High End Lighting Market Size, Share & Trends Analysis Report By Light Source Type (LED, HID, Fluorescent Light, Others), By Interior Design (Modern, Traditional, Transitional), By Application (Wired, Wireless), By End Use (Commercial, Industrial, Residential, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

High End Lighting Market Overview

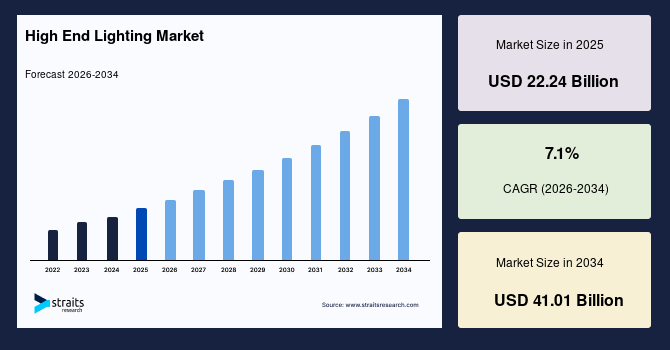

The global high-end lighting market size is valued at USD 22.24 billion in 2025 and is estimated to reach USD 41.01 billion by 2034, growing at a CAGR of 7.1% during the forecast period. The consistent growth of the market is supported by the increasing adoption of energy-efficient LED and smart lighting systems, rising demand for modern and luxury interior designs, and technological advancements that enhance illumination quality, aesthetic appeal, and sustainability across commercial, residential, and industrial applications.

Key Market Trends & Insights

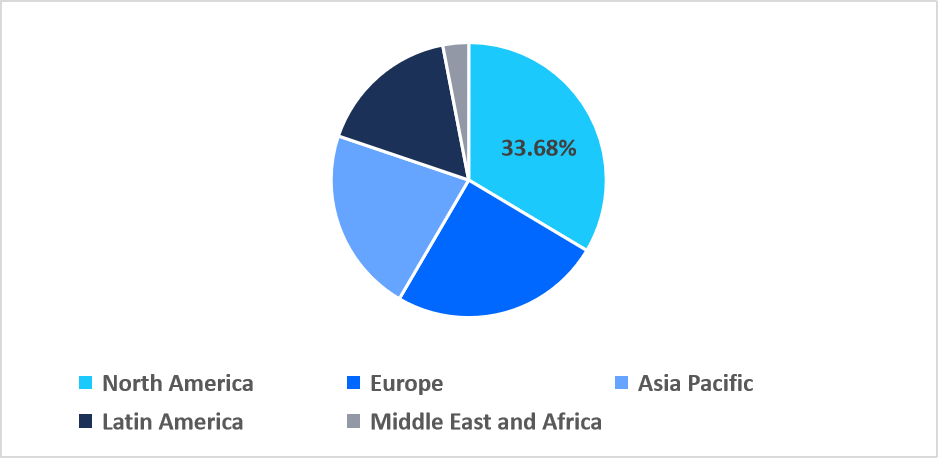

- North America dominated the market with a revenue share of 33.68% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 9.84% during the forecast period.

- Based on light source type, the LED segment held the highest market share of 62.47% in 2025.

- By interior design, the Modern segment is estimated to register the fastest CAGR growth of 8.15% during forecast period.

- Based on application, the Wireless segment dominated the market in 2025.

- By end use, the Commercial segment is projected to grow at a CAGR of 7.6% during the forecast period.

