Commercial Vehicle Market Size, Share & Trends Analysis Report By Vehicle Type (Light commercial vehicle, Heavy vehicles, Buses), By Fuel Type (I.C. engine, EVs), By End-Use (Industrial, Mining, Construction, Logistics, Passenger vehicle) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Commercial Vehicle Market Size

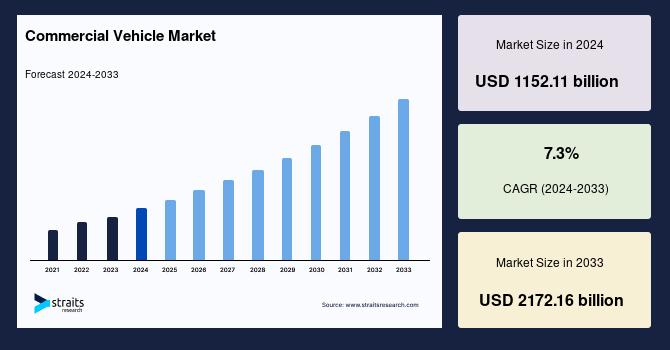

The global commercial vehicle market size was worth USD 1,152.11 billion in 2024 and is estimated to reach an expected value of USD 1,236.22 billion in 2025 to USD 2,172.16 billion by 2033, growing at a CAGR of 7.3% during the forecast period (2025-2033).

A commercial vehicle is any motor vehicle used for transporting goods, passengers, or services for business purposes. These vehicles include trucks, buses, vans, and taxis, which are designed to accommodate heavy loads, long-distance travel, and high-frequency usage. Commercial vehicles are subject to specific regulations regarding safety, emissions, and operational standards to ensure road safety and efficiency. They are widely used in logistics, construction, and public transportation industries. Many modern commercial vehicles incorporate advanced technologies, such as GPS tracking, telematics, and fuel-efficient systems, to enhance operational performance and reduce environmental impact.

The global market, which encompasses trucks, buses, vans, and trailers, is central to logistics, construction, agriculture, and public transport. With urbanization and infrastructure growth accelerating in developing economies, commercial vehicle demand keeps mounting. Technological advances, such as electric and autonomous vehicles, are transforming the sector, boosting efficiency and sustainability. Despite this, volatile fuel prices, regulatory shifts, and supply chain disruptions remain. Despite such challenges, the market is ready for further expansion, buoyed by growing transport needs and investment in infrastructure worldwide. Vehicle technologies and urbanization are providing massive opportunities with promises of an exciting future for the industry.

Source: SIAM

Latest Market Trends

Rise of Electric Commercial Vehicles

The demand for electric commercial vehicles (EVs) is increasing exponentially as companies and governments focus on sustainability and carbon footprint reductions. As the environment attracts tighter and tighter regulations, companies are shifting en masse to electric fleets. Top industry players like Volvo and Daimler are leading the charge with electric trucks built to assist fleet owners in cutting operational expenses while conforming to green standards. This transition to electrification is redefining the commercial vehicle segment and driving the switch to cleaner, more sustainable mobility.

- For instance, in 2023, the European Commission launched the Greening Corporate Fleets initiative to promote zero-emission vehicles. A coalition of 30 companies and industry groups called for a binding target for ZEVs by 2030.

Adoption of Autonomous Vehicles

Self-driving business trucks are reshaping the trucking and freight industries by bringing greater efficiency, lower labor expenses, and road safety. Industry giants like Tesla, Waymo, and TuSimple have been actively evaluating autonomous trucks and planning to turn long-distance cargo transportation on its head. Autonomy-enabled vehicles guarantee higher mileage, less idle time, and better fleet deployment. With advancing technology, self-driving commercial trucks will revolutionize supply chain logistics to provide a future-proof and less expensive way of transportation.

