Fiberglass Market Size, Share & Trends Analysis Report By Product Type (Glass Wool, Roving, Yarn, Chopped Strands, Others), By Resin Type (Thermoset (e.g., Polyester, Epoxy, Vinyl Ester), Thermoplastic), By Application (Composites, Insulation), By End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Wind Energy, Aerospace & Defense, Electrical & Electronics, Marine, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Fiberglass Market Size

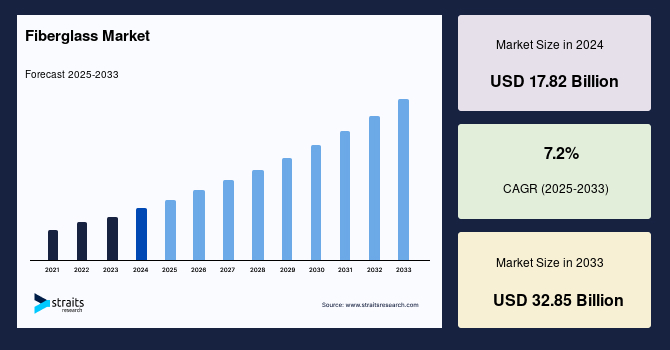

The global fiberglass market size was valued at USD 17.82 billion in 2024 and is projected to grow from USD 18.91 billion in 2025 to USD 32.85 billion in 2033, exhibiting a CAGR of 7.2% during the forecast period (2025-2033).

The global fiberglass market is witnessing steady expansion due to rising demand across the automotive, construction, wind energy, and electrical & electronics industries. Fiberglass composed primarily of fine glass fibers is valued for its high strength-to-weight ratio, corrosion resistance, thermal insulation, and electrical non-conductivity. The growth of lightweight composites in the automotive and aerospace sectors to improve fuel efficiency and reduce emissions is a key driver. Additionally, global infrastructure development especially in Asia-Pacific and the Middle East fuels demand for fiberglass-based building materials such as rebar, insulation, and panels.

One of the major trends shaping the market is the rising use of fiberglass in renewable energy, particularly wind energy. With wind turbine blades requiring strong, lightweight, and durable materials, fiberglass is preferred for rotor blade manufacturing. For instance, Vestas and Siemens Gamesa use fiberglass composites in their wind turbine components. Furthermore, as the electric vehicle (EV) industry scales up, fiberglass is increasingly used in battery enclosures and underbody panels for insulation and safety. Sustainability also plays a growing role, as companies develop recyclable fiberglass materials and improve energy efficiency during manufacturing. This convergence of high-performance and green material demand is expected to reinforce fiberglass as a critical industrial material through 2033.

Fiberglass Market Trend

Demand for Lightweight Automotive Composites

The rising global focus on lightweight vehicle design to enhance fuel efficiency and meet stringent emissions standards is a significant driver of fiberglass demand. The International Energy Agency (IEA) states that automotive emissions must be cut by over 50% by 2035 to meet net-zero targets. As automakers strive to reduce vehicle weight without compromising safety or durability, fiberglass-reinforced composites are increasingly used for body panels, bumpers, dashboards, insulation, and battery enclosures in electric vehicles (EVs).

Compared to traditional steel, fiberglass composites can reduce component weight by up to 30–40% while offering better design flexibility and corrosion resistance. Automotive OEMs such as BMW, Toyota, and Tesla are incorporating fiberglass-reinforced plastics in their vehicle platforms. I.

Moreover, regulatory pressure from the European Union’s Euro 7 standards and the U.S. EPA's new fuel efficiency rules, enforced starting in 2025, will accelerate the adoption of composite materials, including fibreglass. This makes the material crucial in aligning with industry sustainability goals, contributing to increased market penetration.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 17.82 Billion |

| Estimated 2025 Value | USD 18.91 Billion |

| Projected 2033 Value | USD 32.85 Billion |

| CAGR (2025-2033) | 7.2% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Owens Corning, China Jushi Co., Ltd., PPG Industries, Inc., Saint-Gobain S.A., Nippon Electric Glass Co., Ltd. |

to learn more about this report Download Free Sample Report

Fiberglass Market Growth Factor

Expansion of Fiberglass Use in Wind Energy

The use of fiberglass in wind energy is one of the most transformative trends in the market. Fiberglass-reinforced plastics (FRP) are extensively used in manufacturing wind turbine blades due to their lightweight, high tensile strength, and corrosion resistance. According to the Global Wind Energy Council (GWEC), global wind capacity installations reached 117 GW in 2024, with over 80% of rotor blades composed of fiberglass-reinforced composites. The push toward larger, more efficient wind turbines, such as those exceeding 100 meters in blade length, further fuels demand for advanced fiberglass materials with higher strength-to-weight ratios. Leading companies like Owens Corning and Jushi Group are innovating in high-modulus glass fiber to meet the specific structural requirements of offshore and high-capacity turbines.

