Fire Truck Market Size, Share & Trends Analysis Report By Type (Pumper Trucks, Aerial Trucks, Tankers, Rescue Trucks), By Application (Residential & Commercial, Airports & Enterprises, Military), By Propulsion (Internal Combustion Engine (ICE), Electric) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Fire Truck Market Size

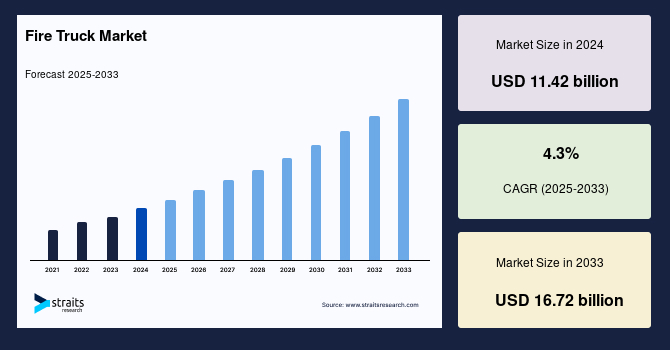

The global fire truck market size was valued at USD 11.42 billion in 2024 and is projected to reach USD 16.72 billion by 2033, exhibiting a CAGR of 4.3% during the forecast period (2025–2033).

The market encompasses specialised vehicles designed for firefighting operations, including fire suppression, rescue missions, and emergency medical services. These vehicles are integral to public safety infrastructure. They are equipped with various critical tools such as hoses, ladders, high-capacity water tanks, hydraulic rescue tools, and advanced pumping systems. Modern fire trucks often feature thermal imaging cameras, communication systems, and high-tech navigation equipment to aid operations. The market includes various types of fire trucks like pumpers, tankers, aerial platforms, wildland fire engines, and rescue trucks, each serving unique operational and geographic needs.

The global fire truck market is expanding rapidly. Growing urban populations, the expansion of industrial complexes, and the rising incidence of natural and artificial disasters have intensified the need for highly responsive and specialised fire apparatus. Additionally, fire departments worldwide are transitioning toward multi-functional units capable of handling diverse emergencies. With increasing emphasis on operational readiness, the global market continues to evolve in design, customisation, and capability to meet the rigorous demands of modern emergency services.

Latest Market Trend

Electrification of Fire Trucks

The fire truck industry is witnessing a paradigm shift towards electrification, driven by the urgent need to reduce greenhouse gas emissions, comply with environmental regulations, and lower long-term operating costs. Electric fire trucks are gaining traction due to benefits such as quieter operation, reduced fuel dependency, improved energy efficiency, and minimal emissions in urban settings. These vehicles also offer lower maintenance needs due to fewer moving engine parts.

- For instance, in April 2025, Denton, Texas, introduced the state's first electric fire truck, the Pierce Volterra, marking a significant move towards sustainable emergency response. The vehicle, costing $1.8 million, offers a quieter operation and reduced emissions, aligning with the city's climate goals.

Similarly, European cities like Berlin and Vienna are expanding trials and procurement of electric fire vehicles from manufacturers like Rosenbauer and Magirus. As battery technology improves and infrastructure for charging becomes more widespread, electric fire trucks are expected to become a mainstay in city fleets by the end of the decade, significantly reshaping the global market landscape.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 11.42 Billion |

| Estimated 2025 Value | USD XX Billion |

| Projected 2033 Value | USD 16.72 Billion |

| CAGR (2025-2033) | 4.3% |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Key Market Players | REV Group (U.S.), Oshkosh Corporation (U.S.), MORITA HOLDINGS CORPORATION (Japan), Rosenbauer International AG (Austria), Alexis Fire Equipment Company (U.S.) |

to learn more about this report Download Free Sample Report

Fire Truck Market Driver

Urbanisation and Infrastructure Development

Rapid urbanisation and large-scale infrastructure development are key catalysts for the growth of the global market. As more people migrate to urban centres and megacities expand, the need for advanced public safety systems, including modern fire departments, becomes imperative. Newly constructed high-rise buildings, industrial zones, airports, and transportation infrastructure carry heightened fire risk, prompting governments to invest in fleet expansion and modernisation. Fire departments are increasingly adopting multi-functional vehicles capable of navigating congested city environments and accessing high elevations.

- For example, in May 2025, the Marrara fire station in Australia's Top End received a new $1.2 million Scania Heavy Urban Pumper, Marrara 44. This advanced fire truck can pump 4,890 litres of water per minute and is equipped with new battery-operated road rescue tools, enhancing the station's firefighting capabilities.

Similar investments are observed in fast-growing economies such as India, Brazil, and Southeast Asia, where city planning now includes robust fire response infrastructure. These developments reflect the ongoing investments in firefighting infrastructure to meet the demands of growing urban populations and complex emergency scenarios.

