Micro-Mobility Market Size, Share & Trends Analysis Report By Vehicle Type (Scooters, Bikes, Skateboards, Others), By Propulsion Type (Electric, Manual), By Sharing Type (Docked, Dockless), By Ownership (Business-to-Business, Business-to-Consumer) and By Region Forecasts, 2025-2033

Micro-Mobility Market Overview

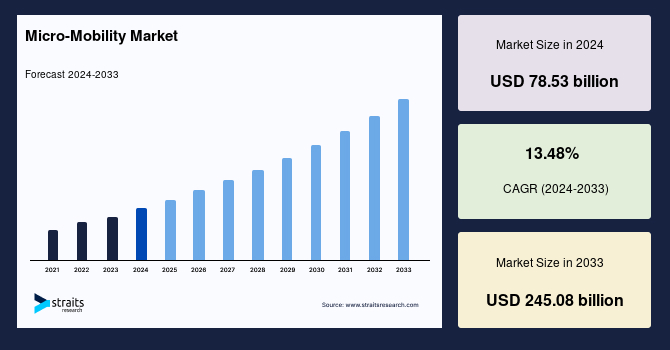

The global micro-mobility market size was worth USD 78.53 billion in 2024 and is projected to grow from USD 89.11 billion in 2025 to USD 245.08 billion by 2033, growing at a CAGR of 13.48% during the forecast period (2025-2033). Rapid technological integration and smart connectivity innovations are enabling real-time data sharing, enhancing route planning, and boosting consumer trust in micro-mobility services.

Key Market Insights

- Europe dominated the micro-mobility industry and accounted for a 50% share in 2025.

- Based on vehicle type, the scooters segment leads the market due to affordability, convenience, and urban adoption, with electric scooters supporting last-mile connectivity and shared mobility.

- Based on propulsion type, the electric segment leads the market due to efficiency, environmental benefits, and improved battery and charging technology.

- Based on sharing type, dockless micro-mobility dominates, offering flexibility, lower costs, and improved accessibility.

Market Size & Forecast

- 2024 Market Size: USD 78.53 Billion

- 2033 Projected Market Size: USD 245.08 Billion

- CAGR (2025–2033):13.48%

- Largest market in 2024: Europe

- Fastest-growing region: Asia-Pacific

The global market is witnessing substantial growth, driven by urbanization, growing traffic congestion, and a rise in sustainable transportation systems. Also, the development of micro-mobility services across key cities is supported by investment in infrastructure and regulatory measures that promote the adoption of alternative means of transport. Moreover, IoT sensors and mobile apps have transformed fleet management. These innovations improve operational efficiency, enhance safety, optimize vehicle performance, and reduce carbon emissions, positioning micro-mobility as a key component of urban sustainability initiatives.

