Green Cardamom Market Size, Share & Trends Analysis Report By Product (Small, Large), By End-Use (Food Service, Retail, Hypermarkets/Supermarkets, Convenience Stores, Online, Others), By Nature (Organic, Conventional) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Green Cardamom Market Overview

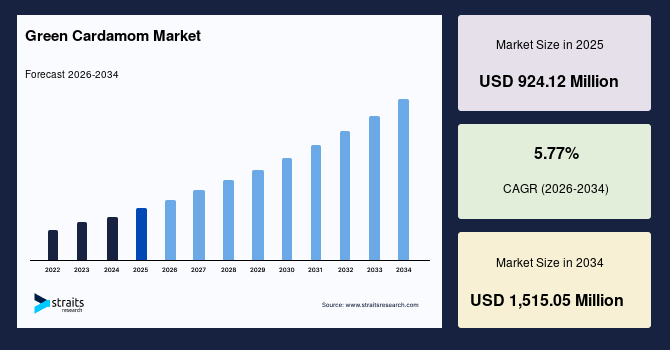

The global green cardamom market size was valued at USD 924.12 million in 2025 and is estimated to reach USD 1,515.05 million by 2034, growing at a CAGR of 5.77% during the forecast period (2026–2034). The global market is driven by rising consumer demand for natural and aromatic spices, expanding use in food, beverages, and wellness products, increasing global trade, and growing awareness of their health benefits, fueling production and export growth worldwide.

Key Market Trends & Insights

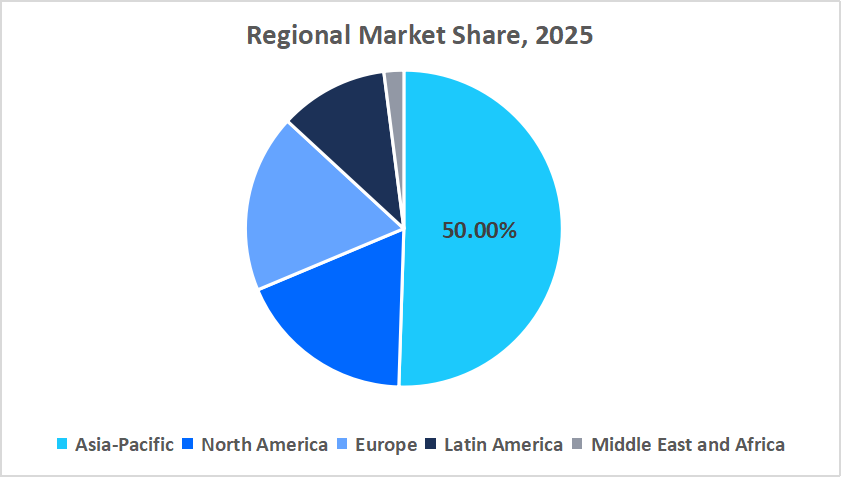

- Asia-Pacific held the largest market share, over 50% of the global market.

- Europe’s green cardamom market is the fastest growing, with a CAGR of 6.67%,

- By Product, the large segment is expected to witness the fastest CAGR of 6.12%.

- By End-use, the retail segment held the highest market share of over 70%.

- By Nature, the organic segment is expected to witness the fastest CAGR of 6.75%.

