Magnesium Sulfate Market Size, Share & Trends Analysis Report By Type (Anhydrous, Monohydrate, Heptahydrate, Others), By Form (Crystal, Powder, Granules, Liquid), By End Use (Agriculture, Pharmaceuticals, Food & Beverages, Chemicals, Cosmetics & Personal Care, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Magnesium Sulfate Market Overview

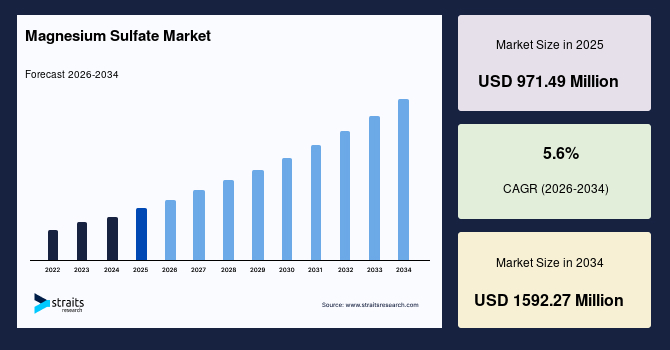

The global magnesium sulfate market size is estimated at USD 971.49 million in 2025 and is projected to reach USD 1,592.27 million by 2034, growing at a CAGR of 5.6% during the forecast period. The growth is driven by a consistently expanding pharmaceutical industry, strategic investments in research and development, the government’s proactive approach to enhance domestic production, and magnesium sulfate’s pivotal role as a laxative and analytical aid in laboratory settings. The pharmaceutical export of India increased from USD 25.4 billion to USD 30.4 billion this year. This remarkable increase in exports underscores the global demand for pharmaceutical products, thereby accelerating the demand for Magnesium Sulfate as a crucial formulation component.

Key Market Trends & Insights

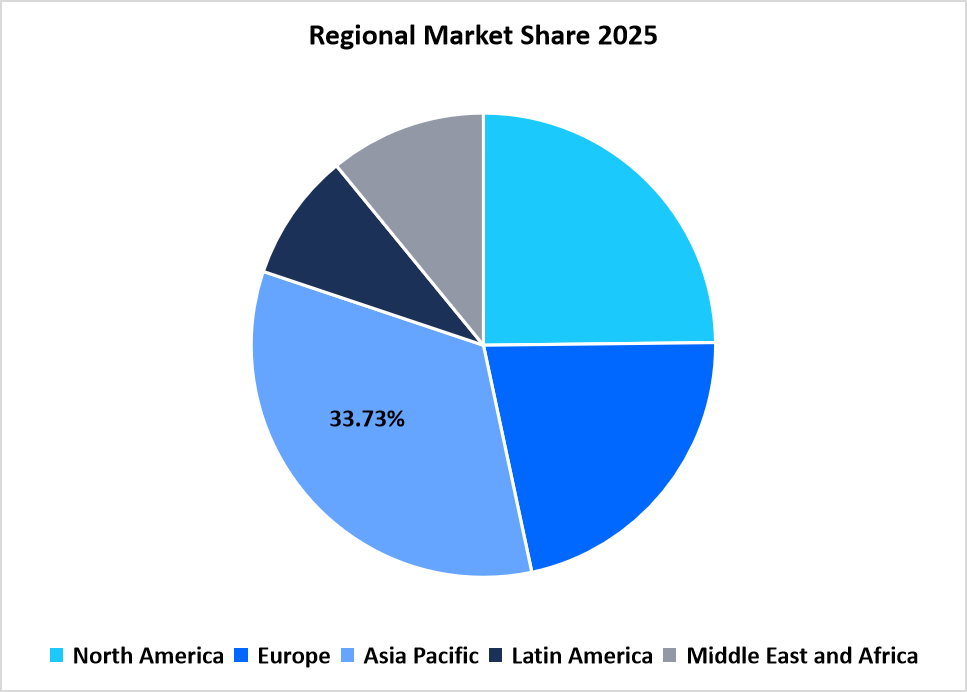

- Asia Pacific held a dominant share of the market, accounting for 33.73% revenue share in 2025.

