Orthopedic Devices Market Size

The global orthopedic devices market size was valued at USD 53.54 billion in 2024 and is projected to grow from USD 56.04 billion in 2025 to USD 76.90 billion by 2033, exhibiting a CAGR of 4.03% during the forecast period (2025-2033).

The orthopedic devices market is primarily driven by the rising number of orthopedic procedures, such as joint replacements and fracture repairs, owing to aging population and increasing cases of musculoskeletal disorders.

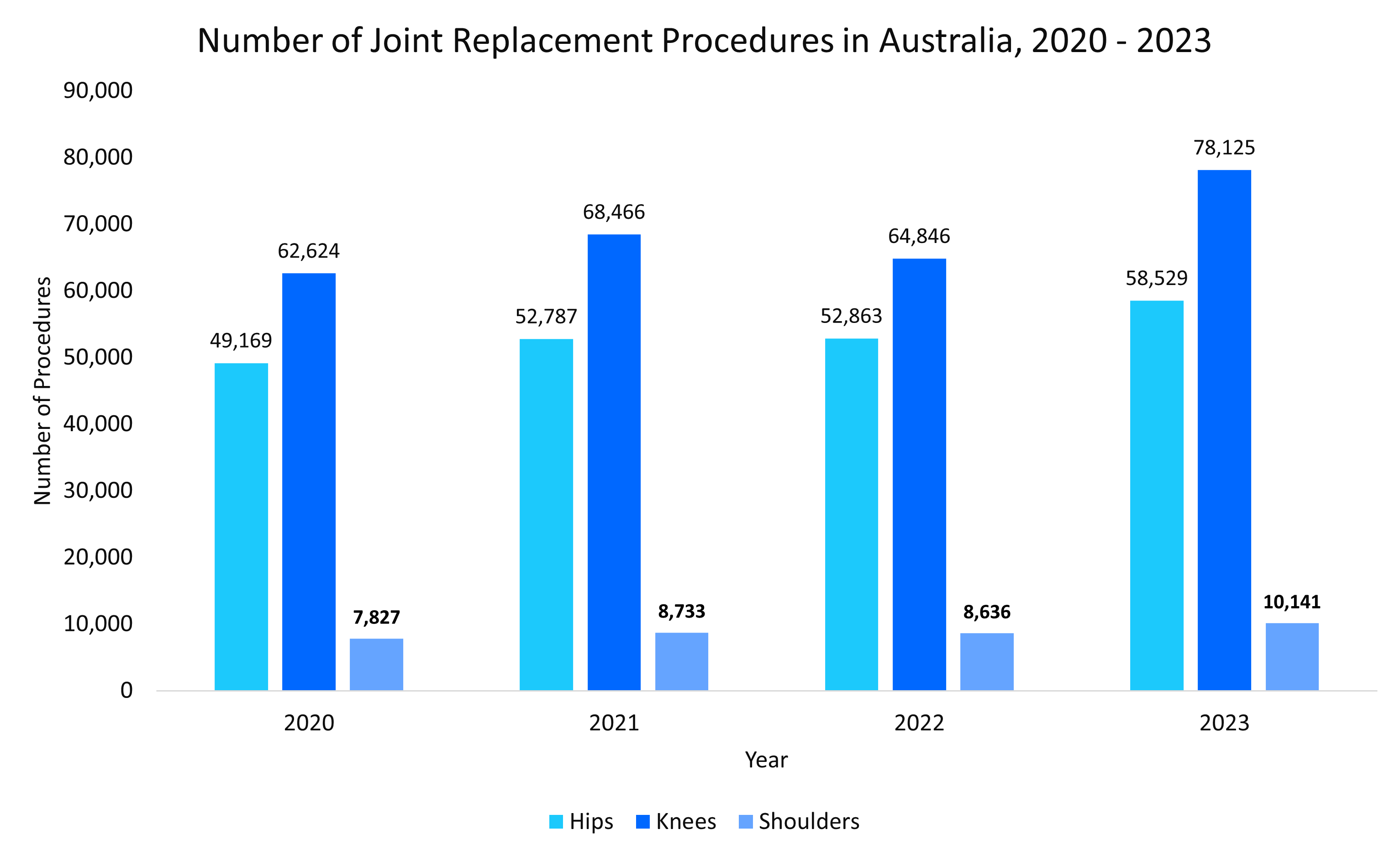

- For instance, the graph below illustrates the number of joint replacement procedures including hip, knee, and shoulder surgeries performed in Australia between 2020 and 2023, reflecting the growing demand for orthopedic interventions in the country.

Source: Australian Orthopaedic Association National Joint Replacement Registry, and Straits Research

Further, the availability of reimbursement schemes through public and private insurers makes these procedures more accessible to patients, thereby boosting demand. Furthermore, the presence of government and institutional grants aimed at improving orthopedic care and supporting research and innovation creates growth opportunities for manufacturers to expand their offerings and invest in advanced technologies.

