Fifth-Party Logistics Market Size, Share & Trends Analysis Report By Service Offering (End-to-End Supply Chain Management, Transportation Management, Warehousing & Distribution, Reverse Logistics, IT Integration & Data Analytics, Supply Chain Consulting), By Integration Model (Domestic 5PL, Global 5PL), By Industry Vertical (Automotive, E-Commerce, Consumer Electronics, Healthcare & Pharmaceuticals, Retail & E-commerce, Industrial & Heavy Machinery, Aerospace & Defense, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Fifth-Party Logistics Market Size

The global fifth-party logistics market size was worth USD 9.8 billion in 2024 and is estimated to reach an expected value of USD 10.56 billion in 2025 to USD 19.27 billion by 2033, growing at a CAGR of 7.8% during the forecast period (2025-2033).

Fifth-party logistics (5PL) is a logistics model that involves the complete outsourcing of supply chain management, integrating advanced technology and data analytics to optimize efficiency. Unlike third-party logistics (3PL), which focuses on transportation and warehousing, or fourth-party logistics (4PL), which manages supply chain coordination, 5PL providers leverage automation, artificial intelligence (AI), and big data to enhance the entire logistics network. They act as strategic partners, handling procurement, distribution, inventory management, and demand forecasting for businesses. 5PL solutions are particularly relevant for e-commerce companies, multinational corporations, and industries that require agile and scalable supply chain operations. These providers optimize digital supply networks using cloud computing, blockchain technology, and real-time tracking to enhance transparency and efficiency.

The global market is poised for transformative growth, propelled by the supply chain's rising complexity and a need for end-to-end integrated logistics solutions. Digital advancements in platforms, data analytics, and automation are redefining classic logistics processes aided by enabling reform legislation and economic recovery by encouraging investments into the sector. Current trends point towards logistics being outsourced to specialized 5PL providers, providing large-scale supply chain management hooked into AI and IoT for real-time monitoring. Other contributory aspects further spurring the market, such as government initiatives for trade facilitation and infrastructural enhancement, economic pressure, and sustainability, remain critical influences.

The figure below shows the top 5 United States Exports, As increasing Global Trade is one of the key market drivers.

Source: Straits Research

Exclusive Market Trend

Digital Integration & Ai-Driven Supply Chain Management

Digital transformation is significantly one of the factors in the 5PL market wherein the technology providers apply AI, IoT, and big data analytics to improve supply chains. This is useful in forecasting inventory management and route optimization. For instance, a pilot program funded by the U.S. Department of Transportation resulted in a 20% reduction in delivery time and a 15% reduction in costs. Greater visibility into data and the automation of processes have propelled efficiency throughout global operations.

Furthermore, one of the most essential focuses in contemporary logistics is sustainability. There are now several moves by world governments and global trade associations to encourage greener supply chain practices.

- For example, the European Green Deal will incentivize eco-friendly logistics solutions, contributing to a 17% uptick in adopting green technologies within 5PL operations. Greater carbon efficiency and lower operating costs from such initiatives thus make sustainability a strategic imperative among market players.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 9.8 Billion |

| Estimated 2025 Value | USD 10.56 Billion |

| Projected 2033 Value | USD 19.27 Billion |

| CAGR (2025-2033) | 7.8% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, CEVA Logistics |

to learn more about this report Download Free Sample Report

Global Fifth-Party Logistics Market Growth Factor

Increasing Global Trade and Supply Chain Complexity

Denser interconnected chains were born from globalization and increased trade volumes, giving rise to an impressive demand for integrated services. Significant economies like the United States and China share observations of enterprises outsourcing functionalities to global partners to achieve operational efficiency. With supply chains spanning multiple continents, businesses require data-driven, technology-enabled logistics solutions to manage their operations effectively. 5PL providers act as strategic partners, offering end-to-end supply chain optimization using artificial intelligence, big data, and cloud-based management systems.

- For instance, recently released U.S. trade data recorded a 22% increase in outsourced logistics services because most firms are determined to enhance their operational efficiency, reduce expenditures on logistics services, and augment their supply chain resilience.

Moreover, as global supply chains become more complex due to geopolitical disruptions, climate-related challenges, and fluctuating demand patterns, 5PL solutions provide real-time monitoring and predictive analytics to mitigate risks. The rise of e-commerce, just-in-time (JIT) inventory models, and multi-modal transportation networks further propel the adoption of advanced logistics strategies. Retail, automotive, and pharmaceutical companies increasingly rely on 5PL providers to manage their networks seamlessly, reducing inefficiencies and ensuring faster delivery times. The continued expansion of global trade agreements and cross-border commerce reinforces the need for sophisticated logistics orchestration, making 5PL services indispensable for modern businesses.