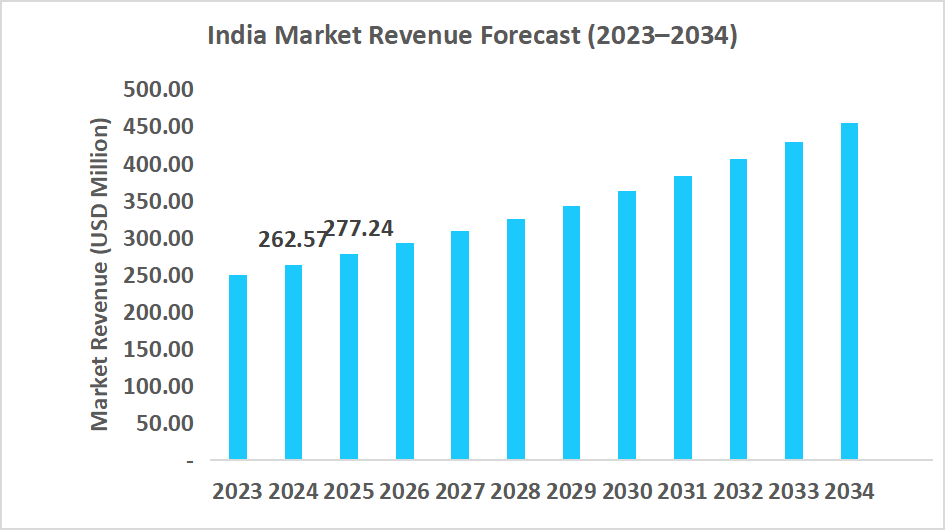

- India’s green cardamom market was valued at USD 262.57 million in 2024 and reached USD 277.24 million in

Graph: The India Market Revenue Forecast (2023 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 924.12 million

- 2034 Projected Market Size: USD 1,515.05 million

- CAGR (2026-2034): 77%

- Dominating Region: Asia-Pacific

- Fastest-Growing Region: Europe

Green cardamom, often called the “queen of spices,” is a highly aromatic seed used for its unique flavor and medicinal properties. It is widely incorporated in culinary applications, including desserts, beverages, savory dishes, and spice blends. Beyond cooking, cardamom finds use in traditional medicine for digestive health, breath freshening, and anti-inflammatory benefits. Its essential oils are utilized in perfumery, cosmetics, and aromatherapy, making it a versatile spice with both gastronomic and wellness applications.

The market benefits from rising consumer preference for organic and sustainably sourced spices, coupled with expanding export opportunities in Europe, North America, and the Middle East. Technological adoption in cultivation, value addition through grading and processing, and government initiatives supporting spice quality enhancement create significant growth prospects. Moreover, niche markets for premium and specialty cardamom products provide lucrative opportunities for producers and exporters worldwide.

Latest Market Trends

Increasing Adoption of Functional Foods and Herbal Teas

The growing interest in health-oriented diets has significantly boosted the inclusion of green cardamom in functional foods and herbal teas. Known for its digestive, antioxidant, and anti-inflammatory properties, cardamom is increasingly used as a natural flavoring and wellness ingredient in beverages, snacks, and supplements, aligning with global clean-label trends.

Moreover, consumers are turning to herbal teas infused with green cardamom for their aromatic and therapeutic appeal. This shift toward caffeine-free, health-promoting drinks has encouraged tea brands to introduce innovative blends that combine cardamom with herbs and botanicals, supporting a broader movement toward preventive health and natural nutrition solutions worldwide.

Advanced Packaging Techniques are Improving Shelf Life and Export Quality

Advancements in packaging technologies are transforming the global green cardamom market by extending shelf life and preserving flavor integrity during long-distance exports. Modern techniques such as vacuum sealing, nitrogen flushing, and moisture-proof pouches help retain freshness, aroma, and essential oils, ensuring that cardamom reaches international markets in optimal condition.

As per Straits Research, exporters are increasingly investing in eco-friendly and high-barrier packaging materials to meet global quality and sustainability standards. These innovations not only reduce post-harvest losses but also enhance brand credibility in competitive export destinations, positioning premium-quality cardamom as a preferred choice among global food and beverage manufacturers.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 924.12 Million |

| Estimated 2026 Value | USD 973.46 Million |

| Projected 2034 Value | USD 1,515.05 Million |

| CAGR (2026-2034) | 5.77% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | South Indian Green Cardamom Company Limited, Pace Ventures Pvt Ltd, The Kerala Cardamom Processing and Marketing Co Ltd, Nelixia Honduras S.A. de C.V., Adani Food Products Pvt Ltd |

to learn more about this report Download Free Sample Report

Green Cardamom Market Drivers

Surging Global Demand

The demand for green cardamom is witnessing remarkable growth, fueled by increasing consumer preference for natural and aromatic spices in culinary and wellness applications. Rising awareness of the spice’s health benefits, including its antioxidant properties and digestive aid, has further boosted its popularity across international markets.