U.S. Grant and Research Awards Cycle, 2025

|

Name |

Grant Amount (USD) |

|

Shoulder Arthritis Research Grant |

USD 500,000 |

|

Return to Play Clinical Research |

USD 200,000 |

|

JRF Ortho Allograft Grant |

USD 50,000 |

|

Young Investigator |

USD 40,000 |

|

Kirkley Clinical Outcomes |

USD 20,000 |

|

Playmaker Grant Lab |

USD 25,000 |

|

Cabaud Memorial Award |

USD 5,000 |

|

O’Donoghue Sports Injury Award |

USD 5,000 |

|

Excellence in Research Award |

USD 2,000 |

|

Bart Mann Award |

USD 5,000 |

Source: American Orthopedic Surgery for Sports Medicine, and Straits Research

Orthopedic Devices Market Trends

Shift toward Outpatient Procedures and Ascs Adoption

Orthopedic surgeries are increasingly being performed in ambulatory surgery centers (ASCs) rather than hospitals, driven by cost savings, quicker recovery times, and improved patient convenience. Procedures such as total joint replacements, once limited to inpatient settings, are now routinely done in ASCs.

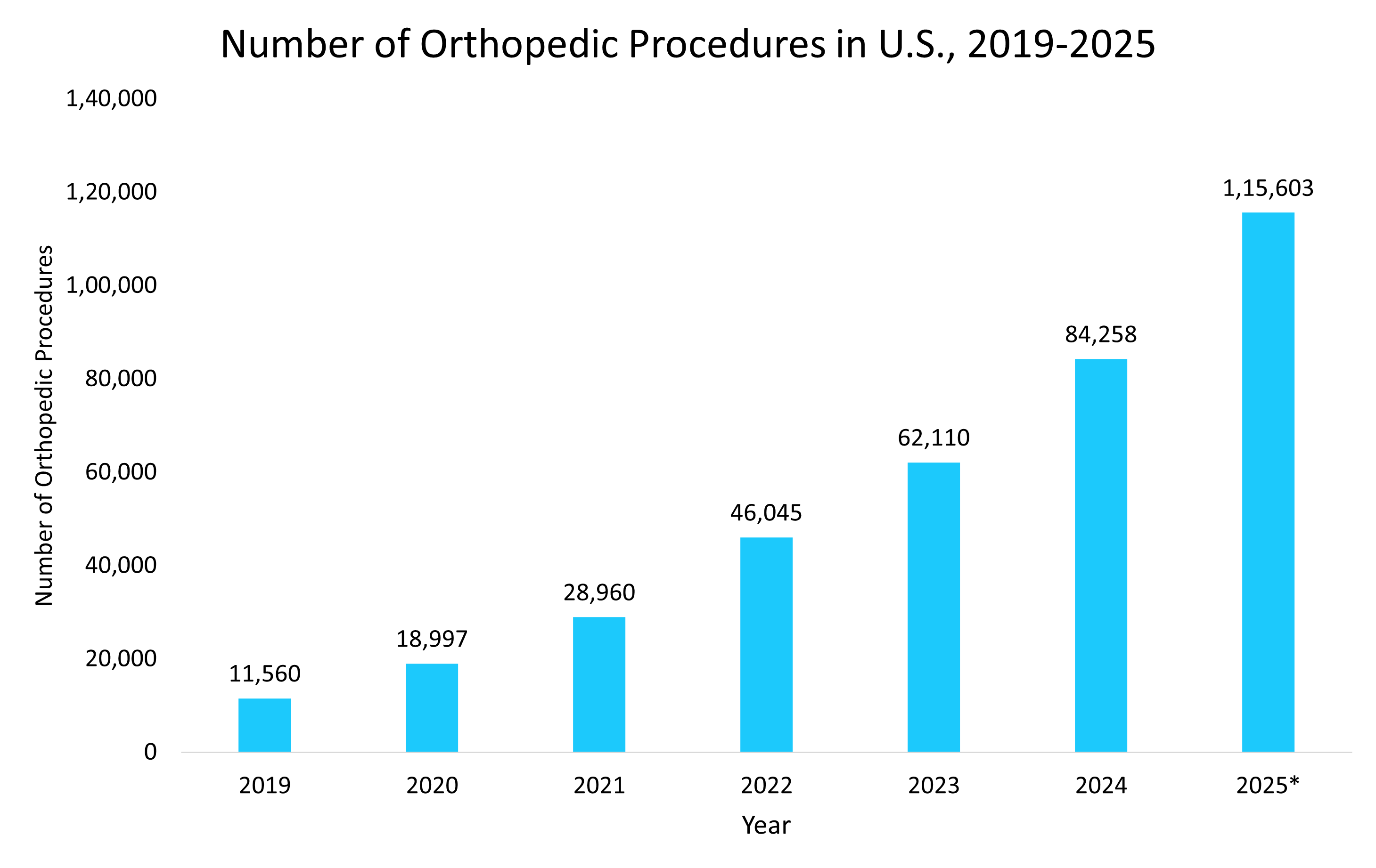

- For instance, the graph below illustrates the growing trend towards outpatient orthopedic care. The cumulative procedure volume in ASCs surged to 62,110 in 2023, with projections indicating a rise to 115,603, demonstrating a rapid shift towards ASC-based surgeries.

