Drone Market Size, Share & Trends Analysis Report By Components (Hardware, Software, Services), By Product (Fixed wing, Multirotor, Single rotor, Others), By Technology (Remotely operated, Semi-autonomous, Fully autonomous), By Payload Capacity (Up to 2KG, 2KG to 19KG, 20KG to 200KG, Over 200KG), By Power Source (Battery powered, Gasoline powered, Hydrogen fuel cell, Solar), By End Use (Consumer, Commercial, Military & Defense, Government & Law enforcement, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Drone Market Overview

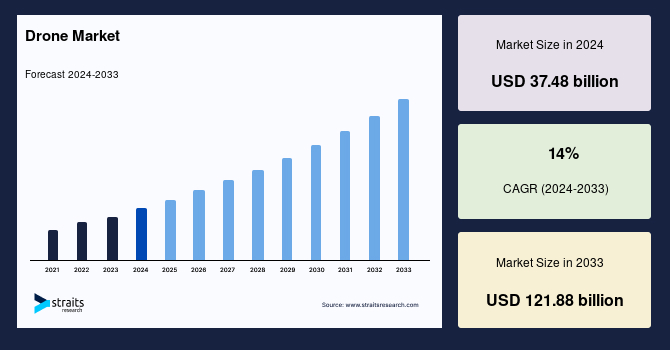

The global drone market size was worth USD 37.48 billion in 2024 and is estimated to reach an expected value of USD 42.73 billion in 2025 to USD 121.88 billion by 2033, growing at a CAGR of 14% during the forecast period (2025-2033).

A drone, also known as an unmanned aerial vehicle (UAV), is a remotely operated or autonomous aircraft used for various applications, including photography, surveillance, delivery, agriculture, and defense. Drones range from small consumer models equipped with cameras to large military-grade aircraft capable of reconnaissance and combat missions. Most drones use multi-rotor designs, like quadcopters, while others resemble fixed-wing aircraft. They rely on GPS, sensors, and AI for navigation and obstacle avoidance. Advances in drone technology enable applications such as precision farming, search-and-rescue, and urban air mobility. Regulatory frameworks govern drone usage to ensure safety and privacy. With ongoing innovation, drones are becoming more autonomous, efficient, and integrated into everyday operations.

The global market is propelled by the rising integration of drones across agriculture, logistics, security, and defense sectors. These technologies optimize operational efficiency in precision farming, surveillance, delivery, and military applications by leveraging AI, machine learning, and advanced sensor capabilities for enhanced functionality. Additionally, rising government investments and supportive regulatory frameworks are fostering industry growth. However, regulatory complexities, airspace constraints, and privacy concerns remain significant challenges to widespread adoption. Despite these hurdles, continuous technological advancements and shifting market dynamics drive sustained innovation, positioning the drone industry for long-term scalability and strategic development.