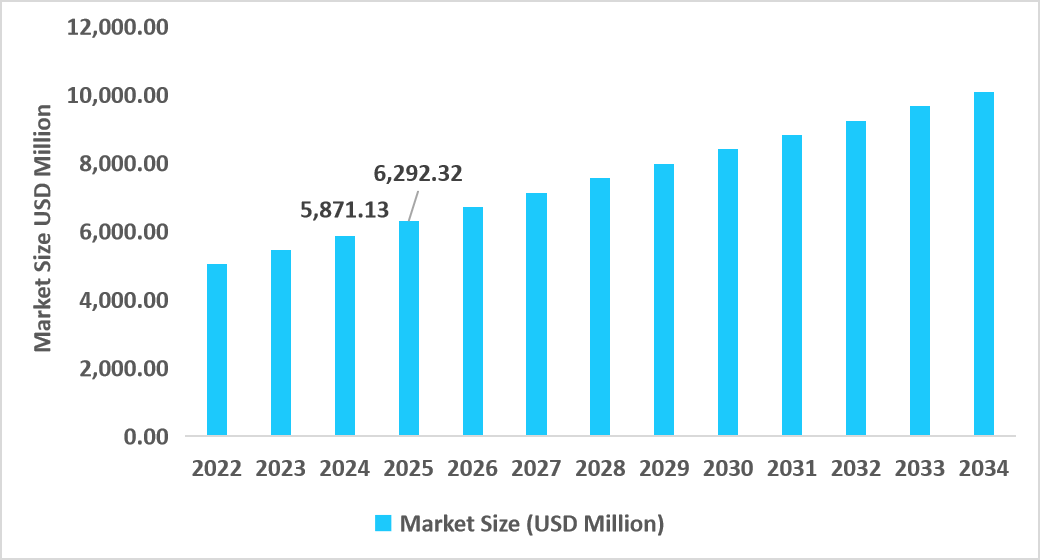

- The United States dominates the high-end lighting market, valued at USD 5.87 billion in 2024 and projected to reach USD 6.29 billion in 2025.

Table: U.S High End Lighting Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 22.24 billion

- 2034 Projected Market Size: USD 41.01billion

- CAGR (2026-2034): 7.1%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global high end lighting market comprises a broad spectrum of high-end illumination solutions, including LED, HID, fluorescent, and other cutting-edge light sources intended to provide unparalleled brightness, energy conservation, and décor value. The light systems are incorporated within diverse design genres such as contemporary, classic, and transitional interiors, custom-designed to promote visual comfort and architectural atmosphere. In addition, luxury lighting is installed in wired and wireless configurations, backed by intelligent control technologies and automation systems. Solutions address varied end-use market sectors such as commercial, industrial, residential, and specialty applications, offering sustainable, technology-based lighting that marries functionality and luxury in global markets.

Latest Market Trends

Transformation Towards Smart and Intelligent Lighting Systems

Premium lighting solutions are gradually shifting from independent units to holistic, networked systems that utilize IoT-capable controls, wireless communication, and intelligent automation. Older lighting arrangements used to be operated manually and had no energy optimization, which resulted in increased operational expenditure and poor flexibility. Contemporary premium lighting platforms support remote operation, scheduled programming, and instant monitoring using mobile applications and building management systems. Governing deployments in commercial spaces, high-end hotels, and intelligent residential environments have shown how networked lighting improves energy savings, user experience, and ambiance control. Early adopters indicate substantial energy consumption reductions, enhanced light quality, and increased user satisfaction, pointing toward a widespread industry shift towards intelligent, technology-enabled illumination products.

Increased use of LED and Energy-Saving Lighting

The premium lighting market is experiencing widespread adoption of LED and sophisticated light sources because of their long lifespan, better energy efficiency, and the capacity to provide high-quality illumination. LED penetration has progressed from niche uses to broad commercial, industrial, and residential use over the last ten years. It is fueled by higher sustainability requirements, corporate energy efficiency goals, and greater recognition of total cost of ownership advantages. Innovative LED solutions also provide adjustability of color temperatures, dim lighting , and smart control integration, making it possible to customize lighting. Such broad acceptance is transforming the market, creating replacement cycles for conventional fixtures, and making high-end lighting a prime driver of energy-efficient and design-sophisticated built spaces across the globe.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 22.24 Billion |

| Estimated 2026 Value | USD 23.82 Billion |

| Projected 2034 Value | USD 41.01 Billion |

| CAGR (2026-2034) | 7.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Signify Holding, Acuity Brands, Inc., Cree Lighting, OSRAM GmbH, Samsung Electronics |

