Food Waste Management Market Size, Share & Trends Analysis Report By Waste Type (Cereals, Dairy & Dairy Products, Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Oilseeds & Pulses, Roots & Tubers, Others), By Source (Residential, Industrial), By Service Types (Collection, Transportation, Disposal/Recycling, Landfill, Incineration, Composting, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Food Waste Management Market Size

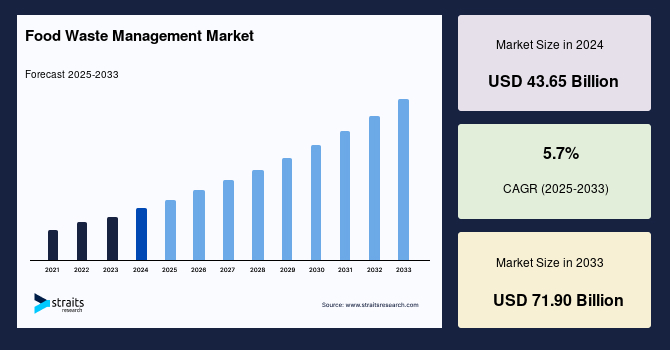

The global food waste management market size was valued at USD 43.65 billion in 2024 and is projected to grow from USD 46.14 billion in 2025 to USD 71.90 billion by 2033, exhibiting a CAGR of 5.7% during the forecast period (2025-2033).

The food waste management market refers to the industry focused on reducing, recycling, and repurposing food waste generated by households, restaurants, food processing industries, and agriculture. It includes waste collection, composting, anaerobic digestion, and waste-to-energy solutions. Government regulations, sustainability initiatives, and increasing awareness of food security drive market growth. The market involves stakeholders, including waste management companies, food producers, and environmental organizations. As food waste contributes to global greenhouse gas emissions, effective management solutions are crucial in sustainability and climate change mitigation.

The global market is growing rapidly mainly because of the increase in population worldwide, more manufactured output, and increased intake levels. The change in consumer demand patterns further propels market growth as there is a heightened focus on minimizing food waste. The COVID-19 pandemic has further complicated this aspect in countries like South Africa, the UAE, and Saudi Arabia by breaking or derailing supply chains. Transportation restrictions, roadblocks, and quarantines have resulted in a massive piling up of perishable food wastes like fruits, vegetables, fish, meat, and dairy. These disruptions have highlighted the necessity of proper food waste management as businesses and governments look into such issues of food security and sustainability.

Emerging Market Trends

Increasing Adoption of Smart Waste Management Technologies

Integrating smart technologies, such as IoT-enabled sensors and AI-driven analytics, revolutionizes food waste management. Businesses and municipalities increasingly use these advanced systems to monitor, optimize, and reduce food waste generation with real-time tracking and predictive analytics. These systems allow companies to track waste generation patterns, identify inefficiencies, and implement targeted waste reduction strategies.

- For example, in January 2025, AMP Robotics developed AI-powered systems that accurately identify and sort waste materials, thereby improving recycling rates and reducing contamination.

AI-powered demand forecasting tools help restaurants and retailers predict food sales trends and optimize inventory management, minimizing surplus food that would otherwise go to waste.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 43.65 Billion |

| Estimated 2025 Value | USD 46.14 Billion |

| Projected 2033 Value | USD 71.90 Billion |

| CAGR (2025-2033) | 5.7% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Veolia, Suez, Waste Management, Inc., Republic Services, Inc., Covanta Ltd. |

to learn more about this report Download Free Sample Report

Food Waste Management Market Growth Factors

Government Initiatives and Regulations

Governments worldwide are taking bold steps to reduce food waste through legislation, incentives, and strategic policies. These initiatives aim to curb food loss across supply chains and promote sustainability by imposing stricter regulations on waste disposal and encouraging the adoption of sustainable practices.

- The European Union, for instance, has committed to reducing food waste by 50% by 2030 as part of its Green Deal. Member states have introduced mandatory food waste tracking for businesses and incentives for surplus food donations. Similarly, in the United States, the Environmental Protection Agency (EPA) and the U.S. Department of Agriculture (USDA) have launched the "Food Recovery Challenge," encouraging businesses to implement waste reduction strategies.

These regulations drive businesses to adopt innovative solutions, significantly shaping the food waste management industry.

Restraining Factors

Regulatory Barriers and Lack of Standardization

The absence of global standardization in food waste management regulations challenges multinational businesses and retailers. Varying food waste policies across regions create complexities in implementing uniform waste reduction strategies.

Some countries enforce strict food waste reduction laws, while others lack comprehensive policies, leading to inconsistent food disposal and recycling practices. For example, the European Union mandates food waste reporting for businesses, whereas many developing nations lack enforceable guidelines. This regulatory fragmentation results in high compliance costs for global companies, operational inefficiencies, and delays in adopting innovative waste reduction technologies.

Market Opportunities

Increasing Focus on Food Waste Reduction in Retail and Food Service Industries

Retailers, food service providers, and hospitality industries are prioritizing food waste reduction due to financial, environmental, and reputational factors. Companies are implementing advanced inventory management systems, demand forecasting tools, and stock rotation strategies to minimize spoilage and enhance efficiency. Businesses also partner with food banks, redistribution networks, and surplus food donation programs to divert excess food from landfills.

- For example, global retail giant Walmart has introduced AI-powered waste tracking to optimize food stocking and reduce waste. At the same time, Tesco and Carrefour have pledged to cut food waste in half by 2030 through enhanced redistribution efforts.

By integrating waste reduction initiatives, businesses can enhance brand reputation, improve operational efficiency, and contribute to a more sustainable global food system.

Regional Insights

North America: Region with 34.1% Market Share

North America, particularly the United States, significantly contributes to the global market, driven by advanced infrastructure and strong sustainability initiatives. Regulatory measures like the EPA's "Food Recovery Challenge" and the USDA’s initiatives to minimize food waste have propelled industry growth. Many retail chains and food service establishments are implementing strategies to divert food waste from landfills to recycling and composting programs. Moreover, technological advancements in organic waste processing and increased investments in anaerobic digestion and bioconversion techniques will support the steady growth of the North American food waste management market through 2025.

Asia Pacific: Fastest-Growing Region with the Highest Market Share

The Asia-Pacific region is projected to witness the highest growth in the global market due to rapid urbanization, shifting consumption patterns, and growing environmental concerns. The increasing populations in China and India contribute to high food waste generation, driving the demand for effective waste management solutions. Government regulations in China have led to the implementation of stringent food waste reduction policies, with investments in recycling, composting, and waste-to-energy initiatives. Japan, recognized for its advanced recycling technologies, plays a leading role in food waste minimization, placing the Asia-Pacific region at the forefront of market expansion. Businesses are increasingly adopting AI-driven waste monitoring systems and food redistribution strategies to enhance sustainability efforts in the area.

Country Insights

The global market is experiencing significant growth across various countries, driven by stringent regulations, increasing consumer awareness, and technological advancements. As food waste concerns continue to rise, nations are embracing sustainable practices, including food recovery, recycling, composting, and waste-to-energy programs.

Key Countries Impacting the Market

- United States: The U.S. is one of the largest markets for food waste management, backed by a well-established infrastructure and government-led initiatives. The EPA’s “Food Recovery Challenge” and the USDA’s food waste reduction programs promote composting, redistribution, and waste-to-energy adoption. Major food retailers and service chains, including Walmart and McDonald’s, are investing in AI-driven waste tracking and sustainable disposal solutions to meet corporate sustainability goals.

- United Kingdom: The UK has prioritized food waste management, with government-backed initiatives such as the “Waste and Resources Action Programme” aiming to cut food waste by 20% by 2025. Food redistribution programs, supermarket waste tracking, and unsold food repurposing are standard practices in the country’s food retail sector. The adoption of waste-to-energy solutions and composting technologies is also accelerating market growth.

- Germany: Germany is a pioneer in waste management, with robust regulations such as the German Packaging Act and the Circular Economy Act mandating stringent food waste reduction measures. Strong consumer awareness and government incentives encourage minimizing food waste in households and industries. Composting and waste-to-energy practices are widely implemented, driving innovation and sustainability in food waste processing.

- France: France leads globally in food waste legislation, with the 2016 “Anti-Waste Law” prohibiting retailers from discarding edible food. Instead, supermarkets must donate surplus food to charities, setting an example for other nations. France also invests in food waste-to-energy solutions, anaerobic digestion facilities, and consumer awareness programs to promote responsible consumption and waste reduction.

- China: China faces rising food waste challenges, particularly in urban centers with increasing food consumption rates. The Chinese government has introduced stringent food waste reduction policies, focusing on waste separation, recycling, and waste-to-energy adoption. Cities such as Beijing and Shanghai have implemented mandatory food waste segregation programs, while investments in composting and bioenergy solutions are rising. The expansion of smart waste management technologies, including AI-powered tracking and blockchain-based food supply chain monitoring, will further drive the market forward.

Food Waste Management Market Segmentation Analysis

By Waste Type

The fruit and vegetable segment holds the largest market share. This dominance is attributed to multiple factors, including improper handling, storage, processing, and cultivation of fresh produce. Fruits and vegetables are highly perishable and susceptible to spoilage if not stored or handled correctly. Significant waste results from inadequate refrigeration, inefficient supply chains, and poor handling practices during harvesting, transportation, and storage. Due to these inefficiencies, a substantial portion of food waste globally consists of fruits and vegetables.

By Source

The residential source segment holds the largest market share. Increasing population growth, evolving consumer lifestyles, and urbanization trends contribute significantly to food waste at the household level. Several factors, including poor food planning, over-purchasing, excessive meal preparation, lack of knowledge regarding food storage, and improper disposal habits, lead to wasting large amounts of food. With modern, fast-paced lifestyles, consumers are more likely to discard food due to spoilage or lack of consumption, increasing household waste volumes.

By Service Types

The collection segment holds the largest market share. The collection process involves segregating food waste, loading and unloading materials, and selecting appropriate storage areas to ensure efficient waste management. Proper waste collection requires designated storage locations strategically placed safely from waste generation points to minimize contamination and optimize transportation. Regular maintenance and cleaning of storage facilities are essential to prevent odor and hygiene concerns. Additionally, food waste collection companies are implementing advanced technologies such as smart waste bins equipped with sensors to monitor fill levels and optimize collection schedules.

Company Market Share

The food waste management market is very competitive, with companies like Veolia, Suez, and Waste Management, Inc. operating as established global leaders and regional players like Biffa and Remondis. These companies maintain leadership in the market with advanced technologies, innovative solutions, and high sustainability and recycling values. With the rise of food waste all over the globe, these players are strategically well-placed to tackle the rising demand for efficient, cost-effective, and environmentally friendly waste management solutions.

Veolia: An emerging player in the market

Veolia is a world leader in waste management, environmental services, and energy solutions. It has a significant market share in food waste management, using its recycling, composting, and waste-to-energy technologies. The company is present in more than 40 countries. It is best positioned to manage food waste for large-scale municipalities and businesses, providing integrated solutions focusing on sustainability and reducing landfill waste. Its strong emphasis on innovative solutions in recycling, including anaerobic digestion and food waste-to-energy plants, contributes to its leadership market position.

Recent developments at Veolia include

- In November 2022, Veolia assisted Defence in meeting this target within the National Waste Policy by designing and implementing an end-to-end strategy to reduce food waste. Based on its extensive analysis of food waste generated across 400 Defence sites in the country, Veolia has now identified a set of recovery, composting, and recycling technologies to support Defence's efforts to achieve their targets.

List of Key and Emerging Players in Food Waste Management Market

- Veolia

- Suez

- Waste Management, Inc.

- Republic Services, Inc.

- Covanta Ltd.

- Stericycle, Inc.

- Remondis SE & Co., KG

- Clean Harbors, Inc.

- Biffa

- Rumpke

- Advanced Disposal Services, Inc.

- Cleanaway

- FCC Recycling (UK) Limited

- DS Smith

to learn more about this report Download Market Share

Recent Developments

- March 2024- Semmaris, Rungis International Market's management company, entrusted SUEZ, a leader in environmental services, with the collection and sorting of waste at the world's largest fresh produce market. Since January 2024, SUEZ has implemented awareness-raising solutions and improved on-site waste sorting and recovery. The idea here is to double the portion of waste sorted by 2025 for the Rungis International Market. This is fully aligned with its CSR strategy of reducing the size of its environmental footprint. This is a seven-year contract worth €31 million.

Analyst Opinion

As per our analyst, the global market is witnessing significant growth driven by heightened awareness of environmental sustainability, stringent government regulations, and rising food insecurity. Increasing volumes of food waste generated across households, restaurants, and food processing units propel demand for efficient waste management solutions. Technological advancements such as anaerobic digestion, composting, and waste-to-energy systems are gaining traction, offering ecological and economic benefits.

Additionally, circular economy initiatives and public-private partnerships encourage adopting sustainable practices. Developed regions like North America and Europe are leading due to regulatory compliance and infrastructure, while emerging economies in Asia-Pacific are rapidly adopting modern waste processing techniques. Growing corporate responsibility and consumer awareness around reducing carbon footprints further support the market’s momentum.

As innovations in bioconversion and smart waste-tracking systems expand, global food waste management is poised for robust growth, creating opportunities across recycling, energy generation, and sustainable agriculture.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 43.65 Billion |

| Market Size in 2025 | USD 46.14 Billion |

| Market Size in 2033 | USD 71.90 Billion |

| CAGR | 5.7% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Waste Type, By Source, By Service Types |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Food Waste Management Market Segments

By Waste Type

- Cereals

- Dairy & Dairy Products

- Fruits & Vegetables

- Meat & Poultry

- Fish & Seafood

- Oilseeds & Pulses

- Roots & Tubers

- Others

By Source

- Residential

- Industrial

By Service Types

- Collection

- Transportation

- Disposal/Recycling

- Landfill

- Incineration

- Composting

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.