Offshore Mooring Systems Market Size, Share & Trends Analysis Report Type (Chain mooring systems, Synthetic rope mooring systems), Application (Oil & gas application, Offshore renewable energy) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Offshore Mooring Systems Market Size

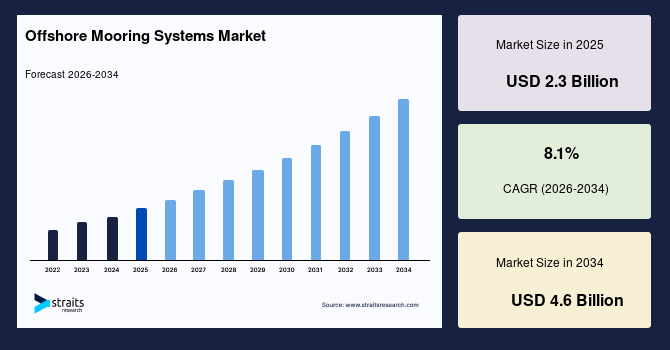

The offshore mooring systems market size was valued at USD 2.3 billion in 2025 and is estimated to reach USD 4.6 billion by 2034, growing at a CAGR of 8.1% during the forecast period (2026-2034). The industry is shifting from using traditional steel chains to advanced fiber materials, such as high-modulus polyethylene, polyester, and aramid fibers. Organizations worldwide are also required to follow regulations related to the structural integrity of offshore setups, which is boosting the demand for advanced mooring systems.

Key Market Insights

- North America dominated the offshore mooring systems market with a 34% share in 2025.

- Asia Pacific is expected to be the fastest-growing region in the offshore mooring systems market during the forecast period, expanding at a CAGR of 8.7%.

- By type, the chain mooring systems segment dominated the market with the largest share of 40% in 2025.

- By application, the offshore renewable energy segment is expected to grow rapidly over the forecast period at a CAGR of 9.1%.

- The US offshore mooring systems market size was valued at USD 0.78 billion in 2025 and is projected to reach 1 billion in 2026.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.3 Billion |

| Estimated 2026 Value | USD 2.8 Billion |

| Projected 2034 Value | USD 4.6 Billion |

| CAGR (2026-2034) | 8.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | SBM Offshore N.V., MODEC, Inc., BW Offshore Limited, Delmar Systems, Inc., Mampaey Offshore Industries |

to learn more about this report Download Free Sample Report

Offshore Mooring Systems Market Trends

Rising deployment of floating offshore wind farms and wave energy installations

There is a global push toward renewable energy, boosting the operations related to harnessing wind and wave resources in deep and ultra-deep waters. The number of floating offshore wind farms is increasing due to the saturation of near-shore shallow sites, and they are comparatively less expensive than conventional systems. The floating platforms rely heavily on the advanced offshore mooring systems to maintain stability against intense winds and waves while allowing controlled movement. For instance, the Hywind Scotland floating wind farm developed by Equinor uses advanced mooring systems to anchor floating wind turbines in the deep waters of the North Sea. Such projects are deployed in deep waters of >60–80 m, where fixed foundations are not feasible. Floating turbines need to be held by a mooring system, making it an essential component. Thus, the shift from conventional to dynamic offshore systems is a major market trend.

Shift toward lightweight, corrosion-resistant materials to enhance mooring system performance

The growing shift toward lightweight, corrosion-resistant materials is driven by the need to improve durability, reduce installation costs, and enhance performance in deepwater and harsh marine environments. The traditional steel chains and wires are heavy, which makes them prone to corrosion, which also requires frequent maintenance, especially in ultra-deepwater applications. Industry players are focusing on advanced synthetic fiber materials such as high-modulus polyethylene, polyester, and aramid fibers. For instance, Trelleborg Marine & Infrastructure develops engineered polymer-based and synthetic mooring solutions for offshore platforms. Such solutions have been adopted to reduce line weight significantly, which lowers tension loads on anchors and platforms.

Offshore Mooring Systems Market Drivers

Preference for semi-submersible platform in oil & gas exploration drives market

Semi-submersible platforms provide stability and operational flexibility in deep- and ultra-deepwater environments. Such platforms are widely deployed in oil & gas exploration, production, and floating wind applications. They also require advanced mooring systems such as spread mooring or hybrid mooring solutions to maintain their position against waves and currents. Semi-submersible platforms can function in varying water depths and harsh conditions, which makes them the preferred choice for offshore operators. This factor directly increases the demand for mooring chains and anchor systems.

