Coronary Stents Market Size, Share & Trends Analysis Report By Type (Drug-Eluting Stents (DES), Bare-Metal Stents (BMS), Bioresorbable Vascular Scaffolds (BVS)), By Material (Cobalt-Chromium (CoCr), Platinum-Chromium (PtCr), Stainless Steel, Nitinol, Bioabsorbable Polymers (e.g., PLLA), Magnesium Alloys), By Mode of Delivery (Balloon-Expandable, Self-Expanding), By End Use (Hospitals, Cardiac Centers, Ambulatory Surgical Centers) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Coronary Stents Market Overview

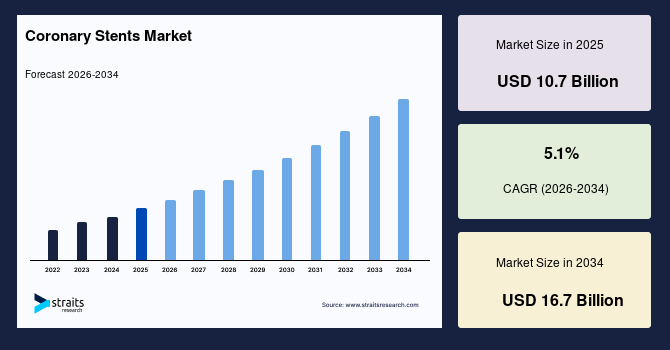

According to Straits Research, the global coronary stents market size was valued at USD 10.7 billion in 2025 and is projected to reach USD 16.7 billion by 2034, exhibiting a CAGR of 5.1% from 2026 to 2034. The market reflected steady expansion as health systems cleared post-pandemic elective procedure backlogs and percutaneous coronary intervention (PCI) volumes normalised. One structural factor that supported growth was the rising prevalence of ischemic heart disease in ageing populations, which drove sustained demand for contemporary drug-eluting stents (DES) and image-guided PCI. Product refresh cycles, improved deliverability in tortuous anatomies, and wider availability of sirolimus-based platforms also bolstered the global market in the base year.

Over the forecast horizon, product differentiation will likely centre on ultra-thin strut designs, bioresorbable polymer coatings, and advanced visualisation support. Cost containment by payers and value-based procurement will continue to favour vendors that demonstrate long-term safety and cost-effectiveness through robust clinical evidence. As emerging economies expand cath lab infrastructure, procedure growth will increasingly shift toward the Asia Pacific, elevating its contribution to global revenue.

Key Market Trends & Insights

- Dominant region (2025): North America at 38% share; fastest-growing region: Asia Pacific at 6.6% CAGR (2026–2034).

- By Type: Drug-Eluting Stents led with 88% share (2025); fastest-growing: Bioresorbable Vascular Scaffolds at 10.4% CAGR.

- By Material: Cobalt-Chromium led with 46% share (2025); fastest-growing: Bioabsorbable polymers/magnesium alloys at 11.2% CAGR.

- By Mode of Delivery: Balloon-Expandable led with 91% share (2025); fastest-growing: Self-Expanding at 7.1% CAGR.

- By End Use: Hospitals led with 62% share (2025); fastest-growing: Ambulatory Surgical Centers at 7.8% CAGR.

- Dominant country: The United States market value was USD 3.2 billion in 2024 and will reach approximately USD 3.37 billion in 2025.

Latest Market Trends

Convergence of Ultra-Thin Struts and Bioresorbable Coatings

Vendors have accelerated the shift toward ultra-thin strut DES, utilising bioresorbable or biodegradable polymers to minimise inflammation and late adverse events. This combination aims to maintain antiproliferative drug delivery while reducing polymer persistence, supporting healthier vessel healing. The outcome is improved long-term safety, which enhances adoption in complex PCI and supports premium pricing in the coronary stents market.

Imaging- and Physiology-Guided PCI Workflows

The broader use of OCT/IVUS imaging and computational FFR/iFR is redefining stent planning and optimisation. Integrated consoles, AI-guided sizing, and post-deployment optimisation protocols enhance outcomes and decrease repeat revascularisation. As hospitals standardise image-guided PCI, vendors that align their stent portfolios with guidance ecosystems will capture a higher share and raise procedure-level value.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 10.7 Billion |

| Estimated 2026 Value | USD 11.25 Billion |

| Projected 2034 Value | USD 16.7 Billion |

| CAGR (2026-2034) | 5.1% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Abbott, Boston Scientific Corporation, Medtronic plc, Terumo Corporation, Biotronik SE & Co. KG |

to learn more about this report Download Free Sample Report

Coronary Stents Market Drivers

Escalating CAD Burden in Ageing Populations

The incidence of coronary artery disease rose with longer life expectancy, sedentary lifestyles, and metabolic risk factors. This demographic shift sustained procedure volumes for PCI and supported the uptake of premium DES due to their superior safety profiles. Clinical data highlighting reduced restenosis underpinned the growth trajectory of the global market.

