Gene Therapy Market Size, Share & Trends Analysis Report By Vector (Viral, Non-Viral), By Indication (Cancer, Cystic fibrosis, Heart diseases, Diabetes, Hemophiles, AIDS, Others), By Route of Administration (Intravenous, Inhalation) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Gene Therapy Market Overview

The global gene therapy market size is estimated at USD 10.14 billion in 2025 and is projected to reach USD 47.58 billion by 2034, growing at a CAGR of 18.78% during the forecast period. The market demonstrated strong clinical momentum, as evidenced by the Alliance for Regenerative Medicine’s Q1 2024 trial data, which showed that over 2,000 regenerative medicine trials were ongoing globally, with gene therapies representing a major share, particularly in Phase III programs targeting oncology and rare diseases. By Q1 2025, the ASGCT Citeline Report indicated that the global pipeline had expanded to 2,154 gene therapy candidates, accounting for 49% of all advanced therapies, with 57% of new trials concentrated in oncology. This trend reflected a strong and sustained momentum in Phase III clinical trials for gene therapy, underscoring the field’s steady progress.

Key Market Highlights

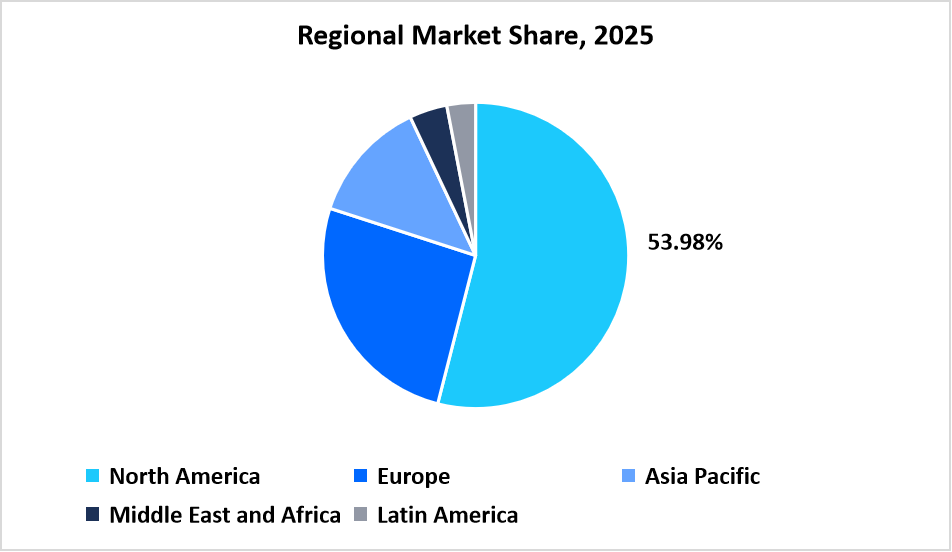

- North Americadominated the market with a revenue share of 53.98% in 2025.

- Asia Pacific is emerging as the fastest-growing region in gene therapy market, exhibiting a CAGR of 20.12% in 2025.

- By Vector,AAV segment dominated the market in 2025, and is anticipated to grow at a CAGR of 19.43%.

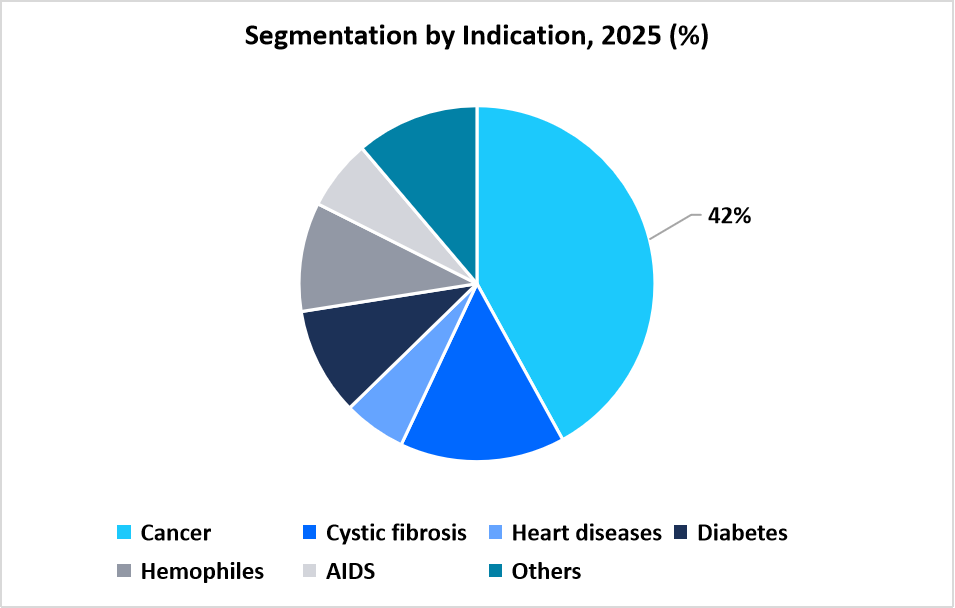

- By Indication,the cancer segment dominated the market with a revenue share of 42% in 2025.

- By Route of administration, the intravenous segmentdominated the market in 2025.

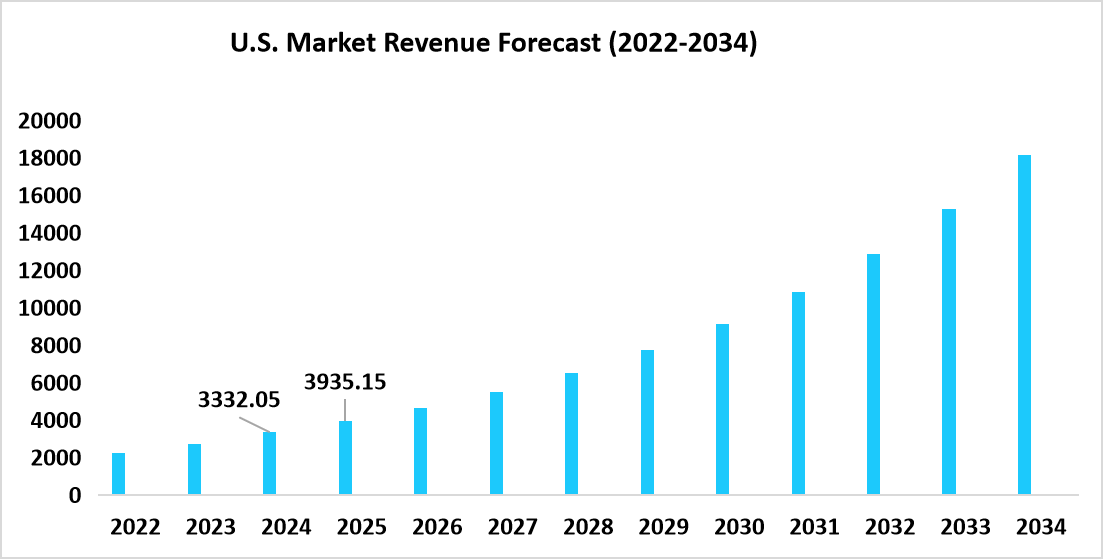

- The S.dominates the gene therapy market, valued at USD 3,332.05 million in 2024 and reached USD 3,935.15 million in 2025.

Table: U.S. Gene Therapy Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size:USD 10.14 billion

- 2034 Projected Market Size:USD 47.58 billion

- CAGR (2026–2034):78%

- Dominating region:North America

- Fastest-growing region:Asia Pacific

The global market encompasses viral and non-viral delivery systems, addressing a wide range of therapeutic areas including cancer, cystic fibrosis, heart diseases, diabetes, hemophilia, AIDS, and other genetic or chronic disorders. Therapies are administered through various routes such as intravenous and inhalation, depending on the disease target and delivery mechanism.

Latest Market Trends

Shift Toward Non double stranded break (non-DSB) gene editing techniques

A major trend in the gene therapy market is the shift from traditional double stranded break (DSB) editing methods, such as CRISPR Cas9 nucleases, to advanced non DSB approaches, such as base editing and prime editing. Researchers at the Broad Institute of MIT and Harvard advanced prime editing technology, which enabled the insertion or substitution of entire genes in human cells with therapeutic efficiency. This innovation enhanced gene therapy potential by allowing precise edits without double stranded DNA breaks, thereby reducing unintended mutations and improves safety profiles.

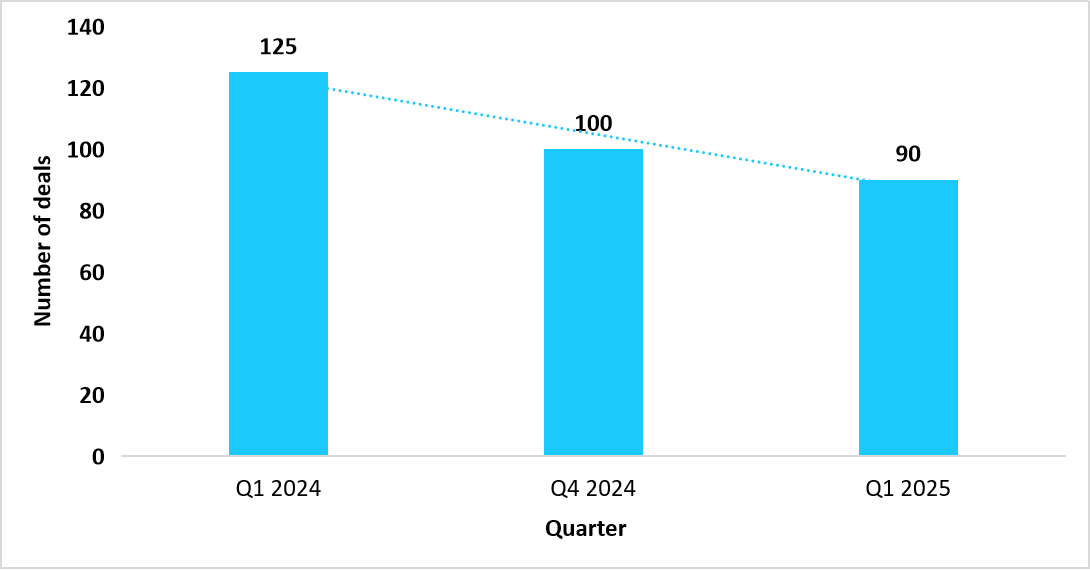

Shift Toward Value Driven Partnerships Amid Slowing Dealmaking

Dealmaking activity in advanced molecular therapies is showing signs of moderation, with fewer financing rounds, strategic alliances, and collaborative agreements observed in early 2025. According to the American Society of Gene & Cell Therapy, dealmaking for advanced molecular therapy companies declined in Q1 2025, as illustrated in the graph below:

Graph: Dealmaking activity for advanced molecular therapy companies, (Q1 2024 to Q1 2025)

Source: American Society of Gene + Cell Therapy and Straits Research

While overall funding momentum has moderated, the focus of industry stakeholders is shifting toward value driven partnerships. Rather than pursuing a high volume of deals, companies are strategically prioritizing collaborations that offer stronger synergies, defined commercial outcomes, and long term competitive positioning. This shift reflects a maturing market dynamic where agile and innovation focused players are leveraging selective alliances to enhance R&D efficiency, access enabling technologies, and strengthen their foothold in the evolving gene therapy landscape.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 10.14 billion |

| Estimated 2026 Value | USD 12.01 billion |

| Projected 2034 Value | USD 47.58 billion |

| CAGR (2026-2034) | 18.78% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Beacon Therapeutics, Astellas Pharma Inc., Novartis AG, Beam Therapeutics, bluebird bio, Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Rising pre registrations of gene therapies

The steady increase in the pre registration of the gene therapies from Q1 2024 to Q1 2025, signifies accelerating R&D activity as well as strong pipeline growth. As shown in the graph below, pre registrations rose from 4 in Q1 2024 to 13 in Q1 2025 (ASGCT), which reflected rapid R&D momentum and pipeline expansion. This surge opened new ways for manufacturers to fast track approvals, broaden portfolios, and ultimately strengthens market presence.

Market Restraint

High cost of gene therapies

The high cost of gene therapies hinders the market growth as it constrains the patient accessibility and affordability. Gene therapies cost up to USD 4.25 million per dose, which depicts pricing concerns. Such pricing challenges limits widespread adoption, strains healthcare budgets, and creates reimbursement hurdles. This also delays insurance coverage decisions, reduces treatment availability, and slows down overall market expansion despite strong clinical potential.

Market Opportunity

Pipeline distribution of gene therapy

The presence of multiple gene therapy candidates under clinical evaluation, represents a major opportunity for market growth. This growing pipeline reflected scientific advancement and industry commitment, which in turn increased the demand for GMP compliant manufacturing facilities. Coupled with upcoming approvals and new partnerships, this enhances revenue growth and expands the global gene therapy market, creating numerous opportunities for stakeholders.

Regional Analysis

The North America region dominated the market with a revenue share of 53.98% in 2025. The growth is driven by high concentration of biotech and pharmaceutical companies which accounts for maximum production of gene therapies, as well as strong presence of academic research institutions. Moreover, robust funding ecosystem in the region, which accelerates the development of novel therapies and also contributes to the regional market growth.

The U.S. gene therapy market is propelling due to the Rare Pediatric Disease Priority Review Voucher (RPDD/PRV) program, a U.S. FDA policy that rewards gene therapies for rare childhood conditions with a voucher for priority review. This incentive enhanced development, boosted investment, and raised the U.S. gene therapy market size.

Asia Pacific Gene Therapy Market Insights

The Asia Pacific is the fastest growing region with a CAGR of 20.12% during the forecast period. The growth is due to the increasing government initiatives to promote advanced therapies, which helps in supporting the commercialization of innovative treatments, hence further enhances the growth of gene therapy across the region.

India’s gene therapy sector is supported by DBT BIRAC’s targeted funding and BioE3 initiatives, which uniquely drove market growth by boosting translational research, biomanufacturing capacity, and skilled workforce training. These government led programs expanded the gene therapy market size in India and strengthened long term gene therapy market growth through GMP upgrades and regulatory support.

Table: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

The gene therapy market in Europe is being propelled by the shift toward centralized innovation hubs, where research, development, and manufacturing activities are brought together in a single ecosystem. Instead of relying on fragmented research centers, European countries such as Germany, the UK, and Belgium are building dedicated hubs that host startups, academic institutes, and GMP certified manufacturing facilities under one roof. This model enables efficient collaboration, provides shared access to infrastructure for vector production and clinical trial support, and reduces both costs and timelines for therapy development.

The market is propelling due to significant rise in funding from national institutes across the country. For instance, National Institute for Health Research (NIHR) funded USD 22.8 million to the Advanced Therapy Treatment Centre (ATTC) network, aimed to develop the environment for advanced therapy medicinal products (ATMP) clinical trials across UK, which further enhanced the market growth.

Middle East & Africa Market Insights

The Middle East and Africa region exhibits a high prevalence of thalassemia, and haemophilia, which significantly drives the demand for gene therapy solutions. These genetic conditions create a pressing need for advanced, targeted treatments, prompting governments and healthcare providers to prioritize research and clinical adoption.

The market is growing due to Saudi Arabia’s emergence as a regional leader in gene therapy, particularly in addressing inherited blood disorders such as sickle cell disease and transfusion dependent beta thalassemia. A landmark development occurred in January 2024 when the Saudi Food and Drug Authority (SFDA) approved Casgevy, the first CRISPR/Cas9 based gene edited therapy for these conditions. This approval marked a major step in integrating advanced genetic medicine into the Kingdom's healthcare system, driving investment, research, and adoption of advanced gene therapies across the country.

Latin America Market Insights

In Latin America, alliances between regional research institutions and international pharmaceutical firms are strengthening local scientific expertise and speeding up the development and commercialization of gene therapies across the region.

In Brazil, several innovative companies are advancing the field of cell and gene therapy. GEMMABio, a therapeutics company, focuses on accelerating research and expanding global access to life-changing advanced therapies for patients with rare diseases. The company has secured a USD 100 million partnership with Brazil's Ministry of Health to bring gene therapies for rare diseases to the country. Similarly, Gen-t, a Sao Paulo based biotech startup, aims to enhance ethnic diversity in human genome collections by systematically gathering genetic data from diverse Brazilian populations to study disease associated traits, with plans to recruit over 200,000 participants. Together, these initiatives highlight Brazil’s growing role in developing and implementing innovative gene and cell therapies.

Vector Insights

The AAV segment dominated the market in 2025, and is anticipated to grow at a CAGR of 19.43%. The growth is attributed to its minimal pathogenicity, ability to establish a long term gene expression in various tissues, making it the backbone for a large number of approved and investigational therapies.

The Non-Viral segment is anticipated to witness a stable growth rate across the analysis timeframe, as it eliminated the use of viral carriers, reducing risks of insertional mutagenesis and immune reactions. These systems using lipid nanoparticles or polymer based vectors offered safer, more flexible, and cost effective gene delivery options, supporting their expanding adoption in large scale and repeat dose therapeutic applications.

Indication Insights

The cancer segment dominated the market with a revenue share of 42% in 2025. The growth is attributed to rising prevalence of various cancer, which increases the need for targeted and personalized therapies.

In the global gene therapy market, the cardiovascular diseases segment is projected to grow at the fastest CAGR of 19.6% during the analysis timeframe. The growth is primarily driven by the increasing development of gene therapies targeting heart failure, ischemic diseases, and myocardial repair, supported by advancements in AAV based cardiac gene delivery and regenerative angiogenesis programs. Ongoing clinical research focusing on gene modulation to restore cardiac function and the rising global burden of heart diseases have further accelerated adoption, positioning cardiovascular applications as the next major growth frontier for gene therapy after oncology.

Table: Segmentation by Indication, 2025

Route of Administration Insights

Intravenous segment dominated the market in terms of revenue in 2025, owing to its ability in ensuring rapid absorption and widespread distribution. This route is essential for treating systemic conditions, such as blood disorders, inherited metabolic diseases, and blood cancers.

The inhalation segment is anticipated to witness a comparatively moderate growth rate of 16.9% during the analysis period, as its application remained limited to localized respiratory conditions, such as cystic fibrosis and pulmonary diseases, rather than systemic disorders. Additionally, challenges related to efficient vector delivery, immune response management, and maintaining gene stability in aerosolized forms restricted its broader adoption compared to intravenous routes.

Competitive Landscape

The global gene therapy market is moderately fragmented in nature due to diverse technological platforms, wide range of therapeutic applications, varying product development stages across different companies, frequent collaborations for manufacturing, commercialization of gene therapies and different approval processes of various countries that result in region-specific players, which further prevents global consolidation.

Beacon Therapeutics: An emerging market player

Beacon Therapeutics company is an ophthalmic gene therapy company that aims to save and restore the vision of patients suffering from a range of prevalent and rare retinal diseases that result in blindness.

- In January 2025, Beacon Therapeutics Holdings Limited announced that the U.S. FDA has granted regenerative medicine advanced therapy designation to laruzova for the treatment of X-linked retinitis pigmentosa.

List of Key and Emerging Players in Gene Therapy Market

- Beacon Therapeutics

- Astellas Pharma Inc.

- Novartis AG

- Beam Therapeutics

- bluebird bio, Inc.

- Adverum Biotechnologies, Inc.

- Benitec Biopharma

- Oxford Biomedica PLC

- Sangamo Therapeutics

- uniQure N.V.

- Verve Therapeutics, Inc.

- CRISPR Therapeutics.

- Krystal Biotech, Inc.

- Editas Medicine

- Taysha GTx

- Voyager Therapeutics, Inc.

- Sarepta Therapeutics, Inc.

- BioMarin Pharmaceutical Inc.

- MeiraGTx Limited.

- Neurogene Inc.

- Others

Recent Developments

- August 2025- U.S. Food and Drug Administration approved Papzimeos (zopapogene imadenovec-drba), a non-replicating adenoviral vector-based immunotherapy for the treatment of adult patients with recurrent respiratory papillomatosis (RRP).

- April 2025- The FDA approved Zevaskyn (prademagene zamikeracel, pz-cel) by Abeona Therapeutics, which marked it as the first gene-modified cell therapy for wounds in patients with recessive dystrophic epidermolysis bullosa (RDEB).

- March 2025- Bharat Biotech established a vertically integrated facility for cell and gene therapy manufacturing in Hyderabad's Genome Valley, India. The company asserted that this USD 75 million investment was the first of its kind in the country, signaling a major regional capacity expansion.

- March 2025- Generium announced a Phase 1/2 clinical trial for GNR-097, an AAV9 based gene therapy for Duchenne muscular dystrophy (DMD). The trial aimed to evaluate the tolerability, safety, and efficacy of the drug and was to be conducted in the Russian Federation and the Republic of Belarus.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 10.14 billion |

| Market Size in 2026 | USD 12.01 billion |

| Market Size in 2034 | USD 47.58 billion |

| CAGR | 18.78% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Vector, By Indication, By Route of Administration |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Gene Therapy Market Segments

By Vector

-

Viral

- AAV

- Lentiviral vectors

- Others

- Non-Viral

By Indication

- Cancer

- Cystic fibrosis

- Heart diseases

- Diabetes

- Hemophiles

- AIDS

- Others

By Route of Administration

- Intravenous

- Inhalation

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.