FPSO Market Size, Share & Trends Analysis Report By Storage Capacity (Less than 1 MMBBLs, 1-2 MMBBLs, More than 2 MMBBLs), By Water Depth (Shallow Water, Deepwater, Ultra-Deepwater), By Hull Type (Single Hull, Double Hull), By Ownership (Contractor Owned, Operator Owned) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Fpso Market Size

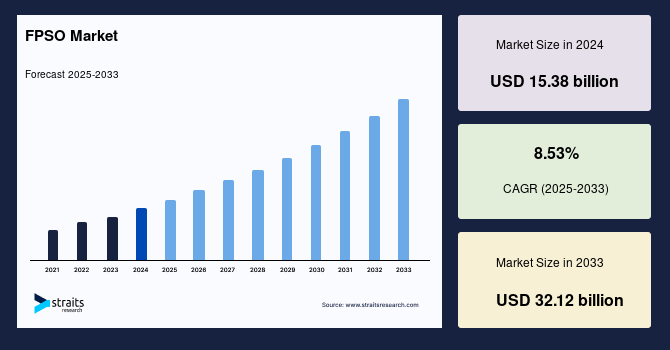

The global FPSO market size was valued at USD 15.38 billion in 2024 and is estimated to grow from USD 16.69 billion in 2025 to reach USD 32.12 billion by 2033, growing at a CAGR of 8.53% during the forecast period (2025–2033).

An FPSO (Floating Production, Storage, and Offloading unit) is a type of offshore vessel used by the oil and gas industry to process and store hydrocarbons extracted from subsea wells. It combines production, storage, and offloading capabilities on a single floating platform. FPSOs are especially useful in deepwater and remote offshore locations where building pipelines is not practical. They can stay in position for years, process the crude oil or gas onboard, store it, and then offload it to shuttle tankers for transport.

The market is being significantly driven by the increasing demand for offshore oil and gas production. As traditional onshore reserves become more depleted, companies are turning to offshore reserves, where FPSOs provide an efficient and cost-effective solution for extracting and storing hydrocarbons in remote or deepwater locations. Technological advancements in FPSO design and production have improved their operational efficiency and safety, making them more attractive for exploration in challenging environments.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 15.38 Billion |

| Estimated 2025 Value | USD 16.69 Billion |

| Projected 2033 Value | USD 32.12 Billion |

| CAGR (2025-2033) | 8.53% |

| Dominant Region | South America |

| Fastest Growing Region | Europe |

| Key Market Players | Chevron, Petronas, Aker Solutions ASA, Bluewater Energy Services B.V., Bumi Armada Berhad |

to learn more about this report Download Free Sample Report

Fpso Market Trends

Shift toward Modular Fpso Designs

The global FPSO (Floating Production Storage and Offloading) market is increasingly embracing modular designs as part of a trend towards greater efficiency and cost savings. Modular FPSOs allow for faster deployment and more flexibility in design, with pre-fabricated modules reducing the complexity of the construction process.

- For instance, in April 2023, MISC Berhad introduced the MMEGA (Mega-Module Engineering & Green Architecture) FPSO at OTC Houston, marking a significant advancement in modular FPSO design. This next-generation newbuild features eight mega-module topsides engineered to minimize interfaces and enhance system integration, thereby reducing the engineering, procurement, construction, installation, and commissioning (EPCIC) schedule and optimizing capital expenditure.

The shift towards modularity is expected to drive down operational costs and improve scalability, making FPSOs more attractive for a wide range of offshore oil and gas projects.

Fpso Market Drivers

Rising Deepwater and Ultra-Deepwater Exploration

One of the key drivers of the global FPSO market is the rising investment in deepwater and ultra-deepwater exploration as traditional reserves decline. Oil and gas companies are increasingly focusing on offshore basins where FPSOs provide a flexible and cost-effective production solution.

- For instance, in April 2025, ExxonMobil's consortium is installing its fourth FPSO, One Guyana, in the Stabroek Block. Built by SBM Offshore, this vessel can produce up to 250,000 barrels per day, boosting the region's output capacity to approximately 940,000 barrels per day later in 2025.

Such large-scale offshore developments highlight the growing reliance on FPSOs to access untapped reserves in challenging environments, reinforcing their importance in the evolving global energy landscape.

Market Restraint

High Capital Investment and Maintenance Costs

A major restraint in the global market is the high capital investment and maintenance costs associated with deploying and operating these complex offshore units. Building a new FPSO can require billions of dollars, making it a financially intensive venture. Moreover, maintenance and periodic upgrades are essential to ensure safety, regulatory compliance, and operational efficiency, which further add to long-term expenses. The need for specialized equipment, skilled labor, and ongoing inspections increases the overall cost burden. These financial challenges can deter smaller operators and delay project approvals, particularly during periods of oil price volatility and uncertain economic conditions.