Need to adhere to safety regulations and asset protection requirements boosts market

Structural failure of the mooring systems leads to platform drift, production shutdown, and oil spills, which result in financial losses and regulatory penalties. International safety regulations and classification standards require the operators to check, inspect, and replace the aging mooring systems. For instance, FPSOs operating in deepwater fields of Brazil and Mexico are required to use high-grade mooring systems combined with redundant mooring lines and real-time tension monitoring to prevent failures. Compliance is a non-negotiable factor for companies operating in this market. Certified designs, periodic re-certification, and scheduled inspection ensure compliance with safety and asset protection. Non-compliance can lead to delayed production, heavy penalties, and operational shutdowns. In January 2026, the North Sea Transition Authority (UK) issued about USD 469,000 to two offshore operators, CNR International and NEO, for exceeding gas venting limits at its North Sea operations and attempting to abandon a well without proper consent and regulatory approval, respectively. Thus, the need to adhere to set standards is a major market driver.

Market Restraints

Complex and customized design requirements restrain growth

Offshore mooring systems are not the same size for all platforms and sites. The platforms and sites must be custom-designed after considering factors such as water depth, seabed composition, wave and current forces, wind intensity, and the type of floating structure. Each project requires detailed engineering analysis and site surveys to maintain platform stability under dynamic offshore conditions. Customization leads to longer lead times as testing and fabrication need to be properly coordinated. These factors collectively restrain the market growth for both the developers and end users.

Market Opportunities

Integration of iot-enabled and predictive mooring solutions creates new market opportunities

Smart systems allow the operators to continuously monitor the condition and performance of the mooring lines, anchors, and other components in real time. Through this monitoring, they can easily detect fatigue or abnormal stress before the failure occurs. Predictive analytics reduces unplanned downtime, ensures operational safety, and extends the service life of the expensive offshore installations. Companies such as RigNet and Trelleborg Marine & Infrastructure are developing solutions that combine sensor-equipped mooring lines with cloud-based analytics to help operators track mooring tensions and environmental loads.

Technological Landscape

- MoorSafe is a monitoring system that uses digital subsea inclinometers to measure line angles and behavior in real time.

- iCUE is a digital cloud-based and integrity management platform, which consolidates information from a variety of sources, such as sensors and inspection reports. It gives alerts and real-time analytics to the operators to monitor critical metrics such as mooring lines and environmental load.

- NX2 is a cloud platform for monitoring subsea and offshore assets, which focuses on capturing and processing precise operational data.

Regional Analysis

The offshore mooring systems market in North America had amarket share of 34% in 2025. The region has a well-established offshore oil and gas activity in the Gulf of Mexico, the world’s most active deepwater regions with continuous investments in deepwater and ultra deepwater exploration and production. North America also witnesses a rapid growth in offshore wind projects along the Atlantic coast. It also leads in the development and deployment of smart mooring technologies.

The US is expected to growth at a faster rate with a CAGR of around 4.5% during the forecast period. The country has many supportive federal leasing policies, stable regulatory framework and long-term offshore energy planning provides investment certainty for operators and equipment suppliers. Developers such as Vineyard Wind, Orsted, and Equinor have committed multi-billion-dollar investments in the Gulf of Maine, Massachusetts Bay and New York Bight.

Europe

Europe accounted for 28% of the global offshore mooring systems market in 2025. It is a global leader in the offshore wind industry, particularly in the North Sea, Baltic Sea, and Atlantic regions. As the projects move from offshore into deep waters, developers rely on floating wind platforms, which require high-value mooring systems. REACH has set rules for the use and disposal of chemicals as well as the materials used, such as coatings, lubricants, and synthetic ropes. Thus, manufacturers in this region are demanding high-tech systems for better compliance with safety regulations.

Norway stands out in the Europe region with a CAGR of 3.8% during the forecast period. The country is a global leader in deepwater and harsh environment offshore operations, particularly in the North Sea and Norwegian sea. In this region, the offshore installation faces extreme weather, strong currents, and deepwater conditions,s which require high-performance, high-engineered mooring systems such as taut-leg and hybrid moorings.

