Glucose Monitoring Devices Market Size, Share & Trends Analysis Report By Product (Self-monitoring Devices, Continuous Glucose Monitoring Devices), By Application (Type 1 Diabetes, Type 2 Diabetes, Others), By End User (Hospitals & Clinics, Home Care Settings, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Glucose Monitoring Devices Market Overview

The global glucose monitoring devices market size is valued at USD 13.88 billion in 2025 and is estimated to reach USD 22.64 billion by 2034, growing at a CAGR of 5.63% during the forecast period. The consistent market growth is supported by the rise in use of implantable long-duration glucose sensors, which last up to six months, and by lowering patient burden.

Key Market Trends & Insights

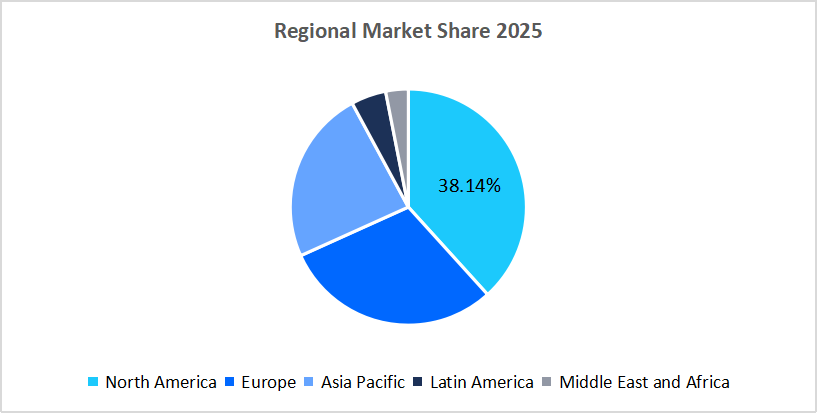

- North America held a dominant share of the global market, accounting for 38.14% in 2025.

- The Asia Pacific region is projected to grow at the fastest pace, with a CAGR of 86%.

- Based on product, the self-monitoring devices segment held the highest revenue market share in 2025.

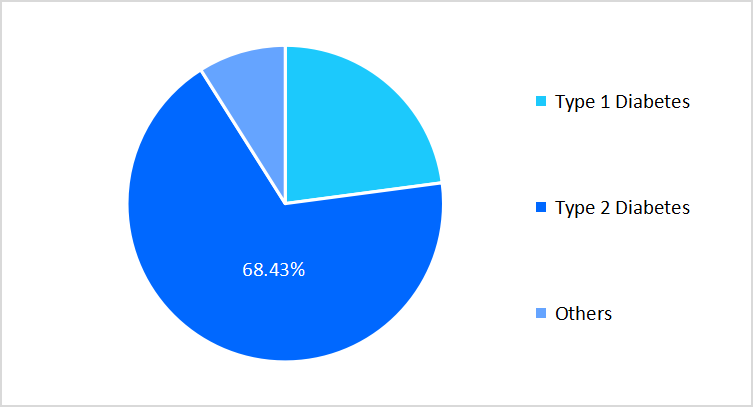

- By application, the type 2 diabetes segment dominated the market, accounting for 68.43% revenue share in 2025.

- Based on end user, the hospitals & clinics segment dominated the market in 2025 with a revenue share of 43.27%.

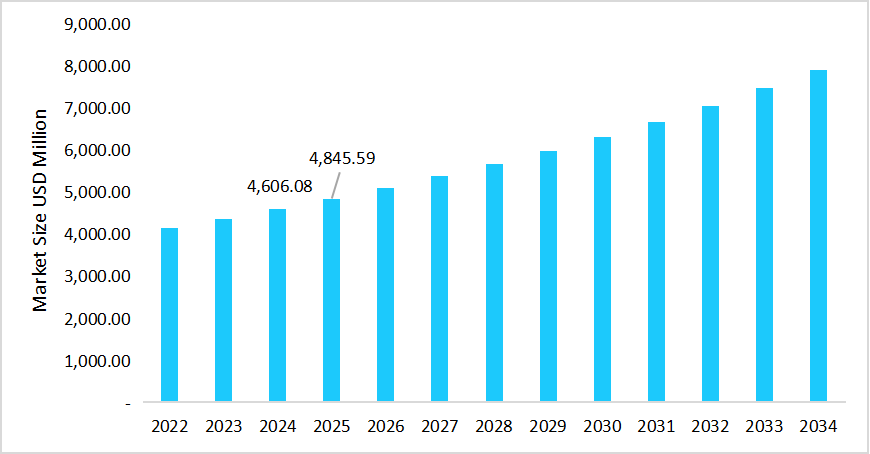

- U.S dominates the global market, valued at USD 4.60 billion in 2024 and reaching USD 4.85 billion in 2025.