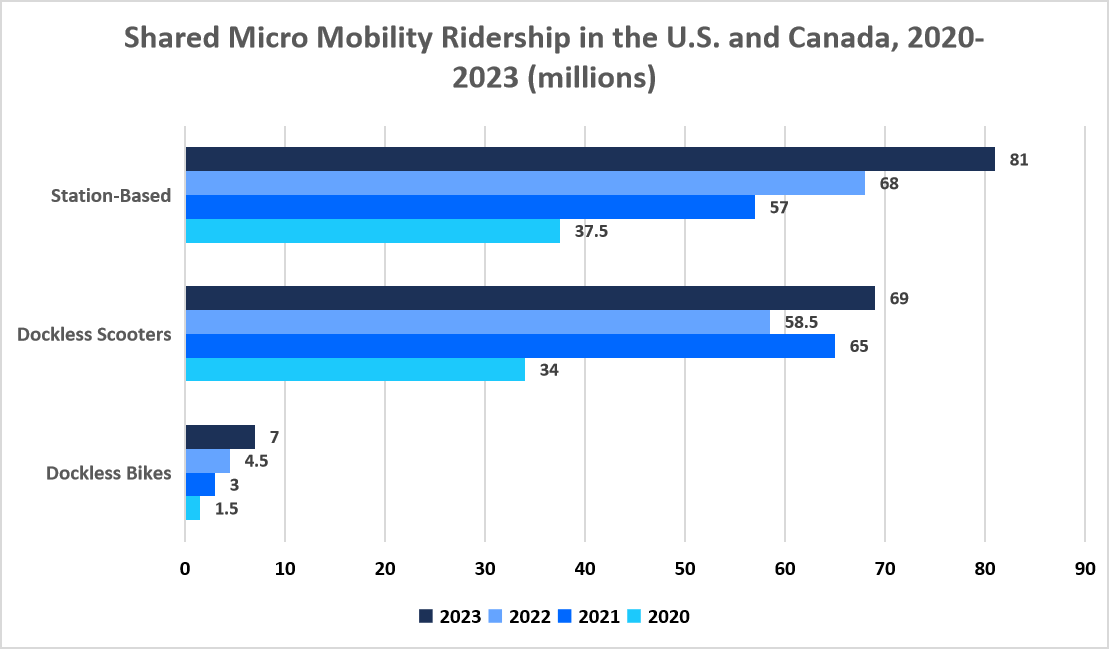

The market's growth is further supported by the increasing adoption of shared micro-mobility services. The chart below shows the development of shared micro-mobility ridership in the U.S. and Canada between 2020 and 2023 across dockless scooters, sockless bikes, and station-based systems.

Source: NACTO and Straits Research

The graph shows the growth of shared micro-mobility ridership in the U.S. and Canada. Station-based ridership saw the highest increase, reaching 81 million in 2023 from 37.5 million in 2020, indicating strong consumer preference and infrastructure expansion. In contrast, dockless scooters grew steadily, though with some fluctuations, rising from 34 million in 2020 to 69 million in 2023. Additionally, dockless bikes had the smallest ridership but grew from 1.5 million to 7 million in the same period.

Further, the strong ridership growth across all the categories highlights an expanding the market driven by urbanization investments, sustainability goals, technological advancements such as app-based ride-sharing improvements, and increasing consumer adoption.

Latest Market Trends

Integration of Micro-Mobility with Public Transit

As cities strive to improve urban mobility, they increasingly integrate micro-mobility solutions with public transport systems. By addressing last-mile connectivity, micro-mobility optimizes travel and reduces dependence on private vehicles.

- For instance, in July 2023, Camden Community Partnership, a non-profit corporation that plans and implements high-quality urban redevelopment projects, in partnership with Via, launched the Camden Loop, an innovative on-demand micro-transit service. Jersey City launched the Via micro-transit system, an app-based system of shared rides that adjuncts existing means of transport.

Such initiatives strengthen the market by increasing demand for integrated transport solutions, expanding accessibility, and encouraging more cities to invest in similar mobility programs, further accelerating market growth.

Mobility-as-A-Service (maas) Integration

Integrating micro-mobility with Mobility-as-a-Service (MaaS) transforms urban transportation by providing seamless, multimodal travel options. This shift is driven by the need for more accessible and efficient transit systems, reducing reliance on private vehicles.

- For instance, mobility-as-a-service apps like Whim and Moovit enable users to plan and pay for e-scooters, e-bikes, and public transport in a single platform, enhancing convenience and connectivity.

As a result, cities such as Helsinki and Los Angeles are at the forefront of implementing MaaS, whereby seamless transit solutions improve connectivity and stimulate sustainability.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 78.53 Billion |

| Estimated 2025 Value | USD 89.11 Billion |

| Projected 2033 Value | USD 245.08 Billion |

| CAGR (2025-2033) | 13.48% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Uber Technologies Inc., Neutron Holdings, Inc. dba Lime, Blue Jay Transit, Inc., DiDi Global, Lyft, Inc. |

to learn more about this report Download Free Sample Report

Micro-Mobility Market Drivers

Smart Connectivity and AI-Driven Innovations

Rapid technological integration, through advanced connectivity and sensor technologies, drives market growth in micro-mobility. Countries worldwide are adopting AI-powered traffic prediction models and 5G connectivity to optimize traffic flow, enhance safety, and improve operational efficiency in micro-mobility systems.

- For instance, countries like Spain have deployed mobility management centers that use AI-powered traffic prediction models to optimize traffic flow. This system has reduced emergency response times by up to 25% and decreased traffic-related fatalities by 30%. 5G connectivity has also enabled real-time data sharing, optimizing route planning and vehicle maintenance.

