Microcontroller Socket Market Size, Share & Trends Analysis Report By Product (SOIC, SOP, BGA, QFP, DIP), By Application (Electronics, Medical Devices, Automotive, Military & Defense, Industrial) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Microcontroller Socket Market Overview

The global microcontroller socket market size is estimated at USD 1.52 billion in 2025 and is projected to reach USD 2.29 billion by 2034, growing at a CAGR of 4.7% during the forecast period. The key drivers of the microcontroller socket market are the increasing, due to rise of the Internet of Things (IoT), advanced functionalities, and the demand for smart devices in consumer electronics, automotive control systems, industrial, and medical devices, which is fostering high demand for high-reliability socket solutions. Continued evolution of socket technology for testing, programming, and prototyping, and the need for secure and accurate solutions, are fueling market growth and facilitating innovation in high-tech markets.

Key Market Trends & Insights

- In 2025, North America held around 36.1% of the market share of the global microcontroller socket market.

- The Asia-Pacific region exhibit the highest growth in the microcontroller socket market, at a CAGR of 5.8% during 2026 to 2034.

- Among products, The DIP segment dominated the market with a revenue share of 10%.

- By application, industrial segment ispredicted to lead in 2025 with the CAGR of 4.9%.

- Automotive applications are anticipated to register a CAGR of 5.2%.

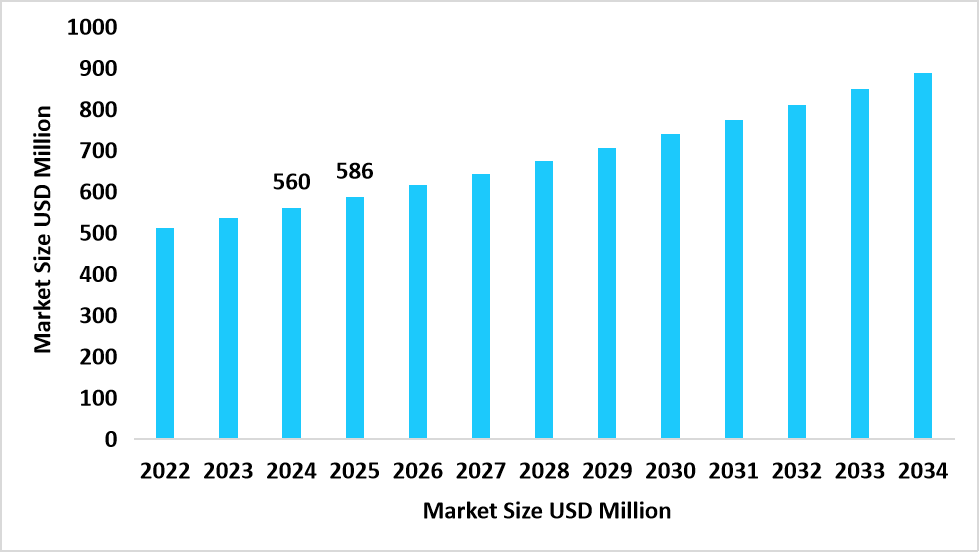

- The United States microcontroller socket market size was USD 0.56 billion in 2024, and it is estimated to reach around USD 0.59 billion in 2025.

Table: U.S Microcontroller Socket Market Size (USD Million)

Source: Straits Research

Market Size and Forecast

- 2025 Market Size: USD 52 billion

- 2034 Projected Market Size: USD 29 billion

- CAGR (2026–2034): 4.7 %

- Largest Market in 2025: North America

- Fastest Growing Region: Asia Pacific

The global market covers an extensive variety of types and architectures of sockets, ranging from high-pin-count BGA sockets to fine-pitch QFP sockets and other sophisticated test interfaces. These sockets are supplied under a variety of manufacturing and deployment schemes, including standardized JEDEC and IPC-conformant designs, automated testing-ready solutions, and IoT-enabled diagnostic interfaces. In addition, microcontroller sockets are available from various manufacturers, such as Amphenol, Samtec, and other top vendors, serving prototyping, testing, and manufacturing requirements of automotive, industrial, and consumer electronics markets with reliable and high-performance solutions throughout world.

Latest Market Trends

Revolutionizing Microcontroller Testing

The microcontroller socket market is moving towards more intelligent, faster, and more versatile testing solutions. In contrast with conventional soldered models, new sockets enable simple chip swapping, which saves time and money. The biggest draw is high-performance sockets supporting next-generation microcontrollers with higher reliability. This trend is fueling quicker product creation and propelling market expansion in electronics sectors. Increasing usage of automated testing systems and IoT-based diagnostic instruments is improving testing precision and scalability. Increased demand from automotive, consumer electronics, and industrial automation sectors further fuels market growth.

More Investment and Strategic Alliances in Microcontroller Socket Solutions

The world microcontroller socket market is witnessing greater strategic investments and alliances to drive testing efficiency, support high-density MCU packages, and enhance prototyping capability. Over USD 420 million was spent globally on leading-edge socket R&D in 2024 with key manufacturers working together to develop solid, high-reliability products. Alliances are also working towards creating next-generation automotive and industrial MCUs with compatible sockets, improving thermal management and signal integrity. Furthermore, joint ventures are hastening the use of standardized testing procedures in several regions. Increasing demand for high-performing, miniaturized electronics also stimulates innovation in socket design and deployment.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.52 billion |

| Estimated 2026 Value | USD 1.59 billion |

| Projected 2034 Value | USD 2.29 billion |

| CAGR (2026-2034) | 4.7% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Amphenol Corporation, TE Connectivity, Mill-Max Manufacturing Corp., Microchip Technology Inc., Johnstech International Corporation |

to learn more about this report Download Free Sample Report

Market Drivers

Implementation of Standardized Test Protocols and Automated Solutions

The increased application of standardized test procedures and automated socket handling technology is revolutionizing socket usage, enabling rapid production cycles and greater throughput in electronics assembly and prototype creation. This also minimizes human error, improves consistency of quality, and enables scalable manufacturing for high-volume microcontroller applications. Use in conjunction with AI-powered monitoring systems enables real-time detection of defects and predictive maintenance, further improving productivity efficiency. Increased use of robotics and robotic pick-and-place systems in test labs is improving flexibility to operate, while cloud-based testing platforms facilitate centralized analysis and enhanced design validation for global production networks.

Industrial growth in Automotive Electronics and Electric Vehicle Applications

Increasing complexity of automotive electronics, particularly in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is fueling the need for high-reliability microcontroller sockets. New cars are embedding multiple MCUs for battery system control, infotainment, and safety functions, with a requirement for precise test and high-speed prototyping solutions. The migration towards connected and autonomous vehicles is growing the demand for high-pin-count and fine-pitch sockets which will enable strenuous testing of sophisticated electronic control units (ECUs) to guarantee dependability, safety, and performance in future automotive platforms.

Market Restraint

Accuracy and Miniaturization Issues in Microcontroller Sockets

The accelerating miniaturization of microcontrollers and the expanding use of high-pin-count packages place stringent design and manufacturing requirements in the microcontroller socket business. The suppliers must incur substantial investment in high-precision engineering, advanced tooling, and stringent quality control processes to deliver repeatable electrical connection, thermal stability, and long-term reliability. Added to the complexity of designing and manufacturing sockets are the provision of signal integrity, crosstalk reduction, and tighter tolerances support for future-generation MCUs, which require innovation and unique manufacturing capabilities.

Market Opportunity

Scaling up Prototyping and Testing Infrastructure in Emerging Electronics Hubs

Growing establishment of electronics manufacturing and prototyping facilities in developing economies is creating strong opportunities for microcontroller socket adoption. Investments are aimed at increasing the scale of test laboratory space, modular assembly plants, and quality control centers to support high-volume MCU integration. These efforts raise production efficiency, increase yield consistency, and create new markets for socket manufacturers, favoring wider adoption across fast-growing automotive, industrial, and consumer electronics markets.

Regional Analysis

The North America region dominated microcontroller socket market, accounting for approximately 36.1% of total revenue in 2025. The growth of the industry is fueled by robust manufacturing base in electronics, sound industrial standards, and compliance with global standards such as JEDEC and IPC quality standards, guaranteeing reliability and consistency in socket production. Amphenol, Samtec, and Molex are some of the players creating strategic alliances with MCU suppliers and industrial partnerships.