Expansion of the Cath Lab Infrastructure and Reimbursement

Many middle-income countries expanded cath lab networks within public hospitals and private chains. Reimbursement frameworks have matured, and bundled payments have increasingly recognised the long-term value of modern DES. These developments improved access, reduced out-of-pocket costs, and increased penetration in secondary cities, thereby bolstering the global market share of established brands and regional manufacturers.

Market Restraints

Pricing Pressure and Tender-Driven Commoditization

National and hospital tenders compressed average selling prices, particularly in cost-sensitive markets. While volume expanded, intense price competition constrained margins and limited the capacity of smaller players to invest in next-generation platforms and large-scale clinical programs.

Market Opportunities

Second-Generation Bioresorbable Scaffolds

Improved strut architecture, refined polymers, and enhanced radiopacity are addressing earlier limitations of bioresorbable scaffolds. As new data demonstrate better deliverability and lower rates of late scaffold thrombosis, this subsegment will re-emerge as a viable option for select patients, unlocking a high-growth niche in the coronary stents market.

Day-case PCI and Ambulatory Expansion

Same-day discharge models and the growth of specialised cardiac centres create demand for stents with superior trackability and predictable procedural efficiency. Vendors that pair stents with streamlined kits, radial-first delivery, and integrated imaging support will benefit from the shift to lower-cost care settings, especially in developed markets with capacity constraints.

Regional Analysis

North America held a 38% revenue share in 2025. Mature PCI volumes, high adoption of image-guided interventions, and rapid uptake of contemporary sirolimus-based DES supported the region’s position. From 2026 to 2034, North America will grow at a CAGR of 4.6%, sustained by technological refresh cycles and the expansion of same-day PCI pathways. Procurement will continue to balance premium features with total cost of care, supporting stable pricing for differentiated portfolios in the coronary stents market.

The United States dominated the region, supported by Medicare coverage for complex PCI procedures, a robust clinical trial infrastructure, and high operator proficiency. Product launches that align with radial access, thin-strut designs, and improved radiopacity will further strengthen U.S. market leadership.

Europe Market Insights

Europe accounted for 30% of global revenue in 2025. The region benefited from standardised cardiac care pathways, widespread DES penetration, and robust outcomes registries. From 2026 to 2034, Europe will expand at a CAGR of 4.3%, with growth varying by country depending on tender cycles, DRG updates, and adoption of imaging-guided optimisation. Sustainability initiatives and value-based procurement will favour proven, long-term outcomes in the coronary stents market.

Germany led Europe due to its well-established hospital network, favourable DRG reimbursement for complex PCI procedures, and consistent investment in cath lab technologies. German centres’ emphasis on evidence-based device selection and imaging-guided PCI will continue to drive high-value stent adoption.

Asia Pacific Market Insights

Asia Pacific captured 24% of the global market in 2025 and will be the fastest-growing region, with a projected CAGR of 6.6% through 2034. Rapid urbanisation, expanding cath lab capacity, and growing private insurance coverage will fuel procedure growth. Domestic manufacturing and tiered product portfolios will raise affordability and access, increasing the region’s share of the Coronary Stents Market over the forecast period.

China dominated the Asia Pacific on the back of large procedure volumes, provincial bulk procurement reforms, and increasing availability of advanced sirolimus-eluting platforms from both local and global vendors. Localisation strategies and post-market surveillance programs will further support scale.

Middle East & Africa Market Insights

The Middle East & Africa region accounted for approximately 3% of global revenue in 2025. It will grow at a CAGR of 5.3% from 2026 to 2034, supported by investments in tertiary cardiac centers, medical tourism, and the expansion of national screening programs. Vendor success will depend on training, service coverage, and inventory reliability across dispersed markets within the Coronary Stents Market.

Saudi Arabia led the MEA, driven by Vision-aligned healthcare investments, the expansion of cardiac centres in major cities, and the integration of international clinical guidelines. The country’s procurement modernisation and clinician training initiatives will enhance the adoption of next-generation DES.

Latin America Market Insights

Latin America accounted for approximately 5% of global revenue in 2025. The region is expected to post a CAGR of 5.0% through 2034, as stabilisation in public health budgets and growth in private care improve access. Broader use of radial access and day-case PCI in urban hubs will raise procedure efficiency. Nonetheless, currency volatility and tender dynamics will influence realised pricing in the coronary stents market.

Brazil was the leading country due to a large patient base, expanding private insurance coverage, and selective upgrades across public hospitals. Local partnerships and regulatory familiarity remain pivotal in accelerating the time to market for innovative stent platforms.

