Catalyst Market Size, Share & Trends Analysis Report By Type (Heterogeneous Catalysts, Homogeneous Catalysts, Biocatalysts), By Raw Material (Mixed Catalysts, Metallic Catalysts, Oxide Catalysts), By Application (Petroleum Refinery, Chemical Synthesis, Petrochemicals) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Catalyst Market Size

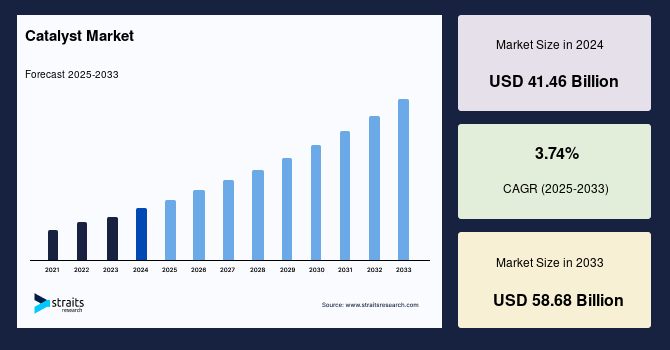

The global catalyst market size was valued at USD 41.46 billion in 2024 and is projected to grow from USD 42.3 billion in 2025 to USD 58.68 billion in 2033, exhibiting a CAGR of 3.74% during the forecast period (2025-2033).

The global catalyst market is experiencing robust growth, driven by the increasing demand for sustainable and efficient chemical processes across various industries. Key drivers include stringent environmental regulations necessitating emission control, the rising need for energy-efficient processes, and the growing adoption of catalysts in producing biofuels and renewable energy. Technological advancements have led to the developing of more selective and durable catalysts, enhancing process efficiencies and reducing operational costs.

The shift towards green chemistry and the circular economy also propels the demand for innovative catalytic solutions. Moreover, expanding the petrochemical industry, especially in emerging economies, contributes significantly to market growth. The integration of catalysts in waste-to-resource technologies and the emphasis on cleaner production methods underscore the market's positive trajectory.

Market Trend

Shift towards Sustainable Catalysts

The catalyst industry is transforming significantly, emphasising sustainability and environmental responsibility. This shift is driven by global efforts to reduce carbon footprints and comply with stringent environmental regulations. The development of catalysts that facilitate the conversion of waste materials into valuable products exemplifies this trend.

- For instance, in December 2024, researchers at the Massachusetts Institute of Technology (MIT) engineered a hybrid catalyst combining zeolite and alcohol oxidase enzymes. This catalyst efficiently transforms methane, a potent greenhouse gas, into urea-formaldehyde polymers under ambient conditions, offering a sustainable approach to methane utilisation.

Furthermore, advancements in photocatalysis have led to the creation of high-entropy oxide catalysts capable of degrading plastic waste while simultaneously producing hydrogen fuel. This dual functionality addresses both environmental pollution and energy generation. These innovations reflect a broader industry trend towards developing catalysts that enhance process efficiency and contribute to ecological sustainability.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 41.46 Billion |

| Estimated 2025 Value | USD 42.3 Billion |

| Projected 2033 Value | USD 58.68 Billion |

| CAGR (2025-2033) | 3.74% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | BASF SE, Johnson Matthey plc, Clariant AG, Dow Inc., Albemarle Corporation |

to learn more about this report Download Free Sample Report

Catalyst Market Growth Factor

Stringent Environmental Regulations

The catalyst industry is experiencing significant growth driven by increasingly stringent environmental regulations worldwide. Governments and regulatory bodies are enforcing policies to reduce emissions and promote cleaner industrial practices, thereby accelerating the adoption of advanced catalytic technologies.

- In the automotive sector, implementing stricter emission standards such as Euro 7 in Europe, effective from July 2025, mandates a 35% reduction in nitrogen oxide (NOx) emissions for passenger cars compared to Euro 6. These regulations compel automakers to integrate advanced catalysts like selective catalytic reduction (SCR) systems and diesel particulate filters (DPFs) to meet compliance, boosting catalyst demand.

- In the chemical industry, the European Union's environmental policies have increased operational costs for chemical firms, with compliance expenses exceeding $20 billion annually. Companies like BASF have dedicated substantial resources, including 250 employees, solely to manage regulatory paperwork under the EU’s REACH regulation.

These developments underscore the pivotal role of stringent environmental regulations in driving innovation and expansion within the catalyst market, as industries adapt to meet evolving compliance requirements and sustainability goals.

Market Restraint

High R&d Costs and Raw Material Price Volatility

The development of advanced catalysts involves significant research and development (R&D) investments, posing a barrier for new entrants and small-scale manufacturers. Moreover, the prices of raw materials used in catalyst production, such as precious metals like platinum, palladium, and rhodium, are subject to market volatility. For instance, geopolitical events and supply chain disruptions have led to fluctuations in the prices of these metals, impacting overall production costs.