Market Restraint

High Costs and Delivery Delays

A major restraint in the fire truck market is the high procurement cost and extended delivery timelines for new vehicles. Due to the complexity of custom manufacturing, integration of advanced technologies, and the specialised nature of components like aerial ladders, hydraulic systems, and pump modules, fire trucks can cost anywhere from $700,000 to over $2.5 million. These prices have surged significantly in recent years, driven by inflation, supply chain disruptions, and labour shortages. Delivery lead times have also increased drastically, stretching up to 4.5 years in some regions, leaving fire departments vulnerable with ageing fleets. For instance, many fire departments in the U.S. are turning to refurbished or used fire trucks to maintain readiness.

At the national level, bipartisan efforts are underway to investigate price inflation and delivery delays, with concerns that private equity ownership of key fire truck manufacturers limits market competition. These challenges significantly burden smaller municipalities and volunteer fire services, potentially delaying critical upgrades and compromising public safety.

Market Opportunity

Integration of Advanced Technologies

The integration of advanced technologies presents significant opportunities in the market. Incorporating telematics, AI, and IoT into fire trucks can enhance operational efficiency, predictive maintenance, and real-time data analysis.

- For example, the PyroGuardian system, developed in November 2024, uses wearable modules to transmit firefighters' health and location data over long-range networks to an Android tablet. This system enables incident commanders to monitor vital signs and positioning, enhancing emergency decision-making.

Manufacturers are incorporating safety technologies such as ergonomics, vision systems, driving assistance systems (ADAS), collision avoidance systems, and autonomous capabilities. Fire departments and universities are actively testing Vehicle-to-Vehicle (V2V) communication systems for potential integration into their fire truck fleets, aiming to improve situational awareness and coordination during emergency responses. These technological integrations are redefining the capabilities of fire trucks, making them more efficient, safer, and better suited to modern emergency response needs.

Regional Analysis

Europe remained the global leader in the fire truck market in 2024, with a market share of 34.6%. This dominance is driven by highly regulated fire safety frameworks, consistent infrastructure investments, and the presence of renowned manufacturers like Rosenbauer International AG, Magirus GmbH, and Iturri Group. European governments continue to fund the modernisation of firefighting fleets in line with broader environmental goals. The European Union's 2030 climate agenda has prompted municipalities to switch to electric and hybrid firefighting vehicles, supported by incentive programs and sustainability grants.

United Kingdom Industry Insights

The UK fire truck market is evolving rapidly, emphasising fleet modernisation and sustainability. The UK government’s commitment to net-zero emissions by 2050 is accelerating the procurement of low-emission firefighting vehicles. Additionally, integrating AI-based dispatch and autonomous support systems enhances emergency response efficiency. Investment is also directed at retrofitting older vehicles with digital technologies such as real-time GPS tracking and predictive maintenance software.

Germany is a powerhouse in Europe’s fire truck manufacturing industry, contributing nearly one-third of regional market share. The country benefits from a robust industrial base, strong export demand, and deep-rooted R&D culture. Leading manufacturers like Magirus GmbH and Ziegler Group are pioneering electric and AI-integrated fire trucks that align with the EU’s Green Deal objectives. Government support through innovation grants and green procurement policies further reinforces Germany’s position as a global leader in emergency vehicle technology.

North American Market Trends

North America is emerging as the fastest-growing market due to a wave of fleet replacement programs, especially in the U.S., where many fire departments operate vehicles exceeding 20 years of service. In 2024, the U.S. held an estimated 84% share of the North American fire truck market, underpinned by robust public safety budgets and a growing focus on integrating cutting-edge technologies such as AI-based dispatch systems, autonomous navigation aids, and hybrid powertrains. State-level climate action plans also push agencies to explore electric and hybrid fire trucks. Notable initiatives in cities like Los Angeles, New York, and Phoenix include pilot programs for zero-emission vehicles and grants for telematics-enhanced trucks.

United States Fire Truck Market Growth Factors

The U.S. remains the largest fire truck market globally. This growth is fueled by a comprehensive disaster management framework, frequent wildfires in states like California and Texas, and increasing urban emergencies. Modernising outdated fleets and integrating electric and hybrid fire trucks, like the Pierce Volterra, are reshaping fire departments' capabilities. In 2025, a bipartisan congressional investigation deepened into the impact of private equity on escalating prices and consolidation within the fire apparatus manufacturing sector, highlighting the urgent need for greater market transparency and policy intervention.

Canada’s fire truck market is experiencing consistent growth, largely driven by governmental support for sustainable public safety infrastructure. Federal and provincial programs are funding the replacement of legacy fire trucks with next-generation electric and hybrid models. Notably, cities like Toronto and Vancouver have deployed the REV Group's Vector electric fire trucks, showcasing Canada’s leadership in clean-tech adoption within emergency services. With a growing emphasis on climate resilience and emissions reduction, Canada’s fire truck fleet transformation reflects both ecological and technological progress.

Asia-Pacific Market Trends

The Asia-Pacific region is projected to register the highest compound annual growth rate (CAGR) from 2024 to 2030, driven by rapid industrialisation, urban expansion, and increasing disaster preparedness funding. Countries like China, India, Indonesia, and South Korea are significantly expanding their fire safety budgets to address the growing complexity of urban fire risks and to improve response times. With industrial and urban zones rapidly proliferating across the region, Asia-Pacific is poised to become the most dynamic and lucrative market for fire truck manufacturers in the coming years.