- The North America region grew at the fastest pace, with a CAGR of 6.81% from 2026-2034

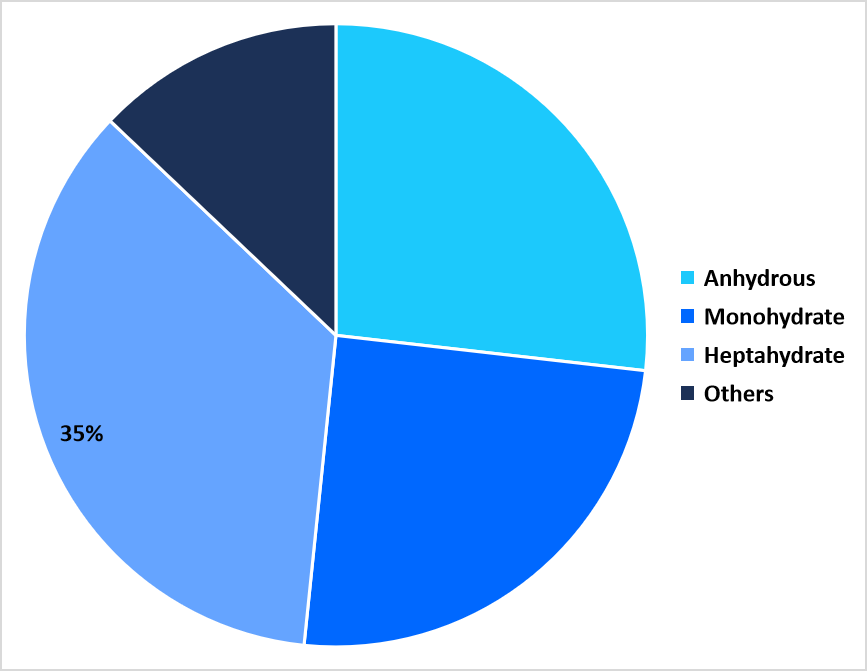

- Based on type, the heptahydrate segment held the highest market share of 35.71% in 2025.

- Based on form, the powder segment is projected to register the fastest CAGR growth of 6.79% from 2026-2034.

- Based on end use, the agriculture segment held the highest market share of 29.57% in 2025.

- China dominated the regional market in 2025 with a revenue share of 32.81%.

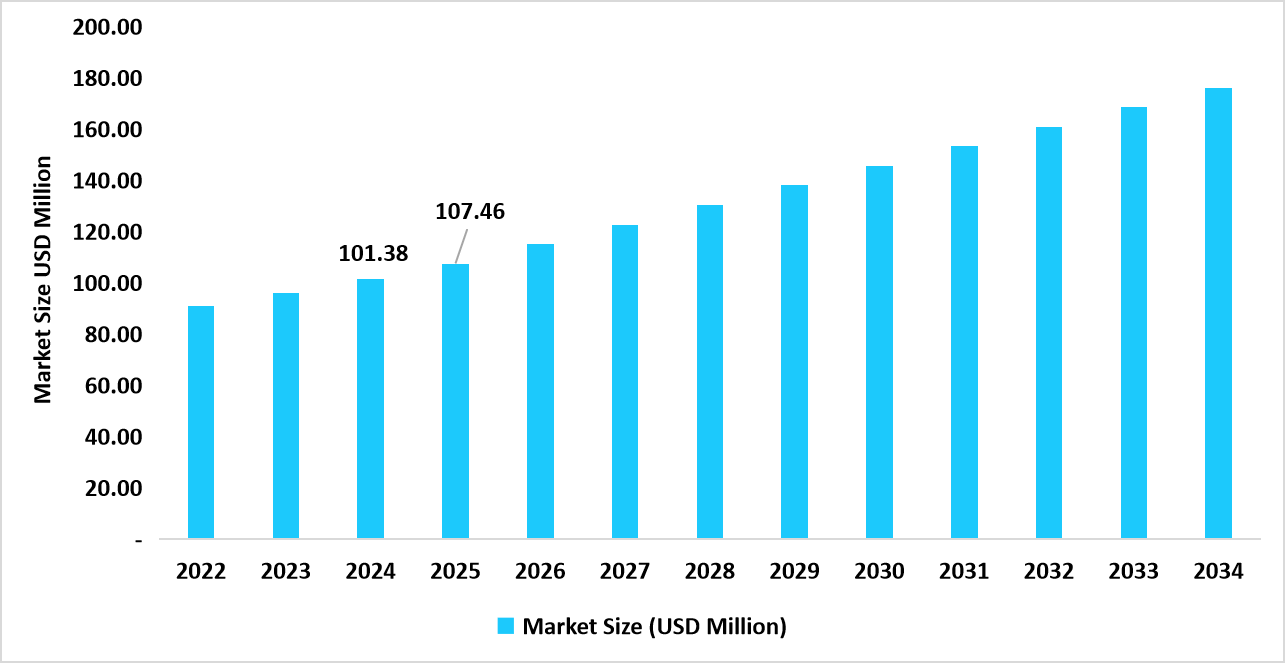

Table: China Magnesium Sulfate Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 971.49 million