to learn more about this report Download Free Sample Report

Market Drivers

Sustainability Laws and State Incentives Driving Adoption

The high-end lighting business is being strongly fueled by policy programs for energy efficiency and green building promoted by governments. Tax rebates, energy performance standards, and green building certifications are triggering the residential, industrial, and commercial markets to switch to superior light solutions. For instance, energy efficiency codes in Europe and North America require buildings to meet high levels of lighting efficiency, which has driven the use of LED and intelligent lighting. Similarly, programs under the United States Department of Energy's Energy Star and the European Union's Ecodesign Directive provide money savings and awards for embracing energy-efficient lighting solutions. These regulatory frameworks not only reduce operation costs for end-users but also enhance environmental sustainability and make a powerful growth driver for high-end lighting manufacturers and system integrators globally.

Market Restraints

Regulatory Complexities of the Government and Certification Issues Discourage Market Growth

The primary restraint in the high-end lighting industry is the intricate and disjointed regulatory standards across geographies, which present barriers in product approvals and market launches. Various countries have stringent compliance with safety, electromagnetic compatibility, and environmental issues like UL, CE, RoHS, and IEC standards. For instance, in America, lighting devices have to pass stringent tests for safety and efficiency under the National Electrical Code (NEC) and Energy Star programs before they can be introduced into the market. The European Union likewise has the Ecodesign and CE marking directives requirements. Survival of these controls entails comprehensive testing, documentation, and certification procedures, which slow down product launches, drive up administrative costs, and restrict market access, particularly for small to medium-sized lighting manufacturers targeting different international markets.

Market Opportunities

Growing Demand for Personalized and Experience-Based Lighting in High-End Commercial Environments

A growing opportunity within the high-end lighting sector is the increasing demand for customized and experiential lighting solutions in high-end commercial settings like flagship store spaces, hotels, casinos, and entertainment facilities. Governments and local governments in major markets are investing in urban development policies that advance tourism and upscale commercial infrastructure, indirectly stimulating the usage of advanced lighting designs that promote higher brand experiences. This trend enables lighting companies and designers to provide extremely tailored solutions, creating a premium revenue segment and positioning high-end lighting as a key differentiator in experiential commercial spaces.

Regional Analysis

North America was leading the market in 2025 with 33.68% market share. This is due to the extensive use of green building codes and sustainable urban development projects, which promote the use of energy-efficient, aesthetically superior high-end lighting systems. Also, cooperative efforts between public authorities and private developers for upgrading commercial as well as public infrastructure with smart and connected lighting solutions are increasing the use of such smart and connected lighting solutions. These points together fuel the demand for high-end lighting solutions in offices, upscale retail, hotels, and public areas in the region.

Development of the high-end American lighting market is fueled by efforts to upgrade public and private infrastructure with high-end lighting solutions. For example, some state programs now require daylight-responsive and occupancy sensor-controlled lighting in commercial and institutional facilities, while maintaining design standards but ensuring energy efficiency. These rules, in addition to growing investments in high-profile business developments like flagship shopping centers and high-end hotels, continue to increase demand for high-end advanced lighting solutions, driving the nation's market growth.

Asia Pacific Market Insights

Asia Pacific is surfacing as the highest-growing market with a CAGR of 9.84% during 2026–2034 due to increased urbanization, government-sponsored smart city projects, and increasing adoption of luxury residential and commercial projects in China, Japan, India, and South Korea. Energy-efficient policies, urbanization, and high-end building design are driving the installation of luxury lighting solutions. The increasing emphasis on commercial real estate development, hospitality growth, and infrastructure improvement within metropolitan cities is further driving the usage of advanced lighting systems in the country.

India's high end lighting market is growing strongly with urban infrastructure and high-end real estate developments. Luxury residential complex builders and five-star hoteliers are including more customizable, design-oriented lighting solutions into their properties for ambiance and energy efficiency. Urban renewal initiatives in large cities, supported by the government, further push the adoption of high-end lighting in public areas, making India an important growth center in the Asia Pacific high-end lighting industry.