Chinese Market Trends

China leads the Asia-Pacific fire truck market, propelled by aggressive urbanisation, rapid industrial growth, and an expanding commitment to public safety. The government’s 14th Five-Year Plan includes targeted investments in emergency infrastructure, including smart fire stations and AI-based fire control systems. Chinese manufacturers like Zoomlion and CIMC produce advanced multifunctional fire trucks with aerial rescue capabilities and integrated surveillance drones. Local innovation, government support, and massive infrastructure projects position China as a major consumer and producer in the global fire truck landscape.

India's fire truck market is poised for robust expansion, with an expected annual growth rate of 4.3% through 2033. This growth is driven by urban sprawl, rising industrial zones, and national policy shifts to improve disaster readiness. The Indian government, through the Smart Cities Mission and the Fire Services Modernisation Fund, is investing in modern firefighting infrastructure. Domestic players such as Rosenbauer India and Tata Motors are developing cost-effective yet technologically enhanced fire trucks tailored to metro and rural deployments. This localisation of innovation is helping meet the country’s diverse and demanding emergency response needs.

Type Analysis

Pumper Trucks dominate the market share. Pumper trucks, also known as engine trucks, maintain a 64% market share as of 2024, solidifying their role as the primary workhorse in firefighting operations. These trucks are highly versatile, capable of transporting firefighters, water, and essential equipment to incident sites while simultaneously delivering powerful water streams through onboard pumps. The segment continues to grow due to advancements in pumping technologies such as high-pressure water discharge systems, smart flow meters, and integrated foam suppression units. Emerging markets increasingly invest in fleet upgrades, with pumper trucks forming the cornerstone of these modernisation programs.

Application Analysis

Residential & Commercial Applications lead the market. The residential and commercial segment accounted for 65% of the global market, driven by rapid urbanisation, high-rise construction, and stringent regulatory frameworks to minimise fire hazards in densely populated areas. With the worldwide trend toward urban vertical expansion, the need for agile, multi-capability fire trucks that can manoeuvre through tight city streets and access tall structures has surged dramatically. Governments are allocating larger portions of public safety budgets to upgrade existing fleets and ensure compliance with international fire standards, especially in cities with rapidly ageing infrastructure. These trends reflect a sustained demand for vehicles tailored to urban firefighting dynamics.

Propulsion Analysis

Electric Propulsion holds the largest market share. The electric propulsion segment is gaining rapid momentum and is projected to surpass ICE in new procurements over the next decade. Increasing global awareness of environmental impact, coupled with regulatory mandates for emissions reduction, is accelerating the transition to electric-powered emergency vehicles. The electric segment is propelled forward by groundbreaking developments such as the Rosenbauer RTX, which was introduced in multiple European and North American cities. In addition, new battery chemistries and extended range capabilities make electric fire trucks viable even for heavy-duty or extended deployment scenarios.

List of Key and Emerging Players in Fire Truck Market

- REV Group (U.S.)

- Oshkosh Corporation (U.S.)

- MORITA HOLDINGS CORPORATION (Japan)

- Rosenbauer International AG (Austria)

- Alexis Fire Equipment Company (U.S.)

- ANGLOCO LIMITED (U.K.)

- Scania (Sweden)

- Magirus GmbH (Germany)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- GIMAEX Fire Trucks (France)

- Acres Emergency Vehicles (Canada)

- Spartan Emergency Response (U.S.)

Recent Developments

- October 2024- Rosenbauer introduced the PANTHER 6×6 electric, a fully electric aircraft rescue and firefighting vehicle, showcasing the company's commitment to sustainable and innovative firefighting solutions.

- September 2024- The Jacksonville Fire and Rescue Department (JFRD) tested a new hybrid fire truck. The diesel-electric hybrid aims to reduce emissions and operational costs while maintaining performance. Mayor Donna Deegan emphasised the importance of electrifying the fleet as part of the city's climate action plan.

Analyst Opinion

According to our analyst, the global fire truck market is set for steady and transformative growth over the next decade. Urban expansion, climate-driven natural disasters, and regulatory reforms intensify the demand for more advanced, versatile, and sustainable fire apparatus. Electric and hybrid models are gaining traction in developed regions and increasingly in emerging markets through technology transfer and local partnerships. However, systemic issues such as rising acquisition costs, raw material shortages, and complex supply chains pose substantial challenges. Addressing these will require coordinated efforts among OEMS, public institutions, and investors. Strategic R&D, supplier diversification, and policy incentives aimed at clean-tech adoption will be pivotal in unlocking the next growth phase in the global fire truck industry.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 11.42 Billion |

| Market Size in 2025 | USD XX Billion |

| Market Size in 2033 | USD 16.72 Billion |

| CAGR | 4.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application, By Propulsion |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Fire Truck Market Segments

By Type

- Pumper Trucks

- Aerial Trucks

- Tankers

- Rescue Trucks

By Application

- Residential & Commercial

- Airports & Enterprises

- Military

By Propulsion

- Internal Combustion Engine (ICE)

- Electric

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.