- 2034 Projected Market Size: USD 1,592.27 million

- CAGR (2026-2034): 5.6%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: North America

Magnesium sulfate is a white, odorless, crystalline solid with high water solubility. There are various types of magnesium sulfate, such as anhydrous, monohydrate, heptahydrate, and others. These types vary according to the number of water molecules. Furthermore, it is available in various forms such as crystal, granules, powder, and liquid as well. With multiple forms and types, magnesium sulfate serves as a key ingredient in multiple key industries such as agriculture, pharmaceutical, food & beverages, cosmetics, and other industries.

Latest Market Trends

Growing Penetration of Controlled-Release Fertilizers

Magnesium sulfate is widely utilized as a fertilizer as well as a fertilizer additive. Its plant nutrition-providing properties mark its vital role in the manufacturing of fertilizers. The rising trend of controlled-release fertilizers is being followed by the magnesium sulfate fertilizer manufacturers as well. Such type of fertilizer releases the active ingredient in a controlled manner, thereby prolonging the release over a long period of time. CR-MAG is the magnesium fertilizer that allows controlled release of magnesium according to the plant’s needs. The development of controlled-release fertilizers directs the flow towards innovative ways of farming, thereby promoting market growth.

Premium Bath Soak Product Development

Magnesium sulfate offers muscle soreness and relaxation activities, thereby relieving nerve pain. Epsom salt bath soak relieves nerve pain after soaking feet for 20-30 minutes in warm water. The bath soak provides deep relaxation, improves skin health, and creates a soothing, therapeutic bathing experience. Epsom-It lotion is a product that offers 50 times more potency than a traditional Epsom salt bath soak. The product comprises a 25% concentration of 100% pure USP grade magnesium sulfate. The launch of such advanced and potent products enhances the consumer experience, thereby promoting the demand for magnesium sulfate.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 971.49 Million |

| Estimated 2026 Value | USD 1039.7 Million |

| Projected 2034 Value | USD 1592.27 Million |

| CAGR (2026-2034) | 5.6% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | K+S Aktiengesellschaft, China Nafine Group International Co., Ltd, UMAI CHEMICAL CO., LTD. , Premier Magnesia, LLC (Giles), Mani Agro Chem |

to learn more about this report Download Free Sample Report

Market Growth Factor

Consistent Agriculture Industry Growth

Magnesium sulfate is widely utilized as a fertilizer and additive in manufacturing fertilizers. Consistent growth of the agriculture sector propels the demand for magnesium sulfate as a crucial component. India is one of the major markets for agriculture, and every year the market is growing constantly. According to the Press Information Bureau, India, from 2017 to 2023, the agriculture and allied activities sector grew by 5% every year and showed a 3.5% growth in the second quarter of the year 2024-25. This notable and consistent growth of the agriculture sector continues to demand fertilizers and, hence, magnesium sulfate as a crucial component in the manufacturing of fertilizers.

Market Restraint

Raw Material Price Fluctuations

Magnesium sulfate offers a wide range of applications across multiple key industries such as agriculture, pharmaceutical, food & beverages, and cosmetics. However, the raw material price fluctuations impose supply chain challenges, thereby limiting the manufacturing rate of magnesium sulfate. Magnesium sulfate is produced from magnesium ore and sulfuric acid. The price fluctuations in the last couple of years for sulfuric acid in countries such as the U.S., India, Chile, Saudi Arabia, Indonesia, and France underscore the supply chain challenges, thereby limiting the market growth.