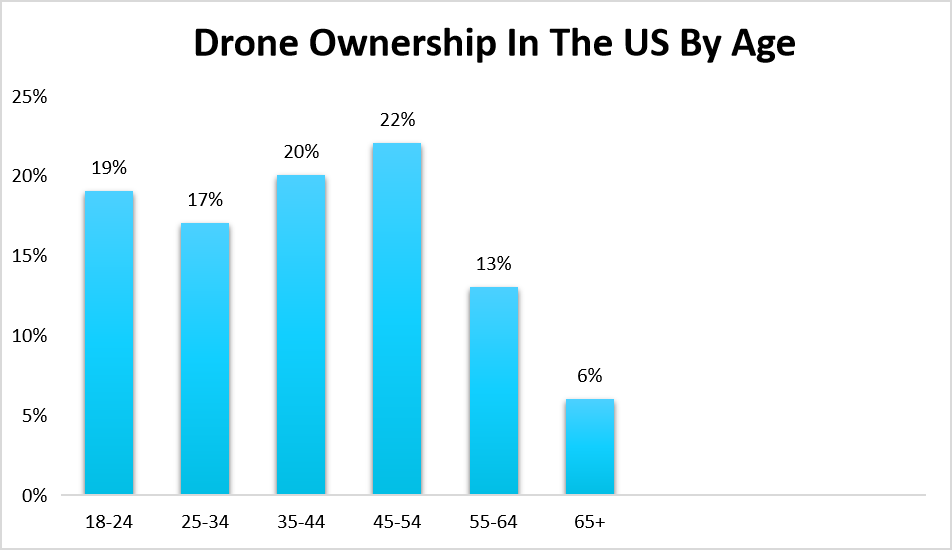

The increasing accessibility and affordability of drones drive widespread adoption across diverse consumer demographics, from hobbyists to professionals. This surge in ownership reflects growing commercial and recreational applications and expanding market opportunities. The graph below represents drone ownership in the U.S. by different age groups.

Source: Straits Research

The graph illustrates drone ownership in the U.S. by age group, showing that the highest ownership rate is among individuals aged 45-54 (22%). The data underscores strong drone adoption among middle-aged consumers, driven by affordability, advanced features, and expanding commercial applications. Additionally, the market growth is propelled by AI, automation, favorable regulations, growing logistics, agriculture, and surveillance applications, further solidifying the industry's expansion.

Market Trends

Advancements in AI-Powered Drones

The adoption of AI in drones is transforming industries with features such as autonomous navigation, real-time data analysis, and enhanced decision-making. AI-driven drones affect surveillance, agriculture, and logistics with an enhanced capability to reduce operational costs while increasing efficiency.

- For instance, in April 2023, the USDA’s National Institute of Food and Agriculture (NIFA) supported AI-powered drones to increase crop yields and resource management, providing critical data on crop health and field conditions for improved agricultural efficiency.

As the trends in AI technology advance, prospective growth in adopting intelligent drones across various fields will continue to offer innovation and empower efficiencies.

Rising Adoption of Delivery Drones

The growing need for drone delivery services is transforming due to e-commerce and medical supply chains, as companies are looking for quicker and cheaper solutions to their logistics problems. Drones deliver faster, relinquishing the traditional transportation network to solve road blockages and remote geographic locations.

- For instance, in November 2024, Amazon launched its Prime Air drone delivery service in Phoenix’s West Valley, bringing rapid, efficient drone deliveries closer to mainstream adoption.

As businesses continue to embrace drone-powered solutions, the industry is set for substantial growth, boosting innovation and streamlining supply chain operations worldwide.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 37.48 Billion |

| Estimated 2025 Value | USD 42.73 Billion |

| Projected 2033 Value | USD 121.88 Billion |

| CAGR (2025-2033) | 14% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | General Atomics, Parrot Drone SAS, Textron Inc., Wing Aviation LLC, Northrop Grumman |

to learn more about this report Download Free Sample Report

Market Drivers

Increasing Use of Drones in Agriculture

The agricultural sector increasingly adopts drones for precision farming, revolutionizing traditional farming methods with advanced technology. Drones are used heavily for crop sensing and helping in pest controllers and soil analysis, making database decisions more manageable for the farmer. Drones with multispectral and thermal sensors provide immediate feedback about crop health, enabling disease diagnosis, soil analysis, and healthy irrigation optimization.

- For instance, in April 2024, DJI introduced the Agras T50, an advanced agricultural drone for autonomous spraying and crop monitoring, enhancing efficiency in large-scale farming operations.

Thus, by enhancing productivity efficiency and reducing run-offs, the agriculture sector is becoming more sustainable and having a minimal environmental impact. Drone technology is being kept as a friendly solution for the future of food production.

Rising Demand for Military Drones

Défense agencies are rapidly investing in military drones for reconnaissance, surveillance, and combat missions. The application of unmanned aerial vehicles (UAVs) is increasing rapidly, driven by their ability to navigate high-risk environments efficiently while mitigating human safety concerns. The deployment of advanced sensors, AI-targeting systems, and real-time data feed UAVs boost the efficacy of modern warfare operations. As military operations change, the adoption of drone technology at the tip of the spear only ramps up as defence-oriented capabilities are caught worldwide across security forces.

