United States Fogging Machine Market Size, Share & Trends Analysis Report By Type (2019-2031) (Thermal, Cold, Electrostatic), By Power Source (2019-2031) (Corded, Cordless), By End-User (2019-2031) (Residential, Commercial, Contract Cleaning), By Distribution (2019-2031) (Online, Offline) and Forecasts, 2025-2033

United States Fogging Machine Market Size

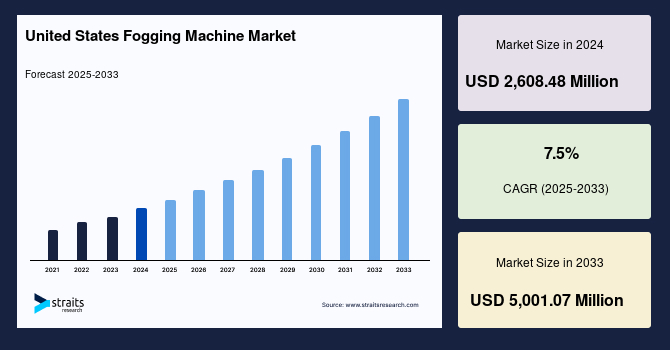

The United States fogging machine market size was valued at USD 2,608.48 million in 2024 and is projected to grow from USD 2,804.11 million in 2025 to reach USD 5,001.07 million by 2033, exhibiting at a CAGR of 7.5% during the forecast period (2025–2033).

The growth is driven by an increasing focus on public health, particularly concerning rising pest-related diseases, expanding agricultural applications, and heightened demand for disinfection solutions across commercial sectors. In addition, innovations in fogging technologies, including the development of smart devices and more energy-efficient machines, are also vital contributors to this market's expansion.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 2,608.48 Million |

| Estimated 2025 Value | USD 2,804.11 Million |

| Projected 2033 Value | USD 5,001.07 Million |

| CAGR (2025-2033) | 7.5% |

| Key Market Players | Curtis Dyna-Fog, IGEBA, Vectorfog, pulsFOG, PESTWORKER |

to learn more about this report Download Free Sample Report

United States Fogging Machine Market Growth Factor

Increasing Demand for Public Health and Hygiene Solutions

A significant driver of the fogging machine market in the United States is the heightened focus on public health, particularly vector-borne diseases such as mosquitoes transmitting Zika, West Nile, and other diseases. The U.S. Centers for Disease Control and Prevention (CDC) continues to advocate for using fogging machines to combat the spread of these diseases. The recent concerns about COVID-19 have further intensified the demand for fogging machines for large-scale sanitation in urban environments, public spaces, and transportation systems.

Municipalities in states like Florida, Texas, and California have deployed fogging machines for pest control and sanitation in response to public health concerns and climate-related shifts in disease vectors. The National Pest Management Association (NPMA) also reports that pest control services in the U.S. are seeing increased demand, with residential and commercial sectors focusing on integrated pest management solutions, further fueling the adoption of fogging machines. Thus, the ongoing efforts to improve hygiene standards and control pests will continue to drive the market growth for fogging machines.

Market Restraint

High Operational Costs and Environmental Impact

The primary restraint faced by the fogging machine market in the United States is the high operational costs associated with using fogging machines, particularly thermal models. These machines often require costly fuel, chemicals, and maintenance, making them less attractive to small businesses or households with budget constraints. Additionally, the growing emphasis on environmental sustainability creates concerns regarding the environmental impact of certain chemicals used in fogging systems.

In particular, concerns regarding the use of pesticides and their impact on local ecosystems have led to stricter regulatory controls in many states. For instance, California has introduced regulations to reduce pesticide use in favor of more eco-friendly alternatives. As a result, fogging machines that rely on potentially harmful chemicals face a higher market entry barrier. Environmental groups are also pushing for more stringent restrictions on the use of thermal foggers, further slowing the adoption of these machines. Thus, addressing the environmental concerns associated with chemical fogging systems and making them more affordable for a broader range of users is critical to overcoming this restraint.

Market Opportunity

Integration of Smart Technology and Iot

The rapid adoption of Internet of Things (IoT) technologies across various industries presents a significant opportunity for the fogging machine market in the U.S. The integration of IoT capabilities into fogging machines can enable more efficient use of resources and greater control over disinfection and pest control applications. Smart fogging machines can provide real-time monitoring, automated scheduling, and remote control, making them highly attractive for commercial and residential sectors.

For example, smart fogging systems can be used in hotels, airports, hospitals, and food processing plants to monitor and adjust the intensity of disinfection as required automatically. Panasonic and leading manufacturers are already introducing cloud-enabled fogging machines with IoT functionality that allows users to manage and optimize usage remotely. Additionally, as urbanization continues to accelerate and commercial sectors demand more sustainable and efficient solutions, smart fogging machines will play a pivotal role in shaping the future of the U.S. fogging machine market.

Country Insights

California's strong focus on agriculture and urban hygiene leads to market growth. The state has an extensive agricultural sector, where fogging machines are used for large-scale pest control in cities such as Los Angeles, San Francisco, and Fresno. Leading players like Thermacell and B&G Equipment Company have capitalized on this demand, providing a variety of fogging machines suited for urban sanitation and agricultural pest management.

Texas' diverse weather conditions contribute to pest issues ranging from mosquitoes to rodents. Texas has seen a significant rise in fogging machine adoption due to increased awareness of diseases like Zika and West Nile virus. Companies like Hudson Fogging Systems and Pestmaster Services are expanding their offerings to cater to residential and commercial sectors, providing essential pest control solutions.

Florida constantly needs fogging machines to manage pest-related issues, especially mosquitoes, which thrive in the warm climate. Miami, Tampa, and Orlando are key cities where fogging machines are used extensively to combat vector-borne diseases like Zika and West Nile virus. Florida’s coastal regions are particularly vulnerable to pest-related issues, prompting municipalities to invest heavily in fogging machines.

New York’s dense urban environment, where fogging machines are employed primarily for disinfection and pest control in high-traffic areas. The city's dense population and commercial infrastructure, including restaurants, offices, and hotels, contribute to the demand for fogging machines to ensure sanitary conditions. Companies like Fogco and Clarke are expanding their regional reach, offering advanced fogging solutions that meet the city's stringent public health regulations. The growing demand for disinfection and pest management continues to boost the market in New York.

Type Insights

Thermal dominates the type segment and is expected to grow at a CAGR of 6.3% over the forecast period. They are widely used in agricultural pest control, vector-borne disease management, and large-scale disinfection applications. These machines are top-rated in California and Florida, with significant priorities for farm production and vector control. Their ability to cover large areas quickly and efficiently makes them ideal for municipal pest control programs.

Power Source Insights

Corded dominates the power source segment and is expected to grow at a CAGR of 6.6% during the forecast period. These devices are reliable and often used for large-scale applications, particularly in agriculture and municipal sectors. In the U.S., agriculture-heavy states like California and Texas employ corded foggers for extensive pest control across wide agricultural areas. The availability of affordable electricity and the efficiency of these foggers contribute to their continued market dominance.

End-User Insights

Commercial dominates the end-user and is expected to grow at a CAGR of 7.1% over the forecast period. This includes applications in healthcare, hospitality, and food production industries. With increasing regulations around cleanliness and hygiene, particularly in sectors like food production and healthcare, the demand for fogging machines to disinfect large spaces is rising. New York, Chicago, and Los Angeles are investing in fogging solutions to maintain public safety in high-traffic areas.

Distribution Insights

Offline dominates the distribution segment and is expected to grow at a CAGR of 6.6% during the forecast period. Offline channels, such as retail stores and distribution networks, dominate the U.S. market. Physical stores allow consumers to view and test the equipment, offering personalized advice and immediate purchases. The presence of specialized stores in cities like Los Angeles and Houston further fuels this segment.

List of Key and Emerging Players in United States Fogging Machine Market

- Curtis Dyna-Fog

- IGEBA

- Vectorfog

- pulsFOG

- PESTWORKER

- Dolphy India

- Airofog Machinery

- Vimal Industries

- Fogmaster Corporation

- Idealin Fogging Systems

- IndoSurgicals

- Skan

Analyst’s Perspective

As per our analyst, the United States fogging machine market is poised for rapid expansion in the coming years. This growth is primarily driven by rising public health awareness, demand for sustainable pest control, and innovations in smart fogging technologies. The increase in vector-borne diseases and the need for large-scale disinfection systems will continue to propel the market forward. The integration of IoT and the growing trend toward eco-friendly solutions will shape the industry's future, creating new opportunities and challenges for manufacturers. Consumers and businesses will benefit from more efficient and targeted fogging solutions as the market adapts to these needs.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 2,608.48 Million |

| Market Size in 2025 | USD 2,804.11 Million |

| Market Size in 2033 | USD 5,001.07 Million |

| CAGR | 7.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type (2019-2031), By Power Source (2019-2031), By End-User (2019-2031), By Distribution (2019-2031) |

to learn more about this report Download Free Sample Report

United States Fogging Machine Market Segments

By Type (2019-2031)

- Thermal

- Cold

- Electrostatic

By Power Source (2019-2031)

- Corded

- Cordless

By End-User (2019-2031)

- Residential

- Commercial

- Contract Cleaning

By Distribution (2019-2031)

- Online

- Offline

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.