Market Restraint

High Capital Costs and Challenges in the Integration of Operations

Deploying state-of-the-art 5PL solutions can require highly high capital investments and complex integration of legacy systems with digital technologies. Many companies, especially small and mid-sized enterprises, struggle with the financial burden of upgrading their logistics operations. Implementing AI-driven analytics, blockchain-based transaction processing, and cloud-based logistics platforms involves significant upfront costs for infrastructure, software, and personnel training. Additionally, integrating advanced 5PL solutions with existing enterprise resource planning (ERP) systems and outdated supply chain management tools presents technical and operational challenges.

- Integration costs may constitute over 15% of a company's operational budget, leading to slow adoption rates, especially among mid-sized operators. The need for skilled IT and logistics professionals to oversee this transition adds another layer of complexity.

Moreover, cybersecurity and data privacy concerns further hinder the adoption of 5PL solutions. Companies operating in industries with strict regulatory compliance, such as pharmaceuticals and food supply chains, may face additional hurdles in ensuring that digital logistics platforms meet industry-specific requirements. These factors collectively contribute to the hesitancy among businesses to fully embrace 5PL, thereby slowing down market growth and scalability. However, these barriers will gradually diminish as technology advances and more cost-effective solutions become available.

Market Opportunity

Entry into Emerging Markets Due to Government Subsidies

Emerging markets offer tremendous opportunities as they have received increased government funding to modernize logistics and trade infrastructure. These regions present untapped potential for logistics service providers as businesses seek to optimize supply chain networks, enhance transportation efficiency, and implement cutting-edge logistics technologies. Governments in Asia, Africa, and Latin America actively invest in logistics hubs, free trade zones, and AI-powered supply chain platforms to facilitate smoother trade operations.

- Initiatives by Digital India and trade facilitation programs in Southeast Asia are providing subsidies to investments in logistics solutions. These initiatives intend to reduce logistics inefficiencies and can drive a probable growth of 20% in 5PL adoption, providing attractive opportunities for providers to secure new business. Additionally, Latin America has seen a surge in e-commerce demand, requiring enhanced logistics solutions to improve last-mile delivery efficiency.

As these markets evolve, 5PL providers can capitalize on government incentives, technological advancements, and digital trade expansion to establish a strong presence. Collaborations between local governments and international logistics firms will further drive growth in these regions, ensuring a broader market reach for advanced 5PL solutions. By leveraging these opportunities, 5PL firms can enhance supply chain agility, reduce operational costs, and strengthen their foothold in rapidly developing economies.

Regional Insights

North America: Dominant Region with A Significant Market Share

North America represents the highest share of the global fifth-party logistics market, backed by superior logistics infrastructure, massive digital adoption, and growth in industrial evolution. For the U.S. and Canadian markets, strong government support for supply-chain modernizations, considerable investments in digital transformations, and regulatory policies that encourage efficiency and innovation in logistics create a robust platform. Together with the high penetration of e-commerce and established trade networks, this enables the North American region to achieve a further lead, setting standards for integrated solutions on a global scale.

- The region's advancements in AI-powered logistics, blockchain-based supply chain management, and IoT-enabled tracking systems further enhance operational efficiency. North America’s well-established logistics companies collaborate with technology firms to develop predictive analytics tools that streamline operations, reduce costs, and optimize supply chains.

Additionally, implementing autonomous delivery systems, drone logistics, and robotics in warehouses ensures faster and more reliable logistics solutions. The presence of large multinational corporations with extensive supply chains also boosts the demand for 5PL services. With increasing concerns over supply chain resilience due to geopolitical factors and economic uncertainties, North American businesses are investing heavily in 5PL solutions to enhance agility and mitigate risks.

Asia-Pacific: Rapidly Growing Region

Asia-Pacific is the fastest-growing region in the global fifth-party logistics market, fueled by rapid industrialization, expanding international trade, and digital transformation initiatives. Countries like China, India, and Southeast Asian nations are experiencing significant growth in e-commerce and manufacturing, which increases the demand for all-inclusive logistics solutions. Government projects such as China's Belt and Road Initiative and India's Digital India drive investments into supply chain infrastructure, enabling market growth at double-digit rates.

