In Vitro Diagnostics Market Overview

The global in vitro diagnostics market size was estimated at USD 84.99 billion in 2025 and is anticipated to grow from USD 90.51 billion in 2026 till USD 138.98 billion in 2034, growing at a CAGR of 6.35% from 2026-2034. The growth is driven by the increasing emphasis on early and accurate disease diagnosis as well as advancements in molecular diagnostics that further fuel market expansion.

Key Market Trends & Insights

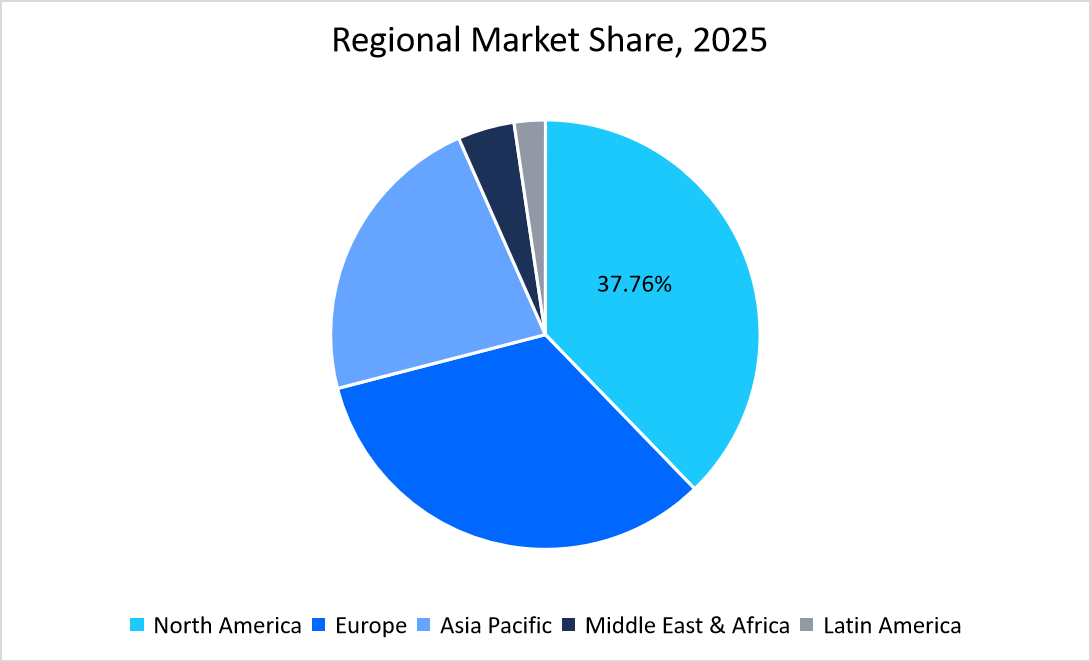

- North America held a dominant share of the global in vitro diagnostics industry, accounting for 37.76% share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 8.37.

