Fiber Optic Connector Market Size, Share & Trends Analysis Report By Connector Format (LC, MPO / MTP, SC, ST, FC, E2000 & other specialty formats, Hybrid / high-density and co-packaged optics interconnects), By Fiber Mode (Single-mode, Multimode), By Application (Telecom networks (backhaul, metro, core), Data centers & cloud interconnect, FTTH / access networks, Enterprise & campus LAN, Industrial automation & harsh-environment connectivity, Military, aerospace & medical, Others), By Distribution Channel (OEM / system integrator direct sales, Distributors and value-added resellers, Online / e-commerce and retail (portable kits), EPC / turnkey project suppliers, Aftermarket services and spares) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Fiber Optic Connector Market Overview

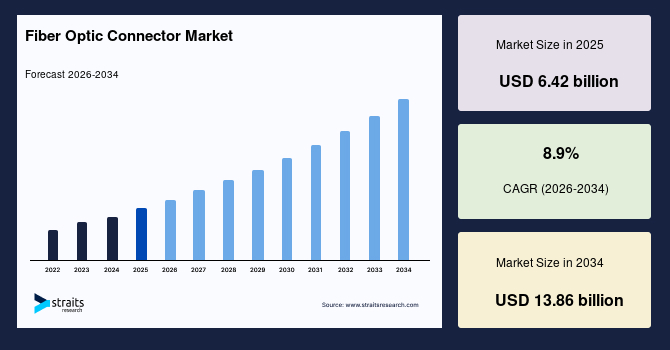

The global fiber optic connector market size is valued at USD 6.42 billion in 2025 and is estimated to reach USD 13.86 billion by 2034, growing at a CAGR of 8.9% during the forecast period. The market is driven by rapid digitalization, the global expansion of 5G networks, accelerating investments in data centers, the rising adoption of cloud computing, and a growing demand for high-speed, low-latency communication infrastructure.

Key Market Trends & Insights

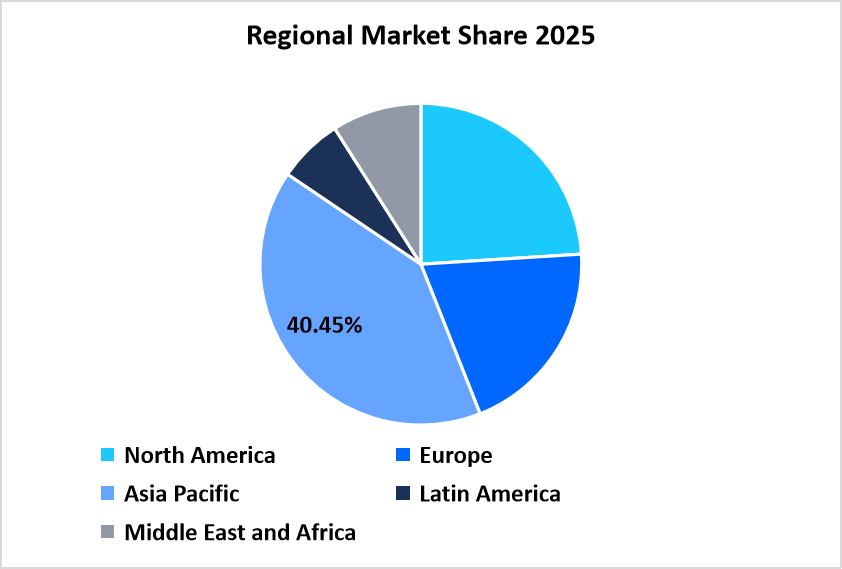

- Asia Pacific dominated the market with a revenue share of 40.45% in 2025.

- The Middle East and Africa is anticipated to grow at the fastest CAGR of 9.3% during the forecast period.

- Based on Connector Format, the LC connectorssegment held the highest market share of 28.8% in 2025.

- By Fiber Mode, the multimode connectorssegment is estimated to register the fastest CAGR growth of 7.0%.

- Based on Application, the Telecom networkscategory dominated the market in 2025 with a revenue share of 30%.

- Based on Distribution Channel, the Online sales segment is projected to register the fastest CAGR of 10.3% during the forecast period.

- China dominates the market, valued at USD 1,197.32 million in 2024 and reaching USD 1,298.74 million in 2025.

China Fiber Optic Connector Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 6.42 billion

- 2034 Projected Market Size: USD 13.86 billion

- CAGR (2026-2034): 8.9%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: Middle East and Africa

The global fiber optic connector market encompasses a range of products, including LC, SC, ST, MPO/MTP, and hybrid connectors, which are utilized across various applications such as telecom networks, data centers, enterprise networks, industrial automation, defense systems, and medical imaging equipment. These connectors enable reliable, low-loss optical signal transmission between fiber cables and active network devices. The market growth is supported by rising bandwidth consumption, increasing deployment of fiber-to-the-home (FTTH) infrastructure, continuous innovation in connector miniaturization and density, and distribution expansion through OEM supply chains, system integrators, and global electronics distributors.

Latest Market Trends

High-Density Connectivity for Data Centers and Cloud Infrastructure

High-density fiber optic connectivity is emerging as a key trend, driven by the surge in global data traffic, which is fueled by artificial intelligence workloads, cloud computing, video streaming, and enterprise digital transformation. Hyperscale and colocation data centers require connectors that support higher port density, faster deployment, and lower insertion loss to efficiently manage growing traffic volumes. The trend is largely driven by the rapid growth of cloud service providers and the need for scalable, energy-efficient network design. This structural shift toward high-density connectivity directly increases unit volumes and average selling prices for advanced fiber optic connectors, supporting sustained market growth.

Standardization and Pre-terminated Fiber Solutions

Standardized and pre-terminated fiber solutions are increasingly adopted to reduce installation time, labor costs, and deployment errors. Factory-terminated assemblies ensure consistent performance, low signal loss, and faster network rollouts. Standard connector formats also improve interoperability in multi-vendor networks and make upgrades more predictable. As plug-and-play connectivity becomes the default for large telecom, enterprise, and data center projects, it generates steady replacement demand, favoring suppliers with strong manufacturing scale and quality certifications.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 6.42 billion |

| Estimated 2026 Value | USD 6.97 billion |

| Projected 2034 Value | USD 13.86 billion |

| CAGR (2026-2034) | 8.9% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Key Market Players | Corning Incorporated, TE Connectivity, Amphenol Corporation, Molex, LLC, 3M Company |

to learn more about this report Download Free Sample Report

Market Drivers

Expansion of 5G, FTTH, and High-Speed Broadband Networks

The global expansion of 5G networks and fiber-to-the-home (FTTH) infrastructure is one of the strongest drivers of the fiber optic connector market. Mobile network densification requires extensive fiber backhaul connectivity between base stations, small cells, and core networks. At the same time, governments and telecom operators are accelerating broadband coverage projects to support digital economies, remote work, and smart city initiatives. These projects directly increase demand for high-reliability fiber connectors in access, aggregation, and core network layers.

Growth of Data Centers and Cloud Service Infrastructure

The continued expansion of cloud computing, artificial intelligence, and enterprise digitization is driving strong growth in global data center construction. Modern data centers rely heavily on high-density fiber interconnects to support massive east-west traffic flows and high-speed communication between servers. Fiber optic connectors serve as critical physical interfaces in these architectures, linking switches, routers, servers, and storage arrays. As AI workloads and cloud adoption continue to scale, connectors remain a foundational component of digital infrastructure build-out worldwide.

Market Restraint

High Installation and Network Upgrade Costs

Despite long-term efficiency benefits, fiber network deployment involves high initial capital expenditure, including trenching, cable laying, termination, testing, and active equipment upgrades. Fiber optic connectors form part of this broader installation ecosystem, and large projects require substantial upfront investment. In cost-sensitive markets, particularly in developing regions, this slows the pace of fiber rollouts and delays demand for connectors. Several emerging economies postponed large-scale FTTH expansions due to public budget pressures and inflation-driven cost escalation for construction materials and skilled labor.

Market Opportunity

Industrial Digitalization and Harsh-Environment Connectivity

Industrial automation, transportation, energy, and defense are creating new high-margin opportunities for fiber connectors. As factories deploy robotics, machine vision, and real-time control systems, demand increases for EMI-resistant and highly reliable fiber connections. Ruggedized connectors built for heat, vibration, dust, and humidity are increasingly required. In 2025, rail networks and smart manufacturing projects across Asia and Europe expanded their use of fiber-based monitoring systems. With the acceleration of Industry 4.0 adoption and the rise of infrastructure modernization, industrial-grade connectors are poised to offer strong long-term growth potential.

Regional Analysis

Asia Pacific dominated the market in 2025, accounting for 40.45% market share, due to massive broadband expansion, large-scale data center growth, and extensive FTTH and mobile backhaul projects across China, India, and Southeast Asia. Heavy public and private investment, strong local manufacturing, and cost-competitive supply chains support large-volume deployment of LC, MPO, and pre-terminated connectors. Rapid industrial digitization and hyperscale data center expansion fuel demand for high-density solutions. The combination of new builds and retrofits ensures both immediate growth and steady demand.

- China is the largest market in the Asia Pacific due to its unmatched scale of FTTH rollout, hyperscale data center construction, and mobile network expansion. Strong government support for broadband access, combined with aggressive telecom capital spending, drives continuous demand for single-mode and high-density connectors. These factors position China as the primary growth engine and volume leader for fiber connector demand across the region.

Middle East and Africa Market Trends

Middle East and Africa is emerging as the fastest-growing region with a CAGR of 9.3% from 2026-2034, driven by smart city projects, national broadband programs, and industrial automation investments. Gulf countries lead through large data center, fiber, and urban infrastructure projects requiring high-density, premium connectors. In Africa, metro fiber corridors and international connectivity projects drive local demand. High project sizes in the Gulf and development-backed investments in Africa accelerate market value growth.

- The UAE leads the MEA market due to aggressive investment in smart infrastructure, data centers, and high-end commercial connectivity. Government-led digital transformation and private-sector projects drive large-scale fiber rollouts with strong demand for pre-terminated, high-density, and premium-quality connector solutions. Its position as a regional technology and data hub makes the UAE the preferred entry market for suppliers targeting Gulf and broader Middle East expansion, supported by high project values and premium infrastructure standards.

Source: Straits Research

North American Market Trends

North America is a high-value, technologically advanced market supported by dense 5G fiber backhaul, large hyperscale data center expansion, and steady enterprise fiber upgrades. U.S. and Canadian operators demand high-reliability, low-loss connectors, with a strong preference for pre-terminated LC and MPO assemblies. Recurring revenue is supported by aftermarket testing and maintenance services. While growth is steadier than in emerging regions, the adoption of advanced optics for AI and cloud workloads ensures that North America remains a premium and high-value market.

- The U.S. dominates North America due to its vast telecom infrastructure, concentration of hyperscale cloud providers, and high enterprise IT spending. Nationwide FTTH and 5G rollouts drive consistent demand from service providers, while data centers require high-density, ultra-low-loss connector systems. The market emphasizes strict quality standards, bundled testing services, and long-term supplier partnerships. Frequent network refresh cycles and large-scale cloud investments make the U.S. the region’s primary revenue contributor.

European Market Growth Factors

Europe’s connector market is shaped by strong broadband regulations, steady public investment, and advanced industrial connectivity needs. Western Europe prioritizes energy-efficient, durable, and standardized connector solutions for metro networks, data centers, and industrial automation. Demand is driven by the expansion of FTTH, upgrades to legacy networks, and environmental compliance requirements. Factory-terminated and modular designs are widely adopted. While overall growth is moderate, consistent retrofit activity and rising-speed network transitions provide long-term market stability.

- Germany leads Europe due to its strong industrial base, advanced manufacturing automation, and expanding data center infrastructure. Strict engineering standards and reliability requirements push demand toward certified, ruggedized connector systems. Industry 4.0 deployments in factories, utilities, and transport networks create steady demand for high-quality optical connectivity.

Latin American Market Trends

Latin America exhibits steady growth, driven by the expansion of urban broadband, rising investments in data centers, and the modernization of enterprise networks. Brazil, Mexico, and Argentina lead adoption. Cost-effective multimode connectors and pre-terminated assemblies are preferred to speed deployment. Budget constraints and regulatory variability limit the pace, but the expanding adoption of cloud services, logistics digitization, and managed services is creating new opportunities. Demand is gradually spreading from major cities into secondary urban and industrial centers across the region.

