Green Building Materials Market Size, Share & Trends Analysis Report By Product Type (Exterior Products, Interior Products, Structural Products, Building Systems, Water Management Systems), By Application (Residential, Commercial, Industrial, Institutional), By End-Use (New Construction, Retrofit) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Green Building Materials Market Overview

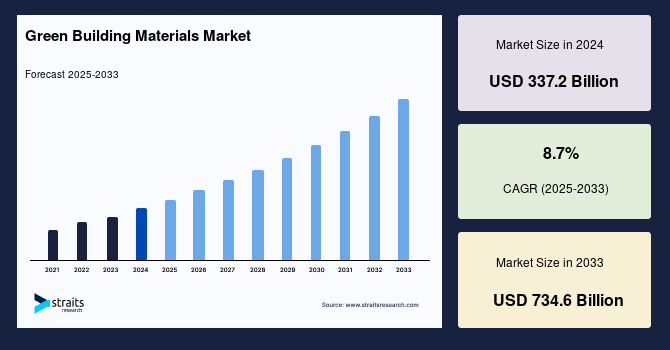

The global Green Building Materials Market size was valued at USD 337.2 Billion in 2024 and is projected to reach from USD 370.1 Billion in 2025 to USD 734.6 Billion by 2033, growing at a CAGR of 8.7% during the forecast period (2025-2033).The growth of the market is attributed to government mandates and green building certifications.

Key Market Indicators

- North America dominated the Green Building Materials Market and accounted for a 31.2% share in 2024

- Based on product type, insulation is the dominant subsegment within interior products

- Based on application, the residential sector dominates the application landscape of green building materials

- Based on end-use, new construction remains the dominant end-use segment

Market Size & Forecast

- 2024 Market Size:USD 337.2 Billion

- 2033 Projected Market Size:USD 734.6 Billion

- CAGR (2025-2033): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Green building materials refer to environmentally responsible construction products and resources that are efficient throughout a building’s lifecycle, from design to demolition. These materials include recycled metal, reclaimed wood, low-VOC paints, energy-efficient insulation, and sustainably harvested timber. Their use minimizes carbon emissions, enhances indoor air quality, and conserves natural resources. With increasing concerns over climate change, government regulations, and rising demand for energy-efficient and sustainable structures, green building materials have become central to modern architecture and urban development.

The green building materials market is driven by the global push for sustainable urban development, energy efficiency mandates, and regulatory frameworks favoring low-emission construction. Governments worldwide incentivize eco-friendly buildings through tax rebates, green certifications, and building codes. Their growing adoption is supported by technological advancements and the expansion of eco-certification programs like LEED, BREEAM, and WELL. A significant trend is the integration of renewable energy sources and smart technologies in green buildings. Additionally, growing awareness among consumers and corporations about environmental impacts fuels demand for sustainable construction practices. Digital platforms like BIM (Building Information Modeling) and prefabricated eco-materials enable faster adoption and innovative designs aligned with ecological goals.

Green Building Materials Market Trends

Circular Economy and Upcycled Materials in Construction

One of the most prominent trends reshaping the green building materials market is the adoption of circular economy principles, particularly through upcycled and reused materials. These materials reduce landfill waste and carbon emissions while conserving virgin resources. According to the World Green Building Council (2024), buildings and construction account for nearly 40% of global carbon emissions, prompting a shift toward more regenerative design practices. Architects and developers increasingly specify materials like reclaimed timber, crushed concrete, recycled plastic composites, and post-consumer metal in new construction and renovation projects.

- For example, the "ZIN building" in Brussels, completed in December 2024, which reused 95% of materials from two demolished office towers, dramatically lowered the carbon footprint of the redevelopment. Companies like Interface Inc. have also used 100% recycled materials in their carpet tiles and flooring products as part of their Climate Take Back™ initiative.

This trend aligns with ESG commitments and appeals to investors and consumers seeking low-impact solutions. As more jurisdictions implement circular economy mandates (e.g., the EU Green Deal 2025 revision), the market for upcycled green building materials is expected to expand significantly over the forecast period.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 337.2 Billion |

| Estimated 2025 Value | USD 370.1 Billion |

| Projected 2033 Value | USD 734.6 Billion |

| CAGR (2025-2033) | 8.7% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | BASF SE, Saint-Gobain, Owens Corning, Kingspan Group, LafargeHolcim |

to learn more about this report Download Free Sample Report

Green Building Materials Market Growth Factors

Government Mandates and Green Building Certifications

Governments across the globe are mandating the use of sustainable building practices through policies, subsidies, and certifications, significantly accelerating the growth of the green building materials market. Certification systems like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) are becoming industry standards. Buildings certified under such programs must use verified green materials and meet stringent energy and environmental benchmarks, boosting demand for low-VOC paints, recycled insulation, and FSC-certified wood.

- For instance, the U.S. Inflation Reduction Act of 2022, extended into 2025, provides over USD 369 billion in climate and energy investments, which target energy-efficient construction and renovation using sustainable materials.

- Similarly, India’s Energy Conservation Building Code (ECBC) 2024 update mandates using energy-efficient, low-carbon materials in large commercial buildings.

These regulatory measures ensure that developers, builders, and architects opt for certified green products to meet compliance, avoid penalties, and gain tax incentives, driving robust market growth across residential, commercial, and industrial sectors.

Market Restraint

High Initial Costs and A Limited Supplier Ecosystem

Despite the long-term cost savings and environmental benefits of green building materials, their high upfront costs remain a major constraint for widespread adoption, particularly in price-sensitive markets. According to a 2024 report by the World Bank, the average price of constructing a certified green building can be 10–20% higher than that of conventional buildings, primarily due to material pricing and specialized labor. Low-emissivity (low-E) windows, sustainably sourced timber, and hempcrete insulation often carry premium price tags.

Additionally, the limited availability of suppliers for high-performance sustainable materials, especially in emerging economies, is a concern. The lack of local manufacturing leads to reliance on imports, increasing project timelines, and transportation-related carbon emissions. Smaller contractors and developers may struggle to access certified green materials or lack awareness of compliance standards, further hindering adoption. Although government subsidies and energy cost savings help offset expenses over time, the perception of high initial investment deters many stakeholders from switching to green materials.

Market Opportunity

Smart Cities and Green Infrastructure Projects

The global surge in smart city development and sustainable urban planning presents a compelling opportunity for green building material providers. Governments worldwide are integrating smart technologies with sustainable architecture to achieve energy neutrality, carbon reduction, and climate resilience. According to the UN-Habitat Smart Cities Report 2025, over USD 2.1 trillion is projected to be spent on smart urban infrastructure globally by 2030, with green construction forming a central pillar. Countries like Saudi Arabia (NEOM project), India (Smart Cities Mission), and the U.S. (Rebuilding American Infrastructure with Sustainability and Equity – RAISE) are incorporating green building mandates into urban infrastructure planning. These initiatives boost demand for green concrete, reflective roofing, solar-integrated façades, and water-efficient plumbing systems.

- For example, Saint-Gobain expanded its India operations in September 2024 to supply energy-efficient glass to meet the growing demand from public housing and commercial skyscrapers under smart city programs.

These developments signify a long-term opportunity for green building material suppliers to align with infrastructure innovation and sustainability mandates globally, fostering partnerships and expanding into new geographic markets.

Regional Insights

North America leads the global green building materials market, driven by stringent building codes, federal sustainability initiatives, and heightened consumer awareness. The region is also experiencing strong private sector investment. Major construction firms are integrating lifecycle assessments and zero-emission material sourcing into their project pipelines. North America’s mature real estate sector, coupled with its emphasis on ESG (Environmental, Social, and Governance) standards, has institutionalized green building practices, placing it at the forefront of market leadership. This regulatory and corporate synergy ensures continuous demand for sustainable materials, especially in the commercial and institutional sectors.

- The U.S. green building materials industry is one of the most mature globally, driven by stringent energy efficiency regulations, LEED certification mandates, and public-private partnerships. According to the U.S. Green Building Council (USGBC), over 100,000 commercial buildings in the U.S. are LEED-certified. Moreover, cities like New York and San Francisco are implementing net-zero carbon mandates for public buildings, further pushing green material adoption.

- Canada’s market is supported by a well-developed sustainability framework, including LEED, Zero Carbon Building Standards, and provincial incentives. Quebec’s focus on wooden skyscrapers and Alberta’s investment in recycled concrete for public works highlight regional diversity in sustainable practices.

Asia-Pacific Green Building Materials Market Trends

Asia-Pacific is witnessing the fastest growth in the green building materials market due to rapid urbanization, rising middle-class income, and government-driven sustainability mandates. According to the Asian Development Bank (2024), urban population growth in the region will add 1.1 billion people to cities by 2050, placing immense pressure on resource-efficient infrastructure. Integrating IoT-based building management systems, renewable energy sources, and recycled construction materials is transforming Asia-Pacific into a high-growth zone for green buildings, making it the most dynamic market in the forecast period.

- China's market is rapidly advancing, supported by government mandates and urban sustainability goals. As part of its 14th Five-Year Plan, China aims to ensure that over 70% of new urban buildings meet green building standards by 2025. The Ministry of Housing and Urban-Rural Development (MOHURD) promotes green product certifications and mandates energy-saving technologies.

- India’s market is booming due to rapid urbanization and government initiatives like the Energy Conservation Building Code (ECBC) and Smart Cities Mission. States like Maharashtra and Tamil Nadu have introduced mandatory green compliance for large residential and commercial developments, significantly pushing demand for eco-friendly bricks, solar facades, and water-efficient plumbing materials.

Europe Green Building Materials Market Trends

The European green building materials market is driven by stringent environmental regulations, ambitious carbon neutrality goals under the European Green Deal, and strong government incentives promoting sustainable construction. High awareness of energy efficiency, coupled with widespread adoption of eco-certifications like BREEAM and LEED, further accelerates demand. Additionally, the region's robust renovation programs, particularly in Western Europe, are boosting the use of sustainable insulation, flooring, and roofing materials. Public-private collaborations also foster innovation in eco-friendly building technologies.

- Germany’s green building materials industry is driven by its energy transition policy, “Energiewende,” and the push for sustainable construction under EU directives. The country is a frontrunner in passive house standards, using advanced insulation and renewable materials. Germany's national renovation wave program, which supports climate-neutral building stock by 2045, offers subsidies for energy-efficient materials and smart HVAC systems.

- The UK market is witnessing strong growth amid its goal to achieve net-zero emissions by 2050. Regulatory pushes such as the Future Homes Standard, coming into effect in 2025, mandate using low-carbon materials and electric heat pumps in new homes. Furthermore, the UK Green Building Council encourages the adoption of life cycle assessments (LCA) in construction planning, influencing material selection in commercial and infrastructure projects.

Product Type Insights

Insulation is the dominant subsegment within interior products due to its significant impact on energy efficiency and indoor climate regulation. Eco-friendly insulation materials, such as cellulose, sheep wool, hemp, and recycled denim, are gaining traction for their low environmental footprint and non-toxic properties. Governments and green building standards like LEED and BREEAM are increasingly mandating higher thermal performance, thereby elevating insulation standards. The ongoing retrofitting of old buildings, especially in Europe and North America, has created a robust market for sustainable insulation materials. Moreover, rising consumer awareness of indoor air quality and the health impacts of traditional insulation are shifting preferences toward organic and bio-based alternatives.

Application Insights

The residential sector dominates the application landscape of green building materials due to rising eco-consciousness among homeowners and growing affordability of sustainable housing solutions. Consumer demand for energy efficiency, healthy indoor environments, and reduced utility bills leads to increased use of green products like non-VOC paints, bamboo flooring, and triple-glazed windows. Government incentives for home retrofitting, such as tax credits and green mortgages, particularly in the U.S., Canada, and Germany, are also accelerating market growth. The shift towards smart homes complements energy-efficient and sustainable building materials, positioning the residential segment as a major global green building movement driver.

End-Use Insights

New construction remains the dominant end-use segment, with governments, developers, and architects embedding sustainability principles from the ground up. The growth of smart cities, urban sustainability initiatives, and government mandates for green certification in new projects has bolstered this segment. Greenfield construction projects present opportunities for integrated sustainable designs, including solar rooftops, energy-efficient envelopes, and recycled structural components. Adopting building information modeling (BIM) and lifecycle analysis tools allows stakeholders to select materials that reduce carbon footprints and enhance long-term building performance. This approach is especially evident in developing countries investing in future-ready infrastructure.

List of Key and Emerging Players in Green Building Materials Market

- BASF SE

- Saint-Gobain

- Owens Corning

- Kingspan Group

- LafargeHolcim

- DuPont

- Interface Inc.

- CSR Limited

- Alumasc Group

- Forbo International

- PPG Industries

- Rockwool International A/S

to learn more about this report Download Market Share

Recent Development

- March 2025: The LafargeHolcim Foundation for Sustainable Construction hosted the 6th International Forum “Re-Materializing Construction” at The American University in Cairo, bringing together experts to discuss new approaches to sustainable building solutions.

- April 2025: Kingspan broke ground on a new €280 million Building Technology Manufacturing Campus in Ukraine, with a focus on producing advanced, high-performance insulation and building envelope solutions.

- April 2025: The company's UK division released its "Top Trends in UK Construction for 2025" report, which highlights its commitment to sustainability, including its "GlassForever" scheme and the introduction of the "PalletLOOP" initiative within its Interior Solutions division.

- May 2025: Kingspan announced that it has achieved a CDP Climate 'A' rating, recognizing the company's efforts to address climate change through its "Planet Passionate" sustainability program.

- July 2025: Saint-Gobain announced the divestment of Brüggemann, a German specialist in prefabricated solutions, as part of its portfolio optimization strategy.

- August 2025: Saint-Gobain commenced construction of a new float glass and insulation line at its facility in Chennai, India, to meet the growing demand for sustainable building solutions in the region.

- August 2025: Holcim announced the closing of its divestment of Holcim Nigeria, a step in its strategy to simplify and optimize its portfolio.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 337.2 Billion |

| Market Size in 2025 | USD 370.1 Billion |

| Market Size in 2033 | USD 734.6 Billion |

| CAGR | 8.7% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application, By End-Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Green Building Materials Market Segments

By Product Type

-

Exterior Products

- Roofing

- Siding

- Windows

- Doors

-

Interior Products

- Flooring

- Insulation

- Wall Finishes

-

Structural Products

- Framing

- Panels

-

Building Systems

- HVAC Systems

- Solar Systems

- Water Management Systems

By Application

- Residential

- Commercial

- Industrial

- Institutional

By End-Use

- New Construction

- Retrofit

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Akanksha Yaduvanshi

Research Analyst

Akanksha Yaduvanshi is a Research Analyst with over 4 years of experience in the Energy and Power industry. She focuses on market assessment, technology trends, and competitive benchmarking to support clients in adapting to an evolving energy landscape. Akanksha’s keen analytical skills and sector expertise help organizations identify opportunities in renewable energy, grid modernization, and power infrastructure investments.