High Voltage Direct Current (HVDC) Capacitor Market Size, Share & Trends Analysis Report By Product Type (Aluminium Electrolytic Capacitors, Film Capacitors (Polypropylene, Polyester), Ceramic Capacitors, Hybrid Capacitors), By Application (HVDC Transmission Converter Stations, Renewable Energy Integration (Wind, Solar), Reactive Power Compensation & Voltage Stabilization, Power Filtering & Harmonics Mitigation), By End-User (Utilities / Power Generation Companies, Independent Power Producers (IPPs), Industrial & Heavy Manufacturing, Infrastructure Developers / EPC Contractors) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

High Voltage Direct Current (HVDC) Capacitor Market Overview

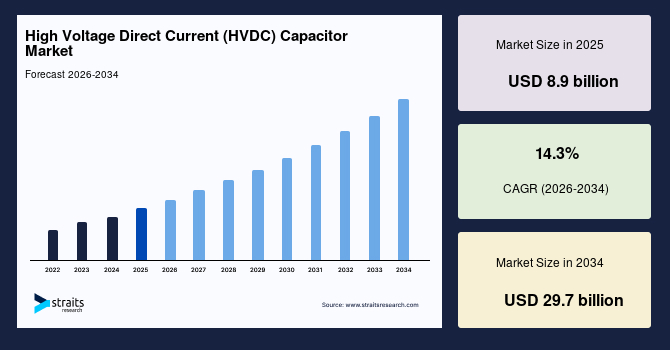

The global high voltage direct current (HVDC) capacitor market size is valued at USD 8.9 billion in 2025 and is projected to reach USD 29.7 billion by 2034, growing at a CAGR of 14.3% during the forecast period. The market is driven by accelerating investment in long‑distance power transmission infrastructure, increased deployment of renewable energy systems, and initiatives to modernise ageing electricity grids across major economies.

Key Market Trends & Insights

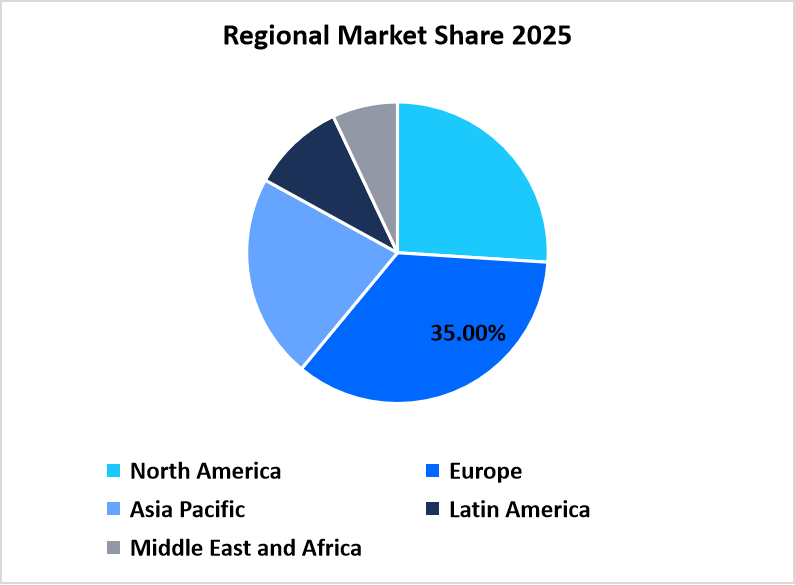

- Europe dominated the market with a revenue share of 35% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 16.2% during the forecast period.

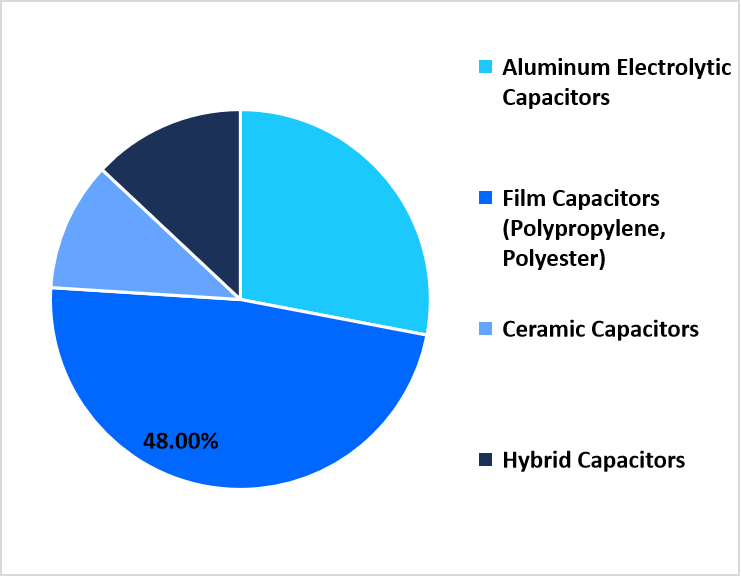

- Based on Product Type, the Film Capacitorssegment held the highest market share of 48% in 2025.

