Mining Lubricant Market Size, Share & Trends Analysis Report By Product Type (Engine Oil, Hydraulic & Transmission Oil, Gear Oil & Grease), By Lubricant Type (Mineral Oil-Based Lubricants, Synthetic Lubricants, Bio-Based Lubricants), By End-Use Industry (Coal Mining, Iron Ore Mining, Bauxite Mining, Precious Metals & Rare Earth Minerals Mining, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Mining Lubricant Market Size

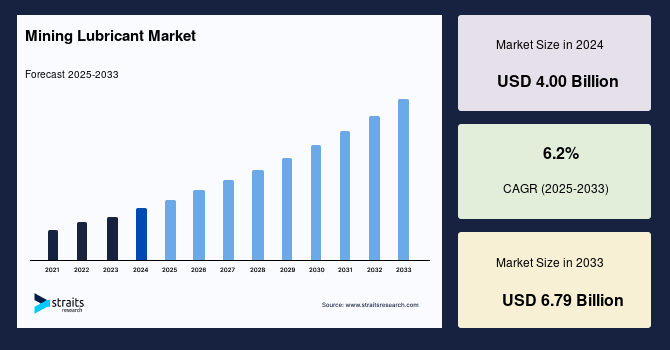

The global mining lubricant market size was valued at USD 4.00 billion in 2024 and is projected to grow from USD 4.20 billion in 2025 to USD 6.79 billion by 2033, exhibiting a CAGR of 6.2% during the forecast period (2025–2033).

The global mining lubricant market growth is driven by escalating global demand for minerals and metals, fueled by industries like construction, electronics, and automotive, necessitating robust lubricants for heavy mining equipment. Rapid industrialisation in emerging economies, particularly in Asia-Pacific, amplifies mining activities. Key trends include the shift toward synthetic and bio-based lubricants, driven by environmental regulations, and the adoption of AI and IoT for predictive maintenance, enhancing equipment efficiency.

Additionally, stringent environmental standards and the need for high-performance lubricants to withstand extreme conditions further propel the market. North America benefits from advanced mining operations, while Asia-Pacific leads due to China’s mineral production. However, volatile raw material prices and environmental concerns pose challenges. The market’s trajectory reflects the critical role of advanced lubricants in ensuring operational reliability and sustainability in mining, aligning with global industrial and environmental goals.

Latest Market Trend

Shift toward Synthetic and Bio-Based Lubricants

The global mining lubricant market is witnessing a significant trend toward synthetic and bio-based lubricants, driven by environmental regulations and the need for high-performance solutions. Synthetic lubricants work well in extreme conditions, while bio-based lubricants are biodegradable and safer for workers and ecosystems. Synthetic lubricants held a 53.04% revenue share in 2024, with bio-based variants projected to grow fastest due to their biodegradability and low toxicity. Stringent regulations, like the EU’s REACH, push for eco-friendly lubricants. Companies invest in these alternatives to stay ahead of rules and meet sustainability targets.

- For example, Interlub, a specialist in industrial fluids, is actively supplying Liplex Bio 2 Moly Plus biodegradable greases and oils for heavy-duty mining equipment, offering sustainable alternatives for open gears and shovels with equivalent or better performance.

This trend is prominent in Asia-Pacific, where China’s environmental policies drive bio-based adoption, ensuring sustainability and compliance while meeting the demands of advanced mining equipment.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 4.00 Billion |

| Estimated 2025 Value | USD 4.20 Billion |

| Projected 2033 Value | USD 6.79 Billion |

| CAGR (2025-2033) | 6.2% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | ExxonMobil Corporation, Shell PLC, Chevron Corporation, BP p.l.c., TotalEnergies SE |

to learn more about this report Download Free Sample Report

Mining Lubricant Market Growth Factor

Increasing Mining Activities and Equipment Demand

The surge in global mining activities, driven by rising demand for minerals and metals, is a key driver of the mining lubricant market. As mining operations expand, especially with larger, more powerful excavators, haul trucks, and crushers, lubricants must withstand heavy loads, extreme temperatures, and dusty environments. Modern high-sump machinery demands oils and greases with enhanced thermal stability and extended service intervals to ensure optimal performance and equipment longevity. Asia-Pacific leads due to China’s coal and rare earth mineral production. This trend is further reinforced by the industry’s shift toward predictive maintenance, using sensor-based lubrication systems to minimise downtime.