- For instance, in March 2024, Baykar Technologies announced contracts to supply Bayraktar TB2 drones to multiple European nations for defense and border surveillance operations.

Thus, with continuous advancements in drone technology, defense agencies are poised to integrate even more advanced UAV systems, ensuring enhanced operational efficiency and strategic superiority on the battlefield.

Market Restraint

Regulatory and Airspace Restrictions

Stringent government regulations constrain the drone market's expansion, including ceiling restrictions, licensing requirements, and airspace prohibitions. Compliance complexities hinder large-scale adoption in logistics, agriculture, and defense. While regulations prioritize safety and privacy, they also pose barriers to innovation and commerce.

- For instance, the European Union introduced new regulations requiring additional certification and pilot training for beyond-visual-line-of-sight (BVLOS) drone operations, enhancing safety and compliance standards.

These stringent requirements act as a market restraint by limiting accessibility for smaller businesses and delaying commercial scalability.

Market Opportunity

Expanding the Use of Drones in Healthcare

Drones are increasingly transforming healthcare logistics, enabling rapid medical emergency deliveries. They are now widely deployed for transporting vaccines, blood supplies, and critical medications to remote and underserved regions, improving healthcare accessibility. Drones improve emergency response and patient outcomes by reducing transit times and overcoming logistical inefficiencies. As technological advancements progress, drone integration will revolutionize the future of medical supply chain management, optimizing efficiency, reducing costs, and strengthening global healthcare infrastructure.

- For instance, in September 2024, the UK Civil Aviation Authority launched trials to assess drone integration for deliveries and emergency services, enhancing airspace safety and advancing regulatory frameworks for the country’s evolving drone industry.

Thus, government initiatives foster market growth by validating drone applications in logistics and emergency response, encouraging investment, technological advancements, and regulatory support, ultimately accelerating the commercialization and scalability of drone services in the U.K.

Regional Insights

North America dominates the global drone market, driven by strong government support, advanced defense applications, and expanding commercial use cases. Significant investments in drone technology, coupled with rising demand for unmanned aerial systems in military, logistics, agriculture, and surveillance, fuel market expansion. Continuous innovation and regulatory advancements position the region at the forefront of drone development, ensuring sustained growth and leadership in integrating autonomous aerial solutions across critical industries.

- For instance, in July 2024, the U.S. Department of Defense allocated $2.1 billion for UAV research and development, strengthening the nation’s defense capabilities.

As the demand for autonomous systems grows across countries, North America remains a leading country in shaping the future of drone innovation and integration across industries.

The U.S. is the most prominent in the global drone market, with strong regulatory frameworks and commercial adoption. In May 2024, the Federal Aviation Administration (FAA) had records of over 50,000 duly registered drones with increasing applications in logistics and security. Furthermore, the country's investment in drone technology keeps multiplying, inducing innovations across different sectors.

Canada has a developing drone ecosystem focused on the defense and infrastructure monitoring aspects. In March 2024, the Canadian government provided USD 200 million for drone innovation, consolidating its UAV development. This investment should improve capabilities within surveillance, logistics, and emergency response applications.

Asia-Pacific Market Insights

The Asia-Pacific region is witnessing rapid growth in the drone market, fueled by large-scale countries with strong governments in research in UAV technology, inspiring improved commercial adoption across the region. With multiple technological advancements enduringly and ensuring laws and regulations, the area has started being an essential key contributor to drone innovation on a global level to adopt drones in varied fields.

- For instance, in September 2021, India announced the Production-Linked Incentive (PLI) Scheme to promote domestic manufacturing of drones and drone components.

This initiative encourages local production of drones and components, fostering a competitive ecosystem and attracting investments in R&D and innovation across the countries.

Australia is encouraging drone innovations through funding efforts and research. The government initiated a fund of USD 100 million intended for UAV startups and supporting research and development in June 2024. With agriculture, mining, and environmental monitoring fields where drones have gained ground, Australia's drone sector is seeing larger opportunities in the near future.

Japan plays a foremost role in drone logistics and urban air mobility applications. In August 2024, the country is expected to invest USD 300 million in logistics, laying a good foundation for drone delivery services and air transport. With the push towards regulation and automation, Japan is integrating the UAVs into smart city infrastructure to improve health, retail, and logistics efficiency.

Europe Market Insights

Germany invests significantly in military drone technology, concentrating on surveillance and border security. The German military allocated € 500 million to UAV development in April 2024, heightening capabilities in national security. With a growing demand for defense drones, it will continue expanding its fleet of UAVs and utilizing advanced technologies for reconnaissance and intelligence operations.

Components Insights

Hardware segment dominated the market with the highest market share. As hardware technology improves and production costs decrease, drones become more accessible, further accelerating market expansion. The demand for high-end UAVs with advanced navigation, AI-driven automation, and superior imaging is further propelling manufacturers to invest heavily in R&D. Such innovation is driving the market's growth, making the hardware segment a market leader in the booming drone industry.

Product Insights

The multi-rotor segment dominates the market, fuelled by rising demand for stable, agile, and easily deployable UAVs (Unmanned Aerial Vehicles). Multi-rotor drones, including quadcopters and hexacopters, offer benefits such as precision navigation and close-in missions. Their deployment in daily inspections, preventative maintenance, and asset monitoring for construction, energy, telecommunications, and utilities establishes their dominance against astronomical changes in the drone marketplace. This increasing reliance on multi-rotor UAVs strengthens their market dominance and reshapes commercial and industrial drone applications.

Technology Insights

The remotely operated segment dominated the market for drone due to its widespread adoption across defense, commercial, and industrial applications. Operators manually control these drones using ground-based remote systems, ensuring precise maneuverability and real-time decision-making. Their reliability, adaptability, and cost-effectiveness make them essential for surveillance, reconnaissance, aerial inspections, and logistics. Continuous advancements in remote control technology, connectivity, and AI-assisted piloting further strengthen the segment’s market position.

Payload Capacity Insights

The up-to-2KG segment dominates the market, driven by the increasing demand for lightweight, agile, and cost-effective UAVs. These drones are widely used in commercial applications such as aerial photography, surveying, environmental monitoring, and small-scale logistics. Their compact design, ease of deployment, and affordability make them ideal for consumer and enterprise use. Their widespread adoption fuels innovation, enhances operational efficiency, and supports market growth across e-commerce, agriculture, and public safety sectors.

Power Source Insights

The battery-powered segment dominates the market, which is driven by advancements in lithium-ion and solid-state battery technology. These drones offer key advantages such as lower operational costs, reduced carbon emissions, and quieter operation compared to fuel-powered alternatives. Their widespread use in commercial, industrial, and consumer applications, including surveillance, delivery services, and aerial inspections, has solidified their market leadership.

End-Use Insights

The military segment dominated the market, as the use of drones to gather intelligence, surveillance, target acquisition, and combat missions is on the rise. As nations are emphasizing defense upgrading, border security, and counter-terrorism activities, spending on sophisticated military drone technology is rising, boosting global defense capabilities.

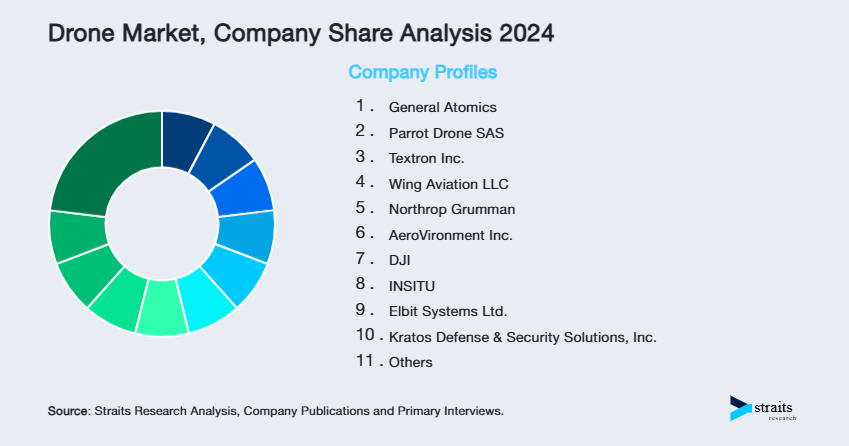

Company Market Share

Key market players are investing in advanced Drone technologies and pursuing strategies such as collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Zipline: An Emerging Player in the Drone Market

Zipline is an emerging global market player specializing in medical drone deliveries to improve healthcare access in remote areas. The company is expanding into e-commerce logistics, leveraging its autonomous drone technology for faster, efficient, and scalable last-mile delivery solutions. Its innovative approach positions Zipline as a key driver of growth in the drone logistics sector.

Recent Developments:

- In April 2023, Zipline’s $330 million Series F funding at a $4.2 billion valuation has strengthened its market position by accelerating technology advancements and global expansion. With a total budget of $821 million, the company is scaling operations, enhancing autonomous drone capabilities, and entering new sectors like e-commerce logistics. This investment boosts competitiveness, enabling Zipline to meet growing demand for efficient, last-mile drone deliveries.

List of Key and Emerging Players in Drone Market

- General Atomics

- Parrot Drone SAS

- Textron Inc.

- Wing Aviation LLC

- Northrop Grumman

- AeroVironment Inc.

- DJI

- INSITU

- Elbit Systems Ltd.

- Kratos Defense & Security Solutions, Inc.

- Lockheed Martin Corporation.

- EHang

- Thales

- Anduril Industries

- Skydio, Inc.

to learn more about this report Download Market Share

Recent Developments

- January 2025- Pix4D and Freefly Systems announced a partnership to integrate Pix4D's photogrammetry software with Freefly's drones, optimizing aerial data processing for construction, surveying, and agriculture. This partnership enhances drone-based data collection efficiency, enabling precise mapping and analytics for construction, surveying, and agriculture industries.

- January 2025- DJI introduces Flip, a portable foldable drone offering up to 30 minutes of flight time, enhancing aerial photography and videography versatility. The extended flight time enhances user experience, driving demand in aerial photography and videography. This innovation expands consumer accessibility and adoption.

Analyst Opinion

As per our analyst, the global market is undergoing substantial expansion, fueled by increasing adoption across diverse industries. Integrating AI, IoT, and 5G is significantly enhancing drone capabilities, enabling more efficient operations and large-scale deployments. While military and defense remain dominant, commercial logistics, healthcare, and agriculture applications are rapidly growing. However, regulatory complexities continue to pose challenges, potentially slowing adoption in certain regions. Though, sustained technological advancements and rising strategic investments are expected to drive long-term market growth, positioning drones as a disruptive force across multiple sectors.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 37.48 Billion |

| Market Size in 2025 | USD 42.73 Billion |

| Market Size in 2033 | USD 121.88 Billion |

| CAGR | 14% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Components, By Product, By Technology, By Payload Capacity, By Power Source, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Drone Market Segments

By Components

- Hardware

- Software

- Services

By Product

- Fixed wing

- Multirotor

- Single rotor

- Others

By Technology

- Remotely operated

- Semi-autonomous

- Fully autonomous

By Payload Capacity

- Up to 2KG

- 2KG to 19KG

- 20KG to 200KG

- Over 200KG

By Power Source

- Battery powered

- Gasoline powered

- Hydrogen fuel cell

- Solar

By End Use

- Consumer

- Commercial

- Military & Defense

- Government & Law enforcement

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.