- Brazil is the largest Latin American connector market, supported by high telecom capital spending, FTTH expansion, and growing cloud and enterprise IT adoption. Its large population, expanding digital economy, and steady infrastructure modernization position Brazil as the primary revenue-generating market for connector suppliers in Latin America.

Connector Format Insights

LC connectors dominated the market with a revenue share of 28.8% in 2025 due to their compact size, low signal loss, and wide compatibility with modern networking equipment. Their small footprint enables high port density in patch panels and transceivers, making them ideal for enterprise networks, access networks, and data centers where space efficiency is critical. A mature global supply chain ensures low costs and strong standardization across vendors.

Hybrid and high-density interconnects, including solutions designed for co-packaged optics, are the fastest-growing subsegment with a CAGR of 11.2%. These connectors reduce cabling complexity, improve thermal control, and support dense switching environments. Hyperscale data centers and advanced switch vendors are the primary drivers of demand. Investments in precision alignment and automated manufacturing improve reliability and scalability.

Fiber Mode Insights

Single-mode fiber connectors represent the majority share in 2025. They support long-distance, high-bandwidth optical transmission required in telecom, metro, and hyperscale data center networks. They enable higher data rates, lower dispersion, and longer reach than multimode systems. Falling production costs and wide adoption in new builds make single-mode solutions the default choice, reinforcing their leading market share globally.

Multimode connectors are expected to expand at the fastest rate, exhibiting a CAGR of 7.0%. Multimode connectors grow strongly in short-distance, high-density environments such as enterprise LANs, campuses, and data halls. These systems offer easier termination, faster testing, and lower installation labor. As enterprises replace copper with fiber for internal networks, multimode remains a cost-effective and practical option, sustaining above-average growth in commercial and industrial premises.

Application Insights

Telecom networks hold the largest application share of 30%. As operators continuously expand fiber backbones, metro networks, and access infrastructure, the segment sustains growth. Growing data consumption, 5G rollouts, and broadband mandates drive recurring demand for high-reliability, standardized connectors. Telecom deployments require durable, interoperable components that perform under varied environmental conditions, making telecom the most stable and volume-driven segment in the market.

Data centers and cloud interconnects are growing at the fastest rate, with a CAGR of 11.8%, driven by rapid hyperscaler expansion and increasing AI-driven workloads. These environments require dense, high-speed optical interfaces with low insertion loss and high fiber counts. Rapid construction cycles, frequent refreshes, and a preference for pre-terminated cabling drive high unit volumes. Large project sizes and continuous patching activity support sustained long-term revenue growth.

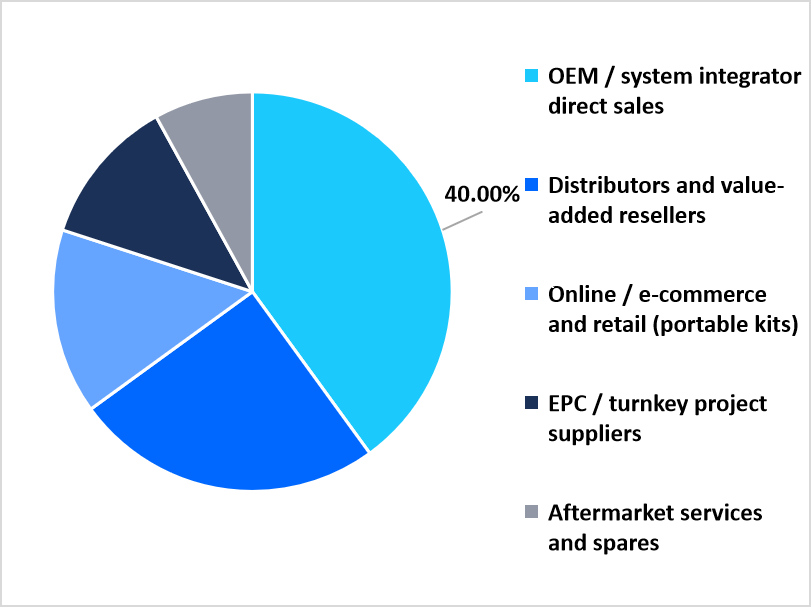

By Distribution Channel Market Share (%), 2025

Source: Straits Research

Distribution Channel Insights

Direct OEM and system-integrator sales account for the largest market share of 40%. Operators procure connectors through multi-year infrastructure contracts covering broadband, fiber backhaul, and access networks. Their focus on standardized, rugged, and certified components ensures consistent procurement volumes and long supplier relationships. Centralized purchasing and large installation footprints favor vendors capable of delivering reliable logistics, testing support, and long-term quality assurance.

Online sales are growing at the fastest rate, with a CAGR of 10.3%, as small businesses, installers, and IT users increasingly purchase connectors through digital platforms. E-commerce enables quick comparison, fast delivery, and easy access to standard products and small-batch orders. Demand is rising for connector kits, pigtails, and portable test tools through online channels. Digital distribution lowers entry barriers for smaller brands, expanding their global reach and driving higher unit volumes and faster market penetration.

Competitive Landscape

The fiber optic connector market is moderately fragmented, with large global manufacturers competing alongside mid-sized and niche players. Established leaders dominate telecom, data center, and industrial contracts using scale, R&D strength, and global distribution. Smaller suppliers compete through pricing, ruggedized designs, and specialized high-density formats. Growth is driven by pre-terminated and high-density solutions, strategic acquisitions, and rising e-commerce and system-integrator partnerships, which are reshaping supplier access to both large and niche customers.

Amphenol Corporation - A Market Leader

Amphenol is a leading global supplier of fiber connectors serving telecom, data center, industrial, and military markets. In 2025, it strengthened its position through acquisitions that expanded its fiber and cable portfolio. Its strengths include a large manufacturing scale, broad product coverage, and the ability to deliver rugged outdoor connectors and high-density data center solutions. Large telecom operators and hyperscale data center builders prefer Amphenol for its reliability, full-system integration, and long-term infrastructure support capabilities.

Latest News:

- In August 2025, Amphenol announced the acquisition of a large broadband connectivity and cable solutions business unit, significantly expanding its fiber-optic interconnect product portfolio and strengthening its position for high-speed data center and broadband infrastructure deployments.

- In Q2 2025, Amphenol’s data-communications division reported more than a doubling of sales year-over-year, reflecting surging demand from AI-driven data center build-outs and broadband infrastructure expansion.

List of Key and Emerging Players in Fiber Optic Connector Market

- Corning Incorporated

- TE Connectivity

- Amphenol Corporation

- Molex, LLC

- 3M Company

- Furukawa Electric Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- SENKO Advanced Components

- OFS Fitel, LLC

- Optical Cable Corporation

- Broadcom Inc.

- Prysmian Group

- Hirose Electric Co., Ltd.

- Huber+Suhner

- Diamond SA

- Radiall

- CommScope (pre-acquisition assets)

- Foxconn (and related divisions)

- JAE (Japan Aviation Electronics)

- Sterlite Optical Technologies Ltd.

- Lapp Group

- Glenair

Strategic Initiatives

- August 2025 - Amphenol Corporation acquired a major broadband connectivity and cable-solutions business unit from another infrastructure vendor, significantly broadening its fiber optic interconnect portfolio to meet growing broadband, 5G, and data-center demand.

- March 2025 - 3M Company partnered with a major fibre-connectivity supplier to introduce a new MPO EBO (Expanded Beam Optical) connector line aimed at outdoor and harsh-environment deployments, targeting utility, broadband, and industrial network projects.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 6.42 billion |

| Market Size in 2026 | USD 6.97 billion |

| Market Size in 2034 | USD 13.86 billion |

| CAGR | 8.9% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Connector Format, By Fiber Mode, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Fiber Optic Connector Market Segments

By Connector Format

- LC

- MPO / MTP

- SC

- ST

- FC

- E2000 & other specialty formats

- Hybrid / high-density and co-packaged optics interconnects

By Fiber Mode

- Single-mode

- Multimode

By Application

- Telecom networks (backhaul, metro, core)

- Data centers & cloud interconnect

- FTTH / access networks

- Enterprise & campus LAN

- Industrial automation & harsh-environment connectivity

- Military, aerospace & medical

- Others

By Distribution Channel

- OEM / system integrator direct sales

- Distributors and value-added resellers

- Online / e-commerce and retail (portable kits)

- EPC / turnkey project suppliers

- Aftermarket services and spares

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.