Hair and Scalp Care Market Size, Share & Trends Analysis Report By Product Type (Shampoo, Conditioner, Hair Oils & Serums, Hair Masks & Treatments, Scalp Treatments & Exfoliants, Hair Colorants & Dyes, Others), By Gender (Male, Female, Unisex), By Application (Hair Loss / Thinning, Dandruff & Scalp Irritation, Dry & Damaged Hair, Oily Hair & Scalp, Color-treated Hair, Anti-aging (Greying Hair & Scalp Rejuvenation), Others), By Distribution Channel (Offline, Online) and By Regio Forecasts, 2025-2033

Hair and Scalp Care Market Overview

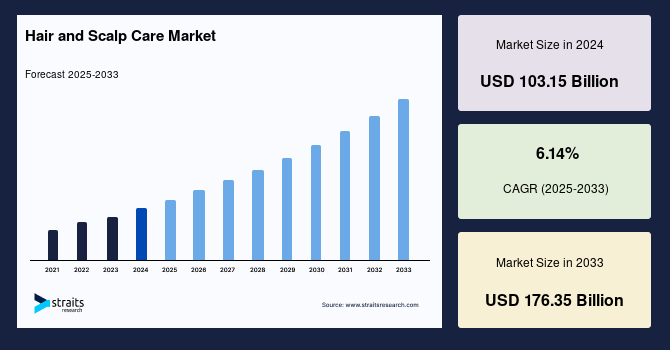

The global hair and scalp care market size was valued at USD 103.15 billion in 2024 and is projected to grow from USD 109.48 billion in 2025 to reach USD 176.35 billion by 2033, growing at a CAGR of 6.14% during the forecast period (2025–2033). The global market is witnessing strong growth driven by the increasing demand for premium, targeted solutions that address specific concerns such as dandruff, thinning hair, and scalp irritation.

Key Market Insights

- The Asia Pacific region dominated the global hair and scalp care industry with the largest revenue share of 39.4% in 2024.

- Based on product type, the shampoo segment leads the market with the largest revenue share of 37% in 2024.

- Based on gender, the female segment holds a significant share of the market.

- Based on the application, the hair loss/thinning segment is witnessing robust growth.

- Based on the distribution channel, the offline segment remains dominant in the global market.

Market Size & Forecast

- 2024 Market Size: USD 103.15 billion

- 2033 Projected Market Size: USD 176.35 billion

- CAGR (2025–2033): 6.14%

- Largest market in 2024: Asia Pacific

- Fastest-growing region: North America

Consumers are shifting toward high-performance formulations enriched with ingredients like biotin, peptides, and caffeine, often inspired by salon-grade products. Social media influencers and celebrity endorsements also play a vital role in shaping trends and driving product sales, especially among younger demographics.

Additionally, the expansion of men’s grooming routines is opening new avenues for brands, with more men seeking hair thickening and scalp-nourishing solutions. The premiumization trend, fueled by a desire for high-efficacy and dermatologist-tested products, is particularly prominent in urban markets. These drivers collectively reflect a broader consumer shift toward holistic, result-oriented, and lifestyle-aligned products in this industry.

Market Trends

Natural & Organic Products Boom

The global market is witnessing a strong shift toward natural and organic formulations as health-conscious consumers seek safer, non-toxic alternatives. Shampoos, conditioners, serums, and scalp treatments free from sulfates, parabens, silicones, and artificial fragrances are increasingly gaining preference.

- For instance, Dyson’s new Omega Nourishing range, slated for launch in late August 2025, introduces a Hydrating Hair Oil (£45.99/$85) and an 8 1 Leave-In Conditioning Spray (£59.99/$95). Both are powered by the proprietary Dyson Oli7™ blend, featuring sunflower oil grown on Dyson’s Lincolnshire farms, plus five other omega-rich plant oils. Silicone-free, refillable, and engineered for strength (up to +94%), shine (+261%), and reduced breakage (73%) across all hair types.