Market Opportunity

Government’s Proactive Approach for Wastewater Management

Magnesium sulfate is utilized as a water treatment aid for the purification of water. It removes heavy metals by precipitation, acts as a coagulant to remove suspended solids, and supplements microbial nutrients in wastewater treatment. Magnesium sulfate’s key role in water treatment propels its demand in water treatment. Government’s national programs and schemes such as National River Conservation Programme (NRCP), National Lake Conservation Programme (NLCP), Atal Mission for Rejuvenation and Urban Transformation (AMRUT), Smart Cities Mission, Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS), Repair, Renovation and Restoration (RRR) schemes promote the wastewater management concept influence the demand for magnesium sulfate as a key water purification agent.

Regional Analysis

According to Straits Research, the Asia Pacific dominated the market in 2025, accounting for 33.73% market share. This dominance is attributed to growing industrialization and urbanization in countries such as China, Japan, South Korea, and India, dominance of the agriculture industry, investments by the government to strengthen the pharmaceutical and chemical industries, and the gradually growing food and beverages industry and cosmetics industry.

India’s strong pharmaceutical sector consistently drives the demand for magnesium sulfate as a key component with multiple roles to play. India’s production-linked incentive scheme encourages investment, thereby bolstering production and diversifying the product reach. Launch of such schemes promotes pharmaceutical manufacturing rate, thereby reflecting the need for magnesium sulfate for manufacturing as well as analytical purposes.

North America Magnesium Sulfate Market Insights

North America is emerging as the fastest growing region with a CAGR of 6.81% from 2026-2034, owing to the dominance of industries such as cosmetics and skin care, food and beverages, a consistently growing pharmaceutical industry with a strong focus on domestic production and research and development, and strategic investments in the agriculture industry.

The magnesium sulfate market in the U.S. is driven by the growing agriculture industry, aligned with the government’s strategic initiatives. The U.S. Department of Agriculture invested USD 9 million in 10 organizations to support urban agriculture and innovative production last year. Such government projects influence the demand for magnesium sulfate as a key component of fertilizer manufacturing.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

The European magnesium sulfate market is driven by the growing demand for magnesium sulfate in the construction industry and the consistent growth of the industry. Magnesium sulfate is utilized to enhance the performance and durability of construction materials such as cement, concrete, and paints as well.

Germany is one of Europe’s leading construction sectors in 2025. As the construction industry is facing challenges with respect to external infrastructure sustainability, magnesium sulfate’s major role in prolonging the durability of material and modifying the viscosity of paints influences the demand for magnesium sulfate, thereby promoting market growth.

Middle East & Africa Market Insights

The MEA market for magnesium sulfate is propelled by the growing focus on the expansion of domestic pharmaceutical production capabilities. As magnesium sulfate is utilized in laxatives and IV solutions and as an analytical aid in laboratories, investments to enhance production capabilities propel the demand for magnesium sulfate.

A high percentage import of medicines and rising demand for medical intervention are influencing the development of local pharmaceutical industry. Aspen, a South Africa-based company, received a loan package of USD 535.7 million from DEG for the expansion of local production capacities. Such investments promoting local production capacities present opportunities for magnesium sulfate market growth.

Latin America Magnesium Sulfate Market Insights

The Latin American market for magnesium sulfate is driven by growing food industry, with strategic investments in the food industry by investment firms, and evolving consumer preferences. These investments promote the demand for magnesium sulfate as a coagulant, nutrient enhancer, flavor-enhancing agent, and fermentation and processing aid.

Strategic investments by the investment firms in food manufacturing explore the demand for magnesium sulfate in Brazil. ACON Investments entered into an investment agreement with KiSabor, a manufacturer and distributor of branded consumer food products in Brazil. Such investments explore the introduction of various types of health-conscious food, switching consumer preferences, and driving the demand for magnesium sulfate.

Type Insights

According to Straits Research, the heptahydrate segment dominated the market with a revenue share of 35.71% in 2025. This growth is driven by its dominant application as a fertilizer providing essential magnesium and sulfur to plants, as a laxative in constipation conditions, and personal care products such as bath salts. Growing innovations and rising adoption of magnesium sulfate-based products across these industries promote the demand for the heptahydrate type.

The anhydrous segment is projected to register the fastest CAGR growth of 6.41% during the forecast period. This growth is attributed to its rising applications in the chemical industry and analytical laboratories. It is widely utilized as a catalyst in the chemical industry for manufacturing other chemicals, as a buffer component in laboratory practices, and as a desiccant to remove water from organic phases.