Source: American Joint Replacement Registry, and Straits Research (*Estimated)

Thus, such sharp rise in orthopedic procedures at ASCs highlights a major shift toward outpatient care. This trend is driving innovation in device design tailored for efficiency, portability, and minimally invasive use.

Manufacturing of Smart Orthopedic Implants with Embedded Sensors

Orthopedic implants are evolving from passive structural supports to digitally connected medical devices that actively track and report how the body is responding post-surgery. These next-generation implants are embedded with micro-sensors that collect real-time data on motion, loading, and joint function, essentially turning implants into smart monitoring tools inside the body.

- For example, Zimmer Biomet offers Persona IQ - The Smart Knee, paired with the mymobility platform, collects real-time data from the knee implant to personalize recovery and helps the medical care team to monitor patients remotely, improving both outcomes and clinical efficiency.

Thus, this trend represents a fusion of biomechanics and digital diagnostics, perfectly aligned with healthcare’s broader push toward personalized, remote, and data-rich treatment models.

To get more insights about this report Download Free Sample Report

Orthopedic Devices Market Growth Factors

Escalating Global Surgical Volumes Are Propelling Growth in Orthopedic Device Adoption

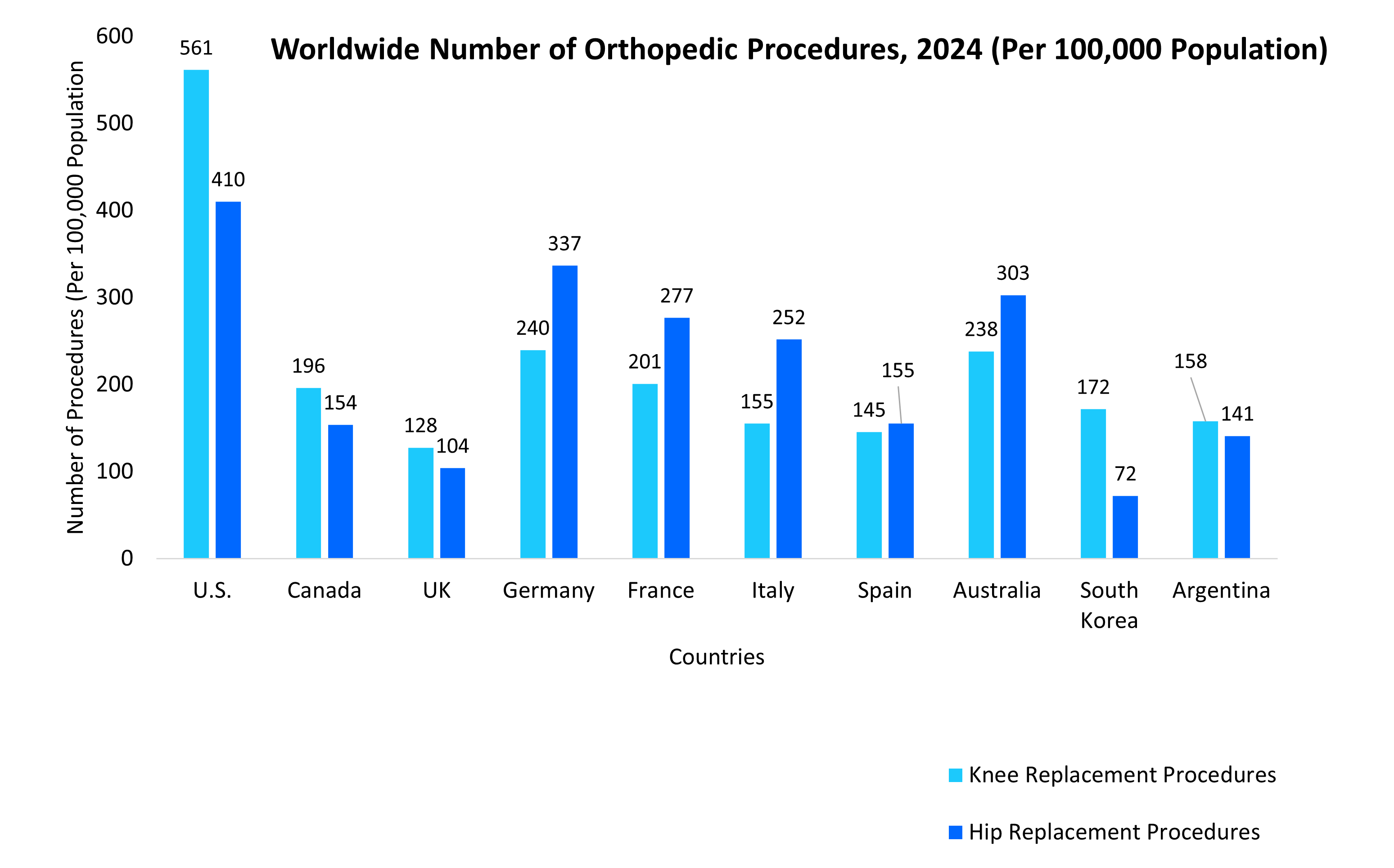

The steady rise in orthopedic surgeries worldwide, driven by aging populations, lifestyle-related joint issues, and improved surgical access is directly boosting the adoption of orthopedic devices. High per capita procedure rates, such as in the U.S. and Germany, reflect increasing demand for implants, fixation systems, and surgical tools.

- For instance, the graph below highlights the number of hip and knee replacement procedures per 100,000 population, showcasing the procedural burden across major economies.

Source: Organisation for Economic Co-operation and Development, Eurostat (European Union), and Straits Research

Thus, this surge in surgical volumes is solidifying orthopedic devices as essential components in modern musculoskeletal care.

Availability of Reimbursement Schemes for Orthopedic Care

The availability of reimbursement schemes for orthopedic care acts as a key driver in the growth of the orthopedic devices market. Reimbursement policies reduce the financial burden on patients, encouraging them to opt for surgical interventions such as joint replacements and spinal procedures. This increases the overall volume of orthopedic surgeries and boosts the demand for related medical devices.

For example:

- In the U.S., Medicare and private insurers cover a substantial portion of the costs for orthopedic procedures such as total hip and knee replacements, especially for elderly patients.

- Germany’s Statutory Health Insurance (SHI) reimburses the full cost of medically necessary orthopedic procedures, making high-cost surgeries accessible to a broader population.

- India’s Ayushman Bharat scheme includes coverage for orthopedic implants and surgeries under its health benefit packages, especially targeting low-income families.

Thus, these supportive reimbursement frameworks across various countries not only improve access to orthopedic care but also propel market growth by driving the utilization of advanced orthopedic devices.

Market Restraining Factor

Packaging and Quality Control Recall Risk

A major restraint in the orthopedic devices market is the recurring product recalls due to packaging flaws and quality control issues, which disrupt surgical procedures, increase revision risks, and undermine stakeholder trust.

- For example, the table below highlights notable recalls in the orthopedic devices market owing to packaging and quality control issues.

Notable orthopedic device recalls due to packaging and quality issues

|

Manufacturer |

Product |

Type of Device |

Reason for Recall |

|

Exactech, Inc. |

Optetrak, Logic, and Truliant |

Knee orthopedic devices |

Defective vacuum-sealed packaging |

|

Zimmer Biomet |

NexGen Stemmed Option Tibial Components |

Knee orthopedic devices |

Higher revision rates when used with LPS Flex or LPS Flex GSF femoral components |

|

NuVasive |

MAGEC Rods |

Spinal orthopedic devices |

Packaging closure integrity issue |

Source: U.S. FDA, Company Press Releases, and Straits Research

Thus, packaging flaws and quality control issues in orthopedic devices pose significant risks, leading to product recalls, increased revision rates, and hinder the market growth.

