Continuous Peripheral Nerve Block Catheters Market Size, Share & Trends Analysis Report By Insertion Technique (Ultrasound, Nerve Stimulation, Hybrid), By Indication (Upper Extremity Surgery, Lower Extremity Surgery), By End-User (Hospitals, Ambulatory Surgical Centers, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Continuous Peripheral Nerve Block Catheters Market Size

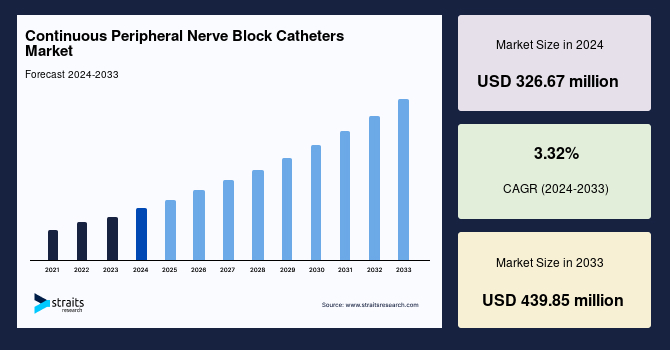

The global continuous peripheral nerve block catheters market size was valued at USD 326.67 million in 2024 and is projected to grow from USD 339.24 million in 2025 to reach USD 439.85 million by 2033, exhibiting a CAGR of 3.32% during the forecast period (2025-2033).

Continuous Peripheral Nerve Block (CPNB) catheters are medical devices used to provide prolonged pain relief by delivering local anesthetics directly to peripheral nerves. These catheters are placed near a targeted nerve or nerve plexus and connected to an infusion pump that continuously administers anesthetic medication, ensuring sustained pain control.

CPNB catheters are commonly used for post-surgical pain management, particularly in orthopedic and trauma surgeries, as they help reduce opioid dependence, improve patient comfort, and facilitate faster recovery. The global continuous peripheral nerve block catheters market is witnessing substantial growth, driven by the increasing shift toward opioid-free pain management and advancements in catheter technology.

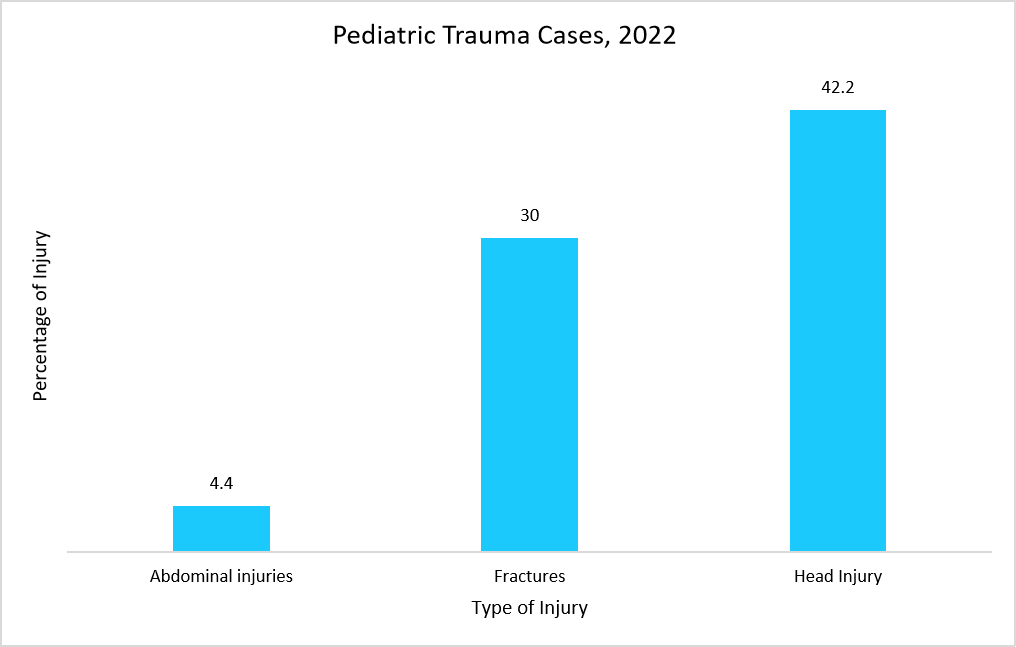

Moreover, the widespread adoption of ultrasound-guided catheter placement is enhancing precision, safety, and efficacy, particularly in orthopedic, trauma, and outpatient surgeries. As surgical volumes continue to rise, particularly in trauma-related cases, the demand for CPNB catheters is expected to grow, further fueling market expansion.