- By Application, the Renewable Energy Integrationsegment is estimated to register the fastest CAGR growth of 16.2%.

- Based on End User, the Utilities or Power Generation Companiescategory dominated the market in 2025 with a revenue share of 50%.

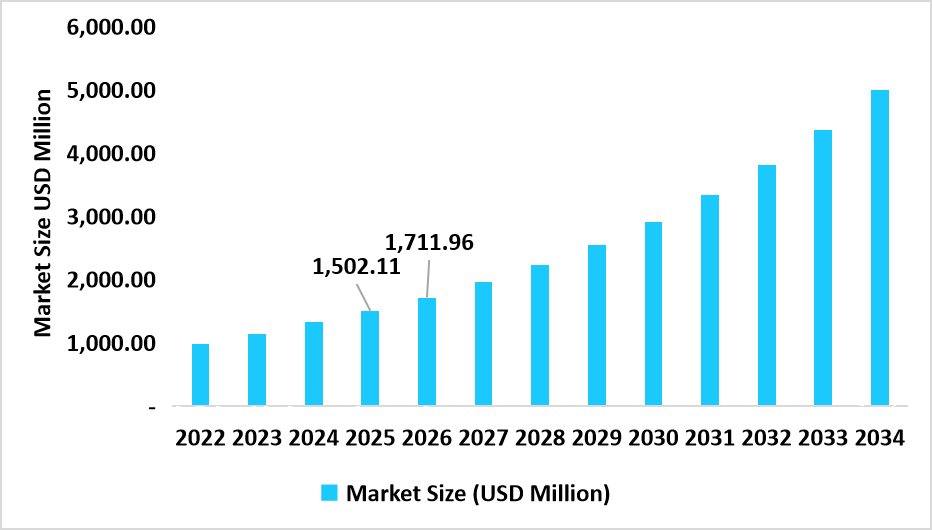

- Germany dominates the market, valued at USD 1,502.11 million in 2025 and reaching USD 1,711.96 million in 2026.

Germany HVDC Capacitor Market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 8.9 billion

- 2034 Projected Market Size: USD 29.7 billion

- CAGR (2026-2034): 14.3%

- Dominating Region: Europe

- Fastest-Growing Region: Asia Pacific

The global HVDC capacitor market encompasses capacitors specifically designed for high-voltage direct current transmission systems, including plastic film capacitors, ceramic capacitors, aluminium electrolytic capacitors, and other advanced high-voltage designs utilised in converter stations, reactive power compensation, voltage stabilisation, and power filtering applications. These components are crucial in HVDC converter stations, grid interconnection projects, and renewable energy integration systems, ensuring efficient power flow, minimising transmission losses, and enhancing system stability. The market growth is supported by the increasing integration of renewable energy, the expansion of cross-border transmission links, and innovation in high-performance capacitor designs that offer improved durability and efficiency under extreme electrical conditions.

Latest Market Trends

Renewable Energy Integration and HVDC Adoption

The integration of renewable energy into power grids is a major trend driving demand for HVDC transmission systems and associated capacitors. Offshore wind farms and large solar projects are often located far from consumption centres, requiring efficient long-distance power transmission with minimal losses. HVDC systems offer superior efficiency compared to conventional AC transmission, making them a vital component in modern grid development. Capacitors within HVDC systems support voltage stabilisation, reactive power control, and harmonic filtering, ensuring grid reliability under variable renewable generation. As utilities prioritise renewable integration and grid stability, demand for high-performance HVDC capacitors continues to rise, supporting steady market expansion.

