OEM Insulation Market Size, Share & Trends Analysis Report By Material Type (Fiberglass, Mineral Wool, Polyurethane (PU) Foam, Polystyrene, Aerogel, Cellulose, Natural Fibers, Others), By Insulation Type (Thermal Insulation, Acoustic Insulation), By End-Use Industry (Automotive OEMs, Construction & Building OEMs, Industrial OEMs, Electrical & Electronics OEMs, Aerospace & Defense OEMs, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Oem Insulation Market Size

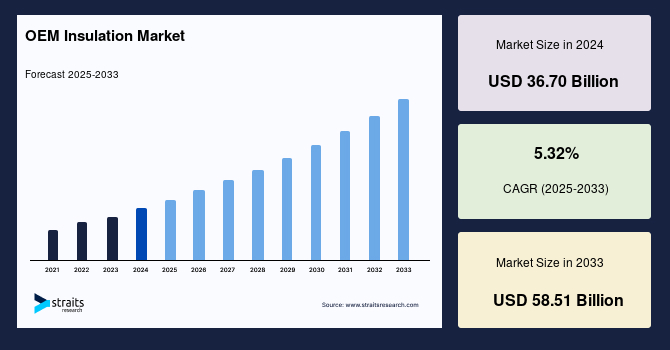

The global OEM insulation market size was valued at USD 36.70 billion in 2024 and is projected to grow from USD 38.65 billion in 2025 to reach USD 58.51 billion by 2033, growing at a CAGR of 5.32% during the forecast period (2025–2033).

One of the primary drivers of the global OEM insulation market is the growing implementation of stringent energy efficiency regulations and building codes across various regions. Governments and regulatory bodies are enforcing performance standards aimed at minimizing energy consumption and greenhouse gas emissions, compelling OEMs in sectors like automotive, construction, and HVAC to incorporate high-performance insulation materials.

Additionally, the increasing production of automobiles, especially electric and hybrid vehicles, is fostering the demand for thermal and acoustic insulation to enhance energy efficiency, passenger comfort, and battery performance.

Furthermore, government-backed incentives and subsidies for sustainable construction practices are accelerating the uptake of OEM insulation in commercial and residential infrastructure. The cold chain logistics and industrial equipment sectors are similarly driving growth, with insulation playing a crucial role in maintaining temperature control and reducing energy costs in storage and transportation systems.

Oem Insulation Market Trends

Growing Adoption of Green Building Certification Systems

One of the key trends driving the global OEM insulation market is the growing adoption of green building certification systems. These systems, such as LEED, BREEAM, and WELL, are setting new benchmarks for sustainability and energy efficiency in construction and infrastructure projects. OEM insulation plays a critical role in helping builders meet thermal performance standards, improve indoor air quality, and reduce energy consumption.

- For instance, in April 2025, the U.S. Green Building Council (USGBC) launched LEED v5, a comprehensive overhaul of its renowned green building certification system. This version places a strong emphasis on decarbonization, with 50% of certification points dedicated to reducing emissions across operations, materials, and infrastructure. Additionally, LEED v5 highlights climate resilience and occupant health, positioning buildings as centers for community well-being and risk mitigation.

Such initiatives are encouraging OEMs to prioritize high-performance insulation materials that support long-term environmental goals.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 36.70 Billion |

| Estimated 2025 Value | USD 38.65 Billion |

| Projected 2033 Value | USD 58.51 Billion |

| CAGR (2025-2033) | 5.32% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Owens Corning, Johns Manville, BASF SE, Knauf Insulation, Saint-Gobain |

to learn more about this report Download Free Sample Report

Oem Insulation Market Growth Factor

Rapid Industrialization and Urbanization, Particularly in Emerging Economies

Rapid industrialization and urbanization, particularly in emerging economies, are key drivers of the global OEM insulation market. As countries expand their manufacturing sectors and cities grow to accommodate increasing populations, the demand for energy-efficient infrastructure and transport systems surges.

- For instance, in China, the urbanization rate rose to 66.16% by the end of 2023, with projections aiming for nearly 70% within the next five years, as per the State Council's action plan. Similarly, Brazil's 2022 Census indicates that 87.4% of its population resides in urban areas, up from 84.4% in 2010, reflecting a substantial migration towards cities.