The growing adoption of cloud-based logistics solutions, AI-driven supply chain analytics, and blockchain-enabled trade platforms further propel the region’s market expansion. As trade agreements and free-trade zones increase cross-border commerce, Asia-Pacific businesses increasingly rely on 5PL solutions to optimize inventory management and streamline transportation networks.

Countries Insights

- United States: The U.S. government allocated $654.73 billion in 2024 for investments in ICT to better the digital infrastructure and cybersecurity. Federal agencies are announcing using 5PL solutions to optimize supply chains, focusing on integrating AI-powered logistics with blockchain. Government initiatives like the National Freight Strategic Plan focus on throwing digital transformation upon transportation efficiency and real-time tracking.

- Canada: Canada is the largest official ICT buyer, getting $5 billion yearly for digital infrastructure. Government push for smart logistics solutions through AI, IoT, and cloud computing provides impetus to support the adoption of 5PL. Programs like the National Trade Corridors Fund invest in supply chain resilience by ensuring that logistics networks are data-driven, transparent, and secure for seamless international trade.

- Germany: From 2020 to date, Germany has injected €2 billion into quantum technologies, strengthening its position as the European leader in digital transformation. As a logistics hub for Europe, Germany offers advanced ICT, adding to multiple avenues of 5PL solutions with enhanced AI-based automation features combined with real-time freight tracking software. In its Digital Strategy 2025, the government fosters data-centric logistics networks driving cross-border transportation and predictive analytics for supply chain efficiency.

- Japan: Japan’s e-Japan Priority Policy Programme promotes ICT development led by the private sector, supported by the government in fostering innovation. As a global logistics powerhouse, Japan applies the capabilities of 5PL related to smart warehousing, digital twins, and IoT-based supply chain management. The Agency focuses on integrating blockchain into logistics, enhancing transparency and security during international trade operations.

- India: In January 2025, the U.S. and India committed to increasing ICT trade and investment. The National Logistics Policy of India integrates AI, 5G, and automation in 5PL, enabling streamlined global supply chains. Government initiatives, such as Digital India and LEADS, center around ICT-oriented logistics hubs and ensure real-time tracking and predictive analytics mechanisms to help enable seamless global trade.

- Brazil: Brazil’s ICT policies drive innovation and digital infrastructure development, fostering a tech-driven market. IoT-enabled transportation management systems support investments in the country's growing 5PL sector. Government programs like ConectarAGRO and the National Internet of Things Plan enable smarter logistics solutions, optimize freight management, and reduce costs while improving real-time data visibility in global supply chain operations.

- South Africa: South Africa’s ICT policies encourage digital transformation, focusing on logistics and supply chain optimization. The government initiatives of Smart Ports and Digital Logistics integrate AI, blockchain, and IoT into 5PL networks, enhancing freight tracking and predictive analytics. Investments in high-speed internet and cybersecurity fortify the resilience of the globally connected logistics sector that supports international trade.

- Australia: In September 2024, NextDC opened a $100 million data center in Adelaide, improving ICT capacity for the government and defense. Australia’s Smart Freight Systems uses AI-powered 5PL solutions to optimize real-time logistics tracking and route optimization. Blockchain and IoT supply chain investments boost international trade efficiencies and thus enable seamless logistics operations for global markets.

Segmentation Analysis

By Service Offering

Reverse logistics is the dominant segment and has the highest market share globally. Market growth, underpinned by demand for complete outsourced logistics solutions, seeks to optimize operations. The growth of complexities in global trade causes companies to push for service consolidation, which takes integrated offerings to have better visibility and will make it gain nearly 40% in market revenue in developed economies.

By Integration Model

Global 5PL segment dominated the market with the largest market share. The Global 5PL segment is developing as it provides unified cross-border logistics solutions for organizations. The growing demand on the global front has opened up new integrations that accounted for approximately 45% of all new contracts in the market, forced by the need for creating transparent and seamless international supply chain management.

By Industry Vertical

E-Commerce segment dominated the market with the largest market revenue. The industries facilitating this demand include automotive, E-Commerce, electronics, pharmaceuticals, retail, industrial equipment, food & beverages, and avionics. The e-commerce sector accounts for a significant portion, over 35%, of transactions in this market since they typically need logistics support for high volume, time-sensitive supply chains and efficient supply chain management.

