Industrial Display Market Size, Share & Trends Analysis Report By Display Type (Rugged Displays, Open Frame Monitors, Panel-Mount Monitors, Video Walls, Marine Displays), By Display Technology (LCD, LED, OLED, TFT), By Resolution (Standard Definition (SD), High Definition (HD), Full HD, 4K and Above), By End Use Industry (Manufacturing, Energy, Oil & Gas, Logistics, Healthcare, Defense & Aerospace, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Industrial Display Market Overview

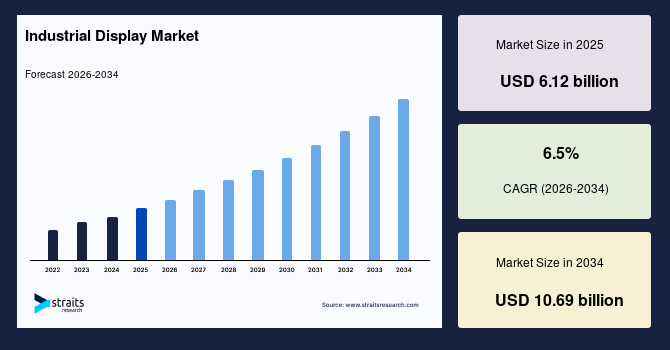

The global industrial display market size is valued at USD 6.12 billion in 2025 and is estimated to reach USD 10.69 billion by 2034, growing at a CAGR of 6.5% during the forecast period. Consistent growth of the market is supported by the rising adoption of industrial automation and Industry 4.0 practices, increasing deployment of human–machine interface (HMI) systems across manufacturing and process industries, and growing demand for rugged and high-performance displays capable of operating reliably in harsh industrial environments.

Key Market Trends & Insights

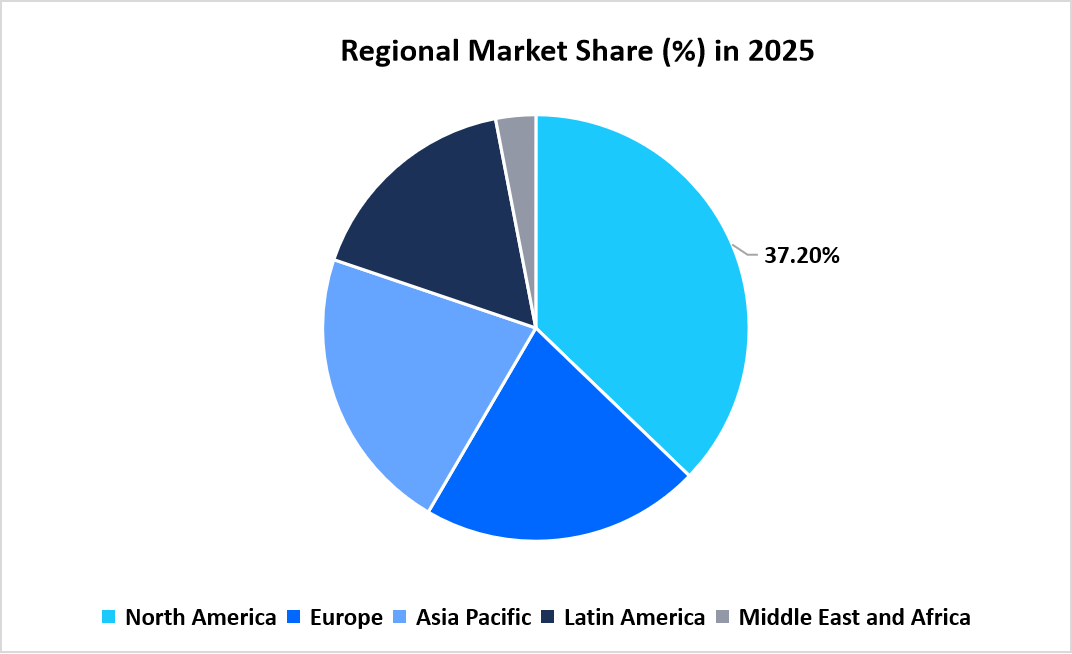

- North America dominated the market with a revenue share of 37.2% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 7.4% during the forecast period.

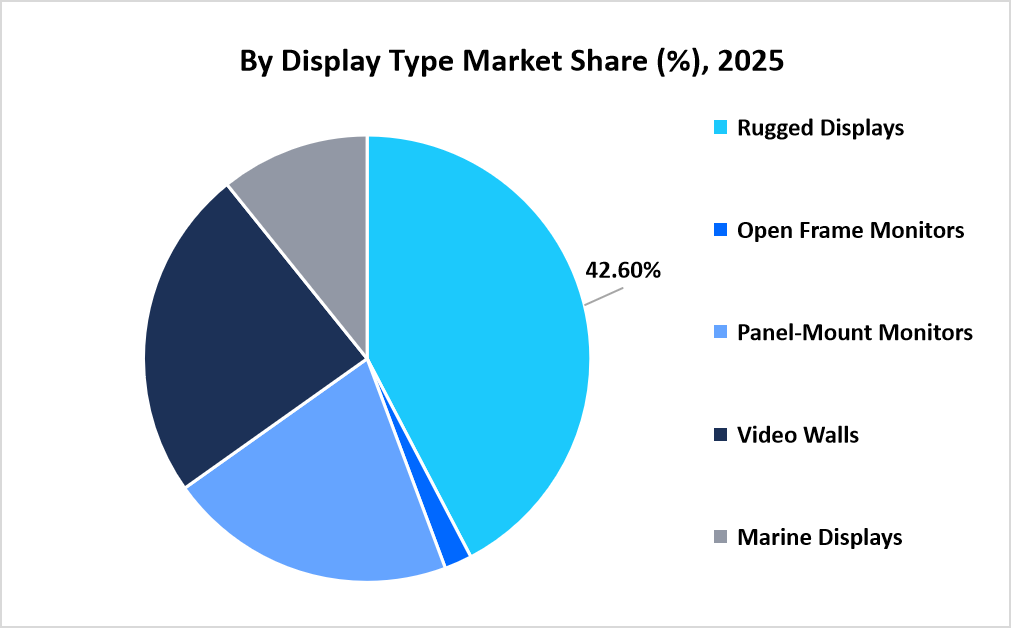

- Based on display type, the Rugged Displays segment held the highest market share of 42.6% in 2025.

- By display technology, the OLED segment is estimated to register the fastest CAGR growth of 7.1% during the forecast period.

- Based on resolution, the Full HD segment dominated the market in 2025, accounting for a market share of 41.2%.

- Based on end-use industry, the Manufacturing segment is anticipated to grow at a CAGR of around 6.9% during the forecast period

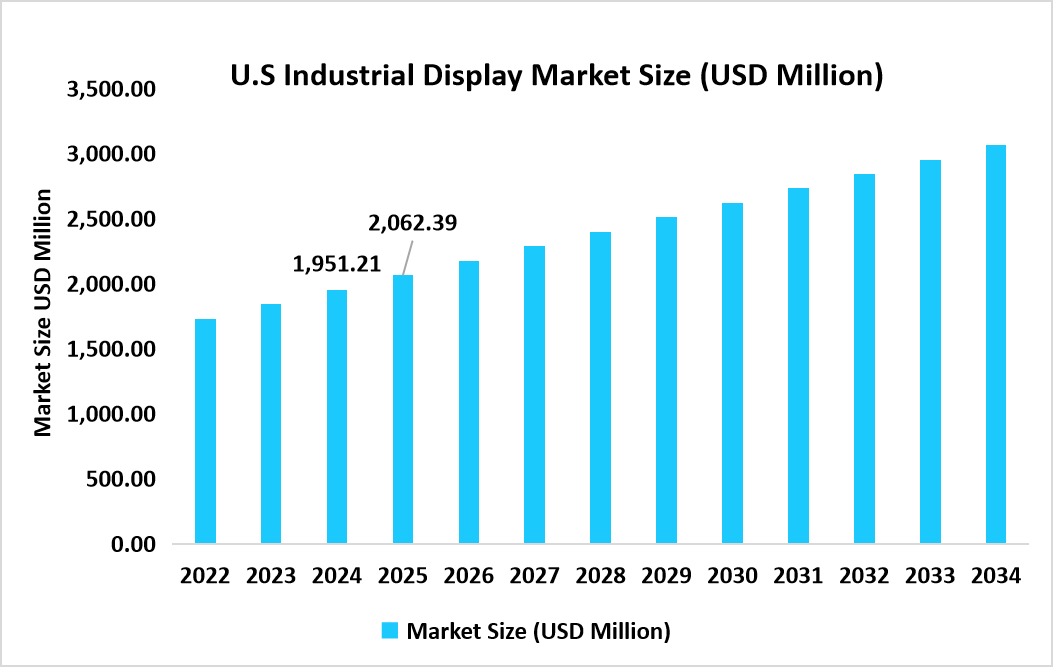

- The U.S. dominates the industrial display market, valued at USD 1.95 billion in 2024 and reaching USD 2.06 billion in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 6.12 billion

- 2034 Projected Market Size: USD 10.69 billion

- CAGR (2026-2034): 6.5%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The global industrial display market covers a broad array of display types, such as rugged display solutions, open-frame monitors, panel mount monitors, video wall display solutions, and marine display solutions, intended for reliable operation in challenging industrial environments for different applications. These display solutions are based on various display technologies, such as LCD, LED, OLED, and TFT, and are available in different display resolution formats, from standard display, high-definition display, full HD display, to 4K and above display solutions, depending on applications and user intent on visualization and display functionalities. Moreover, industrial display solutions are used in a wide array of end-user industry verticals, including manufacturing, energy, oil & gas, logistics, healthcare, and defense & aerospace, for applications in human machine interface, process monitoring, control rooms, and real-time operation visualization using appropriate display solutions based on their technical requirements.

Market Trends

Transition From Traditional Panels To Rugged And Intelligent Industrial Displays

Visualizations in the industrial field are emerging from basic commercial-off-the-shelf panels to more rugged and application-oriented display solutions better suited to challenging operating conditions. In the past, the industrial setting used consumer display panels, with shortcomings in their durability, frequent downtime, and reduced legibility in the presence of temperature, vibration, and dust. However, modern applications are increasingly using customized display solutions for the industrial sector with an improvement in their ingress protection, resistance to shock, and temperature and brightness characteristics of sunlight readability. Furthermore, these display solutions for the industrial sector also come with advanced diagnostic and distant monitoring functions, thereby facilitating the concept of predictive maintenance and lowering unexpected stops in their operations."

Rapid Expansion of High-Resolution Displays In Mission-Critical Operations

There has been a substantial rise in the acceptance of high-resolution industrial displays for handling complex, data-intensive industrial processes. The conventional displays were of low-resolution or standard-definition displays that were only sufficient for basic monitoring. But with the increased complexity in industrial processes, coupled with the rising trend of real-time analytics, the requirement for Full HD or 4K displays with increased clarity and accuracy has increased. There has also been increased focus on improving situation awareness in control room environments, as enhanced visualization has enhanced accuracy in the interpretation of industrial process information, coupled with applications related to machine vision and digital twins, among others.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 6.12 billion |

| Estimated 2026 Value | USD 6.52 billion |

| Projected 2034 Value | USD 10.69 billion |

| CAGR (2026-2034) | 6.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Samsung Display, LG Display, AU Optronics, BOE Technology Group, Innolux Corporation |

to learn more about this report Download Free Sample Report

Market Driver

Acceleration of Industrial Automation Mandates And Digital Manufacturing Policies

Government-driven industrial modernization initiatives are now appearing on the scene as a key driver for the industrial display market. Country-level initiatives such as the U.S. National Strategy for Advanced Manufacturing, the Industry 4.0 mission in Germany, the Made in China 2025 plan in China, and the National Smart Manufacturing Mission in India are actively supporting digital factories, automated lines, and real-time process analysis. These initiatives have now begun to stress the need to use high-end HMIs, control room analysis solutions, and rugged display solutions. Thus, the need for high-end industrial displays has begun to rise.

Market Restraint

Lengthy Regulatory Certification And Compliance Approval Cycles Delaying Deployment

A major factor that hampers the adoption of industrial display solutions is the long time involved in securing all mandatory regulatory certifications and approving them before implementing the solutions in industry. Industrial display solutions implemented in manufacturing, energy, oil & gas, or defense require adherence to severe standards like conformity to IEC 62368-1 (Safety Requirements for Audio/Video and ICT Equipment), CE marking as per EU directives, UL marking in the USA, and ATEX directives (2014/34/EU) in cases where the display solutions are used in environments with explosive substances. This incurs severe testing procedures on display solutions in terms of ensuring their adherence to standards related to electrical safety, EMC standards related to electromagnetic compatibility, environmental tests, and functional reliability. This involved process frequently cultivates delays in launching display solutions in industries.

Market Opportunity

Expansion of Industrial Digital Infrastructure Across Logistics And Critical Facilities

Large-scale development of industrial and logistics infrastructure is opening up new avenues in the industrial display market. Growing global investments in the development of smart warehouses, autonomous ports, rail systems, and airport cargo terminals are fueling the demand for real-time visual solutions that include traffic management and command and control solutions. Increasingly, logistics facilities are adopting command and control rooms as a central part of logistics operations, with industrial displays becoming the central point of all logistics-related operations. A logistics network that is becoming increasingly complex with the rise of global trade and e-commerce is fueling the demand for reliable and high-visibility displays in the market.

Regional Analysis

North America remained at the forefront in 2025, capturing a revenue share of 37.2%. Notably, its leading position can be attributed to its advanced manufacturing facilities and widespread use of industrial automation solutions, in addition to widespread usage in critical industries. Moreover, early adoption of digital control rooms, predictive maintenance tools, and real-time monitoring solutions in the region has contributed to increased demand for industrial displays featuring robust performance. In addition to such factors, industrial OEMs/system integrators in the region continue to ensure sustained market dominance.

The growth in the industrial display industry in the US is led by large-scale modernization in manufacturing plants and logistics facilities. The US has seen substantial adoption in smart factories, automated warehouses, and transport command centers. This has led to a high demand in the US for high-visibility and rugged display solutions. Centralized monitoring dashboards and distributed control systems in manufacturing and defense environments are adding traction in demand and are making the US a major revenue-generating region in North America.

Asia Pacific Market Insights

Asia Pacific is a region that is coming up as the fastest-growing market with a CAGR of 7.4% during the forecast period. This will be aided by the fast-paced industrialization taking place and the adaptation to automation technology. Industrialization in the different countries in the region is on the increase, and the demand for industrial visualization systems will be spurred. The rising electronics manufacturing bases and logistics networks in the region will also boost the adoption of industrial displays.

The market for industrial displays in India is growing progressively because of rising investments in manufacturing clusters, smart industrial corridors, and logistics spots. The growth is being driven by rising adoption of industrial displays in factory automation, power distribution stations, and transport control rooms, aimed at increasing the operational visibility of these applications. Additionally, the rising adoption of digital monitoring solutions in the industry is driving the growth of the market, making India a significant contributor to the Asia Pacific market.

Source: Straits Research

Europe Market Insights

The European market for industrial displays is experiencing growth with the adoption of smart manufacturing and process automation in the automotive, machinery, and energy industries. This region realizes the widespread use of digital control rooms, factory visualization, and human-machine interfaces of a high reliability level in industrial facilities. There has been a growing focus on system interoperability and real-time monitoring, ensuring that the adoption of the technology remains consistent in this region.

The growth in the German industrial display market is driven by the increasing digitalization of manufacturing plants and industrial infrastructure. The strong manufacturing infrastructure present in Germany for automotives, machinery, and process manufacturing is also increasing the use of industrial displays for production monitoring and command centers. A high degree of penetration for factory automation and integrated manufacturing is also increasing the demand for rugged and high-quality industrial display solutions.

Latin America Market Insights

The Latin America industrial display market is fueled by increasing industrial automation efforts in countries such as Brazil, Mexico, and Chile. Growing mining activities, energy, and logistics facilities are boosting requirements for real-time visualization solutions in Latin America, allowing industrial displays to gain mainstream adoption for applications in efficiency, safety, and resource management in industries in geographically challenging locations.

The Brazilian market for industrial displays is growing due to investments in the modernization of manufacturing plants, seaports, and power plants. Brazil is observing an increasing adoption of industrial displays in process monitoring systems, warehouse management systems, and transportation management systems in order to enhance efficiency and reliability. Growing investments in the development of industrial infrastructures are making Brazil an important driver in the adoption of industrial displays in the Latin American market.

Middle East & Africa Market Insights

The Middle East & Africa market for The Middle East & Africa market for industrial displays is being driven by significant investments in the energy, transport, and diversification sectors. Industrial displays are being adopted for use in control rooms, monitoring environments, and high-risk areas for real-time process monitoring. The investment initiatives of the Middle East & Africa in modernization, particularly for building resilient industries, are driving the adoption of rugged visibility displays.

The UAE market for industrial displays is moving ahead as the UAE is speeding up the establishment of smart industrial zones, logistics corridors, and energy management facilities. The rising adoption of command centers and digital surveillance systems in the sectors of utilities, transportation, and industry is driving the UAE market. This scenario is making the UAE a prime market in the Middle East and Africa region for the growth of industrial displays.

Display Type Insights

Rugged Display accounted for the leading share in 2025, contributing 42.6% to the market revenue. This is because displays have wide applications in harsh industrial settings, such as factories, oil & gas stations, military bases, and logistics centers.

Video walls are expected to record the highest growth rate and will expand with a CAGR of about 7.8% over the forecast period. This significant rise in growth can be attributed to the increasing adoption in central control rooms, smart manufacturing environments, transport operation command centers, and energy observation rooms, where the display needs to be massive and highly visible.

Source: Straits Analysis

Display Technology Insights

The market was led by the LCD segment with a revenue share of about 35.8% in 2025. This can be attributed to the fact that industrial displays using LCD technology have been widely embraced across industries because they possess reliability, durability, stability, and compatibility.

The OLED segment is forecast to grow at the highest rate, at a CAGR of approximately 7.1%, during the forecast period. This high growth rate in the market for the next-generation display technology, such as an OLED display, will be driven by the rising requirements for higher contrast ratios, higher blacks, wider angles of view, and improved clarity in the next-generation industrial application areas of human-machine interfaces.

Resolution Insights

By resolution, the dominant market in the year 2025 was the Full HD segment, with a market share of 41.2%, due to the ideal balance of image clarity, processing, and economies for the respective end applications in full HD displays.

The 4K and Above category is likely to exhibit the fastest growth rate during the forecast period. The rising adoption trend in advanced control rooms, surveillance-heavy zones, as well as high-precision industrial sectors that benefit from ultra-high resolution visualization offered by superior situational awareness and complex data analysis translates to the accelerated adoption of high-resolution industrial displays.

End Use Industry Insights

The manufacturing industry is also projected to experience the quickest expansion at a CAGR of 6.9% over the next few years, triggered by the increased adoption of automated manufacturing technology and digital control/monitoring solutions in factories. In response to manufacturing companies continuing to adopt improvements in their processes with greater visibility, the requirement for trustworthy industrial displays has increased, improving market forecasts for this sector.

Competitive Landscape

The global industrial display market is relatively concentrated, with many large display panel manufacturers operating alongside specialized industrial display solution providers. Much of the market is concentrated within a few players due to their strong manufacturing capabilities, wide product portfolios, and long-standing relationships with industrial OEMs and system integrators.

Major players in the market are Samsung Display, LG Display, and AU Optronics, among others. These companies compete to strengthen their market position through continuous product portfolio expansion, capacity optimization, strategic partnerships with industrial solution providers, and targeted investments in high-reliability and application-specific display solutions tailored for industrial environments.

L&D Tech: An Emerging Market Player

L&D Tech, a South Korean firm that innovates industrial display technology, has carved a niche for itself by concentrating on energy-saving LED display technology designed for applications requiring high reliability over prolonged periods.

- In December 2025, L&D Techs announced the global launch plan of its energy-efficient LED display with proprietary 3D-structured LED technology optimized for industrial usage, targeting partners and buyers in North America and Europe as part of its product expansion strategy.

Thus, L&D Tech has become a significant player in the market for industrial display, as it incorporates innovative product offerings with commercialization strategies to meet the challenges in terms of energy efficiency and performance in industrial scenarios.

List of Key and Emerging Players in Industrial Display Market

- Samsung Display

- LG Display

- AU Optronics

- BOE Technology Group

- Innolux Corporation

- Japan Display Inc.

- Sharp Corporation

- Advantech Co., Ltd.

- Siemens AG

- Rockwell Automation

- Schneider Electric

- Panasonic Corporation

- Eizo Corporation

- NEC Display Solutions

- Tianma Microelectronics

- Kontron AG

- Planar Systems

- Barco NV

- Winmate Inc.

- General Electric

- Others

Strategic Initiatives

- October 2025: RJY Display unveiled its next-generation 7-inch round TFT LCD display at Embedded World 2025 in Germany. This product debut introduces a circular high-readability display engineered for industrial HMI, automotive clusters, and space-constrained embedded systems, emphasizing rugged performance and wide-temperature operation for harsh environments.

- May 2025: AUO showcased its 64-inch transparent Micro LED display at SID Display Week 2025, which features 1,000 nits brightness and seamless tiling capabilities, earning the “Best Micro LED Technology” award, underscoring its potential for industrial visualization and immersive workspace environments.

- March 2025: Touch Think showcased its latest industrial all-in-one panel PCs and ultra-thin LCD panel displays at AUTOMATE 2025 in Detroit, highlighting next-generation human-machine interface systems tailored for smart factory and logistics automation applications.

- January 2025: Samsung Display unveiled two cutting-edge 27-inch QD-OLED panels, a UHD 240 Hz and a QHD 500 Hz model at CES 2025, designed to deliver ultra-high resolution and refresh rates for advanced visualization needs. Both panels were slated for mass production in H1 2025, enhancing industrial and professional monitor performance.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 6.12 billion |

| Market Size in 2026 | USD 6.52 billion |

| Market Size in 2034 | USD 10.69 billion |

| CAGR | 6.5% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Display Type, By Display Technology, By Resolution, By End Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Industrial Display Market Segments

By Display Type

- Rugged Displays

- Open Frame Monitors

- Panel-Mount Monitors

- Video Walls

- Marine Displays

By Display Technology

- LCD

- LED

- OLED

- TFT

By Resolution

- Standard Definition (SD)

- High Definition (HD)

- Full HD

- 4K and Above

By End Use Industry

- Manufacturing

- Energy

- Oil & Gas

- Logistics

- Healthcare

- Defense & Aerospace

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.