Technological Innovation in Capacitor Design

Technological innovation is reshaping the HVDC capacitor market, with manufacturers focusing on improved performance, durability, and compact design. Advances in dielectric materials, polymer films, and electrode structures have enabled capacitors with higher voltage ratings, greater energy density, and improved resistance to thermal and electrical stress. Modular and space-efficient designs are increasingly adopted to meet the requirements of modern HVDC converter stations. Continuous product development allows capacitors to perform effectively under demanding grid conditions, expanding their applicability across evolving transmission and energy infrastructure projects.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 8.9 billion |

| Estimated 2026 Value | USD 10.2 billion |

| Projected 2034 Value | USD 29.7 billion |

| CAGR (2026-2034) | 14.3% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | ABB Ltd., Siemens Energy, General Electric (GE Grid Solutions), Mitsubishi Electric Corporation, Hitachi Energy |

to learn more about this report Download Free Sample Report

Market Drivers

Expansion of HVDC Transmission Infrastructure

The ongoing expansion of HVDC transmission networks is a primary driver of the HVDC capacitor market. Utilities are increasingly deploying HVDC systems to connect remote renewable generation sites, support cross-border power exchange, and improve grid reliability. HVDC technology is particularly advantageous for long-distance and submarine transmission, where energy losses are significantly lower than those of AC systems. Capacitors play a critical role in voltage control, reactive compensation, and filtering within these networks. Continued investment in transmission infrastructure directly increases demand for high-voltage capacitors, reinforcing their importance in modern power systems and supporting long-term market growth.

Regulatory Support for Grid Modernisation and Decarbonization

Government policies promoting grid modernization and decarbonization strongly support the HVDC capacitor market. Many countries have introduced regulations and incentives to expand renewable energy capacity, reduce carbon emissions, and upgrade ageing transmission infrastructure. Regulatory support encourages utilities to invest in advanced grid technologies and high-performance components, including HVDC capacitors. Alignment between public policy goals and infrastructure development creates a stable investment environment, sustaining demand for capacitors that meet evolving performance and environmental standards.

Market Restraint

High Capital and Installation Costs

High capital expenditure remains a key restraint for the HVDC capacitor market. HVDC systems require substantial upfront investment in converter stations, transmission equipment, and specialised components. High-performance capacitors designed for extreme voltage and environmental conditions further increase project costs. These financial barriers can delay project approvals, particularly in cost-sensitive or developing regions. Utilities may prioritise alternative grid solutions when budgets are limited. While long-term operational benefits are significant, high initial costs continue to restrict faster market penetration and can slow short-term growth in certain regions.

Market Opportunity

Growing Demand in Emerging Market

Emerging economies present strong growth opportunities for the HVDC capacitor market as they expand electricity access and invest in renewable energy infrastructure. Rapid urbanisation and industrial growth are increasing the need for efficient long-distance power transmission. HVDC systems are increasingly adopted to connect distant generation sources with growing urban demand. These markets offer opportunities for capacitor manufacturers to provide cost-effective, reliable solutions tailored to local grid conditions. Establishing regional partnerships and localised production can further enhance competitiveness. Expansion into emerging markets supports geographic diversification and long-term revenue growth.

Regional Analysis

Europe dominated the market in 2025, accounting for a 35% market share, supported by well-established HVDC infrastructure, early adoption of renewable energy sources, and strong grid interconnection initiatives. Countries in Europe have been pioneers in deploying long-distance and cross-border HVDC transmission systems, particularly for offshore wind farms and hydroelectric power integration. The region benefits from stringent regulatory frameworks that promote energy efficiency, decarbonization, and the modernisation of ageing grids, which drives consistent demand for reliable, high-performance HVDC capacitors. European utilities prioritise longevity and low-maintenance solutions, making the market favourable for advanced film and aluminium electrolytic capacitor technologies.

- Germany leads the European HVDC capacitor market due to its large-scale renewable energy projects, particularly offshore wind and hydroelectric integrations. Utilities and transmission operators in Germany have invested heavily in modern HVDC links that connect generation sites to industrial and urban load centres. The country’s robust regulatory environment, coupled with high technological standards and a culture of energy innovation, sustains strong adoption of high-voltage capacitors in both public and private transmission projects.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 16.2% from 2026-2034. Rapid industrialisation, urbanisation, and increasing electricity demand are driving investments in large-scale transmission infrastructure and the integration of renewable energy. Governments in the region, particularly in China and India, are expanding HVDC networks to enhance grid reliability and connect remote power generation sites to urban centres. The increasing adoption of offshore wind and solar power projects has further accelerated the demand for high-performance capacitors that can efficiently handle long-distance, high-voltage transmission.

- China serves as the principal growth engine for HVDC capacitors in the Asia Pacific due to massive investments in long-distance HVDC links connecting hydroelectric and solar generation to industrial and urban load centres. Regional transmission projects emphasise the integration of renewable energy, reliability, and efficiency, thereby boosting demand for high-voltage capacitors. China’s combination of scale, regulatory support, and technological focus makes it the largest national market in the region.

Source: Straits Research

North America HVDC Capacitor Market Insights

North America accounts for a significant share of the global HVDC capacitor market in 2025, driven by mature transmission infrastructure, high renewable energy penetration, and modernisation initiatives in the United States and Canada. Utilities are increasingly upgrading legacy AC grids with HVDC systems to reduce transmission losses and integrate renewable generation from remote regions. North American projects also emphasise reliability, efficiency, and long-term cost savings, supporting the adoption of durable, high-performance HVDC capacitors.

- The U.S. leads North America in HVDC capacitor demand due to a combination of high electricity consumption, renewable energy integration, and extensive transmission modernisation programs. Utilities and independent power producers invest in high-voltage capacitors for HVDC converter stations and long-distance links connecting remote generation to metropolitan areas. Advanced capacitor technologies and direct-to-utility sales models ensure supply reliability and meet the high technical standards required by U.S. grid operators.

Latin America Market Insights

Latin America represents a developing market with steady growth potential. Investment in HVDC systems is increasing to support long-distance transmission of energy from hydroelectric, solar, and wind resources to urban demand centres. Regional grid modernisation programs, combined with growing electricity demand and cross-border interconnections, underpin demand for high-voltage capacitors. While the infrastructure is less mature than in Europe or North America, the increasing integration of renewable energy creates a positive outlook for market expansion.

- Brazil is the leading Latin American country for HVDC capacitors, driven by its extensive hydroelectric resources and long-distance transmission requirements. HVDC links are crucial for transmitting electricity from remote dams to industrial and urban centers. Government initiatives to modernise the grid and integrate renewable energy sources create demand for capacitors with high reliability and long service life. Brazilian utilities are increasingly adopting both imported and locally manufactured capacitors to meet growing infrastructure needs.

Middle East and Africa Market Insights

Middle East and Africa is a smaller but strategically significant region for HVDC capacitors. The region is investing in HVDC systems to connect renewable energy projects, particularly solar and wind farms, to industrial and urban centres. High-voltage capacitors are essential for stabilising voltage, managing reactive power, and filtering harmonics in these expanding transmission networks. Wealthier Gulf nations with high electricity demand, as well as emerging urban centres in Africa, are increasingly adopting HVDC technology for reliable long-distance transmission.

- The UAE leads the MEA HVDC capacitor market, focusing on renewable energy and grid expansion projects. Capacitors are integrated into HVDC converter stations connecting solar and wind farms to urban areas and industrial hubs. Strong government initiatives, investment in smart grid technologies, and high per-capita electricity consumption support steady market growth. The UAE’s position as a regional energy hub also attracts technology providers and international suppliers, driving adoption of advanced HVDC capacitor solutions.

Product Type Insights

Film Capacitors dominated the market with a revenue share of 48% in 2025, driven by their excellent electrical performance, high reliability, and long operational life. These capacitors are widely used in HVDC transmission lines for voltage stabilisation, reactive power compensation, and harmonic filtering. The rise in cross-border transmission projects, offshore wind farm connections, and large solar PV integrations has further accelerated the adoption of film capacitors. Their robustness and low maintenance requirements ensure long-term reliability, solidifying their position as the leading product type.

Aluminium Electrolytic Capacitors are the fastest-growing segment, expected to record a CAGR of 15.2% from 2025 to 2034. They are favoured for applications requiring compact designs and cost-effective solutions, particularly in renewable energy integration and industrial HVDC projects. The increasing demand from developing markets for affordable HVDC solutions, combined with the ease of deployment and shorter lead times, is fueling the rapid growth of aluminium electrolytic capacitors. Their balance of efficiency, cost, and availability supports their increasing adoption across emerging power grids.

By Product Type Market Share (%), 2025

Source: Straits Research

Application Insights

HVDC Transmission Converter Stations are the dominant application, contributing approximately 45% of total revenue in 2025. The global expansion of HVDC projects connecting remote power generation sites to urban centres, coupled with international interconnection initiatives, underpins strong demand in this segment. Utilities prioritise capacitors that provide long-term reliability and minimal maintenance, as failures can disrupt high-capacity transmission networks. The segment’s dominance is reinforced by ongoing upgrades in legacy AC systems and increasing investment in cross-border power infrastructure.

Renewable Energy Integration represents the fastest-growing application with a CAGR of 16.0%, fueled by the surge in offshore wind, large-scale solar, and hybrid renewable projects. HVDC capacitors stabilise voltage and manage reactive power in long-distance power transfer from remote generation sites to consumption hubs. As renewable energy penetration increases, the demand for capacitors that support reliable, low-loss transmission rises, driving technological improvements and expanding market reach.

End-User Insights

Utilities and power generation companies are the largest end-users, accounting for 50% of the market share in 2025. They deploy capacitors in HVDC converter stations, substations, and grid stabilisation projects. Utilities focus on proven, high-reliability components to minimise operational downtime and ensure compliance with stringent grid codes. Long-term planning of HVDC infrastructure and consistent government funding for transmission modernisation secure steady demand from this segment.

Independent Power Producers (IPPs) are the fastest-growing end-user segment, projected to grow at a CAGR of 15.5%. As IPPs expand renewable energy portfolios, they increasingly invest in HVDC links to transmit generated power efficiently to urban load centers. The combination of aggressive renewable adoption, competitive tariffs, and the need for low-loss transmission infrastructure drives this segment’s rapid expansion. Flexible procurement and cost-optimised capacitors are preferred to balance performance and budget constraints.

Competitive Landscape

The HVDC Capacitor Market is moderately fragmented, characterised by a mix of legacy leaders, diversified global manufacturers, and emerging technology-focused players. Established companies have dominated the market for decades through significant R&D investments, proven reliability in large-scale HVDC projects, and long-term client relationships with utilities and renewable energy developers. Mid-tier manufacturers and new entrants compete by offering cost-efficient solutions, rapid deployment capabilities, and technology innovations such as higher voltage ratings, compact designs, and improved thermal management.

ABB Ltd.: A Heritage Innovator

ABB Ltd., a global leader in electrical transmission solutions, has been a dominant player in HVDC capacitors for decades, supplying components for converter stations and long-distance transmission networks. The company leverages deep R&D expertise, engineering precision, and global project experience to deliver high-performance film and electrolytic capacitors tailored to utility and industrial clients. ABB’s capacitors appeal to large-scale utilities and independent power producers seeking reliable, long-lasting solutions for HVDC and renewable integration projects.

List of Key and Emerging Players in High Voltage Direct Current (HVDC) Capacitor Market

- ABB Ltd.

- Siemens Energy

- General Electric (GE Grid Solutions)

- Mitsubishi Electric Corporation

- Hitachi Energy

- Eaton Corporation

- Fuji Electric

- Schneider Electric

- TDK Corporation

- Vishay Intertechnology

- Panasonic Corporation

- KEMET Electronics

- Nippon Chemi-Con

- Jiangsu Changjiang Electronics Technology (CET)

- EPCOS (TDK Group)

- Nexans

- CDE Global

- Maxwell Technologies

- Samwha Capacitor Group

- Sunlord Electronics

Strategic Initiatives

- December 2025 - GE Vernova, in a consortium with Seatrium, was awarded a contract by TenneT for the BalWin5 2.2 GW HVDC link. GE will provide the complete HVDC technology, which includes large-scale capacitor banks for the onshore and offshore converter stations.

- October 2025 - At the OCP Global Summit, Delta unveiled a new HVDC Power Capacitance Shelf (PCS) using lithium-ion capacitors (LIC). This system is designed to "smooth" the load reflections of next-gen GPUs in AI data centres, bridging the gap between standard capacitors and battery storage.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 8.9 billion |

| Market Size in 2026 | USD 10.2 billion |

| Market Size in 2034 | USD 29.7 billion |

| CAGR | 14.3% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

High Voltage Direct Current (HVDC) Capacitor Market Segments

By Product Type

- Aluminium Electrolytic Capacitors

- Film Capacitors (Polypropylene, Polyester)

- Ceramic Capacitors

- Hybrid Capacitors

By Application

- HVDC Transmission Converter Stations

- Renewable Energy Integration (Wind, Solar)

- Reactive Power Compensation & Voltage Stabilization

- Power Filtering & Harmonics Mitigation

By End-User

- Utilities / Power Generation Companies

- Independent Power Producers (IPPs)

- Industrial & Heavy Manufacturing

- Infrastructure Developers / EPC Contractors

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.