This trend reflects the surging demand for sustainable beauty solutions rooted in wellness and ingredient transparency.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 103.15 Billion |

| Estimated 2025 Value | USD 109.48 Billion |

| Projected 2033 Value | USD 176.35 Billion |

| CAGR (2025-2033) | 6.14% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Procter & Gamble, Unilever, L'Oréal S.A., Henkel AG & Co. KGaA, Johnson & Johnson Services, Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Rising Hair-Related Issues

The increasing prevalence of hair and scalp-related problems is a major driver of the global market. Factors such as pollution, stress, poor diet, hormonal changes, and overuse of styling products contribute significantly to conditions like hair thinning, dandruff, and scalp irritation. Consumers are becoming more proactive in addressing these issues, driving demand for specialized treatments and preventive solutions.

- For instance, according to the National Council on Aging (NCOA), by the age of 50, around 50% of men globally experience noticeable hair loss or thinning, primarily due to androgenetic alopecia. Similarly, the Cleveland Clinic reports that over 40% of women show visible signs of hair loss by the age of 40.

This surge in hair-related concerns has prompted both legacy brands and startups to invest in targeted, evidence-backed hair and scalp care solutions.

Market Restraint

High Cost of Premium Products

The high cost of premium products poses a significant restraint to market growth, particularly in price-sensitive regions. Premium products, often formulated with specialized ingredients like biotin, keratin, argan oil, or backed by dermatological research, are priced significantly higher than mass-market alternatives.

While affluent consumers in North America and Europe are more inclined to invest in such products, middle- and low-income consumers in emerging economies often find them unaffordable. Additionally, rising inflation and economic uncertainties have made consumers more cost-conscious, further hindering the uptake of premium offerings. This pricing barrier limits widespread market penetration and adoption across diverse demographics and geographies.

Market Opportunity

Customization Demand

The growing preference for personalized beauty and grooming experiences is significantly reshaping the global market. Consumers are increasingly seeking products tailored to their unique hair type, texture, scalp health, and lifestyle. Brands are responding by leveraging artificial intelligence, machine learning, and data analytics to offer customized solutions.

- For instance, GHD's AI-powered CurlFinder tool, launched in July 2025, offers a quick, visually guided quiz to help users select styling tools tailored to their hair texture, curl preference, and styling goals. It emulates a salon consultation experience, helping GHD strengthen its AI-driven edge in hair-tech.

This trend is driving innovation across product formulations and digital platforms, creating new revenue streams. Customization enhances customer loyalty, reduces product returns, and meets the rising demand for efficacy and inclusivity in hair care.

Regional Analysis

The Asia Pacific region dominated the global hair and scalp care market with a 39.4% revenue share in 2024 and is experiencing rapid market growth due to rising disposable income, beauty consciousness, and urbanization. Cultural emphasis on hair health, coupled with increased exposure to global trends, is driving the adoption of specialized treatments like anti-hair fall oils, scalp serums, and herbal formulations. The region also witnesses strong demand for personalized solutions, supported by technological integration such as scalp analysis apps. Additionally, local manufacturers are expanding with innovative, traditional ingredient-based products, while the growth of e-commerce accelerates access to a comprehensive range of international and domestic brands.

China’s hair and scalp care industry is witnessing rapid growth due to increasing urbanization, pollution-related hair issues, and demand for premium and anti-hair loss products. Traditional remedies, like ginseng-infused treatments, are being repackaged in modern formats. Domestic brands such as Bloomage Biotech and foreign players like L'Oréal and Unilever are expanding their scalp-care ranges through e-commerce platforms like Tmall and JD.com to reach tech-savvy consumers.

India’s market is expanding due to rising awareness around scalp health, increased disposable income, and a cultural inclination toward natural remedies. Ayurvedic brands like Dabur and Himalaya are leveraging traditional ingredients like amla and bhringraj in modern formulations. The rise of urban hair issues like dandruff and hair fall is also fueling demand for medicated and specialized scalp-care shampoos and oils across both rural and urban areas.

North America Market Trends

The North American market is driven by increased consumer awareness of ingredient transparency and preference for clean, dermatologically-tested formulations. The region shows strong demand for anti-thinning and scalp-revitalizing solutions due to rising concerns over aging and stress-induced hair loss. High spending on premium, salon-grade treatments and a surge in male grooming trends further boost market growth. Additionally, digital platforms and influencer marketing campaigns are significantly influencing purchasing behaviors, driving growth for direct-to-consumer and subscription-based hair care brands.