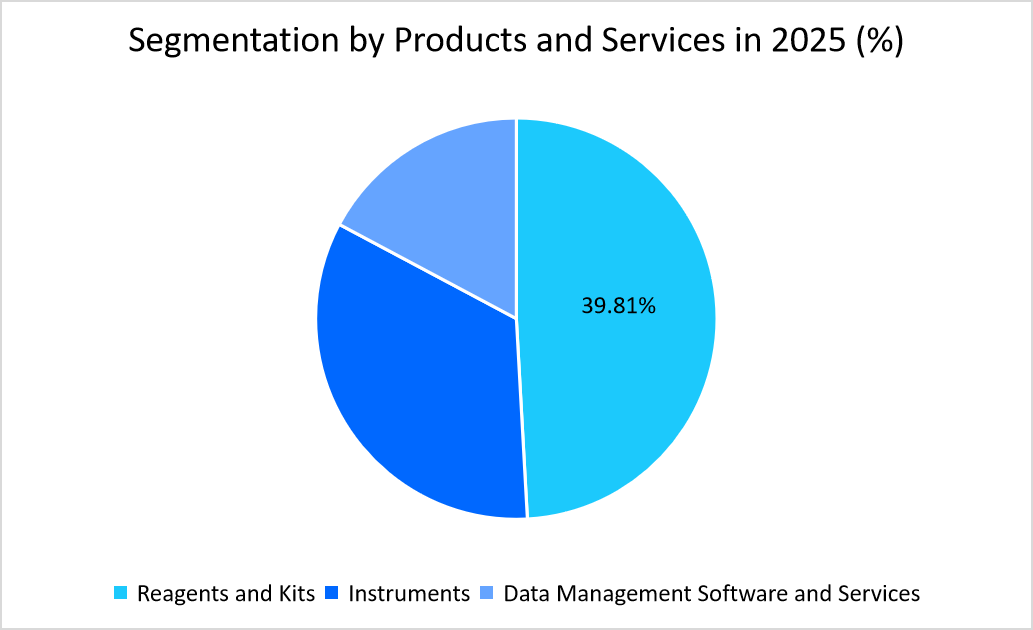

- Based on the Products & Services, the reagents and kits segment held the highest market share of 39.81% in 2025.

- Based on Technology, the immunodiagnostics segment dominated the market in 2025 with a revenue share of 29%.

- Based on the Application, the oncology segment is expected to register the fastest CAGR of 7.82%.

- Based on End User, the Standalone laboratories segment dominated the market in 2025.

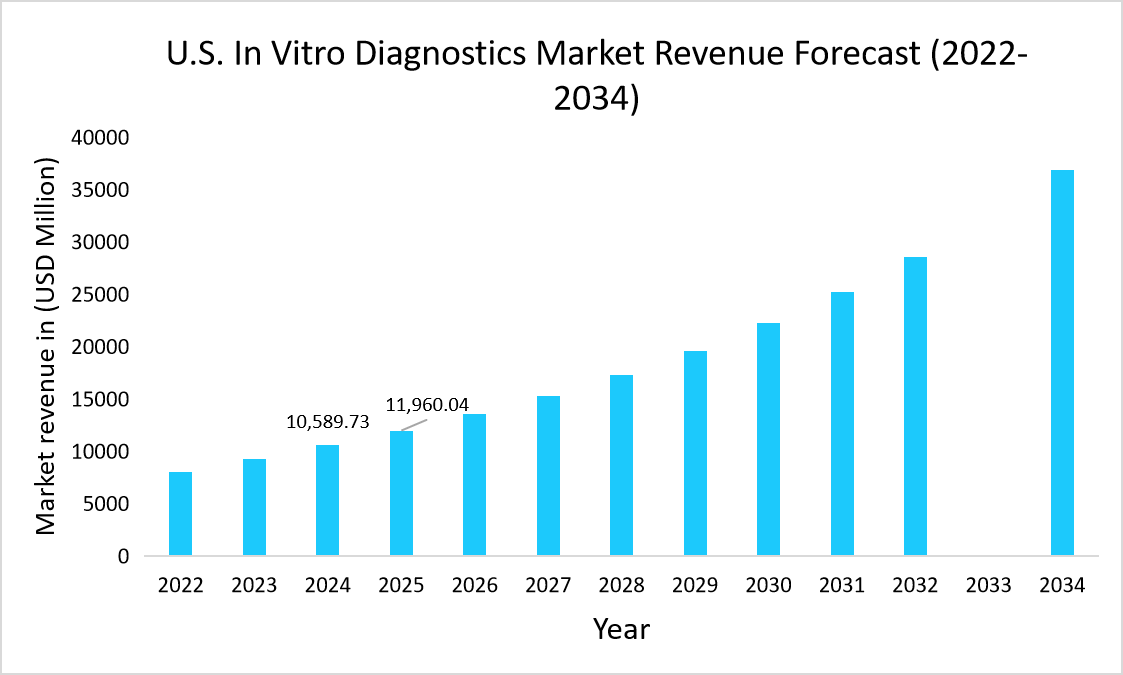

- The U.S. dominates the global in vitro diagnostics market, valued at USD 10,598.73 million in 2024 and reaching USD 11,960.04 million in 2025.