Such innovations, supported by digital infrastructure investments over the past two years, have significantly boosted operational efficiency and consumer trust, positioning technology as a vital factor for market expansion.

Environmental Sustainability Initiatives

Governments and organizations worldwide are promoting green modes of transport to reduce greenhouse gas emissions and combat climate change. Micro-mobility options such as e-scooters, e-bikes, and bicycle-sharing services provide clean alternatives for gasoline-fueled autos, especially for relatively short distances.

- For instance, in August 2024, the North American Bikeshare and Scootershare Association (NABSA) published a fifth annual Shared Micro-mobility State of the Industry Report for North America, which indicates that shared micro-mobility trips saved around 81 million pounds of CO₂ emissions which translates to thousands of cars taken off the roads in North America, representing a massive change in the quality of air in urban areas.

As a result, this significant reduction in CO₂ emissions through shared micro-mobility services creates a strong market demand for sustainable urban transport solutions.

Market Restraint

Regulatory Restrictions and Policies Limiting Growth

The expansion of the market is significantly hindered by regulatory challenges, including safety policies, urban congestion control, and infrastructure limitations imposed by governments and local authorities. While micro-mobility solutions provide sustainable transport alternatives, concerns regarding pedestrian safety, traffic disruptions, and improper parking have led to restrictive regulations in many cities. Some governments impose stringent licensing requirements, operational restrictions, and insurance mandates, making it difficult for companies to scale their services.

- For instance, Italy implemented a legal mandate requiring e-scooter users to wear helmets and carry insurance, significantly increasing costs for users and service providers, which may discourage adoption. Similarly, Paris banned rented e-scooters in 2023 due to safety concerns and the unregulated use of public spaces, affecting the shared mobility industry and forcing operators to reassess their strategies.

Additionally, cities such as Barcelona and Singapore have imposed strict limitations on where e-scooters and shared bikes can operate, leading to reduced availability in densely populated areas. In the U.S., micro-mobility providers must comply with varying state regulations, adding complexity to business expansion. Such regulatory inconsistencies create uncertainty, discourage investment, and slow the adoption of micro-mobility solutions.

Market Opportunity

Government Incentives and Subsidies for Sustainable Transport

Governments worldwide actively support micro-mobility adoption through financial incentives, tax benefits, and infrastructure investments to promote sustainable urban transport. With growing concerns over climate change and urban congestion, policymakers prioritize eco-friendly mobility solutions by integrating micro-mobility with public transportation networks. Many governments subsidize e-bike purchases, fund shared mobility programs, and invest in dedicated lanes and charging stations.

- For instance, the European Union’s Sustainable and Smart Mobility Strategy aims to reduce transport-related emissions by at least 90% by 2050, encouraging cities to integrate micro-mobility into their transport ecosystems. In the United States, federal and state governments offer tax credits for electric bicycles, making them more affordable for consumers.

Such initiatives significantly lower barriers to entry for consumers and businesses, providing growth opportunities for e-scooters, e-bikes, and other low-emission transport providers. As urban populations grow, government support for micro-mobility will be crucial in transforming cities into smart, sustainable hubs with reduced traffic congestion and pollution.

Regional Analysis

Europe leads the global micro-mobility market, driven by progressive government policies, high urban population density, and firm environmental commitments. Countries like Germany, the Netherlands, and France have pioneered micro-mobility integration with public transport, making shared e-scooters and bicycles essential to city commutes. Extensive investment in smart city infrastructure, dedicated cycling lanes, and mobility-as-a-service (MaaS) platforms has further strengthened Europe’s leadership in the sector.

- For example, Germany’s National Cycling Plan 3.0 promotes micro-mobility solutions by improving infrastructure and providing subsidies for electric bicycles. Additionally, the Netherlands, known for its extensive cycling culture, has invested billions in improving bike-friendly urban planning.

Europe’s strict emission reduction goals and increasing preference for green transportation drive market expansion. Public-private partnerships between governments and companies such as Lime, Bird, and Tier have further accelerated the adoption of shared mobility solutions.

- Germany leads Europe with 360 dockless micro-mobility operations in 139 cities, according to The City Fix from the World Resources Institute. Shared e‑scooters and bike‐sharing systems in cities such as Berlin and Munich are central to decreasing urban emissions and alleviating traffic. Federal transport regulations, released by Germany's Ministry of Transport, have led to a mature and safety‑oriented market that enables billions of trips per year.

- Pilot programs and trials in cities such as London have rapidly accelerated micromobility adoption in the UK. Transport for London has reported that early e‑scooter trials delivered over 2.5 million trips, covering more than 6.46 kilometers since launch. These public-private efforts pave the way for a more integrated, sustainable transport network across UK urban areas.

Asia-Pacific Market Trends

Asia-Pacific is emerging as the fastest-growing region in the global micro-mobility market, driven by rapid urbanization, rising disposable incomes, and strong government initiatives supporting sustainable transport. Countries like China, India, and Indonesia are seeing massive demand for micro-mobility solutions due to increasing traffic congestion and pollution concerns. Governments are actively promoting electric two-wheelers and integrating them into public transport networks.

- For instance, China leads the world in e-bike adoption, with over 300 million electric two-wheelers in use, thanks to favorable policies and incentives for electric mobility. India has introduced the Faster Adoption and Manufacturing of Electric Vehicles (FAME) initiative, providing subsidies for electric two-wheelers and encouraging widespread adoption. In Southeast Asia, cities like Bangkok and Jakarta are experimenting with micro-mobility pilot projects to reduce car reliance and enhance last-mile connectivity.

Asia-Pacific’s booming digital economy and increasing focus on smart city development make micro-mobility a vital component of urban transport. As infrastructure investment grows and technological advancements improve vehicle efficiency, the region is expected to witness exponential market growth in the coming years.

- China is generally credited with initiating the micro-mobility revolution. Various innovative private-sector approaches, such as Mobike and Ofo, working hand in hand with government-initiated programs, witnessed the introduction of dockless bicycle systems on an enormous scale into urban transport. According to the report issued by the Beijing Municipal Bureau of Transport, as of 17 November 2023, total rides undertaken on shared bicycles surpassed 1 billion, thus setting a new historical record. The daily mean number of rides stood at 3.1157 million, meaning an increase of 9.04% in 2022.

North America Market Trends

- In 2023, shared micro-mobility in the U.S. reached high levels, with systems nationwide recording 133 million trips, according to the National Association of City Transportation Officials (NACTO). Cities such as New York, San Francisco, and Chicago have rapidly expanded dockless bike and scooter fleets, working closely with operators to improve safety and optimize routes using real-time data. These efforts have driven enhanced last‐mile connectivity and reduced urban congestion.

- In cities such as Toronto and Vancouver, shared e-scooter usage has surged, reflecting a growing demand for sustainable urban transportation. According to NATCO, Canadian cities recorded nearly 24 million micro-mobility trips in 2023. To facilitate this growth, Transport Canada and local governments have introduced promotive initiatives, such as improved infrastructure developments and regulatory frameworks, to ensure that urban mobility is sustainable, accessible, and safe for everyone.

Vehicle Type Insights

Scooters dominate the market due to their affordability, convenience, and increasing adoption in urban areas. Specifically, electric scooters (e-scooters) are widely used for last-mile connectivity, helping reduce traffic congestion and emissions. The rise of shared mobility services such as Lime and Bird has boosted their accessibility.

- For instance, according to the Shared Micromobility Report 2023, e-scooter systems bounced back in 2023 with 69 million in 2023 compared to 58.5 million in 2022, a 15% increase in trips in the U.S. and Canada.

Propulsion Type Insights

Electric propulsion is dominating the market with its efficiency and environmental appeal. Electric micro-mobility vehicles decrease emissions and are superior performers with negligible noise pollution. Constant developments in battery technology and charging networks also further enhance consumer trust and take-up, entrenching electric propulsion's position in the market.

Sharing Type Insights

Dockless micro-mobility solutions dominate the sharing type segment as these solutions offer greater flexibility and convenience compared to docked systems. Dockless allows users to pick up and drop off vehicles anywhere within designated areas, reducing infrastructure costs and increasing accessibility. This model facilitates rapid growth in cities, allowing operators such as Spin, Voi, and Dott to expand rapidly. Also, dockless systems enhance user take-up by avoiding the necessity of finding docking stations, thus making shared micro-mobility services more convenient and accessible.

