India Digital Payments Market Size, Share & Trends Analysis Report By Payment Type (Mobile Wallet Payments, QR Code Based Payments, NFC & Contactless Card Payments, Online Card Payments, Bank Transfer, Digital Currency (e-CNY) Payments, Other Types), By Technology (Mobile Apps, Hosted Payment Gateways, API-Based Payment Integration, Contactless Payment Technologies, Other Technologies), By End-Use Application (Retail, Food & Beverage, Transportation, Utilities, Government & Public Services, Financial Services, Healthcare, Others) and Forecasts, 2026-2034

India Digital Payments Market Overview

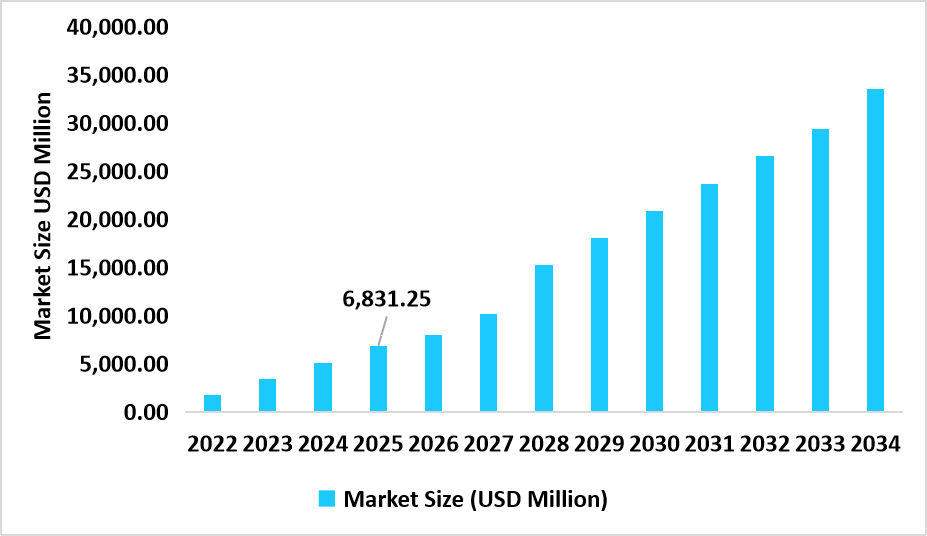

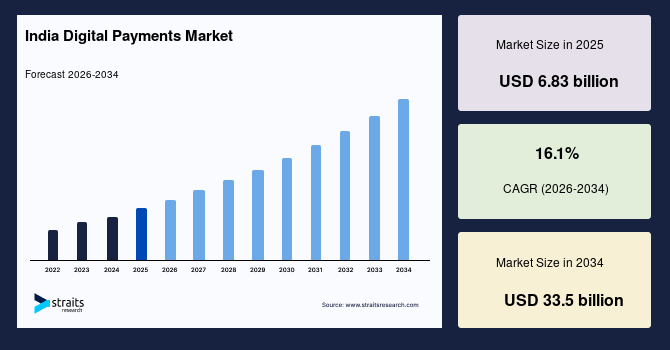

The India digital payments market size is valued at USD 6.83 billion in 2025 and is projected to reach USD 33.5 billion by 2034, expanding at a CAGR of 16.1% during the forecast period. The steady growth of the market is driven by the widespread adoption of UPI, QR-based transactions, and mobile wallets, supported by rapid smartphone penetration, merchant digitization, and government-led financial inclusion initiatives. Additionally, ongoing innovations in contactless payment technologies, API-driven integrations, and the expansion of digital public infrastructure are enhancing transaction speed, security, and accessibility collectively strengthening user confidence and accelerating the shift from cash to digital payments across India.