The United States market is thriving due to strong consumer demand for natural, anti-hair fall, and medicated scalp treatments. Brands like Olaplex and Briogeo are leading with clean-label solutions. The rise of dermatological products such as Nizoral and the growth in male grooming subscriptions like Hims reflect evolving preferences. Digital marketing and influencer collaborations heavily influence product discovery and brand loyalty across demographics.

Canada’s hair and scalp care sector is witnessing growth driven by the surging awareness of scalp health and sustainable grooming. Canadian consumers are leaning toward organic brands like Attitude and Green Beaver, which offer vegan, eco-certified products. The demand for dandruff and sensitivity-targeted solutions is rising, with Head & Shoulders Clinical and natural formulations gaining traction. E-commerce growth and health-conscious trends support the expansion of niche and premium offerings.

Europe Market Trends

In Europe, sustainability and ethical production play central roles in shaping the market. Consumers are increasingly inclined toward organic, cruelty-free, and eco-certified products, especially those with biodegradable packaging. The growing popularity of minimalist routines supports demand for multi-benefit scalp treatments and gentle cleansers. Moreover, concerns around scalp health have fueled demand for pH-balanced, microbiome-friendly formulations. Innovation in botanical actives and dermatologically endorsed brands is gaining traction, supported by a mature retail infrastructure and strong regulatory standards for cosmetic safety and efficacy.

Germany's market for hair and scalp care is driven by a strong preference for natural and dermatologically tested products. German consumers favor brands like Alpecin and Sebamed, which are known for their clinically proven scalp care solutions. The country’s aging population and awareness of scalp health are boosting demand for anti-hair loss treatments. Furthermore, sustainability trends encourage purchases of eco-friendly packaging and organic formulations across both retail and online platforms.

The UK’s hair and scalp care market is witnessing robust growth fueled by rising concerns over hair loss and scalp sensitivity. Popular brands like Head & Shoulders, Nioxin, and The Body Shop are innovating with tea tree oil and scalp detox products. Consumers increasingly seek sulfate-free and vegan options. The rise of male grooming, along with e-commerce growth and influencer-led marketing, further supports expansion in the UK market.

Product Type Insights

The shampoo segment led the global market in 2024, accounting for the highest revenue share of 37% due to its essential role in daily hair hygiene. Consumers are increasingly opting for specialized shampoos targeting dandruff, hair fall, and scalp sensitivity. The surge in demand for natural, sulfate-free, and medicated formulations further drives growth. Brands are also innovating with anti-pollution, anti-aging, and probiotic-infused shampoos. Moreover, rising urban pollution and awareness of scalp health have boosted demand for cleansing and treatment-based shampoos across both developed and emerging economies.

Gender Insights

The female segment holds a significant share of the market, driven by strong demand for personalized and premium hair care products. Women are increasingly concerned about hair texture, damage repair, and scalp health, leading to the adoption of multi-step hair care routines. The surge of social media, beauty influencers, and evolving fashion trends further influences purchase behavior. In particular, women aged 25–45 form a core demographic, with high spending on color protection, anti-hair fall, and nourishing treatments.

Application Insights

The hair loss/thinning segment is witnessing robust growth owing to the rising prevalence of alopecia, hormonal imbalances, and stress-induced hair fall globally. Increased awareness about hair density and scalp health, especially among urban populations, is fueling demand for anti-hair loss solutions. Both men and women are adopting products containing caffeine, biotin, and DHT blockers. Moreover, innovations in dermo-cosmetic formulations and the expansion of anti-hair fall product lines by major brands are driving segment expansion across global markets.

Distribution Channel Insights

The offline segment remains dominant in the global market, as consumers prefer in-person purchases for product trials and expert consultations. Supermarkets, hypermarkets, salons, and specialty beauty stores continue to be the primary retail channels. Trusted recommendations from store associates and real-time product comparisons influence buying decisions. Additionally, offline channels offer exclusive salon-grade products and bundled services. While online sales are growing, in-store promotions and curated shopping experiences help maintain the strong performance of offline retail.

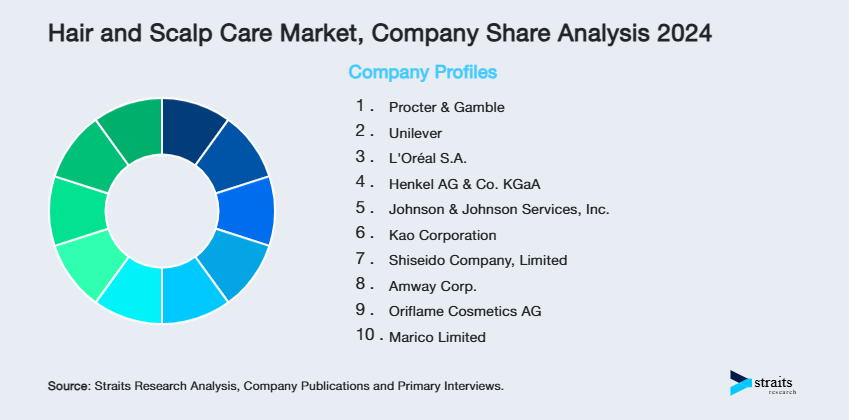

Company Market Share

Companies in the global market are focusing on expanding their portfolios with natural, dermatologically tested, and scientifically backed formulations. They are investing in R&D to develop personalized solutions and scalp-focused treatments. To enhance visibility and consumer trust, firms are leveraging digital marketing, influencer collaborations, and AI-driven tools. Additionally, many are prioritizing sustainability through eco-friendly packaging and ethical sourcing to align with evolving consumer preferences.

L’Oréal S.A.: L’Oréal S.A. is a global leader in this market, renowned for its diverse portfolio of brands such as L’Oréal Paris, Kérastase, Redken, and Matrix. The company invests heavily in R&D, with dedicated research centers developing innovative solutions for hair loss, scalp health, and color treatments. L’Oréal has strengthened its market position through acquisitions and digital initiatives, catering to both mass and premium segments across global markets, particularly in Europe, North America, and Asia-Pacific.

- In June 2025, L’Oréal acquired premium haircare brand Color Wow to strengthen its presence in the high-growth, luxury hair segment. This strategic move enhances L’Oréal’s portfolio with innovative, celebrity-endorsed products targeting frizz control and color-treated hair, reinforcing its leadership in the global market.

List of Key and Emerging Players in Hair and Scalp Care Market

- Procter & Gamble

- Unilever

- L'Oréal S.A.

- Henkel AG & Co. KGaA

- Johnson & Johnson Services, Inc.

- Kao Corporation

- Shiseido Company, Limited

- Amway Corp.

- Oriflame Cosmetics AG

- Marico Limited

to learn more about this report Download Market Share

Recent Developments

- August 2025- Jennifer Aniston’s LolaVie launched Powder Perfect Dry Shampoo, a talc-free, aerosol-free formula designed to absorb oil, add volume, and refresh hair instantly. The product reflects the brand’s clean beauty ethos and multitasking approach, offering consumers a high-performance solution for scalp care and hair styling in one convenient application.

- July 2025- Shakira launched her haircare brand Isima at Ulta Beauty, introducing an eight-product line focusing on scalp health, hydration, and damage repair. Inspired by her personal hair journey, the collection includes serums, masks, and shampoos designed for all hair types, highlighting the growing trend of celebrity-driven, science-backed hair and scalp care solutions.

- April 2025- Unilever launched the CLEAR Scalpceuticals PRO range, a premium anti-dandruff line formulated with lab-proven technology. Targeting oil control, flake reduction, and scalp sensitivity, the range reflects over 50 years of research. The product line debuted in Shanghai, marking a strategic step toward addressing scalp health with advanced dermatological solutions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 103.15 Billion |

| Market Size in 2025 | USD 109.48 Billion |

| Market Size in 2033 | USD 176.35 Billion |

| CAGR | 6.14% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Gender, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Hair and Scalp Care Market Segments

By Product Type

- Shampoo

- Conditioner

- Hair Oils & Serums

- Hair Masks & Treatments

- Scalp Treatments & Exfoliants

- Hair Colorants & Dyes

- Others

By Gender

- Male

- Female

- Unisex

By Application

- Hair Loss / Thinning

- Dandruff & Scalp Irritation

- Dry & Damaged Hair

- Oily Hair & Scalp

- Color-treated Hair

- Anti-aging (Greying Hair & Scalp Rejuvenation)

- Others

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.