Fpso Market Opportunities

Private-Public Partnerships and International Collaborations

One of the most promising opportunities in the global market lies in the rise of private-public partnerships and international collaborations. These alliances help bridge funding gaps, share technological expertise, and reduce project risks, factors crucial for capital-intensive offshore ventures.

- In April 2023, Yinson Production secured a $230 million term loan facility from Global Infrastructure Partners (GIP) for the FPSO Maria Quitéria, destined for Petrobras' Jubarte field. This financing marks GIP's first investment in an FPSO project, underscoring the sector's appeal to global infrastructure investors and the role of international financial collaborations in advancing offshore energy projects.

Such partnerships enable faster project execution and greater innovation, supporting sustainable growth in the market globally.

Regional Insights

South America remains the dominant region in the global market, driven by the rich offshore oil reserves in countries like Brazil. The pre-salt fields of Brazil have significantly increased demand for FPSOs, as the country’s oil industry shifts towards deepwater and ultra-deepwater exploration. Moreover, Petrobras, Brazil's national oil company, has been a key player, leading FPSO projects in the region. Brazil’s strategic focus on expanding its offshore oil capabilities positions it as the top player in the FPSO market, making South America a vital hub for FPSO production and deployment.

Brazil is a dominant player in the global market, driven by its vast offshore oil reserves, particularly in the pre-salt fields. Petrobras, Brazil’s state-run oil company, has been a leader in FPSO deployment, with several units installed in its deep-water fields like the Lula and Búzios fields. The country’s push to increase offshore production ensures continuous demand for FPSOs, with the government aiming to expand oil and gas extraction in its lucrative offshore sector.

Asia-Pacific Fpso Market

Asia-Pacific is emerging as a significant growth region, driven by rising offshore oil and gas production in countries like Malaysia and Indonesia. The region’s growing demand for energy and increasing offshore exploration activities are boosting FPSO utilization. For instance, Malaysia’s Sabah deepwater FPSO project illustrates the region's growing potential. As offshore oil exploration intensifies, more FPSO units are expected to be deployed to meet production needs, making Asia-Pacific a key player in the expanding market.

- China's market is growing as the country intensifies its offshore oil exploration efforts, particularly in the South China Sea. With a focus on securing energy resources to support its vast economy, China is ramping up its FPSO investments. Chinese state-owned enterprises like CNOOC have been instrumental in deploying FPSOs in both domestic and international waters, aiming to improve oil production capabilities. Moreover, China's push for technological advancements in FPSO design is expected to drive future market growth.

- South Korea is a major player in the FPSO market, both as a key consumer and supplier. The country is home to some of the world’s leading FPSO builders, such as Samsung Heavy Industries and Hyundai Heavy Industries, which design and construct FPSOs for global projects. South Korea's robust offshore oil and gas industry, particularly in the South China Sea and offshore Africa, ensures strong demand for FPSOs, and its high-tech manufacturing capabilities continue to drive growth in the sector.

- India is emerging as a key player in the market, particularly with its push to explore and extract offshore oil in the Krishna-Godavari Basin. State-owned companies like ONGC are actively involved in deploying FPSOs in deep-water fields. The Indian government’s policy initiatives to boost offshore oil exploration, including the awarding of offshore blocks to international and domestic firms, are expected to drive demand for FPSOs, making India an increasingly important market in the global FPSO industry.

Europe Fpso Market

- Germany's market is relatively small compared to major oil-producing countries but is growing due to the country's involvement in offshore gas and oil projects, particularly in the North Sea. German companies like Wintershall Dea have been active in the region, contributing to the deployment. With Germany’s commitment to energy transition and renewable projects, there is potential for further development of FPSOs in the country’s gas-rich waters as it seeks to diversify its energy sources.

South Africa Market

South Africa is emerging as a key player, particularly in offshore oil and gas exploration. The country’s oil fields, such as those near the coast of the Western Cape, present opportunities for FPSO deployment. With increasing foreign investments in exploration and production, particularly by companies like TotalEnergies and Chevron, South Africa is looking to enhance its offshore capabilities. However, its global market is still developing compared to other global leaders.

U.s. Market

The United States has a well-established market for FPSO , particularly in the Gulf of Mexico, where oil and gas production is robust. Major oil companies like ExxonMobil, Shell, and Chevron operate numerous FPSOs in the region. With a growing focus on energy independence and offshore exploration, the U.S. is expected to continue expanding its FPSO fleet. Moreover, the U.S. is exploring new deep-water oil reserves, which will further boost demand for FPSOs in the coming years.

Storage Capacity Insights

The "More than 2 MMBBLs" segment dominates the global FPSO market due to the increasing need for large-scale production and storage capacity. These units are primarily used in large offshore fields where high volumes of oil or gas must be processed and stored efficiently. Their dominance is driven by the shift towards deepwater and ultra-deepwater exploration, where larger storage capacities are essential to handle longer production cycles and optimize operational efficiency.

Water Depth Insights

Ultra-deepwater FPSOs are leading the market, driven by the demand for energy in deeper offshore locations, often located beyond 1,500 meters of water depth. As exploration moves further into remote areas, these units are essential for accessing untapped reserves. Their capability to operate in extreme depths supports the growing need for energy from deep-sea reserves, ensuring a continuous supply of oil and gas in regions where other extraction methods are not feasible.

Hull Type Analysis

Double-hull FPSOs dominate the market due to their superior safety features and environmental protection. The double hull design provides an added layer of protection against oil spills and is more resilient in harsh offshore environments. This makes double hulls particularly attractive in regulatory markets where safety and environmental impact are critical. Their dominance is expected to grow with the increasing focus on sustainable and risk-averse energy production in deepwater and ultra-deepwater fields.

Ownership Analysis

Contractor-owned FPSOs lead the market because of their flexible business model and ability to provide specialized services to operators without the long-term financial commitment of ownership. Contractors invest in FPSOs, which are then leased or contracted to operators for specific projects. This model allows operators to mitigate upfront capital costs while benefiting from the contractor’s expertise in managing complex offshore operations, making it the dominant ownership model in the FPSO market.

List of Key and Emerging Players in FPSO Market

- Chevron

- Petronas

- Aker Solutions ASA

- Bluewater Energy Services B.V.

- Bumi Armada Berhad

- BW Offshore

- ExxonMobil

- MODEC

- Petrobras

- SBM Offshore

- Shell

- Teekay Corporation

- Yinson Holdings Berhad

to learn more about this report Download Market Share

Company Market Share

Companies are focusing on expanding their market share by enhancing their technological capabilities and diversifying their portfolios. Key players are investing heavily in the development of advanced FPSO units, focusing on increasing production efficiency and optimizing storage capacity to meet the growing global demand for oil and gas. Many companies are also leveraging partnerships and joint ventures to share the costs and risks of large-scale offshore projects.

Recent Developments

- February 2025 – Petrobras commenced production from the FPSO Almirante Tamandaré (Búzios 7), in the Búzios field, located in the pre-salt layer of the Santos Basin. This high-capacity unit has the potential to produce up to 225,000 barrels of oil per day and process 12 million cubic meters of gas daily. It is connected to 15 wells through subsea infrastructure, including oil producers, water and gas injectors, and a convertible well.

Analyst Opinion

As per our analyst, the market is poised for steady growth, primarily driven by the rising demand for offshore oil and gas exploration, particularly in deepwater and ultra-deepwater regions. FPSOs offer a flexible, cost-effective, and faster deployment alternative to fixed platforms, making them especially suitable for remote and challenging offshore environments. Moreover, advancements in hull conversion technologies and modular topside designs are enhancing efficiency and scalability, further supporting market expansion.

However, the global market for FPS is not without its challenges. High upfront capital investment, complex maintenance operations, and stringent regulatory requirements, especially those related to environmental safety, pose significant hurdles for stakeholders. Despite these challenges, the long-term outlook remains favorable. Moreover, growing global energy demand, coupled with increasing investments by key oil-producing nations in offshore reserves, is expected to drive sustained adoption of FPSOs.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 15.38 Billion |

| Market Size in 2025 | USD 16.69 Billion |

| Market Size in 2033 | USD 32.12 Billion |

| CAGR | 8.53% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Storage Capacity, By Water Depth, By Hull Type, By Ownership |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

FPSO Market Segments

By Storage Capacity

- Less than 1 MMBBLs

- 1-2 MMBBLs

- More than 2 MMBBLs

By Water Depth

- Shallow Water

- Deepwater

- Ultra-Deepwater

By Hull Type

- Single Hull

- Double Hull

By Ownership

- Contractor Owned

- Operator Owned

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Akanksha Yaduvanshi

Research Analyst

Akanksha Yaduvanshi is a Research Analyst with over 4 years of experience in the Energy and Power industry. She focuses on market assessment, technology trends, and competitive benchmarking to support clients in adapting to an evolving energy landscape. Akanksha’s keen analytical skills and sector expertise help organizations identify opportunities in renewable energy, grid modernization, and power infrastructure investments.