Key Market Opportunities

Revolutionizing Orthopedic Surgery: the Role of Robotics Technology

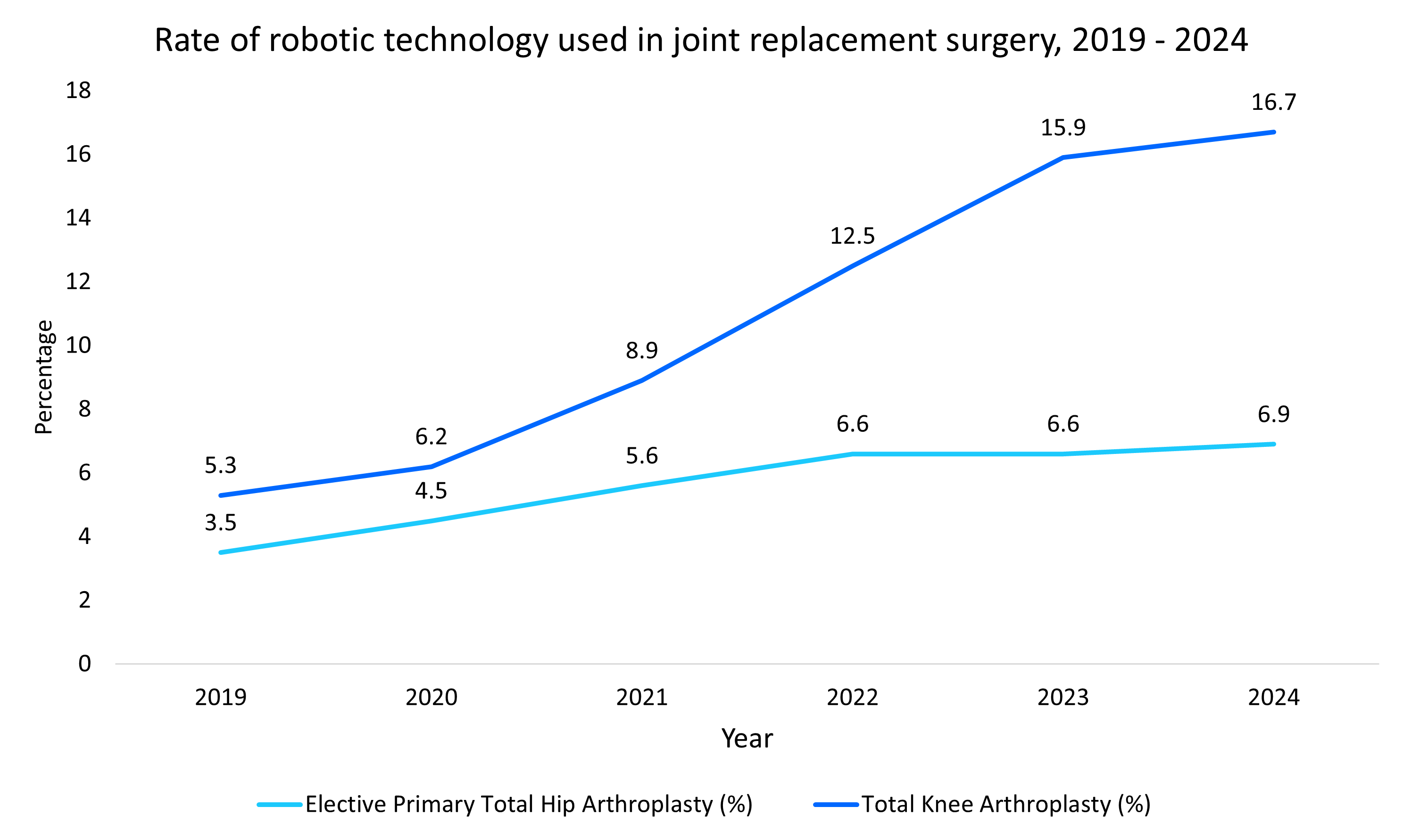

Robotics technology in orthopedic surgery offers a unique opportunity to enhance precision in procedures such as joint replacements and spinal surgeries. It reduces human error, minimizes invasiveness, and leads to faster recovery times. As the demand for more accurate and efficient surgeries rises, robotics-driven solutions present significant growth potential for the orthopedic market.

- For instance, the below graph shows an increasing adoption rate of robotic technology in orthopedic surgeries, specifically for elective primary total hip arthroplasty (THA) and total knee arthroplasty (TKA).

Source: American Joint Replacement Registry, and Straits Research

Thus, the rising adoption of robotic technology in orthopedic surgeries highlights a growing demand for precision and efficiency, offering key opportunities for manufacturers to innovate and expand in the market.

Regional Insights

North America accounted for the major orthopedic devices market revenue with 42.56% market share, owing to a combination of advanced healthcare infrastructure, high procedural volumes, and early adoption of innovative orthopedic technologies. In addition, the region benefits from a robust reimbursement ecosystem, a strong presence of leading global manufacturers, and increased investment in R&D.

U.s. Orthopedic Devices Market Trends

The orthopedic devices sector is experiencing dynamic growth and diversification across the globe, with each country contributing uniquely to the advancement of this transformative field.