Key Market Trends & Insights

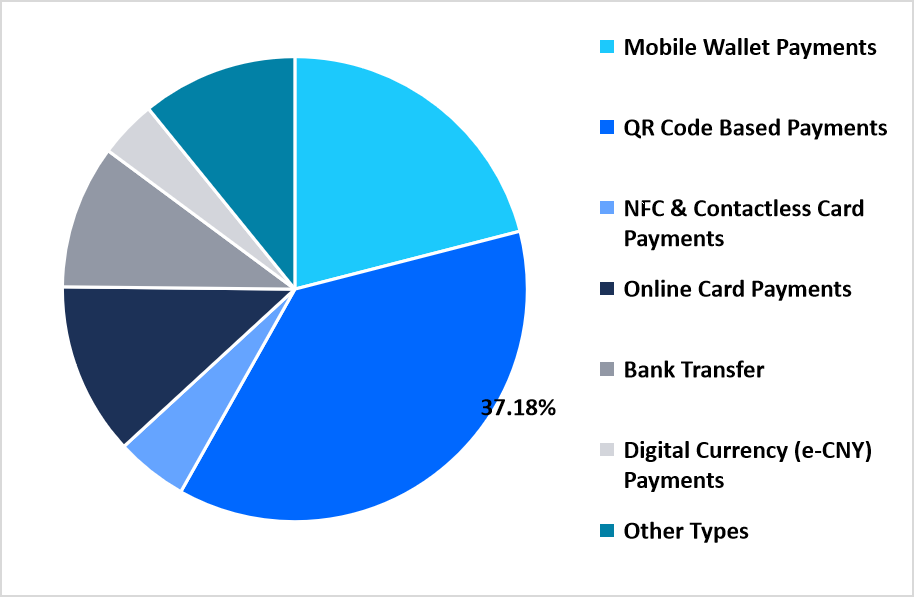

- By Payment Type, QR Code Based Payments dominated the market with a revenue share of 37.18% in 2025.

- Based on technology, the Mobile Apps segment held the highest market share of 36.65% in 2025.

- Based on end-use application, The Financial Services segment is projected to grow at the fastest CAGR of 17.86% during the forecast period.

India Digital Payments Market Size (USD Million)

Source: Straits Research

Market Overview

- 2025 Market Size: USD 6.83 billion

- 2034 Projected Market Size: USD 33.5 billion

- CAGR (2026-2034): 16.1%

The India Digital Payments Market encompasses a wide spectrum of electronic transaction methods: mobile wallet payments, QR code–based transfers, NFC and contactless card transactions, online card payments, bank transfers, and emerging digital currency–based payment modes. These are enabled through multiple technology frameworks such as mobile applications, hosted payment gateways, API-driven payment integrations, and advanced contactless payment technologies, each supporting seamless, high-speed financial interactions across diverse user groups.

Besides this, the digital payment services in India also address an extensive range of end-use applications: retail, food and beverage, transportation, utilities, government and public services, financial institutions, healthcare providers, and other service industries that provide secure, convenient, and interoperable payment experiences, strengthening financial inclusion and accelerating nationwide digital adoption.

Latest Market Trends

Transition from cash-centric behavior to frictionless digital ecosystems

India is seeing a rapid transition from being a cash-heavy transaction economy to a fully connected digital payment ecosystem on the back of UPI, QR code, and mobile apps. For a long time, users relied heavily on hard cash owing to very poor acceptance infrastructure, long queues at ATMs, and a lack of convenience for small-value transactions-friction elements in day-to-day payments. Fast forward to today, interoperable platforms on UPI, instant bank transfers, and QR code-based merchant networks have transformed this landscape.

Consumers access frictionless payment journeys via mobile applications that can facilitate bill payments, online transfers, automated subscriptions, and merchant checkouts in seconds. Integrated digital platforms offer features like UPI AutoPay, voice-enabled payment, and instant refund, thus increasing user convenience and reliability of the transaction. This network effect has further cemented consumer engagement, swelled digital adoption in rural and semi-urban geographies, and perpetuated the march toward a less-cash economy.

Explosive surge in UPI-driven micro-payments

The country's digital payments ecosystem is witnessing an unprecedented rise in UPI-based micro-transactions, thereby reflecting a fundamental shift in the way Indians pay for everyday needs. A few years ago, digital payments were used primarily for mid to high-value transactions such as e-commerce orders, utility bill payments, and travel bookings.

