Marine Propeller Market Size, Share & Trends Analysis Report By Type (Propellers, Thrusters, Others), By Application (Merchant Ships, Naval Ships, Recreational Boats, Others), By Number of Blades (3-blade, 4-blade, 5-blade, Others), By Propulsion (Inboard, Outboard, Sterndrive, Others), By Material (Stainless Steel, Aluminum, Bronze, Nickel-Aluminum Bronze, Others), By End-User (OEM, Aftermarket) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Marine Propeller Market Overview

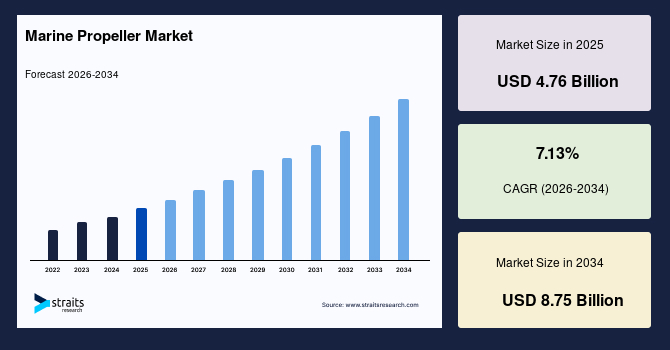

The global marine propeller market size was valued at USD 4.76 billion in 2025 and is estimated to reach USD 8.75 billion by 2034, growing at a CAGR of 7.13% during the forecast period (2026–2034). The market is driven by increasing shipbuilding activities, rising demand for fuel-efficient and high-performance propulsion systems, growth in recreational boating, expansion of naval fleets, and the need for reliable aftermarket replacements and retrofitting of aging vessels.

Key Market Trends & Insights

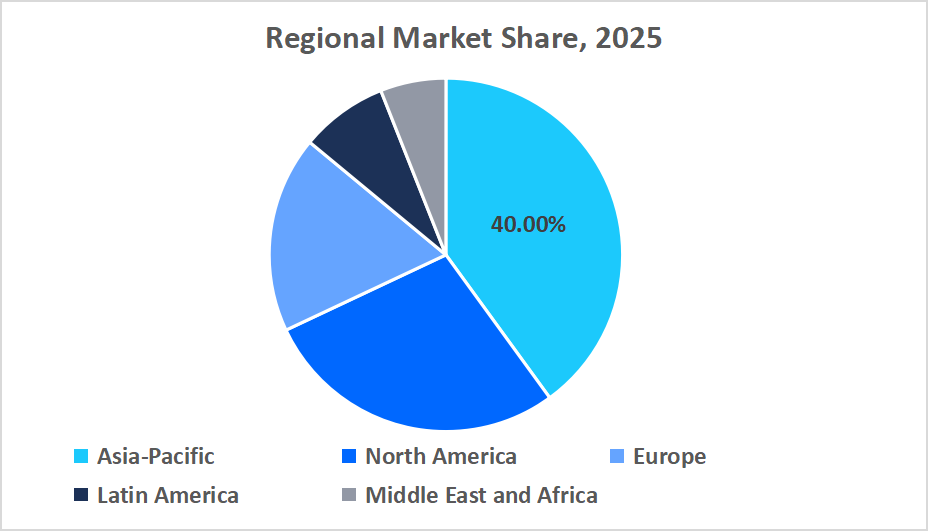

- Asia-Pacific held the largest market share, over 40% of the global market.

- Europe’s marine propeller market is the fastest-growing, with a CAGR of 7.83%.

- By Type, the propellers segment held the highest market share of over 60%.

- By Application, the recreational boats segment is expected to witness the fastest CAGR of 7.87%.

- By Number of Blades, the 4-blade propellers segment held the highest market share of over 35%.

- propulsion, the outboard propulsion segment is expected to witness the fastest CAGR of 7.27%.

- By Material, the Nickel-aluminum bronze segment held the highest market share of over 40%.

- By end-user, the aftermarket services segment is expected to witness the fastest CAGR of 7.25%.