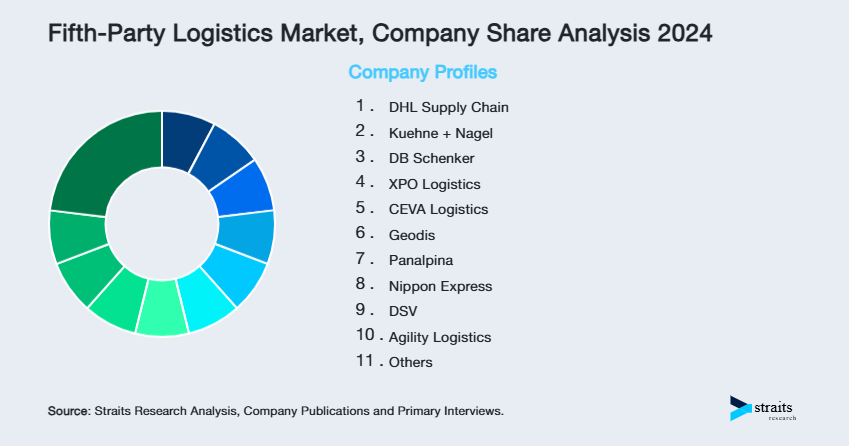

Company Market Share

Key market players are investing in advanced Global Fifth-Party Logistics technologies and pursuing collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Kuehne+nagel: An Emerging Player in the Global Fifth-Party Logistics Market

Kuehne + Nagel, renowned for its comprehensive supply chain and logistics solutions, is rapidly emerging in the fifth-party logistics (5PL) arena. The company’s continuous investment in digitalization and advanced distribution strategies, coupled with its extensive global network, positions it as a pivotal player in integrated logistics services. Their innovative approach to optimizing distribution centers underscores a strong commitment to driving efficiency and value in the evolving 5PL market.

Recent Developments:

- In October 2023, Kuehne + Nagel was honored with the Distribution Center Provider of the Year Award for the fifth consecutive year by Abbott Nutrition.

List of Key and Emerging Players in Fifth-Party Logistics Market

- DHL Supply Chain

- Kuehne + Nagel

- DB Schenker

- XPO Logistics

- CEVA Logistics

- Geodis

- Panalpina

- Nippon Express

- DSV

- Agility Logistics

- Others

to learn more about this report Download Market Share

Recent Developments

- November 2024- XPO Logistics unveiled its next-generation digital logistics platform, which integrates AI-powered analytics and IoT monitoring, reducing delivery times by 18% and significantly enhancing supply chain transparency.

- December 2024- DHL Supply Chain announced a strategic partnership with a significant Asian government initiative to modernize digital trade infrastructures, driving a projected 20% growth in end-to-end logistics solutions in the region.

Analyst Opinion

As per our analyst, the global fifth-party logistics market is on a robust growth trajectory, driven by increasing supply chain complexity and rising global trade volumes. Digital transformation, AI-driven analytics, and government investments are key growth enablers. However, high capital costs and integration challenges pose significant hurdles. Adopting advanced logistics technologies, such as AI-powered predictive modeling, blockchain for secure transactions, and digital twins for supply chain simulation, is expected to accelerate market expansion.

Additionally, as automation and machine learning refine logistics processes, companies will gain enhanced visibility and control over their supply chain networks. The global trend of sustainability in logistics is also shaping the market, with businesses focusing on reducing carbon footprints through eco-friendly transportation solutions and green warehousing practices.

As economies modernize and cross-border trade intensifies, the market is expected to sustain long-term growth, particularly in emerging regions with aggressive digital infrastructure initiatives. Integrating 5PL services with Industry 4.0 innovations and the expansion of e-commerce in developing nations will create new opportunities for logistics service providers. The market’s success will depend on continued technological advancements, supportive regulatory frameworks, and investments in strategic digital supply chain solutions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 9.8 Billion |

| Market Size in 2025 | USD 10.56 Billion |

| Market Size in 2033 | USD 19.27 Billion |

| CAGR | 7.8% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service Offering, By Integration Model, By Industry Vertical |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Fifth-Party Logistics Market Segments

By Service Offering

- End-to-End Supply Chain Management

- Transportation Management

- Warehousing & Distribution

- Reverse Logistics

- IT Integration & Data Analytics

- Supply Chain Consulting

By Integration Model

- Domestic 5PL

- Global 5PL

By Industry Vertical

- Automotive

- E-Commerce

- Consumer Electronics

- Healthcare & Pharmaceuticals

- Retail & E-commerce

- Industrial & Heavy Machinery

- Aerospace & Defense

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.