Data Center Cooling System Market Size, Share & Trends Analysis Report By Air-Based Cooling (Computer Room Air Conditioning & Computer Room Air Handlers, In-Row and In-Rack Cooling, Others), By Liquid-Based Cooling (Direct Liquid Cooling, Immersion Cooling) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Data Center Cooling System Market Size

The global data center cooling system market size was valued at USD 5,109.25 million in 2024 and is projected to reach from USD 5,759.16 million in 2025 to USD 12,090.8 million by 2033, growing at a CAGR of 13.1% during the forecast period (2025-2033).

Data center cooling refers to the process of temperature monitoring and maintenance in a data center environment. The only aim is to make sure the electronic devices including servers, networking equipment, and storage units run at the best possible conditions. Additionally, effective cooling systems are necessary in order to avoid overheating because it could result in equipment failure.

The expansion in the world data center cooling system market will be fueled by the rising number of data centers and efforts from governments towards energy-efficient data centers. The necessity to bridge the water shortage gap has also led to the implementation of data center cooling technologies.

The cooling industry for data centers is guided by numerous regulations with governments around the globe highlighting effective data center incident response and recovery plans. Cooling facilities have a key function in avoiding overheating of equipment and maintaining the operation of data centers during and after incidents.

Vertiv Group Corp., Schneider Electric, Fujitsu, Mitsubishi Electric Corporation and Asetek, Inc drives the data center cooling system market. The companies are emphasizing different strategic initiatives such as new product development, partnerships & collaborations, and agreements in order to take a competitive edge over their competitors. Some examples of such initiatives are mentioned below.

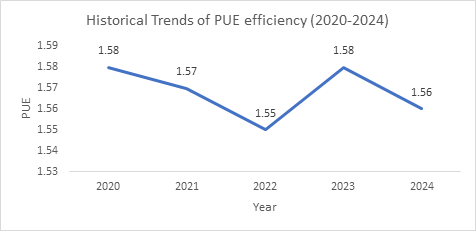

Historical Trends of PUE efficiency (2020-2024)

Source: Straits Research

The above graph indicates the PUE efficiency from 2020 to 2024, with values fluctuating from 1.55 to 1.58. As PUE is considered as one of the important measures that describes how energy efficient a data center is more precisely. The lesser the PUE value is the more the energy efficient. The downward trend of PUE in 2022 indicates the significant improvement in cooling efficiency. The PUE efficiency rise in 2023, may be a result of operation or climatic conditions and again the slight regain in 2024 shows the renewed energy for efficiency improvements. These small changes of the PUE have a direct impact on the data center cooling, because they indicate the continuous demand for more efficient and cost-effective technologies. However, the data centers propel to decrease the PUE, for more sophisticated cooling technologies, such as liquid cooling, immersion cooling and AI-based thermal management increases as all of them are important for enabling operators to achieve both performance and sustainability targets.

Recent Market Trend

Adoption of Cooling Technologies is Increasing Efficiency

As data centers support high-performance computing and AI workloads, there is a growing trend towards liquid cooling solutions. Liquid cooling solutions provide a higher level of heat dissipation compared to conventional air-based solutions, which results in increased energy efficiency and lower operation costs.

- For instance, HPE (Hewlett Packard Enterprise) demonstrated its liquid cooling solution for AI server,s emphasizing its position in addressing the increasing power consumption of contemporary processors.

Integration of Green Cooling Methods

The use of environmentally friendly cooling techniques by data centers is on the rise to reduce the carbon footprint. Developments such as water sources for cooling are facing resistance.

- For instance, in Australia HDR is working on systems utilized for cooling wastewater for use in data centers, to decrease reliance on the potable water and improve sustainability.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 5,109.25 Million |

| Estimated 2025 Value | USD 5,759.16 Million |

| Projected 2033 Value | USD 12,090.8 Million |

| CAGR (2025-2033) | 13.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Schneider Electric Se., Black Box Corporation, Nortek Air Solutions LLC, Airedale International Air Conditioning Ltd, Rittal GmbH & Co. Kg |

to learn more about this report Download Free Sample Report

Data Center Cooling System Market Growth Factors

Increased Adoption of Cloud Computing and Digital Services

Growth of cloud services, streaming media, and big data analytics has absorbed the development of massive data centers. Such centers demand high cooling facilities to function optimally and prevent equipment overheating thus demanding the use of sophisticated cooling technologies.

- For instance, in December 2024, Amazon Web Services (AWS) introduced a new set of data center components designed to make its data centers more capable of supporting the next generation of AI workloads. These technologies range from power and cooling to hardware design and are planned to increase the energy efficiency of AWS facilities.