These factors can hinder the adoption of new catalyst technologies, especially in cost-sensitive markets. Companies need to balance innovation with cost-effectiveness to maintain competitiveness. To mitigate these challenges, some manufacturers are exploring alternative materials and recycling methods. For example, the development of platinum-free hydrogen catalysts and self-regenerating catalysts with extended operational lifespans is an emerging strategy to reduce reliance on expensive raw materials and lower production costs.

Market Opportunity

Expansion in Emerging Economies and Industrial Growth

Emerging economies present significant growth opportunities for the catalyst market due to rapid industrialisation and urbanisation. Countries like China, India, and Brazil are experiencing expansion in the chemical and automotive industries, driving the demand for catalysts. In India, government initiatives such as the "Make in India" and "Atmanirbhar Bharat" programs promote domestic manufacturing and technological advancements, providing opportunities for the development and growth of the catalysts industry. Additionally, India's push for cleaner fuels and stricter emission norms is expected to increase the adoption of catalytic technologies.

- For example, in May 2025, the Indian government identified 10 key highway segments for zero-emission truck movement, aligning with the country's broader environmental objectives and supporting the catalyst market's growth.

Investments in infrastructure and manufacturing sectors in these economies will likely boost the demand for catalysts across various applications, including petrochemical refining, emission control, and renewable energy production.

Regional Analysis

Asia-Pacific leads the global catalyst market, commanding approximately 35% of the total market share in 2024. This leadership is attributed to rapid industrialisation and urbanisation, particularly in China and India, where expanding petrochemical, chemical, and automotive industries drive substantial catalyst demand. Government support through favourable policies, foreign direct investments, and emission regulations fuels market growth. Additionally, the availability of raw materials, low manufacturing costs, and a skilled technical workforce provide a competitive edge. As energy demand grows and nations in the region increase their renewable energy and emission control efforts, the need for catalysts across refining, emissions, and chemical synthesis will continue to surge, reinforcing Asia-Pacific’s dominance in the global market.

- China's catalyst industry is expanding rapidly, fueled by the country's industrial growth and environmental initiatives. The government's focus on reducing emissions and promoting clean energy leads to increased adoption of catalysts in various sectors, including petrochemicals and automotive. Investments in research and development are enhancing the country's capabilities in catalyst manufacturing. Furthermore, China’s “Made in China 2025” initiative prioritises domestic catalyst production for high-tech industries, including electronic chemicals and renewable energy. Rapid urbanisation and environmental regulation enforcement further push industries toward advanced catalytic processes for pollution control and green chemical production.

- India's market is witnessing significant growth, driven by the country's expanding industrial sector and environmental regulations. Government initiatives like "Make in India" and "Atmanirbhar Bharat" promote domestic manufacturing and technological advancements in catalyst production. The demand for catalysts in petrochemicals, chemicals, and refining industries is rising. The push for ethanol blending and clean mobility has also created new opportunities for catalytic technologies in biofuel and battery materials. India’s National Hydrogen Mission aims to establish the country as a hub for green hydrogen, further boosting the need for advanced catalysts in electrolysers and fuel cells. These developments, combined with an increasing focus on sustainability, are setting the stage for long-term growth in India’s catalyst industry.

North America

North America is currently the fastest-growing region in the global catalyst market, driven by stringent environmental regulations and technological innovation. The U.S. Environmental Protection Agency (EPA) continues implementing strict mandates for reducing emissions in power generation, transportation, and industrial sectors. This has accelerated the adoption of advanced catalytic converters, SCR systems, and hydrogen production catalysts. The region also benefits from a strong R&D ecosystem, fostering fuel cell, water treatment, and waste-to-energy catalyst applications breakthroughs. As clean energy infrastructure expands, particularly in hydrogen hubs and carbon capture projects across the U.S. and Canada, the demand for highly efficient and specialised catalysts is expected to rise, cementing North America’s role as a catalyst innovation hub.

- The U.S. catalyst market is driven by stringent environmental regulations and a strong emphasis on research and development. The country's advanced industrial sector, including automotive and chemical manufacturing, relies heavily on catalysts for efficient and sustainable operations. Investments in green technologies and renewable energy stimulate the demand for innovative catalyst solutions. Additionally, leading companies like Albemarle and Honeywell UOP are expanding their catalyst portfolios to meet the evolving needs of clean energy projects and emission control mandates. The U.S. market is positioned for continued innovation and growth with the increasing push towards decarbonisation and circular economy practices.

- Canada's market for catalyst is growing steadily, supported by the country's focus on environmental sustainability and clean energy initiatives. The government's investments in green technologies and emission reduction strategies encourage the adoption of advanced catalysts in various industries. Collaborations between academia and industry are fostering innovation in catalyst development. The Canadian automotive and petrochemical sectors increasingly integrate catalytic systems for fuel efficiency and emissions compliance. Additionally, the country’s participation in cross-border clean tech projects with the U.S. fosters shared innovation and expands catalyst applications in energy transition projects.