Market Size and Forecast

- 2025 Market Size: USD 84.99 billion

- 2034 Projected Market Size: USD 138.98 billion

- CAGR (2025 to 2034): 6.35%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

Source: Straits Research Analysis

The market is transitioning from a COVID-19-driven phase to a more stable, long-term growth trajectory, driven by technological advancements in digital pathology and point-of-care testing, which enables faster and more accurate diagnostics. In addition, automated analyzers and advanced platforms, such as mass spectrometry, provide faster turnaround times while reducing manual errors. At the same time, the consolidation of diagnostic laboratories drives the need for more streamlined and efficient workflows, which influences procurement strategies, with laboratories prioritizing diagnostic systems that could run multiple assays on a single platform and integrate smoothly within laboratory information systems. These changes help the labs in reducing costs and delivering more reliable patient results, which further expands the market growth.

Market Trends

All-in-One Diagnosis: The Emergence of Syndromic Testing

The IVD industry is witnessing a shift from traditional single-pathogen diagnostic tests to syndromic testing panels, which allow simultaneous detection of multiple pathogens linked to a specific clinical syndrome from a single patient sample.

- For example, in January 2025, BioFire Diagnostics received FDA 510(k) clearance for its FilmArray Gastrointestinal (GI) Panel Mid, which expanded upon the capabilities of the original FilmArray GI Panel by incorporating additional pathogens.

Such a transition transformed diagnostics by reducing the need for sequential testing, shortening the time to clinical decision making, and enhancing pathogen detection, particularly in acute care and outbreak settings.

Testing at Your Doorstep: The Rise of At-Home IVD Kits

Decentralized testing through at-home IVD kits is emerging as a transformative trend in diagnostics, empowering individuals to monitor health conditions conveniently, privately, and without visiting clinical settings.

- For example, in March 2025, Visby Medical received FDA De Novo authorization for its Women’s Sexual Health Test, the first over-the-counter PCR diagnostic device for at-home use. This kit allowed women to test for chlamydia, gonorrhea, and trichomoniasis from home and obtain results within 30 minutes, eliminating the need to send samples to a lab.

Such trends are redefining diagnostics by making accurate testing faster, more accessible, and user-friendly, reflecting a broader move toward decentralized healthcare solutions.

To get more insights about this report Download Free Sample Report

Market Driver

Availability of Reimbursement for IVD Tests

The availability of reimbursement encourages wider adoption of diagnostic tests by reducing financial burdens on patients and providers.

- For example, in October 2024, the U.S. Centers for Medicare & Medicaid Services announced the coverage of molecular diagnostics, including genetic and infectious disease tests, under its Clinical Laboratory Fee Schedule. This has led to increased uptake of high-value IVDs such as PCR-based respiratory panels and pharmacogenomic assays, supporting early diagnosis and personalized treatment.

Thus, the availability of reimbursement policies significantly supported IVD adoption by lowering cost barriers and enabling broader access to high-value diagnostics.

Market Restraint

Uneven Regulatory Landscapes Disrupt Global Rollout

Regulatory variations across global markets act as a major restraint for the growth and timely commercialization of IVD products, as they often create delays and increase development costs.

- For instance, in May 2024, as per the U.S. FDA, IVD products must undergo FDA clearance via the 510(k) or PMA routes, which can extend from 6 to 12 months for low to moderate-risk diagnostics to over 2 to 3 years for novel or high-risk assays.

- Similarly, in June 2024, as per the National Medical Products Administration (NMPA), China’s NMPA mandates localized clinical performance studies and in-country product testing for most imported IVDs, often pushing approval timelines to 18 to 24 months, even after global validation has been completed.

Thus, the absence of harmonized frameworks across regions creates barriers to innovation and limits global market expansion in the IVD industry.

Market Opportunity

Government Screening Programs And Preventive Health Policies: Unlocking Diagnostic Demand

Governments are increasingly investing in structured population-level early screening for conditions such as infectious diseases and chronic illnesses, boosting the demand for reliable and scalable diagnostic solutions.

- UK (October 2024): The NHS Bowel Cancer Screening Programme, funded and managed by the UK government’s National Health Service, used faecal immunochemical tests (FIT) to detect colorectal cancer at earlier stages. This policy-driven initiative significantly increased the uptake of molecular and immunoassay based IVDs.

- Australia: At the same time, the National Cervical Screening Program, implemented by the Australian Government Department of Health, replaced Pap smears with HPV based screening. This official shift in national guidelines improved the early detection and established consistent demand for HPV DNA tests across the country.

Thus, such a policy led initiatives not only to increase test volumes but also to support long-term integration of diagnostics into primary and community healthcare systems.

Regional Analysis

The North America region dominated the market with a revenue share of 37.76% in 2025. High shares are due to its highly developed healthcare infrastructure and significant investments in advanced diagnostic technologies. FDA approvals and clear regulatory pathways also encourage innovation while ensuring high-quality and safe diagnostic products.

Source: Straits Research Analysis

The U.S. is propelling in the in vitro diagnostics market due to high testing volumes and an extensive laboratory network. According to the Division of Clinical Laboratory Improvement and Quality Centers for Medicare & Medicaid Services, in March 2024, the U.S. hosted over 300,000 clinical labs and also performed billions of tests annually, which underscores the central role of diagnostics in healthcare delivery.

Asia Pacific Market Trends

The Asia Pacific region is the fastest-growing region with a CAGR of 8.37% during the forecast timeframe. The growth is attributed to factors such as a rapidly increasing aging population, which further enhances the demand for regular health monitoring among the aged population, as well as favourable government policies such as tax reductions and high-tech enterprise incentives, which help in promoting the development of advanced diagnostic technologies.

India continues to position itself in the in vitro diagnostics market, due to strong government initiatives. In August 2025, the Government of India announced programs such as the Production Linked Incentive (PLI) Scheme, which offers up to 5% financial incentives on incremental sales of IVD products from 2022 to 2028, which accelerated domestic manufacturing and also reduced reliance on imports.

One of the strongest drivers for China’s IVD market is the rapid digitalization of healthcare infrastructure, especially through government-backed initiatives like the Healthy China 2030 plan. This push toward integrating AI, big data, and cloud platforms into diagnostics enhances remote access, accelerates test processing, and supports real-time disease surveillance, significantly boosting the adoption of modern IVD solutions across urban and rural healthcare systems.

Products and Services Insights

The reagents & kits segment dominated the market with a revenue share of 39.81% in 2025, owing to their essential role in performing diagnostic tests, as they are considered crucial for detecting and quantifying biomarkers and other analytes in various samples, which further makes them fundamental to diagnostic processes.

Source: Straits Research Analysis

Technology Insights

The immunodiagnostics segment dominated the market in 2025 with a revenue share of 29%. The growth is attributed to its advancements in automation and high-throughput testing, as modern immunodiagnostic platforms are increasingly automated, allowing laboratories to process large volumes of samples with minimal human intervention. This efficiency not only reduces turnaround times but also lowers operational costs, making immunodiagnostics a better option for hospitals and diagnostic centers.

Application Insights

The oncology segment is anticipated to grow at a CAGR of 7.82% during 2026 - 2034. This growth is attributed to the increasing adoption of companion diagnostics in personalized cancer therapy, which enables clinicians to match patients with the most effective targeted treatments while minimizing adverse effects.

End-User Insights

The standalone laboratories segment dominated the market in 2025. High growth is attributed to their widespread accessibility. Standalone labs are often located in urban and semi-urban areas, making diagnostic services more easily available to a larger population. Their convenient locations allow patients to access routine checkups without visiting hospitals, which has significantly increased patient footfall and reinforced their leading position in the IVD market.

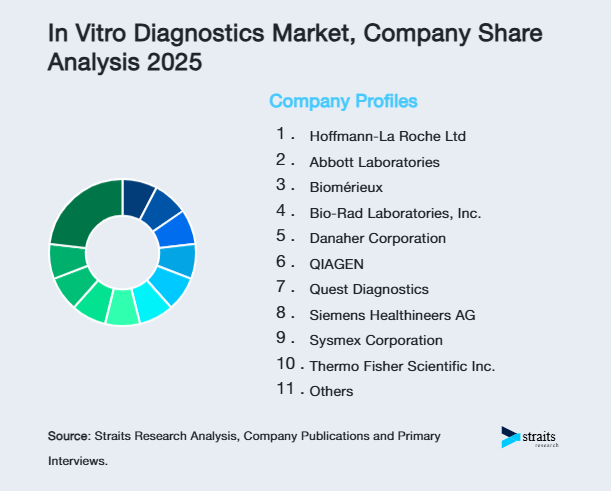

Competitive Landscape

The global in vitro diagnostics market is highly fragmented in nature due to the presence of numerous regional and local players, a wide variety of product offerings, and diverse application areas ranging from clinical laboratories to point-of-care testing.

The major companies are focused on investing in advanced diagnostic technologies and pursuing strategies such as collaborations, acquisitions, and partnerships to enhance their products and expand market presence.

Allez Health, Inc.: An emerging market player

Allez Health, Inc., is an emerging player in the market, focusing on the development of innovative biosensor technologies aimed at revolutionizing disease detection and monitoring.

- In May 2024, Allez Health, Inc. secured USD 60 million in a Series A+ financing round led by Osang Healthcare, a Korean IVD company, with additional support from existing investors. The funding is intended to accelerate pivotal clinical trials and scale manufacturing operations, which directly strengthens Allez Health’s position in the IVD market.

List of Key and Emerging Players in In Vitro Diagnostics Market

- Hoffmann-La Roche Ltd

- Abbott

- Biomérieux

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- QIAGEN

- Quest Diagnostics

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Exact Sciences Corporation

- Illumina, Inc.

- BD

- Beijing Strong Biotechnologies, Inc

To get more findings about this report Download Market Share

Recent Developments

- April 2025: Eurofins announced the successful acquisition of SYNLAB’s clinical diagnostics operations in Spain.

- January 2025: Fremman Capital acquired a majority stake in DIESSE Diagnostica, a leading Italian producer of innovative diagnostic systems and dedicated reagents for the specialty diagnostics market.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 84.99 billion |

| Market Size in 2026 | USD 90.51 billion |

| Market Size in 2034 | USD 138.98 billion |

| CAGR | 6.35% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product and Services, By Technology, By Application, By End User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

Explore more data points, trends and opportunities Download Free Sample Report

In Vitro Diagnostics Market Segments

By Product and Services

- Reagents and Kits

- Instruments

- Data Management Software and Services

By Technology

- Molecular Diagnostics

- Clinical Chemistry

- Immunodiagnostics

- Hematology

- Microbiology

- Others

By Application

- Infectious Diseases

- Oncology

- Cardiac Diseases

- Autoimmune Diseases

- Nephrological Diseases

- Diabetes

- Others

By End User

- Hospitals & Clinics

- Standalone Laboratories

- Home Care Settings

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Jay Mehta

Research Analyst

Jay Mehta is a Research Analyst with over 4 years of experience in the Medical Devices industry. His expertise spans market sizing, technology assessment, and competitive analysis. Jay’s research supports manufacturers, investors, and healthcare providers in understanding device innovations, regulatory landscapes, and emerging market opportunities worldwide.

Our Clients: