Oral Proteins And Peptides Market Size, Share & Trends Analysis Report By Drug Type (Linaclotide, Plecanatide, Calcitonin, Insulin, Octreotide, Others), By Molecule Type (Proteins, Peptides), By Application (Gastric and Digestive Disorders, Bone Diseases, Diabetes, Hormonal Disorders, Cancer, Others), By End-User (Hospitals, Clinics, Homecare Settings, Research Institutes, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Oral Proteins and Peptides Market Size

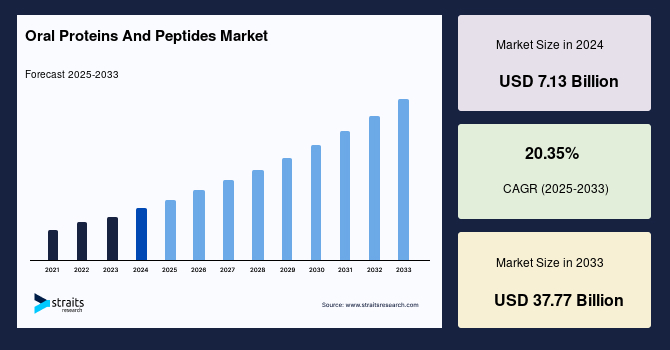

The global oral proteins and peptides market size was valued at USD 7.13 billion in 2024 and is estimated to grow from USD 8.58 billion in 2025 to reach USD 37.77 billion by 2033, growing at a CAGR of 20.35% during the forecast period (2025–2033).

The global oral proteins and peptides market is driven by several key factors. The growing patient preference for non-invasive treatments is significantly boosting demand for oral formulations, as they enhance compliance compared to injectable alternatives. Additionally, biopharmaceutical investments are accelerating research into novel peptide-based therapies, improving drug stability and absorption. The expanding biopharmaceutical industry is fostering innovation, with companies focusing on personalized medicine and targeted therapies to optimize treatment outcomes.

Furthermore, regulatory support for oral biologics is streamlining approval pathways, encouraging market expansion. Moreover, the aging population and rising healthcare expenditures are also fueling the demand for effective, patient-friendly treatments. As pharmaceutical firms continue to refine formulations, the market is expected to witness sustained growth, particularly in gastrointestinal, metabolic, and genetic disorder treatments.

Latest Market Trends

Advancement in Oral Delivery Technologies

The advancement in oral delivery technologies, particularly nanoparticles and microemulsions, is transforming drug administration by enhancing bioavailability, stability, and targeted delivery. These innovations address challenges such as enzymatic degradation and poor permeability, making oral formulations more effective for biologics and peptides.

- A 2024 study in Science Advances introduced a groundbreaking ionic liquid-based nano-carrier that safeguards insulin from stomach degradation while enhancing its absorption in the intestines. This breakthrough represents a major step toward improving oral insulin delivery, potentially reducing the need for injections for diabetic patients. Utilizing ultra-small nano-scale materials, the carrier shields insulin from gastric acids and ensures efficient transport to target areas in the body.

Additionally, self-emulsifying drug delivery systems (SEDDS) and lipid-based nanoparticles are gaining traction, offering controlled release mechanisms that improve therapeutic efficacy and patient compliance.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 7.13 Billion |

| Estimated 2025 Value | USD 8.58 Billion |

| Projected 2033 Value | USD 37.77 Billion |

| CAGR (2025-2033) | 20.35% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Novo Nordisk A/S, Johnson & Johnson Services Inc., Oramed Pharmaceuticals Inc., Emisphere Technologies, Inc., Rani Therapeutics |

to learn more about this report Download Free Sample Report

Oral Proteins and Peptides Market Growth Factors

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases is a major driver of growth in the healthcare market, fueling demand for innovative treatments and advanced drug delivery systems. As lifestyles evolve, factors such as sedentary behavior, poor diet, and aging populations are increasing the burden of chronic illnesses worldwide.

- According to the World Health Organization (WHO), chronic diseases such as cardiovascular diseases, cancer, diabetes, and respiratory illnesses now account for over 75% of global deaths annually. Similarly, the OECD reports that more than one-third of adults across its member countries suffer from a longstanding illness, with diabetes affecting 6.9% of the adult population.

This surge in chronic conditions underscores the need for enhanced preventive healthcare, precision medicine, and biologics. Companies are investing in targeted therapies, AI-driven diagnostics, and patient-friendly formulations to address this growing demand.

Market Restraining Factors

Low Bioavailability

A significant restraint in the global oral proteins and peptides market is the inherently low bioavailability of these therapeutics when administered orally. The gastrointestinal tract presents multiple barriers that drastically reduce absorption, including enzymatic degradation by digestive proteases, poor permeability across the intestinal epithelium due to the large molecular size and hydrophilic nature of biologics, and instability in the harsh acidic environment of the stomach.

These physiological challenges typically result in bioavailability levels below 1-2%, necessitating substantially higher doses to achieve therapeutic effects compared to parenteral administration. This limitation not only affects drug efficacy but also increases development costs and complicates formulation strategies, presenting a persistent obstacle to the widespread adoption of oral protein and peptide therapies in clinical practice.

Market Opportunity

Increased Utilization in New Therapeutic Areas like Nash and Alzheimer's Disease

The expanding role of oral peptides in new therapeutic areas like NASH and Alzheimer's disease presents a promising market opportunity. In NASH, peptides are being explored for their ability to regulate metabolic pathways and reduce liver inflammation. Drugs like semaglutide, initially developed for diabetes, are showing efficacy in improving liver histology and reducing disease progression. Additionally, in Alzheimer's treatment, researchers are exploring peptide-based approaches to combat neurodegeneration.

- A 2024 study published in Brain Research reported the development of PHDP5, a synthetic peptide designed to target tau protein buildup, a key factor in Alzheimer' s-related neurodegeneration. In mouse models, PHDP5 demonstrated potential in reversing memory and learning deficits by restoring nerve cell communication, highlighting its therapeutic promise.

These advancements suggest that peptide-based therapies could transform treatment landscapes, offering non-invasive solutions for complex diseases with improved patient compliance and broader accessibility.

Regional Insights

The North American region demonstrates strong growth due to high healthcare expenditure and advanced pharmaceutical R&D infrastructure. Robust clinical trial activity and adoption of innovative drug delivery systems accelerate market development. The increasing incidence of chronic diseases, such as diabetes and hormonal disorders, supports the demand for oral biologics. Regulatory agencies are also progressively approving novel oral peptides, further encouraging innovation. Moreover, strong collaboration between academic research institutions and biotech firms fosters continuous advancements, positioning North America as a front-runner in the adoption of oral proteins and peptides.

U.s. Oral Proteins and Peptides Market Trends

- The United States market is growing due to rising demand for non-invasive treatments for chronic diseases like diabetes. Companies such as Novo Nordisk have introduced oral GLP-1 analogs like Rybelsus, gaining significant traction. High healthcare spending, strong R&D infrastructure, and favorable FDA pathways are driving innovation in oral biologics and peptide delivery systems.

- Canada's market is expanding with increasing adoption of advanced drug delivery systems and a growing elderly population. The approval of oral semaglutide and the focus on personalized medicine is contributing to market growth. Government support for biotechnology and collaborations between universities and pharmaceutical companies, such as those seen in Ontario's life sciences hubs, are fostering development in oral peptide therapeutics.

Asia-Pacific Oral Proteins and Peptides Market Trends

Asia Pacific is emerging as a high-growth region due to rising healthcare infrastructure and increasing pharmaceutical manufacturing capabilities. A growing patient population with chronic conditions is fueling demand for accessible, non-invasive therapeutic options. Investments in biotech R&D and rising interest in personalized medicine are accelerating innovation in oral protein and peptide delivery. Local pharmaceutical companies are increasingly partnering with global firms to co-develop and commercialize advanced oral therapies. Additionally, government initiatives supporting biotech innovation are expanding the regional market's potential in both domestic and international arenas.

- China's market is witnessing rapid growth due to the rising diabetic population and advancements in drug delivery technologies. Domestic firms like Jiangsu Hansoh Pharmaceutical are investing in oral biologics, while partnerships with international companies are accelerating innovation. Government support for biopharma R&D and an expanding healthcare infrastructure further boost market development, especially for oral insulin and GLP-1 analog-based therapies.

- India's market is gaining traction, driven by a growing burden of chronic diseases and strong generic manufacturing capabilities. Companies like Biocon are pioneering oral insulin research, while Indian startups are exploring nanoparticle-based peptide delivery. The government's encouragement of biotech innovation through initiatives like "Make in India" and increased healthcare spending creates a fertile ground for domestic and foreign players in the oral peptide drug space.

Europe Oral Proteins and Peptides Market Trends

Europe's market growth is driven by significant investments in biopharmaceutical research and favorable healthcare reimbursement frameworks. The region's stringent yet supportive regulatory environment encourages innovation in oral delivery mechanisms. Additionally, market growth is bolstered by an increasingly aging population and rising demand for convenient chronic disease therapies. Several public-private partnerships and academic research programs focus on oral biologics development. Furthermore, increased awareness among healthcare providers and patients about the benefits of non-invasive drug administration supports the region's transition from injectables to oral proteins and peptides across multiple therapeutic areas.

- Germany's market is growing due to strong biotech R&D and public healthcare support. Companies like BioNTech and Evotec are investing in oral biologics research. The country's focus on diabetes and oncology treatment supports the demand for innovative oral formulations. Government funding and academic-industry partnerships further accelerate progress in stabilizing peptides for oral delivery, promoting market expansion.

- The UK market benefits from a robust pharmaceutical ecosystem and innovation in oral drug delivery. Firms like EnteroBiotix and Midatech Pharma focus on improving the bioavailability of oral biologics. NHS support for non-invasive therapies and rising chronic disease incidence drive adoption. The presence of academic leaders such as Oxford and Cambridge enables cutting-edge research in oral peptide stabilization and absorption technologies.

Drug Type Insights

The linaclotide segment holds a significant share in the global market due to its proven efficacy in treating irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation (CIC). As a guanylate cyclase-C agonist, linaclotide enhances intestinal fluid secretion and transit, offering symptomatic relief. Its oral administration improves patient compliance, particularly in long-term therapies. Increasing awareness of gastrointestinal health and favorable clinical outcomes support its growing adoption. Additionally, continued clinical research and geographic expansion by key pharmaceutical players are expected to further drive market growth for linaclotide in the coming years.

Molecule Type Insights

The protein segment represents a robust portion of the market, driven by advancements in oral delivery technologies that address the inherent challenges of protein degradation in the gastrointestinal tract. Therapeutic proteins, such as insulin and calcitonin, are increasingly formulated for oral administration to enhance patient adherence and comfort. Innovations in encapsulation techniques, enzyme inhibitors, and permeation enhancers are enabling better bioavailability of oral protein drugs. With the growing prevalence of chronic diseases and a shift toward biologics, the demand for oral protein therapeutics is rising, making this segment a key area of focus for biopharmaceutical companies globally.

Application Insights

The gastric and digestive disorders segment accounts for a substantial share of the oral proteins and peptides industry, driven by the rising incidence of conditions like irritable bowel syndrome, constipation, and inflammatory bowel disease. Drugs such as linaclotide and plecanatide have gained regulatory approvals and are widely prescribed for these indications, fueling the market growth. Oral formulations offer a non-invasive and convenient treatment alternative, improving patient adherence. Growing healthcare awareness and increased diagnosis rates of gastrointestinal disorders are further contributing to the segment's expansion. Ongoing research into new oral therapies continues to support innovation and adoption in this therapeutic area.

End-User Insights

The hospital segment dominates the end-user landscape of the oral proteins and peptides industry, owing to the high volume of patient visits and the availability of advanced diagnostic and treatment facilities. Hospitals serve as key settings for initiating therapy, managing complex cases, and administering specialized drugs. The presence of skilled healthcare professionals enhances the proper use and monitoring of oral protein and peptide treatments. Additionally, hospitals often act as hubs for clinical trials and drug evaluations, accelerating the adoption of novel therapeutics. Their role in chronic disease management and access to comprehensive care services further strengthens this segment's market presence.

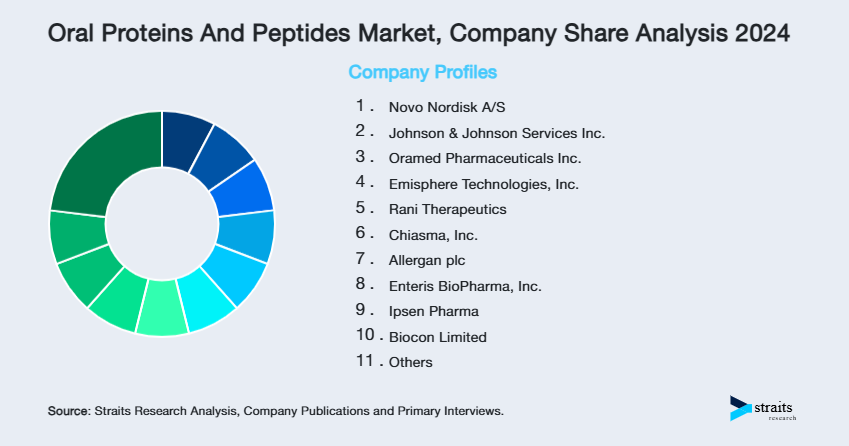

Company Market Share

Companies in the oral proteins and peptides market are focusing on innovative drug delivery technologies to improve bioavailability and patient compliance. They are investing heavily in research and development to overcome gastrointestinal barriers and enhance peptide stability. Strategic partnerships, clinical trials, and regulatory filings are also being pursued to accelerate product pipelines. Additionally, efforts are being made to expand therapeutic indications and enter emerging markets to boost global market presence.

Johnson & Johnson Services Inc.: Johnson & Johnson Services Inc., founded in 1886, is a key player in the global healthcare and pharmaceutical industry. As part of Johnson & Johnson, the company operates through its Janssen Pharmaceutical division to advance innovative drug delivery platforms, including oral proteins and peptides. With a strong emphasis on R&D and strategic collaborations, it focuses on developing oral biologics for chronic conditions like diabetes and autoimmune diseases. Its long-standing expertise and investment in novel therapeutics position it prominently in this emerging market.

- In March 2025, Johnson & Johnson’s Icotrokinra, an oral IL‑23R peptide, showed strong results in Phase 3 trials for plaque psoriasis, with 65% of patients achieving clear or almost clear skin by Week 16. The therapy demonstrated sustained efficacy through Week 24 and is also being studied for psoriatic arthritis and ulcerative colitis.

List of Key and Emerging Players in Oral Proteins And Peptides Market

- Novo Nordisk A/S

- Johnson & Johnson Services Inc.

- Oramed Pharmaceuticals Inc.

- Emisphere Technologies, Inc.

- Rani Therapeutics

- Chiasma, Inc.

- Allergan plc

- Enteris BioPharma, Inc.

- Ipsen Pharma

- Biocon Limited

- Protagonist Therapeutics, Inc.

to learn more about this report Download Market Share

Recent Developments

- April 2025- Eli Lilly and Company (NYSE: LLY) has reported positive topline results from its Phase 3 ACHIEVE-1 trial, which assessed the safety and effectiveness of orforglipron in adults with type 2 diabetes who were not achieving adequate glycemic control through diet and exercise alone. Orforglipron is the first oral small-molecule GLP-1 receptor agonist administered without restrictions on food or water intake to successfully complete a Phase 3 clinical trial.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 7.13 Billion |

| Market Size in 2025 | USD 8.58 Billion |

| Market Size in 2033 | USD 37.77 Billion |

| CAGR | 20.35% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Drug Type, By Molecule Type, By Application, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Oral Proteins And Peptides Market Segments

By Drug Type

- Linaclotide

- Plecanatide

- Calcitonin

- Insulin

- Octreotide

- Others

By Molecule Type

- Proteins

- Peptides

By Application

- Gastric and Digestive Disorders

- Bone Diseases

- Diabetes

- Hormonal Disorders

- Cancer

- Others

By End-User

- Hospitals

- Clinics

- Homecare Settings

- Research Institutes

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Mitiksha Koul

Research Associate

Mitiksha Koul is a Research Associate with 2 years of experience in market research. She focuses on analyzing industry trends, competitive landscapes, and growth opportunities to support strategic decision-making. Mitiksha’s strong analytical skills and research expertise enable her to deliver actionable insights that help businesses adapt to evolving market dynamics and achieve sustainable growth.