Embolic Protection Devices Market Size, Share & Trends Analysis Report By Device Type (Proximal Occlusion systems, Distal Occlusion Systems, Distal Filters), By Application (Cardiovascular Diseases, Neurovascular Diseases, Peripheral Vascular Diseases), By End-User (Hospitals, Ambulatory Surgery Centres) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Embolic Protection Devices Market Size

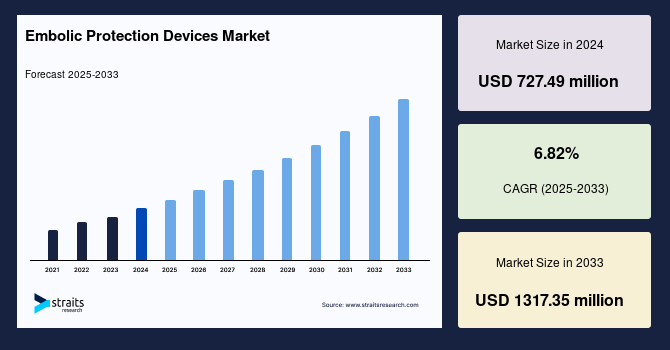

The global embolic protection devices market size was valued at USD 727.49 million in 2024 and is expected to grow from USD 777.1 million in 2025 to reach USD 1317.35 million in 2033, growing at a CAGR of 6.82% during the forecast period (2025–2033).

The embolic protection devices (EPD) market is experiencing significant growth, driven by factors such as the increasing prevalence of cardiovascular, neurovascular, and peripheral vascular diseases, ongoing technological advancements, and a growing preference for minimally invasive procedures. These devices play a crucial role in improving procedural safety by capturing and extracting embolic debris produced during interventions, thereby reducing the risk of complications such as stroke.

In the context of cardiovascular diseases, embolic protection devices are commonly used during procedures like carotid artery stenting, transcatheter aortic valve replacement (TAVR), and coronary interventions. TAVR, a minimally invasive procedure for treating valve diseases, particularly benefits from these devices, as they help reduce the risk of stroke and other complications by preventing embolic particles from reaching critical areas.

Similarly, in patients with neurovascular conditions, including ischemic stroke and transient ischemic attacks (TIAs), cerebral embolic protection devices (CEPD) are employed to prevent ischemic brain damage during TAVR. These devices capture embolic particles, ensuring that the brain is protected from potential harm during the procedure.

- A recent study published by the American Heart Association in June 2024 found that 12.9% of 414,649 TAVR patients were treated with embolic protection devices. The results highlighted that patients using EPDs had a lower risk of disabling strokes compared to those who did not, underscoring the importance of these devices in enhancing patient outcomes.

As embolic protection devices become increasingly integral to modern interventional cardiology and vascular surgery, their market growth will continue to be driven by ongoing research, regulatory approvals, and strategic investments. The adoption of these devices is expected to expand, further solidifying their role in reducing stroke risk and improving the safety of key medical procedures.

Embolic Protection Devices Market Trends

Technological Advancements

Technological innovations have significantly enhanced the efficacy, safety, and functionality of embolic protection devices. Key developments include improved filter designs, dual-protection systems, drug-eluting coatings, and AI-assisted imaging. Manufacturers are increasingly focusing on advancing devices to better treat patients with coronary artery disease.

- For example, in May 2022, Medtronic plc introduced design improvements that enhanced catheter flexibility, integrated a novel dual-layer balloon technology, and reduced the crossing profile. These advancements led to a 16% improvement in deliverability with the Onyx Frontier than its predecessor, the Resolute Onyx DES.

As technology continues to evolve, the scope of embolic protection devices in various cardiovascular interventions is expanding. This progress is expected to further enhance patient safety and improve the success rates of high-risk procedures.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 727.49 Million |

| Estimated 2025 Value | USD 777.1 Million |

| Projected 2033 Value | USD 1317.35 Million |

| CAGR (2025-2033) | 6.82% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Abbott, Boston Scientific Corporation, Medtronic, Edwards Lifesciences Corporation, Thermo Fischer Scientific Inc. |

to learn more about this report Download Free Sample Report

Embolic Protection Devices Market Growth Factors

Regulatory Support

Regulatory approvals play a crucial role in the availability and adoption of embolic protection devices in the healthcare market. The approvals ensure that embolic protection devices are subject to strict safety and efficacy requirements, allowing them to be used across several cardiovascular interventions.

- For instance, In September 2024, InspireMD submitted a Premarket Approval (PMA) application to the FDA for its CGuard Prime Carotid Stent System, which includes an embolic protection element. The application was supported by positive results from the C-GUARDIANS clinical trial, which enrolled 316 patients at 24 trial sites in the U.S. and Europe.

Such regulatory approvals are essential for promoting the safe and effective use of embolic protection technologies, ultimately driving global embolic protection devices market growth and improving patient outcomes in cardiovascular treatments.

Rising Popularity of Minimally Invasive Surgeries

Minimally invasive procedures, which involve smaller incisions, less trauma, and shorter recovery times than traditional open surgeries, are becoming increasingly popular. In cardiovascular procedures like TAVR and carotid artery stenting (CAS), embolic protection devices are used to capture or deflect embolic debris that may be released during the procedure, reducing the risk of stroke and other cerebral complications.

- For instance, a September 2022 study published in the New England Journal of Medicine found that using cerebral embolic protection during TAVR significantly lowered the risk of periprocedural stroke. Among 3,000 patients undergoing TAVR, the use of cerebral embolic protection (CEP) devices reduced the incidence of disabling strokes to 0.5%, compared to 1.3% in the control group.

With the global rise in the adoption of minimally invasive procedures, embolic protection devices are expected to become a standard strategy in high-risk interventions, improving clinical outcomes and patient safety while reducing healthcare costs associated with post-procedure complications.

Restraining Factor

High Cost of Devices

The high cost of embolic protection devices and the associated procedures present a major challenge to the widespread adoption of these technologies. While endovascular procedures, such as carotid artery stenting (CAS) and transcatheter aortic valve replacement (TAVR), are effective in preventing embolic events, they often require expensive, advanced equipment, complex surgical procedures, and extensive post-operative care.

- For example, according to a May 2022 article published in Frontiers, the cost of TAVR devices can vary significantly depending on the region, ranging from USD 17,268 in Canada to USD 45,526 in China.

As a result, the high costs associated with these devices and procedures limit patient access, particularly in regions with less robust healthcare systems or insufficient insurance coverage, thus slowing their widespread adoption.

Market Opportunity

Expansion in Emerging Markets

Emerging markets, particularly in regions like Asia-Pacific, Latin America, and the Middle East & Africa, are making significant investments in advanced cardiovascular care, which is driving the demand for embolic protection devices in procedures such as TAVR and CAS. China, for example, has been actively investing in TAVR procedures, signaling a strong commitment to enhancing cardiovascular treatment.

- In 2023, according to the National Transcatheter Valve Therapeutics Registry, hospitals in mainland China performed 11,614 TAVR procedures over the span of 10 months, marking an increase of more than 40% compared to the previous year.

This rising investment in cardiovascular care, particularly in China, is fueling the adoption of embolic protection devices, supported by improvements in healthcare infrastructure and a growing prevalence of heart disease. As these markets continue to expand, manufacturers have a significant opportunity to develop and introduce innovative embolic protection devices to meet the growing demand.

Regional Insights

North America holds the largest share in the global embolic protection devices market, driven by its advanced healthcare infrastructure, high prevalence of cardiovascular and neurological disorders, and significant investments in research and development. The region benefits from well-established reimbursement policies that facilitate the adoption of innovative medical technologies.

Moreover, the presence of major industry players, growing awareness of embolic protection therapies, and a strong regulatory framework supporting new device approvals further solidify North America’s leadership. The rising number of transcatheter aortic valve replacement (TAVR) and carotid artery stenting (CAS) procedures also contributes to market expansion.

The U.S. embolic protection devices market is expanding due to the rising prevalence of cardiovascular diseases and the adoption of advanced medical technologies. In October 2024, the CDC reported that heart disease accounted for 702,880 deaths in 2022, making it the leading cause of death. With growing demand for innovative cardiovascular solutions, the market is set for continued growth, improving patient outcomes and advancing embolic protection technologies.

Asia Pacific Embolic Protection Devices Market Trends

Asia-Pacific is expected to experience the fastest CAGR in the global embolic protection devices market due to increasing investments in healthcare infrastructure and the rising prevalence of cardiovascular diseases. Countries like China, Japan, and India are witnessing rapid advancements in medical technology and an expanding patient base requiring embolic protection. Government initiatives promoting minimally invasive procedures, increasing clinical trials, and improving healthcare accessibility further drive market growth.

China's market is expanding due to the growing burden of cardiovascular diseases and government-backed medical innovations. Faster regulatory approvals and advancements in healthcare technology are driving adoption. The increasing focus on safer and more efficient cardiovascular interventions, particularly in transcatheter procedures, is propelling market growth and improving patient care, making China a key player in the global embolic protection devices industry.

Australia is actively embracing embolic protection devices to enhance patient safety in cardiovascular treatments. In November 2024, Endovascular Today reported that Arsenal Medical launched the EMBO-02 clinical trial to evaluate its NeoCast liquid embolic for treating chronic subdural hematomas. This commitment to medical innovation is driving market growth, expanding treatment options, and improving cardiovascular intervention outcomes across the country.

Europe Embolic Protection Devices Market Trends

Germany’s embolic protection devices industry is expanding and is driven by leading medical manufacturers and a highly advanced healthcare system. In February 2025, World Business Outlook highlighted ProtEmbo, an intra-aortic filter developed by Protembis GmbH, which reduces stroke risk during transcatheter aortic valve implantation (TAVI). As new cardiovascular technologies gain traction, Germany is fostering market growth, improving procedural success rates, and enhancing patient safety in high-risk cardiovascular interventions.

Latam Embolic Protection Devices Market Trends

Brazil’s market is rising due to the increasing prevalence of cardiovascular diseases and advancements in medical technology. With greater investment in healthcare infrastructure and a shift towards sophisticated treatment options, the adoption of embolic protection devices is improving patient outcomes. As the country continues to develop its cardiovascular care capabilities, the market is expected to witness steady expansion in the coming years.

Device Type Insights

The distal filter segment holds the largest market share due to its widespread use in treating carotid artery stenosis, strokes, deep vein thrombosis, and pulmonary embolism. These filters effectively capture embolic debris, reducing the risk of complications during vascular procedures. Moreover, advancements like transfemoral carotid artery stenting (tfCAS) further enhance their adoption.

- According to a Journal of Vascular Surgery article (June 2023), distal embolic protection filters were used in 95% of 29,853 tfCAS patients, significantly lowering in-hospital stroke and mortality rates compared to those without filters.

Application Insights

The cardiovascular diseases segment leads the market due to the rising prevalence of conditions like carotid artery disease, aortic valve disease, coronary artery disease, and peripheral artery disease. The effectiveness of embolic protection therapies in preventing stroke and improving patient outcomes further drives demand.

- As per an April 2024 Journal of the American College of Cardiology report, there were 315 million prevalent cases of coronary artery disease (CAD) worldwide in 2022, highlighting the growing need for embolic protection devices in cardiovascular procedures.

End-User Insights

Hospitals dominate the market due to their advanced infrastructure, access to specialized healthcare professionals, and ability to provide comprehensive patient care. With the increasing number of cardiovascular procedures, hospitals remain the primary end-users of embolic protection devices.

- According to Spectrum News (July 2024), the U.S. has seen a rise in specialized heart hospitals, with U.S. News & World Report ranking in the top 50 out of nearly 800 institutions based on quality-of-care measures and patient satisfaction, reinforcing hospitals' critical role in market expansion.

Company Market Share

Key players in the global embolic protection devices market are actively pursuing strategic collaborations, acquisitions, and partnerships to strengthen their product portfolios, expand their global footprint, and accelerate technological advancements. By leveraging mergers and alliances with healthcare providers, research institutions, and regulatory bodies, companies are enhancing innovation, improving device efficacy, and streamlining regulatory approvals.

Contego Medical: An Emerging Provider in the Global Market

Contego Medical, Inc. is a leader in developing state-of-the-art solutions that convert complicated cases into easy procedures. Contego Medical, Inc. has a portfolio of integrated, multi-functional solutions that aim to enhance patient results and procedural effectiveness in revascularization treatment for carotid and peripheral vascular disease.

Recent Developments by Contego Medical:

- In October 2024, Contego Medical secured U.S. FDA premarket approval for its Neuroguard IEP System, a groundbreaking 3-in-1 carotid stenting platform designed to enhance patient safety and procedural efficiency. This innovative device integrates an embolic protection filter, an angioplasty balloon, and a high-performance stent into a single system, streamlining the carotid artery stenting process.

List of Key and Emerging Players in Embolic Protection Devices Market

- Abbott

- Boston Scientific Corporation

- Medtronic

- Edwards Lifesciences Corporation

- Thermo Fischer Scientific Inc.

- Cardinal Health

- Innovative Cardiovascular Solutions, LLC

- Transverse Medical Inc.

- L. Gore & Associates, Inc.

- Cordis

- Silk Road Medical

- InspireMD, Inc.

- Emboline, Inc.

- Contego Medical

- MedNova, Inc.

to learn more about this report Download Market Share

Recent Developments

- April 2024 – Emboline, Inc. acquired SWAT Medical’s intellectual property portfolio in embolic protection, strengthening its position in stroke prevention technologies. By integrating these innovations with its existing product line, Emboline aims to enhance embolic protection during high-risk cardiovascular procedures like Transcatheter Aortic Valve Replacement (TAVR).

- March 2024 – CERENOVUS launched the TRUFILL n-BCA Liquid Embolic System Procedural Set, advancing hemorrhagic stroke treatment by simplifying procedure preparation. This system optimizes embolization for arteriovenous malformations (AVMs) and other cerebrovascular conditions, addressing real-world clinical challenges for physicians.

Analyst Opinion

As per our analysts, the global embolic protection devices market is experiencing significant growth, driven by the rising prevalence of cardiovascular diseases, continuous technological advancements, and increasing awareness among healthcare professionals and patients. Innovations in embolic protection technologies are improving procedural safety and clinical outcomes, while supportive government initiatives and favorable reimbursement policies are further accelerating market expansion.

Despite these growth drivers, challenges such as the high cost of devices, regulatory hurdles, and limited accessibility in developing regions pose barriers to widespread adoption. However, market players are actively addressing these issues through strategic collaborations, cost-effective innovations, and expanding their presence in emerging markets. Moreover, the rise of personalized medicine is fostering demand for advanced embolic protection solutions tailored to individual patient needs, ensuring long-term growth potential.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 727.49 Million |

| Market Size in 2025 | USD 777.1 Million |

| Market Size in 2033 | USD 1317.35 Million |

| CAGR | 6.82% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Device Type, By Application, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Embolic Protection Devices Market Segments

By Device Type

- Proximal Occlusion systems

- Distal Occlusion Systems

- Distal Filters

By Application

- Cardiovascular Diseases

- Neurovascular Diseases

- Peripheral Vascular Diseases

By End-User

- Hospitals

- Ambulatory Surgery Centres

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Jay Mehta

Research Analyst

Jay Mehta is a Research Analyst with over 4 years of experience in the Medical Devices industry. His expertise spans market sizing, technology assessment, and competitive analysis. Jay’s research supports manufacturers, investors, and healthcare providers in understanding device innovations, regulatory landscapes, and emerging market opportunities worldwide.