Improvements in High-Density Computing Hardware

The situation of high-density networking and server equipment necessitates the need for effective cooling solutions that can handle the thermal load of contemporary data center hardware.

- For instance, in November 2023, Schneider Electric's collaboration with Intel to design a liquid cooling solution for the Intel Gaudi3 AI accelerator which incorporates Vertiv's pumped two-phase cooling technology to address the thermal requirements of AI-based computing

Restraining Factors

High Costs of Investment and Operations

The installation of sophisticated cooling systems entails some significant capital outlays and recurring maintenance expenses. Thus, these economic factors can be a stumbling block for data center operators, particularly in the small and medium-sized businesses, to embrace the art of cooling technologies.

- For instance, the majority of small-scale data centers in America are reluctant to implement energy-saving options such as liquid immersion cooling because the initial investment of retrofitting current infrastructure is very expensive. For instance, the cost of installing direct-to-chip cooling systems may be a great deal higher than the conventional air-cooling systems discouraging adoption despite future energy savings.

Lack of Technical Expertise and Complexity

Developing and sustaining cultured cooling systems involves profound technical expertise which may not be easily accessed. Combining new cooling technologies with current infrastructure complicates the issue causing delays, mistakes and inefficiencies that discourage operators from improving.

- For instance, in countries like India where the data center industry is expanding fast because of digitalization and unavailability of skilled engineers with knowledge of liquid cooling technologies has delayed adoption. Organizations end up relying on foreign experts which adds expense and project duration.

Market Opportunity

Rising Demand for Energy-Efficient Cooling Solutions

The rise of data center industry in terms of size and density to support cloud computing, AI and 5G. There’s a need for cooling systems that reduce energy consumption while maintaining performance. These updates create numerous opportunities for advanced eco-friendly technologies like liquid cooling and free air cooling.

- For instance, Google have adopted liquid cooling for the high-performance of AI workloads decreasing the energy use by up to 40% compared to traditional air cooling. This trend encourages retailers offering scalable efficient cooling solutions tailored to hyperscale data centers.

Sustainability and Green Data Center Initiatives

With governments and corporations prioritizing carbon neutrality, there’s a growing market for cooling technologies that minimize environmental impact such as those using renewable energy or low-GWP (global warming potential) refrigerants.

- For Instance, in 2023, Equinix global data center provider, partnered with cooling tech firms to deploy free cooling systems in its Northern European facilities, leveraging cold climates to cut energy use. This reflects a broader opportunity for vendors to supply sustainable cooling solutions aligned with ESG goals.

By Air-Based Cooling

Computer Room Air Conditioning & Computer Room Air Handlers stay ahead mostly due to their compatibility with traditional data center setups. The design is simple, and operators prefer this option because of the ease in deployment and operation. It generally maintains balanced airflow across the space, which makes it suitable for average load environments. The system is familiar to many technicians and operators, which also brings down operational risk. Overall, it is considered a reliable choice, especially in facilities where layout and hardware design are conventional.

- For instance, in 2024, a leading telecom company in Chicago still employs CRAC units in its old data center, and it reported inefficiencies in cooling new 5G edge servers, initiating plans to incorporate more sophisticated solutions.

By Liquid-Based Cooling

Direct Liquid Cooling leads this segment mainly because it handles high-density loads more efficiently. The method removes heat directly from the source, which keeps the system cooler and cuts down power usage. It also helps reduce carbon footprint, which is becoming more important in new facility designs. The setup works well in places where traditional air-based systems fall short. Since it's getting easier to implement in modern infrastructure, more operators are shifting towards it. So, this keeps Direct Liquid Cooling ahead in this space.

- For instance, NVIDIA's California data center installed DLC in 2024 to cool its newest AI training servers which improved thermal management by 30%, although the $3 million retrofit price tag postponed wider deployment.

North America: Dominant Region

North America dominates the worldwide data center cooling system market, fueled by a strong IT infrastructure, high density of hyperscale data centers and energy efficiency push. Air-based cooling, specifically CRAC and CRAH, continues to be dominant in legacy facilities because of its established presence and lower capital costs. For example, a Virginia colocation provider still depends on CRAH systems to cool its enterprise data centers with heat loads of up to 15 kW per rack. But the transition towards Liquid-Based Cooling is gaining momentum particularly for AI and HPC workloads.

United States Market Trends

The U.S. leads due to strong cloud growth, with AWS and Azure holding over 50% global share. High-density workloads and AI demand are pushing scalable and efficient cooling solutions across hyperscale and colocation sites.