Asia Pacific

Asia Pacific accounted for 25% of the global offshore mooring systems market share in 2025. The growth is this region is strongly supported by intensifying offshore oil and gas exploration across the South China Sea, the Indian Ocean, Southeast Asian waters, and offshore Australia. There is a rising demand of LNG in the Asia Pacific region, which has led to the development of offshore LNG terminals and FLNG units.

China is the fastest-growing country in the Asia Pacific offshore mooring systems market, expanding at an estimated CAGR of 5.2% during the forecast period. The Chinese government has prioritized offshore energy development under its long-term energy security and carbon transition strategies. China has a well-established marine engineering and heavy manufacturing ecosystem. This enables a cost-effective production of chains, anchors, synthetic ropes, and monitoring systems. Companies such as CACTIC Offshore and China COSCO Shipping are global suppliers in the offshore mooring system. These manufacturers have a strong industrial base and advanced fabrication capabilities.

Middle East & Africa

The Middle East & Africa region accounted for 10% of the global offshore mooring systems market share in 2025. The region has offshore environments that feature high salinity, extreme temperatures, strong currents, and corrosive conditions. This drives the demand for high-performance, corrosion-resistant mooring solutions. The Middle East & Africa host some of the world’s largest hydrocarbon reserves and is a leader in floating production, storage, and offloading units.

The United Arab Emirates is expected to grow at a CAGR of 3.5% during the forecast period. The country is heavily investing in new offshore hydrocarbon fields and upgrading existing facilities to extend operational life. For instance, ADNOC is focusing on enhanced output by expanding production capacity at the Upper Zakum offshore oil field to around 1.2 million barrels per day by 2027. NMDC Energy plans to invest USD 500 million in offshore wind support infrastructure, including vessels for turbine installation and cable laying for broader maritime applications.

Latin America

Latin America held 8% of the global offshore mooring systems market share in 2025. The region is a global hub for Floating Production, Storage, and Offloading (FPSO) based production, especially in Brazil's pre-salt basins. The FPSOs rely entirely on permanent mooring systems for long-term station keeping. National oil companies and international operators are increasing capital expenditure in offshore Latin America due to its attractive reserve potential and improved fiscal frameworks.

Brazil is expected to lead the regional market with a CAGR of 4.9%, during the forecast period. It has one of the most stable and long-term offshore development pipelines globally. Offshore projects in the country are increasingly adopting hybrid mooring systems that combine steel chains and synthetic ropes to reduce weight and improve fatigue resistance in deepwater environments. Companies are using polyester mooring and hybrid chain-fiber configurations for deepwater FPSOs and expanding mooring applications.

Type Insights

The chain mooring systems accounted for the largest offshore mooring system market in 2025. This segment is driven by the widespread use of steel chain mooring lines in deepwater oil and gas platforms. These systems are preferred in applications requiring long term stability and continuous operation, such as ultra deepwater production unit where safety cannot be compromised.

The synthetic rope mooring systems segment is expected to have a considerable growth with a CAGR of 7.9% during the forecast period. The growth is fueled by increasing usage of lightweight and corrosion-resistant synthetic fibers such as HMPE and polyester. They help reduce vessel loads and simplify installation in ultra deepwater projects. Synthetic fibres are gaining traction in floating offshore wind farms and emerging offshore renewable projects.

Application Insights

The oil & gas application segment dominates the offshore mooring systems market, accounting for more than 50% of the total revenue in 2025. By extensive deployment of mooring systems in semi-submersible platforms, spar platforms and drilling rigs which are used for production, storage and offloading of hydrocarbons. Deepwater and ultra-deepwater projects in the Gulf of Mexico and offshore Brazil require reliable and long-life mooring systems to ensure platform stability and safety under extreme conditions.

The offshore renewable energy segment is expected to grow at a faster CAGR, registering a growth of 9.0% during the forecast period. Expansion of floating offshore wind farms and wave energy projects is the growth driver for this segment. Increasing government support for renewable energy, technological advancements in platforms, and rising investments in offshore power generation are accelerating demand for advanced, lightweight, and digitally monitored mooring solutions.

Figure: Offshore Mooring Systems Market Segments

| SEGMENT | INCLUSION | DOMINANT SEGMENT | SHARE OF DOMINANT SEGMENT, 2025 |

|---|---|---|---|

|

TYPE |

|

Chain Mooring Systems |

XX% |

|

APPLICATION |

|

Oil & Gas Application |

XX% |

|

REGION |

|

North America |

34% |

Regulatory Bodies Governing the Offshore Mooring System Market

| REGULATORY BODY | COUNTRY/REGION |

|---|---|

|

Bureau of Safety and Environmental Enforcement (BSEE) |

US |

|

European Maritime Safety Agency (EMSA) |

Europe |

|

South Korea Offshore & Shipbuilding Standards (KOSOS) |

South Korea |

|

Agência Nacional do Petróleo, Gás Natural e Biocombustíveis (ANP) |

Brazil |

|

South African Department of Mineral Resources and Energy (DMRE) |

South Africa |

Competitive Landscape

The offshore mooring systems market is moderately fragmented, with competition spread across all offshore engineering contractors, multinational offshore engineering cooperations, regional manufacturers, and integrated marine service companies. The regional manufacturers and suppliers compete with price, local project expertise, and rapid delivery. The intensity of competition in this market is based on a combination of factors, such as mooring designs, material quality, regulatory compliance, and supply chain efficiency. Emerging trends in this market include the deployment of offshore wind farms anda shift toward lightweight and corrosion-resistant materials.

List of Key and Emerging Players in Offshore Mooring Systems Market

- SBM Offshore N.V.

- MODEC, Inc.

- BW Offshore Limited

- Delmar Systems, Inc.

- Mampaey Offshore Industries

- Trelleborg Marine & Infrastructure

- Bluewater Energy Services

- Offspring International

- NOV Inc.

- Cavotec SA

- InterMoor Inc.

- Vryhof Anchors B.V.

- Encorma

- Timberland Equipment Ltd

- Grup Servicii Petroliere SA

- Mooring Systems Inc.

- Viking Sea Tech

- KTL Offshore Pte Ltd

- CIMC Raffles Offshore

- Restech

- Single Buoy Moorings Inc.

- Deepocean

Latest News on Key and Emerging Players

| TIMELINE | COMPANY | DEVELOPMENT |

|---|---|---|

|

January 2026 |

Delmar Systems |

The company was selected to deliver the complete mooring scope for the Culzean Floating Wind Pilot Project in the central North Sea, a collaboration involving Archer Wind and TotalEnergies. The project features floating wind turbine that will be moored by systems provided by Delmar, supporting a hybrid power solution linked to existing offshore infrastructure.

|

|

November 2025 |

Encorma |

The company received certification for its Squid floating offshore windfarm mooring system for simplified and standardized solutions for floating wind. |

|

October 2025 |

SBM Offshore N.V., SLB and Cognite |

SBM offshore N.V. announced an accelerated digital collaboration with SLB and Cognite to integrate AI and digital asset management across its FPSO and floating production operations, enhancing up time and operational efficiency. |

|

September 2025 |

Intermoor |

Intermoor and Jumbo Offshore entered into an alliance to deliver full lifecycle mooring engineering, logistics, and offshore installation services for oil & gas and floating wind sectors |

|

June 2025 |

Cavotec SA |

The company was commissioned MoorMaster automated mooring systems at Iroquois Lock (Ontario, Canada), marking a notable 2025 installation of its automated mooring technology beyond the traditional offshore field.

|

|

March 2025 |

Model Inc. and Kongsberg Gruppen |

Model Inc. entered a strategic partnership with Kongsberg Gruppen to co-develop integrated offshore mooring, dynamic positioning, and digital monitoring solutions for floating production systems and advanced mooring applications.

|

Source: Secondary Research

| TIMELINE | COMPANY | DEVELOPMENT |

|---|---|---|

|

January 2026 |

Restech |

The company developed hybrid mooring design software for renewable energy applications, adopted by European wind developers |

|

December 2025 |

KTL Offshore Pte Ltd |

The company Completed its mooring component supply for Southeast Asia FLNG project, focusing on corrosion-resistant chains. |

|

November 2025 |

Mooring Systems Inc. |

The company launched its next-gen turret mooring upgrades for Gulf of Mexico drillships, enhancing dynamic positioning integration.

|

|

October 2025 |

DeepOcean |

The company executed its subsea mooring installation for Beihai floating wind project using ROV-assisted deployment |

Source: Secondary Research

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.3 Billion |

| Market Size in 2026 | USD 2.8 Billion |

| Market Size in 2034 | USD 4.6 Billion |

| CAGR | 8.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | Type, Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Offshore Mooring Systems Market Segments

Type

- Chain mooring systems

- Synthetic rope mooring systems

Application

- Oil & gas application

- Offshore renewable energy

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.