Source: Straits Analysis, European Journal of Cardiovascular Medicine

As trauma surgeries continue to rise, hospitals and ambulatory surgical centers are increasingly adopting regional anesthesia techniques, such as continuous peripheral nerve block (CPNB), to improve pain management, shorten hospital stays, and speed up patient recovery. Moreover, the market is benefiting from technological innovations, strategic partnerships, and the development of smart infusion systems, which are shaping the future of pain management in both surgical and non-surgical settings.

Latest Market Trends

Rising Adoption of Outpatient Surgeries

The increasing use of continuous peripheral nerve block (CPNB) catheters in outpatient surgeries is transforming pain management, particularly for procedures like osteoarthritis surgeries. CPNB catheters offer effective postoperative pain relief, enabling patients to recover quickly and, in many cases, return home on the same day.

- According to a study published by the University of Washington in August 2023, nearly 1 billion people are expected to be living with osteoarthritis, the most prevalent form of arthritis, by 2050. This growing prevalence is likely to lead to a rise in the number of osteoarthritis surgeries.

This trend is revolutionizing outpatient surgery by allowing patients to experience faster recovery times and reduced hospital stays, enhancing their overall experience.

Growth of Orthopedic Ambulatory Surgical Centers (ascs)

The rapid expansion of orthopedic ASCs is accelerating the demand for continuous peripheral nerve block (CPNB) catheters. These specialized facilities, which focus on minimally invasive procedures, emphasize fast recovery and optimal pain management. CPNB catheters are becoming a vital part of this paradigm, offering extended postoperative analgesia and reducing opioid dependency.

- In January 2025, UF Health officials and community leaders broke ground on the UF Health Orthopedic Surgical Center, a state-of-the-art 24,000-square-foot facility designed to enhance outpatient services for total joint replacements and other orthopedic procedures.

As orthopedic surgical centers continue to proliferate, the adoption of CPNB catheters will rise, contributing to advancements in pain management and improving overall patient outcomes.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 326.67 Million |

| Estimated 2025 Value | USD 339.24 Million |

| Projected 2033 Value | USD 439.85 Million |

| CAGR (2025-2033) | 3.32% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Braun Medical Inc., Teleflex Incorporated, PAJUNK, Ace-medical, Vygon SAS |

to learn more about this report Download Free Sample Report

Continuous Peripheral Nerve Block Catheters Market Growth Factors

Increasing Preference for Local Anesthesia in Surgeries

Unlike general anesthesia, which induces unconsciousness and affects the entire body, CPNB catheters enable focused pain management in the surgical site, reducing the systemic impact on the patient and enhancing recovery. This targeted approach offers significant advantages, particularly in procedures that require precise pain control, such as vascular surgeries, including atherectomy.

- A study published in January 2025 by the National Library of Medicine highlighted the benefits of local anesthesia in geriatric hip fracture surgeries, revealing that it led to better pain management, faster recovery, and fewer complications compared to general anesthesia. The study also noted a significant reduction in hospital stays and a decline in 30-day mortality rates, further solidifying local anesthesia as a safer and more effective option.

As healthcare professionals increasingly recognize the advantages of local anesthesia over general anesthesia, the adoption of CPNB catheters is likely to continue to grow, further accelerating market demand.

Market Restraining Factors

High Cost of Cpnb Procedures and Equipment

The high cost of continuous peripheral nerve block procedures and equipment is a major barrier to market growth, particularly in low- and middle-income countries. These procedures require specialized equipment, including infusion pumps, ultrasound machines for precise catheter placement, and monitoring devices, all of which contribute to the overall expense.

These costs can be prohibitive for healthcare facilities with limited budgets, making it challenging for them to adopt CPNB catheters. As a result, this financial constraint hampers the widespread implementation of CPNB catheters, limiting their accessibility in certain regions and slowing market growth.

Market Opportunity

Increasing Number of Strategic Collaborations

The increasing number of strategic partnerships among medical device manufacturers, healthcare practitioners, and distribution channels is accelerating innovation and improving the accessibility of continuous peripheral nerve Block (CPNB) catheters. These collaborations facilitate enhanced distribution networks, drive technological advancements, and promote the implementation of opioid-sparing analgesic strategies within surgical environments.

- For instance, in February 2022, InfuSystem Holdings, Inc., a leading national healthcare service provider, announced a national distribution agreement with Solo-Dex, Inc. to supply its proprietary continuous nerve block catheters, enhancing access to advanced pain management solutions in outpatient care.