Type Market Share (%), 2025

Source: Straits Research

Form Insights

The granules segment dominated the market with a revenue share of 32.75% in 2025. This growth is driven by its dominant utilization in the agriculture industry for manufacturing fertilizers. Continuous demand for fertilizers and innovations, such as controlled-release fertilizers, escalates the demand for magnesium sulfate in granular form.

The powder segment is projected to register the fastest CAGR growth of 6.79% during the forecast period. This growth is attributed to dominant application in the pharmaceutical industry for manufacturing laxatives, IV solutions, industrial applications such as drying agent, and filler application in the construction industry. Consistent growth of these industries accelerates the demand for the powder form of magnesium sulfate.

End Use Insights

The agriculture segment dominated the market with a revenue share of 29.57% in 2025. This growth is driven by consistently growing demand for fertilizers, government initiatives aiming growth of the domestic agriculture industry, strategic investments by key players to innovate various types of fertilizers, such as controlled release fertilizers, and growing investments in the agriculture sector by countries such as the U.S. for the development of the industry.

The pharmaceutical segment is projected to register the fastest CAGR during the forecast period. This growth is attributed to the key role of magnesium sulfate in manufacturing laxatives, IV solutions, and as an analytical aid in laboratories. Growing demand for medications and investments by key players for the expansion of business propel the demand for magnesium sulfate.

Competitive Landscape

The global magnesium sulfate market is moderately fragmented, with major manufacturing companies having a global presence, trying to increase their market share by undertaking strategic initiatives, including mergers, acquisitions, new product development, and partnerships.

The major players in the market include K+S Aktiengesellschaft, China Nafine Group International Co., Ltd, UMAI CHEMICAL CO., LTD., ACURO ORGANICS LIMITED, Jost Chemical Co., Oman Chemical, and others. These industry players compete to gain a strong market reach with a continuous supply of quality products.

Tianjin Xingyu Fertilizer Industry Co., Ltd.: An emerging market player

Tianjin Xingyu Fertilizer Industry Co., Ltd. is a China-based chemical manufacturing company. It specifically deals with the manufacturing of magnesium sulfate and other chemicals. Its product portfolio comprises heptahydrate, anhydrous, and monohydrate magnesium sulfate. The company developed its own high-quality magnesium mine base in Liaoning Province.

- 23rdApril 2025: Tianjin Xingyu Fertilizer Co., LTD. transported 114 tons of magnesium sulfate heptahydrate to Brazil.

List of Key and Emerging Players in Magnesium Sulfate Market

- K+S Aktiengesellschaft

- China Nafine Group International Co., Ltd

- UMAI CHEMICAL CO., LTD.

- Premier Magnesia, LLC (Giles)

- Mani Agro Chem

- Anmol Chemicals

- Richase Enterprise PTE. LTD

- ACURO ORGANICS LIMITED

- Laizhou Guangcheng Chemical Co., Ltd

- SHANDONG LAIYU CHEMICAL CO., LTD

- Jost Chemical Co.

- Laizhou City Laiyu Chemical CO., Ltd

- Vinipul Chemicals Pvt. Ltd.

- MUSCAT AND BARKA BUSINESS TRADING

- Oman Chemical

- Laizhou Zhongda Chemical Co., Ltd.

- Rupali Chemicals

- HiTech Minerals and Chemicals Group

- Satyam Laboratories

- SimSon Pharma Limited

- Tianjin Xingyu Fertilizer Industry Co., Ltd.

- Others

Strategic Initiatives

- 3rdApril 2025: Camber launched sodium sulfate, potassium sulfate, and magnesium sulfate oral solution, an osmotic laxative indicated for cleansing of the colon. Launch of this oral solution propels the demand for pharmaceutical-grade magnesium sulfate.

- 30thJanuary 2025: K+S announced offering of CO₂- reduced potassium and magnesium fertilizers. The addition of magnesium fertilizers to the product portfolio escalates the demand for magnesium sulfate as a key component in manufacturing.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 971.49 Million |

| Market Size in 2026 | USD 1039.7 Million |

| Market Size in 2034 | USD 1592.27 Million |

| CAGR | 5.6% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Form, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Magnesium Sulfate Market Segments

By Type

- Anhydrous

- Monohydrate

- Heptahydrate

- Others

By Form

- Crystal

- Powder

- Granules

- Liquid

By End Use

- Agriculture

- Pharmaceuticals

- Food & Beverages

- Chemicals

- Cosmetics & Personal Care

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.