The region is led by the U.S., backed by sophisticated R&D infrastructures and massive electronics manufacturing facilities. High-end presence of semiconductor and automotive electronics makers is driving demand for microcontroller sockets with high reliability. Government support in the form of CHIPS Act funding and partnerships with industry alliances also is boosting innovation, manufacturing efficiency, and adoption of future socket technologies.

Asia Pacific Microcontroller Socket Market Insights

Asia-Pacific is the fastest-growing region with the CAGR of 5.8% in microcontroller sockets, driven by increasing electronics production, prototype sites, and regulatory support for standard-based testing. RoHS, REACH, and IPC-standard-consistent programs are promoting safe, high-quality socket designs for automotive, industrial, and consumer electronics markets. In 2024, public-private joint ventures and electronics consortia spent over USD120 million to establish centralized socket testing and quality assurance centers. Initiatives like these spur adoption, increase production reliability, and turn the region into a prime location for new microcontroller socket opportunities.

India is an emerging nation in apac region, led by government-supported manufacturing efforts and its increasing position in global semiconductor and electronics supply chains. Initiatives like Make in India and the PLI Scheme are promoting local manufacturing of high-performance MCUs and associated components. Moreover, tie-ups of domestic socket manufacturers with foreign electronics companies are promoting technology transfer, raising quality levels, and building market size for microcontroller sockets in automotive, industrial, and consumer electronics applications.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Market share in the European market for the microcontroller socket is slowly growing with strong investment in industrial automation, automotive electronics, and semiconductor manufacturing. Microchip Technology, TE Connectivity, and Johnstech International are industry leaders in creating high-reliability sockets that facilitate high-performance microcontroller integration into automotive, consumer electronics, and industrial industries.

Germany is spurred by large scale automotive and industrial electronics production, huge R&D expenditure in semiconductor packaging, and government policies favoring local chip manufacturing and supply chain solidity. Strong implementation of Industry 4.0 processes and sophisticated automation in factory floors further stimulates need for robust microcontroller sockets. Further, partnerships among local socket makers and top auto OEMs improve precision engineering, quality control, and incorporation of high-performance test solutions.

Middle East & Africa Market Insights

The MEA region is witnessing a steady increase in the microcontroller socket market, with expansion fostered by increasing industrial automation, electronics manufacturing, and government efforts to promote technology infrastructure. PRECI-DIP and Aries Electronics are some of the firms that are offering sockets for use in industrial and automotive applications to meet rising regional demand.

UAE is the leading country in MEA, supported by electronics and semiconductor assembly factory investments, partnerships with international suppliers, and initiatives to create a regional electronics value chain. Expansion of smart manufacturing hubs and free-zone industrial parks is further boosting local microcontroller socket adoption. Additionally, government programs promoting technology transfer and workforce skill development are enhancing production efficiency and market competitiveness in the region.

Latin America Market Insights

Latin America is also experiencing moderate growth within the microcontroller socket market, driven by industrial electronics development, automotive electronics application, and relationships with global semiconductor suppliers. Organizations like Mill-Max Mfg. Corp. and Loranger International are offering high-precision sockets for diverse electronic applications within the region.

The market in Brazil fuelled by production of industrial electronics via government initiatives, expansion of the automotive industry, and collaboration with foreign socket producers to ensure supply reliability and quality levels, is emerging as a key market for microcontroller sockets. Growing investments in local electronics manufacturing clusters and R&D centers are enhancing domestic production capabilities. Additionally, increasing adoption of EVs and industrial automation solutions is driving demand for high-performance, high-pin-count sockets. Supportive policies from agencies like Brazilian Agency for Industrial Development (ABDI) are further encouraging technology transfer and partnerships, strengthening the overall market ecosystem.

Product Insights

The DIP (Dual In-Line Package) segment accounted for the largest share in the market with a revenue percentage of 35.10% in 2025. This is because of a high growth rate in the consumer electronics industry where integrated circuits are increasingly being applied across automotive, industrial, and healthcare electronics.