Such collaborations will not only improve opportunities but also drive advancements, ensuring these solutions become a mainstream approach for managing postoperative pain.

Regional Insights

North America holds a dominant position in the global continuous peripheral nerve block catheters market with 40.12% market share, driven by the widespread adoption of regional anesthesia techniques and increasing surgical volumes. The region's advanced healthcare infrastructure, strong reimbursement policies, and innovations contribute significantly to market growth.

The rising demand for orthopedic, trauma, and outpatient procedures, combined with the growing emphasis on minimizing opioid use and enhancing patient recovery, accelerates the adoption of CPNB catheters. Moreover, the presence of leading healthcare providers and research institutions further supports the expansion of this market.

- U.S. - The U.S. leads the continuous peripheral nerve block (CPNB) catheters market, driven by significant investments in research and development and the rapid expansion of ASCs. For instance, in July 2023, Adventist Healthcare opened a new ASC specializing in orthopedic procedures, further driving demand for CPNB catheters. The U.S. healthcare system's focus on opioid-free pain management, along with its advanced surgical practices, continues to fuel market growth.

Asia Pacific Continuous Peripheral Nerve Block Catheters Market Trends

Asia-Pacific is poised to experience the highest CAGR during the forecast period. This growth is primarily driven by rising surgical volumes, expanding healthcare infrastructure, and the increasing adoption of regional anesthesia. Countries such as China, India, and Japan are investing heavily in the development of hospitals and ASCs, enhancing the accessibility of advanced pain management solutions. Moreover, the growing prevalence of osteoarthritis, trauma cases, and an aging population in the region are fueling the demand for effective postoperative pain management, further accelerating the adoption of CPNB catheters.

- India - India’s CPNB market is expanding rapidly, driven by the growth of healthcare facilities. For example, in August 2024, a new super-specialty surgical building was inaugurated at the Govt. Wenlock Hospital in Mangaluru, improving healthcare infrastructure and expanding access to advanced surgical and pain management solutions, including CPNB catheters. The demand for regional anesthesia techniques is increasing as the country’s population grows and healthcare access improves.

- China - China’s market for continuous peripheral nerve block catheters is expanding rapidly, driven by increasing healthcare investments and growing awareness of regional anesthesia techniques. The country’s high prevalence of osteoarthritis and road accidents further fuel the demand for effective postoperative pain management solutions. As the healthcare sector evolves and more hospitals adopt advanced pain management techniques, the market for CPNB catheters in China continues to gain momentum, addressing both surgical and recovery needs.

- Japan - Japan’s continuous peripheral nerve block catheters industry is witnessing significant growth, driven by the rising number of orthopedic and trauma surgeries. The increasing adoption of regional anesthesia, coupled with the high prevalence of osteoarthritis and hip fractures, is spurring demand for effective pain-related solutions. Moreover, advancements in ultrasound-guided catheter placement and government efforts to promote opioid-free strategies are accelerating market adoption.

- Saudi Arabia – In Saudi Arabia, the market is propelled by rising investments and strategic mergers and acquisitions by key industry players. For example, in July 2023, Solo-Dex, Inc. secured a distribution agreement in Saudi Arabia for its opioid-free acute pain management suite, significantly enhancing access to advanced regional anesthesia solutions. These developments are making CPNB catheters more widely available.

Europe Continuous Peripheral Nerve Block Catheters Market Trends

- Germany - Germany is one of Europe's largest market for continuous peripheral nerve block catheters, supported by a high volume of orthopedic and trauma surgeries and robust reimbursement policies. The rising prevalence of osteoarthritis is further increasing the demand for effective postoperative pain management. Moreover, Germany’s strong emphasis on opioid-free anesthesia techniques and the widespread adoption of ultrasound-guided regional anesthesia contribute significantly.

Insertion Technique Insights

The ultrasound segment dominates the market due to its real-time imaging capabilities, which enhance precision, safety, and overall procedural accuracy during catheter placement. Ultrasound guidance allows for direct visualization of the needle and surrounding tissues, improving needle positioning and reducing the risk of nerve damage. This technique also ensures optimal anesthetic distribution, making it superior to traditional methods like landmark-based techniques or nerve stimulation, which have higher risks of complications and inaccuracies.

