Industrial Enzymes Market Size, Share & Trends Analysis Report By Type (Carbohydrases, Proteases, Lipases), By Source (Microorganisms, Plants and Animals), By Application (Food & Beverages, Detergents, Biofuels, Textiles and Pulp & Paper) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Industrial Enzymes Market Size

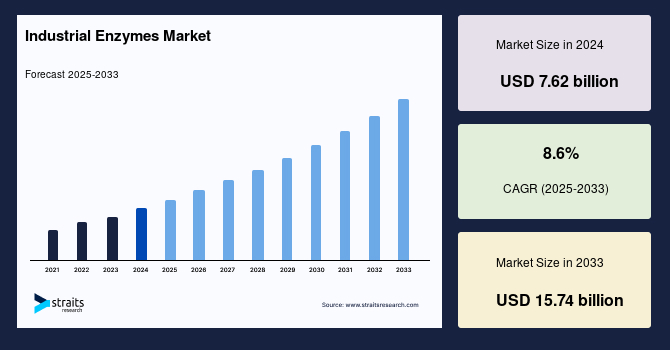

The global industrial enzymes market size was valued at USD 7.62 billion in 2024 and is projected to grow from USD 8.11 billion in 2025 to USD 15.74 billion in 2033, exhibiting a CAGR of 8.6% during the forecast period (2025-2033).

The global industrial enzymes market is experiencing robust growth, driven by increasing demand for sustainable and efficient processing solutions across key sectors such as food and beverages, biofuels, textiles, and pharmaceuticals. These biocatalysts improve production yield, reduce environmental impact, and optimize resource utilization. Rising consumer preference for eco-friendly products and the widespread adoption of green chemistry principles significantly contribute to the market’s momentum. Technological advancements in enzyme engineering, including protein expression systems and directed evolution, enable the development of more stable and specific enzyme formulations tailored to niche industrial applications.

Trends such as clean-label ingredients in food processing and using enzymes in animal feed to enhance digestibility are fueling demand. Furthermore, the emergence of precision fermentation and synthetic biology platforms creates lucrative pathways for industrial enzyme innovation. Moreover, favorable regulations supporting bio-based alternatives, particularly in Europe and North America, reinforce market expansion. The integration of AI and bioinformatics to accelerate enzyme discovery is expected further to revolutionize industrial enzyme applications over the forecast period.

Emerging Market Trends

Precision Fermentation and Tailored Enzyme Design

Precision fermentation is redefining enzyme production by enabling the synthesis of highly specific, high-purity enzymes in controlled fermentation environments. This approach reduces dependency on traditional animal- or plant-based extraction methods, offering consistency and scalability. According to industry reports, over 150 companies are engaged in precision fermentation-based enzyme production, driven by the need for application-specific biocatalysts with improved yield and thermal stability.

- For instance, in January 2024, Novozymes and Chr. Hansen completed their merger, forming Novonesis. This strategic move aims to accelerate innovation in enzyme development, leveraging advanced biotechnological tools such as precision fermentation and AI-driven protein engineering to meet diverse industrial needs.

This shift toward engineered, target-specific enzymes enhances process efficiency while reducing environmental impact, aligning with sustainability goals. As precision fermentation becomes more cost-effective and scalable, the market will likely see broader adoption across industries, marking it as one of the most transformative trends in the enzyme sector.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 7.62 Billion |

| Estimated 2025 Value | USD 8.11 Billion |

| Projected 2033 Value | USD 15.74 Billion |

| CAGR (2025-2033) | 8.6% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Novonesis (Novozymes + Chr. Hansen), DuPont de Nemours, Inc. (IFF), BASF SE, DSM-Firmenich, AB Enzymes GmbH |

to learn more about this report Download Free Sample Report

Industrial Enzymes Market Growth Factors

Growth of the Biofuel and Biorefinery Sector

The biofuel industry is a significant driver for industrial enzymes, particularly cellulases, amylases, and lipases. As countries pursue energy transition strategies, bioethanol and biodiesel production are scaling up, necessitating the use of enzymes for efficient biomass breakdown and conversion. Enzymes are vital in converting lignocellulosic biomass into fermentable sugars, improving the yield and lowering the cost of advanced biofuels. DuPont and Novozymes have pioneered high-performance enzyme solutions for this segment.

- For example, Novozymes introduced Cellic® CTec3, an enzyme enabling cost-efficient biomass conversion to ethanol. This enzyme performs 1.5 times better than its predecessor, Cellic® CTec2, allowing biofuel producers to use only one-fifth of the enzyme dose compared to competing enzymes.

Countries like Brazil, the U.S., and China are investing heavily in biorefineries. Enzymes serve as core components in turning feedstock into multiple end products, including fuels, chemicals, and food ingredients. With climate change targets accelerating decarbonization policies, enzyme technologies are expected to play a pivotal role in expanding the global bio-based economy, thus fueling market demand.

Market Restraint

High Cost and Stability Issues of Enzyme Products

Despite their effectiveness, industrial enzymes face cost, stability, and shelf life limitations. The production process involves complex fermentation and downstream processing steps that require stringent quality control, driving up costs. Stability issues further compound the challenge. Enzymes can lose activity under high temperatures, extreme pH, or exposure to solvents common conditions in industrial operations. This limits their usability across many processes unless stabilized through costly additives or encapsulation techniques.

- For instance, in the paper and pulp industry, variable pH levels and bleaching agents often degrade enzyme efficacy. Although enzyme engineering has improved robustness to some extent, these limitations can hinder widespread adoption in harsh processing environments. Companies are investing in protein engineering and formulation advancements, which add to R&D expenditure, limiting cost-effectiveness for budget-sensitive sectors or emerging economies. Overcoming these hurdles will be essential for broader market penetration, particularly in price-sensitive applications such as textiles and detergents.

Key Market Opportunity

Enzymes in Waste Management and Circular Economy Applications

The rising emphasis on circular economy principles and sustainable waste management creates substantial opportunities for the industrial enzyme market. Enzymes such as proteases, lipases, and cellulases are used to treat organic waste, enabling the conversion of agricultural, food, and municipal waste into biogas, fertilizers, and other value-added products. Governments are backing these initiatives.

- For instance, in March 2025, the European Commission launched a consultation on the EU Bioeconomy Strategy to advance innovation and maintain the EU's leadership in the bioeconomy.

- Similarly, in India, the Ministry of Science & Technology organized the Global Bio-India 2024 event in September 2024 to propel and position India’s biotechnology sector into the global spotlight.

Private sector innovation is also propelling growth. These innovations enable waste-to-resource transformation while reducing carbon emissions and landfill load. Enzymatic waste valorization offers an eco-efficient, low-energy alternative to conventional incineration and chemical treatment methods. As global regulations tighten on landfill usage and waste disposal, this segment is poised to be a lucrative growth frontier for industrial enzyme manufacturers over the next decade.

Regional Analysis

North America leads the global industrial enzymes market due to its advanced biotechnology sector and high adoption of sustainable industrial processes. The region benefits from robust government support for biofuel initiatives, especially in the U.S., where ethanol and biodiesel production heavily rely on enzymatic hydrolysis. Major players in the enzyme industry are headquartered here, facilitating innovation and commercialization. Moreover, the food and beverage sector’s focus on clean-label products and natural ingredients significantly boosts enzyme usage. Regulatory support for environmentally friendly solutions continues to create a favorable business environment.

U.s. Industrial Enzymes Market Trends

The U.S. remains the global leader in the market, supported by its highly developed biomanufacturing ecosystem and favorable policy framework. Public-private partnerships, such as those between the Department of Energy and enzyme producers, continue to drive breakthroughs in sustainable bioprocessing. The rapid growth of plant-based foods and the push for carbon-neutral bioenergy strengthen demand for tailored enzyme formulations. Moreover, U.S.-based research universities collaborate with enzyme manufacturers to accelerate protein engineering and synthetic biology innovation.

- Canada’s enzyme sectoris accelerating due to increasing emphasis on environmental sustainability, waste valorization, and low-carbon industrial processes. The Canadian agri-food sector is a significant consumer of enzymes, particularly for enhancing meat alternatives, baking, and dairy fermentation. Additionally, Canadian firms are investing in cold-active and psychrophilic enzymes tailored for energy-efficient processes in detergents and food production. Partnerships with indigenous communities for biocatalytic forestry and soil restoration projects are also gaining traction, reflecting Canada’s holistic approach to sustainable development.

Asia-Pacific: fastest-growing region

Asia-Pacific is emerging as the fastest-growing market for industrial enzymes, underpinned by rapid economic development and industrial expansion. The region’s booming food and beverage industry and increasing demand for processed and convenience foods are key drivers. Additionally, government policies in China, India, and Southeast Asian countries supporting biofuel adoption and green chemistry are fueling enzyme demand. The rise in disposable income, urbanization, and health awareness is accelerating the transition toward enzyme-based products. Local production capabilities are also improving, with several domestic players entering the market to meet growing demand.

China Industrial Enzymes Market Trends

China’sindustrial enzyme market is booming, driven by government mandates for green industrialization and massive investment in domestic biotech capacity. The 14th Five-Year Plan prioritizes biotech-enabled manufacturing, encouraging widespread enzyme adoption in textile desizing, wastewater bioremediation, and high-efficiency food processing. China’s rising middle class also demands clean-label and functional food products, prompting retailers and manufacturers to integrate enzyme technologies for improved safety, shelf life, and nutritional quality.

- Indiais emerging as a high-potential market for industrial enzymes, driven by cost-effective production, growing export demand, and strategic government support. The Indian Council of Agricultural Research (ICAR) collaborates with enzyme firms to promote bio-based fertilizers and enhance soil microbial activity. The domestic pharmaceutical sector, known for its API production, increasingly utilizes enzymatic synthesis to meet green chemistry standards. India’s vast agro-industrial base and rising investments in enzyme R&D make it a critical player in the global enzyme supply chain.

Europe: Significant Growth

Europe is experiencing steady industrial enzyme growth, supported by strict environmental and food safety regulations. The region’s commitment to reducing carbon emissions has driven investment in bio-based products, including enzymes. The presence of a mature food processing industry and strong consumer demand for natural and organic foods further support market growth. Countries like Germany, France, and the Netherlands are investing in enzyme R&D for pharmaceutical, textile, and animal feed applications. Innovations in enzyme stabilization and formulation also enhance product efficiency and expand application potential across European industries.

Germany Markert Trends

Germany stands at the forefront of Europe’s enzyme innovation, with an ecosystem combining traditional industrial engineering with cutting-edge biotechnology. The country’s advanced infrastructure supports the development of tailored enzymes for bio-based polymers, nutraceuticals, and carbon capture solutions. German universities and companies are engaged in EU-funded Horizon Europe programs targeting enzyme-enabled biorefineries and low-impact chemical synthesis. Germany’s stringent environmental laws and strong consumer demand for green products ensure consistent market growth across established and emerging sectors.

- Franceis evolving as a major innovation hub in Europe’s industrial enzymes landscape, emphasizing bioeconomy integration and green chemistry adoption. Its wine and bakery sectors extensively utilize enzymes for flavor enhancement, process efficiency, and allergen reduction. The country’s biotech clusters in Toulouse and Lyon are rapidly expanding, supported by public and EU funding. Moreover, Carbios’ progress in enzyme-driven plastic degradation technology continues to attract global attention, solidifying France’s position in circular bioeconomy leadership.

Type Insights

Carbohydrases dominate the industrial enzymes market due to their broad utility across various industries. Enzymes such as amylases, cellulases, and xylanases are extensively applied in baking, brewing, and starch processing to improve texture, flavor, and digestibility. In the biofuel sector, carbohydrate breaks down lignocellulosic biomass into fermentable sugars, enhancing ethanol yield and overall process efficiency. Their widespread use in detergents and textiles, where they facilitate stain removal and fiber modification, further cements their market leadership. Continuous innovation in enzyme engineering is expected to expand its applications in non-traditional sectors.

Source Insights

Microorganisms, including bacteria and fungi, are the leading source of industrial enzymes, thanks to their rapid growth, genetic malleability, and cost-effectiveness in large-scale fermentation. Microbial enzymes offer high stability and specificity, making them suitable for various industrial processes. Techniques such as recombinant DNA technology and CRISPR-based genome editing are increasingly employed to enhance enzyme yield and functionality. The consistent quality, ease of manipulation, and the ability to scale production in bioreactors make microbial enzymes the preferred choice across food, pharmaceutical, and biofuel industries.

Application Insights

The Food & Beverages sector is the largest consumer of industrial enzymes, leveraging them for improved product consistency, enhanced nutritional value, and extended shelf life. Enzymes such as proteases, lipases, and lactases are used in cheese production, fat modification, and lactose-free dairy products. In baking, enzymes help in dough conditioning and crust color enhancement. The clean-label trend and consumer preference for minimally processed foods encourage manufacturers to adopt enzymatic processes over chemical additives. Growing health consciousness and demand for functional foods further bolster the segment’s growth.

Company Market Share

The global industrial enzymes market is highly competitive, dominated by large multinational corporations with diversified enzyme portfolios and strong global distribution networks. These players consistently invest in R&D and strategic collaborations to expand their application base across food & beverage, bioenergy, textiles, and pharmaceuticals. Mergers, acquisitions, technological advancements, and product launches define their growth strategy.

Advanced Enzyme Technologies Ltd. is a leading Indian enzyme manufacturer with a global footprint in more than 70 countries. The company focuses on enzyme applications in human health, animal nutrition, and food processing. Its business model centers on customized enzyme solutions, in-house R&D capabilities, and strong export orientation. Advanced Enzyme is expanding its biopharma and nutraceutical enzyme portfolio and investing in fermentation capacity upgrades to meet global demand.

Recent Update

- In March 2025, Advanced Enzyme Technologies launched a new line of plant-based digestive enzyme blends targeting North American health supplement markets, in partnership with a major U.S. nutraceutical distributor. This aligns with the surge in demand for clean-label, vegan products.

List of Key and Emerging Players in Industrial Enzymes Market

- Novonesis (Novozymes + Chr. Hansen)

- DuPont de Nemours, Inc. (IFF)

- BASF SE

- DSM-Firmenich

- AB Enzymes GmbH

- Kerry Group

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme Inc.

- Dyadic International Inc.

- Biocatalysts Ltd.

- Enzymes Solutions Inc.

- Maps Enzymes Ltd.

- Sunson Industry Group Co., Ltd.

- Vland Biotech Group

- Roquette Frères

to learn more about this report Download Market Share

Recent Developments

- January 2025- DSM-Firmenich unveiled an enzymatic solution for methane reduction in dairy cattle, claiming up to a 45% reduction in emissions without affecting yield. The company partnered with a Dutch agricultural cooperative and announced pilot programs in the EU and New Zealand, highlighting enzymatic applications in climate-smart agriculture.

- October 2024- Novonesis launched “InnoZyme-360,” a multi-enzyme solution for next-gen starch processing and low-energy bioethanol production. The product claims to reduce processing energy consumption by 25% while increasing yield by 18%. This is part of their sustainability-driven innovation strategy post-merger.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 7.62 Billion |

| Market Size in 2025 | USD 8.11 Billion |

| Market Size in 2033 | USD 15.74 Billion |

| CAGR | 8.6% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Source, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Industrial Enzymes Market Segments

By Type

- Carbohydrases

- Proteases

- Lipases

By Source

- Microorganisms

- Plants and Animals

By Application

- Food & Beverages

- Detergents

- Biofuels

- Textiles and Pulp & Paper

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.