- For instance, Nepal's cardamom exports nearly doubled in FY 2025/26, rising by 99.5% to Rs. 321.7 million in just one month, highlighting the strong global demand for this premium spice. Similarly, in 2025, Kerala exported an estimated 6,400 tons of cardamom, valued at approximately ₹800 crore (USD 100 million), reinforcing India’s pivotal role in the international spice trade.

This rising demand is encouraging producers and exporters to enhance cultivation practices, invest in supply chain improvements, and explore new markets, ensuring sustained growth.

Market Restraints

High Volatility in Cardamom Prices Due to Fluctuating Crop Yields and Climate Variations

The global green cardamom market faces significant challenges from high price volatility caused by inconsistent crop yields and unpredictable climatic variations. Irregular rainfall, rising temperatures, and pest infestations often disrupt production cycles, leading to unstable supply levels. These fluctuations directly affect market pricing and profit margins for both farmers and exporters. Moreover, dependency on a few key producing regions intensifies the risk of supply shortages. As a result, manufacturers and traders struggle to maintain steady pricing structures, impacting long-term trade stability and market growth potential.

Market Opportunities

Increasing Investments in Spice Value Chains and Export Infrastructure

The market is witnessing promising opportunities as increasing investments in spice value chains and export infrastructure drive growth. Growing consumer demand for natural and organic spices, along with the rising popularity of ethnic cuisines, has encouraged both public and private stakeholders to enhance cultivation, processing, and logistics.

- In May 2025, the government of India launched the SPICED scheme to boost spice exports, including cardamom. This provides financial assistance for replanting and rejuvenating plantations, developing water resources, promoting micro-irrigation, supporting organic farming, and expanding good agricultural practices (GAP).

Such efforts improve yield quality and strengthen supply chains, creating significant prospects for exporters and investors. With these strategic investments, the green cardamom sector is poised for sustained growth worldwide.

Regional Analysis

The Asia-Pacific green cardamom market is dominant with a market share of over 50%, supported by favorable cultivation conditions, strong domestic consumption, and growing export demand. Consumers increasingly prefer natural spices for culinary and medicinal purposes, driving demand across food, beverage, and herbal supplement industries. Companies are investing in sustainable farming practices, modern processing techniques, and supply chain optimization to maintain quality and consistency.

Moreover, expansion in retail and e-commerce platforms ensures wider product accessibility. Innovation in packaging and value-added products like cardamom powders and capsules further strengthens the region’s leadership.

China’s market is growing steadily, with companies like COFCO, Yihai Kerry, and local spice processors focusing on importing, processing, and blending high-quality cardamom for food, beverage, and medicinal applications. Partnerships with domestic retailers and e-commerce platforms are expanding reach.

India’s market is expanding due to high domestic production and export opportunities. Companies like AVT Natural Products, Kannan Devan Hills Plantations, and Erode-based spice exporters focus on sustainable cultivation, advanced processing, and graded packaging to ensure quality. Moreover, emphasis is placed on value-added products, including ready-to-use powders and blended spice mixes.

Europe Market Insights

Europe’s market is the fastest growing, with a CAGR of 6.67%, driven by increasing consumer awareness of natural and functional spices, premium food trends, and rising demand in the beverage and nutraceutical sectors. Imports of high-quality green cardamom are increasing, while sustainable sourcing and traceability have become important for European buyers. Retailers and specialty stores are offering organic and ethically sourced variants to cater to health-conscious consumers. Companies are investing in marketing, quality certifications, and innovative product offerings such as pre-packaged spice blends and functional beverages, boosting adoption and market growth.

The UK market is expanding with companies such as Bart Ingredients, TRS Foods, and S&D Spices importing and distributing high-quality cardamom for culinary and health applications. Focus is on organic, traceable, and premium-grade products. Moreover, growing consumer interest in ethnic cuisines, specialty teas, and functional foods drives market expansion and strengthens the UK’s position as a key European importer.