- For instance, TuSimple (Nasdaq: TSP) completed the world’s first fully autonomous semi-truck run on open public roads, with no human in the vehicle or intervention.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1152.11 Billion |

| Estimated 2025 Value | USD 1236.22 Billion |

| Projected 2033 Value | USD 2172.16 Billion |

| CAGR (2025-2033) | 7.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Cummins Inc., Ford Motor Company, Nikola Corporation, Volvo Group, PACCAR Inc. |

to learn more about this report Download Free Sample Report

Global Commercial Vehicle Market Growth Factors

Increasing E-Commerce and Demand for Efficient Logistics

The high e-commerce growth rate has boosted the need for commercial vehicles in last-mile delivery. While consumers demand faster and more efficient deliveries, logistics businesses invest in smart and efficient delivery vehicles to cater to growing demands. Electric and autonomous delivery vans also transform last-mile logistics, lowering operational costs and environmental footprints. With ongoing technological advancements in automobile technology, the commercial vehicle segment is poised to contribute significantly to e-commerce supply chain efficiency.

- For instance, in 2024, Amazon is advancing its sustainability goals with over 20,000 custom electric delivery vans now deployed across the U.S. as part of its commitment to decarbonizing its fleet.

In addition, governments worldwide are introducing stricter emission regulations to counter climate change's effects and limit air pollution. The regulations drive fleet owners to adopt greener, cleaner vehicle solutions like electric and hydrogen commercial trucks. Consequently, manufacturers are accelerating the development of greener transportation solutions to meet compliance requirements. With green initiatives gaining momentum, the commercial vehicle industry is transforming, promoting sustainability without compromising operational efficiency for logistics and transport companies.

Market Restraint

The High Initial Cost of Electric Commercial Vehicles

The transition towards electric commercial vehicles (ECVs) is gaining momentum globally, but the high upfront costs of these vehicles present a significant challenge to widespread adoption. Electric trucks and vans are substantially more expensive than their traditional internal combustion engine (ICE) counterparts, primarily due to the high cost of lithium-ion batteries, which can account for 30-50% of the total vehicle price.

Additionally, commercial EVs require significant charging infrastructure investments, which further increases the total cost of ownership. Many fleet operators also worry about electric trucks' limited range and payload capacity compared to their diesel counterparts, which can impact efficiency in long-haul operations.

However, technological advancements in battery development, declining battery prices, and government incentives are progressively making EVs more cost-competitive. In 2023, lithium-ion batteries dropped by 14%, and further cost reductions are expected in the coming years, which could help lower the price of commercial EVs. Moreover, manufacturers are introducing leasing models and financing options to help businesses transition to electric fleets more affordably.

Market Opportunity

Government Incentives and Subsidies for Fleet Electrification

Governments worldwide are accelerating fleet electrification by offering financial incentives, tax credits, and subsidies to encourage businesses to adopt electric commercial vehicles. These incentives significantly reduce the upfront costs of purchasing electric vans and trucks, making them more accessible for fleet operators. Governments are also implementing strict emissions regulations, which are forcing companies to shift towards zero-emission transportation. Many cities are introducing low-emission zones (LEZs) that restrict the entry of diesel-powered vehicles, pushing businesses to invest in electric alternatives.

- For instance, the Environmental Protection Agency (EPA) offers grants to support the transition to heavy-duty zero-emission vehicles (ZEVs). These grants can cover up to 100% of the costs related to vehicle replacement, charging infrastructure, workforce training, and ZEV readiness planning. Similarly, the EU has set a 2035 deadline to phase out diesel and gasoline commercial vehicles. The Alternative Fuels Infrastructure Regulation (AFIR) requires the installation of charging stations for trucks every 60 km on major highways, making EV adoption more viable.

These policies are driving record investments in EV manufacturing and green logistics solutions. Major companies such as Amazon, UPS, and FedEx are already electrifying their delivery fleets, while automakers like Tesla, Volvo, Daimler, and Rivian are launching new electric commercial vehicle models to meet rising demand. As governments continue to enforce sustainability targets and provide financial incentives, the global shift towards electric commercial vehicles is expected to accelerate, transforming the transportation and logistics industry.

Regional Insights

North America: Dominant Region with A Significant Market Share

North America is the global commercial vehicle market leader with robust demand from the freight and logistics sectors. The U.S. and Canada are at the forefront, making significant investments in transport infrastructure and adopting the transition to electric commercial vehicles. Fleet operators are switching to sustainable options to meet regulatory requirements and reduce operating expenses. As vehicle technologies progress and with government support, North America will likely remain a future commercial transport driver.

- For instance, the U.S. Department of Energy's Advanced Technology Vehicles Manufacturing Loan Program offers loans up to 30% of the re-equipping or expanding the cost of U.S. manufacturing facilities producing eligible ATVs and alternative fuel infrastructure.

Asia-Pacific: Rapidly Growing Region

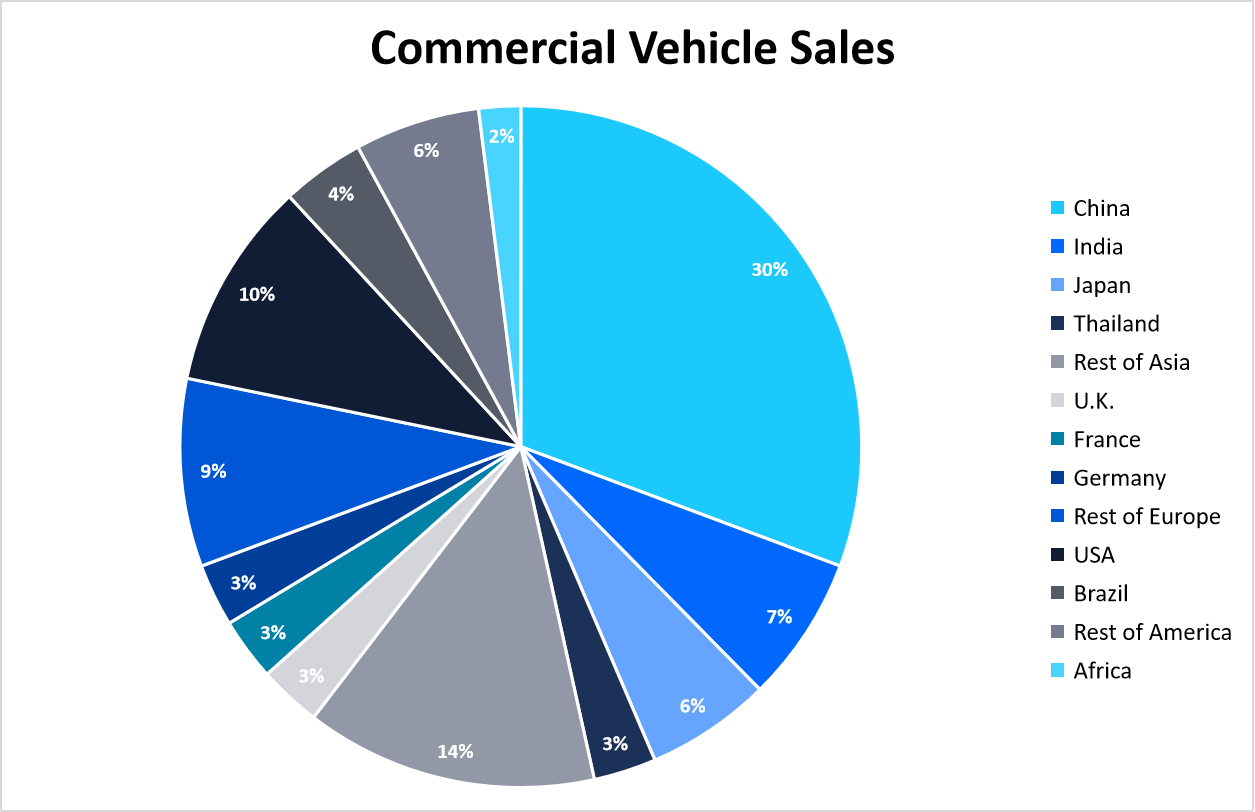

The Asia-Pacific region is set to experience the highest growth in the global market, driven by increasing demand in China, India, and Japan. China’s government is investing significantly in electric vehicle adoption, while India is rapidly expanding its logistics infrastructure. Urbanization and industrial growth in these countries further fuel commercial vehicle demand. With rising economic activity and technological advancements, Asia-Pacific is poised to become a key hub for commercial transportation expansion.

- For instance, in 2023, Asia/Oceania led global passenger vehicle sales with a 54% market share. India ranked third with 4.1 million units sold, capturing a 5.19% global share, behind China and the USA.

Countries Insights

- United States: The U.S. dominates the commercial vehicle market, particularly the electric vehicle market, through heavy investment in last-mile delivery and government subsidy. On March 20, the U.S. Environmental Protection Agency released the strongest ever clean car pollution standards for passenger cars, trucks, and medium-duty vehicles that will cut over 7 billion tons of carbon emissions, bring $100 billion of annual net benefits, and promote public health and air quality.

- China: China's commercial vehicle market is growing rapidly, fueled by government incentives for electric vehicle adoption and investment in infrastructure. The country is heavily investing in clean energy solutions, including electric trucks, with leading manufacturers like BYD leading the way. In 2024, China accounted for approximately 26.06 million units, holding a global market share of roughly 33%.

- India: India's commercial vehicle segment is witnessing sound growth, boosted by the rising need for goods haulage and logistic services. The growing domestic economy and ongoing infrastructure improvements are key to such development. Indian investment in the infrastructure and logistics sector, set to reach a projected $44 billion in spending in 2024, complements the growing commercial vehicle business.

- Germany: Germany is a player in the European commercial vehicle market, and it has made heavy investments in autonomous and electrification technologies. The government's emphasis on sustainability and carbon reduction fuels interest in cleaner and more efficient vehicles. Commercial vehicle sales in Germany increased by 3% in 2023, showing the country's dedication to developing eco-friendly transportation options.

- Japan: Japan is at the forefront of technological innovation, particularly in autonomous truck development. The country invests heavily in AI and automation to optimize commercial vehicle fleets' efficiency. Japan is projected to spend $740 million on AI-powered vehicles by 2024, making it the leader in intelligent and autonomous transport solutions.

- United Kingdom: The U.K. is experiencing unprecedented electric commercial vehicle market growth, encouraged by government subsidies and incentives to electrify the fleet. Phasing out diesel cars by 2030 is increasing the demand for electric commercial vehicles. These actions align with the country's agenda of sustainability and reducing emissions, making the U.K. the world leader in clean transport.

- Brazil: Brazil is focusing on expanding road infrastructure and implementing cleaner technologies in commercial vehicles. The market is gradually increasing, with increasing numbers of logistics companies adding electric cars to their fleets. The year 2022 saw a MoU between SIAM and UNICA, creating a Virtual Center of Excellence to promote the utilization of ethanol and blends, contributing to the environmental objectives of the GBA.

- Canada: Canada is experiencing growth in its commercial vehicle market due to the emphasis on sustainability and green technologies. Electric vehicle adoption is also rising, with some provinces encouraging fleet electrification through incentives. Canada is investing money into developing the infrastructure to facilitate the shift to cleaner, more efficient transportation options, aiding the total market growth.

Segmentation Analysis

By Vehicle Type

Light commercial vehicle segment dominated the market with the largest market share.Light Commercial Vehicles (LCVs) continue to lead the commercial vehicle market because of their versatility and critical role in city logistics. The record growth in e-commerce and increased need for last-mile delivery operations propel expansion in this market. Additionally, advances in electric LCVs are encouraging market growth with Ford and Nissan's introduction of electric van models. These innovations align with sustainability goals, offering businesses low-cost and green alternatives for urban transportation and local logistics.

By Fuel Type

I.C. segment dominated the market with the largest market revenue.The market is experiencing tremendous growth, with the I.C. segment leading in market share. Nevertheless, the EV segment is expected to grow promisingly due to increasing demand fueled by stringent fuel economy regulations. Companies are working on cutting battery costs to boost EV sales. Commercial EVs have several benefits, such as zero noise and air pollution, longer driving ranges, and suitability for autonomous driving. Therefore, the EV segment is expected to have the highest CAGR.