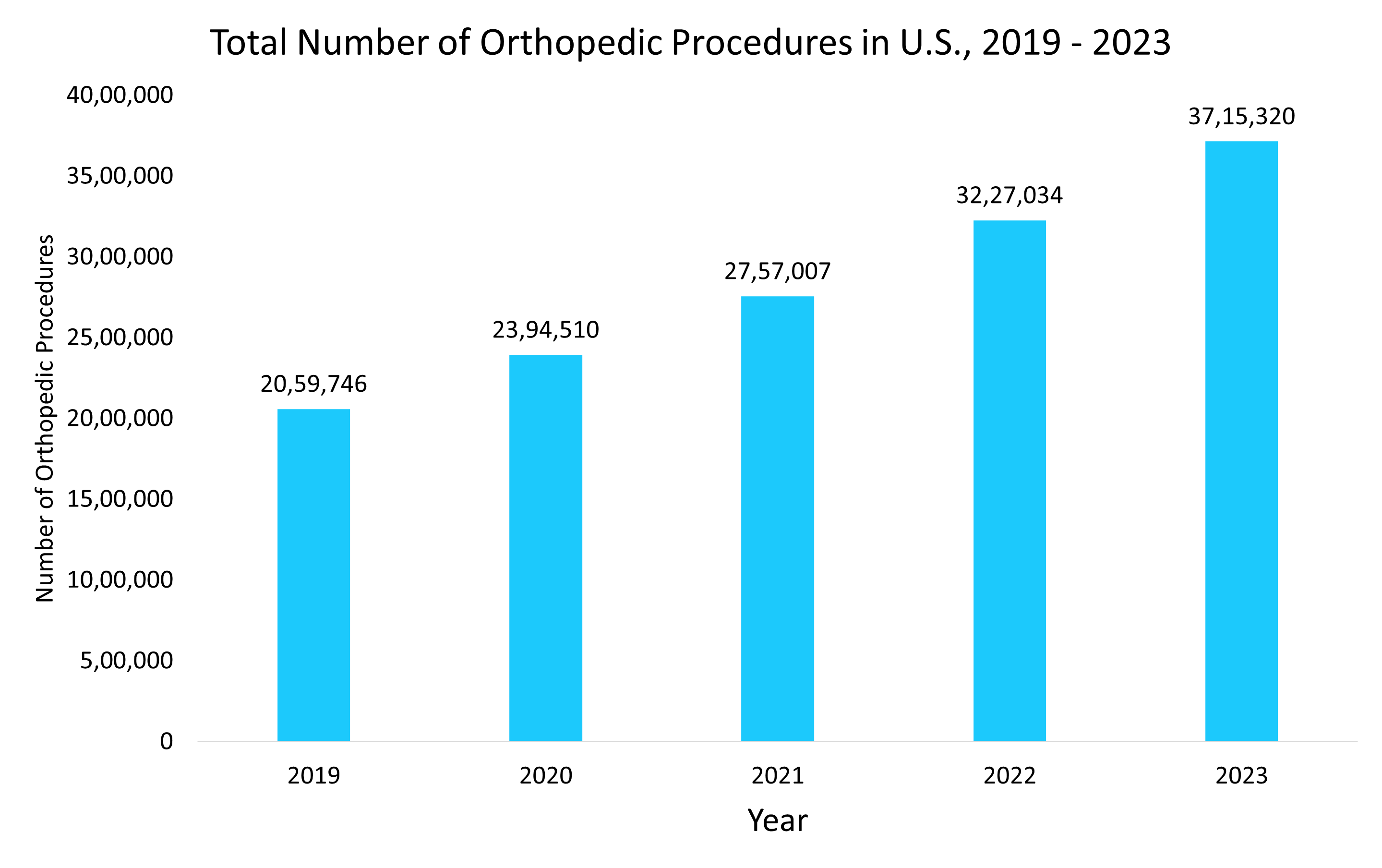

- U.S. - U.S. dominates the orthopedic devices industry, driven by the high volume of orthopedic procedures performed annually, the presence of established manufacturers, and the availability of comprehensive reimbursement schemes for orthopedic care. Furthermore, the growing adoption of value-based care models, focused on improved outcomes and cost-efficiency, is encouraging healthcare providers to invest in advanced, high-quality orthopedic devices. For instance, the below graph shows number of orthopedic procedures carried out in U.S., during the 2019 – 2023 period.

Source: American Joint Replacement Registry, and Straits Research

- Canada – The Canada market is driven by the rising number of orthopedic replacements, growing demand for joint surgeries, and supportive public healthcare funding. According to the Canadian Institute for Health Information (CIHI) 2023 report, over 117,000 hip and knee replacements were performed in 2021–2022, representing a 5.9% increase from the previous year, highlighting the growing need for orthopedic care.