Germany’s market is growing as companies like Fuchs Gewürze, Ostmann Gewürze, and international spice traders supply premium and organic variants for culinary, beverage, and nutraceutical applications. Emphasis is on quality grading, eco-friendly packaging, and value-added products like blended spices and cardamom oils. Retail expansion and e-commerce channels are enhancing accessibility.

Source: Straits Research

North America Market Insights

North America’s green cardamom market is witnessing steady growth, driven by increasing demand for natural spices in culinary, beverage, and health applications. Specialty food stores and online platforms are expanding product accessibility. Companies are focusing on premium, organic, and sustainably sourced cardamom. Moreover, innovation in ready-to-use powders, blends, and functional beverages is further supporting adoption among health-conscious and gourmet consumers.

The US market is expanding with companies such as McCormick, Frontier Co-op, and Spice Islands focusing on importing premium, organic, and sustainably sourced cardamom. They are investing in retail and online distribution, ready-to-use blends, and functional spice mixes for culinary and beverage applications.

Latin America Market Insights

Latin America’s green cardamom market is gradually growing due to rising interest in ethnic cuisines, premium spices, and natural ingredients. Retail chains and specialty stores are enhancing product availability. Companies are investing in value-added formats like ground powders, blends, and packaging innovations. Moreover, awareness of the functional and medicinal properties of cardamom is increasing consumer adoption, while importers and distributors are strengthening supply chains to meet demand.

Brazil’s market is growing as companies like QualiSpice and local importers focus on premium, organic, and ready-to-use cardamom products. Expansion into retail and e-commerce platforms improves accessibility for culinary and health-conscious consumers.

The Middle East and Africa Market Insights

The Middle East and Africa green cardamom market is expanding with rising demand in the culinary, beverage, and traditional medicine sectors. Importers and specialty spice distributors are introducing organic and high-quality cardamom for both domestic and regional consumption. Investment in modern packaging and value-added products like spice blends and capsules enhances shelf appeal. Consumer preference for premium, natural, and sustainably sourced products drives steady adoption across urban centers.

Saudi Arabia’s market is growing as companies such as Al-Rabih Spices and other importers supply premium, organic cardamom for culinary, beverage, and traditional applications. Retail and e-commerce channels are strengthening distribution while consumer demand for authentic, high-quality spices rises.

Product Insights

Small cardamom dominates the market with over 60% share, widely valued for its aroma, flavor, and versatility in culinary and beverage applications. Its strong presence in retail and industrial use ensures steady demand globally. Moreover, consistent quality and established cultivation regions maintain its dominance, making small cardamom the primary contributor to revenue and the preferred choice among manufacturers and consumers in both traditional and modern markets.

Large cardamom is the fastest-growing segment, expanding at a CAGR of 6.74%. Increasing popularity in specialty cuisines, herbal products, and functional foods is driving growth. Regions like North America and Europe are adopting large cardamom for gourmet and premium offerings. Its robust flavor profile and expanding use in processed foods and beverages are steadily increasing market share, positioning it as a high-potential growth product in the global market.

End-use Insights

Retail channels dominate with over 70% market share, including hypermarkets, supermarkets, convenience stores, and online platforms. Consumers increasingly purchase cardamom for household cooking, beverages, and spice blends. The segment’s dominance is reinforced by easy availability, brand visibility, and consistent quality. Retail remains the main revenue generator for cardamom suppliers, maintaining high adoption in both urban and semi-urban regions globally.

Food service applications are the fastest-growing segment, with a CAGR of 7.3%. Hotels, restaurants, and cafés are increasingly using cardamom in beverages, desserts, and culinary preparations. Rising demand in specialty coffee, bakery, and gourmet cuisines in North America and the APAC is driving growth. The segment’s expansion reflects changing consumer preferences for exotic flavors and premium dining experiences, steadily increasing market share in the global foodservice sector.