Regional Market share (%) in 2025

Source: Straits Research

Europe High-End Lighting Market Insights

Europe is seeing steady growth in high end lighting owing to growing take-up of energy-saving standards and upscale architectural lighting in commercial and residential developments. Governments and urban councils are stimulating the installation of traditional lighting with high-end, sustainable alternatives through schemes for urban renewal and incentives for integration into smart buildings. Joint initiatives of private developers and lighting solution manufacturers are accelerating even more deployment of new lighting designs that bring improvement in both aesthetics as well as functionality for offices, hotels, and public places.

Germany's high end lighting market is driven by strict building codes favoring sustainable building and aesthetic superiority. Initiatives favoring adaptive lighting integration, daylight harvesting, and smart control systems in commercial and institutional facilities are stimulating demand for advanced lighting solutions. Top-tier construction developments in Berlin and Munich are increasingly embracing customizable high-end lighting to optimize occupant satisfaction, energy efficiency, and architectural beauty, fostering high growth rates in the market.

Latin America Market Insights

The Latin American high end lighting market is expanding as a result of rising investments in upscale commercial building construction and smart city initiatives across nations like Brazil, Mexico, and Chile. Urban development initiatives for energy-saving lighting installations in airports, hotels, and business offices are driving premium lighting solution adoption. In addition, global partnerships for green lighting initiatives are facilitating knowledge sharing and technology assimilation, aiding market growth.

The market in Brazil is growing as upscale commercial and hospitality developments increasingly incorporate high-end lighting installations. Builders are equipping their developments with efficient, aesthetic-oriented lighting systems for greater beauty and improved functionality. Government-sponsored urban redevelopment projects in Rio de Janeiro and São Paulo are also fuelling contemporary light solutions in urban areas, enhancing overall market usage and making Brazil a leading growth center throughout Latin America.

Middle East and Africa Market Insights

Middle East and Africa's premium lighting market is growing as governments and private developers are investing in city landmarks, hospitality, and commercial projects. UAE, Saudi Arabia, and South Africa's large-scale development are driving the need for smart, high-end lighting to accentuate architectural splendor and achieve sustainability goals. Configurable and smart lighting solutions are increasingly sought by luxury hotels, commercial high-rise buildings, and city centers, driving growth throughout the region.

The Egyptian high-end lighting industry is expanding with the government encouraging public facilities such as cultural monuments, airports, and business centers to modernize. Environmentally friendly city lighting and solutions-based projects for energy efficiency are offering scope to high-end lighting manufacturers. Coupled with increasing awareness towards design-oriented and technology-based lights for luxury homes and offices, it is driving market adoption throughout the country.

Light Source Type Insights

The LED segment dominated the market with a revenue share of 62.47% during 2025. The growth is driven by the increasing application of energy-efficient and long-lifespan lighting products in residential, commercial, and industrial uses.

HID segment is expected to see the highest growth, with a CAGR of approximately 8.25% throughout the projection period. High growth is driven by demand in industrial, large commercial, and outdoor uses where intense lighting is needed.

By Light Source Type Market Share (%), 2025

Source: Straits Research

Interior Design Insights

The transitional segment dominated the market with a revenue market share of 48.53% in 2025. Resilient growth is fostered by growing demand in areas that combine heritage and modern elements, where adaptive lighting solutions are required to enable mixed style designs.

The Modern segment is anticipated to witness maximum growth, with a projected CAGR of 8.12% during the forecast period. The reason behind this growth is the growing popularity of modern style in residential, commercial, and hospitality environments.

Application Insights

Wireless segment led the market in 2025 with a revenue share of 53.21%, as wireless high-end lighting solutions provide interoperable connection to smart building systems, remote controls, and automation through IoT capabilities.

The Wired segment is also expected to achieve the most rapid growth through the forecast period. Its growth is motivated by mass-market commercial and industrial applications where high-performance, reliable wired lighting systems are necessary for safety, regulatory compliance, and operational effectiveness.