Table: U.S. Glucose Monitoring Devices Market Size

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 13.88 billion

- 2034 Projected Market Size: USD 22.64 billion

- CAGR (2026-2034): 5.63%

- Dominating Region: North America

- Fastest-Growing Region: Asia-Pacific

The glucose monitoring devices market includes a wide array of products, including self-monitoring devices such as blood glucose meters, testing strips, and lancets & lancing devices, along with advanced continuous glucose monitoring (CGM) systems comprising sensors, transmitters & receivers, and insulin pumps. The applications of glucose monitoring devices span across Type 1 diabetes, Type 2 diabetes, and other glucose-related disorders, reflecting their critical role in preventive healthcare. Moreover, these devices are extensively utilized across diverse healthcare settings, including hospitals & clinics, home care settings, and other healthcare facilities.

Latest Market Trends

Shift to Continuous Glucose Monitoring from Finger Stick Testing

The key trend in the glucose monitoring devices market is the transition from conventional finger stick blood glucose testing toward continuous glucose monitoring systems, which are increasingly being adopted as the new standard of care for both Type 1 and Type 2 diabetes management. Companies like Dexcom launched their G7 CGM in the U.S., supported by expanded CMS reimbursement, enabling broader patient access.

This trend highlights the growing market preference for advanced, user-friendly monitoring solutions that provide greater accuracy compared to traditional testing methods.

Growing Adoption of Factory-Calibrated Sensors

Growing use of factory-calibrated CGM systems that eliminate the need for routine calibration, improving convenience and user adherence. Traditionally, CGM devices required routine fingerstick calibrations to ensure accuracy; however, technological advancements have led to the development of factory-calibrated systems that eliminate this need. Abbott’s FreeStyle Libre series and Dexcom’s G7 exemplify this innovation, witnessing rapid market uptake due to their no-calibration feature.

Such innovations are making continuous monitoring devices more accessible to the patient population.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 13.88 Billion |

| Estimated 2026 Value | USD 14.57 Billion |

| Projected 2034 Value | USD 22.64 Billion |

| CAGR (2026-2034) | 5.63% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Braun SE, Senseonics, A., DexCom, Inc., Abbott Laboratories, GlySens Incorporated |

to learn more about this report Download Free Sample Report

Glucose Monitoring Devices Market Drivers

Expansion of Reimbursement Coverage and Healthcare Policies

A key driver in the glucose monitoring devices market is the increasing role of governments and insurers in expanding reimbursement coverage and supportive healthcare policies that enhance accessibility of continuous glucose monitoring (CGM) devices. For example, in April 2023, the U.S. Centers for Medicare & Medicaid Services (CMS) expanded coverage of CGMs to all insulin-using individuals and certain non-insulin users with a history of hypoglycemia.

These initiatives are improving affordability, broadening access across diverse patient groups, and reinforcing the potential of proactive diabetes management.

Market Restraints

Regulatory and Approval Complexities for new Technologies

A major restraint in the glucose monitoring devices market is the stringent regulatory approval process, which limits the speed of product commercialization and market expansion. The Senseonics Eversense implantable continuous glucose monitoring (CGM) system underwent several years of review by the U.S. Food and Drug Administration (FDA), including additional post-market study requirements, before securing approval in 2018, followed by authorization for its extended 180-day version in 2022.

Consequently, such complex and prolonged regulatory pathways increase development costs for manufacturers and delay the market entry of innovative glucose monitoring solutions, thereby hindering overall industry growth.

Market Opportunity

Expansion of Glucose Monitoring into Non Diabetic Population

A notable opportunity in the glucose monitoring devices market is the growing adoption of these technologies beyond diabetes management, into preventive health and metabolic wellness. Increasingly, non-diabetic individuals are using glucose monitoring devices for applications such as weight management, fitness optimization, and sports performance enhancement. Various wellness platforms are integrating CGM data into personalized nutrition and fitness programs, allowing users to track metabolic responses to diet and exercise in real time.

Regional Analysis

North America dominated the glucose monitoring devices market in 2025, accounting for 38.14% market share. The growth is supported by the U.S. FDA’s clearance of over-the-counter continuous glucose monitors, which broadened access beyond insulin users and fueled wider consumer adoption. In addition, Canada’s proposed federal diabetes device fund aims to subsidize CGMs nationally, reducing out-of-pocket costs and supporting uniform access. These measures are driving consistent uptake of advanced glucose monitoring technologies across the region.

A surge in healthcare providers prescribing continuous glucose monitoring (CGM) as the standard of diabetes care is a major factor driving the market growth in the U.S. glucose monitoring devices market. According to Dexcom’s State of Type 2 report, 96% of U.S. healthcare professionals agreed that CGM should be the standard for patients on basal insulin, and 94% expressed the same for those on multiple daily injections. This widespread clinical support boosts the adoption of devices and fuels the sustained growth of the market.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 7.86% from 2026 to 2034. This growth is augmented by a growing focus on clinical guidelines recommending broader use of continuous and intermittent glucose monitoring for Type 2 diabetes patients, including those with fasting conditions. In addition, supportive regulatory frameworks in countries such as India are accelerating cost-sensitive innovation and enabling quicker market entry for locally developed glucose monitoring solutions.

In China, the "Healthy China 2030" initiative is a key driver of the market growth. This national strategy, launched by the Chinese government, aims to enhance healthcare services and promote chronic disease management, including diabetes. As part of this initiative, the government implemented subsidies for blood glucose monitoring devices, making them more accessible to patients. These policies increase market awareness and adoption rates of continuous glucose monitoring devices.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe’s glucose monitoring devices market is experiencing strong growth due to the rapid expansion of pharmacy-supported diabetes management programs that offer on-site glucose testing and device counseling, improving patient outreach. Furthermore, the rising adoption of eco-friendly, recyclable glucose monitoring components aligns with Europe’s sustainability regulations, encouraging manufacturers to innovate toward greener medical device solutions.

In Germany, the DiGA fast-track program, introduced by the Federal Institute for Drugs and Medical Devices (BfArM), is a key driver for the market growth. This policy allows doctors to prescribe mobile health apps that connect directly with continuous glucose monitoring systems, with full reimbursement from statutory health insurance.

Latin America Market Insights

Latin America’s glucose monitoring devices market is growing steadily due to the increasing establishment of local manufacturing and assembly facilities in countries like Brazil and Mexico, which reduces import dependence and enhances product affordability. Additionally, the collaboration between public health authorities and digital health startups is improving access to glucose monitoring in rural and underserved regions through teleconsultation and connected mobile platforms.

Argentina's glucose monitoring devices market is expanding rapidly due to government initiatives promoting universal diabetes screening within public healthcare centers. Moreover, the country’s growing adoption of locally developed mobile health apps that integrate glucose data with nutrition tracking is empowering patients with real-time insights, which, in turn, drives the demand for glucose monitoring devices.

Middle East and Africa Market Insights

The Middle East and Africa glucose monitoring devices market growth is propelled by the high and growing prevalence of diabetes, particularly Type 2, in the region. Rising obesity rates, sedentary lifestyles, and urbanization are contributing to increasing disease incidence, driving greater demand for both self-monitoring and continuous glucose monitoring devices to enable early diagnosis, management, and improved patient outcomes.

South Africa's glucose monitoring devices market is witnessing growth driven by the increasing adoption of workplace wellness programs in corporate and industrial sectors, which provide regular glucose screening and monitoring for employees. Additionally, the development of low-energy monitoring devices for rural areas improves diabetes management in underserved communities, thereby supporting market growth.

Application Insights

The type 2 diabetes segment dominated the market in 2025, accounting for 68.43% revenue share, owing to the rising use of combination therapies, where glucose monitoring devices are paired with connected insulin delivery systems for seamless management. Additionally, the growing focus on early detection of prediabetes is pushing healthcare providers to recommend glucose monitoring tools proactively, driving higher adoption even before full disease onset.

The Type 1 diabetes segment is estimated to register the fastest CAGR of 6.86% during the forecast period. This growth is fuelled by the rising availability of advanced biosensor based insulin delivery devices that ensure personalized dosing accuracy for better disease outcomes.

Application Market Share (%), 2025

Source: Straits Research

Product Insights

The self-monitoring devices segment dominated the market and accounted for the highest revenue share in 2025. This growth is attributed to the increasing use of smart glucometers integrated with Bluetooth connectivity, enabling instant data sharing with healthcare providers and family members. This added functionality is particularly appealing to elderly patients and caregivers, as it combines the affordability of SMBGs with digital tracking, strengthening adoption in patient-centric care models.

The continuous monitoring devices segment is projected to register the fastest CAGR of 7.02% during the forecast timeframe, owing to the integration of wearable sensor technologies with predictive analytics, enabling early detection of glucose fluctuations and providing users with actionable insights for proactive diabetes management and reduce risk of hypoglycemic reactions.

End User Insights

The hospitals and clinics segment dominated the market with a revenue share of 43.27% in 2025. This growth is driven by the rising inpatient admissions for diabetes complications, which has increased the need for point-of-care glucose monitoring. Additionally, the adoption of hospital-wide digital platforms that integrate glucose data with electronic health records (EHRs) is improving clinical decision-making, driving higher demand for advanced monitoring devices in hospital settings.

The home care settings segment is expected to register fastest growth during the forecast period, due to the growing availability of subscription based diabetes management programs that deliver customized medical supplies and guidance to patients’ homes, ensuring consistent care access and improved adherence to long term glucose monitoring routines.

Competitive Landscape

The global market is moderately fragmented, with leading medical device and biotechnology companies capturing a notable market share. Key market players maintain strong leadership through product innovation, robust R&D pipelines, and expanding distribution networks for wide product availability. The major players in the market include Abbott Laboratories, Dexcom, Medtronic, Roche Diabetes Care, Senseonics, Ascensia Diabetes Care, and others.

Senseonics Holdings, Inc.: An emerging market player

Senseonics Holdings, Inc., a U.S.-based medical technology company, is emerging in the global market with a focus on implantable continuous glucose monitoring systems.

- In 2022, Senseonics received FDA approval for the Eversense E3 implantable CGM system, which expanded its U.S. market presence.

Through innovative, long-term implantable glucose monitoring devices and digital integration, Senseonics emerged as a key player in the global market.

List of Key and Emerging Players in Glucose Monitoring Devices Market

- Braun SE

- Senseonics, A.

- DexCom, Inc.

- Abbott Laboratories

- GlySens Incorporated

- Menarini Diagnostics S.R.L.

- Novo Nordisk A/S

- Hoffman-La Roche Ltd

- Johnson & Johnson

- Medtronic plc

- Ascensia Diabetes Care

- Ypsomed

- Prodigy Diabetes Care

- Nipro

- Nova Biomedical

- ACON Laboratories, Inc.

- Sinocare

- ForaCare, Inc.

- Trividia Health, Inc.

- AgaMatrix

- Beurer GmbH

- Others

Strategic Initiatives

- August 2025: Abbott launched the FreeStyle Libre 2 Plus sensor. This device offered automatic glucose readings every minute to the phone and helps people with diabetes manage their conditions.

- April 2025: Sequel Med Tech, LLC, and Senseonics Holdings, Inc. partnered with Sequel’s twiist Automated Insulin Delivery System with the Senseonics Eversense 365 for the management of type 1 diabetes.

- August 2024: Abbott partnered with Medtronic to integrate a continuous glucose monitoring system based on Abbott's most advanced, world-leading FreeStyle Libre technology that will connect with Medtronic's automated insulin delivery and insulin pen systems.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 13.88 Billion |

| Market Size in 2026 | USD 14.57 Billion |

| Market Size in 2034 | USD 22.64 Billion |

| CAGR | 5.63% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application, By End User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Glucose Monitoring Devices Market Segments

By Product

-

Self-monitoring Devices

- Blood Glucose Meters

- Testing strips

- Lancets & Lancing Devices

-

Continuous Glucose Monitoring Devices

- Sensors

- Transmitters & Receivers

- Insulin Pump

By Application

- Type 1 Diabetes

- Type 2 Diabetes

- Others

By End User

- Hospitals & Clinics

- Home Care Settings

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.