Europe

Europe continues to demonstrate significant growth in the catalyst market, underpinned by its aggressive climate policies and commitment to net-zero emissions. The European Green Deal and REPowerEU initiatives have spurred investments in hydrogen, waste recycling, and renewable energy sectors all catalyst-intensive domains. Companies like Clariant and Umicore have invested in new R&D centres across Germany and France, focusing on circular economy applications and catalyst recycling. Moreover, the transition to electric and hybrid vehicles and the development of synthetic fuels and green ammonia are opening new avenues for catalytic innovation. With a strong industrial base and policy-driven momentum, Europe is poised to remain a strategic growth region in the global catalyst market, particularly in applications related to energy transition and emissions management.

- Germany is a leader in catalyst innovation, strongly emphasising sustainable and efficient chemical processes. The country's robust automotive and chemical industries are significant consumers of catalysts. Government policies promoting environmental protection and energy efficiency drive the demand for advanced catalyst technologies. The German Federal Ministry for Economic Affairs and Climate Action continues to support R&D in catalytic materials for hydrogen production, carbon recycling, and green ammonia. The automotive sector is also adopting new emission control catalysts to comply with Euro 7 standards, making Germany a central hub for next-generation catalyst development in Europe.

- The UK's catalyst market is growing, supported by investments in research and development and a focus on clean energy technologies. Collaborations between universities, research institutions, and industry players are advancing catalyst design and performance. The country's commitment to reducing carbon emissions drives the demand for sustainable catalyst solutions. Companies like Johnson Matthey are at the forefront of developing catalysts for fuel cells and zero-emission transport. Additionally, academic partnerships with institutions such as the University of Oxford and Imperial College London are accelerating discoveries in low-cost, earth-abundant catalytic materials, further reinforcing the UK’s position as a leader in catalytic science and clean tech deployment.

Type Insights

Heterogeneous catalysts dominate the global market, primarily due to their widespread application across the petrochemical, chemical, and automotive industries. These catalysts operate in a different phase than the reactants, enabling easy separation and reuse, which reduces operational costs and enhances process efficiency. Their robust thermal and mechanical properties make them ideal for high-temperature industrial processes. Companies such as BASF and Clariant have expanded production lines for heterogeneous catalysts to meet growing environmental and process efficiency demands. As industries increasingly prioritise sustainability and regulatory compliance, heterogeneous catalysts are expected to maintain their leading market position well into the forecast period.

Raw Material Insights

Mixed catalysts, comprising multiple metal oxides or combinations of noble and base metals, are gaining prominence in applications requiring complex chemical transformations. These catalysts provide synergistic effects that enhance reaction rates, selectivity, and thermal stability, making them suitable for use in refinery, syngas, and emissions control applications. In 2024, adopting mixed catalysts significantly increased hydrogen production and CO₂ utilisation processes, driven by global decarbonisation efforts. Mixed catalysts offer flexibility in formulation, allowing manufacturers to fine-tune performance and cost-efficiency. Their rising demand is also fueled by their role in advanced catalytic converters and fuel cells, as nations adopt stricter environmental regulations and transition toward low-emission energy systems.

Application Insights

Petroleum refining remains the largest application segment for catalysts, driven by the need to improve fuel quality, meet emission regulations, and optimise output from crude oil. Catalysts are essential for hydrocracking, reforming, and desulfurisation processes that convert heavy hydrocarbons into lighter, cleaner-burning fuels. The segment witnessed robust growth in 2024, particularly in Asia-Pacific and the Middle East, where refining capacity expansions are ongoing. The global push for cleaner fuels, particularly marine and aviation fuels that meet IMO 2020 and CORSIA standards, further fuels demand. With the ongoing energy transition, petroleum refiners are also integrating catalysts into co-processing renewable feedstocks, such as bio-oils, indicating the expanding role of catalysts in bridging conventional and sustainable fuel production.

List of Key and Emerging Players in Catalyst Market

- BASF SE

- Johnson Matthey plc

- Clariant AG

- Dow Inc.

- Albemarle Corporation

- R. Grace & Co.

- Johnson Matthey plc

- Evonik Industries AG

- Haldor Topsoe A/S

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- UOP LLC

- Shell Global Solutions International B.V.

- Sinopec Corp.

- Axens SA

- Zeolyst International

to learn more about this report Download Market Share

Recent Developments

- November 2024- Johnson Matthey launched a new range of emission control catalysts designed to meet the latest Euro 7 emission standards. These catalysts are engineered to enhance performance in reducing nitrogen oxides and particulate matter, aligning with the automotive industry's shift towards cleaner technologies.

- September 2024- Clariant announced the expansion of its catalyst production facility in China to meet the growing demand in the Asia-Pacific region. This strategic move aims to strengthen Clariant's position in the global catalyst market and cater to the increasing needs of the chemical industry in emerging economies.

- April 2024- Chevron Phillips Chemical expanded its polyethylene production facility in Texas, incorporating new catalyst technologies to enhance efficiency and product quality, demonstrating a commitment to innovation and sustainability.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 41.46 Billion |

| Market Size in 2025 | USD 42.3 Billion |

| Market Size in 2033 | USD 58.68 Billion |

| CAGR | 3.74% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Raw Material, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Catalyst Market Segments

By Type

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Raw Material

- Mixed Catalysts

- Metallic Catalysts

- Oxide Catalysts

By Application

- Petroleum Refinery

- Chemical Synthesis

- Petrochemicals

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.