Source: Straits Research

Nature Insights

Conventional cardamom dominates with over 80% market share, benefiting from established farming practices and widespread availability. Its consistent quality, cost-effectiveness, and strong distribution networks make it the preferred choice for industrial and retail use. Conventional cardamom continues to satisfy global demand across both developing and developed regions, remaining the foundation of the market and ensuring predictable revenue streams for suppliers worldwide.

Organic cardamom is the fastest-growing segment, expanding at a CAGR of 6.75%. Rising consumer awareness of clean-label, chemical-free, and sustainably sourced spices is driving adoption. Demand is particularly strong in Europe and North America, where health-conscious and premium buyers prefer organic products. This growth is steadily increasing market share, encouraging producers to expand certified organic cultivation and catering to the premium segment globally.

Competitive Landscape

Companies operating in the global green cardamom market are focusing on enhancing cultivation practices, improving post-harvest processing, and expanding export infrastructure. They are investing in modern drying, grading, and packaging technologies to meet international quality standards. Moreover, there is a growing emphasis on organic farming and sustainable sourcing to cater to the increasing consumer demand for natural and ethically produced spices. These efforts aim to strengthen supply chains, ensure product consistency, and capitalize on the expanding global market for green cardamom.

South Indian Green Cardamom Company Limited

Established in 2006, South Indian Green Cardamom Company Limited (SIGCC Ltd) is a public limited company incorporated under the Companies Act, 1956. Headquartered in Pampupara, Idukki, Kerala, SIGCC Ltd operates as a licensed cardamom auctioneer and a prominent player in the spice industry. The company has a membership base of over 1,400 planters and has auctioned substantial quantities of cardamom annually.

- October 2025 - SIGCC Ltd conducted an auction in Kochi, where 300 lots of cardamom arrived, totaling 83,535.6 kg. Of these, 274 lots were sold, with the highest price reaching ₹2,808 per kg and the average auction price standing at ₹2,405.44 per kg.

List of Key and Emerging Players in Green Cardamom Market

- South Indian Green Cardamom Company Limited

- Pace Ventures Pvt Ltd

- The Kerala Cardamom Processing and Marketing Co Ltd

- Nelixia Honduras S.A. de C.V.

- Adani Food Products Pvt Ltd

- Hộ Kinh Doanh Đỗ Ngọc Hùng

- Bhojraj Jain

- Koko Spices Private Limited

- McCormick & Company, Inc.

- DS Group

- Olam Group Limited

- Frontier Cooperative

- The Spice House

- Eastmade Spices & Herbs Private Limited

- Vandanmedu Green Gold Cardamom Producer Company Limited

- Cardex, S.A.

- Mane Kancor Ingredients Private Limited

- Vora Spice Mills LLP

- Kerry Group

Strategic Initiatives

- July 2025 - The Multi-Commodity Exchange of India (MCX) has reintroduced cardamom futures trading as of July 29, 2025, after a four-year hiatus. This move aims to provide better price discovery and risk management tools for stakeholders in the cardamom sector.

- May 2025 - The Indian Cardamom Research Institute (ICRI) has developed a new cardamom variety, ICRI-10, after a decade of research. This variety is designed to withstand climate-induced stresses, offering improved resilience for farmers.

- August 2024 - Prime Minister Narendra Modi unveiled two new cardamom varieties, IISR Manushree and IISR Kaveri, developed by the Indian Institute of Spices Research (IISR), under the Indian Council of Agricultural Research (ICAR). These varieties were among 109 climate-resilient crops introduced to enhance agricultural productivity and sustainability.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 924.12 Million |

| Market Size in 2026 | USD 973.46 Million |

| Market Size in 2034 | USD 1,515.05 Million |

| CAGR | 5.77% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By End-Use, By Nature |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Green Cardamom Market Segments

By Product

- Small

- Large

By End-Use

- Food Service

- Retail

- Hypermarkets/Supermarkets

- Convenience Stores

- Online

- Others

By Nature

- Organic

- Conventional

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.