Indication Insights

Lower extremity surgeries hold the largest market revenue in the global market, driven by the high surgical volume of procedures such as total knee arthroplasty (TKA), hip replacements, and foot and ankle surgeries. CPNB catheters, specifically femoral, sciatic, and popliteal nerve blocks, offer targeted analgesia, significantly reducing opioid consumption and enhancing patient recovery. These benefits, including improved mobility and the ability to discharge patients on the same day, make CPNB the preferred choice for pain management in outpatient settings.

End User Insights

Ambulatory Surgical Centers (ASCs) hold the largest market share thanks to the growing preference for outpatient procedures. ASCs are designed for efficiency, with a focus on minimally invasive surgeries that prioritize patient safety, quick recovery, and cost-effectiveness. These catheters are ideal for providing prolonged pain relief, reducing opioid use, and enabling same-day discharge, which aligns with the ASC model. The increasing demand for outpatient care continues to drive the adoption of CPNB catheters in these settings.

Company Market Share

Key players in the global continuous peripheral nerve block catheters market are focusing on adopting several key business strategies, such as strategic collaborations, product approvals, acquisitions, and product launches, to strengthen their market presence and expand their customer base. These strategies enable companies to leverage technological advancements, enhance their product portfolios, and improve distribution channels.

Solo-Dex, Inc.: An Emerging Player in the Global Continuous Peripheral Nerve Block Catheters Market

Solo-Dex, Inc. is a growing player in the CPNB market, offering innovative solutions designed to optimize postoperative pain management and facilitate same-day discharge. While its market size is smaller compared to some of the larger, established players, Solo-Dex is actively expanding its footprint in emerging markets, particularly in regions experiencing significant growth in outpatient surgical centers and hospitals.

Recent developments at Solo-Dex, Inc. include:

- In July 2023, Solo-Dex, an innovator in the development, manufacture, and sales of new non-opioid acute pain management solutions, announced a strategic master distribution agreement with CH Trading Group LLC and Farouk, Maamoun Tamer & Co. This historic agreement will introduce the distribution of Solo-Dex's innovative Fascile platform across the Kingdom of Saudi Arabia.

List of Key and Emerging Players in Continuous Peripheral Nerve Block Catheters Market

- Braun Medical Inc.

- Teleflex Incorporated

- PAJUNK

- Ace-medical

- Vygon SAS

- AVNS

- ICU Medical, Inc.

- Scilex Holding

- Henan Tuoren Medical Device Co., Ltd.

- Solo-Dex, Inc.

- Halyard Health, Inc.

- Ace Medical

- Epimed International, Inc

- PAJUNK

- Advin Health Care

to learn more about this report Download Market Share

Recent Developments

- May 2023 – Epimed International, Inc., a leading provider of nerve block products, launched a new product line called Epimed Essentials. This collection features Epidural Nerve Block Needles and Epidural Needles designed to enhance the precision and effectiveness of regional anesthesia procedures. The Epimed Essentials line aims to offer healthcare providers high-quality, reliable tools that support optimal patient outcomes in pain management.

Analyst Opinion

As per our analysts, the global continuous peripheral nerve block catheters market is poised for substantial growth, driven by the increasing shift toward opioid-free pain management, rising surgical volumes, and ongoing advancements in catheter technology. The adoption of ultrasound-guided nerve block techniques is a key factor, significantly enhancing the safety, accuracy, and overall effectiveness of CPNB procedures.

Despite the positive outlook, challenges remain, such as the high cost of CPNB procedures and the specialized equipment required, which could limit market penetration in low- and middle-income countries. Moreover, while technological innovations are advancing rapidly, ensuring widespread access to these cutting-edge solutions remains a hurdle.

However, emerging economies, especially in the Asia-Pacific region, present untapped opportunities for growth. With expanding healthcare infrastructure, increasing investments in ambulatory surgical centers (ASCs), and rising demand for regional anesthesia, these markets are expected to drive significant demand for CPNB catheters.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 326.67 Million |

| Market Size in 2025 | USD 339.24 Million |

| Market Size in 2033 | USD 439.85 Million |

| CAGR | 3.32% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Insertion Technique, By Indication, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Continuous Peripheral Nerve Block Catheters Market Segments

By Insertion Technique

- Ultrasound

- Nerve Stimulation

- Hybrid

By Indication

- Upper Extremity Surgery

- Lower Extremity Surgery

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Jay Mehta

Research Analyst

Jay Mehta is a Research Analyst with over 4 years of experience in the Medical Devices industry. His expertise spans market sizing, technology assessment, and competitive analysis. Jay’s research supports manufacturers, investors, and healthcare providers in understanding device innovations, regulatory landscapes, and emerging market opportunities worldwide.