Edible Insects Market Size, Share & Trends Analysis Report By Product Type (Whole Insects (e.g., crickets, grasshoppers, beetles), Insect Powder (e.g., cricket flour, mealworm powder), Insect Oil, Protein Bars & Snacks, Insect-Based Processed Foods (e.g., pasta, baked goods, confectionery)), By Insect Type (Crickets, Black Soldier Fly (BSF), Mealworms, Grasshoppers, Silkworms, Others (locusts, cicadas)), By Application (Human Food, Animal Feed, Fertilizers, Pharmaceuticals & Cosmetics) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Edible Insects Market Overview

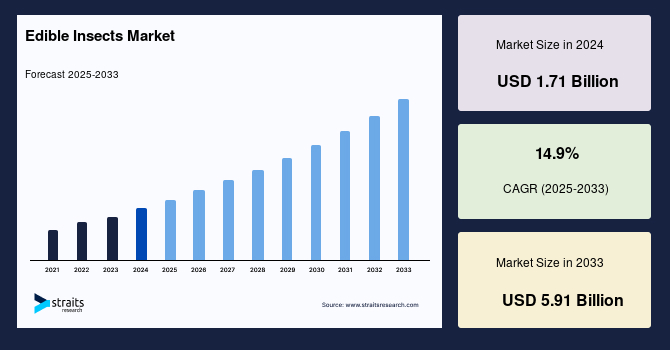

The global edible insects market size was valued at USD 1.71 billion in 2024 and is projected to grow from USD 1.95 billion in 2025 to USD 5.91 billion by 2033, exhibiting a CAGR of 14.9% during the forecast period (2025–2033). The global market is witnessing exponential growth, driven by the increasing global demand for sustainable and protein-rich food alternatives.

Key Market Insights

- Europe dominates the global edible insects industry, holding over 38% of the market share in 2024.

- Based on product type, insect powder led the market in 2024.

- Based on insect type, black soldier fly (BSF) dominated the market in 2024.

- Based on the application, animal feed dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.71 billion

- 2033 Projected Market Size: USD 5.91 billion

- CAGR (2025–2033): 14.9%

- Largest market in 2024: Europe

- Fastest-growing region: North America

Insects such as crickets, mealworms, grasshoppers, and black soldier fly larvae are gaining popularity due to their high protein content, low environmental impact, and efficient feed-to-protein conversion ratio. Growing awareness about climate change and the unsustainable nature of conventional livestock farming encourages consumers and industries to explore insect-based diets. Furthermore, insects are being integrated into snack bars, protein powders, pet food, and livestock feed, expanding their applications across sectors.

Furthermore, the market benefits from supportive policies and investments by organisations like the FAO and the EU, which have recognised insects as a viable food source. However, cultural perceptions and regulatory challenges continue to restrain growth in some regions. Technological advancements in automated insect farming and processing, as well as increased R&D in product development, are expected to improve scalability and consumer acceptance in the coming years.

Market Trend

Innovation in Insect-Based Food Products

A significant trend in the edible insects market is the emergence of innovative insect-based food and beverage products targeting mainstream consumers. With rising global acceptance of alternative proteins, food tech companies are developing insect-based products that are palatable, nutritious, and eco-friendly. Brands are launching cricket-based protein bars, chips, energy drinks, pasta, and baked goods that mask the insect origin, appealing to Western consumers who may be hesitant to consume whole insects.

According to a March 2024 report by the International Platform of Insects for Food and Feed (IPIFF), over 40 new insect-based food SKUs were launched in Europe alone in 2024, driven by updated EU Novel Food regulations that approved several insect species for human consumption.

- In this context, Ynsect, a French startup that expanded its mealworm protein production in 2024, is supplying the pet food and feed sectors and entering human food chains through partnerships with food brands across Europe. In 2025, the company works with bakeries and cereal manufacturers to include mealworm flour in bread and breakfast items.

This trend reflects a shift from niche novelty to mainstream health and sustainability, a trajectory expected to accelerate.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.71 Billion |

| Estimated 2025 Value | USD 1.95 Billion |

| Projected 2033 Value | USD 5.91 Billion |

| CAGR (2025-2033) | 14.9% |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Key Market Players | Aspire Food Group, Entomo Farms, Ÿnsect, Protix, InnovaFeed |

to learn more about this report Download Free Sample Report

Market Driver

Sustainability and Protein Security

The key driver of the market is the urgent global need for sustainable protein sources. With the world population expected to reach 9.7 billion by 2050 (UN, 2024), current meat and dairy production systems are becoming unsustainable due to their excessive land, water, and greenhouse gas emissions. Insects require up to 12 times less feed than cattle, produce 100 times fewer greenhouse gases, and can be reared using organic waste as feed, contributing to circular economy models. According to the FAO’s 2024 assessment, insect farming could reduce agricultural CO₂ emissions by 300 million tonnes annually if scaled appropriately.