- For instance, in November 2024, Siemens Gamesa secured a $1.3 billion contract to supply turbines for the East Anglia TWO offshore wind farm, utilising advanced fiberglass composites to enhance blade efficiency and reduce weight.

As countries like the U.S., India, and China increase their wind power capacity targets for 2030 and beyond, fiberglass consumption in this sector is expected to show above-average growth, cementing its role in the renewable energy value chain.

Market Restraint

Environmental Concerns & Recycling Limitations

While fiberglass offers numerous performance benefits, its environmental impact and end-of-life challenges present significant restraints. The production of fiberglass involves high energy consumption and emits CO₂ and other particulates, particularly during the melting phase of raw materials. According to a 2024 European Environment Agency (EEA) report, fiberglass production emits approximately 1.5 tons of CO₂ per ton of glass fiber, contributing to industrial emissions in key manufacturing countries.

Additionally, fiberglass is difficult to recycle due to its thermoset matrix, which cannot be remelted. Current recycling options such as mechanical grinding for filler use or energy recovery are inefficient and economically unattractive. Landfilling remains the primary disposal method, raising concerns over long-term sustainability and environmental regulation compliance.

Moreover, downstream users' consumer awareness and sustainability commitments (like automotive and construction firms) are prompting a shift toward more eco-friendly materials. If not addressed, these limitations may curb fiberglass demand in favor of more circular alternatives like natural fiber composites or thermoplastic-based solutions.

Market Opportunity

Infrastructure and Urbanisation in Emerging Economies

One of the strongest opportunities for the fiberglass market lies in the rapid urbanisation and infrastructure development in emerging economies across Asia-Pacific, Latin America, and Africa. With governments investing heavily in housing, transportation, and industrial infrastructure, demand for corrosion-resistant, lightweight, and durable materials like fiberglass is rising. The Indian government, for example, allocated over USD 140 billion for infrastructure development in its 2025 Union Budget, focusing on smart cities, metro rail networks, and roadways. Fiberglass rebar and panels are increasingly used in bridges and coastal construction due to their resistance to corrosion compared to steel. Similarly, China’s Belt and Road Initiative (BRI) continues to create demand for industrial and infrastructural composites, with fiberglass gaining traction in utility poles, pipelines, and prefabricated building materials. Companies are capitalising on these.

- For instance, in September 2024, China Jushi expanded its Egyptian fiberglass production facility, increasing annual capacity to 340,000 metric tons.This expansion aims to meet the growing demand for fiberglass in infrastructure projects across the Middle East and Africa, highlighting the material's role in supporting sustainable development in emerging markets.

As urban populations grow and infrastructure becomes more resilient and sustainable, fiberglass is a critical material in next-generation development.

Regional Analysis

Europe holds a dominant position in the market, accounting for 36% of the total market share. Europe dominates the global fiberglass market due to its robust renewable energy, automotive, and construction sectors. Germany, France, and the U.K. lead in composite manufacturing, reinforced by strict EU regulations promoting lightweight and energy-efficient materials. Wind energy is a major driver Europe accounts for nearly 35% of global wind turbine installations, and fiberglass is essential in blade fabrication. The European Union’s Green Deal and Horizon Europe programs have allocated billions in funding for sustainable building materials and lightweight transport systems. For example, Germany’s “Klimaschutzprogramm 2030” promotes energy-efficient housing retrofits, boosting fiberglass insulation demand. Continuous innovation from Owens Corning, Saint-Gobain, and Röchling SE further supports regional dominance.

- The UK's fiberglass industry is characterised by a growing emphasis on sustainable construction and energy efficiency. Government regulations mandating higher insulation standards have propelled the adoption of fiberglass materials in building applications. The automotive industry's pursuit of lightweight components to improve fuel economy has further stimulated demand for fiberglass composites. Leading manufacturers, including Saint-Gobain and Owens Corning, have expanded their operations in the UK, introducing innovative fiberglass products tailored to local requirements.