- For example, in January 2025, ExxonMobil India announced that its Maharashtra lubricant plant, slated to begin operations by the end of 2025, will produce industrial lubricants designed specifically for heavy equipment, including mining and construction machinery.

This strategic investment aims to meet regional demand and enhance supply efficiency for high-powered mining operations, driving lubricant market growth.

Market Restraint

Volatile Raw Material Prices and Environmental Concerns

Volatile raw material prices and environmental concerns significantly restrain the global mining lubricant market. Crude oil price fluctuations, ranging from USD 70–100 per barrel in 2024, impact mineral oil-based lubricants. Environmental regulations, such as the EU’s 2024 carbon neutrality goals, challenge traditional lubricants, with 30% of mining firms citing compliance costs as barriers. In Asia-Pacific, stricter policies in China raise operational hurdles. The slow transition to bio-based lubricants, limited by high R&D expenses, restricts adoption among SMEs. These challenges and supply chain disruptions hinder market growth, particularly in cost-sensitive regions, necessitating innovative, cost-effective, and sustainable lubricant solutions to mitigate restraints.

Market Opportunity

Adoption of Ai and Iot for Predictive Maintenance

The adoption of AI and IoT for predictive maintenance presents a significant opportunity for the global mining lubricant market. In 2024, 40% of mining firms utilised AI and IoT for real-time lubricant monitoring, reducing equipment failures by 25%. These technologies optimise lubricant usage, cutting costs by 15%, particularly in North America and Asia-Pacific.

- For instance, IoT Magazine reports in June 2024 that major producers like Rio Tinto, BHP, and Vale are deploying sensors and AI for predictive maintenance, significantly reducing downtime and optimising lubricant usage.

Government initiatives promote digitalisation, boosting IoT adoption. The rise in high-performance equipment, with 50% of new mining machinery requiring advanced lubricants, amplifies opportunities. This trend supports sustainability and cost optimisation, positioning AI and IoT as transformative drivers for market expansion in smart mining operations.

Regional Analysis

Asia-Pacific dominated the global mining lubricant market, which is projected to grow at a CAGR of 6.7%. China, India, and Australia drive growth, with China producing 50% of global coal in 2024. Major players such as Shell, ExxonMobil, Fuchs, and PetroChina are introducing eco-friendly lubricants tailored for coal, iron ore, and rare earth operations. A surge in smart mining practices across the region benefits companies like Kluber, which supply IoT-compatible lubricant systems. Regulatory emphasis on environmental protection encourages biodegradable alternatives. Asia‑Pacific’s expansive mineral reserves, government-backed modernisation programmes, and rapid tech adoption secure its position as the primary growth engine in the global market.

- China leads the global market due to its vast resource base and rapid industrial modernisation. Government initiatives encourage high-tech, efficient, and eco-conscious mining practices, boosting demand for advanced lubricants. Local giants such as Sinopec are innovating with bio-based and synthetic lubricants to meet new environmental standards. The country’s focus on mining automation and digital monitoring systems increases the need for lubricants that support predictive maintenance. China's cost-effective manufacturing and broad supply chain access make it a hub for both domestic consumption and export of industrial lubricants.

- India’s mining lubricant industry is one of the fastest-growing, fueled by expanding coal and iron ore operations and rapid infrastructure development. The government’s focus on mining reform and domestic capacity enhancement has led to increased equipment deployment that requires efficient lubrication. Companies like HP Lubricants and ExxonMobil are investing in new manufacturing facilities and developing solutions tailored to Indian conditions. As mining becomes more mechanised and environmentally conscious, the need for synthetic and sustainable lubricant solutions is rising steadily across the country.

North America Mining Lubricant Market Trends

North America is the fastest-growing region, projected to exhibit a CAGR of 7%. The U.S. leads, driven by advanced mining operations and a shift to synthetic lubricants. The U.S. leads in adopting synthetic lubricants, with ExxonMobil and Chevron bringing dedicated formulations for coal and metal mines. IoT integration is widespread, companies like Kluber and Shell provide online monitoring systems that enable predictive maintenance and optimise fluid usage. Oil sands and rare earth extraction in Canada demand cold-weather, eco-certified lubricant solutions, often supplied by Petro-Canada Lubricants. The trend toward automation and sustainability drives North American operators and lubricant manufacturers to collaborate on performance-optimised, low-impact products suitable for intensive and environmentally sensitive mining operations.