This urban shift is accompanied by significant infrastructure development, necessitating advanced insulation solutions for energy efficiency and environmental sustainability. OEM insulation is increasingly vital across automotive, construction, and HVAC industries to meet rising energy performance standards and growing urban demands.

Market Restraint

High Initial Cost of Advanced Insulation Materials Compared to Traditional Alternatives

The high initial cost of advanced insulation materials compared to traditional alternatives is a major restraint in the global OEM insulation market. While modern insulation technologies offer superior performance in terms of energy efficiency, thermal resistance, and durability, their production often involves expensive raw materials and complex manufacturing processes.

This leads to higher upfront costs, making it challenging for some OEMs, especially small and medium enterprises, to adopt these materials. Additionally, budget constraints and cost-sensitive markets tend to favor conventional insulation options despite their lower efficiency. This cost barrier slows down widespread adoption and limits market growth, particularly in developing regions where price competitiveness plays a crucial role in procurement decisions.

Market Opportunity

Development of Bio-Based and Recyclable Insulation Materials

The development of bio-based and recyclable insulation materials presents a significant opportunity in the global OEM insulation market, driven by rising environmental concerns and the push for sustainable manufacturing. Manufacturers are increasingly shifting toward renewable and circular materials that reduce carbon emissions and address end-of-life disposal challenges.

- For instance, in August 2024, Nouryon introduced a cellulose-based granulate that serves as a sustainable alternative to traditional expanded polystyrene (EPS). This material boasts over 95% biodegradability and can be recycled alongside paper products, offering a drop-in solution for foam molding applications.

Such innovations not only align with stringent environmental regulations but also cater to OEMs seeking eco-friendly solutions. As industries prioritize green practices, the demand for high-performance, bio-based insulation is expected to rise, especially in the automotive, construction, and appliance manufacturing sectors.

Regional Analysis

Rapid urbanization and industrial growth underpin the Asia Pacific OEM insulation market’s robust expansion. Rising infrastructure development and increasing automotive production contribute significantly to demand. The growing middle class and increased construction activity fuel the adoption of energy-efficient insulation in buildings. Emerging emphasis on sustainable materials and government initiatives for energy conservation accelerate market growth. Additionally, expanding manufacturing bases in electronics and appliances creates opportunities for specialized insulation applications, supporting the region’s position as a high-growth market.

- China’s market is rapidly expanding due to robust automotive manufacturing and construction growth. The government’s stringent energy efficiency standards and “Green Building Action Plan” drive demand for advanced insulation materials. Companies like BASF and Owens Corning are investing heavily in China to supply thermal and acoustic insulation for OEMs. Rising EV production also boosts demand for lightweight, high-performance insulation solutions in vehicles.

- India’s market is growing with increased infrastructure development and rising automotive production. Government initiatives like the Energy Conservation Building Code (ECBC) promote energy-efficient insulation use. Domestic companies such as Supreme Industries and international players like Rockwool are expanding their presence. The booming electric vehicle sector is creating demand for innovative insulation materials for battery packs and thermal management in OEM applications.

North America Market Trends

The North American OEM insulation market is growing due to strict energy efficiency regulations and strong demand for sustainable construction and automotive solutions. Increasing investments in green infrastructure and modernizing industrial facilities further propel market expansion. The rise in electric vehicle production fuels the demand for lightweight and high-performance insulation materials. Additionally, growing consumer awareness about indoor air quality and thermal comfort boosts the adoption of advanced insulation in residential and commercial buildings.

- The US OEM insulation industry benefits from large-scale automotive manufacturing hubs and strong government incentives promoting energy-efficient construction. Major OEMs like Ford and General Motors are increasingly using lightweight, sustainable insulation materials to improve vehicle efficiency. Additionally, companies such as Johns Manville provide innovative insulation solutions for HVAC and appliance manufacturers, capitalizing on the rising demand for thermal and acoustic insulation in residential and commercial sectors.

- Canada’s market for OEM insulation is driven by stringent energy efficiency regulations and the push for green building certifications like LEED. The country’s cold climate increases demand for high-performance thermal insulation in the automotive and construction sectors. Companies like Owens Corning and Roxul (Rockwool) have expanded operations in Canada, supplying advanced mineral wool and fiberglass insulation tailored for OEM applications in buildings and vehicles.

Europe Market Trends

Europe’s OEM insulation market benefits from comprehensive environmental policies promoting energy conservation and emissions reduction. The strong push for sustainable building certifications drives demand for eco-friendly insulation materials. Growth in the automotive and aerospace sectors encourages innovation in lightweight, multi-functional insulation solutions. The region’s mature construction market focuses on retrofitting older buildings with advanced insulation to meet evolving energy codes. Investment in renewable energy infrastructure also supports market expansion, alongside rising consumer preference for sustainable products.

- Germany’s OEM insulation industry is driven by stringent energy efficiency regulations and a strong focus on sustainable manufacturing. German automotive giants like BMW and Volkswagen are increasingly using advanced thermal and acoustic insulation materials made from recycled and bio-based sources to reduce vehicle weight and emissions. Additionally, Germany’s construction sector adopts high-performance insulation in prefabricated building components, supporting the country’s ambitious climate targets under the Energy Transition (Energiewende) initiative.

- The UK’s market benefits from growing demand in the automotive and construction sectors, emphasizing energy conservation and sustainability. Leading UK-based manufacturers such as Jaguar Land Rover have started integrating lightweight, eco-friendly insulation materials in vehicles to improve fuel efficiency. The government’s push for green building standards, including the Future Homes Standard, accelerates the adoption of innovative insulation solutions in OEM products, boosting demand for recyclable and high-performance insulation technologies across industries.

Material Type Insight

Mineral wool is a dominant material type in the global OEM insulation market due to its excellent thermal and acoustic insulation properties, fire resistance, and durability. It is widely used across various OEM industries because it effectively withstands high temperatures and provides superior soundproofing. Mineral wool’s non-combustible nature makes it highly preferred in safety-critical applications such as automotive, construction, and industrial sectors. Additionally, its eco-friendly production process and recyclability further strengthen its market position. These advantages have contributed to mineral wool maintaining a leading share in the OEM insulation materials segment.

Insulation Type Insight

Thermal insulation holds a significant share in the global OEM insulation market as it helps reduce energy consumption and improve efficiency in various applications. It is essential for maintaining temperature control in automotive engines, building envelopes, and industrial equipment. The growing emphasis on energy efficiency regulations and green building standards has further boosted the demand for thermal insulation. This segment includes materials that minimize heat transfer, thereby enhancing comfort and reducing operational costs. The versatility and critical role of thermal insulation across multiple industries solidify its dominance in the market.

End-Use Industry Insight

The automotive OEM segment is a key end-use industry driving growth in the global market. Insulation materials are increasingly used in vehicles to enhance passenger comfort by reducing noise and regulating cabin temperature. Additionally, stringent regulations on vehicle emissions and fuel efficiency push manufacturers to adopt lightweight and high-performance insulation solutions. Thermal, acoustic, and vibration insulation applications are critical in electric and conventional vehicles to optimize energy use and safety. Rising automotive production and the shift toward electric vehicles further propel the demand for advanced OEM insulation materials within this sector.

List of Key and Emerging Players in OEM Insulation Market

- Owens Corning

- Johns Manville

- BASF SE

- Knauf Insulation

- Saint-Gobain

- Kingspan Group

- Rockwool International

- Armacell International

- Huntsman Corporation

- Dow Inc.

to learn more about this report Download Market Share

Recent Developments

- April 2025- Knauf Insulation has expanded its Performance+® portfolio by introducing new pipe and tank insulation products. These additions are formaldehyde-free and aim to enhance energy efficiency and indoor air quality in residential and commercial applications. This launch underscores Knauf’s commitment to sustainable and health-conscious insulation solutions.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 36.70 Billion |

| Market Size in 2025 | USD 38.65 Billion |

| Market Size in 2033 | USD 58.51 Billion |

| CAGR | 5.32% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material Type, By Insulation Type, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

OEM Insulation Market Segments

By Material Type

- Fiberglass

- Mineral Wool

- Polyurethane (PU) Foam

- Polystyrene

- Aerogel

- Cellulose

- Natural Fibers

- Others

By Insulation Type

- Thermal Insulation

- Acoustic Insulation

By End-Use Industry

- Automotive OEMs

- Construction & Building OEMs

- Industrial OEMs

- Electrical & Electronics OEMs

- Aerospace & Defense OEMs

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.