- Germany is a pivotal player in the European fiberglass market, underpinned by its advanced manufacturing capabilities and stringent environmental regulations.The country's automotive sector, renowned for engineering excellence, extensively employs fiberglass composites to reduce weight and enhance vehicle performance. In the construction domain, the push for energy-efficient buildings has led to widespread use of fiberglass insulation. Companies like Knauf Insulation and Johns Manville have invested in research and development to deliver high-performance fiberglass solutions aligning with Germany's sustainability goals.

Asia-Pacific Market Trends

Asia-Pacific is the fastest-growing region, projected to grow at a CAGR of 8.4% from 2025 to 2033. China, India, and Southeast Asia are witnessing booming demand for fiberglass across construction, automotive, and electronics. China’s "New Infrastructure Plan" and India’s "Smart Cities Mission" are key government-led initiatives accelerating fiberglass use in roads, bridges, and public infrastructure. Additionally, lightweight fiberglass composites are replacing traditional metals in China and South Korea electric vehicle production. China alone contributed over 30% of the global fiberglass production in 2024 and is a major exporter. The expansion of wind energy projects in countries like Vietnam and India also drives demand for fiberglass turbine blades.

- China dominates the global market, accounting for a substantial share of production and consumption. The nation's rapid industrialisation and urbanisation have spurred demand across the construction, automotive, and wind energy sectors. Government initiatives like the "New Infrastructure Plan" have further accelerated the adoption of fiberglass in various applications. Leading domestic manufacturers, including China Jushi and Taishan Fiberglass, have expanded their production capacities to meet both domestic and international demand.

- India's market is on an upward trajectory, driven by infrastructure development and the government's focus on sustainable growth. Programs such as the "Smart Cities Mission" have increased the incorporation of fiberglass in urban infrastructure projects. The automotive industry's shift towards lightweight materials for improved fuel efficiency has also contributed to the rising demand for fiberglass composites. International players like Saint-Gobain have strengthened their foothold in India through strategic acquisitions, enhancing the availability of advanced fiberglass solutions in the market.

North America Market Trends

North America remains a significant market with increasing demand in infrastructure redevelopment, automotive lightweighting, and clean energy. The U.S. Bipartisan Infrastructure Law, passed in late 2021 and implemented over the following years, allocates over $1.2 trillion toward transportation, energy, and public buildings many requiring advanced fiberglass solutions. Fiberglass insulation is gaining traction in sustainable buildings under programs like ENERGY STAR and LEED certification. Major regional players include Owens Corning, PPG Industries, and Johns Manville, all investing in R&D for advanced fiberglass solutions.

- The U.S. maintains a significant position in the global market, driven by robust demand in construction, automotive, and renewable energy sectors. The emphasis on energy-efficient buildings has led to increased adoption of fiberglass insulation, supported by federal initiatives promoting sustainable construction. In the automotive industry, the shift towards lightweight materials to enhance fuel efficiency has bolstered the use of fiberglass composites. Additionally, the expansion of wind energy projects has amplified the demand for fiberglass in turbine blade manufacturing. Major players like Owens Corning continue to innovate, with developments such as the PINK Next Gen Fiberglas insulation, facilitating faster installation and improved performance.

- Canada's market is experiencing steady growth, primarily fueled by the construction sector's focus on energy efficiency and sustainability. Government programs aimed at reducing greenhouse gas emissions have incentivized the use of fiberglass insulation in residential and commercial buildings. The country's commitment to renewable energy, particularly wind power, has also contributed to the increased utilization of fiberglass in turbine components. Companies like Johns Manville and Saint-Gobain have strengthened their presence in Canada, offering advanced fiberglass solutions to meet the evolving demands of the market.

Product Type Insights

Roving holds the largest market share within the product type segment due to its superior mechanical properties and broad application in composites. Roving consists of continuous strands of fiberglass and is widely used in automotive, wind energy, and construction for its high strength-to-weight ratio. According to the European Composites Industry Association (EuCIA), demand for fiberglass roving is rising in the wind energy sector, driven by the expansion of offshore and onshore wind projects. In 2025, roving is expected to account for over 35% of the total fiberglass volume used in composites, especially in Asia-Pacific and Europe, where structural lightweight materials are prioritised for energy efficiency and sustainability.