Europe Orthopedic Devices Market Trends

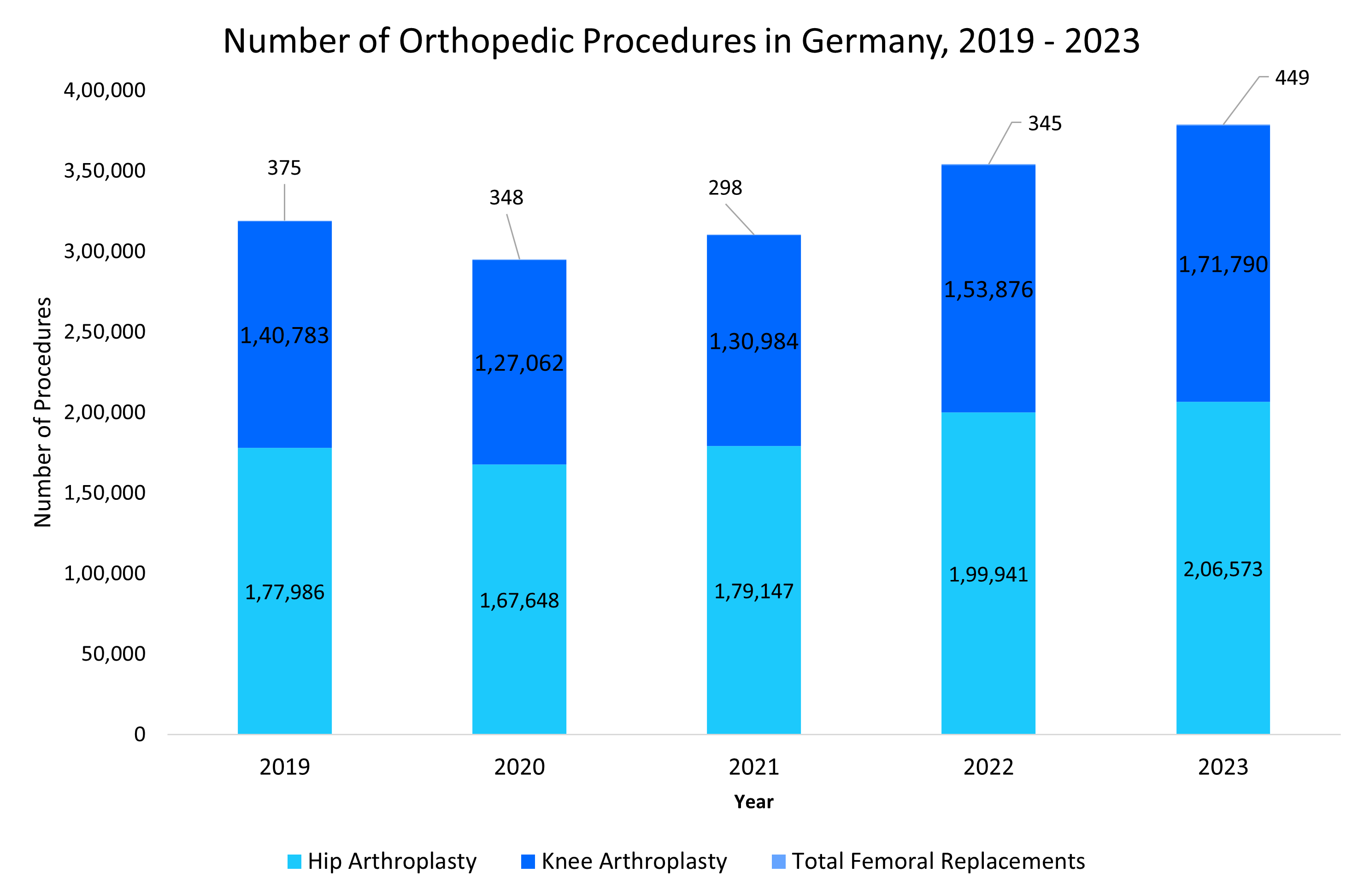

- Germany – The major factors driving the growth of the market are the rising number of femoral replacement procedures, such as knee arthroplasty & hip arthroplasty, the availability of reimbursement schemes for orthopedic care, and advancements in surgical technologies, including robotic-assisted orthopedic procedures. For instance, the graph below illustrates the annual number of knee arthroplasty, hip arthroplasty, and other femoral replacement procedures, highlighting the increasing procedural volume and growing demand for orthopedic solutions in the country.

Source: German Arthroplasty Registry (EPRD), and Straits Research

- UK – The UK orthopedic industry is fueled by a rising number of hip fractures, growing investments in orthopedic treatment, and strong support from the National Health Service (NHS) for orthopedic interventions. For instance, according to the UK National Hip Fracture Database 2024, the number of hip fracture procedures increased by 3.3% between 2020 and 2023, reflecting an upward trend in orthopedic surgical demand.

- France – The major factors propelling the demand for orthopedic implants are the increasing volume of arthroplasties, the rising number of people suffering from osteoarthritis, and supportive government healthcare policies that facilitate access to joint replacement surgeries. Additionally, growing adoption of advanced implant materials and minimally invasive surgical techniques further supports market expansion. For instance, the below graph highlights the rising volume of arthroplasties carried out in France during the 2019–2023 period.

Source: French Society for Orthopaedic Surgery and Traumatology, and Straits Research

Asia Pacific Orthopedic Devices Market Trends

The Asia Pacific region is anticipated to grow at the fastest CAGR of 6.83% during the forecast period, driven by rising healthcare investments, a growing patient population, increasing adoption of advanced orthopedic procedures, and heightened awareness of musculoskeletal health. This growth is further supported by improved healthcare infrastructure and government initiatives aimed at expanding access to orthopedic care across emerging economies such as China, India, and Southeast Asia.