Type Insights

Drug-eluting stents (DES) dominated the market in 2025 with an 88% share, reflecting their superior safety and efficacy profiles compared to older platforms. Everolimus- and sirolimus-eluting variants with ultra-thin struts and bioresorbable polymer coatings accounted for the majority of implantations in both routine and complex PCI procedures. Bare-metal stents and early-generation bioresorbable scaffolds held a minimal share due to higher restenosis risk and earlier performance concerns in the coronary stents market.

Bioresorbable Vascular Scaffolds will be the fastest-growing type, with a projected CAGR of 10.4% from 2026 to 2034. Second-generation designs, featuring improved radial strength, enhanced radiopacity, and optimised degradation profiles, will expand their use in specific patient cohorts, particularly those with future surgical considerations or younger age groups.

Material Insights

Cobalt-Chromium (CoCr) alloys led the market in 2025 with a 46% share due to a favourable balance of strength, flexibility, and thin-strut manufacturability. Platinum-Chromium (PtCr) is used for its radiopacity advantages in complex anatomies. Stainless steel and nitinol-based platforms served select use cases, while polymeric scaffolds remained niche in the coronary stents market.

Bioabsorbable materials, including PLLA-based polymers and magnesium alloys, are projected to post the fastest growth at a 11.2% CAGR through 2034. Incremental improvements in scaffold design, combined with growing physician confidence and maturing data, will support broader adoption in carefully selected lesions.

Mode of Delivery Insights

Balloon-expandable stents accounted for a 91% share in 2025, supported by precise deployment, broad device compatibility, and operator familiarity in coronary anatomies. Their predictable expansion behaviour and compatibility with imaging-guided optimisation ensured dominance in the coronary stents market.

Self-expanding stents will grow fastest at a 7.1% CAGR, finding niches in tortuous vessels or ostial lesions where continuous outward force is advantageous. Enhanced deliverability and sizing options will expand their role in challenging anatomies.

End Use Insights

Hospitals led the market in 2025 with a 62% share, reflecting the concentration of cath labs, availability of advanced imaging, and access to multidisciplinary care for complex cases. Tertiary centres performed the bulk of complex PCI, supporting utilisation of premium DES in the coronary stents market.

Ambulatory Surgical Centres will be the fastest-growing end-use setting with a projected 7.8% CAGR. The expansion of day-case PCI, standardised recovery protocols, and payer incentives to shift care to lower-cost settings will drive stent demand outside large hospitals, particularly in mature markets.

Competitive Landscape

The coronary stents market is moderately consolidated, with global leaders competing on the basis of clinical evidence, deliverability, imaging integration, and cost of use. Key players include Abbott, Boston Scientific, and Medtronic, alongside agile challengers such as Terumo and Biotronik. Abbott remained a front-runner with a broad DES portfolio and strong clinical outcomes. In March 2025, Abbott announced a next-generation sirolimus-eluting platform with enhanced radiopacity and an updated delivery system, aiming to improve performance in complex anatomies.

List of Key and Emerging Players in Coronary Stents Market

- Abbott

- Boston Scientific Corporation

- Medtronic plc

- Terumo Corporation

- Biotronik SE & Co. KG

- MicroPort Scientific Corporation

- B. Braun Melsungen AG

- Cordis

- Biosensors International

- OrbusNeich

- Lepu Medical

- Meril Life Sciences

- SMT (Sahajanand Medical Technologies)

- Translumina

- Balton

- Alvimedica

- Nipro Corporation

- Hexacath

- Blue Sail Medical

- Relisys Medical

Strategic Initiatives

- October 2025 - MicroPort Coronary announced that the cumulative global shipments and implantations of its coronary stent systems have each surpassed 10 million units.

- March 2025 - Boston Scientific announced a definitive agreement to acquire SoniVie Ltd., a medical device company developing the TIVUS™ Intravascular Ultrasound System for renal denervation (RDN) therapy to treat hypertension.

- January 2025 - Boston Scientific announced an agreement to acquire Bolt Medical, which develops the Bolt IVL system (a laser-based platform) used to treat coronary and peripheral artery disease by breaking up hardened masses in the arteries.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 10.7 Billion |

| Market Size in 2026 | USD 11.25 Billion |

| Market Size in 2034 | USD 16.7 Billion |

| CAGR | 5.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Material, By Mode of Delivery, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Coronary Stents Market Segments

By Type

- Drug-Eluting Stents (DES)

- Bare-Metal Stents (BMS)

- Bioresorbable Vascular Scaffolds (BVS)

By Material

- Cobalt-Chromium (CoCr)

- Platinum-Chromium (PtCr)

- Stainless Steel

- Nitinol

- Bioabsorbable Polymers (e.g., PLLA)

- Magnesium Alloys

By Mode of Delivery

- Balloon-Expandable

- Self-Expanding

By End Use

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.