By End-Use

The passenger transport segment has a significant market share and is expected to grow profitably in the next few years. Increased commuting costs, better accessibility and affordability, and the rising trend of shared mobility are some key drivers. Moreover, regulatory policies governing the movement of vehicles on the road are expected to propel the segment's growth. These drivers and shifting consumer patterns put passenger transportation in the position to expand even more shortly.

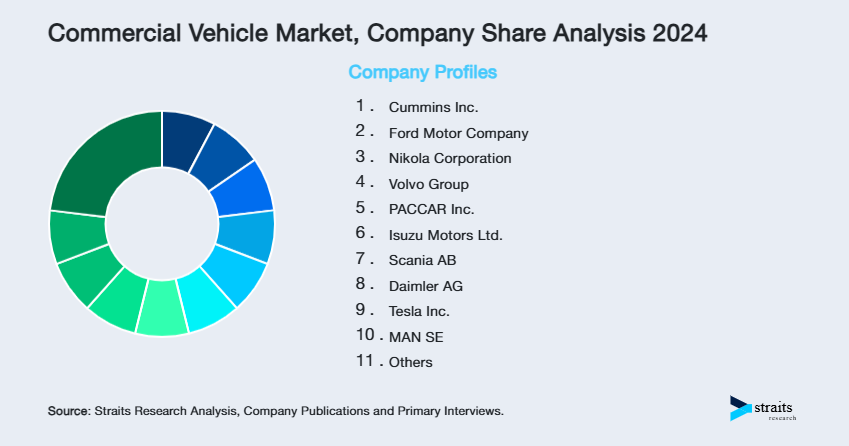

Company Market Share

Key market players are investing in advanced Commercial Vehicle technologies and pursuing strategies such as collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Rivian: An Emerging Player in the Commercial Vehicle Market

Rivian is an electric vehicle company based in America that produces all-electric trucks and SUVs. The company is popular for its R1T pickup truck and R1S SUV, aimed at sustainability and adventure-based electric vehicles. Rivian has gained massive investments and is set to change the world of cars with its green, innovative designs.

Recent Developments:

- In November 2024, Volkswagen raised its stake in Rivian to $5.8 billion under a joint venture to create new electric architecture and vehicle software for upcoming models, such as subcompact vehicles, by 2027.

List of Key and Emerging Players in Commercial Vehicle Market

- Cummins Inc.

- Ford Motor Company

- Nikola Corporation

- Volvo Group

- PACCAR Inc.

- Isuzu Motors Ltd.

- Scania AB

- Daimler AG

- Tesla Inc.

- MAN SE

- Toyota Motor Corporation

- BYD

- Iveco

- Navistar

to learn more about this report Download Market Share

Recent Developments

- October 2024- Rivian partnered with Amazon to deploy 100,000 electric delivery vans across the U.S. to reduce carbon emissions in last-mile delivery.

- September 2024- Volvo is set to launch a long-range version of its FH Electric truck, offering up to 600 km on a single charge. The new model will be available for sale in late 2025.

Analyst Opinion

As per our analyst, the global commercial vehicle market is witnessing strong growth, led by growing demand for goods haulage, logistics, and the popularity of electric vehicles. Government incentives towards cleaner technology speed up the growth even more. With urbanization rising and e-commerce thriving, developing economies in the Asia-Pacific region are likely to see growth in the market. Additionally, infrastructure spending and vehicle technology advancements, such as electrification and automation, drive the industry's future. With sustainability and efficiency as its focus, the commercial vehicle industry is set to continue growth, adapting to the changing demands of international logistics and transportation.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1152.11 Billion |

| Market Size in 2025 | USD 1236.22 Billion |

| Market Size in 2033 | USD 2172.16 Billion |

| CAGR | 7.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Vehicle Type, By Fuel Type, By End-Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Commercial Vehicle Market Segments

By Vehicle Type

- Light commercial vehicle

- Heavy vehicles

- Buses

By Fuel Type

- I.C. engine

- EVs

By End-Use

- Industrial

- Mining

- Construction

- Logistics

- Passenger vehicle

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.