Liquid Laundry Detergents Market Size, Share & Trends Analysis Report By Product Type (Standard Liquid Detergent, High-Efficiency (HE) Liquid Detergent, Concentrated Liquid Detergent, Specialty Liquid Detergent), By Applications (Household, Commercial(Hotels, Hospitals, Laundries, etc.)), By Distribution Channel (Online Retail, Offline Retail, Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Liquid Laundry Detergents Market Overview

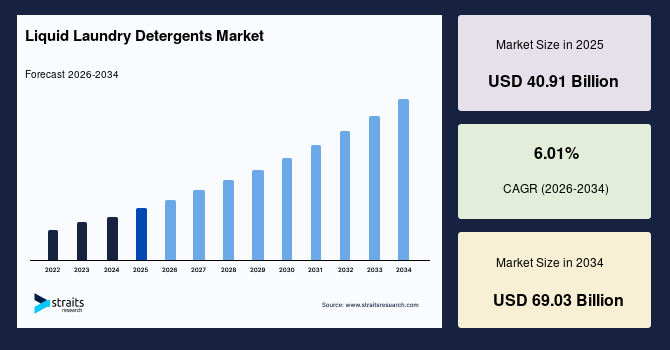

The global liquid laundry detergents market size was valued at USD 40.91 billion in 2025 and is estimated to reach USD 69.03 billion by 2033, growing at a CAGR of 6.01% during the forecast period (2026–2034). The market is driven by rising consumer preference for convenient, efficient cleaning solutions, increasing awareness of eco-friendly formulations, growth in urban households, and the expanding demand for smart washing machines and high-performance detergents.

Key Market Trends & Insights

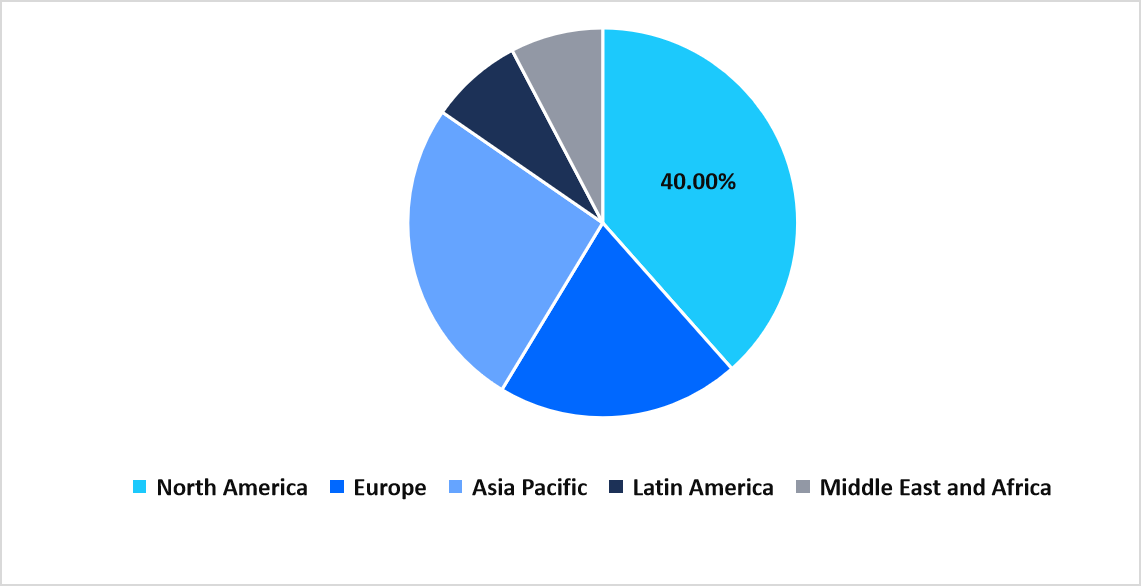

- North America held the largest market share, over 40% of the global market.

- Asia-Pacific is the fastest-growing region with a CAGR of 6.87%.

- By product type, the standard liquid detergent segment held the highest market share of over 30%.