The BGA (Ball Grid Array) segment is anticipated to grow at the highest rate, realizing a forecasted CAGR of around 6.95% during the forecast period. The segment is witnessing significant growth owing to growing adoption of high-pin-count MCUs in advanced automotive, industrial automation, and data center applications where thermal management is crucial and form factor needs to be minimized.

Application Insights

Industrial applications dominated with the CAGR of 4.9%, driven by extensive use of MCU-based control systems, automation platforms, and robotics. Over 950 million socket insertions were witnessed across industrial applications, and this suggested that sockets need to be of quality in production efficiency and quality control.

Competitive Landscape

The international microcontroller socket market is moderately fragmented, with major market players including Amphenol, Samtec, Molex, TE Connectivity, and AVX Corporation collectively holding around 62.4% of total socket production in 2025. Market players are spending heavily on high-precision socket prototype development, automated test platforms, and fine-pitch BGA and QFP socket solutions, with global investment topping USD 210 million in 2025.

Strategic partnerships between socket makers and MCU providers are propelling efficiency and reliability in automotive, industrial, and consumer electronics applications. More than 2.4 billion socket insertions were made worldwide in 2025 through co-operative R&D programs and harmonized test programs. Competitive strategy is centered on following JEDEC and IPC quality standards, increasing lifecycle durability, insertion accuracy, and providing scalable solutions in worldwide emerging electronics hubs.

Amphenol: A Leading Global Microcontroller Socket Manufacturer

Amphenol, one of the largest microcontroller socket makers, provides a comprehensive portfolio of high-precision BGA, QFP, SOIC, and DIP socket solutions for automotive, industrial, and consumer electronics applications. Its sockets are used widely in prototyping, test, and high-volume assembly worldwide.

- Amphenol announced more than USD 620 million socket insertions on global automotive and industrial electronics production plants in 2025, facilitating stable MCU integration in more than 15,000 production lines. The record demonstrates the company's ability to increase manufacturing accuracy, guarantee lifecycle longevity, and simplify testing processes, leading the high-performance socket solutions market while gaining the trust of electronics OEMs.

List of Key and Emerging Players in Microcontroller Socket Market

- Amphenol Corporation

- TE Connectivity

- Mill-Max Manufacturing Corp.

- Microchip Technology Inc.

- Johnstech International Corporation

- Advanced Interconnections

- Aries Electronics Inc.

- Loranger International Corporation

- PRECI-DIP SA

- Samtec Inc.

- AVX Corporation

- Molex LLC

- Hirose Electric Co., Ltd.

- JST Manufacturing Co., Ltd.

- Wurth Elektronik GmbH & Co. KG

- Omron Corporation

- Fujitsu Component Limited

- Yamaichi Electronics Co., Ltd.

- Zhen Ding Technology Holding Limited

- Shenzhen Kinwong Electronic Co., Ltd.

Strategic Initiatives

- August 2025: Amphenol is buying CommScope's Connectivity and Cable Solutions (CCS) business for USD10.5 billion in cash. The deal will significantly expand Amphenol's portfolio, adding fiber optic products for fast-growing markets like AI and data centers.

- October 2025: Qualcomm announced its acquisition of Arduino, the renowned open-source electronics platform. This strategic move aims to integrate Arduino's microcontroller boards into Qualcomm's edge AI ecosystem, enhancing accessibility and scalability for AI development.

- April 2025: Infineon Technologies acquired Marvell Technology's automotive ethernet division forUSD2.5 billion. This acquisition strengthens Infineon's microcontroller portfolio, particularly in the automotive sector, by integrating advanced networking capabilities

- March 2025: 3M Electronics Division announced a significant investment in a new, highly automated production line at its Singapore facility. The investment is specifically aimed at increasing the manufacturing capacity and quality of its fine-pitch microcontroller test and burn-in sockets to meet rising global demand from semiconductor test houses.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.52 billion |

| Market Size in 2026 | USD 1.59 billion |

| Market Size in 2034 | USD 2.29 billion |

| CAGR | 4.7% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Microcontroller Socket Market Segments

By Product

- SOIC

- SOP

- BGA

- QFP

- DIP

By Application

- Electronics

- Medical Devices

- Automotive

- Military & Defense

- Industrial

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.