Cross-Laminated Timber Market Size, Share & Trends Analysis Report By Product Type (Cross-Laminated Timber (CLT) Panels, Glue-Laminated Timber (Glulam), Laminated Veneer Lumber (LVL)), By Application (Residential Buildings, Commercial Buildings, Industrial Buildings, Infrastructure Projects, Others (Educational, Healthcare, etc.)), By End-Use Industry (Construction, Furniture and Interior, Others (Packaging, Automotive, etc.)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Cross-Laminated Timber Market Overview

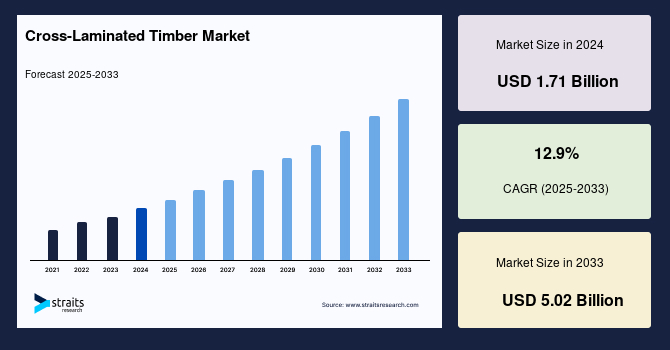

The global cross-laminated timber market size was valued at USD 1.71 billion in 2024 and is projected to reach from USD 1.90 billion in 2025 to USD 5.02 billion by 2033, growing at a CAGR of 12.9% during the forecast period (2025-2033). Cross-laminated timber, as a renewable, carbon-storing, and highly durable material, provides a viable alternative to concrete and steel, advancing the worldwide drive toward sustainable and carbon-neutral construction.

Key Market Indicators

- Europe dominated the cross-laminated timber industry and accounted for a 54% share in 2024

- Based on product type, CLT panels dominate due to their strength, fire resistance, fast assembly, and carbon-sequestering benefits.

- Based on the application, residential buildings lead the CLT market, driven by eco-friendly housing demand and lower construction emissions.

- Based on end use, the construction industry leads the CLT market, driven by sustainable building demand and green certifications.

Market Size & Forecast

- 2024 Market Size: USD 1.71 Billion

- 2033 Projected Market Size: USD 5.02 Billion

- CAGR (2025-2033): 12.9%

- Largest market in 2024: Europe

- Fastest growing market: North America

The global cross-laminated timber (CLT) market is witnessing strong momentum as sustainable construction gains prominence across the globe. CLT, a prefabricated engineered wood product made from glueing layers of solid-sawn timber at right angles, is becoming a core material in modern green architecture due to its structural strength, low carbon footprint, and efficient prefabrication capabilities. Growing environmental concerns, increasing restrictions on CO₂ emissions in the construction sector, and government incentives for green buildings are key drivers of this market.

Additionally, rising urbanisation and the shift toward modular construction in Europe, North America, and Asia-Pacific reinforce demand. The adoption of CLT in residential, commercial, and institutional buildings is supported by its superior fire resistance, seismic performance, and shorter construction timelines. Trends such as the emergence of tall timber buildings, circular economy principles, and integration with Building Information Modelling (BIM) are pushing innovation in the sector. Furthermore, companies are investing in automation and robotics in CLT production to enhance precision and output. These trends highlight CLT’s transition from a niche product to a mainstream construction material globally.

Cross-Laminated Timber Market Trends

Surge in Tall Timber Construction Projects

One of the most transformative trends in the global CLT market is the rise of tall timber buildings. Architects and developers are increasingly adopting CLT for constructing multi-story commercial and residential buildings, due to its strength-to-weight ratio, seismic performance, and low environmental impact. As of 2025, several high-rise timber structures are being commissioned globally, showcasing CLT’s architectural and engineering feasibility.

- For example, Stockholm Wood City, Sweden, initiated by Atrium Ljungberg, is an ambitious project to construct the world's largest wooden urban area, spanning 250,000 square meters. Scheduled to break ground in 2025, the development will feature 2,000 homes and 7,000 office spaces, emphasising the scalability of CLT in large-scale urban planning.