- The United States is a leading hub for mining lubricant demand, supported by a highly mechanised mining sector and robust infrastructure. The country invests in critical mineral extraction and advanced mining technologies, which require high-performance lubricants to maintain productivity and minimise downtime. The growing use of AI and IoT-based predictive maintenance enhances surface and underground mining operational reliability. Regulatory frameworks promote sustainability, pushing firms to adopt cleaner alternatives. The U.S. market is shaped by equipment and lubrication technology innovation, making it one of the most advanced and resilient globally.

- Canada’s mining lubricant sector is driven by its diverse mineral extraction landscape, including oil sands, rare earths, and metals. The country’s challenging weather conditions require cold-resistant, high-performance lubricants, prompting innovation from players like Petro-Canada Lubricants and Klüber. Environmental regulations and a focus on emissions reduction have encouraged widespread adoption of synthetic and bio-based products. The integration of digital monitoring systems helps operators predict maintenance needs and extend equipment life. Canadian mining firms increasingly align with global ESG goals, and government-backed innovation programs further support sustainable lubricant technologies.

Europe Mining Lubricant Market Trends

Europe held a 19.6% share of the global mining lubricant market, driven by environmental regulations and mature mining sectors in Germany and France. Companies like Fuchs and Klüber Lubrication are leading the push to bio-based alternatives, especially for iron ore and industrial mineral sectors, matching the ambitions of Germany, France, and Spain. Mining safety and emissions standards in the UK drive higher-quality lubricant adoption. Vendors are also working to integrate IoT-enabled monitoring and grease lubrication systems to serve more automated underground and surface operations. European governments continue to promote clean technologies under initiatives like the Green Deal and national recovery plans, encouraging lubricant mixes compatible with low-temperature performance and low toxicity, supporting quieter, cleaner mining operations in mature markets.

- Germany stands out in the mining lubricant market due to its emphasis on sustainable industrial practices and precision engineering. The nation supports environmentally friendly lubricants, with firms like Fuchs and Klüber pioneering bio-based and low-emission formulations for the mining sector. As part of its broader energy and resource transition strategy, Germany promotes automation and high-tech mineral extraction equipment, boosting demand for advanced lubrication solutions. Strict environmental laws ensure that lubricant manufacturers focus on biodegradable and long-lasting solutions, making Germany a benchmark for sustainability in industrial lubricant innovation.

- The United Kingdom’s mining lubricant sector is defined by its regulatory approach to safety and sustainability in extractive industries. Mining activities, particularly for coal and industrial minerals, demand high-performance lubricants that ensure equipment durability under stringent operational conditions. Companies like BP have introduced synthetic products tailored for the UK’s mining requirements. IoT integration and automation are gradually being adopted by mining operators to improve efficiency and reduce unscheduled maintenance. With government support for modernising legacy mining infrastructure, the UK remains relevant in Europe’s industrial lubricant landscape.

Product Type Insights

The gear oil & grease segment dominated the mining lubricant market with a significant share in 2024, driven by its critical role in protecting heavy-duty equipment under extreme conditions. With global mineral production rising by 10% from 2020 to 2022, gear oils and greases are essential for reducing friction in the gears and bearings of excavators and haul trucks, enhancing durability. The segment is growing due to its ability to withstand high loads and temperatures. The segment’s growth is fueled by increasing automation and larger sump sizes in modern machinery, particularly in Asia-Pacific’s coal mining operations, ensuring operational efficiency and reduced downtime in harsh mining environments.

Lubricant Type Insights

Mineral oil-based lubricants led the market with a 63.7% revenue share in 2024, due to their widespread availability, cost-effectiveness, and adequate performance for most standard applications. These lubricants are well-suited to regions where budget constraints influence equipment maintenance decisions, making them a preferred choice for large-scale and small-scale mining companies. In March 2023, ExxonMobil’s Raigad plant in India produced 159,000 kl of mineral oil lubricants, meeting Asia-Pacific’s coal mining demand. The segment’s dominance is supported by the high volume of coal and iron ore mining in China and Australia, where cost optimisation is critical. Despite environmental pressures, mineral oil’s established infrastructure ensures its continued leadership in cost-sensitive markets.

End-Use Industry Insights

The coal mining segment held the largest market share in 2024, driven by global coal demand for power generation and industrial applications. Heavy-duty mining equipment used in coal extraction requires consistent lubrication to function efficiently in abrasive and moisture-heavy conditions. The segment’s dominance is fueled by extensive coal extraction in China, which accounted for 50% of global production in 2024, and India’s growing energy needs. Government policies, like China’s coal self-sufficiency drive, further support demand. Despite renewable energy transitions, coal’s role in developing economies ensures the segment’s leadership, necessitating robust lubricants for operational reliability.

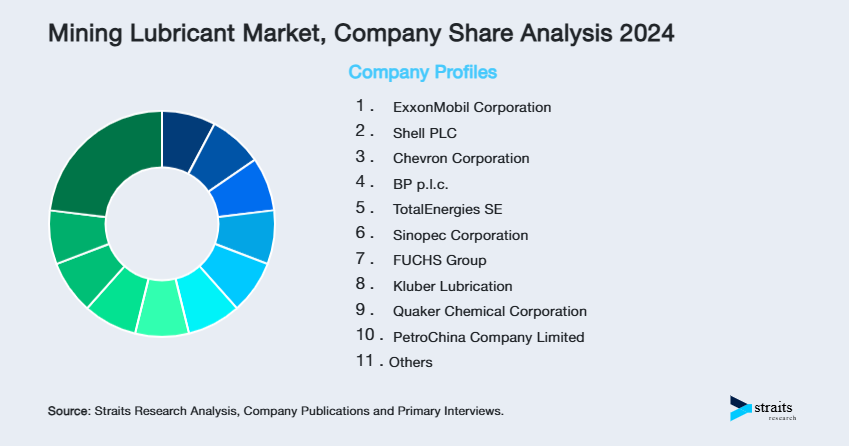

Company Market Share

Key players in the global mining lubricant market focus on innovation, strategic acquisitions, and sustainability to maintain competitiveness. Companies invest in R&D for synthetic and bio-based lubricants, addressing environmental regulations. Partnerships with mining firms and equipment manufacturers, like ExxonMobil’s with Indian mines, expand market reach. Mergers, such as FUCHS’s 2024 acquisitions, enhance portfolios. Subscription-based IoT monitoring services and eco-friendly formulations cater to modern mining needs, focusing on Asia-Pacific and North America for growth.

ExxonMobil Corporation: ExxonMobil holds a leading share in the mining lubricant market, leveraging its global supply chain and advanced formulations. Its business pattern emphasises R&D for synthetic and bio-based lubricants, strategic expansions, and partnerships with mining firms. The company’s IoT-integrated solutions optimise equipment performance. ExxonMobil’s growth, projected at a CAGR of 6% through 2030, is driven by demand in Asia-Pacific and North America, where it caters to coal and rare earth mining, ensuring reliability and sustainability.

Latest News

- In March 2023, ExxonMobil expanded its Raigad plant in India, producing 159,000 kl of high-performance lubricants annually for mining operations. This USD 110 million investment meets 20% of India’s mining lubricant demand, enhancing equipment efficiency and supporting the National Mineral Policy 2024, reinforcing ExxonMobil’s leadership in Asia-Pacific.

List of Key and Emerging Players in Mining Lubricant Market

- ExxonMobil Corporation

- Shell PLC

- Chevron Corporation

- BP p.l.c.

- TotalEnergies SE

- Sinopec Corporation

- FUCHS Group

- Kluber Lubrication

- Quaker Chemical Corporation

- PetroChina Company Limited

- Savita Oil Technologies Ltd.

- Schaeffer Manufacturing Co.

- Petro-Canada Lubricants Inc.

- Idemitsu Kosan Co., Ltd.

- HP Lubricants

to learn more about this report Download Market Share

Recent Developments

- November 2024-FUCHS acquired STRUB & Co. AG, a Swiss industrial lubricant manufacturer, securing direct market access in Switzerland and expanding its research and production capabilities. The acquisition enhances FUCHS’s portfolio with specialty lubricants for mining equipment, improving performance under extreme conditions and supporting Europe’s demand for sustainable solutions, strengthening its global market position.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 4.00 Billion |

| Market Size in 2025 | USD 4.20 Billion |

| Market Size in 2033 | USD 6.79 Billion |

| CAGR | 6.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Lubricant Type, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Mining Lubricant Market Segments

By Product Type

- Engine Oil

- Hydraulic & Transmission Oil

- Gear Oil & Grease

By Lubricant Type

- Mineral Oil-Based Lubricants

- Synthetic Lubricants

- Bio-Based Lubricants

By End-Use Industry

- Coal Mining

- Iron Ore Mining

- Bauxite Mining

- Precious Metals & Rare Earth Minerals Mining

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.