Commercial Food Dehydrators Market Size, Share & Trends Analysis Report By Equipment Type (Continuous belt/tunnel dehydrators (conveyor, air-impingement), Cabinet/tray dryers (batch), Drum/roller dryers (for flakes/powders), Freeze/lyophilisation systems (high-value specialty), Spray drying / fluid-bed finishing (for powders and ingredients), Hybrid/modular systems (combinations, integrated inline systems)), By Product (Dried fruits and fruit leather, Vegetable chips and vegetable ingredients, Herbs, spices, and botanicals, Meat jerky and seafood drying, Pet food inclusions and treats, Ingredient powders (fruit/veg powders, bakery inclusions)), By End User (Industrial food manufacturers (large processors), Co-packers / toll driers (contract processors), Small and micro food processors / artisanal producers, Foodservice / institutional kitchens) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Commercial Food Dehydrators Market Overview

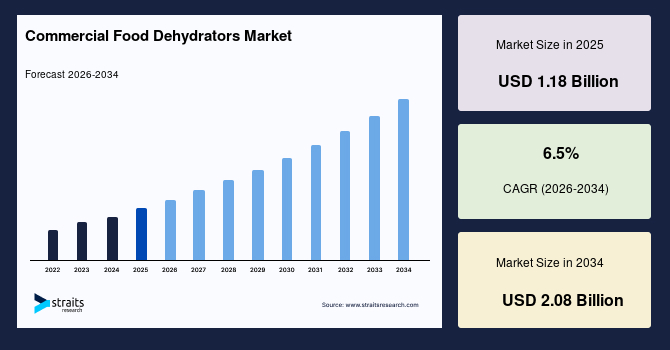

The global commercial food dehydrators market size was estimated at USD 1.18 billion in 2025 and is anticipated to grow from USD 1.26 billion in 2026 till USD 2.08 billion by 2034, growing at a CAGR of 6.5% from 2026-2034. The growth of the global market is driven by rising consumer demand for convenient, shelf-stable, and healthy snack foods like dried fruits and vegetable chips. This trend pushes food manufacturers to invest in equipment that can efficiently remove moisture while preserving nutritional value. Additionally, stricter food safety and regulatory pressures are incentivizing companies to upgrade their equipment to ensure controlled and consistent processes.

Key Market Insights

- Asia Pacific held a dominant share of the global commercial food dehydrators industry with a market share of 41% in 2025.

- North America region is growing at the fastest pace, with a CAGR of 6.5%.

- Based on Equipment Type, the Continuous belt and tunnel dehydrators are estimated to grow at a CAGR of 7.5%.

- Based on end user, Industrial food manufacturers led with a market share of 52% in 2025.

- The U.S. dominates the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.18 billion

- 2034 Projected Market Size: USD 2.08 billion

- CAGR (2026-2034): 6.5%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: North America

Market Trends

Shift to Energy-Efficient, Modular Continuous Drying Systems

A key trend in the market is the shift from older batch dryers to continuous, modular systems that boost efficiency and throughput. These modern dehydrators, often featuring air-impingement belt systems and real-time process controls, accelerate heat transfer and reduce product residence time. This improves product consistency and lowers energy consumption, which is a major concern as energy costs rise. Modular designs also allow medium-sized companies to scale their production capacity more affordably. Bühler's conveyor dryers, for example, are a strategic response to these demands, aimed at providing consistent quality while reducing energy bills.

Rising Demand for Shelf-Stable, Healthy Snacks and Ingredient Powders

The primary driver for the commercial food dehydrators market is the growing consumer demand for convenient, healthy, and shelf-stable snacks. Products like vegetable chips, fruit leather, and fruit-and-nut bars are becoming increasingly popular, driving the need for high-capacity dehydrators. Dehydrated ingredients are also used in other food products, such as baked goods and cereal bars, which broadens the market. As food processors expand their product lines and private-label offerings, they are investing in domestic drying lines to source ingredients and shorten lead times. This structural demand for capacity and product diversification fuels capital spending on new equipment.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.18 Billion |

| Estimated 2026 Value | USD 1.26 Billion |

| Projected 2034 Value | USD 2.08 Billion |

| CAGR (2026-2034) | 6.5% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Bühler, GEA, JBT Corporation, Heat & Control, TNA Solutions |

to learn more about this report Download Free Sample Report

Market Drivers

Integration of Process Automation and Digital Moisture Control

The integration of process automation and digital controls is another major trend. Food processors are using sensor networks and automation to gain precise control over moisture levels, temperature, and product variability. These systems reduce human error and allow for faster product changeovers, which is crucial for companies that produce multiple types of snacks. Real-time moisture monitoring and recipe management systems also simplify food safety reporting and traceability.

- For example, in September 2025, GEA launched InsightPartner EvoHDry, a digital condition-monitoring solution for dairy and beverage plants that provides real-time diagnostics, pre-alarm notifications, and machine health status via app and web.

Overall, integrated drying and automation solutions that allow validated processes to be repeated across different facilities provide a significant competitive advantage.

Sustainability and Energy-Cost Pressure

Drying is one of the most energy-intensive operations in food processing. Rising energy prices and corporate sustainability goals are pushing manufacturers to upgrade to more efficient systems. Modern dehydrators that reduce residence time and recycle process air help lower fuel and electricity consumption, which in turn reduces greenhouse gas emissions. Large processors are evaluating the total cost of ownership and are willing to invest more upfront for equipment that provides long-term operational savings. OEMs like Bühler are actively promoting energy-efficient designs to help processors meet both cost targets and their sustainability commitments.

Market Restraint

High Capital Cost and Long Payback for Industrial Systems

A key restraint for the market is the high capital cost of continuous, high-capacity dehydration systems. These machines require substantial upfront investment and complex plant integration. For many small and medium-sized processors, these costs are prohibitive, forcing them to either delay investment or outsource their drying needs to contract processors. This results in a market where only large companies can afford the most advanced dehydrators, while smaller producers continue to use less-efficient batch drying methods. Even with energy savings, the long payback period for these systems can be a barrier to adoption.

Market Opportunity

Demand from Ingredient and Specialty-Powder Markets

Dehydration offers a gateway to higher-margin ingredient and specialty-powder markets. Processors can capture more value by investing in integrated lines that combine drying with milling and packaging. This allows them to produce high-value products like fruit powders, powdered botanicals, and pet-food ingredients, rather than just selling bulk dried slices. Companies like GEA offer specialized systems, such as aseptic spray dryers, that enable processors to enter premium markets with high hygiene standards.

- For instance, in July 2025, GEA opened a facility in North America to scale alternative protein & sustainable food production; it includes capacity for spray drying and related process technologies.

The growing demand from the healthy snack, bakery, and nutraceutical sectors makes this a clear commercial opportunity.

Regional Analysis

In 2025, the Asia Pacific region accounted for a leading 41% of the global market share. Asia Pacific leads the global commercial food-dehydrator market because of large agricultural production, strong processing growth, dense manufacturing clusters, and active public programmes that support food-processing capacity. Major processors in China, India, Thailand, and Vietnam expand fruit and vegetable processing for both domestic consumption and export. The region's dense manufacturing clusters and proximity to raw materials also make it an ideal location for both local consumption and export, ensuring sustained demand for dehydrators. E-commerce and growing middle classes in APAC drive demand for dried snacks and ingredient inputs, generating repeat processing demand.

China's market for commercial dehydrators is one of the largest and fastest-expanding globally. Its growth is fueled by vast agricultural production, rapid urbanization, and strong government support. In 2025, China is planning to issue new treasury bonds to support large-scale equipment upgrades. This, combined with a rising middle class and growing demand for dried snacks, is encouraging both domestic and international manufacturers to invest in local production and service to meet the high demand for continuous drying lines.

India's dehydrator market is being driven by government initiatives like the Mega Food Parks and the PMFME scheme, which aim to formalize and add value to agricultural produce. These programs provide capital subsidies and shared facility centers with modern drying equipment, enabling small and micro-processors to access advanced technology. The focus on producing exportable products also encourages investment in controlled, continuous dryers to ensure quality and compliance for international buyers.

North America Market Trends

North America is experiencing the fastest growth, with a CAGR of 6.5%. North America is the fastest-growing market for commercial dehydrators, fueled by a combination of government grants, strong consumer trends, and a shift toward domestic sourcing. Federal and state-level grants in the U.S. are reducing the capital barrier for small and mid-sized processors, allowing them to invest in specialized drying equipment. A growing consumer demand for healthy, convenient snacks supports this. The rise of toll-drying facilities and "drying as a service" models also enables small brands to scale up without the need for large capital investments, accelerating the adoption of new, modular dehydrators.

U.S. : Large industrial food manufacturers and a growing number of contract processors lead the U.S. market for commercial dehydrators. The market is driven by strong consumer demand for healthy snacks and specialty powders, as well as federal programs that offer grants for equipment purchases. For example, the USDA's Value-Added Producer Grants and Rural Development programs are actively supporting small-scale processors in acquiring modern dehydrators. This combination of consumer-driven demand and government financial support is helping to accelerate the market's growth and modernization.

Canada: Canada's market is strategically growing with the support of government programs focused on local food infrastructure. The Agriculture and Agri-Food Canada (AAFC) fund explicitly helps small and medium-sized enterprises purchase processing equipment like dehydrators. This support, combined with a focus on food safety and traceability, encourages processors to invest in hygienic, energy-efficient systems. The strong export capabilities of Canadian processors also drive the need for high-quality dehydrators that can meet international standards.

Germany Market Trends

Germany is a highly technology-intensive market for commercial dehydrators, driven by a strong emphasis on high-spec, energy-efficient systems. German food manufacturers and ingredient processors invest in continuous tunnel dryers and fluid-bed systems with integrated automation to meet strict food safety and sustainability requirements. Government bodies and industry forums also support value-chain modernization and innovation financing. The presence of major equipment manufacturers with strong local service and R&D further reduces the friction for adopting complex, high-performance dehydrators.

Equipment Type Insights

Continuous belt and tunnel dehydrators dominate the market and are forecasted to grow at a CAGR of 7.5%, driven by the demand for high throughput and consistent product quality in large-scale food manufacturing. These systems allow for constant, single-pass processing, which is essential for industries producing dried fruits and vegetable snacks. Their ability to provide precise control over temperature and residence time helps reduce energy consumption and improve product uniformity. The modular design of modern systems also allows large processors to scale their operations efficiently.

Product Insights

Dried fruits and snack ingredients lead the market, fueled by the consistent and strong global consumer demand for convenient, healthy snacks. Dehydrators in this segment are used to produce a wide range of products, from fruit leathers to vegetable crisps, that are sold directly to consumers or used as ingredients in other products like cereals and baked goods. The continuous growth in the "healthy snack" market ensures a steady demand for high-capacity dehydration equipment, making this application the primary driver for the market.

End User Insights

Industrial food manufacturers hold the largest share of the market, accounting for 52% in 2025 based on end-user segmentation, due to their need for high-throughput, automated, and energy-efficient systems. They have the capital to invest in advanced equipment that offers predictable yields, meets strict food safety standards, and provides long-term operational savings. Industrial manufacturers also have the in-house expertise to manage the technical complexity of these systems, which are often vertically integrated, allowing them to control the entire production process from raw material to finished product.

Competitive Landscape

The market is highly fragmented. Turnkey OEMs that sell high-spec continuous lines plus engineering, commissioning, and long service contracts, and integrators & niche specialists who sell modular belt/tray/dryer units and aftermarket support for snack and ingredient processors. Many suppliers also offer financing, training, and “drying as a service” partnerships to address SME capital constraints. Sustainability, energy efficiency, and digital process control are key differentiators.

GEA is a global engineering OEM that serves food and beverage processors with modular process equipment. Its strategy combines product platforms, localized application centres, and after-sales service to secure long multi-year customer relationships. GEA invests in process automation and sustainability to win large processors seeking validated ingredient and snack production lines. This service-oriented OEM model produces steady project revenue and recurring aftermarket income.

Latest news

- In July 2025 : GEA opened a new Food Application & Technology Center (ATC) in Janesville, Wisconsin (USD 20 million facility) to support alternative-protein and sustainable food scale-up, signalling expanded capability to support drying and downstream processing projects in North America.

List of Key and Emerging Players in Commercial Food Dehydrators Market

- Bühler

- GEA

- JBT Corporation

- Heat & Control

- TNA Solutions

- Buhler Industries

- Amandus Kahl

- Hosokawa Micron

- SPX FLOW

- Glatt

- Key Technology

- Alfa Laval

- PPM Technologies

- Marel

- Premier Tech

Recent Developments

- March 2025 - Buhler Industries (Canada) announced the completion of its planned amalgamation, a corporate reorganization that supports an expanded manufacturing footprint and aftermarket capability in North America. This transaction strengthens Buhler Industries’ ability to serve regional dehydrator and processing equipment demand and enhances spare parts and service delivery for processors.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.18 Billion |

| Market Size in 2026 | USD 1.26 Billion |

| Market Size in 2034 | USD 2.08 Billion |

| CAGR | 6.5% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Equipment Type, By Product, By End User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Commercial Food Dehydrators Market Segments

By Equipment Type

- Continuous belt/tunnel dehydrators (conveyor, air-impingement)

- Cabinet/tray dryers (batch)

- Drum/roller dryers (for flakes/powders)

- Freeze/lyophilisation systems (high-value specialty)

- Spray drying / fluid-bed finishing (for powders and ingredients)

- Hybrid/modular systems (combinations, integrated inline systems)

By Product

- Dried fruits and fruit leather

- Vegetable chips and vegetable ingredients

- Herbs, spices, and botanicals

- Meat jerky and seafood drying

- Pet food inclusions and treats

- Ingredient powders (fruit/veg powders, bakery inclusions)

By End User

- Industrial food manufacturers (large processors)

- Co-packers / toll driers (contract processors)

- Small and micro food processors / artisanal producers

- Foodservice / institutional kitchens

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.