Today, with the ease of use, UPI has become the default even for low-ticket purchases like tea stalls, local kiranas, auto-rickshaw rides, and street vendors. The volume of less-than-₹100 transactions has increased manifold, highlighting that digital payments are getting democratized across all income groups. This behavioral change indicates increased trust, inclusive reach, and high merchant acceptance facilitated by QR codes and affordable smartphones.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 6.83 billion |

| Estimated 2026 Value | USD 7.93 billion |

| Projected 2034 Value | USD 33.5 billion |

| CAGR (2026-2034) | 16.1% |

| Key Market Players | Paytm Payments Bank, PhonePe, Razorpay, PayU India, BharatPe |

to learn more about this report Download Free Sample Report

Market Driver

Mass adoption of UPI as a national financial utility

The unparalleled rise of UPI as a universal financial utility is propelling digital payments in India to become one of the most powerful structural growth drivers of the market. Until a few years ago, digital transactions were fragmented across cards, wallets, and net banking, with restricted merchant acceptance and inconsistent user experience limiting widespread adoption. Today, UPI has emerged as the backbone of India's digital economy, along with instant money transfer, interoperability across banks, and QR-based acceptance reaching even the smallest businesses. According to data from the National Payments Corporation of India, UPI has processed over 14,000 crore transactions in FY 2023–24.

This reflects seamless adoption across urban and rural India. It goes on to state that government initiatives, such as UPI incentives for small merchants, zero-cost transactions for consumers, and the integration with Aadhaar-enabled systems, have further strengthened this surge. UPI's increasing penetration into sectors like public transportation, retail, utilities, and government payments is rapidly accelerating national-level digital adoption.

Market Restraint

Persistent gaps in digital literacy hinder nationwide adoption.

A key restraint in the India Digital Payments Market is unequal digital literacy across the population, limiting confident adoption and regular usage of digital payment systems among users, particularly in rural and low-income segments of society. Though India has shown strong progress in increasing access to smartphones and internet connectivity, quite a segment of its users have difficulties understanding QR payments, steps for authentication, ways to securely create a PIN, and protocols for awareness about fraud, due to which most of these populations are still opting for cash-based transactions.

In fact, according to the reports on digital literacy by NSSO and MeitY, less than 40% of rural households have a digitally literate member who can use basic digital services independently. Further, this gap in digital literacy becomes even more acute when moving to financial applications themselves, with most first-time users needing assistance from shopkeepers, intermediaries, or family members to execute a transaction-a factor that adds further to general hesitation and trust barriers.

Market Opportunity

Digitization of merchant businesses in underrepresented sectors

Rapid digitization of India's small and unorganized merchant ecosystem unlocks a major growth opportunity for the India Digital Payments Market. Historically, millions of micro-businesses operating as roadside vendors, local kirana stores, neighborhood service providers, and small eateries have been running their businesses almost on cash, due to limited access to digital tools, lack of awareness, and absence of formal business infrastructure. This restricts transaction visibility, lowers operational efficiency, and reduces opportunities for scaling their financial footprint.

In recent years, digital payment platforms have begun to penetrate these underserved merchant categories by simplifying onboarding, offering zero-maintenance QR-based acceptance, and enabling instant settlement even for tiny transactions. The growing adoption of digital payments among first–time merchants is reshaping business behavior, improving daily cash-flow management, and enabling microenterprises to build transaction histories that can support future access to credit and other embedded financial services.

Payment Type Insights

The QR Code-Based Payments segment dominated the market, with 37.18% of the revenue share in 2025, driven by rapid growth in the number of QR-enabled acceptance points across urban and rural markets. This enables even micro and informal merchants to adopt digital payments instantly without any additional hardware.

Mobile Wallet Payments will see the fastest growth among all segments, at a projected CAGR of about 17.42%, during the forecast period. Accelerated growth is driven by increasing adoption amongst young users, an increase in integrations of loyalty programmes, and the expansion of app-based ecosystem feature sets such as subscriptions, in-app commerce, and micro-credit.

By Payment Type Market Share (%), 2025

Source: Straits Research

Technology Insights

Mobile Apps segment had the largest market share of 36.65% in 2025, since the mobile-first interface has emerged as the core channel for digital transactions across India. Payment apps combine various functionalities such as bill payments, UPI transfers, QR scanning, ticketing, and subscriptions, thereby ultimately building a cohesive ecosystem that makes user journeys seamless.