Asia-Pacific: Fastest-Growing Region

The Asia-Pacific region is the fastest-growing market, driven by rapid digitalization, cloud computing, and hyperscale data center development in markets such as China, India, and Singapore. Air-Based Cooling especially In-Row and In-Rack solutions are favoured for their scalability for expansion in emerging markets. For example, a Singapore edge data center used In-Row cooling in 2024 to cool 20 kW racks for 5G uses lowering cooling energy by 15%. Liquid-based cooling is gaining traction because of the requirements for high densities and government incentives for green technologies.

China Market Trends

China’s large IDC footprint and rising emissions under the “3060 double carbon” policy are fueling demand for liquid cooling, AI-based optimization, and heat reuse systems to manage energy use and environmental targets.

India Market Trends

India’s growing AI market and digital infrastructure needs are driving the adoption of liquid cooling and airflow automation. Government initiatives and hyperscale expansions in cities like Mumbai and Chennai are accelerating deployments.

Japan Market Trends

Japan’s emission targets (46–50% by 2030) are prompting faster adoption of liquid cooling and AI-driven thermal systems. Dense setups and disaster-readiness needs are shaping efficient cooling infrastructure.

Other Country Insights

- United Kingdom: UK is seeing major investments like the USD 4.1 billion Hertfordshire data center project. Retrofitting and new builds are increasing demand for hybrid and sustainable cooling systems amid rising cloud and streaming loads.

- Australia: Australia is prioritizing energy efficiency. In 2024, NEXTDC launched NABERS 5-star data centers using liquid and free cooling systems, supporting low-energy operations amid rising IT and heat loads.

- Singapore: Singapore’s Green Data Centre Roadmap (May 2024) pushes for 300 MW new capacity and PUE targets below 1.3. Liquid cooling and custom solutions are gaining traction to meet space, energy, and climate constraints.

Company Market Share

Key players in the industry focus on adopting key business strategies, such as strategic collaborations, product approvals, acquisitions, and product launches, to gain a strong place in the market.

Green Revolution Cooling (grc) Inc.: An Emerging Player in the Market

Green Revolution Cooling (GRC) Inc. is an emerging player in the data center cooling space, known for its immersive liquid cooling solutions that help reduce energy consumption, improve cooling efficiency, and support high-density IT environments.

Recent Developments by Green Revolution Cooling (GRC) Inc

- In November 2023, GRC (Green Revolution Cooling), the leader in immersion cooling for data centers, and ENEOS, Japan’s largest lubricant company, released a jointly developed white paper, “Enhancing Data Center Performance with Immersion Cooling and Precision-Engineered Fluids.”

List of Key and Emerging Players in Data Center Cooling System Market

- Schneider Electric Se.

- Black Box Corporation

- Nortek Air Solutions LLC

- Airedale International Air Conditioning Ltd

- Rittal GmbH & Co. Kg

- Stulz GmbH

- Vertiv Co.

- Asetek

- Adaptivcool

- Coolcentric

Recent Developments

- In October 2024, Schneider Electric announced that it plans to acquire Motivair Corp, an American liquid cooling specialist for high-performance computing, a 75% stake for cash of $850 million. Schneider is aiming to improve data center cooling skills by addressing increasing demand for energy-efficient cooling due to the upsurge of generative AI and large language models.

- In November 2024, Super Micro Computer Inc. unveiled a new server liquid cooling solution with coolant distribution units (CDUs) and cooling towers that can handle the high-power demands of artificial intelligence workloads. The technology delivers substantial energy and space savings, cutting infrastructure costs by as much as 40% and space needs by 80%

Analyst Opinion

The global data center cooling system market is transforming at a fast pace as digital infrastructure grows in both mature and emerging markets. The U.S. and China are leading demand through cloud growth, AI workloads, and policy-supported digitization, whereas markets like Germany, Japan, and Singapore are focusing on energy efficiency and sustainable operations. The transition to liquid cooling and AI-optimised thermal management is increasingly in sight as high-density compute environments become the standard. Strategic investment and regulatory drivers throughout these markets are likely to keep energy-efficient, scalable cooling systems at the forefront of future data center design.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 5,109.25 Million |

| Market Size in 2025 | USD 5,759.16 Million |

| Market Size in 2033 | USD 12,090.8 Million |

| CAGR | 13.1% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Air-Based Cooling, By Liquid-Based Cooling |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Data Center Cooling System Market Segments

By Air-Based Cooling

- Computer Room Air Conditioning & Computer Room Air Handlers

- In-Row and In-Rack Cooling

- Others

By Liquid-Based Cooling

- Direct Liquid Cooling

- Immersion Cooling

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.