- Australia – The orthopedic devices market in Australia is expanding due to the increasing number of hip and shoulder replacement procedures, rising investments in the orthopedic sector, and a favourable regulatory environment for medical device manufacturing. The Therapeutic Goods Administration (TGA) supports streamlined approvals and innovation, encouraging both local production and international market entry, thereby fostering overall market growth.

Type Insights

Based on type, the market is segmented into hip orthopedic devices, knee orthopedic devices, spine orthopedic devices, trauma fixation devices, and others. Spine orthopedic devices segment accounted for major orthopedic devices market share, owing to the rising prevalence of spinal disorders such as degenerative disc disease, spinal stenosis, and herniated discs. Increased demand for minimally invasive spine surgeries, coupled with advancements in spinal implants and navigation technologies, has further accelerated the adoption of spine orthopedic devices.

- For instance, the American Spine Registry (ASR) 2025 report revealed a notable increase in the number of spine procedures in the U.S., growing from 259,869 in 2022 to 342,842 in 2023.

End User Insights

Based on end user, the market is segmented into hospitals & clinics, ambulatory surgery centers (ASCs), and others. Ambulatory surgery centers (ASCs) segment is expected to register fastest CAGR during the forecast period, driven by their cost-effectiveness, shorter recovery times, and high-quality surgical outcomes. The growing number of ASCs, coupled with rising orthopedic procedure volumes, advances in anaesthesia and post-operative care, and favourable reimbursement policies, are making ASCs an increasingly preferred setting for both patients and providers.

- For instance, the American Joint Replacement Registry (AJRR) 2025 report highlighted that the number of ASCs performing joint replacements in the U.S. grew from 118 in 2019 to 312 in 2023, reflecting a strong shift toward outpatient orthopedic care.

Company Market Share

Key players in the industry are focus on adopting key business strategies, such as product approvals, acquisitions, and expansions, to gain a strong foothold in the market.

Exactech, Inc.: An Emerging Player in the Orthopedic Devices Market

- Exactech, Inc., is an emerging player in the market, specializing in the development and manufacture of innovative implants and surgical technologies for joint replacement.

Recent developments by Exactech, Inc:

- In October 2024, Exactech, Inc., a global leader in medical technology, announced that it had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Truliant Porous Tibial Tray, a 3D-printed tibial knee implant.

List of Key and Emerging Players in Orthopedic Devices Market

- Johnson & Johnson Services, Inc.

- Stryker

- Zimmer Biomet

- Smith+Nephew

- Arthrex

- Envois

- Medtronic

- Globus Medical

- Orthofix Medical Inc.

- CONMED Corporation

- Braun SE

- Catalyst OrthoScience Inc.

- Avalign Technologies, Inc.

- Maxx Orthopedics, Inc.

- Madison Ortho

- Exactech, Inc.

- MicroPort Orthopedics, Inc.

- United Orthopedic Corporation

- Euromed Implants GmbH

- Bioretec

To get more findings about this report Download Market Share

Recent Developments

- In February 2025, Maxx Orthopedics has received FDA 510(k) clearance for its new asymmetrical Porous Tibial Baseplate for the Freedom Total Knee System.

- In January 2025, Corin has received FDA 510(k) clearance for ApolloHipX, the first hip arthroplasty technology to combine dynamic 3D preoperative planning with intraoperative fluoroscopy for enhanced surgical precision.

Analyst Opinion

The orthopedic devices market is witnessing significant growth, driven by the rising incidence of musculoskeletal disorders, a rapidly aging global population, and growing patient preference for minimally invasive surgical procedures. Technological advancements such as 3D-printed implants, robotics-assisted surgeries, and smart orthopedic devices are further enhancing clinical outcomes and accelerating adoption. Additionally, improved healthcare infrastructure, favourable reimbursement scenarios, and the increasing volume of orthopedic surgeries, particularly in developing regions are collectively contributing to market expansion.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 53.54 Billion |

| Market Size in 2025 | USD 56.04 Billion |

| Market Size in 2033 | USD 76.90 Billion |

| CAGR | 4.03% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

Explore more data points, trends and opportunities Download Free Sample Report

Orthopedic Devices Market Segments

By Type

- Hip Orthopedic Devices

- Knee Orthopedic Devices

- Spine Orthopedic Devices

- Trauma Fixation Devices

- Others

By End-User

- Hospitals & Clinics

- Ambulatory Surgery Centers (ASCs)

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Jay Mehta

Research Analyst

Jay Mehta is a Research Analyst with over 4 years of experience in the Medical Devices industry. His expertise spans market sizing, technology assessment, and competitive analysis. Jay’s research supports manufacturers, investors, and healthcare providers in understanding device innovations, regulatory landscapes, and emerging market opportunities worldwide.

Our Clients: