Gluten Free Sugar Syrup Market Size, Share & Trends Analysis Report By Product (Glucose Syrup, Fructose Syrup, Maltose Syrup, Others), By Application (Bakery Products, Confectionary, Nutrition Bar, Dressings, Beverages, Dairy Products, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Gluten Free Sugar Syrup Market Size

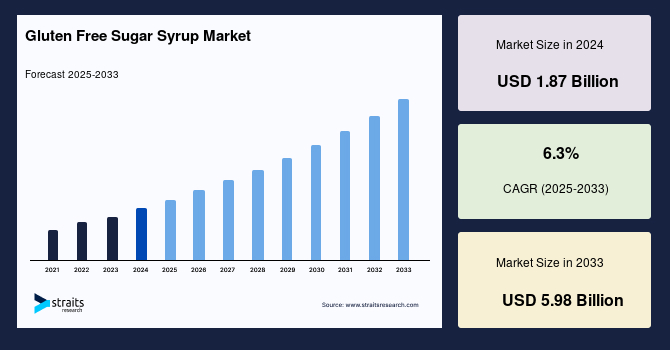

The global gluten free sugar syrup market size was valued at USD 1.87 billion in 2024 and is projected to grow from USD 2.09 billion in 2025 to USD 5.98 billion by 2033, exhibiting a CAGR of 6.3% during the forecast period (2025-2033).

Gluten-free sugar syrup is a liquid sweetener that does not contain gluten, making it suitable for individuals with celiac disease or gluten intolerance. Typically derived from sources like corn, rice, or tapioca, it provides sweetness and viscosity similar to traditional syrups such as malt syrup or barley-based syrups but without the gluten protein found in wheat, barley, or rye. This syrup is commonly used in baking, beverages, and processed foods to enhance flavor and texture while maintaining a gluten-free label.

The global market is driven by the increasing consumer preference for healthier and allergen-free food products. Gluten-free sugar syrups are alternatives to conventional syrups that cater to individuals with gluten intolerance or celiac disease. These syrups are widely used in beverages, bakery products, confectionery, and sauces, offering the same sweetness and texture without gluten-related health risks. Rising health awareness and the growing demand for clean-label and organic products have further boosted the market.

Furthermore, the market presents significant opportunities, especially with the growing trend toward plant-based, low-sugar alternatives. Product innovations focusing on natural, organic, and non-GMO ingredients are opening new doors. Companies are increasingly launching gluten-free syrups from agave, rice, tapioca, and coconut to cater to niche dietary needs. The rise in demand for these products in regions such as North America and Europe drives market growth and creates sustainable opportunities for established players and startups.

The market is expected to grow in the forecasted period owing to the increasing incidences of celiac disease and gluten awareness.

Market Trends

Rising Popularity of Natural and Organic Sweeteners

One of the key trends in the global gluten-free sugar syrup market is the rising popularity of natural and organic sweeteners. Consumers are increasingly shifting toward clean-label products that exclude artificial ingredients, gluten, and genetically modified organisms (GMOs). This trend is powerful in North America and Europe, where health-conscious consumers seek functional food products that align with their lifestyles.

- For example, the organic agave syrup segment has grown rapidly, with companies like Madhava Natural Sweeteners offering gluten-free and organic-certified products. Similarly, Wholesome Sweeteners expanded its product line in 2024 to include gluten-free tapioca syrup, emphasizing sustainability and fair-trade practices.

Another emerging trend is using gluten-free sugar syrups in alternative dairy products and plant-based beverages. Tapioca and rice syrups are becoming common ingredients in plant-based yogurts, smoothies, and protein drinks, adding natural sweetness without allergens. The surge in the plant-based food sector is expected to complement the growth of gluten-free syrups further.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.87 Billion |

| Estimated 2025 Value | USD 2.09 Billion |

| Projected 2033 Value | USD 5.98 Billion |

| CAGR (2025-2033) | 6.3% |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Key Market Players | Cargill Inc., Monin Inc., Wholesome Sweeteners Inc., Canadian Organic Maple Co., Ltd., B&G Foods Inc. |

to learn more about this report Download Free Sample Report

Gluten Free Sugar Syrup Market Driving Factors

Growing Demand for Gluten-Free Food and Beverages

The primary driver for the gluten-free sugar syrup market is the growing demand for gluten-free food and beverages. Rising awareness about celiac disease and gluten intolerance is fueling this demand. According to a 2024 report by the World Health Organization (WHO), approximately 5% of the global population actively avoids gluten due to medical reasons or lifestyle choices. This shift in consumer behavior has created a lucrative market for gluten-free ingredients, including syrups.

The beverage industry, in particular, is a significant driver for gluten-free sugar syrup. Craft sodas, functional beverages, and sports drinks now use gluten-free sweeteners such as agave, maple, and coconut syrups to cater to consumer preferences for natural ingredients. Leading beverage companies, including Coca-Cola and PepsiCo, are exploring gluten-free syrup formulations for their health-focused product lines.

Additionally, government regulations supporting gluten-free labeling and standards have encouraged product development. Regulatory bodies like the U.S. FDA and the European Food Safety Authority (EFSA) enforce strict guidelines on gluten-free claims, boosting consumer confidence in these products.

Restraining Factors

High Production Costs and Limited Raw Material Availability

Despite its growth potential, the global market faces significant challenges, primarily related to high production costs and limited raw material availability. Producing gluten-free syrups often involves stringent sourcing and testing processes to ensure that raw materials are free from gluten contamination. This increases production time and costs, impacting the product's price competitiveness. Moreover, the lack of standardization in gluten-free labeling across regions can confuse consumers. While some countries have well-defined gluten-free standards, others do not, leading to inconsistent labeling practices.

Another major restraint is the perception of gluten-free products as premium or niche items, which limits mass-market appeal. While awareness is growing, many consumers still associate gluten-free products with restrictive diets, which can slow mainstream adoption. The environmental impact of sourcing raw materials like agave and coconut for syrup production is also a concern. Unsustainable farming practices and over-reliance on specific crops could disrupt the supply chain. Addressing these challenges through sustainable sourcing practices and investment in local raw material production is crucial for long-term growth.

Market Opportunities

Development of Innovative and Sustainable Products

The most significant opportunity in the global market lies in developing innovative, sustainable products that cater to health-conscious consumers. As demand for clean-label and allergen-free food increases, companies focus on creating products that offer multiple benefits, such as low glycemic index, organic certification, and sustainable sourcing.

- For instance, Clif Bar & Company launched a new line of gluten-free, low-sugar energy bars featuring rice and tapioca syrups. This innovation reflects the growing need for multifunctional products that meet dietary restrictions without sacrificing taste or quality.

Sustainable sourcing and production methods are also becoming critical. Companies invest in sustainable farming practices and eco-friendly packaging to appeal to environmentally conscious consumers. For instance, Nature’s Agave partnered with small-scale farmers in Mexico to produce organic agave syrup while promoting fair trade and reducing the carbon footprint.

Furthermore, the rise of functional foods and beverages presents opportunities for gluten-free syrups in the wellness industry. Tapioca and coconut syrups are increasingly used in protein shakes, meal replacement bars, and functional teas to offer natural sweetness with added health benefits. Expanding these product categories is expected to drive long-term growth in the global market.

regional Insights

europe: dominated with A Revenue Share of 36.5%

Europe leads the global gluten free sugar syrup market driven by the growing consumer preference for allergen-free, organic products. Countries such as Germany, the U.K., and Italy are at the forefront of this trend, supported by strict regulations and labeling requirements set by the European Food Safety Authority (EFSA).

Germany stands out as a key growth market due to its focus on sustainability and technological innovations in food production. Companies like Rapunzel Naturkost and Südzucker are expanding their gluten-free product portfolios to meet the rising demand. In 2024, Südzucker launched a gluten-free rice syrup product line targeted at the European bakery and confectionery sectors.

Moreover, government support for organic and gluten-free agriculture in Europe is notable. The European Green Deal, launched in 2020, promotes sustainable farming practices, encouraging the growth of raw materials like rice and cassava for gluten-free syrup production.

North America: Consumer Health Awareness

North America is the second-largest region for the global market, due to a combination of consumer health awareness, rising prevalence of gluten intolerance, and increased adoption of clean-label products. According to the Gluten Intolerance Group (GIG), nearly 18% of Americans actively seek gluten-free options, even without celiac disease. This rising demand for healthier alternatives has driven innovations in the syrup industry, particularly in the U.S. and Canada.

Government-backed initiatives promoting healthy eating have further propelled market growth. For instance, the U.S. Department of Agriculture (USDA) supports innovation in the sweetener industry by funding research into sustainable syrup production from alternative sources like sorghum and cassava.

Canada, with its growing gluten-free consumer base, is witnessing rapid adoption of gluten-free syrups in beverages and processed foods. Rogers Sugar, a key player in the Canadian market, introduced gluten-free maple syrup variants in 2025, targeting both domestic and export markets. Additionally, government initiatives promoting local organic production boost market opportunities for gluten-free sugar syrups.

Country Insights

- United States- The U.S. is a global leader in the global gluten free sugar syrup market, driven by rising health consciousness and government-backed support for alternative sweeteners. In 2024, the FDA introduced stricter labeling requirements for gluten-free products, boosting consumer confidence. Companies like Wholesome Sweeteners and Nature’s Agave are at the forefront, offering innovative, organic, gluten-free syrup solutions.

- Canada- Canada’s market is growing steadily, supported by the country’s focus on sustainability and organic farming practices. Rogers Sugar has expanded its product line to include gluten-free options for domestic and international markets. Government initiatives promoting healthy eating and local organic production have also helped drive market growth.

- Germany- Germany is a key player in the European market, with companies focusing on sustainability and technological innovations. Südzucker launched a gluten-free rice syrup line in 2024, targeting the bakery and confectionery sectors. Strong regulatory support from the EFSA ensures high product standards.

- India- India’s market is expanding rapidly, driven by increasing gluten sensitivity awareness and government initiatives like stricter labeling by FSSAI. Companies such as 24 Mantra Organic are introducing gluten-free jaggery syrup and other natural sweeteners, catering to health-conscious consumers.

- China- China is emerging as a significant market for gluten-free sugar syrups due to the growing health food sector. Companies like Yili Group are incorporating gluten-free syrups into plant-based beverages, reflecting the country’s rising demand for allergen-free alternatives.

- United Kingdom- The U.K. is witnessing increased demand for gluten-free syrups due to the rising popularity of plant-based diets. Retail giants like Tesco have expanded their gluten-free product ranges to include innovative sweeteners.

- Brazil- Brazil’s market is growing due to increased awareness and government-backed initiatives promoting organic farming. Companies like Native Organic focus on gluten-free syrups from cassava and sugarcane, addressing domestic and export demand.

Gluten Free Sugar Syrup Market segmentation Analysis

By Product

Glucose syrup is a sugar made from starch hydrolysis (breaking down). It is available in liquid, solid, and transparent forms (similar to honey). Glucose syrup is widely used in bakery products and confectionary products. Glucose syrups prevent biscuits from drying out, keep cakes soft, prevent sugar from crystallizing in sweets and jams, and prevent water crystallization in ice creams. Glucose syrup is a simple carbohydrate. In common with all foodstuffs, sugars should be consumed reasonably and as part of a healthy, varied diet by the body’s physical demands.

Liquid glucose is the syrup form of glucose, a sugar, and one of the derivatives of corn or maize starch. Also known as glucose syrup or confectioner’s syrup, this derivative is made from the hydrolysis of starch. The first and foremost benefit of liquid glucose is that it acts as a flavor enhancer in candies and other foods. Liquid glucose increases the humectancy levels in some types of baked items. This further increases the shelf life of such products.

By Application

Gluten is a protein most often associated with wheat and wheat flour but can also be found in barley, rye, and other types of wheat, including triticale, spelt, einkorn, farina, kamut, farro, durum, bulgar, and semolina. Gluten proteins in wheat flour make dough elastic and stretchy and trap gas within baked goods, providing a light, airy structure. Additionally, gluten can be found in products made with these grains, like salad dressing, sauces, and even cosmetics. Various gluten-free flours, starches, and baking aids can be combined to produce high-quality baked goods and pasta. Recipes calling for 2 cups of flour or less are more easily adapted, especially those that use cake flour because it contains less gluten.

Additionally, Maltose can be used as a replacement for high-fructose corn syrup. Maltose is made through a process known as “enzymatic hydrolysis,” using water and enzymes to break down starch derived from various food sources. Even when maltose is derived from barley malt, it can be considered gluten-free because it has been processed to remove gluten, and the resulting maltose meets gluten-free standards.

Company Market Share

The global gluten free sugar syrup market is dominated by the leading companies Cargill Inc., Monin Inc., and B&G Foods Inc. In the bakery market globally, the key companies are Mondelez International (United States), Associated British Foods Plc (United Kingdom), and Kellogg Company (United States), followed closely by the Mexican Grupo Bimbo. The competition in the bakery industry is very tough; each player competes to offer higher value with different strategies to get a larger market share than the competitors. The key players are emphasizing product development while improving research and development, especially in the bakery and confectionary products.

List of Key and Emerging Players in Gluten Free Sugar Syrup Market

- Cargill Inc.

- Monin Inc.

- Wholesome Sweeteners Inc.

- Canadian Organic Maple Co., Ltd.

- B&G Foods Inc.

- Torani & Co., Inc.

- Fringe Papo International

- Borger GmbH

- Whole Earth Brands

- Skinny Mixes

- Blue Ocean Biotech

- Gulshan Polyols Ltd.

Recent Developments

- January 2025- Under CEO Nick Hampton, Tate & Lyle has focused on healthier food ingredients. The company is developing alternatives derived from corn, tapioca, seaweed, and stevia leaf to reduce sugar content, offer dietary fiber, and enhance food textures without adding calories.

- November 2024- Wisdom Natural Brands, the parent company of SweetLeaf natural sugar substitutes, acquired Canada's Drizzle Honey. Drizzle Honey is known for its sustainably sourced raw and superfood honey products, aligning with the growing demand for natural and gluten-free sweeteners.

Analyst Opinion

As per our analysts, the global gluten-free sugar syrup market is set to grow due to the rising prevalence of gluten intolerance, growing health consciousness, and increasing demand for clean-label products. North America and Europe dominate the market, but Asia-Pacific is expected to witness the fastest growth due to expanding health food markets and government support. Adopting plant-based and natural sweeteners is shaping the market, with tapioca, rice, and coconut syrups gaining popularity.

However, challenges like high production costs, supply chain disruptions, and inconsistent regional labeling standards may hinder growth. Despite these restraints, innovations in sustainable production methods and government initiatives promoting gluten-free alternatives present significant opportunities. The market is expected to thrive as companies innovate and consumers prioritize health and wellness.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.87 Billion |

| Market Size in 2025 | USD 2.09 Billion |

| Market Size in 2033 | USD 5.98 Billion |

| CAGR | 6.3% (2025-2033) |

| Base Year for Estimation | 2024 |

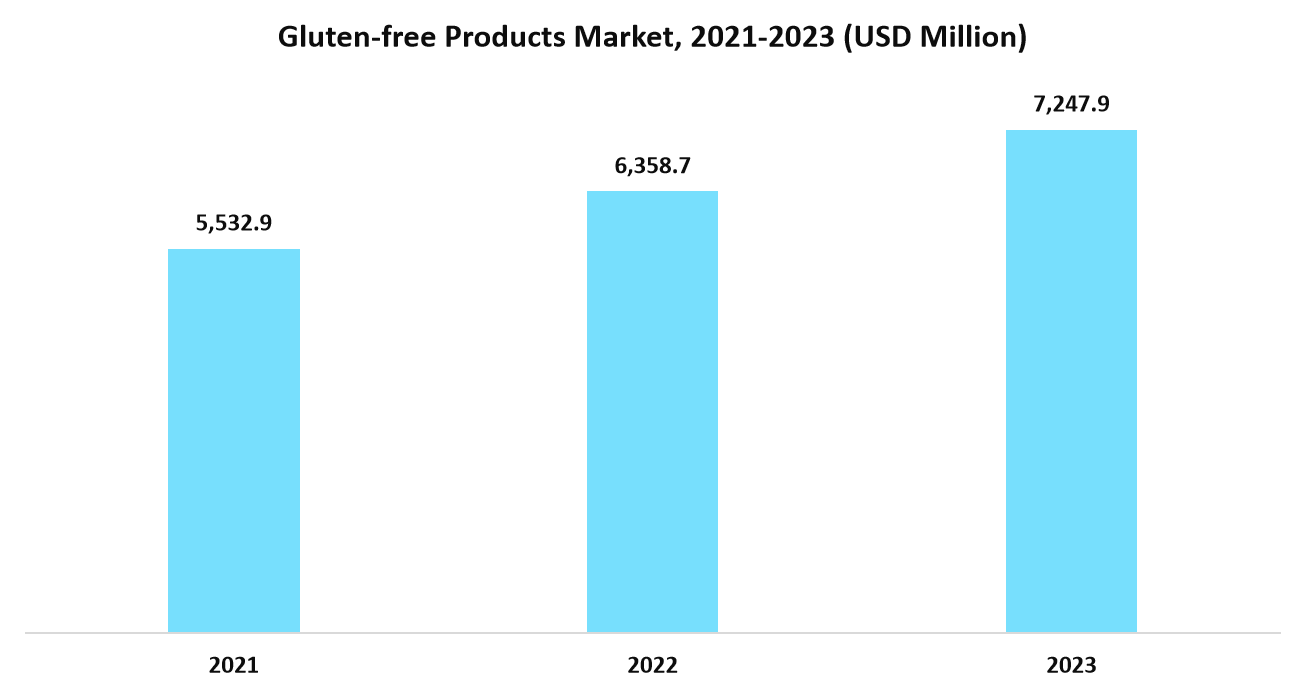

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Gluten Free Sugar Syrup Market Segments

By Product

- Glucose Syrup

- Fructose Syrup

- Maltose Syrup

- Others

By Application

- Bakery Products

- Confectionary

- Nutrition Bar

- Dressings

- Beverages

- Dairy Products

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.