured packaging workflows. Enhancements in regional distribution centers and the expansion of specialized preparation units are contributing to the accelerating uptake of value-added services.

Clinical Phase Insights

Phase III dominated the segment with a share of 48.73%, owing to the extensive distribution requirements associated with large patient populations and multi-site study designs. These trials involve high-volume drug shipments, continuous resupply cycles, and coordinated specimen movement that requires disciplined logistics planning. The scale of global Phase III programs continues to elevate demand for temperature-controlled storage, time-bound dispatches, and structured material returns.

Phase I is the fastest-growing segment with a projected rate of 10.25%, supported by the expansion of early-stage research across oncology, immunology, metabolic disorders, and genetic therapy explorations. Increasing establishment of early-phase units, combined with rising interest in targeted therapies, has elevated requirements for controlled storage, specialized packaging, and tight shipment visibility. Growth in biotech-sponsored first-in-human studies is further boosting demand in this segment.

Therapeutic Area Insights

The Oncology segment dominated the market with a share of 40.12%, driven by extensive global research activities exploring precision therapies, biologics, and complex combination treatments. Oncology trials often require meticulous temperature control, structured material handling, and high-frequency specimen transfers across global centers. Rising involvement of specialized cancer institutes and multi-sponsor clinical networks continues to boost logistics activity within this segment.

The Rare / Orphan Diseases segment is the fastest growing with a projected rate of 10.67%, supported by increasing sponsor focus on treatment development for smaller patient groups and ultra-specialized studies. These trials require tailored logistics strategies, frequent direct-to-site shipments, and precise chain-of-custody management due to limited enrollment and geographically dispersed patients. Expansion of orphan-drug pipelines is further advancing growth in this segment.

End-user Insights

Bio-Pharma Manufacturers dominated the market with a share of 59.23%, attributed to extensive involvement in large-scale global trials that require structured clinical supply distribution, controlled drug storage, and coordinated packaging activities. Sponsors rely on integrated logistics networks to manage complex study timelines, large investigator-site counts, and multi-region material movement that supports Phase I to Phase IV trial portfolios.

CROs and CMOs are the fastest-growing segment with a projected rate of 10.98%, driven by expanding outsourcing of logistics activities as sponsors streamline development timelines. Growth in full-service CRO models, combined with contract manufacturing partnerships, is strengthening the use of coordinated packaging, storage, and distribution systems. Rising project volumes within outsourced clinical programs continue to elevate the segment’s role in trial supply chains.

Source: Straits Research

Temperature Range Insights

The Cold Chain segment dominated the market, supported by the broad distribution of biologics, vaccines, cell-based therapies, and temperature-sensitive investigational drugs that require controlled conditions ranging from ambient to cryogenic storage. Clinical programs involving molecular therapies, live-cell treatments, and advanced biologics depend on stable temperature profiles across the supply cycle, reinforcing the segment’s leading position within trial logistics.

The Non-Cold Chain segment is the fastest-growing, with a projected rate of 10.52%, driven by rising activity in trials involving oral solids, small-molecule therapeutics, and room-temperature formulations. Growth in global site networks conducting non-specialized storage studies has encouraged wider use of standard packaging and transport channels. Expansion of trial diversity across emerging therapeutic areas continues to support growth in this segment.

Competitive Landscape

The global clinical trial logistics market is moderately fragmented, comprising established multinational logistics providers, specialized life-science supply chain companies and emerging niche players that focus on temperature-controlled transport, patient-centric delivery models and complex biologics handling.

Cencora, inc.: An emerging market player

Cencore, inc. has built its position as a premier provider of specialty logistics for clinical trials by delivering high-integrity, temperature-sensitive transport solutions designed for biologics, personalized therapies and time-critical clinical materials. The company differentiates itself through a global network of GDP-certified depots, fully monitored cold-chain lanes and rigorously controlled transport protocols that reduce shipment risk for complex trials. Its focus on last-mile delivery, direct-to-patient logistics and custom-engineered handling procedures enables sponsors to manage decentralized trial models and advanced therapies with greater assurance. By integrating compliance expertise, 24/7 monitoring and tailored routing solutions, World Courier continues to strengthen its role as a trusted partner for pharmaceutical companies and CROs carrying out multi-country and high-sensitivity clinical programs.

List of Key and Emerging Players in Clinical Trial Logistics Market

- Arvato SE

- Eurofins Scientific

- Almac Group

- Thermo Fisher Scientific Inc.

- MARKEN

- DHL Group

- Parexel International (MA) Corporation

- Catalent, Inc

- PCI

- Cencora, inc.

- FedEx

- Kuehne+Nagel

- Biocair

- Movianto

- Caprihans India Limited

- Others

Strategic Initiatives

- June 2025: DHL Group committed €2 billion (USD ≈ 2.29 billion) by 2030 to expand GDP-certified pharma hubs and multi-temperature cold-chain lanes worldwide.

- May 2025: Bionical Emas and Pharma Resources GmbH entered into an exclusive global supply partnership covering clinical-trial logistics (including supply of oncology injectables).

- May 2025: Perceptive eClinical launched ClinPhone Pro, a next-generation RTSM (randomisation & trial-supply-management) platform with rolling-forecast and advanced drug-supply simulation capabilities.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 5.32 Billion |

| Market Size in 2026 | USD 5.79 Billion |

| Market Size in 2034 | USD 11.81 Billion |

| CAGR | 9.30% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service, By Clinical Phase, By Therapeutic Area, By End-user, By Temperature Range |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Clinical Trial Logistics Market Segments

By Service

-

Transportation

- Road

- Air

- Others

- Warehousing & Distribution

- Value-Added Services (Labelling, Kitting, QP Release)

By Clinical Phase

- Phase I

- Phase II

- Phase III

- Phase IV / post-marketing

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Rare / Orphan Diseases

- Immunology & Inflammation

- Endocrine & Metabolic Disorders

- Neurology & Psychiatry

- Others

By End-user

- Bio-Pharma Manufacturers

- CROs (Contract Research Organizations) & CMOs (Contract Manufacturing Organizations)

- Hospitals & Clinical-Trial Sites

- Other End Users

By Temperature Range

-

Cold Chain

- Ambient (15-25 °C)

- Refrigerated (2–8 °C)

- Frozen (0 °C to -20 °C)

- Ultra-Cold / Cryogenic (-20 °C to -150 °C)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.