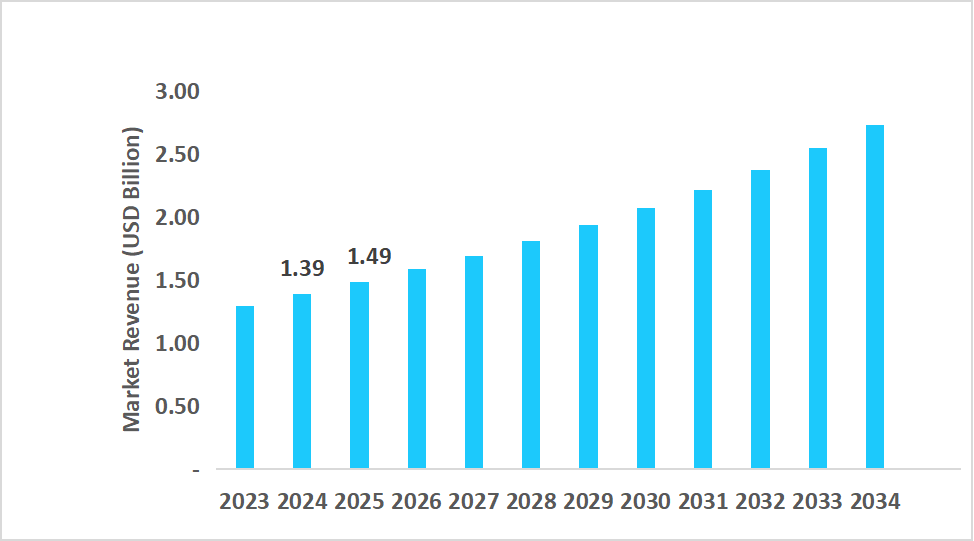

- China’s marine propeller market was valued at USD 1.39 billion in 2024 and reached USD 1.49 billion in 2025.

Graph: The China Market Revenue Forecast (2023 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 4.76 billion

- 2034 Projected Market Size: USD 8.75 billion

- CAGR (2026-2034): 13%

- Dominating Region: Asia-Pacific

- Fastest-Growing Region: Europe

A marine propeller is a mechanical device that converts engine power into thrust, enabling vessel propulsion through water. Typically made from metals such as bronze, stainless steel, or nickel-aluminum alloys, propellers are designed for efficiency, durability, and stability. They are used across merchant ships, naval vessels, recreational boats, and offshore support crafts. Variations in blade number, size, and pitch allow customization for speed, maneuverability, and fuel efficiency, making propellers a critical component in marine transportation and naval engineering.

The market is driven by increasing global shipbuilding activities, rising demand for fuel-efficient propulsion systems, and growing recreational boating and luxury yacht segments. Technological advancements, such as optimized blade designs and precision manufacturing, enhance vessel performance and reduce operational costs. Expanding maritime tourism and offshore industries, including oil and gas and renewable energy, present opportunities for propeller manufacturers. Additionally, demand for aftermarket replacements and retrofitting of aging fleets supports steady market growth worldwide.

Latest Market Trends

Preference for Lightweight and Corrosion-Resistant Materials

The marine industry is increasingly focusing on propeller materials that enhance durability and reduce maintenance costs. Lightweight alloys such as aluminum bronze and composite materials are gaining traction due to their ability to resist corrosion and improve fuel efficiency. These materials extend propeller life while minimizing environmental impact.

As per Straits Research, the growing demand for energy-efficient vessels is accelerating the adoption of corrosion-resistant materials in marine propellers. Manufacturers are investing in advanced metallurgy and coating technologies to combat saltwater degradation, ensuring optimal propulsion performance and lower operational costs for commercial and defense fleets.

Rising Adoption of Fixed Propellers in Marine Propulsion Systems

Fixed-pitch propellers are witnessing growing adoption due to their simplicity, cost-effectiveness, and high reliability in commercial and cargo ships. These propellers offer consistent performance, require minimal maintenance, and are particularly suitable for vessels operating under uniform load and speed conditions across long distances.

Shipbuilders are increasingly opting for fixed propeller systems over controllable pitch variants in medium and small vessels. The preference is driven by lower installation costs and improved energy efficiency. Moreover, technological advancements are enhancing the design precision of fixed propellers, optimizing thrust output while minimizing vibration and underwater noise.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 4.76 Billion |

| Estimated 2026 Value | USD 5.07 Billion |

| Projected 2034 Value | USD 8.75 Billion |

| CAGR (2026-2034) | 7.13% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Key Market Players | Wärtsilä Oyj Abp, Hyundai Heavy Industries, Mitsubishi Heavy Industries, Schottel GmbH, Nakashima Propeller |

to learn more about this report Download Free Sample Report

Marine Propeller Market Driver

Expanding Global Seaborne Trade

The steady expansion of global seaborne trade continues to drive growth in the marine propeller market. As international trade remains the backbone of global logistics, the demand for efficient propulsion systems is rising to support higher shipping volumes.

- A UNCTAD report in September 2025 highlighted that although maritime trade growth is becoming fragile due to rising geopolitical risks and higher costs, trade volumes still grew by 2.2% in 2024. Moreover, UNCTAD projects that seaborne trade will grow on average by around 2.4% annually from 2025–2029, fueled by increased movement of bulk materials and containerized goods.

This expanding trade activity is prompting shipbuilders to invest in advanced, fuel-efficient propellers to enhance vessel performance and reduce operational costs.

Market Restraint

Implementation of Stringent Environmental Regulations

The implementation of stringent environmental regulations poses a significant restraint on the global market. Regulatory bodies, including the International Maritime Organization (IMO), have introduced emission standards and noise control measures that demand cleaner and more efficient propulsion systems.

Manufacturers face challenges in redesigning propellers to comply with these norms while maintaining performance and cost efficiency. Moreover, restrictions on certain materials and coatings used in traditional propellers have increased production complexities and costs, compelling shipbuilders to invest in advanced, eco-friendly technologies, which may slow adoption among smaller operators.

Market Opportunities

Development of Smart and Digitally Monitored Propellers

The growing focus on digitalization and advanced monitoring in the maritime sector presents significant opportunities for the global market. Smart and digitally monitored propellers allow ship operators to track performance metrics in real time, optimize fuel efficiency, and reduce maintenance costs, aligning with sustainability and operational efficiency goals.

- For instance, in September 2025, the UK-based consortium launched the D.E.E.P. (Digitally Enabled Efficient Propeller) project, funded by Innovate UK under the Clean Maritime Demonstration Competition. This initiative aims to produce the world’s first marine propeller that is not only additively manufactured using advanced 3D printing techniques but also embedded with digital twin technology for continuous performance monitoring throughout its lifecycle.

Such innovations enable predictive maintenance, real-time performance optimization, and improved operational efficiency, driving broader adoption of smart propeller systems in commercial and defense vessels.

Regional Analysis

Asia-Pacific’s marine propeller market is dominant with a market share of over 40%, driven by expanding commercial shipping, naval modernization, and growing recreational boating. Rising seaborne trade and investments in maritime infrastructure are increasing demand for high-performance, corrosion-resistant propellers. Manufacturers are focusing on smart and digitally monitored propellers, improving efficiency and reducing maintenance costs. Moreover, the expansion of shipbuilding hubs and strong government support for maritime logistics enhances regional dominance.

China’s market is growing steadily, with companies such as Wärtsilä China, Jiangsu Changbo Marine, and CSSC Power investing in high-efficiency, digitally monitored propellers for merchant and naval vessels. Partnerships with shipbuilders enhance integration and adoption, while investments in R&D aim to optimize performance, fuel efficiency, and noise reduction in both commercial and recreational vessels.

India’s market is expanding with players like Larsen & Toubro, Hindustan Shipyard, and Bharati Shipyard supplying propellers for naval, commercial, and fishing vessels. Companies are emphasizing lightweight, corrosion-resistant, and high-performance designs. Collaboration with naval and private shipbuilders, alongside in-house R&D for smart monitoring and efficiency optimization, is driving adoption.

Europe Market Insights

Europe’s marine propeller market is the fastest-growing, with a CAGR of 7.83%, supported by the modernization of commercial fleets, rising environmental regulations, and the adoption of energy-efficient propulsion systems. Increased investments in port infrastructure and European shipyards are driving demand for technologically advanced propellers. Manufacturers focus on digital monitoring, composite materials, and noise-reducing designs to enhance vessel performance. Moreover, government incentives for green shipping and renewable-powered vessels are fostering product innovation.

The UK market is expanding with companies such as Rolls-Royce Marine, Schottel UK, and BAE Systems focusing on high-efficiency, digitally monitored propellers for naval and commercial applications. Collaborations with shipbuilders and retrofitting services enhance adoption, while R&D investments focus on fuel efficiency and environmentally friendly propulsion technologies.

Germany’s market is witnessing growth with manufacturers like Schottel, Becker Marine Systems, and MAN Energy Solutions supplying propellers for merchant ships, naval vessels, and offshore applications. Companies emphasize energy-efficient, corrosion-resistant designs, as well as digital monitoring and automated maintenance systems.

Source: Straits Research

North America Market Insights

North America’s marine propeller market is witnessing steady growth, driven by the modernization of commercial fleets, rising offshore activities, and increasing adoption of energy-efficient and digitally monitored propellers. Expansion of shipbuilding and repair yards, alongside government initiatives for naval fleet upgrades, enhances demand. Moreover, collaborations with shipbuilders and port authorities further strengthen the supply chain and after-sales service networks across the region.

The US market is growing with companies like Wärtsilä, Caterpillar Marine, and Schottel supplying high-performance, corrosion-resistant propellers. Investments focus on energy-efficient, digitally monitored systems for naval, commercial, and recreational vessels.

Latin America Market Insights

Latin America’s marine propeller market is expanding steadily, driven by growth in merchant shipping, offshore oil exploration, and naval fleet modernization. Investments in port infrastructure, ship repair, and retrofit projects are increasing the adoption of high-efficiency and corrosion-resistant propellers. Moreover, expansion of distribution networks, collaborations with local shipyards, and modernized logistics channels strengthen market penetration and after-sales services across the region.

Brazil’s market is growing with companies like WEG Marine and Atlas Propellers supplying advanced, corrosion-resistant propellers for commercial and offshore vessels. R&D efforts focus on fuel efficiency, durability, and environmental compliance.

The Middle East and American Market Insights

The Middle East and Africa marine propeller market is developing steadily due to rising maritime trade, offshore oil and gas activities, and fleet modernization programs. Manufacturers are introducing corrosion-resistant, energy-efficient, and digitally monitored propellers. Collaborations with naval and commercial shipyards, along with aftermarket and retrofitting services, enhance adoption. Moreover, investment in advanced materials, hybrid designs, and environmentally compliant technologies supports growth.

Saudi Arabia’s market is growing, with companies like Schottel and Wärtsilä supplying high-performance propellers for naval, commercial, and offshore vessels. Focus is on durability, efficiency, and digital monitoring solutions.

Type Insights

Propellers dominate the market with over 60% share, serving as the primary propulsion solution for commercial and recreational vessels. Their reliability, efficiency, and widespread application across merchant and naval ships ensure sustained demand. Strong adoption is reinforced by established manufacturing infrastructure and proven performance in diverse marine conditions, making propellers the leading choice for shipbuilders and OEMs.

Thrusters are the fastest-growing segment, expanding at a CAGR of 7.45%. Increasing adoption in maneuvering, dynamic positioning, and specialized marine operations drives demand. Thrusters are gaining traction in ports, offshore vessels, and luxury yachts, particularly in Europe and the Asia-Pacific region, where precision navigation is critical. Their ability to enhance ship handling and efficiency is steadily increasing market share and encouraging investment in advanced thruster technologies worldwide.

Application Insights

Merchant ships dominate with over 45% market share, driven by global trade growth and the need for reliable propulsion systems. Marine propellers for cargo, container, and bulk vessels ensure operational efficiency and fuel optimization. Strong demand from shipping companies and long vessel lifespans reinforce this segment’s dominance, maintaining a steady contribution to revenue and supporting continuous innovation in propeller design for commercial shipping applications.

Recreational boats are the fastest segment, with a CAGR of 7.87%. Rising disposable income, leisure boating, and luxury yacht investments, particularly in North America and Europe, drive growth. High demand for performance, durability, and noise reduction in propellers for recreational use is steadily increasing market share. Expansion in tourism-driven boating activities also fuels adoption, making this segment a key growth opportunity.

Source: Straits Research

Number of Blades Insights

Four-blade propellers dominate with over 35% share, favored for their balance between efficiency, thrust, and vibration reduction. Commonly used in merchant and naval vessels, they provide smooth operation and high durability. Moreover, established manufacturing and adoption across multiple vessel types reinforce their position as the leading blade configuration, ensuring steady demand and significant contribution to overall marine propeller sales.

Five-blade propellers are the fastest-growing segment, growing at a CAGR of 7.53%. Preferred for recreational boats and specialized vessels, they offer improved thrust, reduced vibration, and smoother handling. Rising consumer interest in performance yachts and luxury vessels, especially in North America and APAC, is driving adoption. Increased usage in high-speed applications is steadily boosting market share.

Propulsion Insights

Inboard propulsion dominates with over 45% market share, widely used in commercial ships and high-powered vessels. Known for reliability, efficiency, and suitability for large vessels, inboard systems remain preferred by OEMs and shipbuilders. Strong adoption in merchant shipping, naval fleets, and industrial vessels ensures consistent revenue contribution, making inboard propulsion the backbone of the marine propeller market globally.

Outboard propulsion is the fastest-growing segment, expanding at a CAGR of 7.24%. Its popularity in recreational and small commercial vessels is rising due to ease of installation, maneuverability, and maintenance. Growth is particularly strong in Asia-Pacific and North America, where boating and tourism activities are increasing. The segment’s expansion is steadily raising market share, driven by demand for versatile, high-performance propulsion systems in smaller craft.

Material Insights

Nickel-aluminum bronze dominates with over 40% market share, favored for its corrosion resistance, durability, and strength in harsh marine environments. It is widely used in large propellers and industrial vessels, ensuring long operational life. Established supply chains and proven performance reinforce its position as the preferred material, sustaining steady revenue and reliability across merchant, naval, and recreational vessel applications.

Stainless steel is the fastest-growing segment, expanding at a CAGR of 7.64%. Preferred for high-performance, precision, and resistance to marine corrosion, it is increasingly adopted in luxury yachts and specialized vessels. Growth is strongest in Europe and North America, where premium marine applications and maintenance-conscious operators drive demand. The segment’s rising adoption steadily increases market share, reflecting preference.

End-User Insights

OEMs dominate with over 55% market share, supplying new vessels with factory-fitted propellers. Long-term contracts, consistent specifications, and integration into shipbuilding projects reinforce their dominance. The segment benefits from stable demand in merchant, naval, and recreational vessels, ensuring predictable revenue streams for manufacturers and maintaining a leading position in the global market.

Aftermarket services are the fastest-growing segment, growing at a CAGR of 7.25%. Demand for replacements, upgrades, and specialized propeller maintenance drives growth. Expansion is strongest in Asia-Pacific and North America, where aging fleets and recreational boating trends create opportunities. Increasing focus on retrofitting and efficiency improvements steadily boosts market share, highlighting the growing importance of the aftermarket sector.

Competitive Landscape

The market is experiencing significant growth, driven by advancements in technology, increasing international seaborne trade, and a focus on operational efficiency. Companies are investing in developing smart and digitally monitored propellers, utilizing additive manufacturing techniques and integrating digital twin technology for real-time performance monitoring. Moreover, there is a growing emphasis on producing lightweight, corrosion-resistant materials to enhance durability and fuel efficiency.

Wärtsilä Oyj Abp

Wärtsilä Oyj Abp was established in 1834 in Vyborg, Finland. Originally focused on sawmill machinery, the company evolved into a global leader in marine and energy solutions, specializing in ship propulsion systems, engines, and smart marine technologies. Wärtsilä is recognized for its innovative azimuth thrusters, propellers, and sustainable energy solutions, serving commercial shipping, naval vessels, and offshore applications worldwide.

- In June 2025, Wärtsilä secured a contract to provide an integrated hybrid propulsion solution for four new 10,700 DWT geared tween decker vessels being built for Dutch ship owner and maritime service provider Vertom Group.

List of Key and Emerging Players in Marine Propeller Market

- Wärtsilä Oyj Abp

- Hyundai Heavy Industries

- Mitsubishi Heavy Industries

- Schottel GmbH

- Nakashima Propeller

- Mecklenburger Metallguss GmbH

- Veem Ltd

- Brunswick (Mercury Marine)

- Kawasaki Heavy Industries

- Schaffran Propeller + Service

- Teignbridge Propellers

- Rolls-Royce plc

- ABB (Azipod)

- Bruntons Propellers

- Flexofold

- Sharrow Marine

- Solas Propellers

- Michigan Wheel

- PowerTech Marine Propellers

- Hill Marine

Strategic Initiatives

- July 2025 - Sharrow Engineering and its marine division, Sharrow Marine, have announced a significant expansion into a new 60,000-square-foot manufacturing facility in Detroit. This move more than triples the company's production capacity, enabling the manufacturing of up to 2,000 units/month to meet the growing global demand for their innovative propeller technology.

- January 2025 - Schottel won a contract to supply propellers and a thruster for a Multi-Purpose Support Ship being built by Damen for the Portuguese Navy. The company will provide two EcoPeller SRE 560 azimuth thrusters, each powered by 2,600 kW electric input, for primary propulsion.

- January 2025 - Kongsberg Maritime secured a contract to deliver advanced propulsion systems for the Indonesian Navy’s new KCR-70 Fast Attack Craft, under construction at Sefine Shipyard, Türkiye. The system combines twin CPP Promas propellers with a central Kamewa waterjet, enhancing speed, maneuverability, and efficiency, enabling vessels to exceed 40 knots.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 4.76 Billion |

| Market Size in 2026 | USD 5.07 Billion |

| Market Size in 2034 | USD 8.75 Billion |

| CAGR | 7.13% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application, By Number of Blades, By Propulsion, By Material, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Marine Propeller Market Segments

By Type

- Propellers

- Thrusters

- Others

By Application

- Merchant Ships

- Naval Ships

- Recreational Boats

- Others

By Number of Blades

- 3-blade

- 4-blade

- 5-blade

- Others

By Propulsion

- Inboard

- Outboard

- Sterndrive

- Others

By Material

- Stainless Steel

- Aluminum

- Bronze

- Nickel-Aluminum Bronze

- Others

By End-User

- OEM

- Aftermarket

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.