End Use Insights

The Commercial segment is anticipated to witness the highest growth of 7.6% as high-quality, energy-efficient lighting solutions gain popularity in offices, hotels, retail buildings, and other high-visibility commercial spaces. As companies focus on customer experience, employee productivity, and brand reputation, they are spending on high-end lighting systems that offer enhanced light quality, smart controls, and custom designs, which in turn results in aggressive adoption in this segment.

Competitive Landscape

The global high-end lighting market is fairly diversified, with some well-established producers, high-end lighting solution providers, and leading-edge technology companies. Several leading players enjoy a substantial market share in their huge product lists, design expertise, and bundled lighting solutions that are suitable for commercial, industrial, and residential sectors.

The key market players are Acuity Inc., Cree Lighting USA LLC., Samsung Electronics, and others. These market players are vying to consolidate their market share through the introduction of new high-end lighting solutions, strategic alliances, mergers and acquisitions, and forays into smart and connected lighting systems.

Balmuda: An emerging market player

Balmuda, a Japanese design firm admired for its minimalist design and forward-thinking engineering, has entered the premium lighting sector with the launch of the "Sailing Lantern." This limited production portable lighting device fuses poetic design and advanced LED technology, showcasing Balmuda's focus on merging form and function.

- In October 2025, Balmuda, in partnership with design company LoveFrom by Jony Ive, introduced the "Sailing Lantern." It costs $4,800 and is available in only 1,000 units. Designed in honor of Ive's lifelong love of sailing, it is a stainless steel-wrapped, polished, textured glass module that produces light that imitates actual flames from red softness to white-blue, mirroring the dynamics of real fire.

With this forward-thinking product, Balmuda is positioning itself as a player of merit within the high-end lighting category, one that would attract consumers who look for both form and function in their light sources.

List of Key and Emerging Players in High End Lighting Market

- Signify Holding

- Acuity Brands, Inc.

- Cree Lighting

- OSRAM GmbH

- Samsung Electronics

- Seoul Semiconductor Co., Ltd.

- Zumtobel Group AG

- Hubbell Lighting, Inc.

- GE Current

- Eaton Lighting

- Lutron Electronics Co., Inc.

- Panasonic Corporation

- LG Innotek Co., Ltd.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Everlight Electronics Co., Ltd.

- Opple Lighting Co., Ltd.

- Havells India Ltd.

- Delta Light N.V.

- Lumileds Holding B.V.

- Others

Strategic initiatives

- May 2025: Pinnacle Lighting introduced the Fina Acoustic DRUM, a lighting product combining high-output illumination with sound absorption capabilities, designed specifically for modern architectural spaces requiring both lighting and acoustic solutions. The product offers configurable illumination options with exceptional design appeal.

- August 2025: TJ2 Lighting, a rising Taiwanese LED manufacturer, expanded its LED panel product line with the launch of a new ultra-thin high-output LED flat panel series delivering up to 150 lumens per watt efficiency. This product targets commercial office spaces and smart building applications with promising energy savings.

- November 2024: Samsung Electronics launched its Outdoor LED Signage XHB Series (P8) at the Shinsegae Department Store in South Korea. This expansive 8K anamorphic display wraps around the building’s exterior, spanning 71.8 meters in width and 17.9 meters in height, roughly the size of three basketball courts.

- June 2024: Signify announced the launch of NatureConnect, an industry-first indoor lighting product designed to mimic natural sunlight variations and enhance well-being by improving circadian rhythm and sleep quality. This innovative lighting technology targets commercial and residential sectors, aiming to create healthier indoor environments.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 22.24 Billion |

| Market Size in 2026 | USD 23.82 Billion |

| Market Size in 2034 | USD 41.01 Billion |

| CAGR | 7.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Light Source Type, By Interior Design, By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

High End Lighting Market Segments

By Light Source Type

- LED

- HID

- Fluorescent Light

- Others

By Interior Design

- Modern

- Traditional

- Transitional

By Application

- Wired

- Wireless

By End Use

- Commercial

- Industrial

- Residential

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.