Additionally, advancements in digital fabrication and fireproof adhesives are expanding CLT’s use cases in complex architectural designs. As tall timber gains regulatory support in markets like the U.S., Canada, and the EU, and code revisions permit wooden buildings over 18 stories, the demand for CLT is projected to surge. This trend promotes sustainability and shortens construction timelines through prefabrication and modular techniques.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.71 Billion |

| Estimated 2025 Value | USD 1.90 Billion |

| Projected 2033 Value | USD 5.02 Billion |

| CAGR (2025-2033) | 12.9% |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Key Market Players | Stora Enso, KLH Massivholz, Binderholz GmbH, Structurlam, SmartLam |

to learn more about this report Download Free Sample Report

Cross-Laminated Timber Market Driver

Environmental Regulations and a Push for Carbon-Neutral Buildings

The global regulatory push toward decarbonising the construction industry is a key growth driver for the CLT market. With buildings accounting for nearly 39% of global CO₂ emissions according to UNEP 2024, stakeholders are increasingly turning to sustainable materials like CLT to meet climate targets. Cross-laminated timber, being renewable, carbon-sequestering, and highly durable, offers a practical alternative to concrete and steel. According to the International Energy Agency (IEA), wood-based construction could cut emissions from the built environment by 30–40% by 2050. Governments are updating building codes and launching incentives to accelerate CLT adoption.

- For instance, in February 2025, the UK introduced stricter carbon standards, including the RICS Whole Life Carbon Assessment Standard and the Future Homes Standard. These regulations mandate the use of low-carbon materials and energy-efficient designs, incentivising the adoption of CLT in construction projects

Private sector initiatives complement these regulatory moves. In 2025, Lendlease launched a global campaign to build all new developments with timber by 2030. The integration of CLT into ESG frameworks and green bond-eligible infrastructure further strengthens its commercial viability. With increasing alignment between climate policy and construction practices, CLT is well-positioned to become a core material in the global sustainable building movement.

Market Restraint

High Initial Costs and Limited Awareness in Emerging Markets

Despite its advantages, adopting cross-laminated timber faces resistance due to high initial investment and limited awareness, particularly in developing regions. While CLT offers lifecycle cost savings through energy efficiency and faster assembly, the upfront costs remain significantly higher than those of conventional materials like concrete or steel. Limited number of CLT manufacturers and high logistics costs for large prefabricated panels also contribute to elevated project budgets. Moreover, most CLT plants are concentrated in Europe and North America, resulting in limited supply chains in Latin America, the Middle East, and Southeast Asia.

In addition, a lack of familiarity among contractors, engineers, and regulatory bodies in many markets hinders mass adoption. Building codes in some countries still do not recognise CLT as a primary structural material, creating delays in approvals and limiting its application in large projects. Furthermore, local timber sourcing and grading challenges complicate adoption in regions with underdeveloped forestry infrastructure. Without subsidies, standardisation, and capacity-building efforts, these areas' CLT market may stagnate. Addressing these barriers will require collaborative efforts between governments, industry stakeholders, and academic institutions.

Market Opportunity

Integration of Clt into Modular and Prefabricated Construction

The growing trend toward off-site construction and modular building presents a significant opportunity for the cross-laminated timber market. CLT’s dimensional stability, high strength, and ease of CNC machining make it ideal for prefabricated structures, offering faster project completion with reduced waste and environmental impact. CLT panels can be manufactured off-site with precise dimensions, integrated openings, and embedded mechanical systems, allowing rapid on-site assembly. This approach aligns with global labour shortages and increasing pressure for construction productivity.

- For example, in April 2024, Stora Enso completed a prefabricated timber school building in Nantes, France, utilising its automated coating line for CLT.This project demonstrates the efficiency and sustainability of CLT in educational infrastructure.

Government support for prefabrication adds further momentum. Singapore’s BuildSG initiative and Australia’s Offsite Construction Framework are promoting mass timber in public infrastructure, recognising its speed, sustainability, and seismic safety benefits. As urbanisation drives demand for scalable, low-emission buildings, integrating CLT into industrialised construction workflows represents a high-growth opportunity. Innovations in robotic manufacturing, BIM-integrated design, and hybrid timber systems are expanding the market scope, positioning CLT as the preferred material for modular construction globally.