Ownership Insights

The business-to-consumer segment dominates the ownership segment in the market due to the rising demand for personal convenience and flexibility. Consumers prefer owning e-scooters and e-bikes for daily commuting, avoiding reliance on shared services. Easy maintenance and government incentives further drive individual ownership. As urban mobility trends shift toward personal transportation, B2C ownership continues to outpace B2B in market growth.

Company Market Share

Dominant companies in the micro-mobility market invest in technology and acquire strategically to control the space. Key players like Lime, Bird, and Tier have increased their fleets and optimized digital platforms for better user engagement. Strategic partnerships with municipal governments have further entrenched market positions.

Yulu: A Prominent Player in the Global Micro-Mobility Market

Yulu is an Indian micromobility startup established in 2017, providing shared electric two-wheelers and bicycles for convenient first- and last-mile connectivity. Yulu streamlines its fleet management and user experience in key cities such as Bengaluru, Delhi, and Mumbai through IoT, machine learning, and AI. The company has grown its network aggressively and launched innovative battery-swapping services through its subsidiary, Yuma Energy.

Recent Developments:

- In February 2024, Bengaluru-based Yulu, which already operates in Bengaluru, Delhi, and Mumbai, announced plans to expand into seven additional Indian metros. The company is also actively exploring third-party partnerships to launch its micro-mobility services across tier 2 and tier 3 cities and towns. This strategic expansion aims to boost urban connectivity and make sustainable, shared electric mobility accessible across diverse markets, further reducing traffic congestion and pollution in India.

List of Key and Emerging Players in Micro-Mobility Market

- Uber Technologies Inc.

- Neutron Holdings, Inc. dba Lime

- Blue Jay Transit, Inc.

- DiDi Global

- Lyft, Inc.

- Voi Technology AB

- TIER-Dott

- Bolt Technology OÜ

- Neuron Mobility

- Beam Mobility Holdings Pte. Ltd.

- Motivate

- Gogoro

- Ola Electric

- Yulu

- Veo Inc.

- Others

to learn more about this report Download Market Share

Recent Developments

- In September 2025, French company ÆMOTION introduced the Aemotion, a compact, innovative, four-wheeled electric two-seater designed for urban mobility. With a width of just 79cm, it offers excellent maneuverability in congested traffic while providing the safety of a fully enclosed cabin. The vehicle features a tilting chassis, swappable and fixed battery options, and a top speed of 115km per hour.

- In September 2025, in Bengaluru, Ultraviolette launched the X-47 crossover electric motorcycle at a starting price of US$3,000. The company aims to boost its sales significantly, setting a target of 10,000 units for the financial year 2025-26, a sharp rise compared to the 2,000 units sold in the previous year.

- In September 2025, Infinite Machine, a New York-based startup, announced the upcoming global launch of its P1 electric scooter. Inspired by sci-fi aesthetics, particularly Blade Runner, the P1 features angular anodized steel bodywork, a 6kW rear hub motor, and a range of about 60 miles per charge. The scooter also supports modular accessories and is priced at $10,000. U.S. deliveries are set to begin in Fall 2025.

- In May 2025, Lime launched 3,000 LimeGliders, new seated scooters in Seattle. These scooters feature a low center of gravity, a step-through frame, and are designed for ease of use without requiring pedaling or pushing off. Seattle became the first city globally to implement this new option, supplementing Lime’s existing fleet of e-bikes and stand-up scooters

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 78.53 Billion |

| Market Size in 2025 | USD 89.11 Billion |

| Market Size in 2033 | USD 245.08 Billion |

| CAGR | 13.48% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Vehicle Type, By Propulsion Type, By Sharing Type, By Ownership |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Micro-Mobility Market Segments

By Vehicle Type

- Scooters

- Bikes

- Skateboards

- Others

By Propulsion Type

- Electric

- Manual

By Sharing Type

- Docked

- Dockless

By Ownership

- Business-to-Business

- Business-to-Consumer

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.