API-Based Payment Integration is expected to see the fastest growth during the forecast period. Indeed, growth is increasing as more e-commerce, logistics, mobility, healthtech, and fintech companies turn to the power of embedded payment capabilities. With enterprises increasingly integrating APIs for instant settlements, automated billing, and seamless checkout flows, demand is accelerating for API-driven infrastructures.

End-use Application Insights

The segment of Financial Services is poised for the quickest growth at a CAGR of 17.86% owing to the rapid growth of digital lending, insurance payments, and investment platforms across India. With more consumers moving to online banking, automated EMI payments, and recurring SIP transactions, seamless digital payment flows are increasingly being integrated into financial institutions for improved ease and efficiency by reducing manual processing.

Competitive Landscape

Competition in the India Digital Payments Market is moderate, with various established payment platforms and specialized service providers offering digital transaction services. Few leading players have captured significant market share on the back of large user bases, diversified payment solutions, and strong merchant networks.

Major market players such as Paytm Payments Bank, PhonePe, Razorpay, among others have been on a continuous drive to strengthen their positions in the market by introducing new product launches, strategic partnerships, and ecosystem integrations. With growing promotional activities towards increasing digital payment acceptance, enhancing user experience, and offering value-added financial services, the competition has turned intense, accelerating digital adoption across India.

Zoho Payment Technologies: An emerging market player

Zoho Payment Technologies, a subsidiary of the broader SaaS-giant in India, launched new fintech payment-acceptance hardware and solutions in 2025 so as to enter the digital payments market and provide for merchants across India's SME sector.

- In October 2025, Zoho launched point-of-sale devices, QR-code payment devices, soundboxes, and an entire suite of payment solutions, including payout capabilities, virtual accounts for collections, and marketplace settlement tools to mark its entry into the payments infrastructure market in India.

Thus, Zoho Payment Technologies emerges as a notable new entrant in the India Digital Payments Market, leveraging its existing software ecosystem and merchant base to offer integrated payment acceptance and financial-workflow tools.

List of Key and Emerging Players in India Digital Payments Market

- Paytm Payments Bank

- PhonePe

- Razorpay

- PayU India

- BharatPe

- MobiKwik

- Easebuzz

- CCAvenue

- Pine Labs

- Ezetap

- FreeCharge

- Cashfree Payments

- Instamojo

- BillDesk

- FSS Technologies

- Atom Technologies

- Citrus Pay

- Zoho Payments

- Oxigen Services

- TranServ Technologies

- Others

Strategic Initiatives

- June 2025: Cashfree Payments (SecureID) launched an RBI-compliant AI-powered Video-KYC (VKYC) solution aimed at improving onboarding conversions—claiming it can boost user conversions by up to 80% for regulated entities such as NBFCs, banks and insurance platforms.

- April 2025: Razorpay became the first payment gateway to enable its platform on the UPI plugin from NPCI BHIM Services Limited (NBSL), enabling seamless in-app payments for businesses.

- August 2024: PhonePe Payment Gateway launched “PhonePe PG Bolt” to revolutionize in-app payments for merchants. The company states the product delivers a 1-second transaction experience with a 99% success rate and is optimised for UPI Lite, wallets and EGVs.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 6.83 billion |

| Market Size in 2026 | USD 7.93 billion |

| Market Size in 2034 | USD 33.5 billion |

| CAGR | 16.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Payment Type, By Technology, By End-Use Application |

to learn more about this report Download Free Sample Report

India Digital Payments Market Segments

By Payment Type

- Mobile Wallet Payments

- QR Code Based Payments

- NFC & Contactless Card Payments

- Online Card Payments

- Bank Transfer

- Digital Currency (e-CNY) Payments

- Other Types

By Technology

- Mobile Apps

- Hosted Payment Gateways

- API-Based Payment Integration

- Contactless Payment Technologies

- Other Technologies

By End-Use Application

- Retail

- Food & Beverage

- Transportation

- Utilities

- Government & Public Services

- Financial Services

- Healthcare

- Others

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.