Regional Insights

Europe led the cross-laminated timber market, capturing a 54% share in 2024, driven by strong demand for sustainable building materials across residential and commercial sectors. The region's strong environmental regulations and carbon neutrality commitments are pivotal to this leadership. Countries such as Germany, Austria, and Sweden are frontrunners in CLT manufacturing and usage, supported by well-established forestry sectors and innovation clusters. Government-led projects such as the Paris Timber Tower Initiative aim to construct multiple high-rise timber buildings by 2030, further validating market momentum.

Additionally, European countries are updating building codes to allow timber constructions up to 18 stories, enhancing CLT's applicability in urban centres. Industry collaborations, like the Woodrise Project funded by Horizon Europe, promote technological advancements and market awareness, consolidating Europe's dominant position in the CLT market.

- The UK market for CLT has seen substantial growth driven by government-led green building policies and increased adoption in residential and commercial construction. The UK Green Building Council promotes CLT as a sustainable alternative to steel and concrete, highlighting its carbon sequestration benefits and waste reduction. Additionally, manufacturers like Stora Enso and James Jones & Sons are expanding production capacity to meet rising demand. The government’s Clean Growth Strategy includes financial incentives for sustainable materials, helping boost CLT utilisation across infrastructure and public buildings in 2025.

- Germany remains one of the largest European markets for CLT, driven by its advanced engineering, mature forestry industry, and strong environmental legislation. The country’s commitment to the Energiewende(energy transition) promotes wood as a renewable, low-carbon building material. The rise of modular construction methods and BIM adoption enhances CLT’s appeal. Recent government-funded pilot projects in cities like Hamburg and Berlin showcase CLT for urban infill developments. German timber producers such as KLH Massivholz continue to innovate in CLT panel fabrication. Germany’s focus on circular economy and sustainable urban planning strengthens its leadership in the CLT market.

North America Market Trends

North America is the fastest-growing region for CLT, with a forecast CAGR of 14% during the forecast period. The U.S. and Canada are aggressively expanding their mass timber ecosystems due to increased environmental regulations and the drive for sustainable urban development. Government incentives, including the U.S. Department of Energy’s Wood Innovations Program, support pilot projects and commercial applications of CLT in public housing, schools, and office buildings.

Additionally, private sector initiatives by companies like StructureCraft and SmartLam are driving innovation in prefabricated mass timber modules, making CLT construction more cost-efficient. The rising consumer demand for sustainable homes, alongside the push for decarbonising commercial buildings, cements North America’s rapid growth trajectory in the CLT market.

- The U.S. market is rapidly expanding due to growing emphasis on sustainable construction and government incentives promoting green building practices. Major infrastructure and commercial projects, including the Brock Commons Tallwood House at the University of British Columbia (a North American benchmark), have showcased CLT’s potential, accelerating interest nationwide. The U.S. Department of Energy’s Wood Innovations Program actively funds research and pilot projects that integrate CLT into public housing, schools, and offices. Private sector investments by firms like StructureCraft and SmartLam further propel the industry, focusing on automated fabrication and prefabricated mass timber modules.

- Canada pioneered in CLT adoption and manufacturing, leveraging its abundant forestry resources and progressive environmental policies. Canadian provinces, especially British Columbia and Quebec, support CLT growth through financial incentives and revisions to building codes that encourage wood-frame high-rises. The Canada Wood Group actively promotes CLT through education and outreach programs. The construction sector benefits from CLT’s carbon storage properties and speed of construction, aligning with Canada’s commitment to reducing greenhouse gas emissions by 40-45% below 2005 levels by 2030.

Asia-Pacific Market Trends

The Asia-Pacific region is emerging as a significant growth market for CLT, with a CAGR estimated around 13%. Urbanisation, government sustainability goals, and modernisation of building codes are fueling adoption in countries like Japan, Australia, China, and South Korea. Japan’s focus on disaster-resilient and sustainable construction has accelerated CLT deployment, particularly after its Smart Timber City initiative launched in 2024, which promotes mass timber in urban housing and public infrastructure. Despite being in an earlier stage than Europe and North America, Asia-Pacific investments in CLT manufacturing and R&D have increased by over 20% in 2024, signalling accelerated market maturation.

- China is one of the fastest-growing CLT markets in Asia-Pacific, driven by rapid urbanisation, smart city initiatives, and sustainability goals under the 14th Five-Year Plan. The government encourages mass timber use to reduce construction emissions and dependence on concrete. Major cities like Shenzhen and Shanghai have piloted CLT in public buildings and affordable housing. Domestic manufacturers are scaling up capacity to meet rising demand. Additionally, partnerships with European CLT technology firms support knowledge transfer and product innovation. China’s push towards low-carbon construction materials, alongside growing timber plantations, is forecasted to boost the market.

- India’s CLT marketis in the nascent stages but shows promising growth due to increased awareness of sustainable construction and government initiatives such as the Smart Cities Mission. While traditional construction methods dominate, demand for green materials like CLT is rising in urban centres focused on affordable and eco-friendly housing. The government has introduced pilot programs supporting mass timber in public infrastructure projects. Additionally, collaborations with foreign CLT producers and technical institutes aim to build local expertise and manufacturing capabilities. India’s forestry resources, though underutilised for engineered wood, offer significant potential for CLT production expansion.

Product Type Insight

CLT panels dominate the product type segment due to their exceptional structural strength, dimensional stability, and fire resistance, making them highly suitable for multi-story and large-scale construction projects. Their prefabricated nature allows for faster assembly on-site, reducing labour costs and construction timelines. The push for green construction and government incentives in Europe and North America further bolsters CLT’s prominence. The increasing preference for CLT over traditional concrete and steel panels also arises from its ability to sequester carbon, estimated at 1.1 tonnes of CO₂ stored per cubic meter of CLT, offering builders a viable strategy to meet carbon-neutrality targets.

Application Insight

Residential buildings constitute the largest application segment for CLT, propelled by rapid urbanisation and growing demand for eco-friendly housing solutions. The integration of CLT panels in single-family homes, apartments, and multi-family residential complexes supports energy efficiency and sustainability goals. The International Energy Agency (IEA) 2025 report highlights that mass timber residential construction can reduce construction waste by 50% and embodied carbon emissions by up to 60%, making it attractive for both developers and regulators. Moreover, growing consumer awareness about indoor air quality and natural materials is enhancing CLT’s demand in residential construction worldwide.

End-Use Industry Insight

The construction industry overwhelmingly dominates the end-use segment for CLT products, driven by the global shift towards sustainable infrastructure. CLT is favoured for its high load-bearing capacity, seismic resilience, and thermal insulation properties, aligning with the increasing requirements of green building certifications such as LEED and BREEAM. Innovations in automated fabrication and digital design tools like Building Information Modelling (BIM) further streamline CLT adoption, reducing errors and rework. Major construction firms such as Lendlease and Skanska have announced multi-billion-dollar commitments to mass timber projects in Europe and North America, underscoring construction as the primary driver for CLT market expansion.

List of Key and Emerging Players in Cross-Laminated Timber Market

- Stora Enso

- KLH Massivholz

- Binderholz GmbH

- Structurlam

- SmartLam

- Mayr-Melnhof Holz

- Metsä Wood

- Lignotrend

- R. Johnson Wood Innovations

- Binderholz

- Rubner Holzbau

- Waugh Thistleton Architects

to learn more about this report Download Market Share

Recent Developments

- In September 2025, Cambium Carbon introduced the first CLT product made entirely from salvaged trees. This innovation not only repurposes underutilized wood but also contributes to reducing deforestation and promoting circular economy practices in the timber industry.

- In February 2025, Timberlab Inc., a subsidiary of Swinerton Incorporated, has commenced construction on a 190,000-square-foot CLT manufacturing facility in Millersburg, Oregon. This facility is set to become one of the largest CLT production sites in the United States, aiming to meet the growing demand for mass timber in construction projects.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.71 Billion |

| Market Size in 2025 | USD 1.90 Billion |

| Market Size in 2033 | USD 5.02 Billion |

| CAGR | 12.9% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Cross-Laminated Timber Market Segments

By Product Type

- Cross-Laminated Timber (CLT) Panels

- Glue-Laminated Timber (Glulam)

- Laminated Veneer Lumber (LVL)

By Application

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Infrastructure Projects

- Others (Educational, Healthcare, etc.)

By End-Use Industry

- Construction

- Furniture and Interior

- Others (Packaging, Automotive, etc.)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.