- By applications, the commercial segment is expected to witness the fastest CAGR of 6.45%.

- By distribution channels, the supermarkets/hypermarkets segment held the highest market share of over 35%.

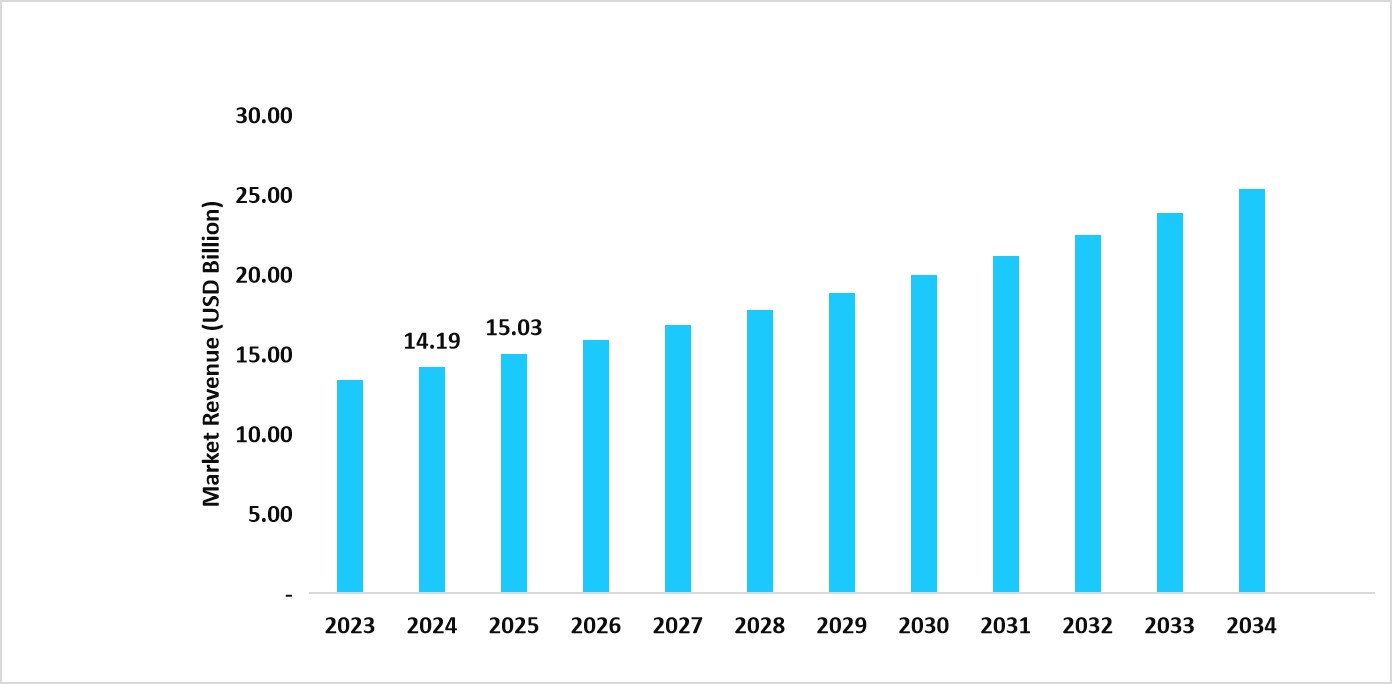

- The U.S. liquid laundry detergents market was valued at USD 14.19 billion in 2024 and reached USD 15.03 billion in 2025.

Graph: The US Market Revenue Forecast (2023 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 40.91 billion

- 2034 Projected Market Size: USD 64.84 billion

- CAGR (2026-2034): 01%

- North America: Largest market in 2024

- Asia-Pacific: Fastest Growing Region

Liquid laundry detergents are concentrated cleaning solutions designed for efficient stain removal and fabric care in both household and commercial settings. They dissolve easily in water, making them suitable for standard and high-efficiency washing machines. Their applications span residential laundry, hotels, hospitals, and industrial laundries, offering convenience and superior cleaning performance. Specialty formulations cater to delicate fabrics or specific cleaning needs, while standard and concentrated versions provide cost-effective solutions for everyday use, meeting diverse consumer and commercial requirements.

The market is propelled by growing urbanization, increased household spending, and rising disposable incomes, which boost demand for premium and convenient laundry solutions. Opportunities lie in product innovation, including high-performance and concentrated detergents, as well as targeted formulations for commercial and industrial use. Moreover, strategic partnerships, regional expansions, and marketing initiatives provide growth avenues. The market also benefits from consumer preference for multi-functional detergents that combine cleaning, fabric care, and fragrance, enhancing overall user experience.

Latest Market Trends

Growing Preference for Concentrated and High-Efficiency Liquid Detergents

Consumers are increasingly shifting toward concentrated and high-efficiency liquid laundry detergents due to their superior cleaning performance and reduced usage per wash. These formulations require less water and energy, making them compatible with modern washing machines and environmentally conscious lifestyles, while also offering cost savings over traditional detergents.

Manufacturers are responding by developing compact, highly concentrated liquids that maintain stain-removal efficiency without compromising fabric care. This trend is particularly strong in urban markets, where convenience, sustainability, and efficiency drive purchasing decisions. High-efficiency detergents are rapidly gaining acceptance across households, boosting overall demand.

Rising Demand for Eco-friendly and Biodegradable Formulations

The market is witnessing a strong shift toward eco-friendly and biodegradable formulations, driven by rising consumer awareness of sustainability and environmental safety. Modern households are increasingly preferring detergents made with plant-based ingredients and natural enzymes that reduce water pollution while being gentle on fabrics.

This trend is further reinforced by government regulations and corporate commitments to sustainable practices, leading major brands to launch green product lines and recyclable packaging. According to Straits Research, the demand for biodegradable detergents is set to grow rapidly as consumers align their choices with eco-conscious living.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 40.91 Billion |

| Estimated 2026 Value | USD 43.23 Billion |

| Projected 2034 Value | USD 69.03 Billion |

| CAGR (2026-2034) | 6.01% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Procter & Gamble (P&G), Unilever, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, Church & Dwight Co., Inc. |

to learn more about this report Download Free Sample Report

Market Drivers

Expanding Demand for Smart Washing Machines

The global liquid laundry detergents market is being significantly driven by the expanding demand for smart washing machines, which are designed to optimize detergent usage and enhance washing efficiency. Consumers increasingly prefer liquid detergents as they dissolve easily and are compatible with these high-efficiency appliances, ensuring better cleaning performance and fabric care.

As per Straits Research, the global smart washing machine market size was valued at USD 12.28 billion in 2024 and is projected to reach USD 62.42 billion by 2033, growing at a CAGR of 19.8% during the forecast period (2025-2033). This rapid adoption of smart washers is encouraging detergent manufacturers to innovate formulas tailored for these advanced machines, further boosting market growth.

Market Restraints

Strong Competition from Substitutes Like Powder Detergents and Detergent Pods

The growth of the global liquid laundry detergents market faces a notable challenge from the strong competition posed by substitutes such as powder detergents and detergent pods. Powder detergents remain popular in many developing regions due to their lower cost and wider availability, making them a preferred choice for price-sensitive consumers.

Meanwhile, detergent pods are gaining traction in mature markets because of their pre-measured convenience and ease of use. This dual pressure from economical powders and innovative pods continues to restrain the broader adoption of liquid detergents.

Market Opportunity

Increasing Popularity of Subscription-based Delivery Models

Rising consumer demand for convenience and sustainability is reshaping the liquid laundry detergents market, creating new opportunities for innovative business models. Subscription-based delivery services are emerging as a key trend, allowing households to receive products regularly without repeated purchases.

- For instance, in July 2025, UK-based eco-conscious brand Re:gn launched a subscription model for its plant-based laundry sheets, offering attractive discounts for new subscribers. The service quickly gained traction, with thousands of customers signing up within the first few months.

This example reflects a broader market shift, where brands that combine eco-friendly products with seamless delivery solutions are capturing consumer attention and driving market growth.

Regional Analysis

North America is dominant with a market share of over 40%, driven by high consumer demand for convenience and premium cleaning solutions. Increasing urbanization, busy lifestyles, and the widespread adoption of high-efficiency washing machines are fueling the growth of liquid laundry detergents. Leading companies are investing in innovative formulations, eco-friendly products, and sustainable packaging to meet evolving consumer expectations. Moreover, the rise of e-commerce platforms and subscription-based delivery models has strengthened market penetration and accessibility across the region.

The US market is dominant, with a strong presence of global and domestic brands focusing on innovation and sustainability. Companies such as Procter & Gamble, Henkel, and Church & Dwight are investing in eco-friendly, concentrated, and high-efficiency detergents. Efforts include biodegradable formulas, improved packaging, and smart washing machine-compatible products.

Canada’s market is growing with an increasing focus on eco-conscious and premium products. Companies are leveraging online platforms, retail chains, and subscription services to improve product accessibility. Moreover, sustainability initiatives, such as recyclable packaging and reduced water consumption formulas, are attracting environmentally aware consumers.

Asia-Pacific Market Insights

Asia-Pacific is the fastest-growing region with a CAGR of 6.87%, driven by rising disposable incomes, urbanization, and increasing adoption of modern laundry appliances. Rapid industrialization and growing awareness of hygiene and convenience are accelerating demand for liquid detergents. Companies are focusing on localized formulations, eco-friendly variants, and convenient concentrated solutions to capture diverse consumer needs. Moreover, strategic collaborations and investments in manufacturing facilities are enabling companies to strengthen distribution, improve supply chains, and cater to the evolving preferences.

China’s market is growing at a significant rate, driven by urban lifestyles and increasing demand for high-quality and eco-friendly products. Key players like Unilever and Liby are focusing on concentrated formulas, biodegradable detergents, and smart washing machine-compatible products. Marketing strategies highlight performance, convenience, and environmental responsibility, while collaborations with local distributors enhance reach.

India’s market growth is fueled by rising urbanization, busy lifestyles, and increasing awareness of hygiene and sustainability. Companies like Hindustan Unilever and Jyothy Laboratories are focusing on concentrated and eco-friendly detergents tailored to local washing habits. Expansion through retail chains, e-commerce, and subscription-based delivery models ensures wider accessibility.

Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe’s liquid laundry detergents market is witnessing steady growth, driven by strong demand for eco-friendly and premium products. Companies such as Henkel, Reckitt Benckiser, and Seventh Generation are focusing on biodegradable ingredients, concentrated formulas, and refillable packaging to reduce environmental impact. As per Straits Research, retail expansion through supermarkets, hypermarkets, and online channels, combined with marketing campaigns emphasizing sustainability and performance, is boosting consumer adoption.

Latin America Market Insights

Latin America’s liquid laundry detergents market is expanding with rising urbanization and growing disposable incomes. Regional companies are investing in retail and e-commerce distribution while promoting sustainability initiatives such as biodegradable ingredients and reusable packaging. Moreover, key players like Natura and Omo are introducing concentrated and environmentally friendly detergents tailored to regional washing habits. Collaborations with regional distributors and community-driven initiatives help strengthen brand visibility and drive market adoption in both urban and semi-urban areas.

Middle East and Africa Market Insights

The Middle East and Africa market is gradually growing, fueled by rising hygiene awareness and increasing modern retail penetration. Expansion through supermarkets, hypermarkets, and online channels ensures wider availability, while marketing strategies emphasize convenience, stain removal performance, and sustainability. Moreover, rising investments in local facilities and strategic partnerships with regional distributors enhance the supply chain, enabling brands to cater effectively to both urban households and emerging consumer segments.

Product Type Insights

The standard liquid detergent segment holds a dominant market share of over 35%, reflecting its widespread use in households globally. Their balance of affordability, cleaning performance, and compatibility with conventional washing machines makes them the go-to choice for everyday laundry needs. This strong consumer reliance secures their position as the leading segment, generating consistent revenue across both developed and emerging regions.

Segmentation by Product Type in 2025 (%)

Source: Straits Research

Applications Insights

Commercial applications, including hotels, hospitals, and laundries, are the fastest-growing segment, with a CAGR of 6.45%. Rising hygiene standards and demand for large-scale, reliable cleaning solutions fuel this growth. Expansion is notable in regions with thriving hospitality and healthcare sectors, where bulk usage of detergents is essential, and steadily increasing commercial demand within the global market.

Distribution Channel Insights

Supermarkets and hypermarkets dominate distribution with over 35% share, offering consumers accessibility, wide product choices, and competitive pricing. These outlets serve as the primary purchase point for laundry detergents, benefiting from strong foot traffic and established supply chains. Their role in brand visibility and consumer trust ensures continued dominance in the retail landscape.

Company Market Share

Leading companies are increasingly emphasizing sustainable practices, such as biodegradable formulations, eco-friendly packaging, and refillable options. At the same time, they are driving product innovation with concentrated solutions, faster wash cycles, cold-water effectiveness, and customizable fragrances. The market is also witnessing a shift toward premium and hypoallergenic products, along with advanced stain and fabric care. Moreover, brands are strengthening their presence through digital platforms, including e-commerce and subscription services, supported by rising urbanization.

Procter & Gamble (P&G)

Procter & Gamble (P&G), established in 1837 in Cincinnati, Ohio, has grown into one of the world’s largest consumer goods companies. Within the liquid laundry detergents market, the company holds a strong global presence with well-known brands that dominate household cleaning segments. P&G focuses on product innovation, eco-friendly formulations, and premium quality offerings, while leveraging strong distribution networks and digital channels to maintain its leadership in both developed and emerging markets.

- In September 2025, Procter & Gamble (P&G) announced the most significant upgrade to its Tide Original Liquid Detergent in two decades. Leveraging years of scientific innovation and large-scale production efficiencies, the new formula enhances cleaning power without increasing consumer costs.

List of Key and Emerging Players in Liquid Laundry Detergents Market

- Procter & Gamble (P&G)

- Unilever

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group plc

- Church & Dwight Co., Inc.

- Kao Corporation

- Lion Corporation

- Wipro Consumer Care and Lighting

- Seventh Generation Inc.

- Guangzhou Blue Moon Industrial Co., Ltd.

- Colgate-Palmolive Company

- The Clorox Company

- C. Johnson & Son, Inc.

- LG Household & Health Care Ltd.

- Amway Corporation

- Nirma Limited

- RSPL Group

- Ecolab Inc.

- McBride plc

Strategic Initiatives

- September 2025: Tide has introduced a new formula featuring innovative soil-release polymer technology, enhancing stain removal and maintaining whiteness, especially on synthetic fabrics. This upgrade marks the most significant change to Tide's liquid detergent in 20 years.

- April 2025: Henkel has unveiled new concentrated formulas for its brands, all®, Persil®, and Snuggle® liquid detergents. These formulations aim to reduce plastic usage by nearly 5% and conserve approximately 9 million gallons of water annually, aligning with sustainability goals.

- October 2025: Leaf & Mineral, a Canadian plant-based detergent brand, is expanding into the U.S. market. Their products are designed to deliver cleaning performance comparable to traditional detergents while being eco-friendly. The brand emphasizes sustainability and natural ingredients in its formulations.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 40.91 Billion |

| Market Size in 2026 | USD 43.23 Billion |

| Market Size in 2034 | USD 69.03 Billion |

| CAGR | 6.01% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Applications, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Liquid Laundry Detergents Market Segments

By Product Type

- Standard Liquid Detergent

- High-Efficiency (HE) Liquid Detergent

- Concentrated Liquid Detergent

- Specialty Liquid Detergent

By Applications

- Household

- Commercial(Hotels, Hospitals, Laundries, etc.)

By Distribution Channel

- Online Retail

- Offline Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.