Additionally, insects are rich in protein (up to 70% by dry weight), vitamins, minerals, and fibre. This makes them highly valuable for addressing malnutrition and protein deficiency in developing countries. Countries like Thailand, Kenya, and Mexico already have established insect farming cultures. However, in 2025, increasing interest is seen from countries like the U.S., the Netherlands, and Germany due to public-private partnerships and state-backed food innovation hubs.

Market Restraint

Regulatory and Cultural Barriers

Despite promising growth, the edible insects market faces significant regulatory and cultural resistance, especially in Western and Middle Eastern regions. Insects have long been consumed in Asia, Africa, and Latin America, but cultural aversion to insect consumption persists in many developed markets, impeding consumer adoption. Additionally, labelling laws, allergen concerns, and limited harmonisation across countries continue to delay product rollouts.

- For example, in the U.S., the FDA classifies insects as food additives, requiring detailed approval processes that can take years.

Additionally, a 2025 survey found that only 17% of U.S. consumers were open to regularly including insects in their diet, citing disgust, safety concerns, and lack of familiarity as major barriers. Retailers also hesitate to stock insect-based items, fearing low turnover. Thus, overcoming the psychological, regulatory, and infrastructural obstacles is critical for market expansion beyond early adopters.

Market Opportunity

Integration into Animal Feed and Pet Food

A rapidly growing opportunity lies in integrating insect proteins into animal feed and pet food markets. Insects are suitable for human diets and excellent feed sources for poultry, fish, pigs, and pets due to their amino acid profile and digestibility. In 2025, several aquaculture farms in Asia and Europe will already use black soldier fly larvae to feed tilapia and salmon, significantly reducing feed costs and environmental impact.

- Key projects include Protix’s partnership with Skretting and Nutreco, where insect-based aquafeed has been commercialised in Norway and the Netherlands.

In the pet food space, brands like Jiminy’s (USA) and Mars Petcare have launched cricket-based dog food lines with strong customer feedback, citing hypoallergenic benefits and sustainability. With increasing pressure to reduce the carbon footprint of livestock and aquaculture, and the growing premium pet food segment, insect protein offers scalable, eco-friendly, and nutritionally adequate alternatives.

Regional Analysis

Europe currently dominates the global edible insects market, holding over 38% of the market share in 2024, due to strong consumer awareness, supportive policies, and a mature food innovation ecosystem. The European Food Safety Authority (EFSA) has approved several insect species, including crickets, yellow mealworms, and BSF larvae, for human and animal consumption under Novel Food Regulations.

- According to IPIFF, more than 35 European companies produce insects commercially, with France, the Netherlands, and Belgium leading in production capacity. Companies like Protix, Ÿnsect, and Entomo Farms are expanding operations with partnerships across the food, feed, and pet food sectors. Europe’s acceptance of insect-based foods is also higher than in many Western regions, especially among younger consumers.

France is a major European edible insects market player, driven by favourable EU Novel Food regulations and consumer openness to sustainable diets. Leading firms such as Ÿnsect have set the pace with large-scale mealworm farms. In October 2024, Ÿnsect secured €160 million in funding to expand its vertical farms and R&D for insect-based ingredients in animal feed and human food. The French National Research Agency supports projects like InPROfood, which aim to advance protein diversification strategies, including insect protein. France's market benefits from integrating gourmet and alternative food trends, with insect-based products now found in retail chains like Carrefour and Monoprix.

Germany represents a mature yet steadily expanding European market for edible insects. Known for its precision in food regulation and sustainability innovation, Germany is pushing insect consumption via institutional and private investments. The German Federal Ministry of Food and Agriculture (BMEL) supports the integration of insect proteins under the Protein Strategy 2030, focusing on alternative proteins. Supermarkets like REWE and Edeka have started pilot programs selling insect-based products, including burgers and pasta. Germany also leads research, with universities like TU Berlin developing processing technologies for safer, allergen-reduced insect products.

North America Market Trends

North America is the fastest-growing region, projected to grow at a CAGR of 17.8% from 2025 to 2033, driven by increasing demand for sustainable protein alternatives and favourable regulatory progress. The U.S. FDA and AAFCO (Association of American Feed Control Officials) have approved the use of crickets and BSF in pet food and poultry feed, unlocking a major market potential. Major investments are pouring into the sector. The region also benefits from consumer trends around health, sustainability, and alternative proteins. Multiple startups are securing Series A/B funding to scale insect farming tech, R&D for flavour improvement, and B2B partnerships in food and beverage sectors, further accelerating North America’s innovation and market adoption leadership.

The U.S. is among the most promising markets for edible insects, driven by increasing interest in sustainable protein sources, especially among millennials and Gen Z. As of 2025, the U.S. edible insects market is projected to grow at a CAGR of 17.5%, supported by rising demand in the pet food and health food sectors. The FDA has expanded approvals for cricket and BSF-based animal feed and human consumption ingredients. The USDA has also begun funding research into alternative proteins as part of its Sustainable Food Systems Initiative 2025, which includes insect protein as a major focus. Additionally, U.S. consumers increasingly prefer environmentally conscious products, and major retail chains like Whole Foods and Sprouts now carry insect-based snacks and protein powders.

Canada has emerged as a North American leader in edible insect farming and exports. Through Agriculture and Agri-Food Canada (AAFC), the government funds innovation programs supporting insect protein development. Entomo Farms, Canada’s largest cricket producer, is expanding its facilities in Ontario to meet growing domestic and international demand. Canada’s market is fueled by high health-consciousness, environmental awareness, and research partnerships with universities focusing on novel food processing and safety. Cricket protein is increasingly used in Canadian-made bars, baked goods, and pet food.

Asia-Pacific Market Trends

Asia-Pacific is a significantly growing region, holding approximately 24% of the market share in 2024, and is expected to grow steadily due to the traditional acceptance of insect consumption and the emerging interest in industrial-scale farming. Countries like Thailand, Vietnam, South Korea, and China have long histories of entomophagy, but are now modernising insect farming for domestic and export markets. Thailand remains a leader in cricket farming with over 20,000 small-scale farms, many of which are supported by the government under agricultural diversification initiatives. The Thai government launched the “Insect for Future” program in 2024, aiming to professionalise insect farming and establish global supply chains. In addition to cultural familiarity, the rising demand for sustainable animal feed and the growing middle class are accelerating Asia-Pacific's role as both a producer and consumer in the global market.

China is one of the fastest-growing edible insects markets, driven by tradition and industrial-scale modernisation. Long familiar with insect consumption, China is now industrialising its insect farming sector, especially for feed and medicinal use. Chinese firms like Guangzhou Unique Biotechnology Co. and Jiangsu Jinyu Environmental Protection Co. are expanding BSF production for aquaculture and poultry feed. In addition to livestock, there is growing interest in cricket powder-based health supplements for export, especially to Europe. State-owned enterprises are also beginning to invest in insect processing technologies and automated rearing systems to support national food security goals.

India's market for edible insects is in its early stages but shows substantial long-term potential due to a large vegetarian population, protein deficiency concerns, and increasing startup activity. India’s Ministry of Fisheries, Animal Husbandry and Dairying included insect protein in the 2024 National Feed Security Program, enabling trials of BSF larvae as fish feed. The Indian Council of Agricultural Research (ICAR) supports R&D in integrating insect rearing and waste management. While direct human consumption is culturally sensitive, using insect ingredients in fortified snacks and health bars is gaining interest among urban populations focused on sustainability and nutrition.

Product Type Insights

Insect powder holds the largest share in the edible insects industry due to its versatility, nutritional density, and ease of integration into various food and beverage products. Cricket and mealworm powders are rich in protein (up to 70%), omega-3 fatty acids, and essential micronutrients such as iron and B12. These powders are increasingly used in energy bars, smoothies, bakery products, and pasta and cereals.

- According to the International Platform of Insects for Food and Feed (IPIFF, 2024), over 65% of insect-based food launches in Europe contained insect powder as a key ingredient. The appeal of powdered form lies in its ability to mask the insect origin, increasing consumer acceptance in Western markets where insect consumption still faces cultural resistance. Startups like Entomo Farms and Protifarm are scaling production and supplying to health-focused food brands globally.

Insect Type Insights

The Black Soldier Fly (BSF) dominates the insect type segment due to its wide application in animal feed and organic waste bioconversion. BSF larvae can remarkably efficiently convert organic waste into high-quality protein, turning 1 ton of food waste into 250 kg of protein-rich biomass. According to the FAO’s 2024 report, BSF-based protein could replace up to 30% of fishmeal in aquaculture, significantly lowering costs and environmental impact. In 2025, leading firms such as AgriProtein (South Africa) and Protix (Netherlands) are producing BSF protein at scale for poultry and fish feed. With growing emphasis on circular agriculture, waste management, and sustainable feed sources, BSF remains a cornerstone in the insect protein value chain.

Application Insights

The Animal Feed segment is the largest application segment in the market for edible insects, particularly driven by the rise of insect-based aquafeed, poultry feed, and pet food. Insect proteins provide a high-quality, digestible alternative to fishmeal and soy, with increasingly unsustainable costs and environmental impacts. According to Alltech’s 2025 Global Feed Survey, demand for insect protein in aquafeed alone is projected to increase by 27% YOY in Asia and Europe.

Governments and research institutions are heavily investing in this segment. Startups like EnviroFlight and InnovaFeed focus on high-efficiency feed solutions that align with zero-waste and low-emission farming goals. As of 2025, insect-based animal feed is a sustainability solution and a cost-efficient and performance-boosting product for modern agriculture.

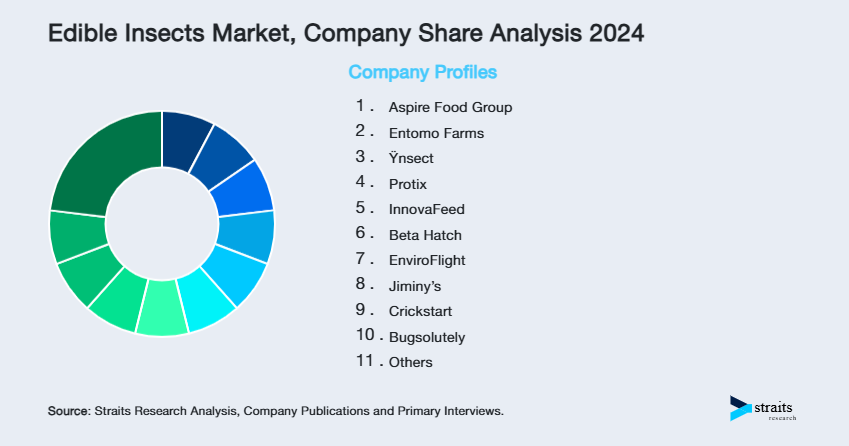

Company Market Share

The edible insects market is highly competitive, with players focusing on scalable production, product innovation, and B2B partnerships. Many operate vertically integrated models, rearing, processing, and distributing under one roof to ensure quality and efficiency. Companies emphasise sustainability and traceability in supply chains to meet consumer and regulatory demands. Strategic partnerships with food manufacturers and retailers help mainstream insect-based products.

Ÿnsect (France): Ÿnsect is one of the world’s leading insect protein companies, focusing on mealworm-based products for animal feed, fertilisers, and human food. The company operates Europe's largest vertical insect farm and maintains a vertically integrated supply chain.

Latest News

- In March 2025, Ÿnsect announced a partnership with Nestlé Purina to supply sustainable insect protein for premium pet food lines across Europe, boosting its expansion into retail channels and reinforcing insect-based ingredients as viable alternatives to conventional animal proteins.

List of Key and Emerging Players in Edible Insects Market

- Aspire Food Group

- Entomo Farms

- Ÿnsect

- Protix

- InnovaFeed

- Beta Hatch

- EnviroFlight

- Jiminy’s

- Crickstart

- Bugsolutely

- NextProtein

- Exo Protein

- Chapul

- Loopworm

- Insectifii

to learn more about this report Download Market Share

Recent Developments

- May 2025- Protix launched an AI-integrated insect feed production line designed to optimise the processing of Black Soldier Fly (BSF) larvae. This innovation enhances protein yield by 18% while reducing energy consumption by 22%, aligning with Protix's 2025 sustainability roadmap. The company also announced plans to establish a facility in South Korea, aiming to upcycle up to 130,000 tons of food waste annually into sustainable protein, oil, and fertiliser.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.71 Billion |

| Market Size in 2025 | USD 1.95 Billion |

| Market Size in 2033 | USD 5.91 Billion |

| CAGR | 14.9% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Insect Type, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Edible Insects Market Segments

By Product Type

- Whole Insects

- Insect Powder

- Insect Oil

- Protein Bars & Snacks

- Insect-Based Processed Foods

By Insect Type

- Crickets

- Black Soldier Fly (BSF)

- Mealworms

- Grasshoppers

- Silkworms

- Others (locusts, cicadas)

By Application

- Human Food

-

Animal Feed

- Aquafeed

- Poultry Feed

- Pet Food

- Fertilizers

- Pharmaceuticals & Cosmetics

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.