Resin Type Insights

Thermoset resins, especially polyester and epoxy, dominate the resin type segment as they offer excellent adhesion, chemical resistance, and durability. Thermoset fiberglass composites are extensively used in automotive parts, wind turbine blades, and marine applications. Thermoset composites accounted for over 75% of global fiberglass resin demand due to their superior performance in high-stress environments. Their cost-effectiveness and widespread availability make them ideal for mass manufacturing and large structural applications.

Application Insights

The composites segment dominates due to fiberglass’s wide usage in reinforced plastic components across construction, automotive, and aerospace sectors. Composite applications are valued for strength, corrosion resistance, and design flexibility. The rise in electric vehicle (EV) production and increased investment in renewable energy is fueling demand for lightweight fiberglass composites. According to the American Composites Manufacturers Association (2024), composites comprised nearly 60% of global fiberglass consumption in 2024 and are projected to grow at a 6.9% CAGR through 2033.

End-Use Industry Insights

Construction & Infrastructure remains the largest end-use segment. Fiberglass is widely used in panels, insulation, reinforcements, and roofing due to its fire resistance, thermal insulation, and low maintenance cost. Rising urbanisation and energy-efficient building codes, especially in Asia and the Middle East, are increasing fiberglass consumption in the building sector. The segment is expected to grow at 7.2% CAGR between 2025 and 2033, driven by sustainable infrastructure initiatives and retrofit projects across emerging markets.

Company Market Share

The global fiberglass market is characterized by the presence of several key players employing diverse strategies to maintain and enhance their market positions. These companies focus on product innovation, strategic partnerships, mergers and acquisitions, and expansion into emerging markets to cater to the evolving demands across various industries.

Owens Corning: Owens Corning, headquartered in Toledo, Ohio, is a global leader in the production of fiberglass composites, insulation, and roofing materials. With a strong emphasis on innovation and sustainability, the company has developed a diverse portfolio catering to various industries, including construction, automotive, and renewable energy.

Latest News

- In May 2024, Owens Corning completed the acquisition of Masonite International for $3.9 billion.This strategic move is expected to enhance Owens Corning's product offerings in the building materials sector, further solidifying its position in the global fiberglass market.

List of Key and Emerging Players in Fiberglass Market

- Owens Corning

- China Jushi Co., Ltd.

- PPG Industries, Inc.

- Saint-Gobain S.A.

- Nippon Electric Glass Co., Ltd.

- Taishan Fiberglass Inc.

- Chongqing Polycomp International Corporation (CPIC)

- Johns Manville Corporation

- AGY Holding Corp.

- 3B-the fibreglass company

- China Beihai Fiberglass Co., Ltd.

- Binani Industries Ltd.

- Nitto Boseki Co., Ltd.

- Advanced Glassfiber Yarns LLC

- BASF SE

to learn more about this report Download Market Share

Recent Developments

- May 2024- BASF announced a collaboration with 3B Fibreglass to incorporate sustainable glass fibers produced using green electricity into its Ultramid A & B product lines. This initiative aims to reduce the carbon footprint of these products by approximately 10%, aligning with BASF's commitment to sustainability and offering eco-friendly solutions to its customers.

- March 2024- Owens Corning announced a strategic review of its glass fiber business to explore potential alternatives to increase shareholder value. This move reflects the company's efforts to optimise its portfolio and focus on high-growth areas within the fibreglass market.

- March 2024- Europe’s leading access solutions provider, WernerCo, launched a new fiberglass work platform under its ZARGES and Werner brands. Designed for low-level on-site tasks, the platform features durable, non-conductive fiberglass legs, ensuring safety when working around electricity.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 17.82 Billion |

| Market Size in 2025 | USD 18.91 Billion |

| Market Size in 2033 | USD 32.85 Billion |

| CAGR | 7.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Resin Type, By Application, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Fiberglass Market Segments

By Product Type

- Glass Wool

- Roving

- Yarn

- Chopped Strands

- Others

By Resin Type

- Thermoset (e.g., Polyester, Epoxy, Vinyl Ester)

- Thermoplastic

By Application

- Composites

- Insulation

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Wind Energy

- Aerospace & Defense

- Electrical & Electronics

- Marine

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.